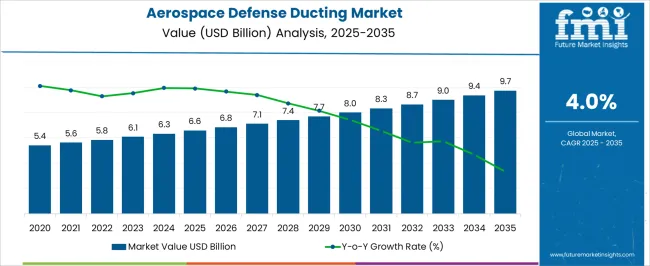

The aerospace defense ducting market is estimated to be valued at USD 6.6 billion in 2025 and is projected to reach USD 9.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

In 2025, the market stands at USD 6.6 billion, with annual values rising gradually from USD 5.4 billion in 2021 to USD 6.8 billion in 2026. Each year sees an increase of approximately 3–4%, reflecting consistent demand across aircraft ventilation, environmental control systems, and ducting components. This predictable YoY expansion enables manufacturers and suppliers to plan production schedules, manage inventory, and secure recurring contracts efficiently. By 2035, the market is expected to reach USD 9.7 billion, representing an absolute increase of USD 3.1 billion from 2025, supported by the 4.0% CAGR.

Year-on-year, the market grows steadily with values rising from USD 7.1 billion in 2027 to USD 9.7 billion in 2035. This consistent growth trend allows stakeholders to anticipate demand, optimize supply chains, and expand operational capacity incrementally. The steady YoY increases provide a reliable outlook for revenue planning and long-term engagement within aerospace ducting and environmental control system applications.

| Metric | Value |

|---|---|

| Aerospace Defense Ducting Market Estimated Value in (2025 E) | USD 6.6 billion |

| Aerospace Defense Ducting Market Forecast Value in (2035 F) | USD 9.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The aerospace defense ducting segment plays a vital role in the broader aircraft systems market, which encompasses avionics, propulsion, and environmental control systems. In 2025, ducting accounts for USD 6.6 billion, representing roughly 15% of the total aerospace systems market. By 2035, the segment is projected to reach USD 9.7 billion, maintaining a similar share of 14–15%. This consistent percentage indicates that ducting will remain a key revenue driver, supported by ongoing aircraft production, retrofits, and maintenance activities.

Its contribution underscores the segment’s importance in ensuring operational efficiency across multiple aircraft platforms. Over the decade, the ducting market grows at a CAGR of 4.0% from USD 6.6 billion in 2025 to USD 9.7 billion in 2035, closely aligning with overall parent market growth. The stable 15% share emphasizes its predictable role within the aerospace systems ecosystem. Manufacturers and suppliers can rely on incremental revenue opportunities from this segment while planning capacity expansions and supply chain optimization. The steady contribution highlights the segment’s strategic value, offering a clear roadmap for investment and operational planning within the larger aerospace and defense market.

The aerospace defense ducting market is witnessing steady growth fueled by rising aircraft production, fleet modernization, and increased defense budgets. The push for lighter, more fuel-efficient aircraft has spurred the adoption of advanced ducting materials that offer durability and performance under extreme conditions.

Regulatory focus on thermal and fire resistance, along with the demand for better airflow management across systems like ECS, hydraulics, and avionics, is further driving duct innovation. Additionally, partnerships between OEMs and ducting system suppliers are fostering development of integrated solutions tailored for next-gen aircraft platforms.

This landscape is expected to evolve with the growing use of composites, 3D printing, and electric propulsion systems.

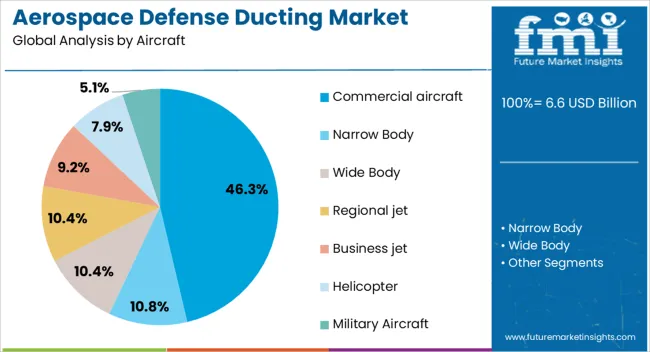

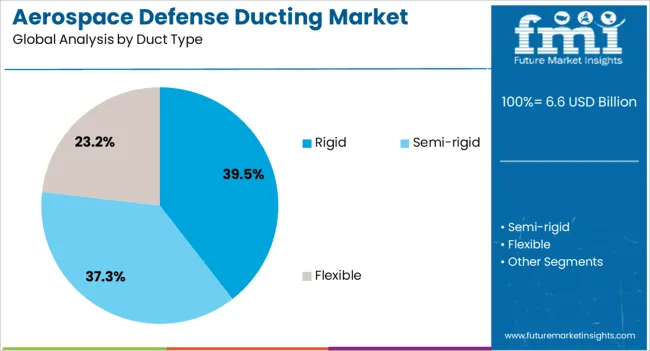

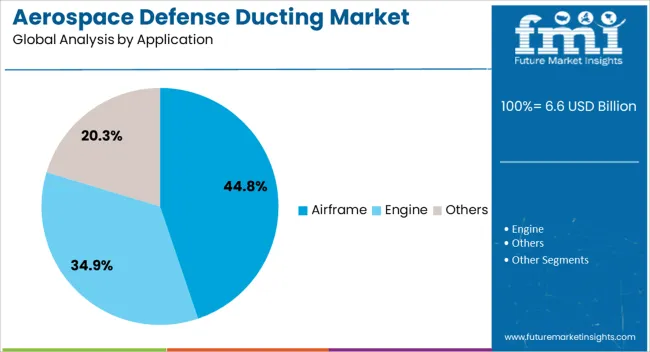

The aerospace defense ducting market is segmented by aircraft, duct type, application, pressure, material, and geographic regions. By aircraft, aerospace defense ducting market is divided into commercial aircraft, narrow body, wide body, regional jet, business jet, helicopter, and military aircraft. In terms of duct type, aerospace defense ducting market is classified into rigid, semi-rigid, and flexible. Based on application, aerospace defense ducting market is segmented into airframe, engine, and others. By pressure, aerospace defense ducting market is segmented into high pressure and low pressure. By material, aerospace defense ducting market is segmented into composites, stainless steel & alloys, titanium & titanium alloys, and others. Regionally, the aerospace defense ducting industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Commercial aircraft accounted for 46.30% of the market share in 2025, making it the dominant aircraft type in the aerospace defense ducting industry. The growth is primarily attributed to the rapid expansion of the global airline fleet, rising air travel demand, and increasing production rates of narrow- and wide-body jets. Airlines’ pursuit of fuel efficiency and cabin comfort is influencing OEMs to integrate lightweight and optimized ducting systems. The prevalence of HVAC and bleed air systems in commercial aircraft further expands the need for complex ducting solutions. Long-term fleet upgrades and regional aircraft manufacturing initiatives are expected to reinforce this segment’s leadership through 2035.

Rigid ducts are projected to hold 39.50% of the global aerospace defense ducting market by 2025, making them the leading duct type. Their dominance stems from their high structural integrity, superior pressure-handling capability, and reliability in fixed installations like engine pylons, avionics bays, and bleed air systems. Rigid ducts are especially favored in military and commercial jets where consistent shape retention and minimal vibration are critical. The use of titanium, stainless steel, and advanced polymers in rigid duct manufacturing has enhanced performance at high altitudes and temperatures. Although flexible ducts are gaining adoption, the rigidity and lifespan of these components continue to sustain their widespread usage.

The airframe segment is anticipated to lead the market with a 44.80% share in 2025. Ducting systems in airframes are crucial for environmental control, thermal management, and structural routing of fluids and gases. As aircraft become more complex and integrated, the need for precise duct placement and aerodynamic efficiency within the airframe is rising. The increased focus on reducing cabin noise and improving air quality is also encouraging innovation in airframe ducting materials and layouts. Defense aircraft modernization programs and commercial jetliner redesigns are emphasizing more advanced duct systems, positioning the airframe segment at the forefront of application-level growth.

The aerospace defense ducting market is growing as demand rises for efficient air distribution, environmental control, and thermal management systems in aircraft and defense platforms. Ducting systems are critical for ventilation, pressurization, heating, cooling, and fuel or hydraulic routing in both fixed-wing and rotary aircraft. Increasing defense modernization programs, fleet expansion, and upgrades in military and commercial aviation are driving adoption. Advanced materials, lightweight designs, and precision manufacturing are enhancing performance, durability, and system integration. Companies offering high-quality, reliable, and certified ducting solutions are well-positioned to capitalize on growth in new aircraft production, maintenance, repair, and overhaul (MRO), and retrofit programs globally.

The market faces challenges related to material selection, manufacturing precision, and regulatory compliance. Aerospace ducting systems must withstand extreme temperatures, vibration, pressure changes, and exposure to chemicals or moisture. Materials must be lightweight yet durable, corrosion-resistant, and compatible with system fluids. Manufacturing precision is critical to ensure proper airflow, minimal leakage, and system efficiency. Compliance with aerospace quality standards, military specifications, and certification requirements adds complexity and increases production costs. Integration with existing environmental control systems or aircraft layouts can also present design challenges. Manufacturers must invest in advanced materials, precision fabrication, testing protocols, and certification processes to deliver reliable, high-performance ducting systems for both defense and commercial applications.

The aerospace defense ducting market is trending toward lightweight materials, advanced alloys, and modular designs. Use of aluminum, titanium, composite materials, and corrosion-resistant coatings reduces weight while maintaining strength and durability. Modular ducting systems simplify assembly, maintenance, and replacement in aircraft, reducing downtime and operational costs. Additive manufacturing and precision bending techniques are being adopted to produce complex geometries with minimal waste. Thermal and acoustic insulation integration is becoming standard to improve passenger comfort, safety, and equipment reliability. Advanced simulation and design software are also enabling optimized airflow, reduced drag, and enhanced system efficiency. These trends improve overall aircraft performance while meeting increasingly stringent defense and aerospace standards.

The market offers opportunities in aircraft modernization, MRO programs, and defense upgrades. Aging military fleets require retrofitting of ducting systems to improve efficiency, thermal management, and compliance with modern standards. New aircraft production and defense platform expansions increase demand for high-performance ducting components. Additionally, retrofit programs in helicopters, unmanned aerial vehicles, and special mission aircraft create recurring opportunities for manufacturers. Growth in defense budgets, focus on fleet readiness, and adoption of advanced environmental control and fuel systems further enhance market potential. Companies providing durable, certified, and modular ducting solutions with strong technical support and logistics capabilities are well-positioned to capitalize on these opportunities globally.

Market growth is restrained by high production costs, technical complexity, and supply chain constraints. Manufacturing aerospace-grade ducting requires specialized materials, precision fabrication, and strict quality control, which increase costs. Complex integration with multiple aircraft systems demands design expertise and rigorous testing. Supply chain limitations for advanced alloys, composites, and coatings can impact production timelines and scalability. Certification and regulatory requirements across regions add operational hurdles for manufacturers seeking global market reach. Until cost-effective materials, standardized manufacturing processes, and reliable supply chains are established, adoption may remain focused on premium aircraft platforms, defense projects, and specialized retrofit programs.

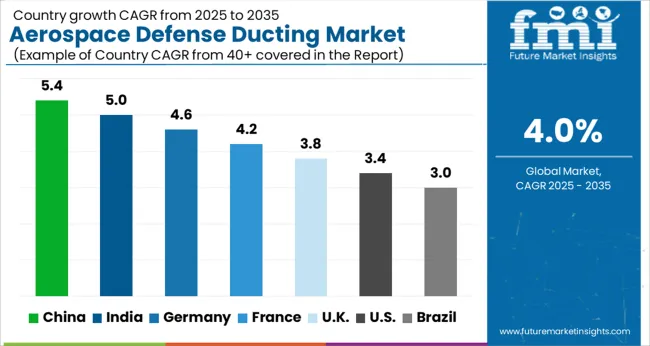

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The global aerospace defense ducting market is projected to grow at a CAGR of 4.0% through 2035, supported by increasing demand across aircraft ventilation, environmental control, and thermal management systems. Among BRICS nations, China has been recorded with 5.4% growth, driven by large-scale production and deployment in military and commercial aircraft, while India has been observed at 5.0%, supported by rising utilization in aircraft environmental control and cooling systems. In the OECD region, Germany has been measured at 4.6%, where production and adoption for aerospace thermal and ventilation ducting have been steadily maintained. The United Kingdom has been noted at 3.8%, reflecting consistent use in aircraft environmental control systems, while the USA has been recorded at 3.4%, with production and utilization across military and commercial aviation sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is experiencing notable growth in its aerospace defense ducting market, supported by expanding domestic aerospace programs, UAV production, and defense modernization, with a CAGR of 5.4%. Manufacturers are focusing on high-strength, lightweight, and corrosion-resistant ducting systems for airframes, engines, and environmental control systems. Government initiatives promoting indigenous defense production, aerospace R&D, and modernization of military aircraft are accelerating adoption. Pilot projects in fighter jets, transport aircraft, and UAV platforms demonstrate operational benefits such as improved airflow efficiency, reduced weight, and enhanced system reliability. Collaborations between domestic suppliers, research institutes, and defense contractors are improving material performance, manufacturing precision, and compliance with aerospace standards. Rising investment in advanced aerospace programs continues to drive China’s defense ducting market.

Aerospace defense ducting market in India is expanding at a CAGR of 5.0%, fueled by modernization of military aircraft, UAV deployment, and domestic aerospace production. Manufacturers are focusing on lightweight, durable, and heat-resistant ducting solutions for engines, environmental control systems, and aircraft airframes. Government programs promoting Make in India, aerospace R&D, and defense procurement are supporting market adoption. Pilot projects in fighter aircraft, transport planes, and UAVs demonstrate operational benefits such as optimized airflow, weight reduction, and improved system efficiency. Collaborations between domestic suppliers, aerospace research institutions, and defense contractors are enhancing design precision, material quality, and manufacturing scalability. Increasing defense modernization programs and domestic aerospace initiatives continue to drive India’s aerospace ducting market.

Aerospace defense ducting market in Germany is witnessing steady growth at a CAGR of 4.6%, supported by industrial aerospace manufacturing, defense upgrades, and high-quality standards. Manufacturers are focusing on precision-engineered ducting systems that are lightweight, corrosion-resistant, and heat-tolerant for aircraft and UAVs. Government programs promoting defense modernization, aerospace innovation, and compliance with European safety standards are driving adoption. Pilot projects in military aircraft, commercial aerospace, and UAVs demonstrate operational benefits such as improved system efficiency, reduced maintenance, and optimized weight. Collaborations between aerospace manufacturers, research institutes, and technology providers are advancing design, material performance, and cost-effective production. Germany’s emphasis on precision engineering and sustainable aerospace technologies continues to strengthen the defense ducting market.

The United Kingdom is experiencing a CAGR of 3.8% in its aerospace defense ducting market, driven by modernization of military aircraft, UAV programs, and high-performance material requirements. Manufacturers are developing lightweight, corrosion-resistant, and heat-tolerant ducting for engines, environmental control systems, and airframes. Government initiatives promoting defense R&D, aerospace innovation, and domestic supply chain development support market adoption. Pilot projects in fighter jets, transport aircraft, and UAV platforms demonstrate operational benefits such as reduced weight, improved airflow, and enhanced reliability. Collaborations between domestic manufacturers, research institutions, and defense contractors are advancing material performance, production efficiency, and design precision. Rising focus on defense modernization and high-performance aerospace systems continues to support growth in the UK ducting market.

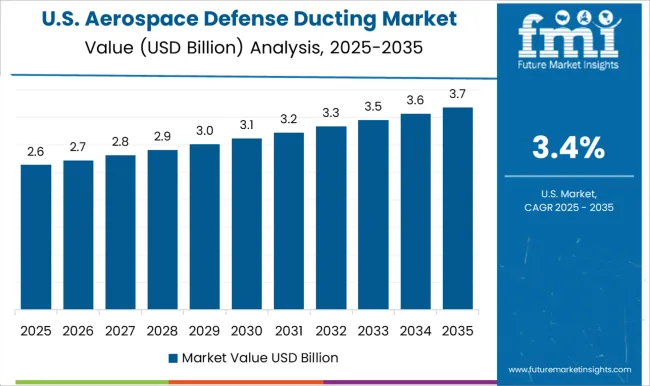

The United States aerospace defense ducting market is growing at a CAGR of 3.4%, fueled by modernization of military aircraft, UAV deployment, and commercial aerospace projects. Manufacturers are investing in high-strength, lightweight, and heat-tolerant ducting solutions for airframes, engines, and environmental control systems. Government programs promoting aerospace R&D, defense modernization, and domestic supply chain development are accelerating adoption. Pilot projects in fighter jets, transport aircraft, and UAV systems demonstrate operational benefits including optimized airflow, weight reduction, and enhanced system reliability. Collaborations between aerospace manufacturers, research institutions, and defense contractors are advancing material innovation, precision manufacturing, and cost efficiency. Strong investment in defense programs and advanced aerospace technology continues to drive steady growth in the USA ducting market.

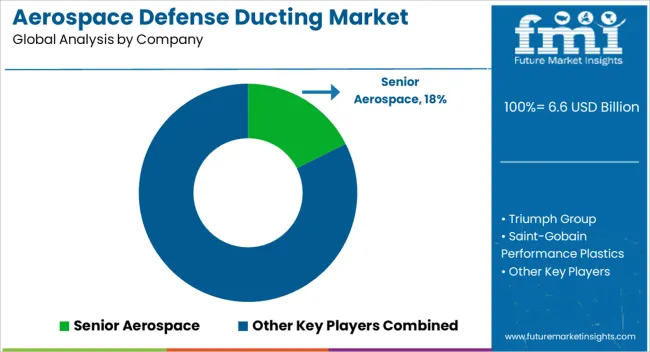

The aerospace defense ducting market is defined by specialized suppliers providing air management and fluid transfer components for aircraft and defense systems. Senior Aerospace is positioned as a leading provider, with brochures emphasizing lightweight aluminum and composite ducting solutions, airflow performance, and compliance with aerospace material standards. Triumph Group competes with engineered duct assemblies and flexible conduits, with technical literature highlighting thermal tolerance, vibration resistance, and dimensional precision. Saint-Gobain Performance Plastics delivers polymer-based ducting and seals, with brochures detailing chemical resistance, temperature range, and material properties.

Eaton Aerospace offers modular ducting systems, with literature presenting installation guidance, airflow ratings, and compatibility with multiple aircraft platforms. Arrowhead Products, AIM Aerospace, and Zodiac Aerospace focus on custom and retrofit solutions, with brochures emphasizing precise fit, system integration, and structural integrity under operational stresses. PFW Aerospace GmbH, RMB Products, Inc., Meggitt PLC, Sigma Precision Components UK Ltd., Unison Industries, and Stelia Aerospace supply both standard and mission-specific ducting components, with technical literature highlighting corrosion resistance, weight optimization, and performance under extreme conditions. Other regional suppliers compete with rapid delivery, tailored geometries, and cost-effective materials for secondary aircraft and defense applications. Operational strategies are focused on material selection, manufacturing accuracy, and system compatibility. Investments are directed toward high-strength alloys, polymer composites, and precision forming techniques to ensure dimensional stability and airflow efficiency. Partnerships with airframe manufacturers, defense contractors, and integrators are leveraged to secure long-term supply agreements. Observed industry patterns indicate a focus on lightweight construction, vibration dampening, and ease of installation in confined aircraft spaces.

Product roadmaps prioritize enhanced modularity, standardized interfaces, and corrosion protection. Market differentiation is achieved through documentation of certified materials, detailed installation procedures, and compliance with international aerospace standards. Brochures and technical datasheets are central to market positioning, conveying material specifications, airflow ratings, dimensional tolerances, and installation guidance. Senior Aerospace literature emphasizes airflow efficiency, weight reduction, and mechanical performance. Triumph and Eaton brochures highlight thermal and vibration resistance, airflow capacity, and assembly instructions. Saint-Gobain, Zodiac, and AIM Aerospace materials detail chemical resistance, operational temperature limits, and fit verification. Meggitt, PFW, and Unison brochures provide guidance on integration, environmental resistance, and long-term reliability. Charts, diagrams, and tables are used consistently to allow engineers, procurement specialists, and installers to assess suitability quickly. Market success is determined not only by duct performance but also by the clarity and comprehensiveness of brochures, making technical literature essential for adoption and competitive positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.6 billion |

| Aircraft | Commercial aircraft, Narrow Body, Wide Body, Regional jet, Business jet, Helicopter, and Military Aircraft |

| Duct Type | Rigid, Semi-rigid, and Flexible |

| Application | Airframe, Engine, and Others |

| Pressure | High pressure and Low pressure |

| Material | Composites, Stainless steel & alloys, Titanium & titanium alloys, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Senior Aerospace, Triumph Group, Saint-Gobain Performance Plastics, Eaton Aerospace, Arrowhead Products, AIM Aerospace, Zodiac Aerospace, PFW Aerospace GmbH, RMB Products, Inc., Meggitt PLC, Sigma Precision Components UK Ltd., Unison Industries, and Stelia Aerospace |

| Additional Attributes | Dollar sales vary by duct type, including flexible ducts, rigid ducts, and composite ducts; by application, such as air conditioning, environmental control systems, fuel and hydraulic systems, and avionics cooling; by end-use, spanning military aircraft, commercial aviation, and unmanned aerial systems; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing aircraft production, demand for lightweight and durable materials, and rising focus on system efficiency. |

The global aerospace defense ducting market is estimated to be valued at USD 6.6 billion in 2025.

The market size for the aerospace defense ducting market is projected to reach USD 9.7 billion by 2035.

The aerospace defense ducting market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in aerospace defense ducting market are commercial aircraft, narrow body, wide body, regional jet, business jet, helicopter and military aircraft.

In terms of duct type, rigid segment to command 39.5% share in the aerospace defense ducting market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Avionics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Lightning Strike Protection Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Titanium Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA