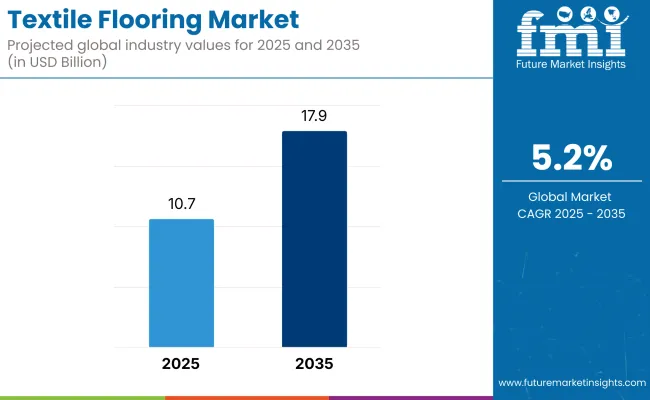

Global demand for textile flooring is estimated at USD 10.7 billion in 2025. With a CAGR of 5.2%, the market is projected to reach a valuation of USD 17.9 billion by 2035. This expansion is being driven by rising urbanization, a surge in construction activities, and growing emphasis on acoustically and thermally efficient interior solutions.

The architectural shift toward design-centric commercial and residential spaces has significantly increased the adoption of textile flooring. A growing preference for aesthetic and functional flooring options has been observed across healthcare, hospitality, and corporate sectors. In 2025, Shaw Contract, a subsidiary of Shaw Industries Group, reported a notable increase in orders for carpet tiles from hospitals and assisted living facilities. According to CEO Tim Baucom, the growing demand was influenced by textile flooring’s ability to provide sound absorption, comfort, and cleanability, aligning with post-pandemic hygiene expectations.

Increased construction of office spaces in urban centers has also contributed to the demand. In its 2025 sustainability update, Interface Inc. stated that sales of carbon-neutral carpet tiles grew steadily in the APAC region, attributing the growth to urban densification and eco-conscious procurement policies in the region’s infrastructure sector.

Meanwhile, Tarkett S.A. introduced the "Desso Air Master Gold" collection in 2024, which has been certified for its fine dust capturing capacity. This launch was intended to align with heightened indoor air quality standards in commercial buildings and was supported by indoor air safety certification bodies.

Technological advancements have allowed the development of antimicrobial and anti-static textile flooring solutions. These features have attracted substantial interest from the education and IT sectors. Mohawk Group, in a 2025 press statement, emphasized its focus on modular carpet innovation designed for high-traffic institutional spaces. The company cited rising demand for recyclable, low-emission materials in large-scale educational tenders as a core driver of growth.

Production bases in South Asia and Eastern Europe have been strategically expanded to reduce logistics costs and improve responsiveness. These regions have seen increased foreign direct investment due to availability of low-cost labor and supportive trade policies. Despite optimistic forecasts, the market continues to face challenges related to microplastic shedding and end-of-life recycling limitations. In response, R&D efforts by industry players are targeting closed-loop recycling systems and biodegradable fibers.

The market is segmented based on material type, product type, technology, and region. By material type, the market includes synthetic textiles, animal textiles, and plant textiles. Synthetic textiles are further segmented into polypropylene, PET, acrylic, and nylon.

In terms of product type, it is divided into rugs and carpets. By technology, the market is segmented into tufting, woven, and needlefelt. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia Pacific, and the Middle East & Africa.

The PET (polyethylene terephthalate) segment is expected to grow at the fastest CAGR of 6.4% from 2025 to 2035. This growth is driven by rising environmental concerns, regulatory support for circular materials, and increasing adoption of recycled PET fibers in residential and commercial flooring.

PET offers excellent stain resistance, vibrant coloration, and affordability-making it highly suitable for carpets and rugs alike. Manufacturers are focusing on integrating post-consumer recycled PET to meet sustainability certifications and consumer preferences for eco-conscious materials.

Meanwhile, polypropylene continues to dominate the synthetic segment by volume, favored for its affordability, moisture resistance, and durability in high-traffic environments. Nylon remains popular in commercial-grade carpets for its superior resilience and elasticity, although its higher cost restrains adoption in price-sensitive segments.

Acrylic textiles are used in decorative rugs where softness and color vibrancy are prioritized, but adoption is niche. Animal textiles, such as wool, hold steady demand in premium flooring categories, particularly for high-end hospitality and bespoke residential interiors. Plant textiles, including cotton and jute, cater to artisanal and eco-friendly buyers but remain constrained by durability concerns and limited scalability.

| Material Type Segment | CAGR (2025 to 2035) |

|---|---|

| PET | 6.4% |

The rugs segment is projected to grow at the fastest CAGR of 6% from 2025 to 2035. This growth is fueled by a rising preference for modular, easy-to-install flooring solutions that allow greater personalization in both residential and commercial spaces.

Rugs are increasingly viewed as flexible design elements that offer warmth, acoustic insulation, and visual zoning without the permanence of wall-to-wall carpet installations. The surge in e-commerce channels has also made it easier for consumers to access a wider variety of styles, materials, and price points, accelerating adoption, particularly among urban and younger demographics.

Meanwhile, carpets continue to dominate the overall market by volume and floor coverage, especially in hospitality, corporate offices, and institutional spaces where seamless aesthetics, underfoot comfort, and large-area installation are preferred. Carpets benefit from better insulation properties and have long been a staple in commercial interiors, although their growth is more gradual due to longer replacement cycles and installation complexity.

Despite this, rugs are gaining ground as renters, DIY renovators, and sustainable consumers increasingly favor versatility, recyclable materials, and reusability. Their rise reflects a broader market shift toward more customizable and adaptive textile flooring solutions.

| Product Type Segment | CAGR (2025 to 2035) |

|---|---|

| Rugs | 6% |

The tufting segment is projected to grow at the fastest CAGR of 6.1% between 2025 and 2035. This growth is fueled by its production efficiency, design flexibility, and cost-effectiveness across both commercial and residential flooring applications. Tufting technology allows for rapid production of intricate patterns, varying pile heights, and complex textures, qualities in high demand across modern interiors. Its adaptability for both carpet tiles and wall-to-wall formats makes it ideal for high-volume deployment in offices, hotels, and housing projects.

Woven textile flooring, though slower-growing, retains relevance in the luxury and heritage segment. Products made via weaving offer high-end aesthetics, dimensional stability, and long-term performance, but involve higher costs and longer production cycles.

They are often preferred in premium retail, hospitality, and historic restoration projects. Needlefelt flooring continues to serve functional, heavy-duty applications such as transportation, exhibition halls, and temporary commercial spaces. Its dense construction and affordability make it a practical solution for projects requiring durability over decorative appeal. While all three technologies play important roles, tufting’s balance of efficiency, customization, and broad market compatibility positions it as the dominant and fastest-expanding technology across global textile flooring investments.

| Technology Segment | CAGR (2025 to 2035) |

| Tufting | 6.1% |

Challenges

High Cost of Premium Textile Flooring

One of the major challenges is the high costs of these premium textile flooring, particularly in price-sensitive markets. While luxury carpets and rugs provide superior aesthetics and durability, consumers in developing economies find them unaffordable. Consequently, these markets tend to be more-trend driven towards cheaper flooring options, while limiting the overall market penetration of high-end textile flooring products.

The price difference between premium and budget-friendly options makes it harder for consumers to adopt these products, particularly in price-sensitive segments of the residential and commercial markets. The challenge is that manufacturers need to identify ways to cut down production prices or offer cheaper substitutes.

Environmental Concerns and Recycling Issues

Although sustainability is a growing trend in the textile flooring market, many products still rely on synthetic fibers, chemical treatments, and non-biodegradable materials. recycling carpets has proven difficult the materials used in textile flooring can be hard to process and can leave waste in the environment. Carpeting is another huge contributor to our landfills due to its disposal and recycling.

Manufacturers need to invest in more sustainable production processes, biodegradable materials, and improved recycling technologies to overcome this challenge. Significant pressure is mounting to design closed-loop systems that decrease waste and the overall environmental impact of textile flooring products.

Opportunities

Rising Demand for Sustainable Flooring Solutions:

As awareness of environmental sustainability grows, there is an increasing demand for eco-friendly flooring options, such as recyclable and bio-based textile flooring. Fuelled by regulations and the need to cut their carbon footprints, consumers and companies have elevated sustainable products. Additionally, to manufacturers, creating environment-friendly, low-emission flooring may prove to be a very competitive product in the growing natural building market.

Governments are cracking down more and more on environmental abuses, while the green building movement continues to make LEED certifications more common and more desirable, and the customer demand for environmentally friendly flooring products is likely to boom, providing excellent growth for eco-friendly flooring.

Technological Advancements in Textile Flooring

Technological innovation in textile flooring is creating new opportunities, particularly in specialized sectors like healthcare, education, and high-traffic commercial spaces. The new generation of antimicrobial, waterproof, and stain-resistant textiles will appeal to beyond just beauty for flooring where cleanliness and durability are top concerned.

Innovations in 3D printing and smart textiles could also lead to more customized and flexible flooring options. These breakthroughs allow manufacturers to improve the style and functionality of textile flooring, resulting in improved marketability and new product ideas. However, this is an ever-evolving field, and such technologies could pave the way for the future of the textile flooring.

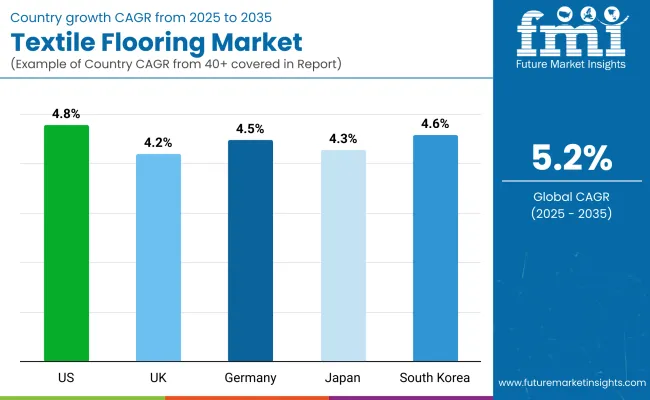

Demand for new residential construction, rising demand for luxury flooring, commercial projects, etc. are expected to drive the USA textile flooring market. Hotels and resorts are among the biggest buyers of plush carpets and top-end rugs. There has also been an increase in demand for modular carpet tiles due to their design flexibility and easy maintenance, propelled by the growing corporate office spaces.

Moreover, sustainability trends are compelling manufacturers to design and build recyclable textile floor coverings wicker. But competition from hard flooring solutions such as vinyl and laminate is a threat. The market is expected to maintain growth, owing to an increase in home renovations and remodeling activities.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.8% |

The UK textile flooring market is expanding due to rising urban housing projects, increasing demand for soft flooring, and sustainability trends. Carpet flooring is still popular for residential use, with consumers showing preference for wool-based and recycled textile materials.

Hospitality and office sectors are significantly demanding durable and stylish carpets, while anti-bacterial and slip resistant flooring is required in healthcare institutions. Brexit-related trade challenges caused volatility in raw material prices, hitting local manufacturers. The trend towards circular economy practices are encouraging recyclable and sustainable textile flooring solutions in the commercial and residential markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.2% |

The demand for high-quality carpets, sustainability trends, and smart flooring innovations drive Germany’s textile flooring market. Textile flooring is consumed predominantly in the commercial sector, with office buildings, schools, and hotels representing major use categories. A strong emphasis on environmentally friendly materials in the country has resulted in the growing production of bio-based and recycled carpets.

The increasing technological developments in the field of acoustic and thermal insulation flooring are also enhancing the demand in this market. Nevertheless, the costs to produce and floor covering alternatives presented by durable floor covering sensor-based functionalities is expected to create new opportunities in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 4.5% |

Growth in urbanization, demand for comfort-oriented flooring systems, and innovations in modular carpet tiles are key propellers of the textile flooring market in Japan. The country’s hospitality industry is a significant driver, with luxury hotels and ryokans choosing premium carpets.

Combining a stylish and functional aesthetic with modern textile flooring solutions for your home, tatami is making a return, albeit a contemporary one. Moisture-resistant and anti-bacterial flooring are the technological developments that are stimulating growth in the healthcare and commercial fields.

But in urban apartments where living space is limited, demand for wall-to-wall carpeting has faded, with preference for small and modular flooring options. Japan’s emphasis on recyclable and biodegradable materials is spurring innovation in the sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.3% |

The South Korea carpet tile market is directly growing because of the increasing amount of real estate projects, growing inclination towards soft flooring and rising technological advancements. Durable yet elegant carpets are strong consumers in the corporate and hospitality markets, fueled by a rise in demand for stain-resistant and easy-to-maintain textile flooring. Interest in customizable and sensor-integrated flooring solutions is being propelled by the country’s smart home industry.

But the presence of vinyl and laminate flooring products restricts the growth of this market. The sustainability drive of the South Korean government encourages manufacturers to develop low-emission and recyclable textile flooring materials for environmentally conscious consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The textile flooring market is one of the segments of the flooring market which provides carpet and textile-based flooring solutions for residential, commercial, and industrial applications. The properties of softness and sound absorption offered by textile flooring make it a preferred choice among various end-users.

Technological advancements, rising demand for sustainable flooring solutions, and growing commercial infrastructure are propelling the market. The industry is dominated by global players, but regional manufacturers partner local and niche markets.

The Textile Flooring Market is undergoing changes with advancements being made in design, sustainability, and performance. The industry is dominated by established players that are cutting their teeth with sustainable and innovative flooring solutions, while challengers target niche applications and low-cost products.

The market is anticipated to grow further with rising commercial infrastructure projects along with the upsurge in the demand for sustainable interiors. The industry's future is one of competition, driven by global players, and will be shaped by key trends like recyclable materials, energy-efficient production, and smart flooring technologies.

In terms of Material Type the industry is divided into Synthetic Textiles, (Polypropylene, PET, Acrylic, Nylon), Animal Textiles, Plant Textiles.

In terms of Product Type the industry is divided into Rugs, Carpets.

In terms of Technology the industry is divided into Tufting, Woven, Needlefelt.

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global market is expected to reach USD 17.9 billion by 2035, growing from USD 10.7 billion in 2025, at a CAGR of 5.2% over the assessment period.

The synthetic textiles segment is projected to dominate the market, owing to their durability, stain resistance, cost-effectiveness, and widespread use in residential, commercial, and hospitality flooring applications.

Key drivers include rising construction activity, growing preference for soft floor coverings, advancements in stain-proof and eco-friendly textile technologies, and increased investments in interior aesthetics and acoustic performance.

Residential buildings, commercial spaces, and hospitality sectors are key contributors, with demand driven by ease of maintenance, design flexibility, and improved indoor air quality solutions.

Top companies include Beaulieu International Group, Bentley Mills Inc., Forbo Flooring Systems, Balta Group, Victoria PLC, and Mannington Mills, recognized for product innovation, sustainability focus, and expansive distribution networks.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Sq. Meter) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Sq. Meter) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (Sq. Meter) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 8: Global Market Volume (Sq. Meter) Forecast by Technology, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: Global Market Volume (Sq. Meter) Forecast by Application, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Sq. Meter) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Sq. Meter) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Sq. Meter) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 18: North America Market Volume (Sq. Meter) Forecast by Technology, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: North America Market Volume (Sq. Meter) Forecast by Application, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Sq. Meter) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Sq. Meter) Forecast by Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (Sq. Meter) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 28: Latin America Market Volume (Sq. Meter) Forecast by Technology, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Latin America Market Volume (Sq. Meter) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Sq. Meter) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Sq. Meter) Forecast by Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Western Europe Market Volume (Sq. Meter) Forecast by Product Type, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Western Europe Market Volume (Sq. Meter) Forecast by Technology, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Western Europe Market Volume (Sq. Meter) Forecast by Application, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Sq. Meter) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Sq. Meter) Forecast by Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Eastern Europe Market Volume (Sq. Meter) Forecast by Product Type, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 48: Eastern Europe Market Volume (Sq. Meter) Forecast by Technology, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 50: Eastern Europe Market Volume (Sq. Meter) Forecast by Application, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Sq. Meter) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Sq. Meter) Forecast by Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Sq. Meter) Forecast by Product Type, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Sq. Meter) Forecast by Technology, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Sq. Meter) Forecast by Application, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Sq. Meter) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Sq. Meter) Forecast by Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 66: East Asia Market Volume (Sq. Meter) Forecast by Product Type, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 68: East Asia Market Volume (Sq. Meter) Forecast by Technology, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 70: East Asia Market Volume (Sq. Meter) Forecast by Application, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Sq. Meter) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Sq. Meter) Forecast by Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Sq. Meter) Forecast by Product Type, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Sq. Meter) Forecast by Technology, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Sq. Meter) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Sq. Meter) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Volume (Sq. Meter) Analysis by Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (Sq. Meter) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 19: Global Market Volume (Sq. Meter) Analysis by Technology, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 23: Global Market Volume (Sq. Meter) Analysis by Application, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 26: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Technology, 2023 to 2033

Figure 29: Global Market Attractiveness by Application, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Sq. Meter) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Volume (Sq. Meter) Analysis by Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (Sq. Meter) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 49: North America Market Volume (Sq. Meter) Analysis by Technology, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 53: North America Market Volume (Sq. Meter) Analysis by Application, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 56: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Technology, 2023 to 2033

Figure 59: North America Market Attractiveness by Application, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Sq. Meter) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Sq. Meter) Analysis by Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (Sq. Meter) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 79: Latin America Market Volume (Sq. Meter) Analysis by Technology, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 83: Latin America Market Volume (Sq. Meter) Analysis by Application, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Sq. Meter) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Sq. Meter) Analysis by Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Western Europe Market Volume (Sq. Meter) Analysis by Product Type, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 109: Western Europe Market Volume (Sq. Meter) Analysis by Technology, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 113: Western Europe Market Volume (Sq. Meter) Analysis by Application, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Sq. Meter) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Sq. Meter) Analysis by Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Sq. Meter) Analysis by Product Type, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Sq. Meter) Analysis by Technology, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Sq. Meter) Analysis by Application, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Sq. Meter) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Sq. Meter) Analysis by Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Sq. Meter) Analysis by Product Type, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Sq. Meter) Analysis by Technology, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Sq. Meter) Analysis by Application, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Sq. Meter) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Sq. Meter) Analysis by Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 195: East Asia Market Volume (Sq. Meter) Analysis by Product Type, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 199: East Asia Market Volume (Sq. Meter) Analysis by Technology, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 203: East Asia Market Volume (Sq. Meter) Analysis by Application, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Sq. Meter) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Sq. Meter) Analysis by Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Sq. Meter) Analysis by Product Type, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Sq. Meter) Analysis by Technology, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Sq. Meter) Analysis by Application, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Textile Machine Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Textile Colorant Market – Trends & Forecast 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Textile Tester Market Growth – Trends & Forecast 2025 to 2035

Textile Colors Market Growth - Trends & Forecast 2025 to 2035

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Textile Staples Market Size & Trends 2025 to 2035

Textile Auxiliaries Market Trends 2024-2034

Textile Printing Ink Market

Geotextile Tube Market Growth – Trends & Forecast 2024-2034

Agri Textiles Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Agro textiles Market

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA