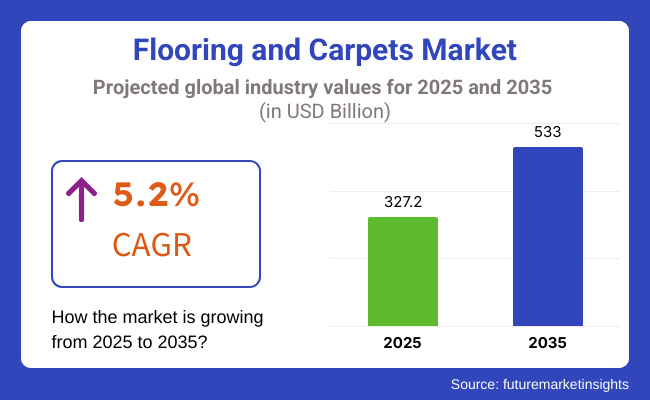

The flooring and carpets market is set for steady growth from 2025 to 2035, driven by increasing urbanization, rising demand for aesthetic interiors, and advancements in sustainable flooring solutions. The market size is projected to expand from USD 327.2 billion in 2025 to USD 533.0 billion by 2035, registering a compound annual growth rate (CAGR) of approximately 5.2% over the forecast period.

Growing construction activities in residential and commercial spaces, along with the increasing preference for luxury and customized flooring solutions, are key factors fueling market expansion. Technological innovations in eco-friendly materials, smart flooring, and antimicrobial carpets are shaping market trends. Additionally, the demand for modular carpets and sustainable flooring options, such as recycled and bio-based materials, is expected to witness a surge.

Consumers increasingly prefer high-end flooring materials such as hardwood, marble, and luxury vinyl tiles (LVT) for aesthetic appeal and durability. Sustainability trends drive demand for eco-friendly flooring options, including bamboo, reclaimed wood, and recycled carpets, with brands emphasizing low-VOC and non-toxic materials.

The shift towards modular and customizable carpet solutions allows consumers to create unique interior spaces. Carpet tiles, area rugs, and patterned wall-to-wall carpets gain traction in residential and commercial spaces. Leading brands offer stain-resistant, hypoallergenic, and easy-to-maintain options, catering to modern lifestyle needs.

The hospitality, office, and retail sectors increasingly adopt premium flooring and carpets to enhance ambiance and functionality. In residential spaces, home renovation trends boost demand for stylish and durable flooring solutions. Smart carpets with integrated temperature control and noise-reduction properties gain popularity.

Online retail platforms provide extensive flooring and carpet selections, with virtual room visualizers and AI-driven recommendations simplifying customer choices. Smart flooring technologies, including self-cleaning surfaces and IoT-enabled heating systems, gain consumer interest. Digital marketing and influencer collaborations further boost brand visibility and sales.

North America is expected to dominate the flooring and carpets market, driven by the high demand for luxury vinyl tiles (LVT), eco-friendly carpets, and innovative flooring solutions. The USA and Canada are witnessing increased residential and commercial remodeling activities, boosting market demand. Additionally, the growing trend of smart homes and IoT-integrated flooring solutions is gaining traction, further fueling industry growth.

Europe remains a key player in the market, with strong demand for sustainable and premium flooring solutions. Countries such as Germany, the UK, and France are experiencing growth due to strict environmental regulations promoting eco-friendly flooring materials. The rising preference for underfloor heating-compatible carpets and non-toxic, biodegradable materials is shaping consumer service purchasing decisions.

Asia-Pacific is expected to witness the fastest growth, driven by rapid urbanization, increasing disposable income, and expansion in the residential and commercial real estate sectors. Countries like China, India, and Japan are experiencing rising demand for cost-effective yet durable flooring solutions. The hospitality and retail sectors are also major contributors, with a growing preference for aesthetic and easy-to-maintain flooring options.

The Middle East & Africa region is experiencing growth due to increasing investments in commercial infrastructure, luxury hotels, and premium real estate projects. Countries like the UAE and Saudi Arabia are seeing high demand for high-quality carpets and premium flooring solutions, particularly in the hospitality and corporate sectors. Additionally, rising interest in sustainable and temperature-resistant flooring solutions is driving innovation in the market.

High Raw Material Costs and Market Saturation in Developed Regions

One of the key challenges in the flooring and carpets market is the high cost of raw materials, particularly for premium and eco-friendly options. Additionally, developed regions face market saturation, limiting the scope for new entrants. Volatility in raw material prices and supply chain disruptions further add to the cost burden on manufacturers.

To tackle these challenges, industry players focus on cost-effective manufacturing processes, strategic sourcing of sustainable materials, and exploring emerging markets for growth opportunities.

Rise of Smart and Sustainable Flooring Solutions

The growing demand for smart and sustainable flooring presents a significant opportunity for market expansion. Consumers are increasingly seeking flooring solutions that are durable, energy-efficient, and environmentally friendly. Innovations in antimicrobial carpets, self-cleaning flooring, and IoT-integrated solutions are transforming the industry.

Additionally, the rise of e-commerce and direct-to-consumer sales channels makes flooring products more accessible, allowing consumers to explore customized and modular flooring options. Companies prioritizing sustainability, digital integration, and personalized solutions will gain a competitive edge in the evolving flooring and carpets market.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 85.30 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 47.20 |

| Country | India |

|---|---|

| Population (millions) | 1,450.9 |

| Estimated Per Capita Spending (USD) | 22.10 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 72.80 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 65.40 |

The USA flooring and carpets market, valued at USD 29.46 Billion, is driven by residential renovations, premium carpeting, and sustainable flooring solutions. Hardwood, luxury vinyl tiles (LVT), and eco-friendly materials dominate demand. E-commerce and home improvement retailers significantly impact consumer choices, while DIY flooring trends fuel additional market growth.

China’s USD 66.96 Billion flooring and carpets industry benefits from rapid urbanization, large-scale commercial projects, and increasing disposable incomes. Luxury vinyl tiles, engineered wood, and ceramic flooring are popular choices. Government policies promoting sustainable infrastructure and a surge in modern home décor trends drive the expansion of premium flooring solutions.

India’s USD 32.06 Billion flooring market is growing due to urbanization, rising construction activities, and affordable flooring solutions. Ceramic tiles and engineered wood are in high demand, while handwoven carpets from regions like Kashmir and Rajasthan remain a strong niche. Government housing schemes and middle-class home improvements boost market growth.

Germany’s USD 6.12 Billion market prioritizes high-quality, sustainable flooring solutions. Engineered wood, laminate, and cork flooring are in demand, particularly in eco-conscious households. Smart home integration and underfloor heating solutions further shape consumer preferences. Strict environmental regulations and premium imports influence the country's high per capita spending.

The UK flooring and carpets market, valued at USD 4.46 Billion, is driven by home refurbishments, commercial real estate growth, and demand for premium carpets. Luxury vinyl tiles and sustainable wool carpets dominate sales. E-commerce and direct-to-consumer brands have gained traction alongside a rising preference for custom flooring solutions.

The flooring and carpets market is witnessing steady growth, driven by rising demand for aesthetic home interiors, increasing construction activity, and sustainability-conscious consumer preferences. A survey of 250 respondents across the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East flooring and carpet highlights key trends shaping purchasing behavior.

70% of respondents prioritize durability and ease of maintenance, with 68% in the USA and the UK favoring hardwood and luxury vinyl flooring for their longevity and low upkeep. 65% of consumers in Japan and Korea prefer minimalist and eco-friendly flooring options, such as bamboo market and engineered wood, while 58% in Southeast Asia and China seek cost-effective yet stylish tile and laminate flooring.

Pricing sensitivity varies, with 60% of USA and EU respondents willing to spend USD 1,500+ on premium hardwood or luxury carpets. In contrast, only 45% in Southeast Asia and China opt for high-end flooring solutions. 52% of global buyers expect flooring products to offer a balance of affordability, aesthetic appeal, and long-term value, making mid-range options a significant market driver.

E-commerce is expanding, with 64% of respondents in the USA, UK, and China preferring to explore flooring options online before purchasing from platforms like Home Depot, Wayfair, and Alibaba. 50% of buyers in Japan and Korea still prefer physical showrooms, where they can assess texture, quality, and installation services before purchasing. 47% of respondents globally consider expert recommendations and home renovation trends as key influences in their decision-making process.

Sustainability is an emerging priority, with 58% of respondents in the UK and EU favoring recycled materials, non-toxic finishes, and eco-conscious carpet fibers. 55% of buyers in Australia and the Middle East seek luxury, custom-designed carpets, while 50% in Southeast Asia and China prioritize moisture-resistant and easy-to-clean flooring solutions.

Premium hardwood and luxury carpet demand is high in North America and Europe, while affordable yet durable flooring materials, such as laminate and vinyl, dominate in Southeast Asia and China. E-commerce, customization, and sustainable materials are reshaping the market, making digital engagement, AR-powered visualization tools, and smart flooring innovations crucial for brands.

Local manufacturers have an opportunity to introduce region-specific designs and materials, while global players must emphasize durability, eco-friendliness, and affordability to capture market share. The flooring and carpets market is evolving, with strong opportunities in sustainable materials, smart flooring technology, and digitally driven shopping experiences.

| Market Shift | 2020 to 2024 |

|---|---|

| Material Innovation | Brands focused on eco-friendly materials such as bamboo, recycled wood, and PET carpets. Water-resistant and antimicrobial flooring solutions gained traction. |

| Sustainability & Circular Economy | Companies adopted recycled and low-VOC flooring materials. Cradle-to-cradle certification and carbon-neutral manufacturing gained popularity. |

| Technology & Smart Features | Smart carpets with IoT-enabled sensors for foot traffic analysis and safety alerts emerged. Flooring with integrated underfloor heating and energy-efficient properties gained traction. |

| Market Expansion & Consumer Adoption | Demand surged in residential and commercial segments, driven by rising disposable incomes and home improvement trends. Online customization tools and virtual room visualization enhanced consumer experience. |

| Regulatory & Compliance Standards | Governments imposed stricter environmental regulations on carpet and flooring production. Industry standards for sustainable materials and indoor air quality improved. |

| Customization & Personalization | Modular flooring solutions allow easy customization and installation. Digital platforms enable customers to personalize textures, patterns, and colors. |

| Influencer & Social Media Marketing | Interior designers and home improvement influencers played a significant role in marketing luxury and sustainable flooring. Social media platforms like Instagram and Pinterest influenced design trends. |

| Consumer Trends & Behavior | Consumers prioritized durability, ease of maintenance, and sustainability. The demand for hypoallergenic and pet-friendly carpets increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Material Innovation | AI-driven material selection allows for hyper-personalized, durable flooring solutions. Biodegradable and self-repairing smart materials dominate the market. |

| Sustainability & Circular Economy | Fully circular flooring solutions with zero waste have become the industry standard. Innovations in bio-based polymers and carbon-negative carpets reshape sustainability trends. |

| Technology & Smart Features | AI-powered flooring adapts to temperature, pressure, and wear. Self-cleaning and air-purifying flooring systems become mainstream in residential and commercial spaces. |

| Market Expansion & Consumer Adoption | AI-driven consumer insights drive demand for personalized flooring solutions. Growth accelerates in emerging economies with localized production and supply chain optimization. |

| Regulatory & Compliance Standards | Global regulations mandate net-zero carbon flooring solutions. Blockchain technology ensures transparency in ethical sourcing and manufacturing processes. |

| Customization & Personalization | AI-powered room scanning provides real-time flooring recommendations. On-demand 3D-printed carpets and tiles revolutionize the personalization trend. |

| Influencer & Social Media Marketing | Virtual influencers and metaverse-based home design experiences redefine digital marketing. Augmented reality shopping allows consumers to preview flooring options in real time. |

| Consumer Trends & Behavior | Biohacking-inspired flooring integrates wellness features such as stress reduction and antimicrobial properties. Consumers embrace AI-driven smart flooring that adapts to lifestyle needs. |

The USA flooring and carpets market is experiencing steady growth, driven by increasing demand for high-quality home renovations, sustainable materials, and luxury flooring solutions. Major players such as Mohawk Industries, Shaw Industries, and Interface dominate the market.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.2% |

The UK flooring and carpets market is expanding due to rising urbanization, increased demand for high-quality interiors, and growing emphasis on sustainable flooring materials. Key retailers include Victoria PLC, Amtico, and Brintons.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.9% |

Germany’s flooring and carpets market is growing, with a strong demand for high-performance, durable flooring solutions. Key manufacturers such as Tarkett, Forbo, and Gerflor play a dominant role.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.5% |

India’s flooring and carpets market is witnessing significant growth, driven by rising urbanization, infrastructure development, and increasing consumer preference for modern interiors. Companies like Welspun Flooring, Greenlam, and Responsive Industries dominate the sector.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.7% |

China’s flooring and carpets market is experiencing rapid growth, fueled by increasing urban development, technological innovations, and the expansion of the e-commerce sector through platforms like Alibaba and JD.com.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.0% |

The global flooring and carpets market is experiencing significant growth, driven by rapid urbanization, increasing construction activities, and a rising preference for aesthetically pleasing and durable flooring solutions. The market encompasses a variety of products, including carpets, vinyl flooring, laminate, and hardwood, catering to both residential and commercial applications.

Companies are focusing on product innovation, sustainable materials, and strategic acquisitions to strengthen their market positions. The industry is characterized by both established players and emerging firms striving to capture market share through diverse product offerings and targeted marketing strategies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Mohawk Industries, Inc. | 12-15% |

| Shaw Industries Group, Inc. | 10-13% |

| Tarkett S.A. | 8-11% |

| Beaulieu International Group | 6-9% |

| Interface, Inc. | 5-8% |

| Other Companies (combined) | 44-59% |

| Company Name | Key Offerings/Activities |

|---|---|

| Mohawk Industries, Inc. | Offers a comprehensive range of flooring products, including carpets, hardwood, laminate, and vinyl. Focuses on sustainability initiatives, such as using recycled materials and reducing environmental impact. |

| Shaw Industries Group, Inc. | Provides a diverse portfolio of flooring solutions, emphasizing innovation and design. Invests in technology to enhance product durability and aesthetics, catering to both residential and commercial markets. |

| Tarkett S.A. | Specializes in resilient and non-resilient flooring products, including vinyl, laminate, and carpet tiles. Prioritizes eco-friendly products and has implemented circular economy principles in its operations. |

| Beaulieu International Group | Offers a wide array of flooring solutions, including carpets, vinyl, and laminate. Focuses on design innovation and has a strong presence in both residential and commercial sectors. |

| Interface, Inc. | Known for modular carpet tiles and resilient flooring, emphasizing sustainability and carbon-neutral products. Pioneers in environmental initiatives within the flooring industry. |

Strategic Outlook of Key Companies

Mohawk Industries, Inc. (12-15%)

Mohawk leads the flooring and carpets market with a broad product portfolio that caters to various consumer preferences. The company emphasizes sustainability by incorporating recycled materials into its products and implementing eco-friendly manufacturing processes. Mohawk continues to expand its market presence through strategic acquisitions and investments in innovative technologies.

Shaw Industries Group, Inc. (10-13%)

Shaw Industries focuses on delivering innovative and high-quality flooring solutions. The company invests in advanced technologies to enhance product durability and design, appealing to both residential and commercial customers. Shaw's commitment to sustainability is evident through its various environmental initiatives and sustainable product offerings.

Tarkett S.A. (8-11%)

Tarkett specializes in a wide range of flooring products, with a strong emphasis on sustainability. The company has implemented circular economy principles, focusing on recycling and reducing waste. Tarkett's eco-friendly products and commitment to environmental responsibility resonate with environmentally conscious consumers.

Beaulieu International Group (6-9%)

Beaulieu offers a diverse range of flooring solutions, focusing on design innovation and quality. The company has a significant presence in both residential and commercial markets, providing products that meet various aesthetic and functional requirements. Beaulieu continues to invest in new technologies and design trends to stay competitive.

Interface, Inc. (5-8%)

Interface is renowned for its modular carpet tiles and commitment to sustainability. The company has been a pioneer in environmental initiatives within the flooring industry, offering carbon-neutral products and focusing on reducing its ecological footprint. Interface's innovative designs and eco-friendly approach appeal to a growing segment of environmentally conscious consumers.

Other Key Players (44-59% Combined)

Several other companies contribute to the growth of the flooring and carpets market by focusing on niche segments, innovative designs, and sustainable practices. Notable brands include:

These companies leverage their unique strengths and market insights to offer products that cater to specific consumer preferences. They employ strategies such as product diversification, strategic partnerships, and investments in sustainable technologies to enhance their market positions.

The flooring and carpets market is projected to expand at a CAGR of 5.0% between 2023 and 2033.

The flooring and carpets market is anticipated to surpass USD 485,371.5 million by 2033.

The global worth of flooring and carpets market is USD 297,976 million in 2023.

Some leading companies in the market are Mohawk Industries Inc., Interface Inc., Beaulieu International Group N.V.

Carpets hold a significant market share of 33.90% in 2023, driven by the resurgence of comfort and style.

The United States, with a substantial market share of 27.8% in 2023, leads the market due to design-driven demand.

One of the key challenges in the market is the fluctuation in raw material prices, which can impact profit margins.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Sq.Mtr) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Flooring Type, 2018 to 2033

Table 4: Global Market Volume (Sq.Mtr) Forecast by Flooring Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 6: Global Market Volume (Sq.Mtr) Forecast by Material Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Sq.Mtr) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Sq.Mtr) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Flooring Type, 2018 to 2033

Table 12: North America Market Volume (Sq.Mtr) Forecast by Flooring Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Sq.Mtr) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Sq.Mtr) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Sq.Mtr) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Flooring Type, 2018 to 2033

Table 20: Latin America Market Volume (Sq.Mtr) Forecast by Flooring Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 22: Latin America Market Volume (Sq.Mtr) Forecast by Material Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Sq.Mtr) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Sq.Mtr) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Flooring Type, 2018 to 2033

Table 28: Western Europe Market Volume (Sq.Mtr) Forecast by Flooring Type, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 30: Western Europe Market Volume (Sq.Mtr) Forecast by Material Type, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Sq.Mtr) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Sq.Mtr) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Flooring Type, 2018 to 2033

Table 36: Eastern Europe Market Volume (Sq.Mtr) Forecast by Flooring Type, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 38: Eastern Europe Market Volume (Sq.Mtr) Forecast by Material Type, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Sq.Mtr) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Sq.Mtr) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Flooring Type, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Sq.Mtr) Forecast by Flooring Type, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Sq.Mtr) Forecast by Material Type, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Sq.Mtr) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Sq.Mtr) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Flooring Type, 2018 to 2033

Table 52: East Asia Market Volume (Sq.Mtr) Forecast by Flooring Type, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: East Asia Market Volume (Sq.Mtr) Forecast by Material Type, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Sq.Mtr) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Sq.Mtr) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Flooring Type, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Sq.Mtr) Forecast by Flooring Type, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Sq.Mtr) Forecast by Material Type, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Sq.Mtr) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Flooring Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Sq.Mtr) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Flooring Type, 2018 to 2033

Figure 10: Global Market Volume (Sq.Mtr) Analysis by Flooring Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Flooring Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Flooring Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 14: Global Market Volume (Sq.Mtr) Analysis by Material Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Sq.Mtr) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Flooring Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Flooring Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Sq.Mtr) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Flooring Type, 2018 to 2033

Figure 34: North America Market Volume (Sq.Mtr) Analysis by Flooring Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Flooring Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Flooring Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 38: North America Market Volume (Sq.Mtr) Analysis by Material Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Sq.Mtr) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Flooring Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Flooring Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Sq.Mtr) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Flooring Type, 2018 to 2033

Figure 58: Latin America Market Volume (Sq.Mtr) Analysis by Flooring Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Flooring Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Flooring Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 62: Latin America Market Volume (Sq.Mtr) Analysis by Material Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Sq.Mtr) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Flooring Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Flooring Type, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Sq.Mtr) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Flooring Type, 2018 to 2033

Figure 82: Western Europe Market Volume (Sq.Mtr) Analysis by Flooring Type, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Flooring Type, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Flooring Type, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 86: Western Europe Market Volume (Sq.Mtr) Analysis by Material Type, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Sq.Mtr) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Flooring Type, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Flooring Type, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Sq.Mtr) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Flooring Type, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Sq.Mtr) Analysis by Flooring Type, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Flooring Type, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Flooring Type, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Sq.Mtr) Analysis by Material Type, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Sq.Mtr) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Flooring Type, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Flooring Type, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Sq.Mtr) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Flooring Type, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Sq.Mtr) Analysis by Flooring Type, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Flooring Type, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Flooring Type, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Sq.Mtr) Analysis by Material Type, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Sq.Mtr) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Flooring Type, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Flooring Type, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Sq.Mtr) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Flooring Type, 2018 to 2033

Figure 154: East Asia Market Volume (Sq.Mtr) Analysis by Flooring Type, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Flooring Type, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Flooring Type, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 158: East Asia Market Volume (Sq.Mtr) Analysis by Material Type, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Sq.Mtr) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Flooring Type, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Flooring Type, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Sq.Mtr) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Flooring Type, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Sq.Mtr) Analysis by Flooring Type, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Flooring Type, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Flooring Type, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Sq.Mtr) Analysis by Material Type, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Sq.Mtr) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Flooring Type, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Flooring Market Size and Share Forecast Outlook 2025 to 2035

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Eco Flooring Market Analysis - Growth, Demand & Forecast 2025 to 2035

Vinyl Flooring Market Growth - Trends & Forecast 2025 to 2035

Modular Flooring Market Size and Share Forecast Outlook 2025 to 2035

Textile Flooring Market Trends & Growth 2025 to 2035

Cleanroom Flooring Market Growth - Trends & Forecast 2024 to 2034

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Automotive Flooring Market Size and Share Forecast Outlook 2025 to 2035

Middle East Flooring and Carpet Industry Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Hard Surface Flooring Market Size and Share Forecast Outlook 2025 to 2035

Middle East Wood Flooring Market Growth – Trends & Forecast 2024-2034

Luxury Vinyl Tile Flooring Market Size and Share Forecast Outlook 2025 to 2035

WPC Floorings Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA