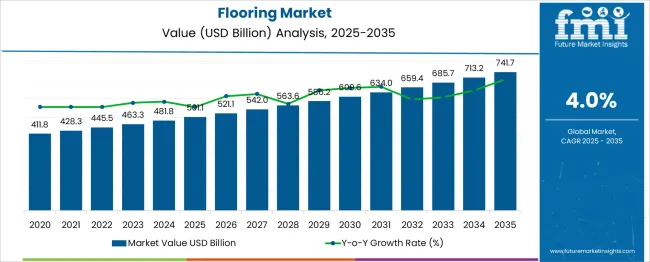

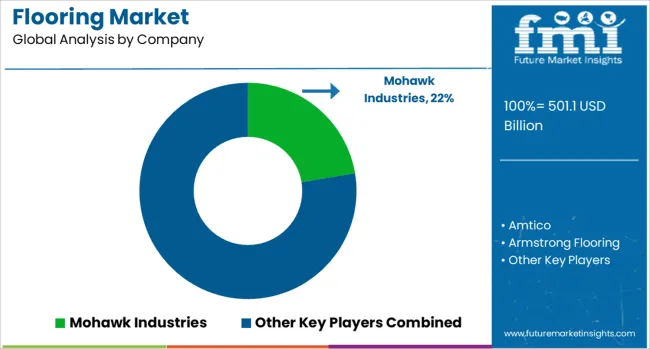

The Flooring Market is estimated to be valued at USD 501.1 billion in 2025 and is projected to reach USD 741.7 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

| Metric | Value |

|---|---|

| Flooring Market Estimated Value in (2025 E) | USD 501.1 billion |

| Flooring Market Forecast Value in (2035 F) | USD 741.7 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The flooring market is growing steadily, driven by increased demand in residential construction and renovation projects. Rising consumer preference for durable and aesthetically pleasing flooring options has encouraged the adoption of diverse product types. Non-resilient flooring is gaining attention due to its long-lasting nature and ability to withstand heavy foot traffic.

Expanding urbanization and growing disposable incomes have fueled investments in residential infrastructure, supporting market growth. Additionally, design trends favoring natural materials and sustainable products have influenced product development.

The market outlook is positive as homeowners seek flooring solutions that combine functionality with style. Accessibility through multiple retail channels has also enhanced consumer reach. Segmental growth is expected to be led by Non-Resilient Flooring products and the Residential application segment, reflecting consumer priorities for durability and comfort in home environments.

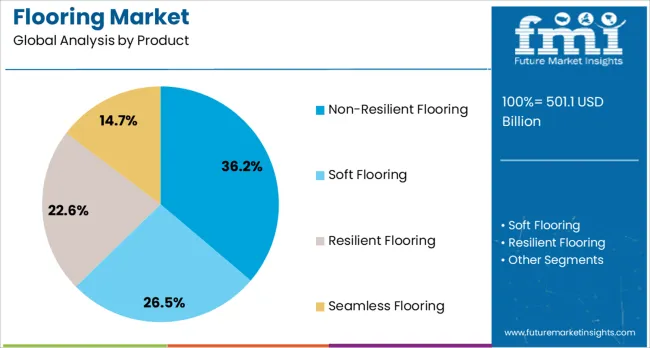

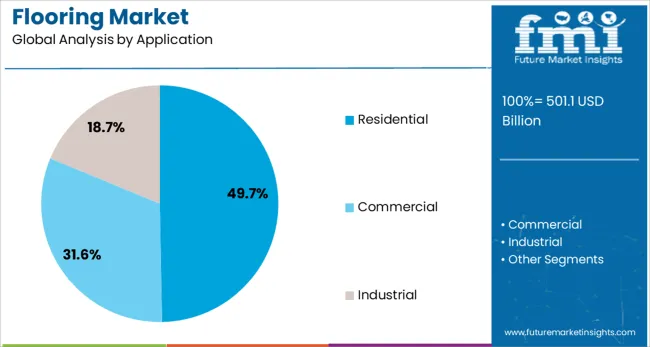

The flooring market is segmented by product and application and geographic regions. By product of the flooring market is divided into Non-Resilient Flooring, Soft Flooring, Resilient Flooring, and Seamless Flooring. In terms of application of the flooring market is classified into Residential, Commercial, and Industrial. Regionally, the flooring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Non-Resilient Flooring segment is expected to account for 36.2% of the flooring market revenue in 2025, maintaining its leadership in product types. This segment’s growth can be attributed to the durability and low maintenance requirements of non-resilient materials such as hardwood, ceramic, and stone. These flooring types are preferred for their resistance to wear and ability to enhance the aesthetic value of interiors.

Consumers have increasingly selected non-resilient flooring for areas with high foot traffic and where longevity is a priority. The segment also benefits from advancements in installation techniques and surface treatments that improve performance and ease of care.

As demand for premium and sustainable flooring continues, the Non-Resilient Flooring segment is poised to sustain its market share.

The Residential segment is projected to hold 49.7% of the flooring market revenue in 2025, retaining its position as the largest application segment. Growth in this segment is driven by rising home construction and renovation activities, especially in urban and suburban regions. Homeowners are increasingly investing in quality flooring materials that offer comfort, durability, and design appeal.

The segment has benefited from greater awareness of flooring options that complement interior aesthetics and improve living environments. Additionally, government incentives for housing development and improved mortgage access have boosted residential construction.

Consumer demand for eco-friendly and low-emission flooring products has also influenced purchasing decisions. As lifestyle trends continue to emphasize home improvement, the Residential segment is expected to remain the key revenue contributor.

Flooring market growth is driven by rising renovation rates, modular material innovation and increasing online sales channels. In 2024 approximately 34 % of new home and commercial flooring projects used prefinished hardwood, tile-vinyl plank or engineered composite formats. Demand patterns diverge across regions-North America sees strong laminate upgrades, while Europe shifts toward luxury vinyl tiles in retail spaces, and Asia focuses on bamboo-engineered panels. Channel evolution brings more direct-to-consumer supply chains and fast-track installation models. Pricing models and supply support services are adapting to shorter project cycles and growing consumer flexibility demands.

Across North American residential markets builders and remodelers adopted prefinished hardwood and laminate systems that eliminate onsite sanding. This transition cut installation cycles by 18 % and reduced contractor scheduling conflicts. DIY-friendly vinyl planks with click-lock systems grew by 21 % in European home renovation channels. Asian real estate developers deployed engineered bamboo flooring layered with moisture-resistant cores in 42 % of new apartment projects, reducing acclimation time. Distribution centres consolidated stock of LVT, laminate and prefinished options, lowering floor stock inventory by 14 %. Retailer partnerships with packaging-first suppliers increased turnaround speed, enabling faster delivery windows for fewer minimum order lines.

Despite strong demand, suppliers face volatility in raw material and composite resin costs, rising 9-13 % in 2024. Certification requirements for formaldehyde emissions and fire ratings differ across countries, adding four to six weeks to new product approvals. Importers report tariff and documentation delays, slowing cross-border logistics by up to 8 days in Asia and Europe. Complex pattern-matching and multi-format installations also challenge installers-a 7 % increase in wasted material was reported where installers lacked calibration tools. Smaller flooring firms with manual-fit operations saw average downtime of 11 % due to supply mismatch and scheduling inefficiencies.

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK | 3.8% |

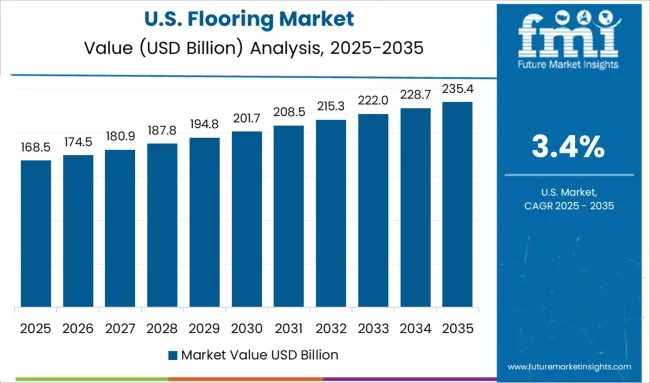

| USA | 3.4% |

| Brazil | 3.0% |

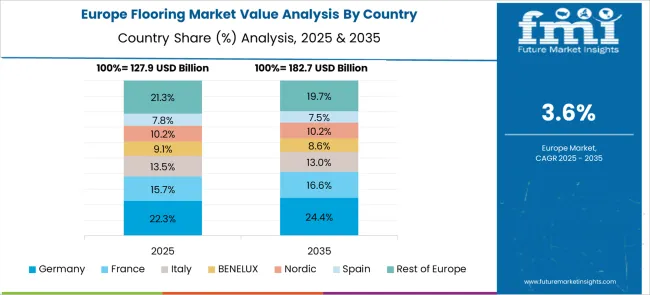

The global flooring market is projected to expand at a 4.0% CAGR between 2025 and 2035. China leads with a 5.4% growth rate, translating to a +35% premium over the global average. India follows with 5.0%, reflecting a +25% margin, while Germany records 4.6%, or +15% above the baseline. The UK, at 3.8%, trails slightly below the global trend, and the USA, with 3.4%, lags further at -15%.

China and India are seeing stronger demand due to increasing commercial and residential construction activity. Germany maintains steady growth driven by investments in modern flooring technologies. Slower replacement cycles and renovation trends in the UK and US contribute to relatively moderate expansion in those markets. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

The flooring market in China is projected to expand at a CAGR of 5.4% between 2025 and 2035. Rapid urban construction, commercial fit-outs, and retail development are the key contributors. Wood-look vinyl and ceramic tiles dominate both residential and commercial segments. Domestic producers like Nature Home and Der International account for a large share.

Export-oriented demand from Southeast Asia and Africa supports volume growth. Renovation projects in Tier 1 cities also accelerate laminate flooring uptake. Newer product categories with anti-slip and antimicrobial coatings have gained interest in high-density urban areas.

The flooring market in India is expected to grow at a CAGR of 5.0% over the next decade. Residential construction remains the main demand source, especially for ceramic and vitrified tiles. South and West India continue to drive premium vinyl demand in luxury housing. Kajaria Ceramics, Somany, and H&R Johnson lead with broad dealer networks. Infrastructure upgrades in airports and metro stations also influence the adoption of granite and engineered wood flooring. The shift from traditional materials like cement to designer tiles improves retail margins.

The flooring market in Germany is forecast to grow at a CAGR of 4.6% through 2035. Renovation of residential buildings under energy-efficiency directives supports growth. Oak parquet and engineered wood are commonly used in high-income households.

Tarkett, MeisterWerke, and Parador lead the market. Increasing non-residential demand is seen in schools and healthcare facilities. PVC-free resilient flooring is gaining preference due to stricter VOC regulations. Imports from Poland and Austria meet commercial segment demand. Digitally printed vinyl is growing in hospitality installations.

The flooring market in the United Kingdom is projected to grow at a CAGR of 3.8%. Hybrid flooring options such as SPC and rigid-core vinyl have shown strong performance in new builds. Carpets are still preferred in older residential units but are gradually losing share.

Top players include Victoria PLC and Carpetright. Non-slip surfaces and water-resistant materials are now standard in kitchen and bathroom installations. Imports from Europe have declined post-Brexit, leading to increased local sourcing and private-label launches by retailers.

The United States flooring market is expected to grow at a CAGR of 3.4% over the forecast period. Single-family home remodeling and commercial upgrades in office spaces are key drivers. Luxury vinyl tile (LVT) and engineered hardwood are preferred in urban areas.

Shaw Floors, Mohawk Industries, and Armstrong Flooring are among the leading players. Large-format tile formats are gaining interest in high-end residential applications. DIY sales through Lowe’s and Home Depot have increased post-pandemic.

The global flooring market is led by Mohawk Industries, with major competitors including Shaw Floors, Tarkett, and Armstrong Flooring offering diverse solutions across residential and commercial segments. Luxury vinyl tile (LVT) specialists such as Amtico and Polyflor Ltd. are gaining market share through innovative designs, while carpet producers like The Dixie Group focus on sustainable fibers.

The industry is experiencing a shift toward waterproof flooring options, with Mannington Mills and Congoleum Corp. expanding their rigid core product lines. European manufacturers including Forbo Flooring Systems and Gerflor lead in commercial resilient flooring, particularly in healthcare and education sectors. Emerging trends include digital printing for realistic wood/stone visuals and increased use of recycled materials. The market faces raw material cost volatility but benefits from strong renovation activity in North America and Europe.

In April 2025, Lowe’s entered into a definitive agreement to acquire Artisan Design Group (ADG) for approximately US USD 1.3 billion, targeting ADG’s expertise in flooring, cabinetry, and countertop installation services. ADG generated around USD 1.8 billion in revenue in fiscal 2024 and operates a nationwide installer network across 132 facilities and 3,200 technicians.

| Item | Value |

|---|---|

| Quantitative Units | USD 501.1 Billion |

| Product | Non-Resilient Flooring, Soft Flooring, Resilient Flooring, and Seamless Flooring |

| Application | Residential, Commercial, and Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mohawk Industries, Amtico, Armstrong Flooring, Congoleum Corp., Forbo Flooring Systems, Gerflor, Interface Inc., Kingspan Group Public Ltd. Company, Mannington Mills Inc., Polyflor Ltd., Pergo, Shaw Floors, Tarkett, Beaulieu, Balta, Flowcrete, Delconca, Instarmac, Parador, The Dixie Group, Hyosung Swan Carpet, EGGER, SWISS KRONO Holding AG, and Neuhofer |

| Additional Attributes | Dollar sales by material type (vinyl, ceramic tiles, engineered wood) and application (residential, commercial, industrial), demand dynamics across renovation projects, new housing starts, and workspace redesigns, regional trends led by Asia‑Pacific with North America advancing resilient format adoption, innovation in click-lock installation, waterproof core technologies, and low-VOC surface treatments, and environmental impact of recycling mandates, indoor air quality norms, and raw material sourcing restrictions. |

The global flooring market is estimated to be valued at USD 501.1 billion in 2025.

The market size for the flooring market is projected to reach USD 741.7 billion by 2035.

The flooring market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in flooring market are non-resilient flooring, soft flooring, resilient flooring and seamless flooring.

In terms of application, residential segment to command 49.7% share in the flooring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Eco Flooring Market Analysis - Growth, Demand & Forecast 2025 to 2035

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Textile Flooring Market Trends & Growth 2025 to 2035

Cleanroom Flooring Market Growth - Trends & Forecast 2024 to 2034

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Automotive Flooring Market Size and Share Forecast Outlook 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Middle East Wood Flooring Market Growth – Trends & Forecast 2024-2034

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

WPC Floorings Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA