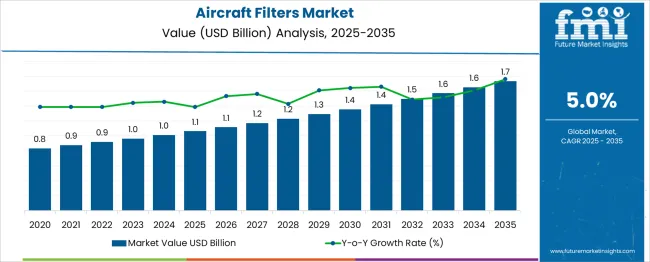

The Aircraft Filters Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 1.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. The aircraft filters market is expected to create an absolute dollar opportunity of USD 0.6 billion over the forecast period. This growth represents a multiplier of 1.55x, supported by a steady CAGR of 5%, driven by rising commercial aircraft deliveries, increasing maintenance requirements, and regulatory emphasis on safety and efficiency.

During the first five-year phase (2025–2030), the market is projected to reach approximately USD 1.4 billion, adding USD 0.3 billion, which accounts for 50% of the total incremental gain, fueled by aftermarket filter replacements and growing demand for cabin air and hydraulic filtration systems. The second half (2030–2035) contributes the remaining USD 0.3 billion, representing 50% of incremental growth, highlighting a consistent growth trajectory rather than a late-cycle surge. Annual increments will average USD 0.06 billion in early years, rising slightly as next-generation aircraft incorporate advanced filtration technologies for fuel systems, environmental control, and engine oil applications. Manufacturers focusing on lightweight, high-efficiency filter media and predictive maintenance capabilities will capture the largest share of this USD 0.6 billion opportunity, particularly as fleet modernization and air traffic recovery continue across key aviation markets worldwide.

| Metric | Value |

|---|---|

| Aircraft Filters Market Estimated Value in (2025 E) | USD 1.1 billion |

| Aircraft Filters Market Forecast Value in (2035 F) | USD 1.7 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The aircraft filters market occupies a critical share across several aerospace and aviation-related sectors. In the aerospace components market, its share is approximately 5–6%, as this category includes engines, avionics, and structural components with higher cost contributions. Within the aircraft systems and parts market, it accounts for about 8–10%, given the essential role of filtration in hydraulic, fuel, lubrication, and environmental control systems. In the aviation MRO (maintenance, repair, and overhaul) market, aircraft filters represent roughly 4–5%, as they require regular inspection and replacement to maintain operational safety and compliance. For the fluid and air filtration systems market, the share is around 12–14%, reflecting strong demand for specialized filters designed for high-pressure and high-temperature aviation environments.

In the commercial and military aviation equipment market, the share is relatively small at 3–4%, as it includes a broad range of high-value components like engines, radar, and weapon systems. Growth is driven by the increasing global aircraft fleet, rising air traffic, and stricter regulations for air quality and safety in aircraft cabins and systems. Technological advancements in lightweight materials, high-efficiency particulate filters, and extended service life products are enhancing market adoption. As aviation safety standards become more stringent, the aircraft filters market will continue strengthening its presence across these parent markets.

As global air traffic recovers and new aircraft programs gain momentum, filtration technologies are being integrated to meet stricter emission standards and reduce particulate contamination in key systems. Airlines and manufacturers are prioritizing filters that ensure clean airflow in engines, cabins, and hydraulic systems to enhance performance and reduce maintenance frequency.

The adoption of lightweight, high-efficiency filter materials is also contributing to fuel savings and overall system reliability. The future outlook is defined by the increasing need for durable and scalable filtration systems that can support next-generation aircraft platforms and withstand extreme operational environments. Maintenance, repair, and overhaul (MRO) providers are expected to invest significantly in filtration upgrades to meet regulatory and safety standards. These factors combined are paving a sustained path of growth for the Aircraft Filters market globally..

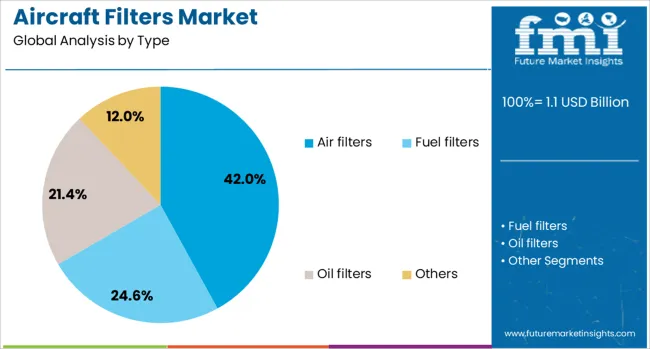

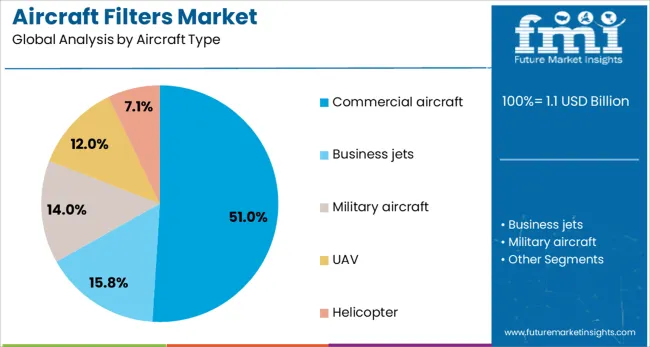

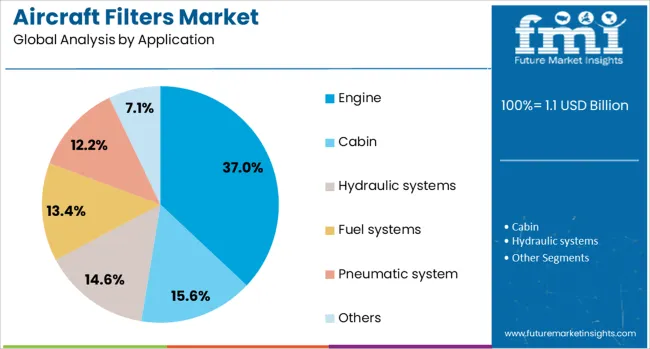

The aircraft filters market is segmented by type, aircraft type, application, sales channel, and geographic regions. The aircraft filters market is divided by type into Air filters, Fuel filters, Oil filters, and Others. The aircraft type filters market is classified into Commercial aircraft, Business jets, Military aircraft, UAVs, and helicopters. Based on the application, the aircraft filters market is segmented into Engine, Cabin, Hydraulic systems, Fuel systems, Pneumatic systems, and Others. The sales channel of the aircraft filters market is segmented into OEM and Aftermarket. Regionally, the aircraft filters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air filters segment is projected to account for 42% of the Aircraft Filters market revenue share in 2025, positioning it as the leading filter type. This dominance has been driven by the critical role of air filters in maintaining clean air circulation within aircraft cabins and ensuring the protection of sensitive avionics and engine components.

Airborne contaminants, including dust, microorganisms, and particulate matter, must be efficiently removed to uphold passenger safety and system performance. As commercial aviation activity increases and cabin air quality standards become more stringent, the demand for high-efficiency air filters has grown considerably.

These filters are being incorporated into environmental control systems to ensure consistent pressure and temperature conditions, especially in long-haul aircraft. In addition, the increased awareness of respiratory health and regulatory emphasis on inflight air purification have elevated the relevance of air filters in modern aircraft design and retrofitting initiatives..

The commercial aircraft segment is expected to contribute 51% of the Aircraft Filters market revenue share in 2025, making it the largest aircraft type segment. Growth in this segment has been supported by the global resurgence in air travel, rising fleet modernization programs, and increased production of narrow-body and wide-body aircraft. Filters used in commercial aviation must perform under demanding conditions and meet rigorous standards for engine efficiency, environmental compliance, and cabin air safety.

Airlines have shown a clear preference for advanced filtration systems that reduce contamination risks and minimize unscheduled maintenance. Additionally, with growing concerns around passenger health and pressure to reduce emissions, commercial aircraft manufacturers are increasingly incorporating high-performance filters during production and through aftermarket services.

These systems not only protect onboard systems but also contribute to extending service intervals and improving aircraft availability. The high volume of commercial aircraft operations, combined with evolving regulatory frameworks, has solidified this segment’s leading position..

The engine segment is anticipated to hold 37% of the Aircraft Filters market revenue share in 2025, establishing it as the primary application area. This segment's prominence has been attributed to the essential need for effective filtration systems to protect aircraft engines from airborne contaminants, such as dust, sand, and debris, which can significantly impair performance and durability.

The adoption of engine filters has grown in response to the increasing operational complexity and stringent fuel efficiency requirements in modern jet engines. These filters ensure clean airflow into the combustion chamber, optimizing thrust generation and minimizing erosion of engine components.

With rising fuel costs and environmental mandates, engine efficiency has become a central performance metric, further enhancing the demand for precision-engineered filter systems. In high-altitude and desert operations, where particulate exposure is elevated, engine filters have become indispensable to maintaining safety, reliability, and long-term operating cost advantages across both commercial and military aircraft fleets..

The aircraft filters market is expanding steadily, driven by fleet modernization, stricter emission norms, and rising air travel demand. Key opportunities exist in lightweight filtration systems for next-generation aircraft and high-performance filters for electric aviation platforms. Trends include the adoption of advanced composite materials, integration of predictive maintenance technologies, and development of long-life filters reducing maintenance downtime. Restraints involve high certification costs, complex regulatory compliance, and supply chain disruptions impacting raw material availability. The overall market outlook reflects strong momentum from commercial aviation growth and defense procurement programs worldwide.

Major growth drivers include increasing global aircraft deliveries and the need for efficient maintenance solutions. In 2024 and 2025, commercial airlines expanded fleets to accommodate rising passenger volumes, creating higher demand for air, fuel, and hydraulic filters. Defense aviation programs in North America and Asia also accelerated procurement of advanced filtration components. Filters offering improved contaminant removal efficiency became standard for modern engines and hydraulic systems. This trajectory underlines the market’s dependency on fleet expansion, making manufacturers focus on high-performance products meeting stringent operational and safety standards.

Significant opportunities are emerging in developing lightweight filtration systems for electric aircraft and hybrid propulsion technologies. In 2025, several aerospace suppliers launched ultra-light filters to optimize fuel efficiency and reduce aircraft weight. Demand for extended-life filters with enhanced durability gained momentum, particularly among low-cost carriers aiming to minimize operational downtime. Defense operators have shown interest in integrated filter monitoring systems to reduce unplanned maintenance. These developments indicate that suppliers focusing on energy-efficient, lightweight, and easy-to-maintain products are well-positioned to capture market share across evolving aviation platforms.

Emerging trends include the use of composite materials for filter housings and the integration of predictive analytics for condition monitoring. In 2024, leading manufacturers introduced filters with advanced synthetic media for superior fluid compatibility and longer replacement intervals. Digital solutions for monitoring filter performance in real time have become popular among MRO service providers. Adoption of modular filter designs for quick replacement in modern aircraft configurations also gained attention. These advancements highlight an industry transition toward smart, lightweight, and maintenance-friendly products aligned with the growing complexity of aircraft systems.

Market restraints stem from expensive certification processes, regulatory approvals, and raw material shortages. In 2024 and 2025, delays in aerospace projects were linked to challenges in obtaining regulatory compliance for newly developed filtration systems. Rising material costs, especially for advanced composites and specialty metals, impacted production budgets. Smaller suppliers faced barriers to entry due to these financial and technical requirements. These limitations suggest that manufacturers must prioritize cost control strategies and strong supplier networks to ensure consistent delivery and maintain competitiveness in a heavily regulated environment.

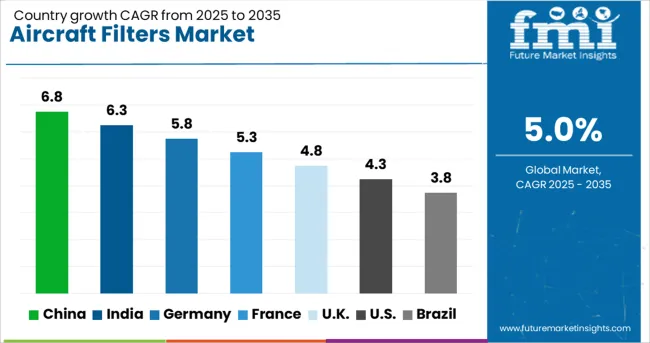

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| UK | 4.8% |

| USA | 4.3% |

| Brazil | 3.8% |

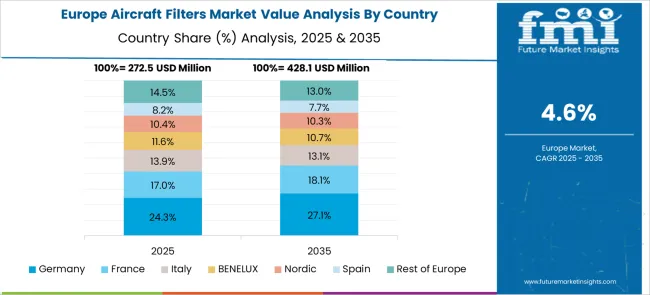

The global aircraft filters market is projected to grow at 5.0% CAGR between 2025 and 2035. China leads at 6.8% CAGR, driven by fleet expansion and new manufacturing programs for commercial and military aircraft. India follows at 6.3%, supported by increasing domestic air traffic and MRO (Maintenance, Repair, and Overhaul) investments. France records 5.3% CAGR, anchored by strong aerospace manufacturing and EU regulatory standards. The UK posts 4.8%, while the United States grows at 4.3%, reflecting steady aftermarket demand in a mature aviation market. Asia-Pacific dominates growth due to rapid fleet modernization and new aircraft deliveries, while Western markets prioritize advanced filtration technologies for efficiency, emissions compliance, and cabin air quality.

China remains the leading growth market with a projected 6.8% CAGR through 2035. The country’s aggressive aircraft manufacturing programs, including COMAC initiatives, drive demand for advanced hydraulic, fuel, and cabin air filters. Rising passenger traffic and expansion of airline fleets reinforce aftermarket opportunities. Environmental compliance regulations and focus on high-efficiency particulate filters for cabin air systems create demand for innovative designs. Partnerships between domestic OEMs and global suppliers accelerate localization of filter manufacturing for both commercial and defense aviation sectors.

The market in India is expected to grow at 6.3% CAGR, driven by increasing air travel demand, government initiatives for aerospace manufacturing, and rising MRO activity. Commercial airlines expanding regional connectivity and new defense procurement programs fuel adoption of advanced filter technologies. Cabin air quality and regulatory compliance encourage use of high-efficiency filtration solutions. Domestic manufacturers focus on basic components, while international players invest in partnerships for high-performance hydraulic and fuel filter systems. The rapid development of regional airports also drives the demand for reliable filtration to maintain operational safety.

France posts a 5.3% CAGR, supported by its strong aerospace ecosystem led by Airbus and multiple Tier-1 suppliers. The country’s emphasis on cleaner and energy-efficient aircraft systems promotes adoption of advanced fuel, oil, and air filtration solutions. Increasing integration of smart monitoring in filters for predictive maintenance is becoming a key trend. Cabin air quality concerns drive demand for HEPA and antimicrobial filter technologies in commercial aviation. Additionally, investment in hybrid-electric propulsion R&D supports new opportunities for lightweight and high-capacity filter systems.

The United Kingdom is projected to grow at 4.8% CAGR, with steady demand from commercial aviation, defense programs, and MRO facilities. Cabin air systems, hydraulic filters, and environmental control system (ECS) filters dominate product requirements. Sustainability regulations under European frameworks drive interest in advanced, reusable filtration systems with lower environmental impact. UK-based suppliers are investing in nanofiber technology and smart sensors integrated into filter assemblies for real-time condition monitoring. The retrofit segment also grows as older fleets adopt upgraded filtration systems to meet emission and safety standards.

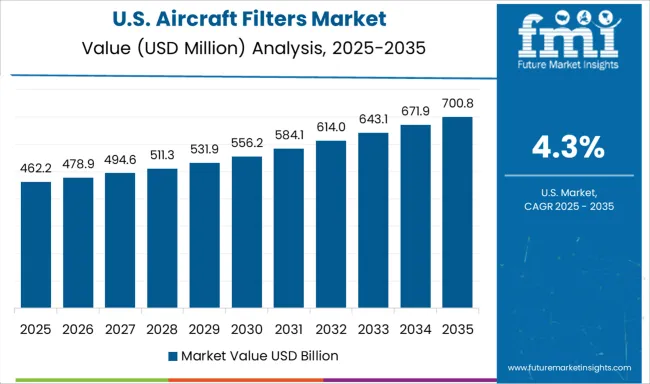

The United States market is expected to grow at 4.3% CAGR, reflecting maturity but steady aftermarket and retrofit opportunities. Demand is supported by extensive airline fleets, military aviation projects, and business jet upgrades. Cabin air quality initiatives and regulatory compliance for emissions management accelerate adoption of HEPA and multi-stage filtration systems. Defense contracts, particularly for next-generation fighter and transport aircraft, contribute to filter procurement. OEMs and Tier-1 suppliers focus on lightweight filter materials and IoT-based performance monitoring for operational cost optimization.

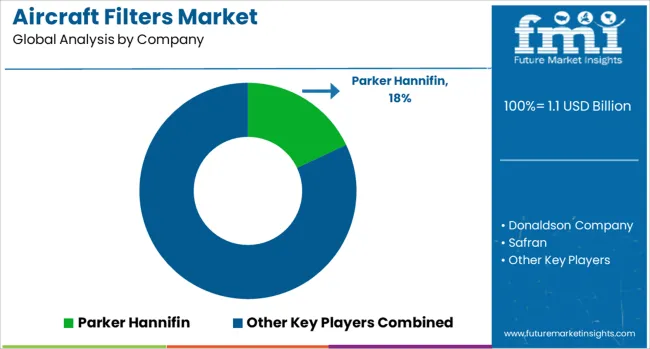

The aircraft filters market is moderately consolidated, with Parker Hannifin recognized as a leading player due to its comprehensive range of filtration systems for hydraulic, fuel, air, and lubrication systems in both commercial and military aircraft. The company’s focus on high-efficiency filter designs and compliance with stringent aviation standards ensures reliability in critical flight operations. Key players include Donaldson Company, Safran, Pall Corporation, and Eaton Corporation. These companies offer advanced filtration solutions designed to enhance system performance, prevent contamination, and extend component life across various aircraft subsystems. Their product portfolios cover engine intake filters, cabin air filters, hydraulic filters, and fuel filtration units optimized for modern aircraft platforms.

Market growth is driven by the rising demand for new-generation aircraft, increased focus on safety and operational efficiency, and growing maintenance requirements in expanding global fleets. Leading manufacturers are investing in lightweight materials, high-dirt-holding capacity filter media, and smart sensor integration for real-time monitoring. Emerging trends include filters designed for sustainable aviation fuels (SAF) and electric aircraft systems, as well as innovations in additive manufacturing for precision filter components. North America and Europe dominate the market due to strong aerospace manufacturing bases, while Asia-Pacific shows rapid growth supported by increasing aircraft production and maintenance, repair, and overhaul (MRO) activities.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Type | Air filters, Fuel filters, Oil filters, and Others |

| Aircraft Type | Commercial aircraft, Business jets, Military aircraft, UAV, and Helicopter |

| Application | Engine, Cabin, Hydraulic systems, Fuel systems, Pneumatic system, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Parker Hannifin, Donaldson Company, Safran, Pall Corporation, and Eaton Corporation |

| Additional Attributes | Dollar sales by filter category (air, hydraulic, fuel, oil) and platform (commercial, military, business, UAV). North America leads, while Asia-Pacific grows fastest with increased fleet size and air traffic. Buyers demand HEPA-grade, lightweight, and compact designs. Innovations include activated-carbon media, smart condition monitoring, and advanced weight-optimized composite filtration materials. |

The global aircraft filters market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the aircraft filters market is projected to reach USD 1.7 billion by 2035.

The aircraft filters market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in aircraft filters market are air filters, fuel filters, oil filters and others.

In terms of aircraft type, commercial aircraft segment to command 51.0% share in the aircraft filters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA