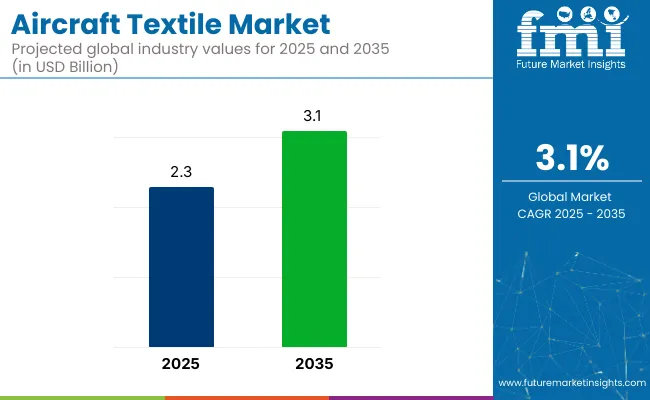

The aircraft textile market is anticipated to expand from USD 2.3 billion in 2025 to USD 3.1 billion by 2035, reflecting a CAGR of 3.1% over the forecast period. The demand is expected to be driven by evolving airline cabin aesthetics, growing emphasis on passenger comfort, and stringent safety regulations that govern material selection. North America and Western Europe are projected to remain the leading markets, owing to fleet modernization and premium cabin refurbishments.

As of 2025, the aircraft textile market maintains a niche yet essential share across several broader parent markets. Within the global aerospace interior market, it holds an estimated 6-8% share, as textiles play a critical role in passenger seating, carpeting, and cabin paneling.

In the technical textiles market, aircraft textiles account for around 2-3%, given their use in high-performance applications requiring fire resistance and durability. Within the aircraft components market, its contribution is approximately 1-2%, due to its role in non-structural interior parts.

In the aviation supply chain market, the share stands at about 0.5-1%, as textiles represent a smaller but necessary category. In the transportation textiles market, aircraft textiles contribute around 3-5%, reflecting aviation’s share within overall transit-focused textile demand.

Innovation is being seen in antimicrobial coatings, stain-resistant fabrics, and 3D-knitted textiles that reduce waste during production. Manufacturers are also focusing on customizability to cater to both commercial and private aviation interiors. As the aviation industry recovers and airlines compete on passenger experience, aircraft textiles are being reimagined as key differentiators in cabin design and operational efficiency.

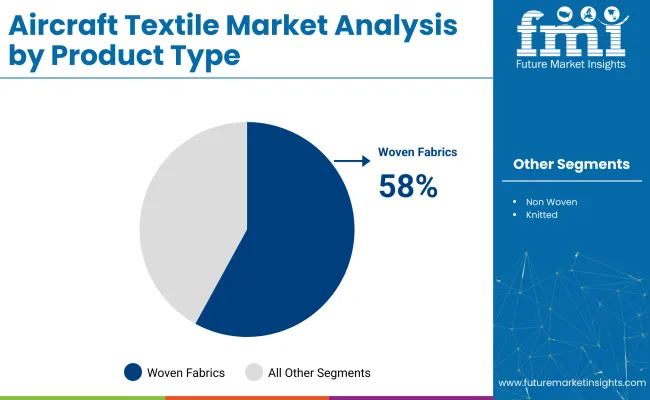

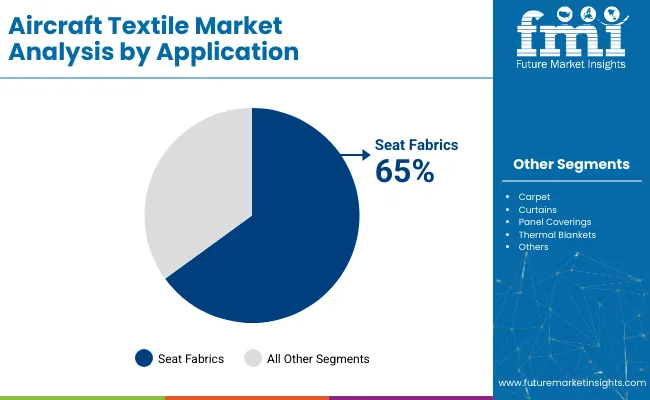

Woven fabrics are projected to dominate the product type segment with a 58% market share by 2025, while seat fabrics applications are expected to lead the application segment with a 65% share, driven by rising demand for lightweight and flame-retardant materials in aircraft interiors.

Woven aviation fabrics are projected to dominate the product type segment, accounting for 58% of the global market share by 2025. These materials are preferred for their durability, safety compliance, and lightweight nature in aviation interiors.

Seat fabrics are expected to lead the application segment, accounting for 65% of the global market share by 2025. Demand is being propelled by greater emphasis on passenger comfort and regulatory compliance in cabin interiors.

The first fit (OEM) segment is projected to capture approximately 70% of the market share by 2025. Aircraft manufacturers are incorporating premium textile materials into cabins during initial assembly to meet evolving passenger and airline expectations.

The industry is evolving rapidly due to increased air travel, rising demand for lightweight and durable materials, and a focus on passenger comfort and cabin aesthetics. Airlines and aircraft OEMs are working with textile suppliers to develop flame-retardant, low-weight, and customizable fabrics that meet strict regulatory and design standards.

High Demand for Seating Upholstery and Cabin Interior Applications

Aircraft textiles are extensively used in seat covers, headrests, carpets, curtains, and wall panels to enhance cabin ambiance and passenger comfort. Airlines are selecting materials that offer durability, stain resistance, and ease of maintenance. Lightweight textiles are preferred to support fuel efficiency goals, while fabric color and texture are tailored to airline branding and premium cabin differentiation.

Emphasis on Fire Safety, Compliance, and Regulatory Standards

Strict fire safety regulations in aviation are driving the adoption of flame-retardant textiles that comply with FAA and EASA standards. Materials are engineered to withstand ignition, reduce smoke emission, and limit toxic gas release during emergencies. Textile suppliers are investing in advanced coatings and fiber blends to meet evolving safety benchmarks and certification requirements.

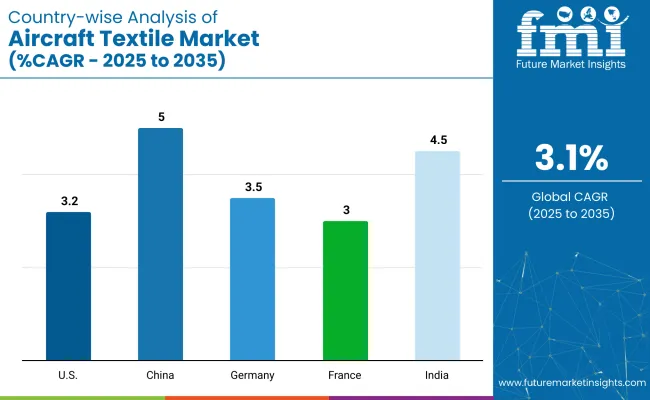

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.0% |

| India | 4.5% |

| Germany | 3.5% |

| United States | 3.2% |

| France | 3.0% |

The global market is projected to grow at a CAGR of 3.1% from 2025 to 2035, fueled by increasing aircraft deliveries, cabin refurbishments, and regulatory shifts toward lighter, safer cabin materials. China leads the top five countries with a CAGR of 5.0%, supported by aggressive airline expansion and growing domestic supply capabilities.

India follows with a 4.5% CAGR, driven by low-cost carriers and regional aircraft demand. Mature aviation hubs such as Germany (3.5%), the USA (3.2%), and France (3.0%) are prioritizing in-cabin comfort, textile sustainability, and refurbishment cycles.

While BRICS nations like China and India focus on capacity-building and local sourcing, OECD members such as Germany, France, and the USA are driving innovation in flame-retardant, eco-certified, and aesthetic-centric cabin textiles.

The report provides insights across 40+ countries. The five below are highlighted for their strategic influence and growth trajectory.

China’s market is forecast to grow at a CAGR of 5.0%, the highest among the five, reflecting rapid domestic airline fleet expansion and airport infrastructure growth across Tier 2 and Tier 3 cities. The country is investing in vertically integrated cabin interior supply chains, including synthetic and blended fabric production for seat covers and flooring.

Regional OEMs such as COMAC are adopting localized textile sourcing to reduce cost and comply with safety standards for narrow-body jets. Demand is particularly high for durable, low-weight seat upholstery in fast-turnaround domestic carriers.

Indian market is projected to expand at a CAGR of 4.5%, driven by the surge in domestic air travel and ongoing fleet acquisitions by budget carriers. A notable differentiator is India’s growing reliance on retrofit solutions for aging aircraft interiors, especially among legacy carriers.

The demand is skewed toward low-maintenance materials such as synthetic leather seat covers, antimicrobial curtains, and stain-resistant carpets. Domestic textile firms are entering the aerospace sector via public-private partnerships and DGCA-certified production hubs focused on flame-retardant weaves.

Germany is forecast to grow at a CAGR of 3.5%, supported by strong demand from its embedded aerospace manufacturing sector and premium airline refurbishment cycles. A defining characteristic of the German market is its focus on recyclable and low-smoke emission textiles in line with EU aviation material directives.

German suppliers are leading in developing eco-engineered wool blends and technical textiles with integrated temperature regulation for business and first-class cabins. Innovations in antimicrobial coatings and biodegradable yarns are gaining traction in VIP and charter jet interiors.

The USA market is expanding at a CAGR of 3.2%, underpinned by high aircraft replacement rates and a mature MRO ecosystem. What differentiates the USA is its emphasis on multifunctional textiles-materials that combine flame retardancy with anti-static, stain resistance, and moisture-wicking capabilities.

USA-based MRO facilities and cabin suppliers are innovating with modular textile systems that simplify installation and reduce maintenance time. Demand is especially high in regional and private aviation, where branding, comfort, and rapid refurb cycles intersect.

France is projected to grow at a CAGR of 3.0%, reflecting a stable outlook driven by its deep integration into Airbus supply chains and sustainable aviation goals. The French market is unique for its focus on aesthetics and brand personalization in cabin textiles.

Airlines and OEMs are collaborating with design studios to customize seating fabrics, wall panels, and curtains to align with cabin ambience themes. France is also investing in closed-loop textile recycling models for cabin interiors, especially for short-haul aircraft, aligning with national green aviation targets.

The industry is moderately consolidated, with prominent players such as Lantal, Tapis Corporation, and Tex Tech Industries leading the segment through specialized innovations in flame-retardant, lightweight, and durable fabrics. Lantal is recognized for its complete aircraft textile solutions including seat covers, carpets, and curtains, offering both design customization and technical compliance. Tapis Corporation specializes in eco-friendly synthetic leather and soft goods tailored for premium cabin interiors.

Other active players such as Tisca Tiara and DIATEX SAS provide woven and nonwoven technical fabrics for both commercial and military aircraft. Companies like Belgraver Aircraft Interiors and Acme Mills focus on refurbishments and aftermarket solutions, while SNT Group and NIEMLA enhance their footprint through regional contracts and customized offerings for emerging airlines.

Recent Aircraft Textile Industry News

In April 2025, a consortium comprising Studio ID, TrendWorks, Sabeti Wain Aerospace and Botany Weaving launched Monova PE, the world’s first fully recyclable mono-material laminated aircraft seat cover. Made entirely of polyester, Monova PE supports closed-loop recycling, reduces cabin weight and aligns with growing sustainability goals in aviation interior design.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.3 billion |

| Projected Market Size (2035) | USD 3.1 billion |

| CAGR (2025 to 2035) | 3.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for market value |

| Product Types Analyzed (Segment 1) | Woven, Non-Woven, Knitted Fabrics |

| Applications Analyzed (Segment 2) | Seat Fabrics, Carpet, Curtains, Panel Coverings, Thermal Blankets |

| Sales Channels Analyzed (Segment 3) | First Fit, Aftermarket |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Japan, China, India, South Korea, Brazil |

| Key Players | Tex Tech Industries, Tisca Tiara, Tapis Corporation, Acme Mills, Belgraver Aircraft Interiors, Lantal, DIATEX SAS, NIEMLA, SNT Group |

| Additional Attributes | Dollar sales by application and sales channel, growing aircraft fleet size, emphasis on lightweight and fire-retardant materials, and steady demand in both commercial and defense aviation sectors. |

The market is segmented by product type into woven, non-woven, and knitted fabrics.

Key applications include seat fabrics, carpet, curtains, panel coverings, and thermal blankets.

Based on the sales channel, the market is divided into first fit and aftermarket segments.

Regionally, the market spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and the Middle East & Africa.

The market is expected to reach USD 3.1 billion by 2035.

The market size is projected to be USD 2.3 billion in 2025.

The market is expected to grow at a CAGR of 3.1% from 2025 to 2035.

Woven fabrics are expected to lead the product type segment with a 58% market share in 2025.

China is anticipated to grow at the highest CAGR of 5.0% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA