The Aircraft Fairings Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period.

The aircraft fairings market is projected to create an absolute dollar opportunity of USD 2.2 billion over the forecast period. Phase-wise analysis shows that the first half of the period (2025–2030) will increase the market from USD 2.7 billion to 3.7 billion, adding USD 1.0 billion, which represents about 45% of the total incremental growth. This stage is supported by the steady recovery of aircraft production and retrofit initiatives aimed at improving fuel efficiency through lightweight composite materials. The second half (2030–2035) contributes USD 1.2 billion, accounting for 55% of overall growth, reflecting stronger momentum from next-generation aircraft development and the adoption of advanced aerodynamic structures for drag reduction and compliance with environmental standards. Annual increments expand from approximately USD 0.2 billion in the early years to nearly USD 0.3 billion by the end of the period, driven by increased integration of additive manufacturing and high-performance composite technologies. The trend indicates that manufacturers focusing on cost-efficient production processes, material innovation, and automation will be well-positioned to meet evolving OEM requirements across both commercial and defense aviation segments during the forecast horizon.

| Metric | Value |

|---|---|

| Aircraft Fairings Market Estimated Value in (2025 E) | USD 2.7 billion |

| Aircraft Fairings Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

The aircraft seating market represents a vital component across several aviation-related parent markets, with varying degrees of contribution. In the aircraft interiors market, seating accounts for 25–28%, as seats are a major cost and design element in cabin layouts. Within the commercial aircraft components market, the share is about 10–12%, given that this segment also includes avionics, engines, and landing systems.

In the aerospace manufacturing supplies market, seating contributes 6–8%, since this category encompasses a wide range of structural materials and hardware. For the in-flight passenger experience and comfort market, aircraft seating dominates with a share of 30–35%, as passenger comfort largely depends on seating configuration, design, and ergonomics. In the airline cabin retrofit and maintenance market, the share is estimated at 18–20%, as seating upgrades and reconfigurations are key elements in refurbishment projects for both narrow-body and wide-body fleets.

Although shares vary, the importance of aircraft seating is reinforced by rising demand for lightweight structures, modular designs, and premium economy configurations. Growth in air travel, low-cost carrier expansion, and cabin densification strategies are driving airlines to invest in advanced seating solutions that balance comfort, space optimization, and compliance with stringent safety standards.

The aircraft fairings market is undergoing notable transformation due to the rising emphasis on fuel-efficient and aerodynamically optimized airframes. As global aviation recovers from past disruptions, there has been a sharp resurgence in aircraft production and retrofitting programs, directly impacting the demand for high-performance fairings. Technological advancements in composite materials and the integration of noise-reduction features are enabling manufacturers to meet regulatory emission and environmental compliance standards.

Strategic collaborations between OEMs and tier-one suppliers are supporting the incorporation of advanced fairing designs aimed at reducing drag and enhancing structural integrity. With strong order backlogs for narrow-body and wide-body aircraft, especially in commercial aviation, demand for durable and lightweight fairings is expected to remain high.

Investment flows into aerospace manufacturing hubs across Asia and North America, alongside innovations in thermoplastic composites and additive manufacturing, are expected to shape the future growth trajectory. The market outlook remains positive as airframe developers increasingly prioritize modularity, efficiency, and sustainability in component design.

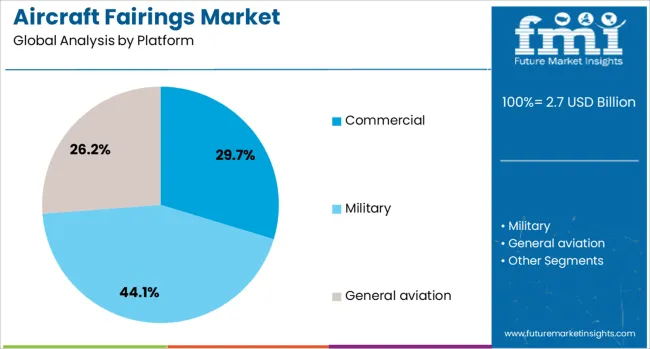

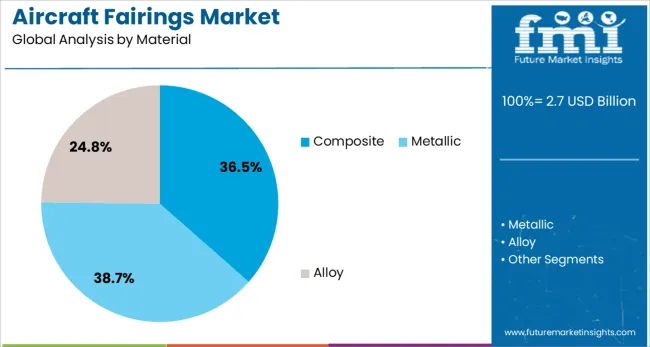

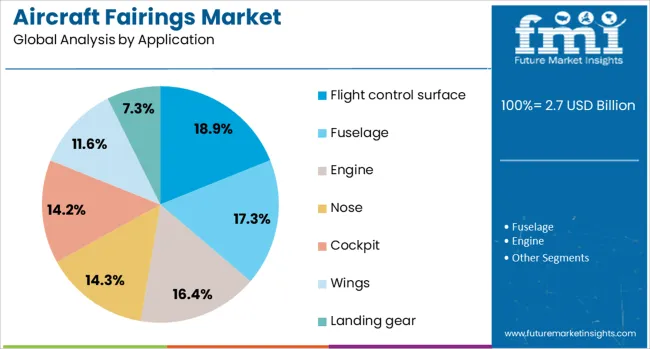

The aircraft fairings market is segmented by platform, material, application, end use, and geographic regions. The aircraft fairings market is divided into Commercial, Military, and General aviation. In terms of the material of the aircraft fairings, the market is classified into Composite, Metallic, and Alloy. Based on the application of the aircraft fairings, the market is segmented into Flight control surfaces, Fuselage, Engine, Nose, Cockpit, Wings, and Landing gear. By end use, the aircraft fairings market is segmented into OEM and Aftermarket. Regionally, the aircraft fairings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The commercial platform segment is projected to account for 29.7% of the revenue share in the aircraft fairings market in 2025, reflecting its dominant role in driving fairing integration and development. The segment’s growth has been influenced by increased aircraft deliveries and backlogs from leading commercial aircraft manufacturers, resulting in higher demand for aerodynamic structures such as fairings. Emphasis on reducing operational costs and emissions has led to widespread adoption of lightweight fairings designed for enhanced fuel economy and noise reduction.

Continuous upgrades in aircraft fleets across global airlines have further elevated demand for advanced fairing solutions. These components are playing a critical role in improving overall airframe efficiency and minimizing environmental impact.

High traffic volumes across international and regional air travel markets have compelled OEMs and suppliers to prioritize performance-centric fairing designs. As fleet modernization remains a key focus area for commercial operators, this segment is expected to maintain sustained traction throughout the forecast period.

The composite material segment is anticipated to represent 36.5% of the aircraft fairings market’s revenue share in 2025, making it the leading material type. The use of composite fairings has been preferred due to their lightweight characteristics, corrosion resistance, and superior strength-to-weight ratio. As aircraft manufacturers seek to reduce overall airframe weight for fuel efficiency, composites are being integrated across major fairing structures including flap track, belly, and wing-to-body fairings.

These materials also allow for more complex aerodynamic shapes, supporting both drag reduction and aesthetic design goals. Enhanced fatigue resistance and ease of maintenance have made composite fairings more viable over traditional metallic counterparts. Advancements in resin systems and thermoplastic technologies are further improving production efficiency and structural performance.

The demand for composites has also been supported by their compatibility with automated manufacturing processes, reducing lead times and improving scalability. The segment’s dominance is expected to continue with ongoing innovation in high-temperature and impact-resistant composite formulations.

The flight control surface application segment is projected to contribute 18.9% of the aircraft fairings market revenue share in 2025, highlighting its critical function in aircraft aerodynamics. Fairings used in flight control surfaces are designed to reduce turbulence and aerodynamic drag around movable parts such as ailerons, rudders, and elevators. Their integration improves control surface efficiency and contributes to overall aircraft stability during various flight phases.

Increasing focus on enhanced flight performance and energy efficiency has made this application segment vital in both new aircraft programs and retrofit activities. The design complexity of these fairings requires precise engineering to maintain smooth airflow and minimize vibration, contributing to reduced fuel consumption and noise emissions.

The trend toward more electric aircraft and fly-by-wire systems has further influenced the structural and functional design of these fairings. With regulatory bodies mandating higher environmental and operational standards, the demand for optimized flight control surface fairings is expected to grow consistently across all major aircraft categories.

Aircraft fairings are being employed to streamline aerodynamics, reduce drag, and improve fuel performance across airframes. Composite and advanced polymer aerodynamic covers are being installed on wings, landing gear, and engine pylons to enhance airflow and reduce turbulence. Uptake has been observed in commercial airliners, business jets, and rotorcraft platforms where performance margins and operational costs are tightly evaluated. Manufacturers offering lightweight, fatigue-resistant fairings with optimized surface finishes are positioned to win contracts as precision engineering becomes critical for both fuel economy and maintenance efficiency.

Fairing systems have been designed to smooth airflow over critical airframe assemblies such as wing roots, flap tracks, and landing gear structures. The usage of composite materials and high-strength polymers has allowed weight reduction while maintaining structural integrity under operational stresses. Computational fluid dynamics models have been applied during design to refine fairing profiles for minimum drag penalties. Installation of lightweight fairings has contributed to reduced fuel burn and extended flight range for aircraft across commercial, military, and business aviation sectors. Maintenance intervals have been extended due to improved environmental resistance and fatigue control. As regulators and operators focus on operational efficiency and lower emissions, high-performance fairings have become essential components of modern aircraft.

Fairing development has been constrained by stringent aerodynamic and structural qualification requirements imposed by aviation authorities across jurisdictions. Design validation requires wind tunnel testing and fatigue analysis to certify performance and durability over thousands of flight cycles. Material selection for temperature resistance, UV exposure tolerance, and impact resilience adds complexity to manufacturing protocols. Retrofit of new fairing designs onto existing airframes may demand engineering rework, systems interference analysis, and flight test validation. Long lead times for composite part tooling and production equipment have increased program costs. Suppliers have also faced supply chain challenges sourcing aerospace-grade resin systems and specialty composites. These factors have slowed broader adoption of optimized fairing solutions across retrofit and small fleet applications.

Notable opportunities have been identified through the rising demand for cabin upgrades and premium seating options. Airline operators are investing in lie-flat business class and ergonomic economy seating to enhance passenger comfort and drive ancillary revenue through seat selection fees. Retrofits of older aircraft are opening avenues for seat suppliers to introduce lightweight, modular seating systems that reduce fuel consumption. Demand from narrow-body replacement programs is creating openings for scalable designs across regional and low-cost fleets. Partnerships with aircraft OEMs and retrofit service providers are enabling integrated cabin modernization offerings. Pressure from passenger comfort trends and airline branding strategies is reinforcing adoption of differentiated seating products in global fleets.

Strong trends have been observed toward the use of advanced composite and aluminum alloys to reduce seat weight and support fuel efficiency goals. Integration of in-seat power outlets, USB-C charging ports, and wireless entertainment systems has been adopted to enhance the passenger experience. Design standards for slimmer seat profiles are being applied to increase aisle space and boarding efficiency. Smart seat features such as pressure mapping and personalized adjustment options are gaining traction for health-conscious travelers. Cabin configuration flexibility is being improved through modular seating units suited for mixed-class layouts or quick role changes. VR visualization tools are being employed by airlines to simulate cabin interiors during seat design and selection processes.

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

| USA | 5.3% |

| Brazil | 4.7% |

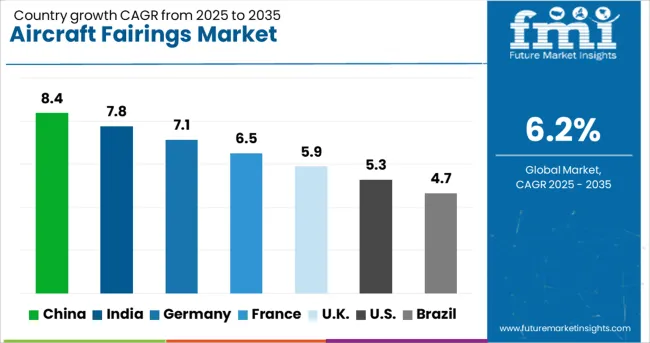

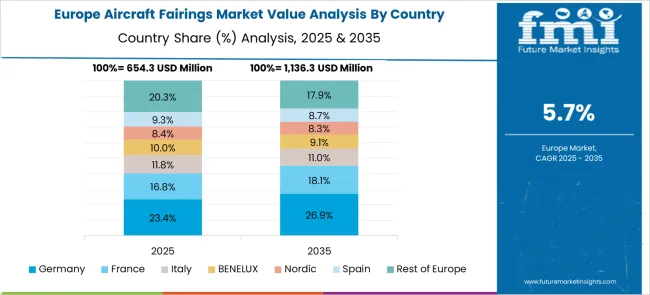

The global aircraft fairings market is projected to grow at a 6.2% CAGR between 2025 and 2035, supported by rising aircraft production, weight reduction targets, and advanced composite adoption. China leads at 8.4%, driven by extensive aircraft manufacturing programs and domestic composite material integration. India follows at 7.8%, backed by aerospace infrastructure growth and increased participation in global supply chains. Germany records 7.1%, benefiting from innovations in aerodynamic efficiency and partnerships with major OEMs. France posts 6.5%, supported by fairing upgrades in next-generation aircraft platforms. The United Kingdom grows at 5.9%, influenced by design improvements and production modernization. The report includes an analysis of over 40 countries, with top countries highlighted below.

China is forecast to grow at an 8.4% CAGR, supported by large-scale commercial aircraft manufacturing programs such as COMAC’s initiatives. Domestic firms are increasing their capacity for producing composite fairings to enhance aerodynamic efficiency and reduce weight. Government incentives for advanced material research encourage innovation in high-strength carbon fiber fairings. Expansion in the regional jet and narrow-body aircraft segments boosts demand for nose and wing-to-body fairings. Collaborations between Chinese suppliers and global aerospace OEMs accelerate technology transfer and improve local design capabilities for premium-quality fairings.

India is projected to grow at a 7.8% CAGR, driven by aerospace manufacturing expansion under national aviation development programs. Domestic suppliers are investing in tooling and automation to deliver lightweight fairings for commercial and defense aircraft. Partnerships with global OEMs enhance local expertise in aerostructure component production. Rising maintenance, repair, and overhaul (MRO) activities in India create incremental demand for fairing replacements and retrofits. Increased focus on using advanced polymers and carbon composites for structural fairings ensures compliance with fuel efficiency targets. Government policies promoting domestic aerospace clusters accelerate supplier participation in international projects.

Germany is expected to grow at a 7.1% CAGR, supported by advanced research in lightweight composites and precision manufacturing. Aerospace firms are leveraging robotic assembly and additive manufacturing techniques for producing aerodynamic fairings with improved tolerances. The strong presence of European aircraft programs such as Airbus continues to drive large-scale demand. Investments in eco-efficient aircraft models create opportunities for suppliers offering optimized fairing systems. Cross-border R&D projects funded by EU aerospace programs are promoting the development of noise-reducing fairing designs for next-generation fleets.

France is projected to record a 6.5% CAGR, driven by the modernization of aero structure designs and the integration of composite-based fairings. Leading aerospace firms are deploying automated processes for producing critical fairing components, including belly and wing fairings. Research initiatives under European aerospace consortiums emphasize aerodynamic optimization and drag reduction. France’s aftermarket demand is increasing due to fairing replacements in aging commercial fleets. Local suppliers focus on improving thermal resistance and durability in fairings to support high-performance aircraft platforms.

The United Kingdom is projected to grow at a 5.9% CAGR, driven by technological upgrades in fairing design for weight reduction and fuel efficiency. Local aerospace companies are investing in advanced composites and digital simulation tools to optimize fairing performance. Demand is supported by commercial aircraft retrofitting projects and regional participation in European aerospace programs. The push toward high-efficiency aero structures reinforces the development of multi-functional fairings integrating noise-dampening properties. Strategic collaborations with global manufacturers enable access to advanced manufacturing technologies for premium-quality components.

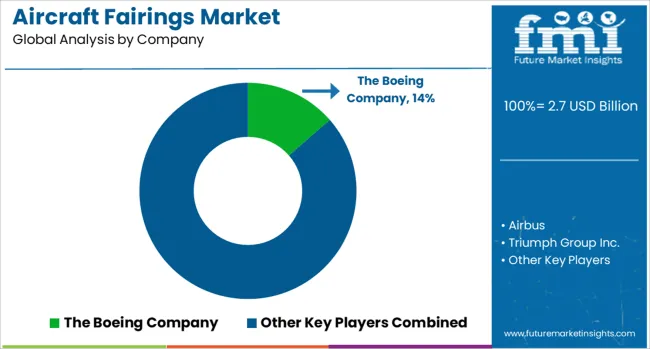

The aircraft fairings market is highly competitive, dominated by major aerospace manufacturers and specialized component suppliers such as The Boeing Company, Airbus, Triumph Group Inc., AAR Corporation, The NORDAM Group LLC, and FACC AG, all of which focus on delivering lightweight, aerodynamic structures essential for fuel efficiency and aircraft performance. Boeing and Airbus lead the market by leveraging integrated production systems, proprietary composite technologies, and global supply chain networks to meet the rising demand for commercial and defense aircraft. Tier-1 suppliers like Triumph Group, NORDAM, and FACC AG specialize in advanced fairing solutions for fuselage, wings, and nacelles, utilizing carbon fiber-reinforced polymers (CFRP) to reduce weight and enhance durability. Strata Manufacturing, Avcorp, and Shinmaywa strengthen their positions through strategic partnerships with OEMs, emphasizing high-precision manufacturing and quality compliance. Daher and Barnes Group target niche applications and provide structural components for both fixed-wing and rotary aircraft, while Royal Engineered Composites, Fiber Dynamics, and Malibu Aerospace focus on custom fairing designs and retrofitting solutions for business jets and aftermarket services. Competitive differentiation is driven by innovation in lightweight composite materials, cost-efficient manufacturing processes, and compliance with stringent FAA and EASA safety standards. The market faces high entry barriers due to certification requirements and long production cycles, limiting new entrants. Future competitiveness will center on the development of next-generation fairings optimized for electric and hybrid aircraft, integration of additive manufacturing for complex geometries, and digital simulation tools to reduce design-to-production timelines, ensuring enhanced fuel efficiency and operational sustainability in modern aviation.

Recent DevelopmentThe aircraft fairings market has seen notable developments focused on improving performance and durability. Manufacturers are increasingly adopting advanced composite materials such as carbon fiber and thermoplastics to reduce weight and enhance strength. Additive manufacturing has gained traction for producing complex fairing structures with precision and cost efficiency. AI-driven aerodynamic design and integration of low-drag coatings are being implemented to boost fuel efficiency. Additionally, adaptive and morphing fairings are being developed to optimize performance under varying flight conditions. These innovations, combined with rising emphasis on maintenance-friendly designs, are transforming production strategies and shaping the competitive landscape of the aircraft fairings industry.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Platform | Commercial, Military, and General aviation |

| Material | Composite, Metallic, and Alloy |

| Application | Flight control surface, Fuselage, Engine, Nose, Cockpit, Wings, and Landing gear |

| End Use | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | The Boeing Company, Airbus, Triumph Group Inc., AAR Corporation, The NORDAM Group LLC, FACC AG, Strata Manufacturing, Avcorp, Shinmaywa, Daher, Barnes Group, Royal Engineered Composites, Fiber Dynamics, Inc., and Malibu Aerospace |

| Additional Attributes | Dollar sales by fairing type (nose, tailcone, wing-to-body) and material (carbon fiber, glass fiber, thermoplastics), with demand driven by aircraft fleet expansion and retrofits for fuel efficiency. North America leads in commercial aviation installations, while Asia-Pacific grows rapidly in regional aircraft manufacturing. Innovation focuses on high-performance composites, automated composite forming techniques, and digital twin–enabled design validation for aerodynamic performance and structural integrity. |

The global aircraft fairings market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the aircraft fairings market is projected to reach USD 4.9 billion by 2035.

The aircraft fairings market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in aircraft fairings market are commercial, _narrow body aircraft (nba), _wide body aircraft (wba), _very large aircraft (vla), _regional transport aircraft (rta), _business jets, military, _fighter aircraft, _military transport and general aviation.

In terms of material, composite segment to command 36.5% share in the aircraft fairings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA