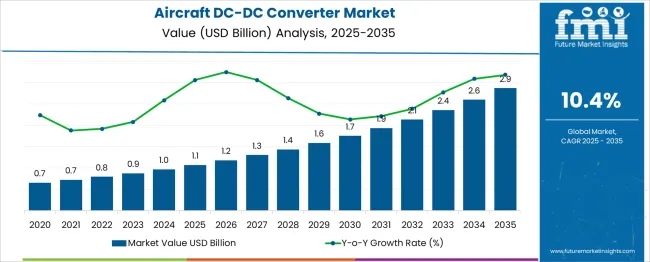

The Aircraft DC-DC Converter Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 10.4% over the forecast period. From 2025 to 2030, the market is expected to rise from USD 1.1 billion to USD 1.7 billion, driven by the increasing electrification of aircraft systems and adoption of advanced avionics. Year-on-year analysis shows progressive gains, reaching USD 1.2 billion in 2026 and USD 1.3 billion in 2027, supported by the development of more electric aircraft platforms and higher demand for efficient power conversion solutions.

By 2028, the market is forecasted to hit USD 1.4 billion, advancing to USD 1.6 billion in 2029 and USD 1.7 billion by 2030. Growth is anticipated to be reinforced by rising integration of DC-DC converters in electric propulsion systems, power distribution units, and cabin electronics. Manufacturers are expected to focus on high-efficiency, lightweight designs and thermal management solutions to meet aerospace performance standards. These factors position DC-DC converters as a critical enabler for next-generation aircraft, supporting energy efficiency, weight reduction, and improved power reliability across commercial, military, and urban air mobility applications.

| Metric | Value |

|---|---|

| Aircraft DC-DC Converter Market Estimated Value in (2025 E) | USD 1.1 billion |

| Aircraft DC-DC Converter Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 10.4% |

The aircraft DC-DC converter market represents a critical segment within aviation electrical and power electronics systems. In the aerospace power conversion systems market, its share is approximately 18–20%, as DC-DC converters are essential for converting voltage levels to power avionics and subsystems. Within the avionics systems market, its contribution is smaller, around 6–8%, since avionics also includes navigation, communication, and flight management systems. In the aircraft electrical systems market, the share stands at about 10–12%, reflecting its integral role in distributing and regulating power across multiple systems.

For the power electronics market, aircraft DC-DC converters account for roughly 3–4%, given the dominance of automotive and industrial applications. In the defense and commercial aircraft components market, the share is approximately 2–3%, as this category includes engines, landing gear, and structural components. Market growth is driven by rising demand for advanced electrical architectures in modern aircraft, the shift toward more electric and hybrid-electric propulsion, and the integration of lightweight, high-efficiency power systems.

Increasing adoption of wide bandgap semiconductor materials like SiC and GaN is improving converter efficiency and thermal performance. As electrification trends gain momentum in aviation, aircraft DC-DC converters are expected to capture a larger share within these parent markets over the next decade.

The aircraft DC DC converter market is witnessing significant momentum as the aviation sector prioritizes efficient power management systems to meet the growing electrical demands of modern aircraft. Increasing integration of advanced avionics, in-flight entertainment, and more electric aircraft architectures is driving the need for compact, reliable, and high-performance DC DC converters.

The shift toward fuel efficiency and reduced emissions has further accelerated the adoption of electrical subsystems over traditional hydraulic and pneumatic ones, creating a favorable environment for converter deployment. Future growth is expected to be supported by advancements in semiconductor materials, miniaturization techniques, and enhanced thermal management capabilities, all of which are paving the way for higher power density and reliability standards.

Regulatory pressures to improve energy efficiency and growing aircraft production rates globally are reinforcing the market’s expansion trajectory.

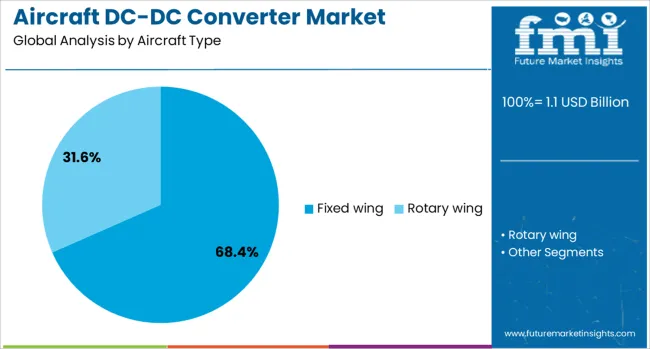

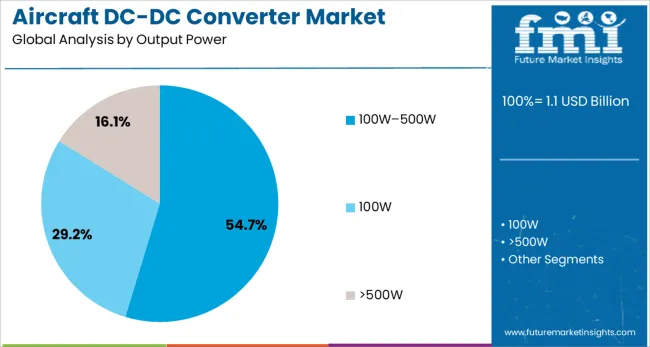

The aircraft DC-DC converter market is segmented by aircraft type, output power, category, application, and geographic regions. By aircraft type, the aircraft DC-DC converter market is divided into fixed-wing and rotary-wing. In terms of output power, the aircraft DC-DC converter market is classified into 100W–500W, 100W, and >500W.

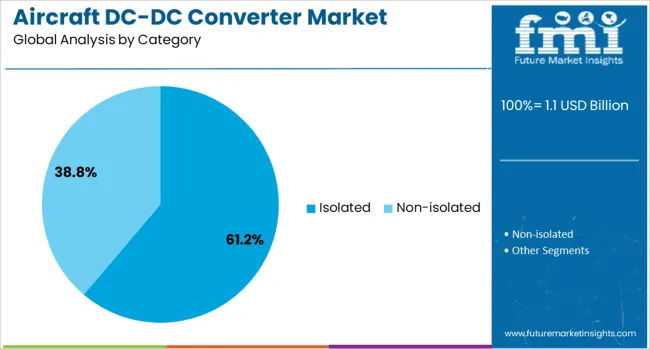

Based on the category of the aircraft, the DC-DC converter market is segmented into Isolated and Non-isolated. By application of the aircraft DC-DC converter, the market is segmented into Avionics, Power distribution, Lighting systems, Radar & electronic warfare systems, In-flight entertainment (IFE), and Others. Regionally, the aircraft DC-DC converter industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by aircraft type, the fixed-wing segment is expected to hold 68.4% of the total market revenue in 2025, making it the leading aircraft type. This dominance is attributed to the substantial demand from commercial, business, and military fixed-wing aircraft, which require reliable DC-DC converters to power a wide range of onboard electrical systems.

The larger size and higher electrical load of fixed-wing platforms compared to rotary-wing aircraft have necessitated the deployment of more robust and numerous power conversion units. Enhanced focus on passenger comfort, advanced navigation systems, and increasingly electrified propulsion components have also reinforced the segment’s prominence.

The ability of fixed-wing platforms to accommodate higher capacity and more sophisticated electrical architectures has strengthened their leadership in this market.

In terms of output power, the 100W 500W segment is projected to account for 54.7% of the market revenue share in 2025, positioning it as the leading power range. This leadership has been driven by the optimal balance it offers between size, efficiency, and power delivery for most avionics, communication, and control systems within aircraft.

The segment has gained traction because it adequately serves the medium-power applications that dominate modern aircraft interiors and operational systems without incurring the complexity or costs associated with higher power units. Furthermore, the scalability and reliability of converters in this power range have enabled widespread integration across both commercial and defense applications.

The segment’s adaptability to evolving aircraft electrical designs and ability to meet stringent certification standards have further reinforced its growth.

When segmented by category, the isolated segment is forecast to capture 61.2% of the market revenue in 2025, securing its position as the leading category. This segment’s leadership is attributed to the critical safety and performance benefits provided by electrical isolation in aviation systems.

Isolated converters have been favored because they protect sensitive onboard electronics from voltage spikes, ground loops, and other disturbances, ensuring stable operation of mission-critical components. Their ability to maintain signal integrity and provide galvanic isolation between input and output circuits has made them indispensable in high-reliability aircraft environments.

Additionally, the isolated category has been supported by advancements in transformer design and insulation materials, which have improved efficiency and reduced weight without compromising safety. The stringent regulatory and operational requirements of the aerospace industry have further solidified the isolated segment’s dominance in the market.

The aircraft DC-DC converter market is being shaped by rising production of next‑generation narrowbody jets, higher adoption of more-electric aircraft architectures, and growth in UAV and eVTOL platforms. Opportunities are arising in wide‑bandgap SiC/GaN devices and remotely monitored modules tailored for aerospace systems.

Emerging trends include modular brick designs, increased power density, and compliance with stringent safety standards. Market restraints involve high qualification costs, long certification cycles, and supply chain disruptions for aerospace-grade semiconductors, particularly affecting smaller suppliers lacking scale.

Market growth is strongly driven by rising production of new-generation commercial aircraft, military UAVs, and electric vertical takeoff and landing systems. In 2024, major aerospace programs accelerated electrification to improve fuel efficiency and reduce maintenance.

This transition increased demand for DC-DC converters capable of handling high power density and stringent voltage regulation. Aerospace OEMs have integrated isolated converters for avionics systems, cabin electronics, and power distribution networks. It is widely believed that converters offering extended operational reliability in high-altitude and temperature-variant conditions will remain critical for aircraft manufacturers and defense aviation platforms.

Opportunities are seen in silicon carbide and gallium nitride-based converter modules that enable reduced energy loss and improved thermal resilience. These devices are increasingly deployed in electric propulsion systems and energy storage subsystems for advanced aircraft designs. Electrification programs in regional aviation and hybrid-electric propulsion initiatives have accelerated demand for lightweight, efficient converters.

It is considered that suppliers developing aerospace-certified wide-bandgap power solutions and modular architectures can capture substantial market share as OEMs seek higher energy efficiency and system integration for next-generation platforms, including UAVs and urban air mobility solutions.

The market is witnessing a trend toward modular brick-based converter architectures optimized for space-constrained aircraft systems. These solutions simplify installation and improve scalability across multiple voltage requirements within the same platform. Converters exceeding 250 W output are gaining prominence in avionics and electric drive applications. Certification-ready products aligned with aviation standards are increasingly preferred to minimize qualification timelines for OEMs. It is strongly believed that manufacturers offering high-density modular converters with integrated monitoring capabilities will maintain a competitive edge as aerospace electrification accelerates globally.

Key restraints include high certification expenses associated with aviation-grade DC-DC converters and prolonged qualification cycles for new semiconductor technologies. Aerospace programs are facing additional delays due to material shortages affecting silicon carbide and gallium nitride device availability. Price volatility and extended lead times have challenged smaller suppliers without strong sourcing agreements. Companies investing in vertically integrated manufacturing and maintaining partnerships with wafer producers are better positioned to overcome these challenges and meet the growing demand for reliable power conversion systems.

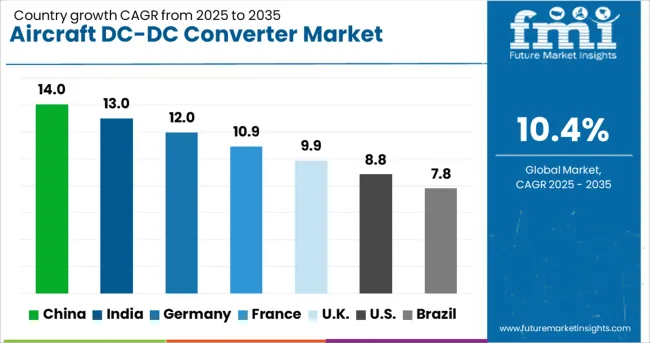

| Country | CAGR |

|---|---|

| China | 14.0% |

| India | 13.0% |

| Germany | 12.0% |

| France | 10.9% |

| UK | 9.9% |

| USA | 8.8% |

| Brazil | 7.8% |

The global aircraft DC-DC converter market is projected to grow at a CAGR of 10.4% from 2025 to 2035. China leads with 14.0%, followed by India at 13.0% and Germany at 12.0%. France records 10.9%, while the United Kingdom posts 9.9%. Growth is driven by the increasing shift toward electrification in aircraft systems, advancements in power electronics, and rising production of commercial and military aircraft. China and India dominate due to fleet expansion and defense modernization programs, while Germany focuses on high-reliability converters for advanced avionics. France and the UK emphasize lightweight, energy-efficient solutions to support next-generation aircraft platforms.

The aircraft DC-DC converter market in China is projected to grow at 14.0%, supported by large-scale commercial aircraft production and military aviation projects. Isolated DC-DC converters dominate adoption in power-critical avionics systems. Manufacturers invest in gallium nitride (GaN)-based designs for higher efficiency and thermal performance. Partnerships with domestic aerospace companies strengthen localized converter production capacity.

The aircraft DC-DC converter market in India is expected to grow at 13.0%, driven by rising investments in indigenous aircraft programs and MRO (Maintenance, Repair, Overhaul) services. Non-isolated converters dominate low-power applications in cabin systems. Manufacturers develop cost-optimized high-efficiency designs to serve regional aircraft manufacturers. Expansion of defense procurement programs accelerates demand for ruggedized power electronics.

The aircraft DC-DC converter market in Germany is forecast to grow at 12.0%, supported by strong adoption in electric propulsion and advanced avionics systems. Multi-output converters dominate integration in hybrid and electric aircraft projects. Manufacturers prioritize thermal management and miniaturization to meet aerospace weight constraints. EU green aviation initiatives further accelerate converter innovation.

The aircraft DC-DC converter market in France is projected to grow at 10.9%, driven by its role in regional jet production and next-generation aircraft designs. High-voltage DC-DC converters dominate electric actuation systems. Manufacturers integrate digital control features for enhanced voltage regulation. Collaboration with leading aerospace OEMs accelerates development of high-reliability power systems.

The aircraft DC-DC converter market in the UK is expected to grow at 9.9%, supported by advanced aerospace R&D and electric aircraft development programs. Ruggedized converters dominate use in defense and commercial sectors. Manufacturers focus on achieving high power density while meeting DO-160 compliance standards. Investments in hybrid-electric propulsion systems strengthen long-term demand.

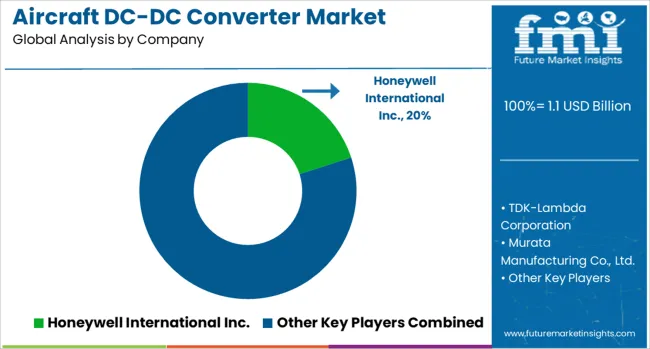

The aircraft DC-DC converter market is moderately consolidated, with Honeywell International Inc. recognized as a leading player due to its extensive expertise in avionics and power conversion systems. Honeywell provides highly reliable DC-DC converters designed for critical aerospace applications, ensuring efficiency, thermal stability, and compliance with stringent aviation standards.

Key players include TDK-Lambda Corporation, Murata Manufacturing Co., Ltd., Advanced Energy, and Vicor Corporation. These companies specialize in high-performance power conversion solutions that support modern aircraft systems, including flight control electronics, communication equipment, in-flight entertainment, and electric propulsion components. Their offerings focus on lightweight, compact designs with high power density, improved thermal management, and fault-tolerant architectures for safety-critical operations.

Market growth is driven by the increasing electrification of aircraft systems, demand for fuel-efficient designs, and the adoption of more electric aircraft (MEA) architectures. Manufacturers are investing in wide-bandgap semiconductor technologies such as GaN and SiC to improve power efficiency and reduce system weight.

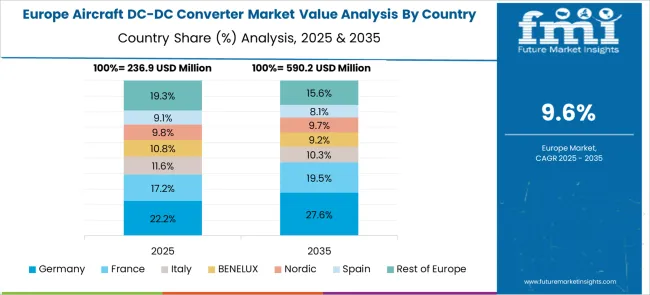

Additionally, trends such as hybrid-electric and fully electric aircraft development are accelerating the need for advanced DC-DC converters with higher power ratings and enhanced reliability. North America and Europe dominate the market due to strong aerospace manufacturing bases, while Asia-Pacific is witnessing rapid growth with rising investments in regional aircraft and urban air mobility platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Aircraft Type | Fixed wing and Rotary wing |

| Output Power | 100W–500W, 100W, and >500W |

| Category | Isolated and Non-isolated |

| Application | Avionics, Power distribution, Lighting systems, Radar & electronic warfare systems, In-flight entertainment (IFE), and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., TDK-Lambda Corporation, Murata Manufacturing Co., Ltd., Advanced Energy, and Vicor Corporation |

| Additional Attributes | Dollar sales categorized by converter type (isolated vs non-isolated), output power (≤100 W, 100–500 W, >500 W), and aircraft platform (fixed-wing, rotary, UAV). Regional demand trends highlight strong uptake in North America and rapid growth in Asia-Pacific. Buyers prioritize lightweight, high-efficiency designs integrated with avionics. Innovations focus on SiC/GaN semiconductors and AI-driven monitoring systems. |

The global aircraft dc-dc converter market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the aircraft dc-dc converter market is projected to reach USD 2.9 billion by 2035.

The aircraft dc-dc converter market is expected to grow at a 10.4% CAGR between 2025 and 2035.

The key product types in aircraft dc-dc converter market are fixed wing and rotary wing.

In terms of output power, 100w–500w segment to command 54.7% share in the aircraft dc-dc converter market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA