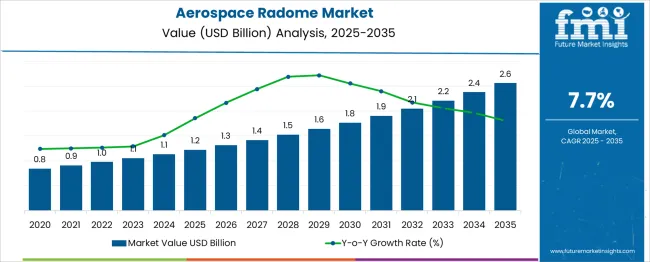

The Aerospace Radome Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 7.7% over the forecast period.

The aerospace radome market is projected to grow from USD 1.2 billion in 2025 to USD 2.6 billion by 2035, with a CAGR of 7.7%. A rolling CAGR analysis reveals steady growth across the forecast period with variations in growth rates. Between 2025 and 2030, the market grows from USD 1.2 billion to USD 1.8 billion, contributing USD 0.6 billion in growth, with a CAGR of 8.1%. This early-phase growth reflects increased demand for radomes driven by the expansion of the aerospace and defense sectors, particularly with the rise of next-generation aircraft and the growing need for radar-based communication systems.

Between 2030 and 2035, the market continues its upward trajectory, expanding from USD 1.8 billion to USD 2.6 billion, contributing USD 0.8 billion in growth, with a slightly lower CAGR of 7.1%. This deceleration in growth can be attributed to the maturing nature of the market, as more aerospace companies adopt established radome technologies. The innovations in materials, such as lighter and more durable composites, continue to support growth. The rolling CAGR analysis shows consistent expansion with slight variations in growth rates, indicating that while the market experiences a slight slowdown toward the latter part of the forecast period.

| Metric | Value |

|---|---|

| Aerospace Radome Market Estimated Value in (2025 E) | USD 1.2 billion |

| Aerospace Radome Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The aerospace radome market is witnessing steady growth due to increasing demand for high-performance airborne communication and radar systems across civil and defense aviation sectors. Radomes are becoming increasingly crucial for protecting sensitive antenna systems while maintaining electromagnetic transparency and aerodynamic efficiency. The market is being shaped by the need to support multi-mode radar, satellite communication, and electronic warfare systems, especially in next-generation aircraft programs.

Lightweight composite materials, enhanced thermal stability, and reduced radar cross-section are key design imperatives influencing radome development. Additionally, stricter regulatory standards related to fuel efficiency and safety are accelerating the integration of radomes that support minimal drag and maximum signal fidelity.

The rise in air travel, global fleet modernization, and adoption of low-Earth orbit satellite connectivity are further contributing to market expansion. As aerospace platforms increasingly rely on real-time data transfer and advanced sensor integration, radomes are expected to play a strategic role in improving aircraft performance, situational awareness, and operational reliability across global airspace.

The aerospace radome market is segmented by material, aircraft type, frequency band, application, platform, end use, and geographic regions. By material of the aerospace radome market is divided into Glass Fiber, Quartz, Kevlar, Carbon Fiber, Others (Ceramics, Composites, etc.). In terms of aircraft type of the aerospace radome market is classified into Commercial Aircraft, Military Aircraft, Business Jets, Unmanned Aerial Vehicles (UAVs). Based on frequency band of the aerospace radome market is segmented into L Band, S Band, C Band, X Band, Ku Band, Ka Band, Multi-band. By application of the aerospace radome market is segmented into Nose Radome, Tail Radome, Fuselage Radome, Others (Wing-tip, Dorsal, etc.). By platform of the aerospace radome market is segmented into Fixed-wing, Rotary-wing. By end use of the aerospace radome market is segmented into OEM (Original Equipment Manufacturer), Aftermarket. Regionally, the aerospace radome industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

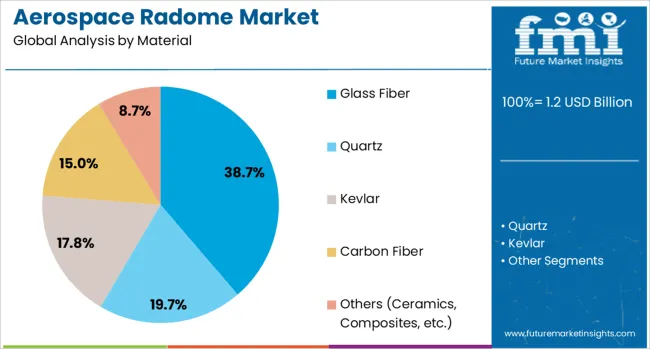

The glass fiber material segment is projected to account for 38.7% of the aerospace radome market revenue share in 2025, driven by its superior balance of electromagnetic transparency, structural durability, and cost-effectiveness. Glass fiber composites have been widely adopted in radome applications due to their ability to withstand varying aerodynamic pressures and environmental stresses while maintaining signal transmission clarity. The material offers favorable dielectric properties essential for minimizing signal loss, especially in communication and radar-intensive applications.

Its ease of molding into complex aerodynamic shapes allows for compatibility with a wide range of aircraft designs. Additionally, resistance to UV exposure, temperature fluctuations, and corrosion has made glass fiber suitable for both military and commercial platforms operating under demanding flight conditions.

The segment’s growth is also being supported by ongoing advancements in resin systems and layered reinforcement technologies, which have enhanced strength-to-weight ratios and long-term performance. As a result, glass fiber continues to be the preferred material in radome manufacturing across a broad spectrum of aerospace programs.

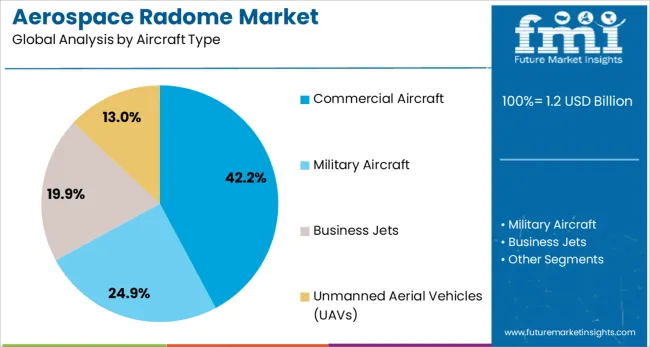

The commercial aircraft segment is anticipated to hold 42.2% of the aerospace radome market revenue share in 2025, reflecting the growing adoption of advanced radome systems in civil aviation. The expansion of global airline fleets, increasing aircraft production rates, and growing reliance on satellite-based communication are key factors driving radome integration in commercial platforms.

Modern airliners require continuous connectivity for real-time navigation, weather updates, and passenger entertainment systems, all of which rely on robust radome-enclosed antennas. The segment’s growth has also been supported by the rising demand for fuel-efficient and aerodynamically optimized designs, where radomes contribute to minimizing drag while ensuring uninterrupted signal performance.

Regulatory mandates on aviation safety and communication reliability are prompting OEMs to invest in high-performance radome solutions that comply with evolving standards. As commercial aviation continues to recover and expand, especially in emerging markets, the need for advanced, durable, and lightweight radomes is expected to increase significantly across narrow-body and wide-body aircraft categories.

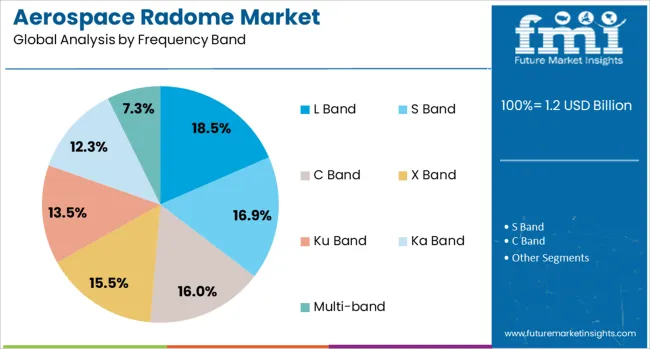

The L band frequency segment is projected to capture 18.5% of the aerospace radome market revenue share in 2025, driven by its extensive use in radar surveillance, GPS navigation, and communication systems. The segment’s significance lies in its long-range transmission capability and reliable performance under various atmospheric conditions. L band radomes are critical in supporting essential airborne functions such as enroute navigation, air traffic control radar, and tactical communications.

The growing deployment of these systems in both military and civil aircraft has created sustained demand for radomes that maintain performance integrity at these frequencies. Material compatibility and precise electromagnetic design are essential to prevent signal distortion, which has led to innovations in radome architecture tailored for L band applications.

The increased focus on global positioning systems and interoperable communication networks is further supporting the adoption of L band radomes. As aircraft fleets modernize and new platforms are introduced, the segment is expected to maintain stable growth driven by operational requirements and technological consistency.

The smart elevator market is experiencing growth due to increasing demand for efficient, automated, and energy-saving solutions in both residential and commercial buildings. These elevators integrate advanced technologies like IoT, AI, and machine learning to enhance safety, reduce wait times, and improve energy consumption. The rise of smart cities, urbanization, and the need for accessibility in high-rise buildings are key factors driving the adoption of smart elevators. Although challenges such as high initial investment and system integration complexity exist, opportunities are emerging through innovations in energy-efficient solutions and the expansion of infrastructure in developing regions.

The growing demand for energy-efficient and automated solutions is a key driver for the smart elevator market. As cities grow and buildings become taller, the need for smart elevators that offer advanced features such as automatic scheduling, energy savings, and real-time monitoring is increasing. Smart elevators equipped with IoT technology can optimize energy usage by adjusting operations based on building traffic patterns. Additionally, these elevators can enhance user convenience by providing faster wait times, automated destinations, and remote monitoring. As more buildings integrate smart technologies for enhanced safety and efficiency, the adoption of smart elevators is expected to increase across both commercial and residential sectors, driving market growth.

The primary challenge in the smart elevator market is the high initial investment required for the installation of these advanced systems. Smart elevators involve the integration of cutting-edge technologies, such as IoT connectivity, AI-driven algorithms, and energy-efficient mechanisms, which increases their upfront costs compared to traditional elevators. The integrating smart elevator systems into existing building infrastructures can be complex and time-consuming, especially in older buildings that may require significant retrofitting. Ensuring compatibility with other building management systems and overcoming the technical hurdles associated with system integration can delay adoption. These factors may deter some property developers, particularly in price-sensitive markets, from investing in smart elevators.

The rise of smart cities presents significant opportunities for the smart elevator market. As urbanization increases, there is growing demand for infrastructure that supports energy-efficient, automated, and connected systems. Smart elevators align with the vision of smart cities, offering efficient vertical transportation that contributes to overall energy savings and sustainability. The technological advancements in AI, machine learning, and IoT are enabling the development of smarter, more efficient elevator systems. These innovations allow for predictive maintenance, better load management, and enhanced user experiences. As more governments and developers focus on urban development and the creation of connected, eco-friendly cities, the demand for smart elevators is expected to rise, especially in emerging markets.

A prominent trend in the smart elevator market is the integration of IoT and AI technologies, which enhance the user experience and operational efficiency. IoT-enabled smart elevators allow for real-time monitoring, predictive maintenance, and remote control, providing greater convenience and safety. These elevators are also equipped with AI-powered algorithms that optimize elevator usage based on building traffic patterns, reducing wait times and improving energy efficiency. The rise of touchless control and voice-activated elevators is gaining traction in response to the growing demand for hygiene and convenience. As these technologies continue to evolve, smart elevators are becoming more intuitive, energy-efficient, and user-friendly, further driving their adoption across residential, commercial, and public infrastructure.

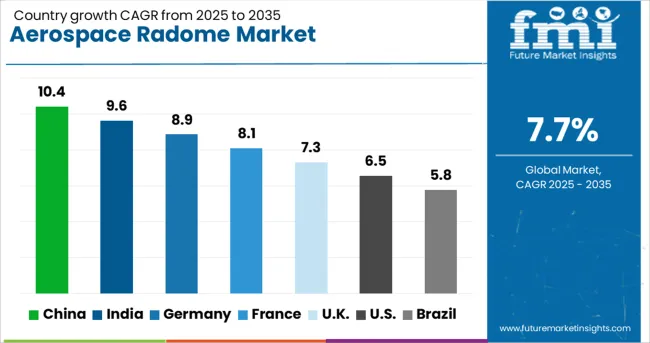

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

| USA | 6.5% |

| Brazil | 5.8% |

The aerospace radome market is projected to grow at a global CAGR of 7.7% from 2025 to 2035. China leads the market at 10.4%, followed by India at 9.6%, and France at 8.1%. The United Kingdom is expected to grow at 7.3%, while the United States is projected to grow at 6.5%. China and India’s growth is driven by their booming aerospace industries, with increasing demand for radar protection in aviation and defense sectors. In OECD nations like France, the UK, and the USA, steady growth is supported by advancements in radar technology, military applications, and commercial aviation. The analysis spans 40+ countries, with the leading markets shown below.

China is projected to grow at a CAGR of 10.4% through 2035, leading the aerospace radome market. With significant investments in both its civilian and military aerospace sectors, China is embracing innovative technologies to enhance radar systems, boosting the demand for radomes. The growing number of military aircraft and commercial airlines in China requires advanced radar protection, making aerospace radomes a crucial component of modern aircraft. China’s robust manufacturing sector ensures the domestic production of high-performance radomes for both defense and commercial aviation needs.

India is projected to grow at a CAGR of 9.6% through 2035, driven by significant investments in the aerospace and defense sectors. As India continues to enhance its defense capabilities and expand its aerospace industry, the demand for advanced radar technologies and radar protection systems like aerospace radomes is increasing. The country’s growing defense budget and the increasing need for surveillance and communication systems further boost demand for radomes. India’s rising aviation sector also contributes to this growth, with increasing aircraft fleets requiring advanced radome technology.

Germany is projected to grow at a CAGR of 8.9% through 2035, supported by the country’s strong aerospace industry and increasing demand for advanced radar systems. As one of Europe’s leaders in aerospace manufacturing, Germany’s growing defense sector and robust commercial aviation industry are driving demand for aerospace radomes. The increasing integration of radar technologies in military and civilian aircraft, alongside investments in advanced communication and surveillance systems, continues to expand the aerospace radome market in Germany. Germany’s focus on enhancing radar systems further boosts the adoption of radomes in both military and commercial applications.

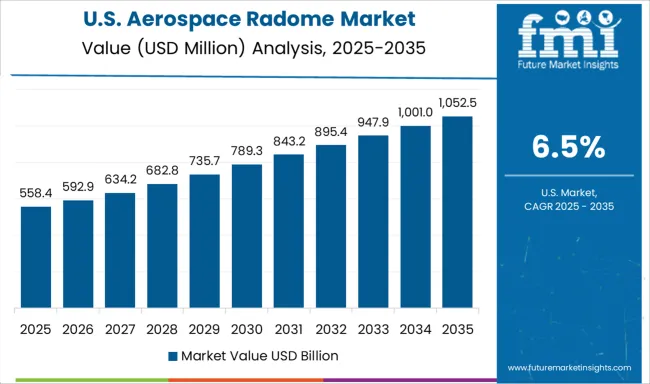

The United States is projected to grow at a CAGR of 6.5% through 2035, driven by advancements in aerospace technology and the growing defense sector. As the USA continues to modernize its defense and commercial aviation fleets, the demand for high-performance radar protection is rising, contributing to the growing need for aerospace radomes. The country’s focus on integrating advanced radar systems in military aircraft, drones, and commercial aircraft further accelerates market growth. The increasing use of radomes for surveillance, weather detection, and communication purposes in both military and civilian applications will drive demand in the USA

The United Kingdom is projected to grow at a CAGR of 7.3% through 2035, with the demand for aerospace radomes driven by the growth of the aerospace sector and increasing defense investments. The UK is increasingly adopting advanced radar systems for both military and civilian applications, boosting the demand for radar protection solutions like aerospace radomes. The growth of the UK’s aviation industry, the rise in military aircraft procurement, and investments in surveillance and communication technologies all contribute to the increasing need for high-performance radomes.

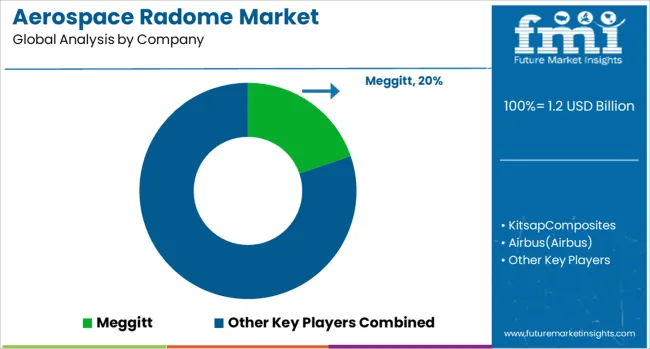

The aerospace radome market is driven by key players offering advanced materials and solutions for radar protection in both commercial and military aerospace applications. Meggitt is a market leader, providing high-performance radomes that ensure the protection of radar systems while maintaining minimal interference. Their focus is on lightweight, durable materials designed for harsh aerospace environments.

Kitsap Composites offers advanced composite solutions for radomes, known for their high-strength and low-weight characteristics, ideal for both commercial and military aircraft. Airbus contributes to the market with aerospace radomes designed for both civilian and military aircraft, offering superior protection and aerodynamic performance. Saint-Gobain provides materials for radomes, focusing on advanced composites and ceramics that enhance performance while meeting the stringent requirements of the aerospace industry.

Nordam is a key player in providing custom radome solutions, with an emphasis on precision engineering and lightweight composite materials that optimize radar functionality. General Dynamics offers advanced radar systems and radomes for military and defense applications, focusing on high-performance materials that provide radar protection while minimizing signal loss. Orbital ATK (now part of Northrop Grumman) is recognized for its radome solutions used in both military and commercial aerospace, providing cutting-edge radar protection with a focus on cost-effective and innovative materials.

Competitive differentiation in the aerospace radome market is driven by factors such as material performance, radar transparency, weight, and durability. Barriers to entry include high R&D costs, stringent military and aerospace standards, and the complexity of designing materials that balance protection with minimal interference. Strategic priorities include improving the efficiency of radome materials, expanding product offerings for both civilian and military sectors, and ensuring compliance with aerospace safety regulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Material | Glass Fiber, Quartz, Kevlar, Carbon Fiber, and Others (Ceramics, Composites, etc.) |

| Aircraft Type | Commercial Aircraft, Military Aircraft, Business Jets, and Unmanned Aerial Vehicles (UAVs) |

| Frequency Band | L Band, S Band, C Band, X Band, Ku Band, Ka Band, and Multi-band |

| Application | Nose Radome, Tail Radome, Fuselage Radome, and Others (Wing-tip, Dorsal, etc.) |

| Platform | Fixed-wing and Rotary-wing |

| End Use | OEM (Original Equipment Manufacturer) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Parker Meggitt; Kitsap Composites; Airbus; Saint-Gobain; NORDAM; General Dynamics; Northrop Grumman (formerly Orbital ATK); Collins Aerospace |

| Additional Attributes | Dollar sales by radome type (composite radomes, ceramic radomes, metal radomes) and end-use segments (commercial aerospace, military aerospace, unmanned aerial vehicles). Demand dynamics are influenced by the increasing demand for radar-based systems in both military defense and commercial aviation, alongside the growing need for lightweight and efficient radar protection. Regional trends indicate strong growth in North America and Europe, with increasing demand for military and commercial aircraft. |

The global aerospace radome market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the aerospace radome market is projected to reach USD 2.6 billion by 2035.

The aerospace radome market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in aerospace radome market are glass fiber, quartz, kevlar, carbon fiber and others (ceramics, composites, etc.).

In terms of aircraft type, commercial aircraft segment to command 42.2% share in the aerospace radome market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Radome Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Engineering Services Outsourcing (ESO) Market Analysis - Size, Share, and Forecast Outlook (025 to 2035

Aerospace DC-DC Converter Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Aerospace Fastener Market Analysis Size Share and Forecast Outlook 2025 to 2035

Aerospace 3D Printing Materials Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Interior Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Tester Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Landing Gear Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA