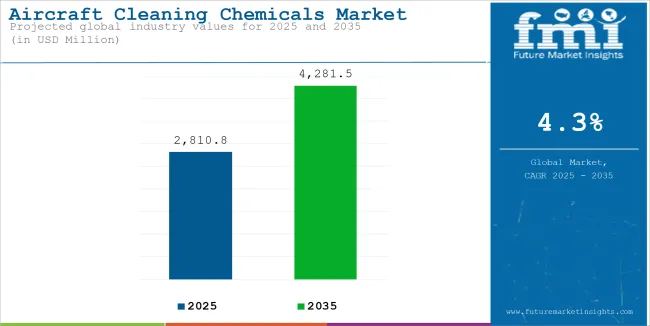

The global sales of Aircraft Cleaning Chemicals are anticipated to reach USD 2,694.9 million by 2024, with a growing demand increase from end users at 4.3% CAGR over the forecast period. The market value is forecast to grow from USD 2,810.8 million in 2025 to USD 4,281.5 million by 2035.

The global market for aircraft cleaning chemicals is expected to rise significantly over the next few years due to the increasing air traffic, the introduction of strict regulations on hygiene, and the sustainability push in the aviation and aircraft sectors. Cleaning chemicals ensure that the airplane looks fresh, that the cabin air is safe for passengers, and that the airplane does not suffer from corrosion or other damage and lasts longer in operation.

| Attributes | Key Insights |

|---|---|

| Market Value, 2024 | USD 2,694.9 Million |

| Estimated Market Value, 2025 | USD 2,810.8 Million |

| Projected Market Value, 2035 | USD 4,281.5 Million |

| Market Value CAGR (2025 to 2035) | 4.3% |

The market consists of many types such as exterior surface cleaning agents, interior cabin cleaning agents, or purpose engine cleaning agents. Airlines and maintenance providers are beginning to use environmentally friendly and biodegradable cleaning agents to satisfy tough environmental laws reducing carbon footprints. This is consistent with the net zero goal of the air transport sector as a whole.

The market for aircraft cleaning chemicals and other related products is on an upward growth due to commercial operators having high standards for passenger hygiene. This at the same time has increased the demand for sanitizers, disinfectants, and other cleaning tools. Further - business expansion in the Asia Pacific and Middle Eastern regions has led to an increased use of aircraft and thus equipment needed for cleaning them.

With the development of nontoxic, high-effectiveness formulas on the rise, the market is experiencing dramatic shifts. The availability of automated cleaning devices is also on the rise which shows economic benefits removing the need for maintenance and lowering labor costs.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and current year (2025) for the global Aircraft Cleaning Chemicals market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year. The first half of the year, or H1, spans from January to June. The second half, H2, includes the months from July to December.

The below table presents the expected CAGR for the global Aircraft Cleaning Chemicals sales over several semi-annual periods spanning from 2024 to 2034. In the first half (H1) from 2024 to 2034, the business is predicted to surge at a CAGR of 3.9%, followed by a slightly higher growth rate of 4.4% in the second half (H2).

| Particular | Value CAGR |

|---|---|

| H1 | 3.9% (2024 to 2034) |

| H2 | 4.4% (2024 to 2034) |

| H1 | 4.1% (2025 to 2035) |

| H2 | 4.5% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 4.1% in the first half and remain relatively moderate at 4.5% in the second half. In the first half (H1) the market witnessed an increase of 20 BPS while in the second half (H2), the market witnessed an increase of 10 BPS.

Increasing Demand for Aircraft Hygiene and Safety Standards

The trends in the aircraft cleaning chemicals market, passengers' safety, and hygiene are of top-notch importance to every airline in the world post-pandemic. The aircraft cleaning chemicals market has seen some growth primarily due to an increase in the cleanliness and hygiene standards of aircraft cabins. Disinfectants, and cleaning chemicals specific to the aircraft's interior and exterior are some of the innovations made in the cleaning technologies sector and surely complimented the post-pandemic goals.

The requirements set in place by various regulatory bodies highlight the need for proper sanitation protocols to be exercised in the cabins to meet the cleaning standards aircraft need to achieve to cabin high-volume surfaces such as armrests, overhead compartments, and lavatories.

Due to these standards becoming more and more strict, there was a spotlight put on disinfectant products that are specifically geared for air cleaning. These regulations become the reason why many aircraft cleaning chemicals have been created and are being used by airlines to guarantee the highest level of security for their passengers. Due to these amendments, airlines have also moved towards longer cleaning cycles and more frequent disinfections.

Cleaning of engines, fuselages, landing gears, and other components of an aircraft should be done regularly in order to avoid the accumulation of residues that would lead to a detrimental impact on fuel economy and performance. Such factors propelled the demand for both efficient and environmentally friendly cleaning products due to the increased attention towards the well-being of passengers and overall safety within the Aviation sector.

Rising Focus on Sustainability and Eco-Friendly Solutions

Sustainability is a critical driver in the aircraft cleaning chemicals market. With global aviation contributing significantly to carbon emissions, the industry is under increasing pressure to adopt environmentally friendly solutions. This trend is not just limited to fuel efficiency but also extends to the maintenance and cleaning processes. Airlines and manufacturers are increasingly focusing on eco-friendly cleaning products that reduce their environmental footprint.

Solvent-based chemicals traditionally used in aircraft cleaning can be harmful to the environment, leading to growing concerns about their long-term impact. As such, there is a rising demand for biodegradable, non-toxic, and low-VOC (volatile organic compounds) cleaning products. The adoption of these eco-friendly solutions is aligned with the broader sustainability goals of the aviation industry, which aims to minimize waste, reduce chemical pollution, and promote resource efficiency.

Leading manufacturers of cleaning chemicals are investing heavily in the development of green products that meet both regulatory requirements and environmental standards. Airlines, in turn, are increasingly prioritizing sustainability when selecting cleaning solutions, recognizing that eco-friendly practices can improve their brand image and appeal to environmentally-conscious passengers.

Furthermore, regulatory bodies are tightening guidelines on the use of harmful chemicals, pushing the industry to transition toward more sustainable alternatives.

The Booming Aviation Sector presents a Huge Opportunity for Aircraft Cleaning Chemicals.

The global aviation market is expected to grow at a CAGR of around 6.2%. An increasing number of passengers opting to travel via aircraft because of shorter journey duration is one of the reasons that is expected to drive the aviation market.

The key players in the aviation sector are expected to invest in aircraft cleaning chemicals because of the ability of these chemicals to maintain a clean ambiance within the aircraft. Not only that, but they also assist in the removal of dust particles outside the aircraft.

Based on the information available in Statista, the number of airline passengers from January 2022 to October 2022 has already crossed 3432 million, which is much greater than the number of airline passengers in 2021, which was 2277 million. These figures represent the potential of the airline industry and the kind of opportunity they bring to the aircraft cleaning chemicals market.

Ability to Increase the lifespan of the Aircraft to Increase the Adoption of Aircraft Cleaning Chemicals

The aircraft cleaning chemicals assist in increasing the lifespan of aircraft. When different types of metals are mixed, it might lead to a weakening of the parts. The application of aircraft cleaning materials ensures that they are covered using protective films and coatings.

Moreover, the surface of the aircraft might become contaminated with sea salt with each flight. These layers, when left as it is, might lead to corrosion. The usage of aircraft cleaning chemicals ensures that such undesirable coatings are removed. Moreover, these also keep the condition engine exhaust-free from dirt and oil residue, thereby acting as aircraft degreasers.

One of the most crucial parts of an airplane is the undercarriage. The accumulation of dust and dirt in the undercarriage can lead to hydraulic leaks. This scenario can only be avoided by the application of aircraft cleaning chemicals.

Apart from maintaining exterior cleanliness, the cleaning chemicals also help in maintaining the interior cabin. It shows that the owners and other stakeholders are serious about maintaining a clean interior cabin, thus addressing the problem of public health issues. This as well might increase the sales of aircraft cleaning chemicals during the forecast period.

From 2020 to 2024, the global aircraft cleaning chemicals market experienced steady growth, largely driven by the aviation industry's recovery from the pandemic. The increased focus on passenger safety and hygiene, coupled with strict regulatory requirements, spurred demand for advanced cleaning solutions. During this period, airlines emphasized cabin disinfection, leading to heightened sales of interior cleaning and disinfectant chemicals. The shift towards environmentally friendly and sustainable products also gained momentum, as companies prioritized low-VOC and biodegradable solutions.

Looking ahead, from 2025 to 2035, the market is expected to witness robust growth, fueled by rising air traffic, fleet expansions, and increased MRO (maintenance, repair, and overhaul) activities. The demand for high-performance cleaning chemicals will escalate, particularly in emerging economies like Asia-Pacific and the Middle East, where aviation markets are expanding rapidly. Furthermore, technological advancements in chemical formulations and automated cleaning systems will drive innovation and efficiency in the sector.

Sustainability will remain a pivotal factor, with airlines and regulatory bodies pushing for greener products to meet environmental goals. Overall, the market’s evolution from 2025 onward will be shaped by technological advancements, stringent hygiene standards, and the growing need for eco-friendly solutions, positioning it for sustained long-term growth.

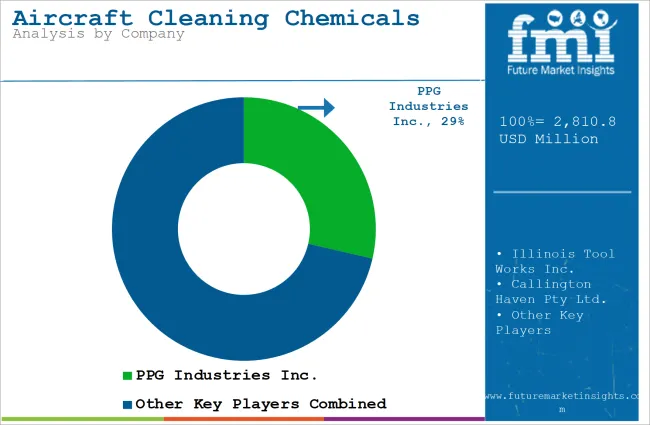

Tier 1 companies include industry leaders with annual revenues exceeding USD 100 Million. These companies are currently capturing a significant share of 50% to 60% globally. These frontrunners are characterized by high production capacity and a wide product portfolio. They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base.

These firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within Tier 1 include BASF SE, Honeywell International, Callington Haven, McGean-Rohco, Inc., Arrow Solutions, ALMADION International, Chemetall GmbH, and others.

Tier 2 includes most of the small-scale companies operating at the local level-serving niche Aircraft Cleaning Chemicals vendors with low revenue. These companies are notably oriented toward fulfilling local demands. They are small-scale players and have limited geographical reach. Tier 2, within this context, is recognized as an unorganized segment, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the analysis of the Aircraft Cleaning Chemicals industry in different countries. Demand analysis of key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The USA is anticipated to remain at the forefront in North America, with a value share of 72.7% in 2035. In South Asia, India is projected to witness a CAGR of 4.3% through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 4.1% |

| India | 3.8% |

| China | 3.4% |

| Germany | 2.9% |

| Japan | 2.5% |

Increased investment in Research and Development to develop a better form of aircraft cleaning chemicals and stringent government norms to maintain a clean environment are expected to surge the demand for aircraft cleaning chemicals in the USA. Additionally, higher disposable income coupled with increased awareness regarding the negative effects of the polluted surroundings is expected to further increase the sales of aircraft cleaning chemicals during the forecast period.

Massive technological development in the aviation industry, coupled with proactive steps taken by the authorities to maintain a hygienic ambiance in the aircraft, is expected to surge the sales of aircraft cleaning chemicals during the forecast period in the United States.

Based on the reports available from aviationbenefits.org, air transport contributes nearly USD 1.1 trillion to the North American GDP. Apart from that, the aviation industry facilitates the maximum number of domestic and international tourists in North America. Moreover, the easy availability of ammonia-free aircraft cleaner spray, which penetrates quickly to lift and dissolve dirt deposits, oily stains, smoke films, fingerprints, etc., from the glass surface is further expected to increase the aircraft cleaning chemicals market share.

The China market is expected to reach a valuation of USD 800 million by 2034. Based on the report from Global Times, the number of daily flights in China climbed to 6000 after mid-March 2022, and that too at a time when Shanghai was in lockdown. This shows the potential of aircraft cleaning chemicals in the China market.

Moreover, based on Oliver Wyman's MRO Market Economic Assessment, it is expected that China will become the largest air travel market by 2030, and China's MRO market is expected to reach an estimated USD 23.1 billion by 2030. These stats are a representation of the fact that China is nothing less than a gold mine for the aircraft cleaning chemicals market.

Apart from that, the introduction of FDI in the aviation sector, coupled with various other supportive government initiatives to set up a suitable infrastructure in the Asia Pacific, is expected to further expedite the market growth of aircraft cleaning tools and chemicals.

As per a report published by Outlook, the number of air passengers in the Asia Pacific stood at 1.5 billion in 2021, which represents a massive 33% of the global share. These figures highlight the fact that the Asia Pacific is no less than a gold mine, given the fact that the region is undergoing massive development on almost all fronts.

Additionally, based on a report published in Simple Flying, it was found that the Association of Asia Pacific Airlines recorded a mammoth increase of nearly 800% in August 2022 alone, and these figures would certainly mean an anticipated massive demand for aircraft cleaning chemicals during the forecast period.

Germany is expected to be one of the largest markets for aircraft cleaning chemicals. The reason is that the country is home to some of the largest aircraft manufacturers. The country is mainly meant for its world-class Research and Development in the aviation sector. Apart from that, the supply and manufacturing power associated with the aviation sector makes Germany one of the most attractive markets. This is expected to increase the demand for aircraft cleaning chemicals during the forecast period in Germany.

Germany as a leader in aviation research and development and a strong manufacturing industry provides not only a broad market for aircraft cleaning chemicals but also makes improvements in cleaning solutions. With the growth of the aviation sector in Germany, there will be an increase in the demand for effective, environment-friendly, and high-quality cleaning chemicals and thus the growth of the market.

This section below examines the value shares of the leading segments in the industry. In terms of product type, the Interior segment is expected to have the Highest Market Share during the Forecast Period and generate a CAGR of around 5.4% in 2025.

Based on the Formulation, the solvent-based Chemicals segment is projected to account for a share of 53.5% in 2025. The analysis would enable potential clients to make effective business decisions for investment purposes.

| Segment | Value CAGR (2024) |

|---|---|

| Interior segment (product type) | 5.4% |

The interior segment is expected to have the highest market share during the forecast period. In the last couple of years, airline companies have significantly invested in the cleanliness aspect to promote a healthy ambiance.

The interior segment is a significant driver in the aircraft cleaning chemicals market due to the growing emphasis on passenger safety, comfort, and hygiene. Post-pandemic, there has been a heightened demand for advanced cleaning and disinfectant solutions to ensure cabin cleanliness and prevent the spread of infectious diseases. Airlines are prioritizing rigorous sanitization of high-touch areas, such as seats, tray tables, and lavatories, to enhance passenger trust and satisfaction.

The increasing focus on premium passenger experiences has also spurred the demand for specialized interior cleaning chemicals that not only sanitize but also preserve the aesthetic appeal of aircraft interiors. Furthermore, regulatory bodies have mandated stringent hygiene standards for aircraft cabins, further driving the use of effective and certified cleaning chemicals.

| Segment | Value Share (2024) |

|---|---|

| Solvent Based Chemicals (Formulation) | 28.3% |

Solvent-based chemicals are anticipated to hold the highest market share in the aircraft cleaning chemicals market due to their superior performance and widespread applicability. These chemicals are highly effective in removing tough stains, grease, oil residues, and other contaminants that commonly accumulate on aircraft surfaces. Their strong cleaning capabilities make them indispensable for exterior cleaning and engine maintenance, ensuring optimal aircraft performance and safety.

The durability of solvent-based chemicals in extreme environmental conditions further boosts their demand. Aircraft often operate in harsh weather conditions and accumulate stubborn dirt, which requires powerful cleaning solutions. Solvent-based chemicals excel in such scenarios, providing reliable and efficient cleaning even in the presence of tough grime or grease.

The aircraft cleaning chemicals market is moderately fragmented, with competition driven by innovation, sustainability, and adherence to regulatory standards. Major players like BASF SE, Honeywell International, and Callington Haven dominate the market due to their advanced R&D capabilities, global reach, and strong relationships with airlines and maintenance organizations. These companies focus on developing eco-friendly and high-performance products, catering to the growing demand for sustainable aviation solutions.

Mid-sized players, such as Arrow Solutions and Chemetall GmbH, compete by offering specialized products tailored to regional markets or specific cleaning applications. Their ability to adapt quickly to evolving customer requirements gives them a competitive edge.

Key strategies in the market include partnerships with airlines, acquisitions to expand portfolios, and investments in environmentally friendly products. Rising competition is also seen in the growing number of players adopting automation technologies to streamline cleaning processes. The competitive landscape remains dynamic, with sustainability and innovation as central themes.

Industry Updates

In terms of product type, the industry is segmented into Exterior (Dry & Wet Wipes, Dry wash Cleaning, Wet Wash Cleaning, Degreasers, Exhaust & Soot removers, Polishes), Interior (Equipment Cleaning, Flight Wipes, Glass Cleaners, Air Fresheners, Leather Cleaner, Carpet Cleaner, lavatory Cleaner, Disinfectant and Insecticides).

In terms of formulation type, the industry is segmented into Water based, Solvent-based (Synthetic and Bio-Based), and Wax Based.

By end use, the industry is segmented into Civil Aircraft, Commercial/Cargo Aviation and Military.

Regions considered in the study are North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa.

The industry was valued at USD 2,694.9 Million in 2024

The industry is set to reach USD 2,810.8 Million in 2025

The industry value is anticipated to rise at 4.3% CAGR through 2035

The industry is anticipated to reach USD 4,281.5 Million by 2035

China accounts for 17.2% of the global Aircraft Cleaning Chemicals market revenue share alone.

Japan is predicted to witness the highest CAGR of 6.1% in the Aircraft Cleaning Chemicals market.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2032

Table 2: Global Market Volume (Tons) Forecast by Region, 2017 to 2032

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 5: Global Market Value (US$ Million) Forecast by Formulation, 2017 to 2032

Table 6: Global Market Volume (Tons) Forecast by Formulation, 2017 to 2032

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 8: Global Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 9: North America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 10: North America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 11: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 12: North America Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 13: North America Market Value (US$ Million) Forecast by Formulation, 2017 to 2032

Table 14: North America Market Volume (Tons) Forecast by Formulation, 2017 to 2032

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 16: North America Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 19: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 20: Latin America Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 21: Latin America Market Value (US$ Million) Forecast by Formulation, 2017 to 2032

Table 22: Latin America Market Volume (Tons) Forecast by Formulation, 2017 to 2032

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 26: Europe Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 27: Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 28: Europe Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 29: Europe Market Value (US$ Million) Forecast by Formulation, 2017 to 2032

Table 30: Europe Market Volume (Tons) Forecast by Formulation, 2017 to 2032

Table 31: Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 32: Europe Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 36: Asia Pacific Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Formulation, 2017 to 2032

Table 38: Asia Pacific Market Volume (Tons) Forecast by Formulation, 2017 to 2032

Table 39: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 40: Asia Pacific Market Volume (Tons) Forecast by End Use, 2017 to 2032

Table 41: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2032

Table 42: Middle East and Africa Market Volume (Tons) Forecast by Country, 2017 to 2032

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2032

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2017 to 2032

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Formulation, 2017 to 2032

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Formulation, 2017 to 2032

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2017 to 2032

Table 48: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2017 to 2032

Figure 1: Global Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 2: Global Market Value (US$ Million) by Formulation, 2022 to 2032

Figure 3: Global Market Value (US$ Million) by End Use, 2022 to 2032

Figure 4: Global Market Value (US$ Million) by Region, 2022 to 2032

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2017 to 2032

Figure 6: Global Market Volume (Tons) Analysis by Region, 2017 to 2032

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 9: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 10: Global Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 13: Global Market Value (US$ Million) Analysis by Formulation, 2017 to 2032

Figure 14: Global Market Volume (Tons) Analysis by Formulation, 2017 to 2032

Figure 15: Global Market Value Share (%) and BPS Analysis by Formulation, 2022 to 2032

Figure 16: Global Market Y-o-Y Growth (%) Projections by Formulation, 2022 to 2032

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 21: Global Market Attractiveness by Product Type, 2022 to 2032

Figure 22: Global Market Attractiveness by Formulation, 2022 to 2032

Figure 23: Global Market Attractiveness by End Use, 2022 to 2032

Figure 24: Global Market Attractiveness by Region, 2022 to 2032

Figure 25: North America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 26: North America Market Value (US$ Million) by Formulation, 2022 to 2032

Figure 27: North America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 28: North America Market Value (US$ Million) by Country, 2022 to 2032

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 30: North America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 33: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 34: North America Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 37: North America Market Value (US$ Million) Analysis by Formulation, 2017 to 2032

Figure 38: North America Market Volume (Tons) Analysis by Formulation, 2017 to 2032

Figure 39: North America Market Value Share (%) and BPS Analysis by Formulation, 2022 to 2032

Figure 40: North America Market Y-o-Y Growth (%) Projections by Formulation, 2022 to 2032

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 45: North America Market Attractiveness by Product Type, 2022 to 2032

Figure 46: North America Market Attractiveness by Formulation, 2022 to 2032

Figure 47: North America Market Attractiveness by End Use, 2022 to 2032

Figure 48: North America Market Attractiveness by Country, 2022 to 2032

Figure 49: Latin America Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 50: Latin America Market Value (US$ Million) by Formulation, 2022 to 2032

Figure 51: Latin America Market Value (US$ Million) by End Use, 2022 to 2032

Figure 52: Latin America Market Value (US$ Million) by Country, 2022 to 2032

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 58: Latin America Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 61: Latin America Market Value (US$ Million) Analysis by Formulation, 2017 to 2032

Figure 62: Latin America Market Volume (Tons) Analysis by Formulation, 2017 to 2032

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Formulation, 2022 to 2032

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Formulation, 2022 to 2032

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 69: Latin America Market Attractiveness by Product Type, 2022 to 2032

Figure 70: Latin America Market Attractiveness by Formulation, 2022 to 2032

Figure 71: Latin America Market Attractiveness by End Use, 2022 to 2032

Figure 72: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 73: Europe Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 74: Europe Market Value (US$ Million) by Formulation, 2022 to 2032

Figure 75: Europe Market Value (US$ Million) by End Use, 2022 to 2032

Figure 76: Europe Market Value (US$ Million) by Country, 2022 to 2032

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 81: Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 82: Europe Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 83: Europe Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 85: Europe Market Value (US$ Million) Analysis by Formulation, 2017 to 2032

Figure 86: Europe Market Volume (Tons) Analysis by Formulation, 2017 to 2032

Figure 87: Europe Market Value Share (%) and BPS Analysis by Formulation, 2022 to 2032

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Formulation, 2022 to 2032

Figure 89: Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 90: Europe Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 91: Europe Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 92: Europe Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 93: Europe Market Attractiveness by Product Type, 2022 to 2032

Figure 94: Europe Market Attractiveness by Formulation, 2022 to 2032

Figure 95: Europe Market Attractiveness by End Use, 2022 to 2032

Figure 96: Europe Market Attractiveness by Country, 2022 to 2032

Figure 97: Asia Pacific Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 98: Asia Pacific Market Value (US$ Million) by Formulation, 2022 to 2032

Figure 99: Asia Pacific Market Value (US$ Million) by End Use, 2022 to 2032

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2022 to 2032

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Formulation, 2017 to 2032

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Formulation, 2017 to 2032

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Formulation, 2022 to 2032

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Formulation, 2022 to 2032

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 114: Asia Pacific Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 117: Asia Pacific Market Attractiveness by Product Type, 2022 to 2032

Figure 118: Asia Pacific Market Attractiveness by Formulation, 2022 to 2032

Figure 119: Asia Pacific Market Attractiveness by End Use, 2022 to 2032

Figure 120: Asia Pacific Market Attractiveness by Country, 2022 to 2032

Figure 121: Middle East and Africa Market Value (US$ Million) by Product Type, 2022 to 2032

Figure 122: Middle East and Africa Market Value (US$ Million) by Formulation, 2022 to 2032

Figure 123: Middle East and Africa Market Value (US$ Million) by End Use, 2022 to 2032

Figure 124: Middle East and Africa Market Value (US$ Million) by Country, 2022 to 2032

Figure 125: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2032

Figure 126: Middle East and Africa Market Volume (Tons) Analysis by Country, 2017 to 2032

Figure 127: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 128: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 129: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2032

Figure 130: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2017 to 2032

Figure 131: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2022 to 2032

Figure 132: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2022 to 2032

Figure 133: Middle East and Africa Market Value (US$ Million) Analysis by Formulation, 2017 to 2032

Figure 134: Middle East and Africa Market Volume (Tons) Analysis by Formulation, 2017 to 2032

Figure 135: Middle East and Africa Market Value Share (%) and BPS Analysis by Formulation, 2022 to 2032

Figure 136: Middle East and Africa Market Y-o-Y Growth (%) Projections by Formulation, 2022 to 2032

Figure 137: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2017 to 2032

Figure 138: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2017 to 2032

Figure 139: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2022 to 2032

Figure 140: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2022 to 2032

Figure 141: Middle East and Africa Market Attractiveness by Product Type, 2022 to 2032

Figure 142: Middle East and Africa Market Attractiveness by Formulation, 2022 to 2032

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2022 to 2032

Figure 144: Middle East and Africa Market Attractiveness by Country, 2022 to 2032

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA