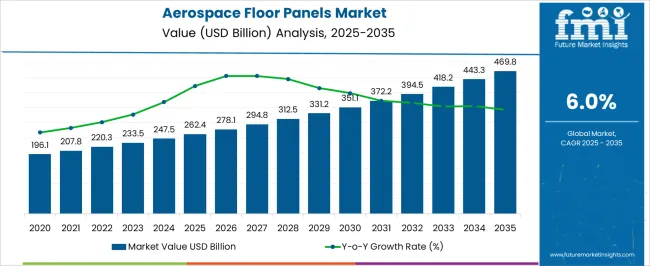

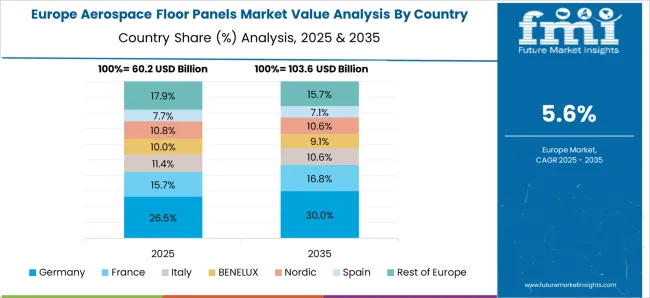

The Aerospace Floor Panels Market is estimated to be valued at USD 262.4 billion in 2025 and is projected to reach USD 469.8 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The aerospace floor panels market is projected to experience steady growth, expanding from USD 196.1 billion in 2020 to approximately USD 469.8 billion by 2035, reflecting a substantial increase over the 16-year period. During the initial phase from 2020 to 2025, the market value rises from USD 196.1 billion to USD 247.5 billion, driven by increasing demand for lightweight and durable materials in aircraft manufacturing and refurbishment. This growth is supported by the expansion of commercial and military aviation sectors, with airlines seeking to improve fuel efficiency and reduce operational costs through advanced composite floor panels.

The rising production of next-generation aircraft and retrofitting activities contribute to market expansion during this period. Between 2026 and 2030, the market further advances from USD 262.4 billion to USD 331.2 billion, fueled by technological innovations in material science, including the use of carbon fiber-reinforced polymers and improved manufacturing processes. Increasing focus on passenger comfort and safety, as well as regulatory mandates on aircraft weight reduction, enhance demand for high-performance floor panels.

From 2031 to 2035, the market accelerates from USD 351.1 billion to USD 469.8 billion, supported by ongoing aircraft fleet modernization and the integration of sustainable materials that meet environmental regulations. Overall, the aerospace floor panels market is positioned for robust and sustained growth through 2035, driven by evolving industry standards, technological advancement, and the global expansion of the aviation sector.

| Metric | Value |

|---|---|

| Aerospace Floor Panels Market Estimated Value in (2025 E) | USD 262.4 billion |

| Aerospace Floor Panels Market Forecast Value in (2035 F) | USD 469.8 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

Industry focus on structural efficiency and weight reduction is prompting manufacturers to adopt high-performance panels that meet stringent safety and fire-resistance standards. Increased fleet expansion across commercial and defense sectors, along with modernization initiatives in aircraft interiors, is creating demand for customizable and durable flooring systems. Regulatory alignment with fire, smoke, and toxicity (FST) norms, along with growing reliance on honeycomb structures for enhanced stiffness-to-weight ratios, is further shaping procurement decisions.

The market is also benefiting from long-term contracts between OEMs and composite suppliers, ensuring consistency in quality and integration with evolving cabin design specifications. As sustainability gains traction, recyclable and energy-efficient panel manufacturing processes are expected to support future growth in global aerospace production cycles.

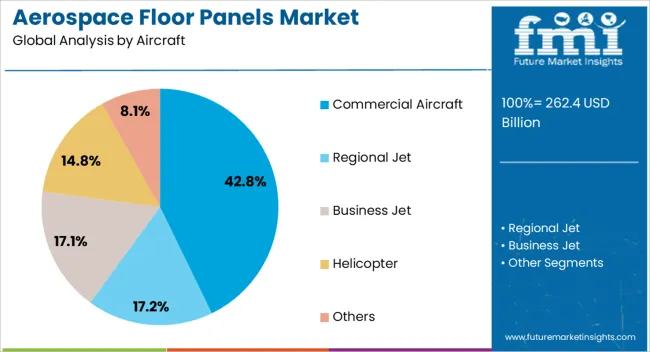

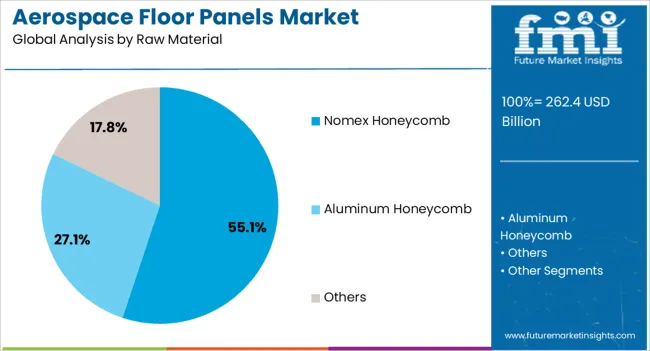

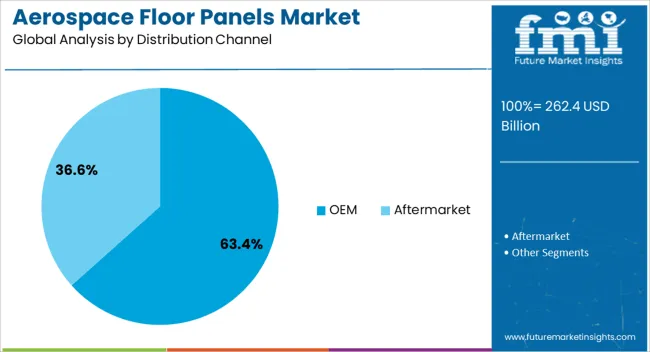

The aerospace floor panels market is segmented by aircraft, raw material, distribution channel, and geographic regions. The aerospace floor panels market is divided by aircraft type into Commercial Aircraft, Regional Jet, Business Jet, Helicopter, and Others. In terms of raw materials, the aerospace floor panels market is classified into Nomex Honeycomb, Aluminum Honeycomb, and Others. The distribution channel of the aerospace floor panels market is segmented into OEM and Aftermarket. Regionally, the aerospace floor panels industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Commercial aircraft are projected to account for 42.8% of the aerospace floor panels market revenue in 2025, making them the leading aircraft category. This segment’s dominance is being driven by consistent growth in global air traffic, renewed aircraft procurement by major carriers, and rising preference for weight-saving solutions to improve fuel efficiency.

Floor panels designed for commercial fleets must balance strength, fire resistance, and integration with modular cabin systems, factors that are increasingly being met through advanced materials. The expanding backlog of commercial jets and an increase in narrow-body aircraft deliveries are contributing to consistent demand.

Additionally, retrofit programs for older aircraft cabins are creating recurring revenue streams for panel suppliers. Strong OEM pipelines and airline partnerships are further anchoring this segment’s leadership in global panel consumption.

Nomex honeycomb is expected to hold 55.10% of the total revenue share in 2025, positioning it as the preferred raw material for aerospace floor panels. This material’s popularity is attributed to its exceptional thermal insulation, low flammability, and excellent strength-to-weight ratio.

Its compatibility with phenolic or epoxy prepregs allows for easy fabrication of sandwich structures that meet FST compliance standards required in aviation interiors. Nomex honeycomb's mechanical stability and fatigue resistance make it ideal for withstanding long flight cycles without degradation.

The growing emphasis on aircraft weight reduction to cut emissions and fuel burn is aligning strongly with the use of lightweight core materials like Nomex. Its adaptability for both OEM and MRO applications ensures continuous demand across new builds and maintenance programs.

OEMs are projected to contribute 63.40% of the aerospace floor panels market revenue by 2025, affirming their role as the dominant distribution channel. This is being driven by their integration into aircraft assembly lines, where custom-fitted floor panels are installed during fuselage and cabin outfitting stages.

Stringent certification requirements, long-term supplier agreements, and a focus on lifecycle cost efficiency characterize OEM procurement. Tier-1 suppliers are increasingly collaborating with OEMs to co-develop floor panel systems that align with evolving cabin configurations and modular architecture.

Strong order backlogs from commercial jet manufacturers and a surge in wide-body production are further consolidating OEM-driven demand. As OEMs prioritize weight, safety, and ease of maintenance, their role as primary distribution partners is expected to remain central to market growth.

The aerospace floor panels market is driven by the growing demand for lightweight, durable materials, the expansion of the global aircraft fleet, stringent safety regulations, and technological innovations in manufacturing. These factors together shape the market’s future outlook.

A key driver for the aerospace floor panels market is the demand for lightweight and durable materials to optimize aircraft performance. Aircraft manufacturers and airlines seek to reduce fuel consumption while maintaining the strength and longevity of aircraft interiors. Materials like carbon fiber composites and advanced polymers are becoming increasingly popular for floor panels due to their superior strength-to-weight ratio. These materials provide the necessary durability without adding excessive weight, aligning with the aviation industry's goal to improve fuel efficiency. The integration of these high-performance materials in floor panels has contributed to a more sustainable and cost-effective approach to aircraft design, particularly for commercial and military aircraft.

As global passenger traffic continues to rise, the need for new and upgraded aircraft fleets is expanding rapidly, contributing to the growth of the aerospace floor panels market. The aviation industry’s recovery from the pandemic has led to increased demand for both commercial and private aircraft. Consequently, airline operators are investing heavily in the upgrade and maintenance of aircraft interiors, which includes replacing or reinforcing floor panels. As airlines aim to improve passenger comfort and meet modern design standards, the demand for advanced, customized floor solutions is projected to grow. This demand is supported by increasing passenger volumes, particularly in regions with rising middle-class populations.

Strict safety regulations and standards set by aviation authorities globally significantly influence the design and material selection for aerospace floor panels. Panels must meet rigorous fire resistance, impact, and weight standards to ensure the safety of passengers and crew. These safety requirements are integral to the design process, driving manufacturers to innovate materials that meet or exceed regulatory demands. Floor panels are required to comply with fire safety standards, such as flammability and smoke emission levels, especially for commercial aircraft. Consequently, manufacturers are focusing on meeting stringent safety criteria while also ensuring performance and durability over the lifecycle of the aircraft.

Ongoing advancements in manufacturing technologies and materials are shaping the future of aerospace floor panels. The shift towards high-performance composite materials and advanced manufacturing processes, such as 3D printing and automated layup techniques, has opened new possibilities for the production of lightweight, customized floor panels. These innovations enhance not only the strength and durability of floor panels but also reduce production time and costs. The ability to produce complex, tailored designs more cost-effectively is driving manufacturers to push the boundaries of floor panel performance. Additionally, the incorporation of these technologies improves the precision and reliability of aerospace components, enhancing overall aircraft safety and passenger experience.

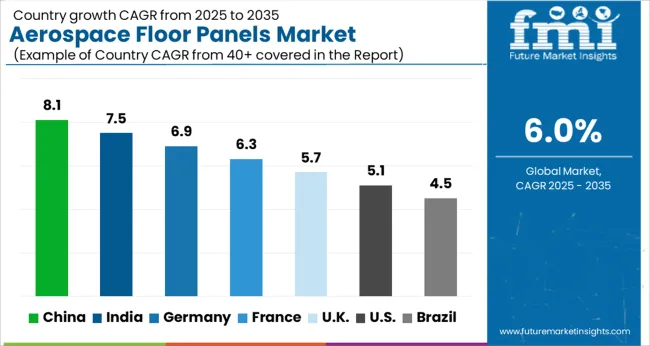

The aerospace floor panels market is projected to grow globally at a CAGR of 6.0% from 2025 to 2035, driven by increasing demand for lightweight materials, advancements in aircraft design, and the growing need for enhanced fuel efficiency. China leads with a CAGR of 8.1%, supported by rapid growth in the aviation industry, expansion of domestic aircraft manufacturing, and increasing demand for high-performance floor panel materials. India follows at 7.5%, fueled by the growing aviation sector, rising air travel, and government initiatives to boost domestic manufacturing capabilities.

France grows at 6.3%, benefiting from strong demand in the aerospace and defense sectors, as well as technological advancements in composite materials. The United Kingdom achieves a CAGR of 5.7%, driven by steady demand from commercial and military aircraft manufacturers, while the United States records a CAGR of 5.1%, supported by demand from major aerospace companies and increasing investments in advanced materials and manufacturing processes. This growth trajectory reflects the increasing importance of lightweight, durable, and efficient materials in aerospace design, driven by both commercial and military sector requirements for optimized performance.

The UK’s aerospace floor panels market grew at a CAGR of 4.5% from 2020 to 2024 and is projected to rise to 5.7% during 2025-2035. The growth during 2020-2024 was relatively moderate, driven by consistent demand from the aerospace sector, particularly in commercial and military aircraft. In the coming decade, the market is expected to accelerate due to increasing air travel, higher passenger capacity in aircraft, and advancements in lightweight composite materials for floor panels. Additionally, the UK’s emphasis on developing next-generation aircraft with enhanced fuel efficiency will drive demand for high-performance floor panel solutions. Technological advancements in material science, along with the push for cost-effective and eco-friendly solutions in aircraft manufacturing, will further contribute to this growth.

China’s aerospace floor panels market is projected to grow at a CAGR of 8.1% from 2025 to 2035, significantly surpassing the global CAGR of 6.0%. During 2020-2024, the market grew at a CAGR of 6.5%, supported by the country’s rapidly expanding aerospace industry, significant investments in domestic aircraft manufacturing, and rising demand for passenger aircraft. The rise in air travel, coupled with China’s ambition to become a leader in global aerospace manufacturing, will contribute to a substantial increase in demand for high-performance and lightweight floor panel materials. The Chinese government's support for the development of advanced materials and technologies in aviation will further fuel the demand for innovative floor panel solutions in commercial and military aircraft.

India’s aerospace floor panels market is expected to grow at a CAGR of 7.5% from 2025 to 2035, exceeding the global average of 6.0%. During 2020-2024, the market grew at a CAGR of 6.2%, driven by increasing air travel, expansion of the domestic aviation industry, and investments in indigenous aerospace manufacturing. The expected growth in the coming decade will be propelled by rising passenger air traffic, demand for eco-friendly and lightweight aircraft materials, and India’s focus on becoming a key player in the global aerospace supply chain. The government’s initiatives to boost domestic aerospace manufacturing and the growth of the defense aviation sector will also contribute to market expansion.

France’s aerospace floor panels market is expected to grow at a CAGR of 6.3% during 2025-2035. The market grew at a CAGR of 5.0% during 2020-2024, supported by France's strong aerospace industry, particularly in commercial and military aviation. In the coming decade, the market will likely accelerate due to increasing demand for lightweight and fuel-efficient aircraft, as well as technological advancements in composite materials. France’s aerospace industry’s emphasis on sustainability and the use of eco-friendly materials will contribute to the growing adoption of advanced floor panel solutions. The rise in aircraft manufacturing, both commercial and defense, will further drive market demand.

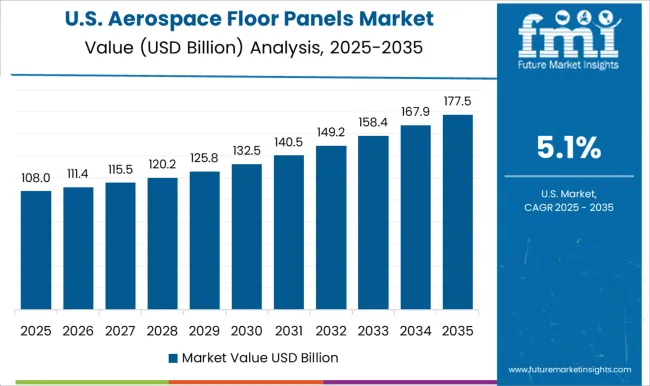

The USA aerospace floor panels market is projected to grow at a CAGR of 5.1% during 2025-2035. The market grew at a CAGR of 4.2% during 2020-2024, driven by steady demand from both commercial and military aviation sectors. The market is expected to rise in the coming decade, primarily due to the increasing demand for fuel-efficient aircraft, the integration of advanced materials in aerospace designs, and technological advancements in floor panel materials. The USA aerospace sector's focus on reducing carbon emissions and improving operational efficiency will drive further adoption of advanced and lightweight floor panels. Additionally, the growing number of aircraft manufacturers and suppliers in the USA will contribute to market expansion.

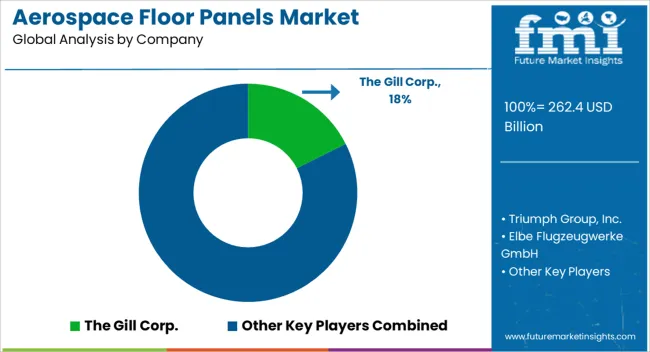

The aerospace floor panels market is highly competitive, shaped by global leaders such as The Gill Corp., Triumph Group, Inc., Elbe Flugzeugwerke GmbH, Nordam Group, Avcorp Industries, Inc., Zodiac Aerospace, and EnCore Group. These players compete through innovation in lightweight materials, composite structures, and advanced manufacturing techniques to meet the growing demand for durability, safety, and efficiency in aircraft interiors.

The Gill Corp. maintains a strong position by focusing on the development of advanced composite flooring solutions, particularly for military and commercial aircraft. Triumph Group, Inc. is recognized for its robust portfolio in aerospace interiors, including floor panels, with an emphasis on supporting major aerospace OEMs and their requirements for high-performance materials.

Elbe Flugzeugwerke GmbH specializes in providing custom aerospace components, including floor panels, to ensure compliance with strict safety and regulatory standards. Nordam Group is known for its expertise in aerospace structures and interiors, offering a comprehensive range of floor panel solutions for commercial and defense sectors.

Avcorp Industries, Inc. leverages its advanced aerospace composite technology to deliver lightweight, fire-resistant floor panel solutions. Zodiac Aerospace, a prominent player in aircraft interior solutions, continues to innovate with designs that improve both functionality and aesthetics. EnCore Group excels in creating customized interior solutions, including floor panels, which meet modern passenger experience expectations.

Competitive strategies within this market include technological advancements in material development, partnerships with OEMs, and geographical expansion. Future success will hinge on continuous innovation in lightweight, cost-effective materials that adhere to strict safety and performance standards, positioning these players as key contributors to the evolving landscape of aerospace floor panels.

Leading manufacturers of aerospace floor panels are collaborating with aircraft OEMs (Original Equipment Manufacturers) to design and produce custom solutions that meet the unique specifications of specific aircraft models. This collaboration ensures that floor panels are seamlessly integrated into the overall design of the aircraft, enhancing their performance and compatibility. These partnerships also promote innovation in material selection and manufacturing techniques.

| Item | Value |

|---|---|

| Quantitative Units | USD 262.4 Billion |

| Aircraft | Commercial Aircraft, Regional Jet, Business Jet, Helicopter, and Others |

| Raw Material | Nomex Honeycomb, Aluminum Honeycomb, and Others |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Gill Corp., Triumph Group, Inc., Elbe Flugzeugwerke GmbH, Nordam Group, Avcorp Industries, Inc., Zodiac Aerospace, and EnCore Group |

| Additional Attributes | Dollar sales projections to understand the market dynamics. Key data on the share of different regions and material types would be crucial for identifying high-demand areas and forecasting growth. They would also want to track innovations in materials, particularly lightweight composites, and other high-performance materials that balance cost with durability. |

The global aerospace floor panels market is estimated to be valued at USD 262.4 billion in 2025.

The market size for the aerospace floor panels market is projected to reach USD 469.8 billion by 2035.

The aerospace floor panels market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in aerospace floor panels market are commercial aircraft, regional jet, business jet, helicopter and others.

In terms of raw material, nomex honeycomb segment to command 55.1% share in the aerospace floor panels market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Floor-standing Brain Function Monitor Market Size and Share Forecast Outlook 2025 to 2035

Floor Screed Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fastener Manufacturing Solution Market Size and Share Forecast Outlook 2025 to 2035

Floor Standing Filtered Bottle Filling Stations Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Fluid Conveyance System Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Adhesives and Sealants Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Forging Materials Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Aerospace and Defense Cyber Security Market Size and Share Forecast Outlook 2025 to 2035

Floor Transition Strips Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Floor Scales Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Cold Forgings Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense Ducting Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Defense C Class Parts Market Size and Share Forecast Outlook 2025 to 2035

Floor Lamp Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaning and Mopping Machine Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Electrical Inserts Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Foams Market Size and Share Forecast Outlook 2025 to 2035

Aerospace Robotics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA