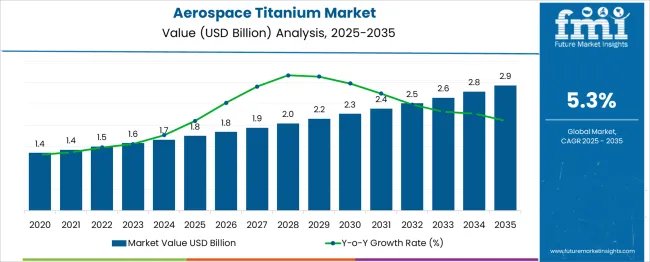

The Aerospace Titanium Market is estimated to be valued at USD 1.8 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. This moderate compound growth reflects stable but steady demand from commercial and defense aircraft manufacturing. Between 2025 and 2030, the market expands from USD 1.8 billion to USD 2.3 billion, with a 5-year CAGR of approximately 4.9%. This phase is expected to be shaped by recovery in commercial aviation orders and titanium alloy demand for weight-sensitive components such as landing gear, airframes, and engine parts.

During the second half of the forecast period, from 2030 to 2035, the market rises from USD 2.3 billion to USD 2.9 billion, resulting in a 5-year CAGR of around 5.7%. Growth in this phase is expected to be supported by next-generation aircraft programs, increased deliveries of narrow-body and mid-range models, and heightened use of titanium in hybrid and electric propulsion systems. The CAGR trend over the full period reflects low volatility, underpinned by long aircraft build cycles, defense procurement timelines, and titanium’s durability advantages. Consistent expansion in both volume and unit value is projected to sustain the market’s compound growth without sharp year-to-year fluctuations.

| Metric | Value |

|---|---|

| Aerospace Titanium Market Estimated Value in (2025 E) | USD 1.8 billion |

| Aerospace Titanium Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

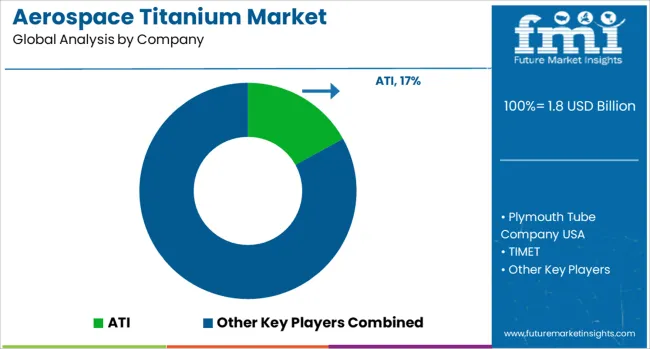

The aerospace titanium market accounts for about 28 % of the global aviation titanium alloy sector, supported by ATI’s specialty alloy portfolio. VSMPO AVISMA holds approximately 25 %, anchored in vertically integrated supply to leading aircraft manufacturers. Timet (Titanium Metals Corporation) captures around 21 % of the aerospace titanium space, focused on premium ingot and mill product offerings. Baoji Titanium Industry and Howmet Aerospace each represent about 10–12 %, delivering high performance alloys for next generation aircraft and engine components. The remaining 14–16 % is supplied by regional specialists and smaller mills serving niche applications and localized fleets.

Demand is rising as titanium alloys are preferred for their high strength to weight ratios, fatigue and corrosion resistance, especially in components such as engine rotors, landing gear, airframe attachments, and spacecraft structures. Additive manufacturing and titanium powder metallurgy are gaining traction for parts with complex geometry and reduced waste. Suppliers are expanding supply chain resilience by diversifying raw material sources, recycling scrap, and reducing exposure to single country chronic dependencies. Collaborative alloy development between OEMs and alloy producers seeks lighter, higher temperature capable grades. Supply constraints and backlog pressures persist as aerospace production rebounds and military programs accelerate. These trends reflect a growing focus on material efficiency, advanced fabrication, and supply stability in aerospace titanium systems.

The aerospace titanium market is expanding steadily, driven by rising demand for lightweight, high-strength materials that improve fuel efficiency and reduce emissions in next-generation aircraft. Titanium’s exceptional corrosion resistance, high temperature stability, and fatigue strength make it a preferred choice in airframes, engine components, and landing gear systems.

Aerospace OEMs are increasingly sourcing titanium to meet structural performance and sustainability standards, especially in single-aisle and wide-body aircraft. Furthermore, supply chain consolidation and investments in vertical integration are improving material availability and price predictability.

With the resurgence in commercial aircraft deliveries and defense aviation programs, titanium demand is expected to accelerate across both traditional and additive manufacturing routes. Industry participants are also focusing on closed-loop recycling and sustainable sourcing practices to address ESG goals without compromising material integrity.

The aerospace titanium market is segmented by form type, manufacturing method, grade, end-user type, and geographic regions. The aerospace titanium market is divided by form type into Plate, Round Bar, Block, Sheet, and Others. In terms of manufacturing methods, the aerospace titanium market is classified into Traditional Manufacturing and Additive Manufacturing. Based on the grade, the aerospace titanium market is segmented into 6AL-4V, 5AL-2.55N, 15V-3CR-3SN-3AL, 6AL-2SN-4ZR-2MO, 3Al-2.5V, and Others. By end-user type, the aerospace titanium market is segmented into Commercial Aircraft and Regional & Business Aircraft. Regionally, the aerospace titanium industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

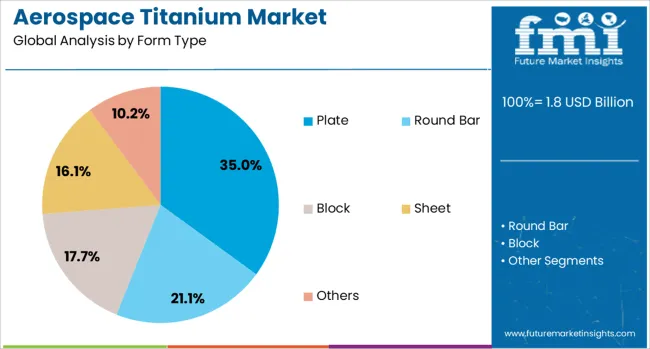

The plate segment is expected to lead the aerospace titanium market by form type, accounting for 35.0% of total revenue in 2025. Titanium plates are extensively used in structural airframe applications, where high mechanical strength, dimensional stability, and machinability are critical.

Their large surface area and uniform thickness make them suitable for wing spars, fuselage panels, and bulkheads. Advancements in hot-rolling and forging processes have enhanced the quality and consistency of aerospace-grade plates, supporting their use in both commercial and military aircraft.

The segment's dominance is further reinforced by its compatibility with CNC machining and precision cutting tools used in large component fabrication.

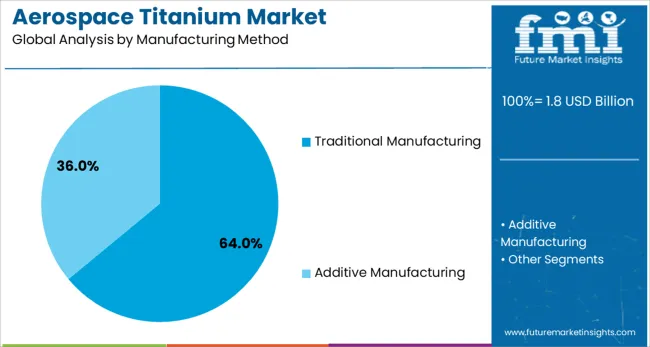

Traditional manufacturing is projected to dominate the aerospace titanium market by method, capturing 64.0% of total share in 2025. Conventional production techniques such as forging, casting, and rolling continue to offer reliability, scalability, and cost-effectiveness for high-volume aerospace parts.

These methods are well-established within certified aerospace supply chains and meet stringent material and dimensional standards. While additive manufacturing is gaining traction for complex geometries and low-volume components, traditional processes remain preferred for producing critical parts with predictable mechanical performance and well-documented quality assurance protocols.

OEMs continue to invest in advanced process controls and automation within traditional workflows to reduce scrap rates and improve throughput.

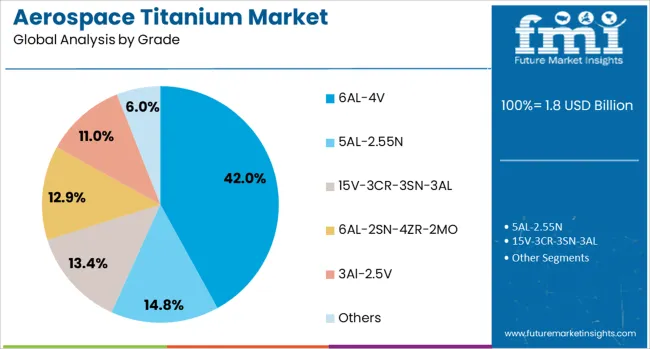

The 6AL-4V titanium alloy grade is forecast to hold a 42.0% market share in 2025, making it the leading alloy in aerospace applications. Known for its superior strength-to-weight ratio, fatigue resistance, and weldability, 6AL-4V is used extensively in aircraft engine components, landing gear, and structural frames.

Its performance characteristics under high stress and temperature make it suitable for critical load-bearing parts. The alloy's widespread acceptance is supported by decades of application data and aerospace certifications, making it a low-risk, high-performance choice for both commercial and defense sectors.

The ability to process 6AL-4V using both traditional and additive methods enhances its flexibility in the design and manufacturing of modern aircraft components.

The aerospace titanium market has grown as lightweight, high-strength alloys are increasingly used in aircraft structures, engines, and landing gear. Demand is driven by rising commercial and defense aircraft orders, where titanium’s corrosion resistance and high-temperature performance are prioritized. Advanced manufacturing techniques—such as powder metallurgy and near-net-shape forging—are enabling better alloy precision and reduced waste. Supplier collaboration with OEMs and tier 1 integrators has accelerated qualification of new titanium grades. This shift supports fuel efficiency, extended service life, and enhanced safety in both narrowbody and widebody platforms globally.

Titanium is used extensively in aerospace due to its favorable strength-to-weight ratio, high fatigue life, and resistance to corrosion in marine and high-altitude environments. Aero-engine components such as fan blades, compressor discs, and casings are now made from Ti 6Al 4V and newer high temperature alloys. Structural airframe sections—including landing gear, fasteners, and primary ribs—rely increasingly on titanium for weight savings. Its use has enabled fuel consumption reductions of up to 15% compared with steel or nickel-based alloys. New manufacturing methods like 3D-printed titanium and forged billets have minimized machining waste and reduced lead times. Tier 1 suppliers are collaborating on next-generation liner and structural alloy programs to optimize aircraft performance and reduce lifecycle maintenance needs.

Despite its advantages, aerospace titanium faces constraints related to sourcing, cost, and certification. Raw titanium sponge and ingot suppliers remain concentrated in a few countries, which occasionally leads to supply tightness. Processing facilities require costly vacuum-induction and electron-beam melting equipment, limiting rapid expansion. Novel titanium alloy grades must undergo rigorous testing and qualification cycles, including fatigue, stress-corrosion cracking, and thermal stability validation. Qualification of new alloy grades or forging processes may take years before entering service. Price volatility in input costs and long lead times for certified materials have deterred smaller aerospace OEMs. Production planning must account for batch traceability, metal certifications, and hydrogen embrittlement prevention protocols, adding complexity and cost to project execution.

Investment in novel titanium alloys and fabrication techniques has expanded application scope. Programmable chemistry alloys and titanium aluminides are enabling higher-temperature use in engine hot section components. Powder metallurgy and additive manufacturing facilitate intricate geometry fabrication for weight-critical parts. Thermo-mechanical treatments are improving creep resistance and ligament strength. Surface coatings and hybrid composite–titanium assemblies have emerged in architecture-intensive parts such as wing spars and fuselage sections. Industry consortia are validating titanium use in ultra-efficient aircraft and hypersonic platforms. Recycling and remelting protocols are being refined to recycle scrap titanium without compromising purity. Integration of titanium structures into lean manufacturing and digital twin simulations supports faster qualification and operational verification across aircraft programs.

Asia-Pacific leads global titanium sponge production, accounting for over 60% capacity, with major output in China, Japan, and India. North America and Europe maintain strong fabrication and alloy development capabilities, focusing on certified aerospace supply chains. Defense procurement in the United States and Europe fuels demand for titanium components for military transport, fighter platforms, and naval systems. Civil aerospace OEMs globally continue to source material from established certified mills. Export restrictions and trade classifications influence supply access in emerging markets. Investment in domestic titanium manufacturing and recycling infrastructure is underway in regions aiming to reduce import dependency. Long-term demand is shaped by growing widebody replacement cycles, rising defense budgets, and structural weight-reduction targets across new aircraft classes.

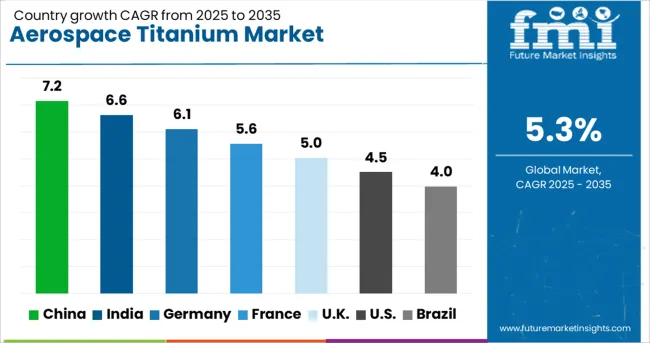

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

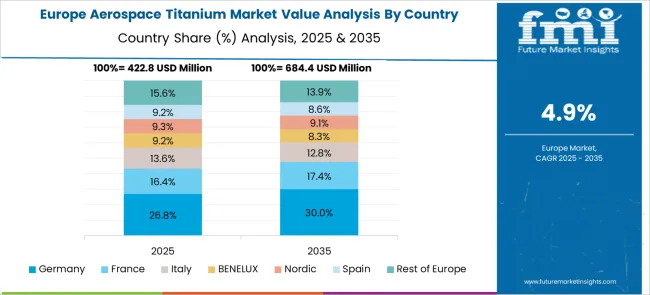

The global aerospace titanium market is anticipated to grow at a CAGR of 5.3% from 2025 to 2035. China leads with a CAGR of 7.2%, followed by India at 6.6% and Germany at 6.1%, expanding 36%, 25%, and 15% faster than the global average. The United Kingdom and the United States are forecast to grow at 5.0% and 4.5% respectively, underpinned by component-level integration and defense procurement cycles. Titanium demand has been driven by weight optimization across aircraft classes and extended part lifecycle in civil aviation. Heat-resistant alloy use in propulsion systems and structural assemblies continues to influence market direction. National supply chains, smelting technology upgrades, and aerospace-grade certification capabilities shape competitive intensity across each region.

China is forecast to register a CAGR of 7.2% from 2025 to 2035 in the aerospace titanium market. Alloy processing has been scaled up across Shanxi, Sichuan, and Hunan where smelter retrofits and rolling mill automation were prioritized. Government-facilitated raw titanium availability has improved cost efficiency for forging-grade and billet applications. Aerospace structural components and landing gear assemblies have been widely localized by domestic OEMs. Partnerships between aviation consortia and specialty alloy producers have accelerated titanium frame development for drones and unmanned aerial systems. Export clearance for forged parts has widened access to Southeast Asian and African operators.

India is projected to expand at a CAGR of 6.6% from 2025 to 2035 in the aerospace titanium market. Structural titanium demand has risen from state-run aerospace corporations and joint Indo-foreign manufacturing initiatives. ISRO and DRDO programs have increased procurement of lightweight high-strength alloys for airframe and payload design. Investment into titanium sponge facilities and electron beam melting capabilities has enabled pilot production of aircraft-grade forgings. Civil aviation MRO centers are seeking localized supply of corrosion-resistant titanium parts to reduce import dependence. Export scope is gradually expanding as metallurgical validation aligns with global standards.

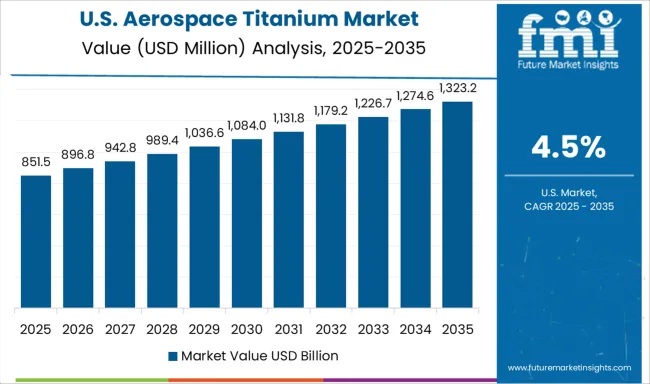

The United States is projected to grow at a CAGR of 4.5% from 2025 to 2035 in the aerospace titanium market. Military aircraft programs and turbine engine upgrades continue to drive alloy consumption across Virginia, Ohio, and California. OEMs have optimized inventory management of forging stock for fuselage and rotary system components. Titanium superplastic forming and diffusion bonding capabilities have expanded to support satellite and defense aerospace applications. Raw titanium sponge imports from Japan and Kazakhstan support part of the domestic demand base. However, slower FAA approvals for new titanium-based designs have limited broader usage in regional aircraft.

The United Kingdom is forecast to grow at a CAGR of 5.0% from 2025 to 2035 in the aerospace titanium market. Growth remains supported by civil aircraft upgrades, engine servicing operations, and experimental flight testbed projects. Titanium sourcing is partially dependent on international semi-finished imports which are then precision-machined domestically. Demand from Tier-1 suppliers to European airframe builders continues to reinforce alloy demand for landing gear and wing box assemblies. Titanium recycling capabilities have improved in aerospace parts decommissioning facilities, aligning with reduced cost pressures across smaller OEMs.

Germany is expected to grow at a CAGR of 6.1% from 2025 to 2035 in the aerospace titanium market. Demand is linked to commercial aircraft airframe, engine casing, and cabin structure applications. Foundries in Bavaria and North Rhine-Westphalia have transitioned toward high-purity batch melting and laser additive manufacturing for titanium parts. Titanium-aluminum alloy developments for weight optimization have entered multi-tier component supply chains. Regulatory support for hydrogen propulsion initiatives has increased interest in temperature-resistant titanium alloy components. Export markets in Eastern Europe and the Middle East remain key for semi-finished aerospace titanium products.

ATI (Allegheny Technologies Inc.) remains a primary supplier of aerospace-grade titanium products, focusing on high-strength alloys for jet engine components and structural airframe parts. Its integrated operations, from raw sponge to finished mill products, support consistent supply for major OEMs. Plymouth Tube Company USA provides seamless titanium tubing tailored for hydraulic systems and instrumentation lines in both commercial and military aircraft, emphasizing precision manufacturing and tight tolerance control.

TIMET (Titanium Metals Corporation), a subsidiary of Precision Castparts Corp., offers a wide range of titanium mill products with long-term contracts supporting aircraft production programs. Dynamic Metals Ltd. and Smiths Advanced Metals supply custom-cut titanium bar, sheet, and billet primarily for MRO services and low-volume aerospace manufacturing. Reliance Steel & Aluminum Co. serves as a key distributor of aerospace-grade titanium, leveraging its expansive warehouse network to meet rapid fulfillment requirements. JINHAO Co., Ltd. and Shenyang Yongye Industry Co., Ltd. supply titanium mill forms to both domestic and export markets, focusing on commercial aerospace and rotorcraft.

ASM Aerospace Specification Metals, Inc. and Jaco Aerospace specialize in certified aerospace-grade titanium distribution, offering traceable stock to meet stringent industry specifications. Aubert & Duval supports high-performance alloy needs in European aerospace programs, supplying titanium forgings and precision blocks.

Between 2023 and mid 2025, the aerospace titanium market saw clear developments enhancing resilience and capacity. Global airframers reduced reliance on Russian sources by partnering with 3D printing suppliers for critical structural parts. A major aerospace-grade titanium plant was inaugurated in India, boosting indigenous capability and lowering import dependency.

Hybrid production methods combining additive manufacturing and superplastic forming significantly cut cycle times and costs. Meanwhile, geopolitical shifts accelerated investments in domestic recycling and powder production facilities across North America and Europe, strengthening regional titanium supply chains.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.8 Billion |

| Form Type | Plate, Round Bar, Block, Sheet, and Others |

| Manufacturing Method | Traditional Manufacturing and Additive Manufacturing |

| Grade | 6AL-4V, 5AL-2.55N, 15V-3CR-3SN-3AL, 6AL-2SN-4ZR-2MO, 3Al-2.5V, and Others |

| End-User Type | Commercial Aircraft and Regional & Business Aircraft |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ATI, Plymouth Tube Company USA, TIMET, Dynamic Metals Ltd., Reliance Steel & Aluminum Co, Smiths Advanced Metals, JINHAO Co., Ltd., ASM Aerospace Specification Metals, Inc., Aubert & Duval, Jaco Aerospace, and Shenyang Yongye Industry Co., Ltd. |

The global aerospace titanium market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the aerospace titanium market is projected to reach USD 2.9 billion by 2035.

The aerospace titanium market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in aerospace titanium market are plate, round bar, block, sheet and others.

In terms of manufacturing method, traditional manufacturing segment to command 64.0% share in the aerospace titanium market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA