The radome market is experiencing robust expansion, supported by the increasing integration of radar and communication systems across defense, aerospace, and telecommunication sectors. The demand surge is driven by the growing need for high-performance protective enclosures that ensure signal transparency while shielding sensitive antennas from environmental stress.

Technological advancements in composite materials and manufacturing techniques have enhanced radome durability, thermal resistance, and weight optimization. The market benefits from expanding military modernization programs and the proliferation of airborne and naval platforms equipped with advanced radar technologies.

Additionally, the rapid deployment of 5G infrastructure and satellite communication systems has increased the use of radomes in civil applications. With continuous innovation in stealth-compatible materials and compact designs, the market outlook remains optimistic, reinforced by sustained defense spending and rising commercial aerospace deliveries globally..

| Metric | Value |

|---|---|

| Radome Market Estimated Value in (2025 E) | USD 4.1 billion |

| Radome Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

The market is segmented by Offerings, Platform, Application, and Frequency and region. By Offerings, the market is divided into Product and Service. In terms of Platform, the market is classified into Airborne, Ground, and Naval. Based on Application, the market is segmented into Communication Antenna, Radar, and Sonar. By Frequency, the market is divided into X-Band, HF/UHF/VHF-Band, L-Band, S-Band, KU-Band, KA-Band, and Multi-Band. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The product segment dominates the offerings category in the radome market, holding approximately 51.40% share. Its leadership is attributed to the consistent demand for high-performance physical enclosures that protect radar and antenna systems in varying operational environments.

The segment benefits from widespread adoption across aerospace, naval, and telecommunication applications, where reliability and minimal signal attenuation are critical. Continuous advancements in materials, including fiberglass, PTFE composites, and ceramic substrates, have improved radome efficiency and reduced maintenance requirements.

The market has also witnessed growing investments in lightweight and stealth-compatible designs tailored for next-generation defense platforms. With ongoing aerospace production and radar system upgrades, the product segment is expected to maintain its leading position over the forecast horizon..

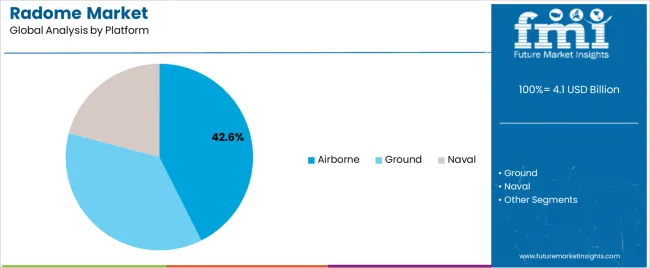

The airborne segment leads the platform category, accounting for approximately 42.60% of the radome market. Its dominance stems from the increasing installation of radomes in aircraft, UAVs, and defense systems that rely heavily on radar and satellite communication technologies.

The segment’s growth is supported by heightened global defense budgets and expanding commercial aviation fleets. Lightweight construction, aerodynamic performance, and superior signal transparency are key design requirements driving innovation in airborne radomes.

The integration of advanced radar arrays in surveillance and reconnaissance aircraft further reinforces segment demand. As aerospace OEMs expand production and upgrade radar capabilities, the airborne segment is expected to remain the largest platform category in the market..

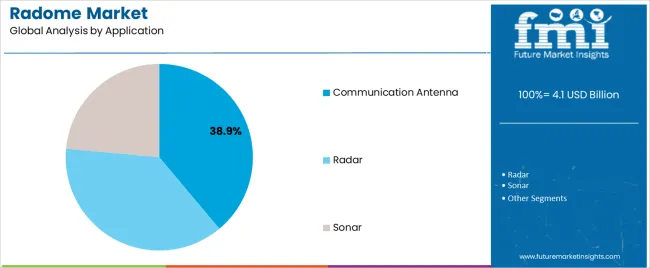

The communication antenna segment dominates the application category with approximately 38.90% share. This segment’s strength is underpinned by the surge in satellite-based and wireless communication systems across both defense and civilian applications.

Radomes are essential in ensuring signal integrity and weather protection for antennas in these systems. Increased demand for reliable broadband connectivity, particularly in remote and maritime environments, has expanded deployment.

The ongoing expansion of global 5G and satellite networks continues to accelerate the need for radomes optimized for frequency transparency and mechanical stability. With continued investment in communication infrastructure and aerospace connectivity solutions, this segment is poised for sustained growth in the coming years..

From 2020 to 2025, the radome market experienced a CAGR of 20.3%. The utilization of radomes extends beyond traditional applications to include weather radar systems and navigation aids. Factors such as government investment in meteorological infrastructure and advancements in navigation technology can significantly impact the demand within this segment.

Innovations in materials, manufacturing processes, and design methodologies hold the potential to revolutionize the radome market by enhancing performance, durability, and cost efficiency.Top of Form Projections indicate that the global radome market is expected to experience a CAGR of 15.8% from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 20.3% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 15.8% |

The table showcases the leading five countries in revenue generation, with South Korea and Japan taking the top positions on the list.

South Korea's strong focus on national security and defense modernization drives the demand for radomes used in military applications, such as radar systems for surveillance, early warning, and missile defense.

Japan's aerospace industry, including both commercial and military sectors, drives the demand for radomes for aircraft, UAVs, and space systems.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| United States | 16.1% |

| United Kingdom | 17.1% |

| China | 16.5% |

| Japan | 17.5% |

| South Korea | 18% |

The radome market in the United States is expected to grow with a CAGR of 16.1% from 2025 to 2035. The radome market benefits significantly from the robust growth of the United States aerospace industry, especially in commercial aviation.

With rising air travel demand and the expansion of aircraft fleets, radomes play a vital role in ensuring the functionality of weather radar systems, traffic collision avoidance systems (TCAS), and satellite communication antennas installed on commercial aircraft.

As the demand for commercial airliners and business jets continues to escalate, the need for reliable and high-quality radomes amplifies accordingly, reflecting the symbiotic relationship between aerospace growth and radome demand.

The radome market in the United Kingdom is expected to grow with a CAGR of 17.1% from 2025 to 2035. The presence of a strong defense sector and growing investment in modernizing military capabilities, including radar systems in the United Kingdom drives market growth.

Radomes are essential components of radar systems used in military aircraft, naval vessels, ground installations, and missile defense systems. With ongoing advancements in aerospace technology and increasing demand for air travel, the demand for radomes in the United Kingdom's aerospace industry continues to grow.

The radome market in China is expected to grow with a CAGR of 16.5% from 2025 to 2035. Government support and initiatives to promote domestic manufacturing, research, and development in aerospace, defense, and telecommunications sectors further boost the growth of the radome market in China.

Regulatory requirements and standards also drive demand for radomes that meet stringent performance and safety criteria. China relies on advanced weather radar networks and navigation systems for accurate forecasting, aviation safety, and maritime operations, driving the market demand for radome in the country.

The radome market in Japan is expected to grow with a CAGR of 17.5% from 2025 to 2035. Japan relies on advanced weather radar networks and navigation systems for accurate forecasting, aviation safety, and maritime operations.

Radomes are essential for protecting radar antennas and supporting these systems. Radomes play a crucial role in weather radar systems and navigation aids used for weather monitoring, air traffic management, and maritime navigation in Japan.

The radome market in South Korea is expected to grow with a CAGR of 18.0% from 2025 to 2035. The presence of advanced telecommunications infrastructure, with investments in 5G networks, satellite communication systems, and broadband services in South Korea boosts the radome market.

Radomes are used to protect antennas and satellite communication systems from environmental elements while ensuring optimal signal transmission. As South Korea continues to expand its telecommunications infrastructure, the demand for radomes is expected to increase.

Technological advancements in radome design, materials, and manufacturing processes contribute to the growth of the radome market in South Korea.

The below section shows the leading segment. The product segment is to grow at a CAGR of 15.6% from 2025 to 2035. Based on platforms, the airborne segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 15.4% from 2025 to 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Product | 15.6% |

| Airborne | 15.4% |

Based on offering, the product segment is anticipated to thrive at a CAGR of 15.6% from 2025 to 2035. Radomes are integral components in various industries, including defense, aerospace, telecommunications, and weather monitoring.

They protect radar antennas and sensitive equipment from environmental elements while ensuring optimal performance. Radomes find applications in diverse sectors, including military surveillance, commercial aviation, telecommunications infrastructure, and weather forecasting. Their versatility and reliability make them indispensable across different industries.

Based on the platform, the airborne segment is anticipated to thrive at a CAGR of 15.4% from 2025 to 2035. Advancements in aerospace technology have led to the development of more advanced and sophisticated airborne platforms with enhanced radar capabilities.

Radomes play a crucial role in protecting these advanced radar systems from environmental elements while maintaining optimal performance, driving the demand for radomes in the airborne platform segment.

With the growth of the commercial aviation industry and increasing air travel demand, there is a rising need for radomes to support radar systems on commercial airliners, regional jets, and business aircraft.

Market players are focusing on developing innovative radome designs that offer improved performance, durability, and cost-effectiveness. Market players expand their geographical presence through strategic partnerships, acquisitions, and establishing manufacturing facilities or distribution networks in key regions.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 3.5 billion |

| Projected Market Valuation in 2035 | USD 15.1 billion |

| Value-based CAGR 2025 to 2035 | 15.8% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | Offerings, Platform, Application, Frequency, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

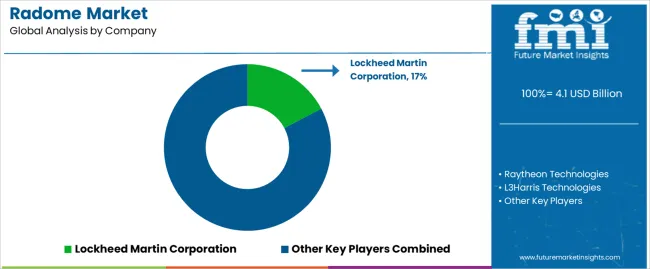

| Key Companies Profiled | Lockheed Martin Corporation; Raytheon Technologies; L3harris Technologies; Northrop Grumman Corporation; BAE Systems; Thales Group; Saint-Gobain; General Dynamics Nordam; Comtech Telecommunications; Cobham PLC |

The global radome market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the radome market is projected to reach USD 11.3 billion by 2035.

The radome market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in radome market are product and service.

In terms of platform, airborne segment to command 42.6% share in the radome market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aerospace Radome Market Size and Share Forecast Outlook 2025 to 2035

Antenna, Transducer, and Radome (ATR) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA