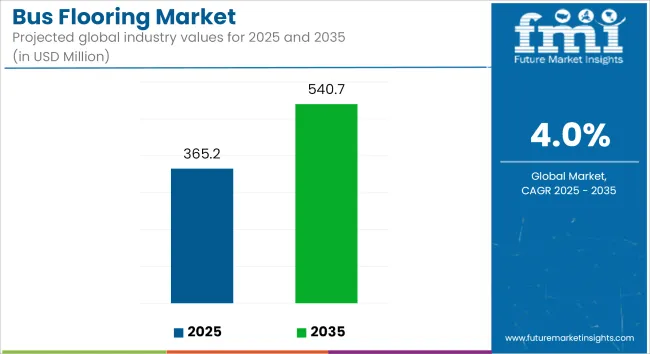

The global bus flooring market is projected to grow from USD 365.2 million in 2025 to USD 540.7 million by 2035, reflecting a CAGR of 4.0% throughout the forecast period. Growth is being supported by rising bus fleet electrification, demand for lightweight yet durable materials, and enhanced hygiene and acoustic performance in public transport interiors.

In April 2024, Altro introduced a new series of flooring products aimed at zero-emission electric buses. The Transflor Artis, Metris, and Sonis ranges were engineered to balance insulation, weight, and recyclability. According to Serge Townsend, Global Commercial Manager for Transport at Altro, design freedom and improved service efficiency were prioritized to accommodate new challenges associated with electric-vehicle fleet operation.

Vinyl-based resilient safety floor solutions were described by Altro as “highly durable, non-porous, non-shedding, and stain resistant,” supporting rapid cleaning cycles in city buses. It was noted that weight reductions of up to 20% had been achieved in heavy-duty city bus models since 2017 through compact vinyl designs.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 365.2 Million |

| Market Value (2035F) | USD 540.7 Million |

| CAGR (2025 to 2035) | 4.0% |

Tarkett launched its Trend Oak Natural and Smart Walnut lines for bus and coach interiors in 2024. The products were described as “durable, resilient safety floors with high abrasion resistance,” formulated specifically for coach and transport use . Emphasis was placed on recyclable, slip-resistant flooring for high-traffic applications.

Lightweight, low-profile flooring solutions with acoustic insulation were introduced in 2024. Altro’s Transflor Metris Custom flooring reportedly provided up to 15 dB of airborne sound reduction while maintaining a layer thickness below 3 mm-meeting acoustic standards under ISO 717-2.

Market demand has been driven by regulatory and operational needs, including weight control for EV range maximisation, compliance with accessibility and slip-resistance regulations, and crew-cleanable interiors. Flooring manufacturers have responded with pre-cut, self-adhesive, and reverse-welded installation systems to reduce downtime during fleet maintenance.

Sustainability and lifecycle management have been addressed via recyclable vinyl compositions and participation in training initiatives like the Tarkett Academy to support proper installation and repair techniques across global regions

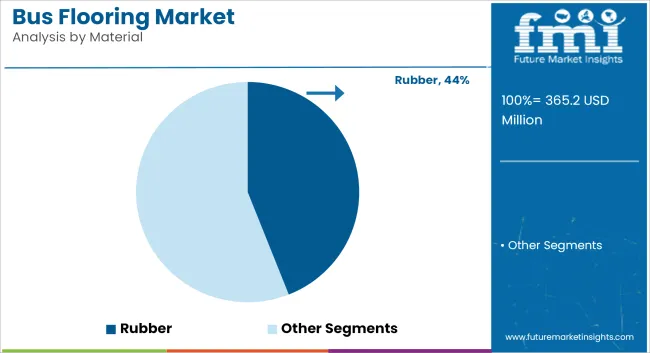

Rubber flooring is estimated to account for approximately 44% of the global bus flooring market share in 2025 and is projected to grow at a CAGR of 4.2% through 2035. Its dominance stems from favorable characteristics such as slip resistance, noise insulation, thermal comfort, and ease of cleaning-making it well-suited for urban and intercity transit buses. In 2025, public and private fleet operators continue to prioritize rubber-based flooring to meet passenger safety standards and reduce operational maintenance.

The material’s resilience under frequent boarding, resistance to chemical agents, and compatibility with anti-bacterial coatings make it preferred in both standard and low-floor bus designs. Manufacturers also offer customizable textures and color variants to align with branding or regulatory requirements in mass transit systems.

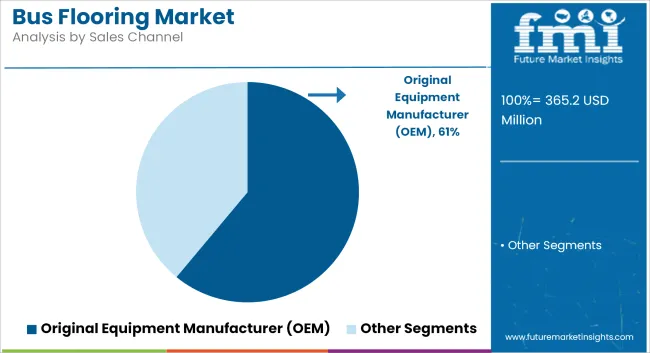

Original Equipment Manufacturer (OEM) sales are estimated to hold nearly 61% of the global bus flooring market in 2025 and are expected to grow at a CAGR of 4.1% through 2035. OEMs procure flooring materials that comply with fire safety, slip resistance, and durability specifications directly during vehicle assembly.

This integration supports consistent quality control and minimizes retrofitting needs in end-user fleets. In 2025, OEMs across Asia-Pacific, Europe, and North America continue to partner with certified flooring suppliers to meet stringent public transportation safety codes and design modular interiors. With the rising trend toward electric and hybrid buses, OEMs increasingly seek lightweight and recyclable materials like rubber and aluminum composites, further strengthening the OEM-driven demand.

Durability Concerns and Installation Complexities in Harsh Environments

This type of flooring already faces one of the most significant challenges in the bus floor market when it comes to performance in harsh conditions such as frequent traffic, cleaning, and wear.

And flooring systems that buckling, warping or delaminating under high stress, such as in buses need to be able to withstand such conditions with minimal maintenance a tall order in regions that face extreme temperature swings or high humidity. Also, an inert flooring system is a long process that can lead to delays,which results in a higher total cost of ownership for transit operators.

Rising Demand for Eco-Friendly and Smart Flooring Solutions

This is a definite opportunity for manufacturers of environment friendly, smart, and lightweight flooring systems. The market is moving toward recyclable and low-emission materials consistent with global environmental goals. Further, advancements in technology like embedded sensors to count passengers, heated floor technologies, and modular structures for rapid repair are also making headway.

Companies that specialize in the supply and specification of an array of advanced construction solutions supporting the goals of rapid installation, antimicrobial surfaces, and sophisticated fire-resistance properties will be poised to capture their share of future transit modernization programs around the world.

The United States Bus Flooring Market is estimated to rise with 4.4% CAGR between 2025 and 2035. Growth is mainly attributed to the country’s tensile overhaul of public transport facilities and focus on sustainable mobility solutions. Federal and state-level funding to electric bus buses and low-emission transport systems is driving demand for advanced, lightweight and slip-resistant flooring materials.

Rising demand for ADA-compliant flooring used in accessible transit has prompted manufacturers to rethink as far as product design and durability of the materials. Growing awareness regarding the advantages of using composite and vinyl flooring in mass transit fleets is further driving the market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.4% |

The United Kingdom Bus Flooring Market would witness a CAGR of 3.8% during 2025 and 2035. Involving investments in sustainable public transport and net-zero emission goals, are modernising municipal bus fleets. This also leads to the incorporation of lightweight, durable, and easy-to-clean flooring.

In the UK, applications to phase out diesel buses are encouraging operators to retrofit their interiors (including flooring) to prepare for accepting electric or hybrid vehicles. Additionally, collaborations between the public and private sectors for urban transit development are indirectly driving demand for anti-slip and antibacterial flooring materials designed for high foot traffic areas.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.8% |

The Bus Flooring Market in continental Europe would be growing with the CAGR of 4.1% during this time period of 2025 to 2035. Countries as diverse as Germany, France and the Netherlands are ramping up investments in regional and intercity bus services, including all-electric and hydrogen-powered fleets.

With this, an increasing need for lightweight, fire-resistant, and eco-certified flooring systems to keep up with changing regulations and safety standards. The EU Green Deal initiatives and urban transport sustainability targets apply more pressure to develop higher grade materials like PVC composites and rubber-based flooring, providing advanced comfort and hygiene for the passengers to OEMs and flooring makers.

| Region | CAGR (2025 to 2035) |

|---|---|

| E urope | 4.1% |

Japan Bus Flooring Market size is expected to register a decent CAGR of 3.6% during the forecast periodic time period. Strong government support for sustainable transport infrastructure and growing demand for aging friendly public transportation has led to gradual but steady demand for low maintenance, high friction flooring on city and intercity buses.

Exciting new antimicrobial surface technologies and vibro damping flooring materials are getting attention particularly for metropolitan transit systems. To meet the country’s ambitious environmental targets, Japanese manufacturers are also focusing on recyclable flooring options. We expect smart mobility programs and urban transit revitalization initiatives to drive more.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

In South Korea, the Bus Flooring Market will register a 4.2% CAGR during the forecast period. Growing demand for resilient, noise-reducing, and flame-retardant flooring solutions are also being supported by government-led initiatives to modernize public transit systems in urban centres, particularly in Seoul and Busan.

As South Korea moves to fully electrify its bus fleet by the end of the decade, it is causing OEMs to reassess such things as interior components, like flooring systems that could enhance thermal insulation and occupant safety. Domestic suppliers are stepping up R&D on environmentally sustainable materials that provide a balance of performance, aesthetics, and durability.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The market for Bus Flooring is growing at a rapid pace due to increasing demand for durable, lightweight and slip resistant flooring materials in public and private transport systems. Suppliers are working on eco-friendly and antimicrobial flooring options to improve passenger health and comfort.

Players in the industry are also utilizing advanced composite technologies to lighten the weight of vehicles and enhance fuel economy. Key players in the mass transit flooring systems space are dedicated to rubber, vinyl and thermoplastic flooring systems.

Other Key Players

Additional companies bring diversity in materials, designs, and regional availability to the bus flooring market:

The overall market size for the Bus Flooring Market was USD 365.2 Million in 2025.

The Bus Flooring Market is expected to reach USD 540.7 Million in 2035.

The demand is driven by increasing urbanization, expansion of public transportation networks, and advancements in flooring materials emphasizing safety, durability, and environmental sustainability.

The top 5 countries driving market growth are the USA, UK, Europe, Japan, and South Korea.

The Rubber segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Busbar for Industrial Market Size and Share Forecast Outlook 2025 to 2035

Bus Isolator Market Size and Share Forecast Outlook 2025 to 2035

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Bus Bellows Market Insights – Growth & Forecast 2025 to 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Competitive Overview of Business Analytics BPO Services Companies

Business Card Holder Market from 2024 to 2034

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Bus Chassis Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA