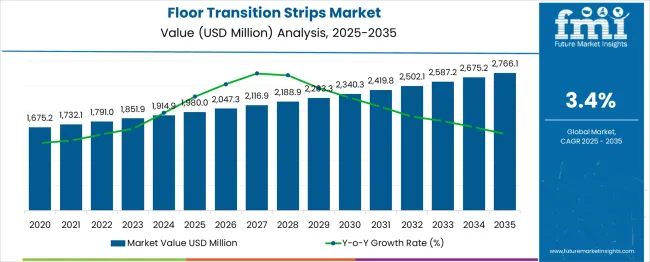

The global floor transition strips market is projected to grow from USD 1,980.0 million in 2025 to approximately USD 2,766.1 million by 2035, recording an absolute increase of USD 786.2 million over the forecast period. This translates into a total growth of 39.7%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.4% between 2025 and 2035. The overall market size is expected to grow by nearly 1.40X during the same period, supported by the rising adoption of premium flooring solutions and increasing demand for seamless floor transitions in residential and commercial construction projects.

Between 2025 and 2030, the floor transition strips market is projected to expand from USD 1,980.0 million to USD 2,340.3 million, resulting in a value increase of USD 360.3 million, which represents 45.8% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of premium flooring materials in global construction activities, increasing renovation and remodeling projects requiring professional transition solutions, and growing awareness among contractors about the importance of proper floor transition systems. Manufacturers are expanding their product portfolios to address the growing complexity of modern flooring combinations and aesthetic requirements.

From 2030 to 2035, the market is forecast to grow from USD 2,340.3 million to USD 2,766.1 million, adding another USD 425.9 million, which constitutes 54.2% of the overall ten-year expansion. This period is expected to be characterized by expansion of innovative profile designs, integration of advanced materials with enhanced durability, and development of standardized installation systems across different flooring types. The growing adoption of luxury vinyl tiles and engineered hardwood flooring will drive demand for more sophisticated transition strips and specialized installation expertise.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,980.0 million |

| Forecast Value in (2035F) | USD 2,766.1 million |

| Forecast CAGR (2025 to 2035) | 3.4% |

Between 2020 and 2025, the floor transition strips market experienced steady expansion, driven by increasing construction activities in emerging markets and growing awareness of professional finishing requirements in flooring installations. The market developed as construction contractors recognized the need for specialized transition solutions to create seamless floor transitions and maintain aesthetic continuity. Building codes and architectural standards began emphasizing proper transition strip installation to ensure safety compliance and professional finishing quality.

Market expansion is being supported by the rapid increase in flooring renovation projects worldwide and the corresponding need for specialized transition solutions to accommodate different flooring materials and heights. Modern buildings utilize diverse flooring materials including hardwood, laminate, tile, carpet, and luxury vinyl, requiring precise transition systems to ensure smooth transitions and prevent trip hazards. Even minor height differences between adjacent floors can require comprehensive transition strip solutions to maintain optimal functionality and aesthetic appeal.

The growing complexity of flooring technologies and increasing safety concerns are driving demand for professional transition strip solutions from certified manufacturers with appropriate materials and engineering expertise. Building codes are increasingly requiring proper transition strip installation following flooring installations to maintain safety compliance and ensure long-term durability. Regulatory requirements and manufacturer specifications are establishing standardized installation procedures that require specialized profiles and trained installation technicians.

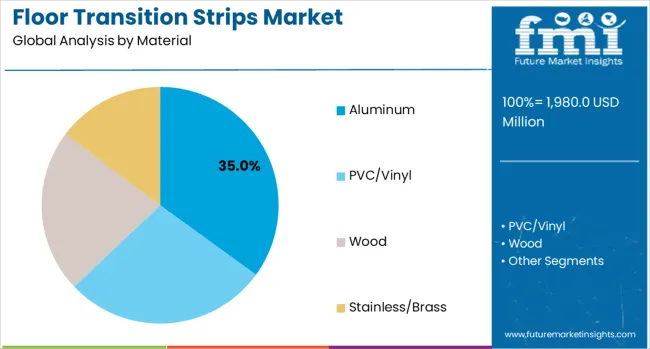

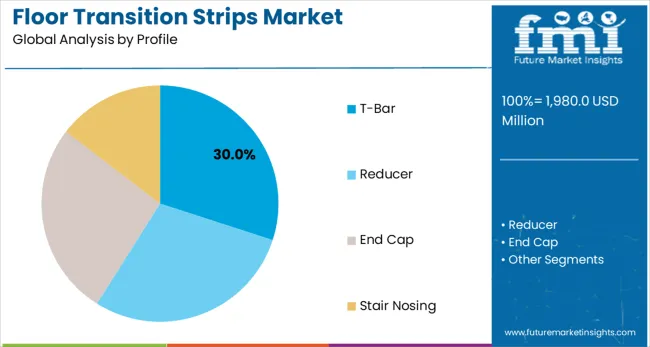

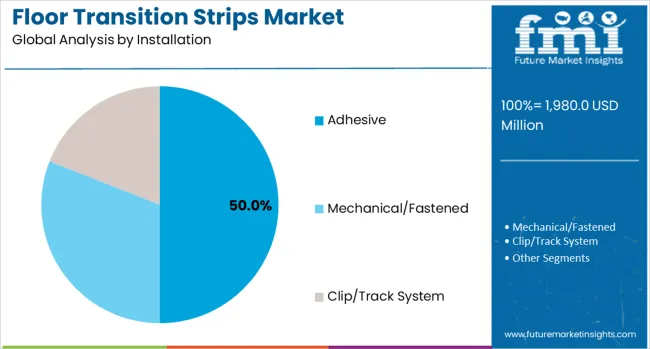

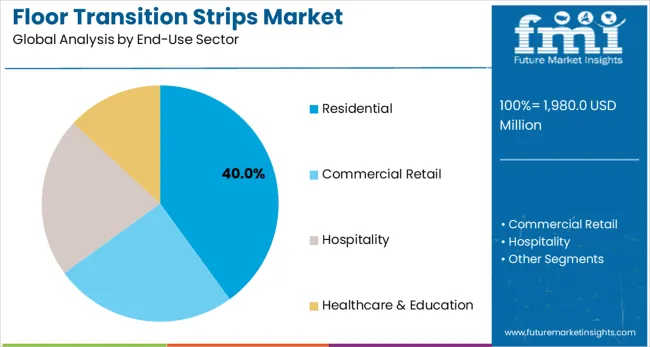

The market is segmented by material, profile type, installation method, end-use sector, and region. By material, the market is divided into aluminum, PVC/vinyl, wood, and stainless steel/brass. Based on profile type, the market is categorized into T-bar, reducer, end cap, and stair nosing. In terms of installation method, the market is segmented into adhesive, mechanical/fastened, and clip/track system. By end-use sector, the market is classified into residential, commercial retail, hospitality, and healthcare & education. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The aluminum segment is projected to account for 35% of the floor transition strips market in 2025, reflecting its dominance as the preferred material across both residential and commercial applications. Aluminum profiles are valued for their durability, corrosion resistance, and ability to withstand heavy foot traffic, making them suitable for high-use environments such as malls, airports, offices, and residential spaces. Their lightweight yet strong properties allow for versatile designs, with finishes ranging from brushed metallic looks to anodized or powder-coated options that complement modern architectural aesthetics.

Established extrusion and fabrication processes ensure cost-effective production and widespread availability across global markets. In addition, aluminum transition strips are recyclable, aligning with growing demand for sustainable building materials. With construction activity expanding globally and homeowners seeking durable, stylish finishing solutions, aluminum continues to set the standard for functional and aesthetic performance in transition strip applications.

T-bar and reducer profiles are each expected to represent 30% of the floor transition strips market in 2025, together accounting for a commanding 60% share. These profiles address the two most common flooring transitions: equal-height connections and height differentials. T-bar profiles ensure smooth, seamless connections between same-level floors such as tile-to-tile or wood-to-laminate, enhancing both safety and appearance. Reducer profiles, on the other hand, provide gradual transitions where one flooring surface is higher than another, minimizing trip hazards and protecting edges from wear.

Their versatility and practicality make them indispensable in both residential and commercial settings. Growing global construction activity and increased investment in professional finishing solutions continue to drive demand for these core profiles. With strong functional relevance and wide product availability, T-bar and reducer designs remain the backbone of the floor transition strip market.

The adhesive installation method is projected to account for 50% of the floor transition strips market in 2025, reflecting its strong preference in residential and light commercial applications. Adhesive-based systems offer clean aesthetics by eliminating visible fasteners, while also providing secure attachment across diverse substrates such as concrete, wood, and tile. Installation is simple and efficient, requiring minimal tools or technical expertise, which makes it particularly attractive for DIY projects and contractor-driven renovations.

Adhesives also allow flexibility in accommodating irregular subfloors and prevent damage that can occur with mechanical fasteners. Growing home improvement trends and demand for quick-turn renovation projects further reinforce adoption. As building owners and contractors seek both efficiency and visual appeal, adhesive installation remains the most widely used and practical method for transition strip applications, ensuring its ongoing leadership in the market.

The residential sector is projected to hold 40% of the floor transition strips market in 2025, reflecting its role as the largest end-use application. Residential construction and renovation projects consistently generate strong demand for transition strips, which are critical in delivering seamless finishes between flooring materials such as wood, laminate, vinyl, and tile. Homeowners are increasingly attentive to details that enhance property value and interior aesthetics, driving adoption of both functional and decorative profiles.

The segment benefits from the surge in global housing development as well as rising DIY renovation activities, where ease of installation and affordability are key decision factors. Residential contractors also prioritize transition strips as part of quality finishing standards. With growing emphasis on professional-grade home design and the expansion of middle-class housing markets, the residential sector will continue to anchor demand for diverse transition strip solutions.

The floor transition strips market is advancing steadily due to increasing construction activity and growing recognition of professional finishing importance. However, the market faces challenges including material cost fluctuations, need for skilled installation expertise, and varying building code requirements across different regions. Standardization efforts and sustainable material development continue to influence product innovation and market development patterns.

The growing deployment of premium materials including brushed metals, engineered composites, and eco-friendly alternatives is enabling enhanced aesthetic options and environmental compliance for diverse project requirements. Advanced materials provide improved durability, aesthetic versatility, and sustainable credentials while meeting stringent building performance standards. These solutions are particularly valuable for luxury residential projects and commercial applications requiring superior finishing quality and long-term performance reliability.

Modern transition strip manufacturers are incorporating advanced profile geometries and integrated installation systems that improve installation efficiency and performance reliability. Integration of snap-fit mechanisms, adjustable height systems, and modular components enables more precise installations and comprehensive compatibility with diverse flooring combinations. Advanced systems also support installation of next-generation flooring technologies including waterproof luxury vinyl and engineered hybrid materials.

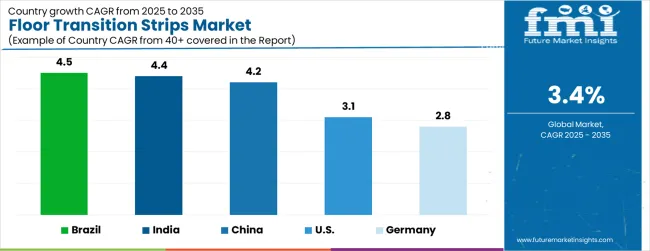

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 4.5% |

| India | 4.4% |

| China | 4.2% |

| United States | 3.1% |

| Germany | 2.8% |

The floor transition strips market is growing rapidly, with Brazil leading at a 4.5% CAGR through 2035, driven by robust construction activity, expanding residential market, and increasing adoption of premium flooring solutions. India follows at 4.4%, supported by rising construction investments in urban areas and growing awareness of professional finishing standards. China grows steadily at 4.2%, integrating transition strips into its extensive construction and renovation activities. The United States records 3.1%, emphasizing quality standards, code compliance, and renovation market growth. Germany shows steady growth at 2.8%, focusing on precision engineering, sustainability, and advanced installation systems.

The report covers an in-depth analysis of 40+ countries; five top-performing countries are highlighted below.

Revenue from floor transition strips in Brazil is projected to exhibit strong growth with a CAGR of 4.5% through 2035, driven by rapid expansion of residential construction and increasing consumer demand for professional finishing solutions. The country's growing middle class and urbanization trends are creating significant demand for quality transition strip products. Major construction companies and flooring contractors are establishing comprehensive supplier relationships to support the growing population of premium flooring installations across urban markets.

Revenue from floor transition strips in India is expanding at a CAGR of 4.4%, supported by increasing construction activity in urban areas and growing adoption of modern flooring materials requiring professional transition solutions. The country's expanding commercial sector and residential development are driving demand for quality transition strip products. Construction contractors and flooring specialists are gradually establishing comprehensive product availability to serve the growing population of premium flooring installations.

Revenue from floor transition strips in China is growing at a CAGR of 4.2%, driven by continued construction activity and increasing integration of professional finishing solutions in residential and commercial projects. The country's established manufacturing capabilities and extensive construction industry are creating sustained demand for transition strip products. Construction companies and flooring contractors are investing in comprehensive product inventories and installation expertise to address growing market requirements.

Demand for floor transition strips in the United States is projected to grow at a CAGR of 3.1%, supported by the country's emphasis on building code compliance and professional installation standards. American construction contractors are implementing comprehensive transition strip solutions that meet stringent safety regulations and aesthetic requirements. The market is characterized by focus on product reliability, installation efficiency, and compliance with comprehensive building safety codes.

Demand for floor transition strips in Germany is expanding at a CAGR of 2.8%, driven by the country's focus on engineering precision and sustainable building materials. German construction contractors are establishing comprehensive transition strip capabilities that meet stringent environmental standards and manufacturing quality requirements. The market benefits from emphasis on product durability, sustainable materials, and precision installation techniques following construction and renovation activities.

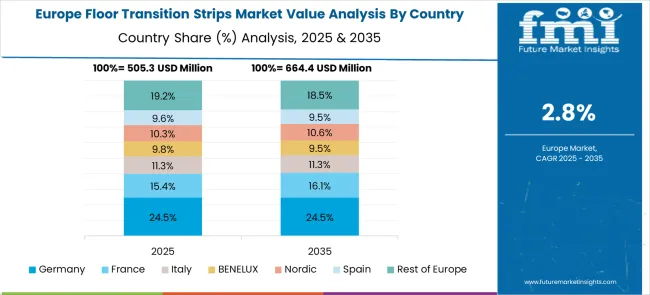

The European floor transition strips market demonstrates sophisticated development across major economies with Germany leading through its precision engineering capabilities and strong construction industry, supported by companies like Schlüter-Systems, Küberit, and Progress Profiles pioneering innovative transition solutions for diverse flooring applications. Italy shows significant strength through companies like Profilitec and Progress Profiles, leveraging expertise in architectural finishes and design-focused solutions. The UK contributes through Quantum Profile Systems, while international players like ArchiProfiles and Dural establish strong European presence.

France and Spain exhibit expanding adoption in residential and commercial construction projects, driven by modern architectural trends and quality flooring installations. Nordic countries emphasize sustainable construction practices and premium finishing solutions, while Eastern European markets show growing interest in upgrading construction standards and architectural finishes. The market benefits from strict building codes, quality construction standards, and the region's leadership in architectural innovation, positioning Europe as a key innovation center for next-generation floor transition solutions across residential, commercial, and industrial construction applications requiring professional finishing systems and architectural coordination.

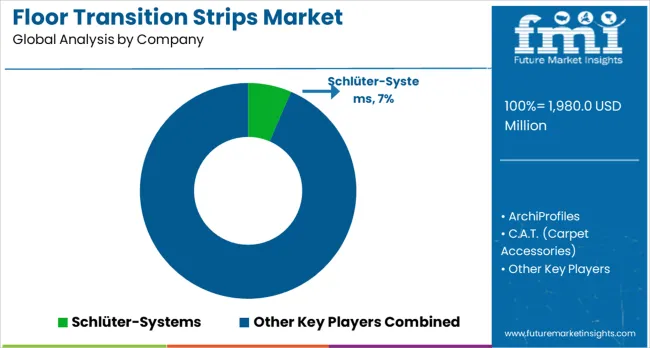

The floor transition strips market is defined by competition among specialized manufacturers, building product companies, and construction supply distributors. Companies are investing in advanced materials, innovative profile designs, comprehensive product lines, and technical support services to deliver durable, aesthetic, and cost-effective transition solutions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening product portfolios and market presence.

ArchiProfiles, Italy-based, offers comprehensive transition strip solutions with focus on architectural design, premium materials, and technical excellence. C.A.T. (Carpet Accessories), UK-based, provides specialized transition strips for carpet installations with emphasis on durability and installation efficiency. Dural, Germany, delivers engineered transition solutions with standardized profiles and comprehensive technical support. Genotek, UAE/Italy, emphasizes innovative materials and international market coverage for diverse construction applications.

Küberit, Germany, offers precision-manufactured transition strips with focus on quality standards and technical innovation. MD Building Products (Loxcreen), USA, provides comprehensive building product solutions including diverse transition strip options. Profilitec, Italy, delivers architectural finishing solutions with premium aesthetics and professional installation support. Progress Profiles, Italy, offers innovative transition systems with focus on ease of installation and aesthetic versatility.

Quantum Profile Systems, UK, provides engineered transition solutions for commercial and residential applications. Schlüter Systems, Germany, delivers comprehensive tile installation systems including specialized transition profiles with emphasis on technical excellence and professional support.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,980.0 million |

| Material | Aluminum, PVC/Vinyl, Wood, Stainless Steel/Brass |

| Profile | T-Bar, Reducer, End Cap, Stair Nosing |

| Installation | Adhesive, Mechanical/Fastened, Clip/Track System |

| End-Use Sector | Residential, Commercial Retail, Hospitality, Healthcare & Education |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, China, Japan, Brazil, India, South Korea, and 40+ countries |

| Key Companies Profiled | ArchiProfiles, C.A.T. (Carpet Accessories), Dural, Genotek, Küberit, MD Building Products (Loxcreen), Profilitec, Progress Profiles, Quantum Profile Systems, Schlüter Systems |

| Additional Attributes | Dollar sales by material type and profile design, regional demand trends, competitive landscape, buyer preferences for DIY-friendly versus professional-grade options, integration with sustainable flooring systems, innovations in click-fit mechanisms, recycled materials, and enhanced durability finishes |

The global floor transition strips market is estimated to be valued at USD 1,980.0 million in 2025.

The market size for the floor transition strips market is projected to reach USD 2,766.1 million by 2035.

The floor transition strips market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in floor transition strips market are aluminum, pvc/vinyl, wood and stainless/brass.

In terms of profile, t-bar segment to command 30.0% share in the floor transition strips market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Floor Screed Market Size and Share Forecast Outlook 2025 to 2035

Floor Standing Filtered Bottle Filling Stations Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Floor Scales Market Size and Share Forecast Outlook 2025 to 2035

Floor Lamp Market Size and Share Forecast Outlook 2025 to 2035

Floor Cleaning and Mopping Machine Market Size and Share Forecast Outlook 2025 to 2035

Floor Marking Tape Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Flooring Market Size and Share Forecast Outlook 2025 to 2035

Floor Displays Market Growth from 2025 to 2035

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Floor Grinding Machine Market

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Eco Flooring Market Analysis - Growth, Demand & Forecast 2025 to 2035

Gas Floor Fryers Market

Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Underfloor Air Distribution Systems Market

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Pelvic Floor Diagnostics Market - Demand & Forecast 2025 to 2035

Pelvic Floor Stimulators Market – Trends & Forecast 2025 to 2035

Pelvic Floor Diagnostic Testing Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA