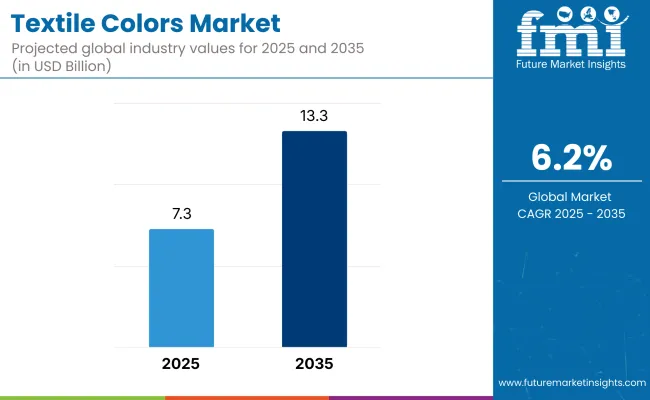

The global textile colors market was valued at USD 5.4 billion in 2020. Growing 5.8% year on year, it is estimated at USD 7.3 billion in 2025. From 2025 to 2035, the market is projected to register a CAGR of 6.2%, culminating in a value of USD 13.3 billion by 2035. This expansion is being driven by increased regulatory pressure to eliminate hazardous dyes and rising demand for sustainable coloration technologies.

REACH regulation updates were enacted by the European Chemicals Agency in early 2024. Multiple synthetic textile dyes were added to the Substances of Very High Concern list. As a result, major chemical producers began scaling sustainable dye solutions. A press release issued by Huntsman Textile Effects on January 9, 2025, confirmed the expansion of its AVITERA SE range. According to Rajiv Banavaliker, Head of Global Marketing at Huntsman, this product line reduced water consumption by 50% per batch in controlled trials and was designed to align with brands pursuing Science-Based Targets.

Asia Pacific textile centers-specifically Bangladesh and Vietnam-recorded increased installations of digital pigment printing systems in Q1 2025, as reported by the International Textile Manufacturers Federation (ITMF). These pigment-based inks require no steam fixation or wash-off. During an April 2025 media briefing, Kornit Digital CEO Ronen Samuel disclosed that shipment volumes had doubled year on year, citing increased demand for sustainable, waterless print workflows from global sportswear brands.

DyStar, in its December 2024 technical release, introduced DIRESUL EVOLUTION Black. This dye was formulated for high-reactivity and reduced salt input by up to 40% in polyester-blend processing. Laboratory testing at the Hohenstein Institute confirmed improved shade depth and rinse fastness at lower liquor ratios, supporting efficient closed-loop dyeing systems.

Across North America and Western Europe, biosynthetic dyes gained commercial acceptance. In its Spring 2025 environmental impact report, Colorifix stated that a collaboration with Italian denim producer Candiani enabled a microbial-dyeing trial that cut water consumption by 80%. The dye was synthesized using engineered microbes fed on agricultural waste, with validation provided by Textile Exchange.

Supply challenges for fermentation-derived dye intermediates persist. Feedstock variability and fermentation cycle stability were identified as key cost drivers in a January 2025 joint assessment by Geno and Archroma. Nevertheless, a strategic R&D partnership was announced to scale bioindigo at a 50,000-liter capacity by Q4 2025. Archroma’s CTO, Gina Cattaneo, emphasized that this project would mark a shift from pilot to full industrial deployment of biosynthetic colorants.

The table below presents the annual growth rates of the global textile colors industry from 2025 to 2035. With a base year of 2024 extending to the current year 2025, the report examines how the sector's growth trajectory evolves from the first half of the year (January to June, H1) to the second half (July to December, H2). This analysis offers stakeholders insights into the industry's performance over time, highlighting potential developments that may emerge.

These figures indicate the growth of the sector in each half year, between the years 2024 and 2025. The industry is expected to grow at a CAGR of 5.9% in H1-2024. In H2, the growth rate increases.

| Particular | Value CAGR |

|---|---|

| H1 2024 | 5.9% (2024 to 2034) |

| H2 2024 | 6.1% (2024 to 2034) |

| H1 2025 | 6.0% (2025 to 2035) |

| H2 2025 | 6.2% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2025, the CAGR is projected to slightly decrease to 6.0% in the first half and relatively increase to 6.2% in the second half. In the first half (H1), the sector saw an increase of 10 BPS while in the second half (H2), there was a slight increase of 10 BPS.

The viscose fiber textile color market witnessed notable advancements during 2024 and 2025, driven by shifts in dye chemistry and sustainability mandates. A steady rise in demand for low-impact coloration has been observed across Asia Pacific, particularly in India and Indonesia, where viscose production remains concentrated. Reactive and vat dyes continued to dominate viscose dyeing; however, innovations in fiber-reactive liquid dyes have been scaled to reduce salt and alkali discharge.

In 2024, Archroma introduced EarthColors® tailored for regenerated cellulose like viscose, utilizing plant-based waste for chromophores. The company’s 2025 environmental bulletin noted a 45% reduction in carbon emissions compared to conventional dye routes. Concurrently, Lenzing AG reported in its 2025 material innovation brief that its EcoVero viscose lines achieved better dye uptake and color retention using closed-loop dyeing systems tested in partnership with textile mills in Turkey.

Stringent EU regulations on azo-based dyes also pushed manufacturers to develop compliant alternatives for viscose application. This led to increased R&D in metal-free dye chemistries. Despite market volatility in raw material costs, the segment recorded steady growth in 2025, supported by fashion brands targeting biodegradable, ethically sourced fabric lines. The viscose textile color segment is expected to maintain a forward trajectory anchored in circular design principles.

The direct dye textile color market experienced stable yet niche-specific growth in 2024 and 2025, primarily led by applications in cellulosic fibers such as cotton, rayon, and linen. While demand for reactive dyes overshadowed direct dye consumption, select markets-particularly in low-cost apparel manufacturing and institutional textiles-retained direct dyes due to cost efficiency and ease of application.

In 2024, reports from the Indian Textile Journal highlighted increased uptake of salt-free direct dyes across dyeing clusters in Gujarat and Tamil Nadu. These formulations were adopted to meet Zero Liquid Discharge (ZLD) mandates. Huntsman, in a June 2025 technical brief, confirmed upgrades to its Terasil® and NOVACRON® series for enhanced lightfastness and wash durability in direct dye categories, especially for lightweight printed cotton fabrics.

However, environmental concerns around high effluent load from traditional direct dyes triggered regulatory scrutiny. As a response, research units in South Korea and Germany piloted direct dye encapsulation technologies aimed at improving fixation rates while lowering water usage-details of which were published by the Korean Textile Development Institute in April 2025.

Expansion of Global Textile Production Drives Increased Demand for Various Textile Colors in Fabrics

Growth in demand for clothes and fashion: Owing to the increase in textile production globally, a high volume of textile colorants is required for various colors of textiles to be utilized in meeting an increasing demand for fashionably and trendily appealing clothes.

The apparel industry is highly seasonal, driven by shifting fashion trends that demand a wide range of colors to create diverse fabric shades. As textile production grows to accommodate changing preferences, the demand for textile colorants also increases, driving market growth.

The contribution to the demand created by textile colors is highly associated with those of the requirement for home textiles such as rugs, curtains, bedding, and upholstery. While every consumer shows great interest in staying handsome inside homes, increasing coloring is put up to fulfill variable design fashion needs. It was this that formed the growth for textile colorants throughout expanded regions until its recent stabilization.

The textile industry’s shift toward emerging markets, particularly in Asia, Latin America, and Africa, accelerates production volumes. These regions generally possess high-capacity, lower costs of production, thus giving filled demand for dyes and pigments. This immense manufacturing activity upwardly feeds this textile colors market continuously.

Higher Disposable Incomes Boost Consumer Spending on Fashion, Elevating Demand for Colorful, High-Quality Textiles

With increased disposable incomes, especially in emerging markets like East Asia, South Asia, and Latin America, people have more money to spend. Increasing income is, therefore, boosting demand for fashionable and high-quality clothing. The increasing propensity of consumers to spend on clothes results in the need for more colors of textiles due to different fashion preferences, hence driving demand for dyes and pigments.

With higher disposable incomes, consumers will prefer premium and colorful textiles over basic and plain fabrics. Thus, with consumer tastes shifting toward luxury and high-end fashion, manufacturers need to infuse a wide variety of vibrant colors into their textiles to meet the demand for stylish and attractive clothing, thereby driving the demand for advanced textile colorants.

A rapidly growing middle class in developing nations has increased the demand for multi-colored, fancy textiles. This leads to the point that with improved disposable income comes a direct influence on the market demand for textile colors; similarly, higher demand for diverse types of dyes and pigments will emerge based on changing consumer preferences.

Increased Use of Synthetic Fibers, Like Polyester, Stimulates the Demand for Disperse and Reactive Textile Colors

Among all synthetic fibers, polyester has become one of the most consumed fibers by the textile industry worldwide due to its strong and economical features, added to its versatility.

In this context, the demand for polyester fabrics from both fashion and mass-market apparel increases the need for suitable dyes like disperse and reactive dyes. These fibers require particular colorants that can give them a vibrant and durable look, increasing the demand for the market.

Synthetic fibers, like polyester, can be manufactured by producers at a lower cost compared to their natural fiber counterparts. These cost advantages raise their appeal and make them very popular, particularly in high-volume textile production.

The greater demand for polyester in fashion, home textiles, and industrial textiles increases the demand for textile colorants that can be used on synthetic fibers, thereby expanding the market.

Disperse dyes have their main field of application in polyester and possess very good fastness and brightness properties. This increases demand for synthetic fibers like polyester, which require these kinds of dyes, helping to drive the market for colors within textiles. The versatility and performance benefits of these dyes bode well with the growing usage of synthetic fibers.

Synthetic Dyes and Hazardous Chemicals Contribute to Pollution, Leading to Stricter Environmental Regulations on Textile Colors

The raw materials for synthetic dyes, specifically azo dyes, are prepared from harmful chemicals that are causing water and soil pollution, leading to toxicity in aquatic life. There is a serious threat of environmental hazard through the discharge of such chemicals by manufacturing and washing.

Increasing awareness results in increasingly strict environmental regulations being laid down around the world, thus placing limits on the use of such dyes in the textile industry. The manufacturers are presented with fewer numbers of colorants, hindering market growth.

The textile manufacturers are compelled to invest in advanced technologies and sustainable dyeing processes, which are costly, to meet the strict environmental regulations.

The implementation of such eco-friendly alternatives requires huge capital investment, increasing the cost of production for textile colorants. These financial pressures inhibit small-scale manufacturers from entering the market and thus dampen the growth of the overall industry.

The growing demand for different types of eco-friendly dyes, such as natural or at least azo-free dyes, is forcing the industry toward greener alternatives. Alternative dyes tend to be more expensive and take longer to develop and fixate. This shift toward safer alternatives, though crucial in terms of sustainability, is slowing the growth of the textile colors market in the near term.

Complex and Energy-Intensive Dyeing Techniques, Especially for Natural Fibers, Increase Operational Costs and Production Time

Dyeing natural fibers like cotton, wool, and silk requires intricate processes, including multiple stages of dye application, washing, and heat treatment. Natural fibers require high operational costs due to higher energy and water consumption.

Special equipment with skilful labor is a factor for handling the processes, which makes these techniques highly non-cost-effective than synthetics. Higher prices would make the colorants of textiles more unaffordable and less usable, hence affecting market growth.

The complex nature of dyeing natural fibers leads to longer production times. This is because the process entails several steps to achieve the desired depth and consistency of color, which reduces production efficiency.

The time-consuming nature of these dyeing methods can lead to delays in meeting market demands and increased labor costs, limiting the ability of manufacturers to scale operations rapidly. This constraint affects market expansion, especially in industries requiring high-volume production.

Various value-consuming techniques for dyeing natural fibers exist and bring several negative environmental influences. Most of these methods involve higher consumption of energy and water and create pressure on manufacturing for sustainable development with ecological concerns in view. Moving to a greener alternative makes the complexity increase and expensive too, hence acting as another potential restriction for this market.

The global textile colors industry recorded a CAGR of 5.6% during the historical period between 2020 and 2024. The growth of textile colors industry was positive as it reached a value of USD 6.9 billion in 2024 from USD 5.4 billion in 2020.

The textile colors market grew from 2020 to 2024 at a CAGR of 5.6% due to several reasons. Consumer demand for fashionable and colorful textiles increased due to changing fashion trends and a growing middle class, especially in emerging markets.

Therefore, as disposable incomes rise, consumer demand for rich and colorful textiles is driving demand for a range of textile colors. Another significant growth-supportive factor is the high usage of synthetic fibers, such as polyester, on a massive scale. These synthetic fibers require other kinds of dyes, such as disperse and reactive dyes, to achieve brilliance in color and colorfastness.

While synthetic fibers are the dominating class of fibers throughout the world in textiles, owing to their economical and versatile nature, they keep raising demand for synthetic textile colorants. Increasing volume output of textile industries mainly in developing countries promotes the demand for textile colors on a higher scale in different industries: clothing, home textile, and industry.

The textile colors market is concentrated with key participants accounting for 45-50% of market share. Some technologies are really capital intensive, demanding high expertise and practical usages in order to attain wide acceptance among end customers.

Such firms are leveraging this capability for customized solutions to reinforce their positions within regional high-demand markets of North America, the Middle East, and Asia-Pacific. These companies are referred as Tier-I players in the assessment. Examples of such players include Huntsman Corporation, Kiri Industries Ltd., Atul Ltd., LANXESS AG, and Zhejiang Longsheng Group Co. Ltd.

The second level of players account for 15-30% of the market in total. These companies are regional players and their product offerings are either technology-specific or specification-specific. These players have been termed as Tier-II players in the report. Companies such as Zhejiang Runtu Co. Ltd., Colorant Limited, and JAY Chemicals Industries Limited are a few examples of this category.

The remaining chunk of the market share is enjoyed by small and niche players, which target particular technologies or localized markets, generally smaller industrial set-ups or captive power generation.

They often try to compete with bigger firms on the basis of flexibility and competitive pricing. Such firms are termed as Tier-III players in this market assessment. Examples include Jiangsu Yabang Dyestuff Co. Ltd, Shanghai Anoky Group Co. Ltd.

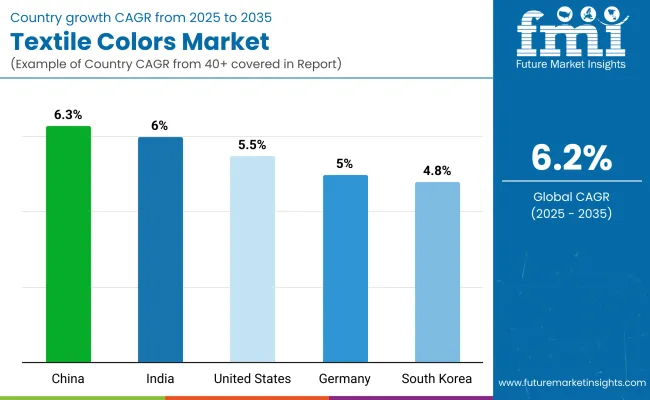

The countries that lead in adopting textile colors include China, India, and United States, driven by due to expanding textile production, rising consumer demand, growing synthetic fiber use, and fashion trends.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

| India | 6.0% |

| United States | 5.5% |

| Germany | 5.0% |

| South Korea | 4.8% |

As China is the largest textile manufacturer and exporter in the world, its textile production has great importance in the market of textile colorants. Textile manufacturing-from apparel to home textiles to industrial fabrics-requires a large amount of various colorants due to the wide variety of colors.

Because Chinese production is expanding its share of international markets, the demand for textile colorants develops-for functional and aesthetic needs-accordingly.

This growing production of synthetic fibers, mainly polyester, in turn propels growth in the textile colors market in China. Synthetic fibers have a need for dyes that are appropriate for their unique types-such as disperse and reactive dyes-to produce brilliant colors.

An increased capacity for producing synthetic fibers from China leads to an increased requirement for these particular colorants. This, in turn, improves the overall market. The movement from natural to synthetic fibers strengthens the demand for innovative and efficient dyeing solutions.

The growing middle-class population with increased disposable income in China increases higher demand both in fashion and textiles used at home. With more textiles being produced and consumed, there is Chinese consumer interest in diversified quality textile colors that result in extremely high demand for different textile colorants. Both local textile production and exports tend to be showing strong demands continuously in their respective sectors for these colorants.

India is experiencing significant growth in domestic textile consumption, driven by a burgeoning middle class and increasing disposable incomes. The country's fashion industry is in fast motion, and consumers are demanding a greater range of textiles in a variety of colors. This is encouraged by the fast-expanding retail marketplaces, as traditional stores and e-commerce make fashion more accessible to more people.

With India becoming more fashion-conscious, the demand for high-quality, colorful textiles increases, which, in turn, boosts the textile color market. The rising interest in both traditional attire and contemporary fashion requires a range of textile colorants to meet the various needs of consumers, thereby propelling the growth of the overall market.

The trend towards synthetic fibers, especially polyester, is driving the textile industry in India. Synthetic fibers have huge applications in fashion, industrial textiles, and home décor goods. These man-made fibers require very specific dyes like disperse and reactive dyes.

For instance, the continuous scaling up of production of synthetic textiles in India intensifies demand for such colorants. Growth within the synthetic fiber segment consequently gives way to newer, more effective dyeing techniques, furthering the demand for textile colors in the country. This trend has been playing a vital role in driving the Indian textile colorants market.

In the United States, the demand for high-quality textiles has surged, especially within the fashion industry. As consumers prioritize quality, durability, and aesthetics, the need for vibrant and premium textile colorants has risen accordingly.

This demand is reflected in the increasing consumption of fashion-forward and luxury apparel, where designers and manufacturers focus on creating textiles that not only meet functional requirements but also offer striking visual appeal.

The growing interest in eco-conscious fashion and sustainable textiles has led to the development of innovative colorants that cater to environmentally aware consumers. As a result, high-end textile producers and fashion brands require a wide variety of textile colorants to meet these preferences, contributing to the growth of the market.

The demand for home textiles, such as bed linens, upholstery, and curtains, is increasing significantly in the USA market-all requiring different types of textile colorants to meet the latest interior trends.

Besides, increasing usage of synthetic fibers such as polyester and nylon is adding to the demand for textile colorants. Synthetic fibers, in both fashion and home textiles, require special dyes, like disperse and reactive dyes, which are designed to work efficiently with the material. Again, the move toward synthetic textiles propels colorant consumption and boosts growth in the overall market.

Competition is rife in the Textile Colors industry, pitting established big names against newly rising start-ups. Established players increasingly pursue innovation; substantial investments have been made to support research and development that will facilitate improved lubricity in various manners, including thermal stability, friction reduction, and energy efficiency for these additives, resulting from continuous industrial demand, particularly in the automobile, aeronautical, and energy industries.

Commonly, there are strategic partnerships and joint ventures whereby company’s partner in the co-development of innovative solutions, expansion of their resource base, and access to new markets. Other key strategies will include geographic expansion, particularly into high-growth regions such as Asia-Pacific and Latin America.

Leading companies are working on developing new products for specific applications, like electric vehicles and renewable energy, targeting the emerging demand for specialty solution areas. This will attract start-ups over the next few years, promoting further competition that comes with incentives for continuous innovation.

Industry Updates

On the basis of dye type, the market is categorized into Disperse, Reactive, Direct, Acid, Vat, and Basic

On the basis of fiber type, the market is categorized into Cotton, Viscose, Wool, Nylon, Polyester, and Acrylic

Key regions considered for the study include North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and Middle East and Africa

The overall market size for Textile Colors was USD 6.9 billion in 2024.

The Textile Colors Market is expected to reach USD 7.3 billion in 2025.

The demand for textile colors during the forecast period will be driven by growing fashion trends, increased synthetic fiber production, rising disposable incomes, and the adoption of sustainable and innovative dyeing solutions.

The Textile Colors Market is projected to reach USD 13.3 billion in 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Textile Machine Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Textile Colorant Market – Trends & Forecast 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Textile Flooring Market Trends & Growth 2025 to 2035

Textile Tester Market Growth – Trends & Forecast 2025 to 2035

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Textile Staples Market Size & Trends 2025 to 2035

Textile Auxiliaries Market Trends 2024-2034

Textile Printing Ink Market

Geotextile Tube Market Growth – Trends & Forecast 2024-2034

Oil Colors Market Trends – Growth & Demand Forecast 2025 to 2035

Agri Textiles Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Agro textiles Market

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA