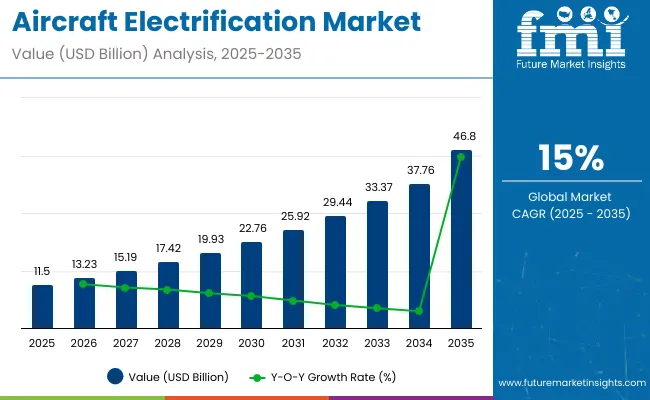

The aircraft electrification market is valued at USD 11.5 billion in 2025 and will advance to USD 46.8 billion by 2035, growing at a CAGR of 15% with a multiplying factor of about 4.1x.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 11.5 billion |

| Industry Value (2035F) | USD 46.8 billion |

| CAGR (2025 to 2035) | 15% |

Growth momentum analysis highlights how adoption accelerates in phases across the forecast horizon. In the early years, momentum is supported by regulatory pressure to lower emissions, rising fuel costs, and pilot programs from major aircraft manufacturers that integrate electric propulsion and hybrid systems in regional and short-haul aircraft. This stage is marked by strong investment in R&D and collaboration between aerospace firms, battery developers, and system integrators.

Between 2028 and 2032, momentum intensifies as technology breakthroughs in energy density, thermal management, and power electronics enhance operational feasibility. Commercialization of hybrid-electric aircraft and electrification of auxiliary systems drive steady adoption across both passenger and cargo fleets. Toward 2033 to 2035, growth momentum peaks as infrastructure for charging and maintenance matures, fleet operators adopt electric aircraft at larger scale, and new entrants push competition. This acceleration underscores the role of continuous innovation, cost optimization, and regulatory support in shaping market dynamics. Growth momentum across these phases illustrates a shift from experimental adoption to mainstream integration, reinforcing electrification as a transformative force in aviation.

Electrification programs are moving from prototypes to pre-production with measurable gains. High-voltage architectures (540-800 V) now feature in ~60% of active demonstrators, while next-gen SiC/GaN power stages deliver >98% inverter efficiency. Aviation-grade battery packs have advanced to 250-300 Wh/kg at system level in flight-test configurations, extending endurance by 15-25% versus prior iterations. Motor specific power in prototypes has reached 10-15 kW/kg, enabling megawatt-class propulsion for regional and eVTOL concepts. Hybrid-electric test hours expanded by 20% year-on-year in 2024-2025, and fleet simulations show 8-12% block-fuel reduction on short sectors using parallel-hybrid assist. Airports piloting MW-class charging report turnaround times under 30 minutes for eSTOL/eVTOL operations, supporting early commercial use cases.

The aircraft electrification market is underpinned by five primary parent sectors with differentiated influence. Aircraft OEMs and eVTOL developers account for approximately 33%, as platform design choices determine electrical architectures and demand for electric subsystems. Power electronics and distribution (inverters, converters, HVDC systems) contribute about 26%, enabling efficient energy flow and protection at high voltages. Batteries and energy storage represent roughly 21%, covering cells, battery management systems, and thermal control. Electric propulsion (high-specific-power motors and generators) holds near 12%, driving thrust and taxi functions. MRO, certification, and ground infrastructure comprise the remaining 8%, supporting compliance, upgrades, and charging logistics.

Rising fuel costs, stricter emission regulations, and the aviation industry’s commitment to carbon reduction are fueling adoption of electric propulsion technologies. Asia Pacific leads the adoption curve with a growing focus on regional electric aircraft programs, while North America and Europe are advancing through investments in hybrid-electric and fully electric systems. Key applications include electric propulsion, power distribution, and auxiliary systems. Airlines and manufacturers are collaborating with technology providers to integrate advanced batteries, fuel cells, and power electronics into future fleets to enhance efficiency, reduce emissions, and optimize operational performance.

Driving Force Fuel Efficiency and Emission Reduction

Fuel efficiency and emission reduction are primary drivers in the aircraft electrification market. Aviation fuel accounts for nearly 25 to 30% of airline operating costs, making alternatives highly attractive. Electric propulsion systems can cut fuel consumption by up to 15% in hybrid aircraft and completely eliminate it in fully electric platforms. Regulatory pressures in Europe and North America are compelling airlines to adopt greener technologies, while Asia Pacific is leading in electric commuter aircraft projects. In my view, the demand for sustainable aviation will accelerate adoption of electrified systems, positioning them as a critical solution for both cost savings and environmental compliance.

Growth Opportunity Regional Commuter Aircraft and Urban Air Mobility

Regional commuter aircraft and urban air mobility represent the strongest growth opportunities for aircraft electrification. By 2035, more than 6,000 electric and hybrid-electric aircraft are expected to enter service, primarily for short-haul flights under 500 km. Urban air mobility vehicles, including air taxis and cargo drones, are gaining traction in North America, Europe, and Asia Pacific. Investments in high-energy density batteries and fast-charging infrastructure will expand market opportunities. From my perspective, regional routes and urban mobility hubs will act as testing grounds for wider electrification in commercial aviation, creating long-term adoption pathways for large passenger and cargo aircraft.

Emerging Trend Integration of Advanced Batteries and Power Electronics

The integration of advanced batteries, fuel cells, and high-efficiency power electronics is reshaping aircraft electrification. Lithium-sulfur and solid-state batteries are expected to deliver energy densities 2 to 3 times higher than conventional lithium-ion, enabling longer flight ranges. Electric power distribution units and high-voltage converters are being developed to manage aircraft systems efficiently. Hybrid architectures combining fuel cells with batteries are also under research to extend endurance. In my opinion, the ability of manufacturers to integrate next-generation energy storage and distribution systems will determine how quickly electrified aircraft can transition from prototypes to mainstream aviation fleets.

Market Challenge High Costs and Energy Storage Limitations

High upfront costs and limitations in energy storage technology remain critical challenges for the aircraft electrification market. Development of electric propulsion systems, high-capacity batteries, and power electronics requires significant investment, raising the overall cost of aircraft production. Current battery technologies offer limited flight range compared to traditional aviation fuel, restricting adoption in long-haul segments. Infrastructure for charging and maintenance is underdeveloped in many regions, slowing deployment. In my opinion, unless battery energy density improves and costs decline, electrification will remain limited to regional and short-haul markets, delaying broader adoption in large commercial aircraft.

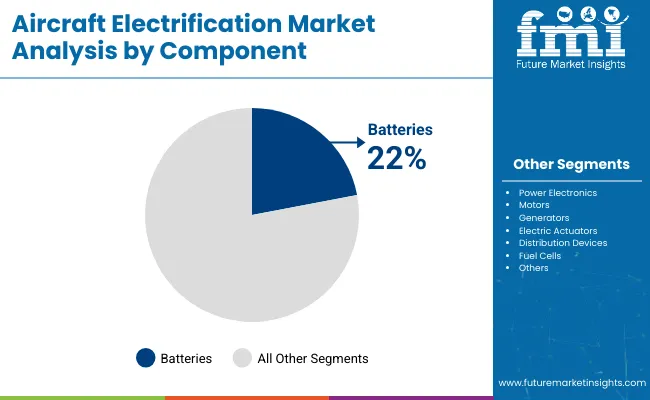

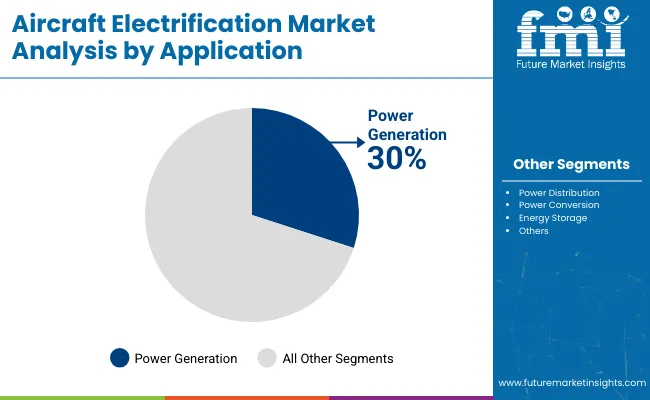

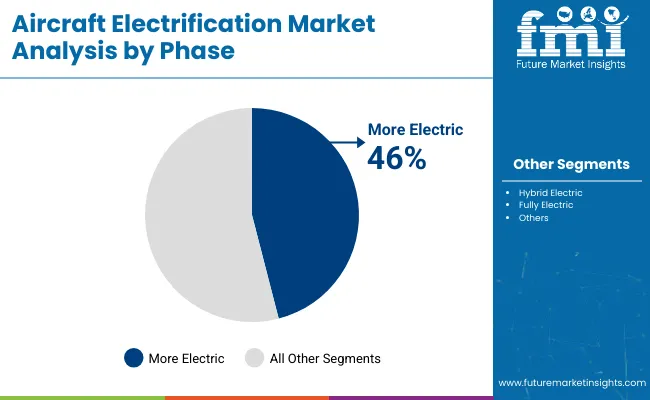

The aircraft electrification market is expanding as OEMs, Tier 1 suppliers, and airlines invest in energy-efficient systems to reduce reliance on traditional propulsion. Components such as batteries, power electronics, and motors represent core areas of development. Applications are concentrated in power generation and distribution, while energy storage gains importance with rising hybrid programs. More electric configurations dominate, though hybrid and fully electric platforms continue to gain attention. Market players focus on balancing weight, power density, and system integration for both commercial and defense aviation projects.

Batteries hold 22% share, making them the leading component in electrified aircraft systems. High-density lithium-ion and next-generation solid-state chemistries are increasingly adopted to support hybrid and fully electric platforms. Aircraft programs prioritize lightweight battery packs with enhanced safety and thermal management features. Outsourcing partnerships focus on testing cycle durability and optimizing charging efficiency for aviation requirements. As energy demands rise across propulsion and auxiliary systems, OEMs integrate modular battery packs to achieve redundancy and reliability. Continuous research in high-power storage ensures steady growth of this segment across commercial and regional fleets.

Power generation accounts for 30% share, the largest among applications in aircraft electrification. The segment includes electric generators that convert mechanical to electrical energy for avionics, actuation, and propulsion support. Hybrid-electric aircraft programs require high-output generators to balance engine load and distribute power efficiently. Industrial players are investing in lightweight, high-speed generator designs to improve efficiency. Military aviation also drives demand for enhanced onboard generation capacity, supporting advanced radar and sensor payloads. Ongoing adoption of more electric aircraft architectures reinforces generator system integration across fleets worldwide.

More electric configurations represent 46% share, leading the market by phase adoption. This approach replaces hydraulic and pneumatic subsystems with electric alternatives to improve efficiency and reduce maintenance costs. Aircraft models such as the Boeing 787 and Airbus A350 already integrate more electric architectures, driving continued outsourcing of system development. The focus lies on electric actuation, power conversion, and high-voltage distribution technologies. OEMs are gradually extending these architectures across new-generation regional and narrow-body aircraft. This segment serves as a bridge toward hybrid and fully electric designs, making it the largest and most established approach today.

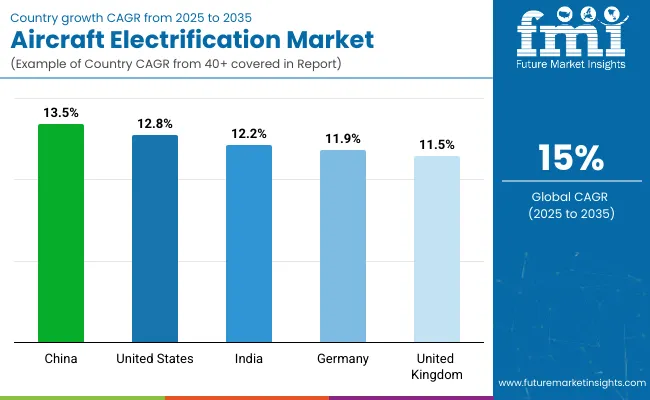

China is positioned at a CAGR of 13.5% from 2025 to 2035, which is −10% below the global benchmark of 15%. Growth in the country is tied to BRICS-led aircraft modernization programs, expanding domestic fleets, and government-backed initiatives in electric propulsion. The United States follows with 12.8%, −15% under the global rate, shaped by OECD-supported advances in hybrid-electric aviation, aerospace R&D, and integration of next-generation battery systems. India records 12.2%, −19% compared to the global CAGR, with expansion supported by fleet electrification programs and rising regional air traffic. Germany stands at 11.9%, −21% under the global average, reflecting strong aerospace manufacturing capabilities but slower adoption timelines due to regulatory alignment and infrastructure readiness. The United Kingdom posts 11.5%, −23% below the global benchmark, with activity centered on research partnerships and incremental technological integration. BRICS economies highlight scaling adoption, while OECD markets prioritize precision engineering, safety standards, and phased implementation.

The aircraft electrification market in China is forecast to expand at a CAGR of 13.5%, supported by state-backed aviation programs and domestic manufacturing capacity. The growth rate is driven by government funding for COMAC’s hybrid-electric aircraft, combined with strong demand for short-haul aviation in densely populated corridors. Local supply chain strength in batteries and power electronics accelerates development. Integration of electric taxiing at major hubs such as Shanghai Pudong cuts fuel costs and reduces emissions, further justifying investments. These factors together explain why China’s CAGR remains higher than other regions, as policy direction and manufacturing scale align with commercial demand.

The United States market is projected to grow at a CAGR of 12.8%, reflecting strong innovation pipelines and public-private collaborations. Growth is driven by NASA and FAA initiatives promoting sustainable aviation, as well as Boeing and Honeywell’s focus on regional electric propulsion systems. Federal grants and ARPA-E funding ensure steady progress in lightweight motor design and thermal management, which lowers development barriers. Airport readiness programs, including charging installations at hubs like Dallas-Fort Worth, reinforce adoption potential. This CAGR is supported by large-scale R&D funding, mature aerospace infrastructure, and regulatory push, which collectively strengthen market expansion prospects.

The demand of aircraft electrification in Germany is expected to register a CAGR of 11.9%, driven by Airbus-led innovation and federal research funding exceeding €300 million. The comparatively steady growth rate is influenced by Germany’s focus on gradual integration of hybrid and hydrogen-electric systems rather than rapid commercialization. Munich and Hamburg aerospace clusters nurture startups specializing in solid-state batteries, while airport electrification projects reduce fuel dependence. The strong automotive-electronics base supports engineering expertise, but cautious certification frameworks temper growth. Germany’s CAGR reflects the balance between ambitious innovation funding and regulatory conservatism, resulting in structured yet consistent expansion.

The United Kingdom market is projected to grow at a CAGR of 11.5%, largely shaped by Rolls-Royce and BAE Systems projects in hybrid propulsion. The pace is influenced by funding programs from the Aerospace Technology Institute worth £250 million, which prioritize long-term R&D over immediate commercialization. Airports like Bristol and Glasgow test electric ground handling, showing operational readiness, yet regulatory caution slows deployment speed compared with China or the USA The CAGR reflects steady growth, where funding and innovation pipelines exist, but timelines for large-scale adoption extend further due to safety and certification procedures.

The aircraft electrification market in India is forecast to grow at a CAGR of 12.2%, supported by strong policy backing and regional aviation demand. The UDAN scheme encourages hybrid-electric adoption for short-haul connectivity, especially in under-served airports. HAL and DRDO’s R&D in electric UAVs and light aircraft provides local technological capability. The CAGR is explained by India’s expanding domestic battery production and collaborations with global energy firms, which enhance supply chain readiness. Rapid aviation growth, combined with government incentives, ensures a higher-than-average pace of electrification deployment, even though infrastructure is still in early development.

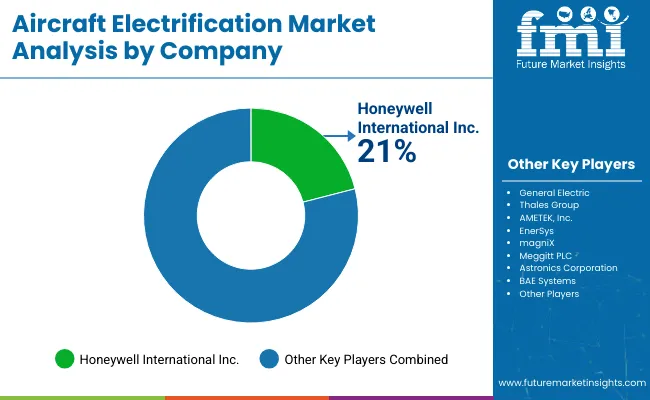

Competition in the aircraft electrification market is being defined by product innovation, system integration, and specialized solutions tailored for commercial and defense aircraft. Strong positioning is being reinforced through portfolios that include power electronics, energy storage units, electric propulsion, and high-efficiency distribution equipment. Strategies are built around differentiation, collaborations with manufacturers, and extensive validation of electric and hybrid-electric systems. Emphasis is placed on lightweight design, higher energy density, and performance reliability to meet operational requirements. AMETEK and Astronics are advancing in power conversion and distribution, while EnerSys and EaglePicher Technologies are strengthening rechargeable battery offerings with enhanced safety margins.

Electric propulsion is being delivered by magniX, with General Electric and Safran driving system-level integration. Thales Group and Honeywell are expanding avionics-focused electrification solutions with integrated control systems. Crane Aerospace & Electronics and BAE Systems are concentrating on actuation, power management, and advanced converters. Auxiliary systems are being provided by Radiant Power Corporation and PBS Aerospace to complement broader architectures. Product brochures highlight compact form, modular layouts, reduced weight, improved efficiency, and compliance with aviation standards. Extended service life, thermal performance, and adaptability with existing fleets are presented as key differentiators. Collective strategy across these companies is directed toward enhancing aircraft power capabilities while lowering reliance on traditional fuel-based systems, moving electrification closer to widespread adoption in aerospace.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 11.5 billion |

| Projected Market Size (2035) | USD 46.8 billion |

| CAGR (2025 to 2035) | 15% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Component Segments | Batteries, Fuel Cells, Electric Actuators, Generators, Motors, Power Electronics, Distribution Devices, Others |

| Application Segments | Power Generation, Power Distribution, Power Conversion, Energy Storage |

| Phase Segments | More Electric, Hybrid Electric, Fully Electric |

| Regions Covered | North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East and Africa (MEA) |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, Australia, Saudi Arabia, United Arab Emirates, South Africa |

| Leading Players | Honeywell International Inc., General Electric, Thales Group, AMETEK Inc., EnerSys, magniX, Meggitt PLC, Astronics Corporation, BAE Systems, Crane Aerospace & Electronics, EaglePicher Technologies, PBS Aerospace, Radiant Power Corporation, Raytheon Technologies, Safran, Lee Air Inc. |

| Additional Attributes | Dollar sales by component and aircraft type, demand dynamics across commercial, defense, and regional aircraft, regional adoption trends, innovation in hybrid and fully electric propulsion, environmental impact of reduced emissions and fuel use, and emerging use in urban air mobility and next-generation electric aircraft. |

The market size is valued at USD 11.5 billion in 2025.

It is projected to reach USD 46.8 billion by 2035.

The market is expected to grow at a CAGR of 15% during 2025-2035.

Batteries hold the largest share with 22% in 2025.

Honeywell International Inc. is the leading player with 21% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA