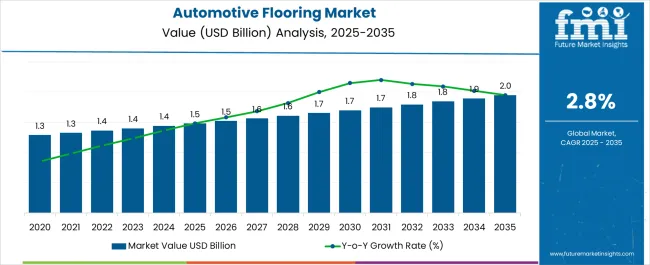

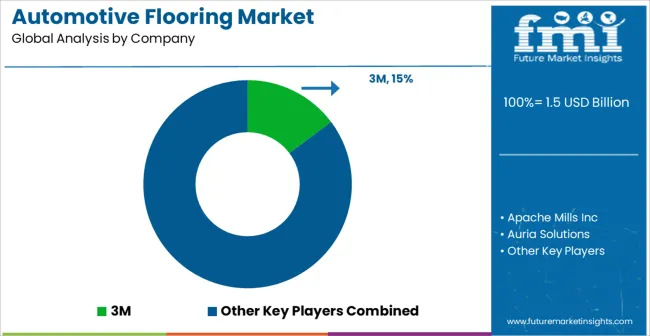

The Automotive Flooring Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.0 billion by 2035, registering a compound annual growth rate (CAGR) of 2.8% over the forecast period.

| Metric | Value |

|---|---|

| Automotive Flooring Market Estimated Value in (2025 E) | USD 1.5 billion |

| Automotive Flooring Market Forecast Value in (2035 F) | USD 2.0 billion |

| Forecast CAGR (2025 to 2035) | 2.8% |

The Automotive Flooring market is experiencing sustained growth, driven by increasing demand for durable, functional, and aesthetically appealing flooring solutions across passenger and commercial vehicles. Rising vehicle production globally, particularly in emerging markets, is supporting the expansion of automotive flooring adoption. Advanced manufacturing techniques, including tufted non-needle punch processes, and the use of innovative materials such as rubber and synthetic blends, are enhancing product performance in terms of durability, stain resistance, and ease of maintenance.

Growing consumer preference for comfort, safety, and vehicle customization is encouraging manufacturers to develop high-quality flooring solutions tailored to specific vehicle segments. Additionally, stringent regulatory requirements regarding fire resistance, slip resistance, and environmental compliance are shaping material selection and product design.

Integration of lightweight, sustainable, and recyclable materials is further influencing market growth As automotive manufacturers focus on providing premium interior experiences while reducing vehicle weight and environmental impact, the automotive flooring market is expected to sustain strong growth, with innovations in materials, processes, and design driving adoption over the coming decade.

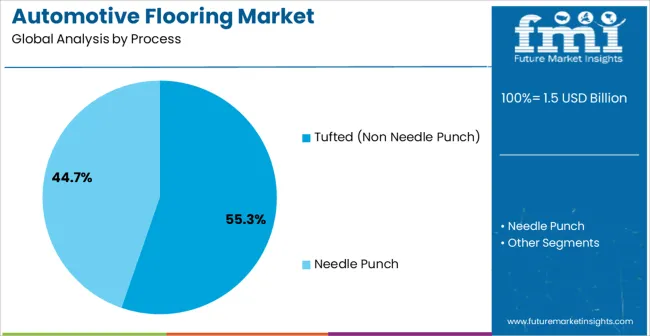

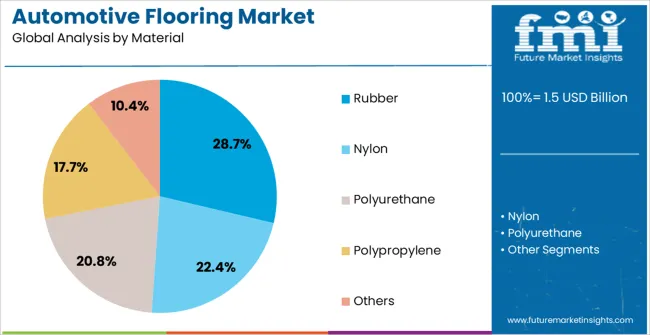

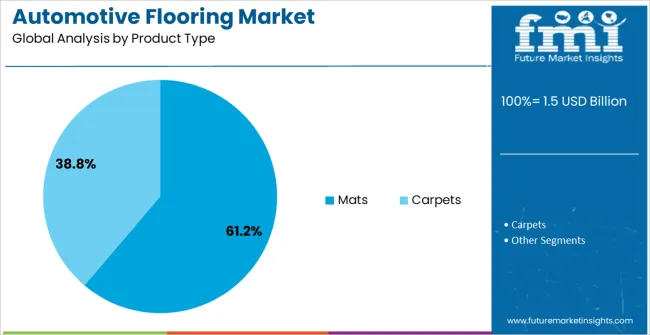

The automotive flooring market is segmented by process, material, product type, channel, vehicle type, and geographic regions. By process, automotive flooring market is divided into Tufted (Non Needle Punch) and Needle Punch. In terms of material, automotive flooring market is classified into Rubber, Nylon, Polyurethane, Polypropylene, and Others. Based on product type, automotive flooring market is segmented into Mats and Carpets. By channel, automotive flooring market is segmented into After Market and OEM. By vehicle type, automotive flooring market is segmented into Passenger Car (PC), Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV). Regionally, the automotive flooring industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tufted non-needle punch process segment is projected to hold 55.3% of the market revenue in 2025, establishing it as the leading process category. Growth is being driven by the efficiency, scalability, and versatility of this manufacturing technique, which enables high-quality flooring products with uniform texture and durability. The process allows precise control over pile density, thickness, and resilience, resulting in products that meet stringent automotive performance and safety standards.

Cost-effective production and reduced material wastage further support adoption, making it suitable for large-scale manufacturing. Tufted non-needle punch flooring is also compatible with a wide range of materials, allowing customization to meet vehicle-specific requirements for comfort, noise reduction, and thermal insulation.

Increasing demand for premium interiors, combined with rising vehicle production and replacement demand in aftermarkets, is expected to reinforce the leading position of this process segment Continued innovations in tufting technology, sustainability improvements, and enhanced material integration are likely to maintain its dominance in the automotive flooring market.

The rubber material segment is anticipated to account for 28.7% of the market revenue in 2025, making it the leading material category. Growth is being driven by the inherent durability, flexibility, and ease of maintenance offered by rubber-based flooring products. Rubber provides excellent resistance against wear, moisture, chemicals, and temperature fluctuations, ensuring long-term performance in both passenger and commercial vehicles.

Its non-slip properties contribute to vehicle safety, while customization options in texture, color, and embossing enhance aesthetic appeal. Compatibility with modern manufacturing processes, including tufted and molded techniques, further strengthens adoption.

Rising consumer expectations for comfort, ease of cleaning, and noise reduction in vehicle interiors are also supporting growth in this segment As automotive manufacturers continue to focus on high-performance, safe, and customizable interiors, rubber flooring is expected to maintain its leading share, driven by its versatility, resilience, and alignment with evolving vehicle design and sustainability trends.

The mats product type segment is projected to hold 61.2% of the market revenue in 2025, establishing it as the leading product category. Growth in this segment is being driven by the ease of installation, customization, and replacement offered by automotive mats. Mats provide targeted protection for vehicle floors against dirt, moisture, abrasion, and chemical exposure, extending the life of interior flooring.

The ability to use a variety of materials, including rubber, polypropylene, and carpet blends, allows for cost-effective and premium product offerings tailored to passenger preferences and vehicle specifications. Increasing consumer awareness of interior maintenance, coupled with the rising trend of vehicle personalization, is reinforcing demand.

Mats are also widely adopted in commercial vehicles where durability and hygiene are critical As automotive manufacturers and aftermarket providers focus on high-quality, versatile, and aesthetically appealing interior solutions, the mats product type is expected to maintain its market dominance, supported by advancements in material technology, design customization, and ease of maintenance.

Stringent regulations for increasing provision of safe and economical automotive flooring by automotive industry governing bodies for preventing safety hazards has created opportunities for vehicle manufacturers and OEMs. Automotive industry is witnessing increasing demand for customized flooring systems for enhancing ergonomic value of passenger cabins, thereby triggering industry growth.

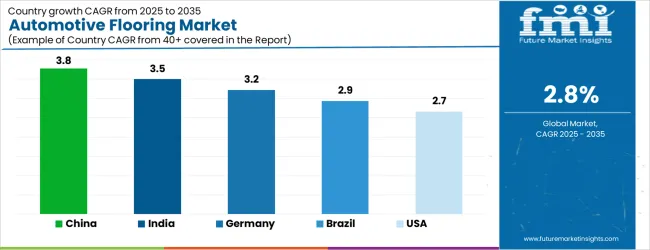

| Country | CAGR |

|---|---|

| China | 3.8% |

| India | 3.5% |

| Germany | 3.2% |

| Brazil | 2.9% |

| USA | 2.7% |

| UK | 2.4% |

| Japan | 2.1% |

The Automotive Flooring Market is expected to register a CAGR of 2.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 3.8%, followed by India at 3.5%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 2.1%, yet still underscores a broadly positive trajectory for the global Automotive Flooring Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.2%. The USA Automotive Flooring Market is estimated to be valued at USD 524.6 million in 2025 and is anticipated to reach a valuation of USD 524.6 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 68.1 million and USD 45.5 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Process | Tufted (Non Needle Punch) and Needle Punch |

| Material | Rubber, Nylon, Polyurethane, Polypropylene, and Others |

| Product Type | Mats and Carpets |

| Channel | After Market and OEM |

| Vehicle Type | Passenger Car (PC), Light Commercial Vehicle (LCV), and Heavy Commercial Vehicle (HCV) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | 3M, Apache Mills Inc, Auria Solutions, Auto Custom Carpets Inc, Autoneum, Dorsett Industries, DuPont, Foss Performance Materials, Freudenberg SE, GAHH, LLC, Gemini Group Inc., and Hyosung Corporation |

The global automotive flooring market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the automotive flooring market is projected to reach USD 2.0 billion by 2035.

The automotive flooring market is expected to grow at a 2.8% CAGR between 2025 and 2035.

The key product types in automotive flooring market are tufted (non needle punch) and needle punch.

In terms of material, rubber segment to command 28.7% share in the automotive flooring market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Domain Control Module Market Forecast and Outlook 2025 to 2035

Automotive Remote Diagnostic Market Forecast and Outlook 2025 to 2035

Automotive Seating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Appearance Chemical Market Size and Share Forecast Outlook 2025 to 2035

Automotive-grade Inertial Navigation System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Thin IGBT Module Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hydrogen Leak Detection Sensors Market Size and Share Forecast Outlook 2025 to 2035

Automotive Hybrid IGBTs Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Extraction Hose Reels Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electroplating Service Market Size and Share Forecast Outlook 2025 to 2035

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA