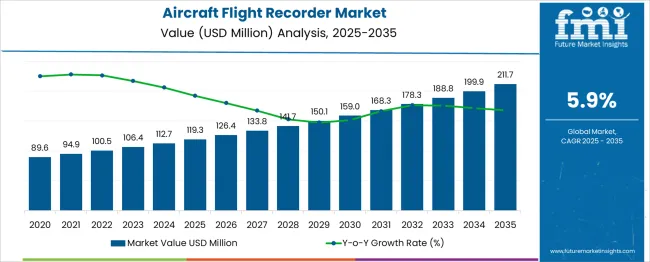

The Aircraft Flight Recorder Market is estimated to be valued at USD 119.3 million in 2025 and is projected to reach USD 211.7 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. During the initial phase from 2020 to 2025, the market value rises from USD 89.6 million to USD 119.3 million, driven by increasing investments in aviation safety and stringent regulatory mandates requiring enhanced flight data recording capabilities. This period is characterized by the growing adoption of advanced cockpit voice recorders and flight data recorders with improved storage capacity and real-time data transmission features. Between 2026 and 2030, the market expands from USD 126.4 million to USD 159.0 million, supported by rising global air traffic and fleet modernization initiatives.

The integration of cutting-edge technologies, such as wireless data streaming and enhanced crash survivability, increases the demand for next-generation flight recorders. From 2031 to 2035, growth accelerates, with the market advancing from USD 168.3 million to USD 211.7 million. This phase benefits from continued regulatory focus on aviation safety, including mandates for deployable and real-time flight recorders, alongside increasing investments in unmanned aerial vehicle (UAV) flight recording solutions. Overall, the Aircraft Flight Recorder Market is positioned for sustained growth through 2035, driven by regulatory compliance, technological innovation, and expanding global air transportation activities.

| Metric | Value |

|---|---|

| Aircraft Flight Recorder Market Estimated Value in (2025 E) | USD 119.3 million |

| Aircraft Flight Recorder Market Forecast Value in (2035 F) | USD 211.7 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The aircraft flight recorder market secures a critical role within the broader aviation safety and monitoring ecosystem, accounting for approximately 38–42% share of the overall aircraft safety equipment market, driven by its mandatory integration in all commercial and defense aircraft. Within the avionics systems segment, flight recorders contribute around 18–20%, reflecting their vital function in ensuring operational integrity, accident investigation, and compliance with global aviation regulations.

In the global crash-survivable memory unit category, they dominate with nearly 60% share, underlining their irreplaceable value for data retention under extreme conditions. Flight data recorders (FDR) and cockpit voice recorders (CVR) collectively form the core components of this market, with increasing emphasis on combined units offering space and weight optimization. Rising demand is supported by growth in commercial aviation fleets, defense modernization programs, and regulatory frameworks mandating improved survivability and extended recording durations. The introduction of deployable flight recorders and cloud-based real-time data streaming is further enhancing safety standards, reducing incident investigation timelines, and improving predictive maintenance capabilities.

Despite high penetration in developed markets, emerging economies show strong adoption due to fleet expansions and stricter oversight by regional aviation authorities. Market dynamics are further influenced by technological upgrades for crash protection, underwater locator beacons, and integration with satellite-based communication systems, positioning aircraft flight recorders as an indispensable component of modern aviation safety infrastructure across global markets.

Technological advancements in data acquisition, storage capacity, and real-time transmission capabilities have elevated the role of flight recorders in modern aircraft safety and investigation protocols. Regulatory mandates from civil aviation authorities have made the installation of advanced flight recording systems mandatory in both new aircraft and retrofits.

Additionally, rising investments in fleet modernization and the growing emphasis on predictive maintenance solutions are contributing to sustained demand for next-generation flight data recorders. The market is also benefitting from the growing commercial aviation sector, where passenger safety, compliance, and operational efficiency remain top priorities.

As aircraft become more digitally connected, the importance of resilient, high-capacity flight recorders that support detailed flight analytics is expected to increase. This trend positions the market for steady growth, particularly in high-compliance regions with strong safety oversight and airline fleet expansion..

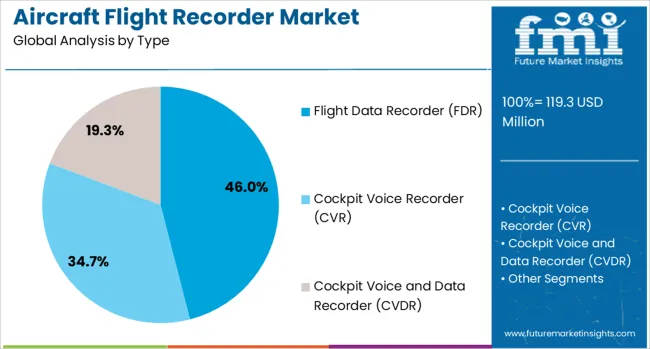

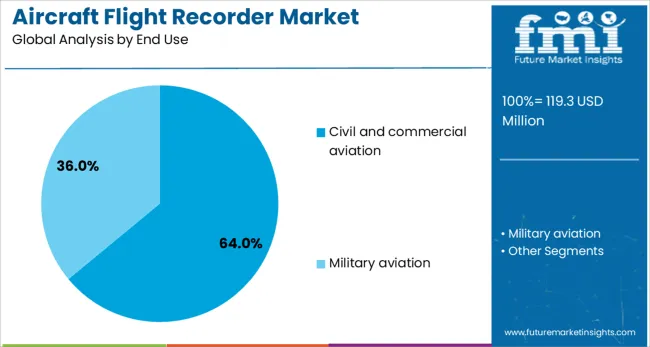

The aircraft flight recorder market is segmented by type, end use, and geographic regions. The aircraft flight recorder market is divided by type into Flight Data Recorder (FDR), Cockpit Voice Recorder (CVR), and Cockpit Voice and Data Recorder (CVDR). In terms of end use, the aircraft flight recorder market is classified into Civil and commercial aviation and Military aviation. Regionally, the aircraft flight recorder industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The flight data recorder segment is projected to account for 46% of the Aircraft Flight Recorder market revenue share in 2025, making it the leading type. This segment's dominance has been driven by the increasing need for comprehensive flight performance monitoring, accident investigation, and regulatory compliance. Flight data recorders have been widely adopted in both fixed-wing and rotary-wing aircraft due to their ability to capture thousands of parameters per flight, offering valuable insights into engine performance, flight control systems, and pilot inputs.

Their evolving capability to interface with modern avionics systems and transmit real-time data to ground control has further strengthened their adoption. Civil aviation regulators have enforced the mandatory integration of advanced flight data recorders in commercial aircraft, which has accelerated procurement.

In addition, the continuous push for enhanced safety standards by international aviation bodies has led to the integration of longer-duration and crash-survivable recorders. These factors have positioned the flight data recorder as an essential component in the safety ecosystem of modern aviation..

The civil and commercial aviation segment is expected to contribute 64% of the Aircraft Flight Recorder market revenue share in 2025, emerging as the largest end use sector. The growth of this segment has been attributed to the rapid expansion of global air travel and increasing aircraft fleet sizes across both established and emerging markets. Airlines and aircraft manufacturers have prioritized compliance with international flight safety regulations, which mandate the use of high-performance flight recorders.

This segment has also benefited from the rising demand for aircraft equipped with real-time diagnostics and monitoring systems, particularly in passenger carriers and air cargo operators. The deployment of predictive maintenance and the need for data-driven operational insights have further fueled the adoption of advanced recorders in commercial fleets.

Additionally, the strong focus on passenger safety, insurance accountability, and regulatory investigations has driven investment in robust and technologically advanced flight data and cockpit voice recorders. As global airspace becomes more congested, civil and commercial aviation stakeholders are expected to maintain high adoption levels of flight recording solutions..

The aircraft flight recorder market is driven by regulatory compliance, fleet expansion, and demand for integrated systems with enhanced survivability. Emerging trends like real-time data streaming and retrofitting programs are shaping the next phase of industry growth.

The aircraft flight recorder market is witnessing increasing adoption of combined flight data recorder (FDR) and cockpit voice recorder (CVR) units to optimize weight and space while ensuring compliance with global safety mandates. Airlines are prioritizing integrated solutions to streamline maintenance and improve operational efficiency. These systems enable recording of multiple data parameters essential for accident analysis and predictive maintenance. The trend is reinforced by regulations requiring extended recording duration and higher memory capacity. Manufacturers are focusing on designs that meet crash survivability standards and integrate seamlessly with modern avionics systems, positioning multi-functional recorders as a preferred choice for both commercial and defense fleets.

Stringent regulations by aviation authorities such as EASA, FAA, and ICAO continue to drive adoption of advanced flight recorders globally. Mandates on data retention periods, crash survivability, and the addition of underwater locator beacons have shaped procurement strategies for airlines and defense operators. These requirements extend beyond commercial aviation to business jets and cargo fleets, creating consistent demand across segments. Governments are also pushing for enhanced data transmission capabilities to improve post-incident investigations. Compliance remains a key market driver, compelling manufacturers to innovate within strict timelines while ensuring certification for international operations.

The surge in global air traffic and fleet expansion in emerging economies is creating significant opportunities for the flight recorder market. Airlines in Asia-Pacific, the Middle East, and Africa are investing in new aircraft and upgrading legacy fleets to meet modern safety standards. Retrofit programs targeting older aircraft have gained momentum, as carriers seek to comply with evolving regulatory frameworks without replacing entire fleets. These initiatives are particularly strong in regional and charter operators, where cost-effective retrofitting ensures regulatory adherence while extending service life. This trend underscores the need for adaptable flight recording solutions for diverse aircraft configurations.

The aviation industry is moving toward real-time flight data streaming to enhance situational awareness and accident investigation processes. While traditional crash-protected recorders remain indispensable, the integration of data transmission via satellite links is gaining traction. These systems allow continuous monitoring of flight parameters, enabling faster response during emergencies and improving predictive maintenance accuracy. Airlines and regulators view this capability as essential for reducing risks and operational disruptions. Although adoption is gradual due to cost and connectivity challenges, the shift toward hybrid solutions combining onboard recorders with real-time streaming is poised to redefine safety and maintenance strategies in aviation.

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

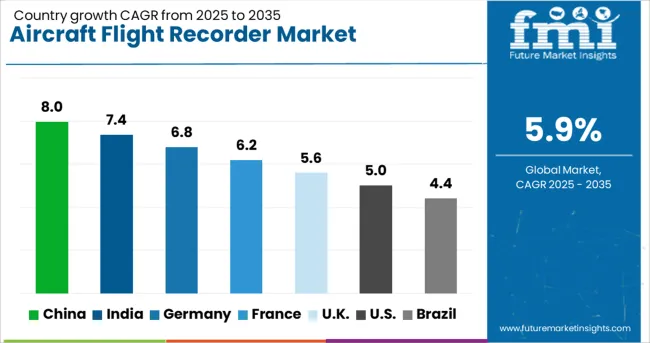

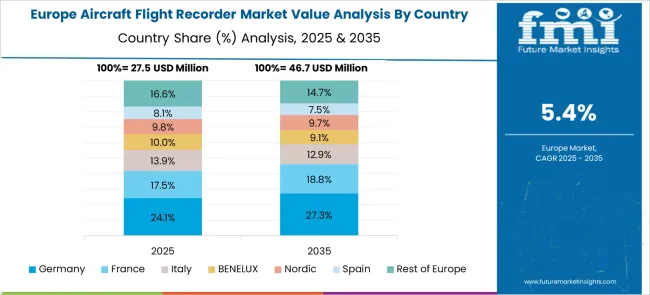

The aircraft flight recorder market is projected to grow globally at a CAGR of 5.9% between 2025 and 2035, fueled by regulatory compliance, fleet modernization, and demand for integrated safety systems. China leads with a CAGR of 8.0%, supported by rapid commercial aviation expansion and strict safety mandates for new fleets. India follows at 7.4%, driven by growing domestic air travel and government initiatives promoting modern avionics integration. France records 6.2%, leveraging its strong aerospace manufacturing base and regulatory alignment under EASA standards. The United Kingdom grows at 5.6%, influenced by retrofitting programs in regional carriers and demand for advanced data retention systems. The United States posts a CAGR of 5.0%, reflecting a mature market where incremental growth is linked to upgrades in crash survivability and hybrid real-time data transmission solutions. The analysis spans over 40 markets globally, with these five countries serving as benchmarks for strategic planning in the next few years.

China is projected to achieve a robust CAGR of 8.0% during 2025–2035, up from an estimated 7.1% in 2020–2024, well above the global average of 5.9%. The acceleration reflects aggressive fleet expansion plans, strong domestic air travel growth, and ICAO-aligned safety mandates. Rapid adoption of advanced flight recorders with crash survivability enhancements and deployable configurations has gained traction across new-generation aircraft programs. Local manufacturing capabilities and government-backed initiatives for aviation modernization continue to support this surge. Partnerships between global OEMs and Chinese avionics suppliers are fostering integration of real-time data transmission features, positioning China as a global leader in recorder deployment.

India is forecasted to grow at a 7.4% CAGR between 2025–2035, up from about 6.6% during 2020–2024, reflecting a notable uptick driven by rising commercial airline penetration and regional connectivity initiatives. The introduction of ultra-low-cost carriers and government-backed UDAN projects are fueling demand for modern avionics systems including flight recorders. Increased focus on safety compliance by the Directorate General of Civil Aviation (DGCA) has accelerated upgrades and installations. As domestic carriers expand fleets with narrow-body aircraft for short-haul routes, flight recorder adoption becomes indispensable for meeting ICAO norms, enabling significant opportunities for both OEMs and retrofit solution providers.

France is expected to post a 6.2% CAGR in 2025–2035, compared to 5.4% during 2020–2024, marking a steady rise driven by strong demand from Airbus-led production programs and compliance with EASA regulations. Early growth was moderate as fleet modernization was focused on incremental retrofits. However, the upcoming decade will see faster adoption of integrated CVR/FDR units and floating recorder technology in alignment with ICAO recommendations. Continuous upgrades in data survivability standards and enhanced memory capacity have created a competitive market landscape in Europe, positioning France as a strategic hub for advanced avionics manufacturing.

The United Kingdom is projected to register a CAGR of 5.6% during 2025–2035, up from nearly 4.8% in 2020–2024, supported by increased retrofit programs for regional and charter fleets. The earlier phase experienced slower growth due to limited new aircraft orders and Brexit-related disruptions in aerospace supply chains. Post-2024, accelerated compliance with European and ICAO safety standards has driven investments in next-generation flight recorders featuring real-time data streaming capability. Enhanced integration with predictive maintenance platforms is becoming a competitive advantage for operators aiming to optimize operational safety and reduce investigation timelines.

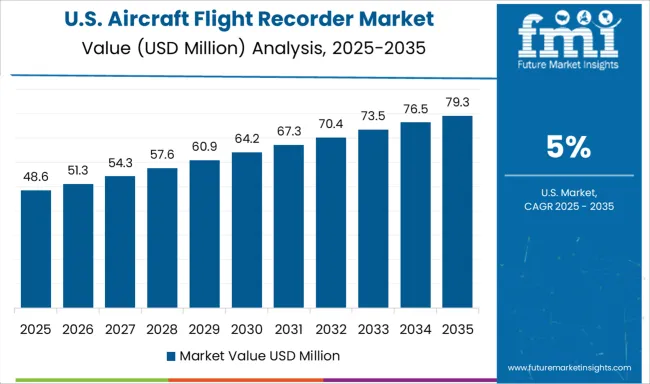

The USA is anticipated to grow at 5.0% CAGR in 2025–2035, compared to approximately 4.2% in 2020–2024, reflecting modest gains in a mature market. The rise is attributed to regulatory mandates for enhanced crash survivability, longer-duration voice recording, and deployable recorders for oceanic routes. The implementation of real-time data transmission in commercial and business jets is gradually shaping procurement strategies. OEMs and major airlines are adopting hybrid systems combining physical crash-protected units with satellite-based streaming solutions to meet next-gen safety requirements while ensuring operational efficiency.

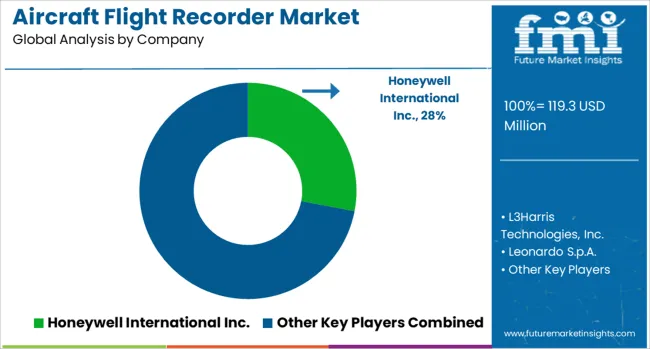

The aircraft flight recorder market is shaped by globally recognized aerospace and avionics leaders such as Honeywell International Inc., L3Harris Technologies, Inc., Leonardo S.p.A., Curtiss-Wright Corporation, Safran S.A., and Teledyne Technologies Incorporated. These companies compete on product reliability, regulatory compliance, and integration of advanced data capture technologies to enhance operational safety and accident investigation processes. Honeywell International Inc. dominates with a comprehensive portfolio of cockpit voice recorders (CVRs) and flight data recorders (FDRs), emphasizing real-time data streaming capabilities and extended memory capacity for modern aircraft systems.

L3Harris Technologies, Inc. holds a strong position with innovative deployable recorders designed to improve post-crash recovery and ensure compliance with ICAO and EASA mandates for data survivability and transmission standards. Leonardo S.p.A. and Safran S.A. are leveraging their expertise in integrated avionics and aerospace systems to offer high-performance recorders tailored for both commercial and defense applications. Curtiss-Wright Corporation is expanding its footprint through advanced lightweight designs and digital recording solutions optimized for next-generation aircraft platforms. Teledyne Technologies Incorporated contributes significantly through specialized solutions for underwater locator beacons and crash-protected storage, critical for meeting stringent aviation safety norms. The competitive environment is characterized by high entry barriers due to complex certification requirements, strict international regulations, and rigorous reliability standards under extreme conditions.

In 2024 and 2025, the aircraft flight recorder market will include compliance with ICAO and FAA mandates requiring 25-hour cockpit voice recorders and deployable units, boosting replacement and retrofit demand. Airlines are prioritizing integrated CVR/FDR systems with real-time data streaming to enhance safety and predictive maintenance.

Partnerships between OEMs and avionics suppliers for advanced crash-protected recorders are increasing, alongside investment in lightweight, high-capacity designs for modern fleets. Growth is reinforced by rising aircraft deliveries in Asia-Pacific, fleet modernization programs in Europe, and the adoption of cloud-enabled flight data monitoring for operational efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 119.3 Million |

| Type | Flight Data Recorder (FDR), Cockpit Voice Recorder (CVR), and Cockpit Voice and Data Recorder (CVDR) |

| End Use | Civil and commercial aviation and Military aviation |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., L3Harris Technologies, Inc., Leonardo S.p.A., Curtiss-Wright Corporation, Safran S.A., and Teledyne Technologies Incorporated |

The global aircraft flight recorder market is estimated to be valued at USD 119.3 million in 2025.

The market size for the aircraft flight recorder market is projected to reach USD 211.7 million by 2035.

The aircraft flight recorder market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in aircraft flight recorder market are flight data recorder (fdr), cockpit voice recorder (cvr) and cockpit voice and data recorder (cvdr).

In terms of end use, civil and commercial aviation segment to command 64.0% share in the aircraft flight recorder market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA