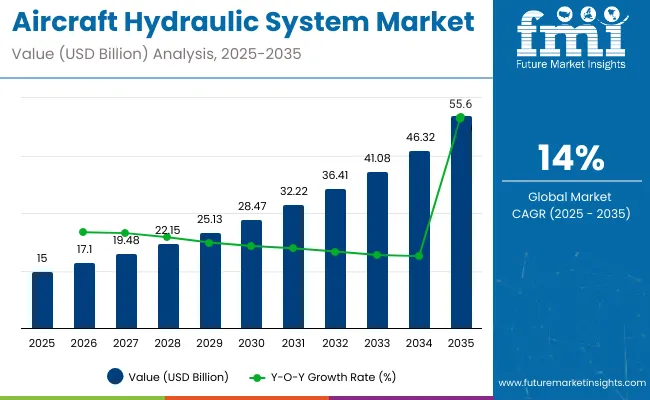

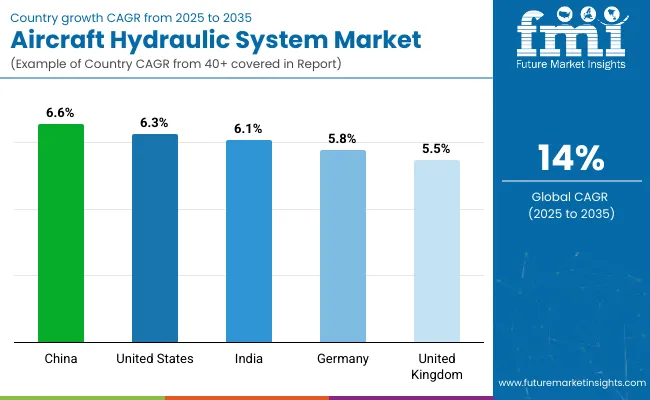

The aircraft hydraulic system market is valued at USD 15 billion in 2025 and will expand to USD 55.6 billion by 2035, advancing at a CAGR of 14% with a multiplying factor of about 3.7x.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 15 billion |

| Industry Value (2035F) | USD 55.6 billion |

| CAGR (2025 to 2035) | 14% |

Market growth curve shape analysis indicates that expansion follows an S-curve pattern, beginning with a phase of gradual acceleration, followed by rapid adoption, and eventually tapering as technologies stabilize and markets mature. In the initial years from 2025 to 2028, growth is moderate as demand is primarily tied to replacement cycles, incremental upgrades, and rising aircraft production.

From 2028 to 2032, the curve steepens significantly, reflecting accelerated adoption of advanced hydraulic systems with lighter materials, higher pressure ratings, and integration with digital monitoring tools. Growth momentum during this phase is supported by rising fleet modernization and increased aircraft deliveries in both commercial and defense sectors. Toward the later phase, 2032 to 2035, the curve begins to stabilize as the market approaches maturity, with demand shifting toward efficiency improvements, predictive maintenance, and hybrid electro-hydraulic solutions. This shape illustrates that while rapid gains dominate the middle years, long-term sustainability depends on continuous innovation and system optimization, ensuring hydraulic systems remain critical in next-generation aircraft architectures.

The aircraft hydraulic system market is closely tied to several upstream industries. Aircraft OEMs account for around 35%, since design and integration of hydraulic subsystems depend directly on new aircraft programs. Component manufacturers including pumps, actuators, valves, and reservoirs contribute nearly 28%, as they provide critical parts for flight control and landing gear. Maintenance, repair, and overhaul (MRO) services represent approximately 18%, driven by replacement cycles and service checks. Defense aviation programs hold about 12%, with military fleets requiring high-performance hydraulic systems for combat aircraft. Aerospace fluid and seal suppliers cover the remaining 7%, ensuring system reliability and durability.

The market is evolving as aircraft platforms increasingly shift toward electro-hydraulic and hybrid actuation systems. Demand for more energy-efficient hydraulic pumps is rising, with variable-displacement units cutting energy losses by nearly 15% compared to conventional fixed-displacement designs. Digital monitoring solutions are expanding, enabling predictive maintenance and extending component life by 10-12%. Electric-hydraulic actuators are gaining traction, particularly in regional jets and advanced air mobility projects, reducing overall hydraulic fluid usage. Military modernization programs are supporting investments in next-gen high-pressure systems operating at 5,000 psi, enhancing responsiveness and reducing weight. Airlines are also emphasizing lighter hydraulic components to improve fuel efficiency and lower operating costs.

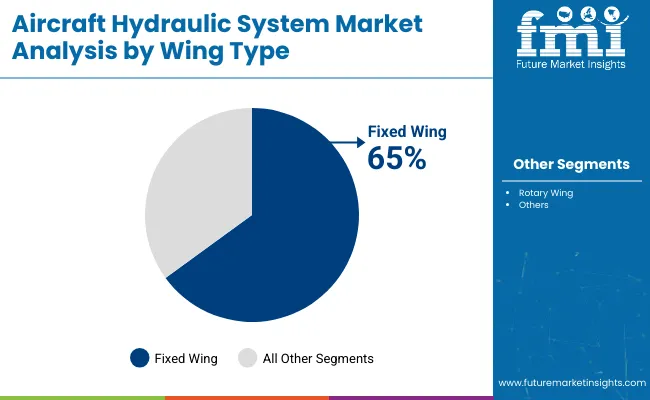

Growth is fueled by rising aircraft production, increasing passenger traffic, and upgrades in commercial and military fleets. Hydraulic systems remain vital for flight control, braking, and landing gear operations, where high power-to-weight ratio and reliability are essential. North America accounts for the largest market share due to strong aerospace manufacturing activity, while Asia Pacific is witnessing rapid expansion driven by surging airline fleets. Advancements in electro-hydraulic actuators and lightweight hydraulic components are also shaping adoption in both fixed-wing aircraft and helicopters.

Driving Force Rising Aircraft Deliveries and Fleet Expansion

Increasing global aircraft deliveries are the key driver for the hydraulic system market. By 2035, the commercial fleet is expected to cross 46,000 aircraft, supported by growing air passenger demand and replacement of aging fleets. Hydraulic systems provide essential functions such as flap control, thrust reversers, and landing gear retraction. Military modernization programs in countries such as the United States, China, and India further support demand for advanced hydraulic solutions. From my perspective, continued investments in fleet expansion and defense aviation will sustain demand for hydraulic systems, ensuring steady integration across both new and retrofitted platforms.

Growth Opportunity Lightweight and Electro-Hydraulic Systems

Opportunities are emerging with the adoption of lightweight hydraulic components and electro-hydraulic systems that improve efficiency and reduce maintenance. Airlines are prioritizing fuel savings, driving the need for lightweight designs without compromising reliability. Electro-hydraulic actuators offer precise control, energy efficiency, and reduced fluid dependency, aligning with the shift toward more-electric aircraft architectures. In my opinion, suppliers who invest in innovative hydraulic technologies and collaborate with aircraft OEMs will gain long-term advantages as the aviation sector transitions toward energy-efficient and hybrid systems.

Emerging Trend Integration with More-Electric Aircraft

The shift toward more-electric aircraft is influencing hydraulic system design. Airlines and manufacturers are moving toward reduced hydraulic dependency by integrating electro-hydraulic and electric actuation systems. However, hydraulic systems remain indispensable for applications requiring high force density, particularly in large aircraft. Integration with smart monitoring systems allows predictive maintenance, improving reliability and reducing downtime. From my viewpoint, the gradual evolution toward hybrid architectures will keep hydraulic systems relevant while allowing smoother transition to electric aviation technologies.

Market Challenge Fluid Leakage and Maintenance Costs

One of the main challenges in the aircraft hydraulic system market is the issue of fluid leakage, which raises maintenance costs and affects reliability. Hydraulic fluids are also flammable, creating safety concerns in high-temperature environments. Airlines face high expenses in inspection, replacement, and compliance with strict safety regulations. Smaller regional operators often struggle with the high cost of maintaining complex hydraulic assemblies. In my opinion, manufacturers must focus on advanced sealing technologies, environmentally friendly hydraulic fluids, and simplified system architectures to minimize these challenges while ensuring compliance with aviation safety standards.

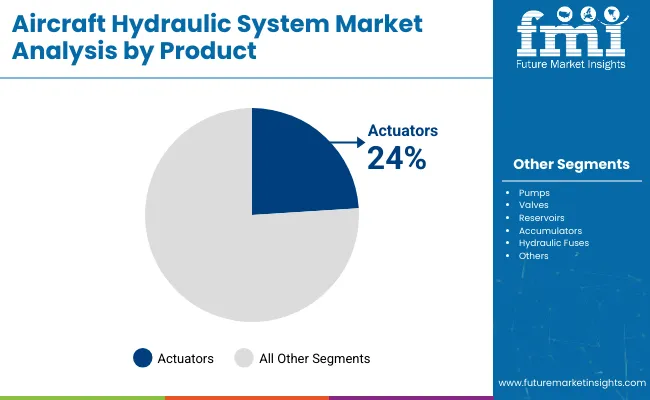

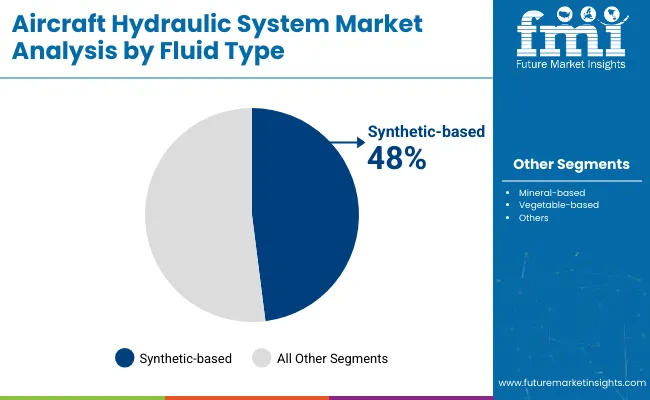

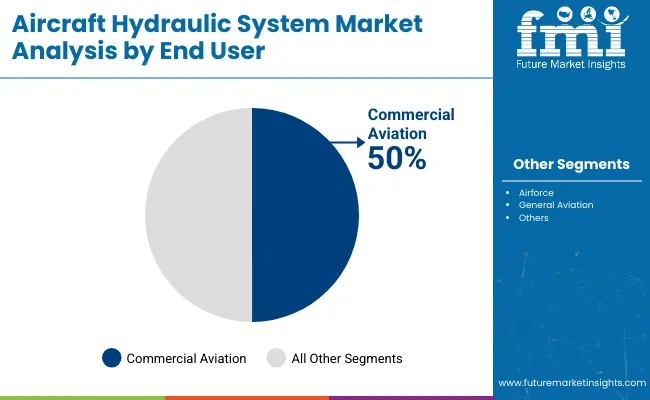

The aircraft hydraulic system market continues to expand with rising demand for efficient actuation, flight control, and landing gear operations. Actuators, pumps, and valves represent the most dominant product categories, while synthetic-based fluids remain the preferred choice due to durability. Fixed-wing aircraft account for most system integration, supported by large-scale commercial and defense procurement. End users are concentrated in commercial aviation, followed by airforce fleets requiring advanced hydraulic assemblies. Growth in both new aircraft deliveries and maintenance cycles drives continuous outsourcing and upgrades in hydraulic components.

Actuators capture 24% share, ranking highest among hydraulic products. They are critical for primary flight control surfaces, landing gear deployment, and thrust reverser systems. Aircraft rely on linear and rotary actuators to provide the necessary force for high-load maneuvers and stability during operations. Service providers focus on improving actuator efficiency through lighter housings and enhanced sealing technologies. OEMs outsource actuator testing and integration to reduce assembly delays in narrow-body and wide-body programs. The segment continues to gain from both commercial aircraft production ramp-ups and aftermarket replacements.

Synthetic-based fluids hold 48% share, the leading fluid type in aviation hydraulics. These fluids are designed for high thermal stability, low flammability, and resistance to oxidation, making them essential for modern aircraft. Compared with mineral and vegetable-based fluids, synthetics allow operation under higher temperature ranges and reduce maintenance requirements. OEMs prefer synthetic fluids for new-generation commercial fleets such as the Airbus A350 and Boeing 787. Airforces also adopt these fluids for advanced fighter jets, where reliability under extreme stress conditions is vital. Their superior performance characteristics ensure long-term preference across segments.

Fixed-wing aircraft dominate with 65% share of the hydraulic system market. Narrow-body and wide-body fleets require multiple hydraulic assemblies for flight controls, brakes, and landing gear. Hydraulic systems in fixed-wing platforms are designed to withstand repetitive high-pressure cycles across long operational lifetimes. OEMs outsource design and integration of hydraulic modules to maintain production schedules. Aftermarket demand is also strong as airlines replace aging components to ensure safety and compliance. Fleet modernization programs, especially in Asia-Pacific and North America, continue to reinforce demand for fixed-wing hydraulic systems.

Commercial aviation represents 50% share, the top end-user segment. Hydraulic systems are indispensable for controlling wing flaps, rudders, landing gear, and braking functions in commercial jets. As global air travel grows, OEMs and MRO providers emphasize hydraulic component production and maintenance to ensure aircraft reliability. Airlines focus on predictive maintenance for hydraulic systems to minimize downtime. Increasing deliveries of narrow-body aircraft amplify demand for efficient hydraulic assemblies. Regional operators also contribute, with strong reliance on aftermarket services to manage lifecycle replacements and upgrades of hydraulic systems across fleets.

In 2025, China is forecast at a CAGR of 6.6% through 2035, which is −53% below the global average of 14%. Growth is supported by BRICS-backed expansion in aircraft manufacturing and modernization of hydraulic systems across domestic and regional fleets. The United States follows with 6.3%, −55% under the global rate, driven by OECD-based advancements in aerospace engineering and system reliability, though adoption is moderated by a stronger push toward electrified alternatives. India posts 6.1%, −56% compared with global performance, reflecting expansion of indigenous aerospace capacity and rising commercial air travel demand. Germany records 5.8%, −59% below the global CAGR, where hydraulic system upgrades are incremental within established fleets. The United Kingdom stands at 5.5%, −61% under the global rate, with conservative integration as investments shift toward electric propulsion. Overall, hydraulic systems remain relevant, but global momentum increasingly favors electrification.

The United States aircraft hydraulic system market is projected to grow at a CAGR of 6.3%, driven by high replacement demand in commercial and defense fleets. Boeing’s extensive production lines and the USA Air Force modernization programs contribute significantly to hydraulic actuator and pump demand. Investments in lightweight hydraulic components, along with digital pressure monitoring systems, support aircraft efficiency. The CAGR reflects steady growth from retrofitting requirements in older fleets and consistent procurement of next-generation aircraft. Maintenance, repair, and overhaul (MRO) activities at major hubs further accelerate hydraulic system adoption in both narrowbody and widebody aircraft.

The demand aircraft hydraulic system in China is estimated to grow at a CAGR of 6.6%, supported by the expansion of domestic air travel and indigenous aircraft manufacturing. COMAC’s C919 program has created strong demand for locally sourced hydraulic actuators and power units. Rapid fleet expansion by carriers such as China Southern and Air China increases hydraulic component procurement. The CAGR reflects strong fleet additions and rising MRO activity within Chinese airlines. Government incentives for domestic production of hydraulic pumps and accumulators further strengthen the supply chain, reducing dependence on imports. This ensures sustained growth, particularly across commercial and regional aircraft categories.

The aircraft hydraulic system market in Germany is expected to grow at a CAGR of 5.8%, primarily driven by Airbus operations in Hamburg and Munich. Hydraulic systems are integral in Airbus A320 and A350 programs, where actuators and landing gear systems are developed with local suppliers. The CAGR is explained by Germany’s role as a core European manufacturing hub with steady, not rapid, expansion. Maintenance centers such as Lufthansa Technik create consistent aftermarket demand. Research initiatives in reducing hydraulic weight and integrating electronic-hydraulic hybrids provide long-term growth opportunities, though adoption is gradual due to cost considerations.

The United Kingdom market for aircraft hydraulic systems is forecast to grow at a CAGR of 5.5%, supported by participation in Airbus, BAE Systems, and Rolls-Royce supply chains. The slower growth compared to Asia and the USA is linked to moderate fleet expansion and focus on high-value defense projects rather than volume-driven civil aviation. MRO activity around London Heathrow and military bases generates aftermarket sales for actuators and hydraulic valves. Investments in hybrid power systems have shifted research partially away from traditional hydraulic dominance, moderating the CAGR but maintaining steady demand.

The aircraft hydraulic system market in India is projected to grow at a CAGR of 6.1%, fueled by rapid expansion in commercial aviation and defense modernization. HAL and DRDO projects, including the Tejas fighter jet, integrate high-performance hydraulic actuators and pumps. Airbus and Boeing deliveries to carriers such as IndiGo and Air India create additional demand. The CAGR reflects a mix of domestic defense procurement and strong commercial aircraft additions. Hydraulic system suppliers benefit from India’s push for localized production, particularly under the Make in India initiative, which encourages domestic manufacturing partnerships.

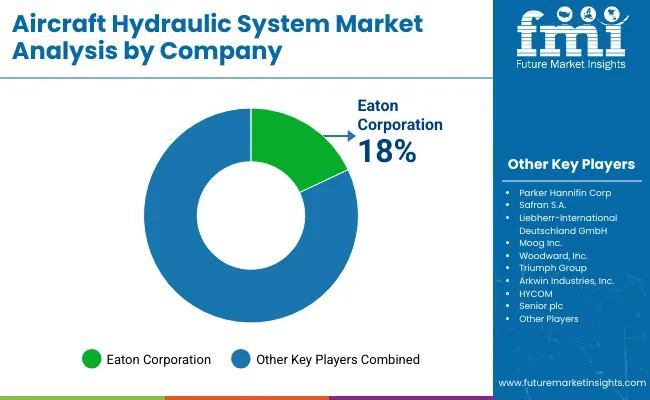

Competition in the aircraft hydraulic system market is being shaped by specialized suppliers delivering critical components such as pumps, actuators, valves, reservoirs, and power units for commercial, regional, and military fleets. Strategies are centered on system reliability, high-pressure performance, and integration with digital monitoring. Eaton and Parker Hannifin are extending leadership through wide-ranging hydraulic product lines that include engine-driven pumps, servo valves, and filtration solutions designed for large aircraft platforms.

Safran and Liebherr are emphasizing complete hydraulic systems optimized for advanced aircraft programs, with efforts directed toward weight reduction and operational efficiency. Moog and Woodward are targeting actuation and precision control components, reinforcing their presence in flight control applications. Triumph Group and Arkwin Industries are positioned with specialized niche products, particularly in actuators and accessory-driven systems.

HYCOM is supporting the market through hydraulic testing solutions, while Senior plc is advancing with engineered tubing and fluid conveyance components. Product brochures typically stress durability, lightweight construction, resistance to extreme temperature conditions, and simplified maintenance. Highlighted features also include compliance with international aviation standards, high fluid compatibility, and extended lifecycle performance. The competitive approach across these companies is aligned toward strengthening efficiency, reducing downtime, and delivering hydraulic architectures that are adaptable to both legacy and next-generation aircraft platforms.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 15 billion |

| Projected Market Size (2035) | USD 55.6 billion |

| CAGR (2025 to 2035) | 14% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Segments | Reservoirs, Pumps, Valves, Hydraulic fuses, Accumulators, Actuators, Others |

| Fluid Type Segments | Vegetable-based, Mineral-based, Synthetic-based |

| Wing Type Segments | Fixed Wing, Rotary Wing |

| End User Segments | Airforce, General Aviation, Commercial Aviation |

| Regions Covered | North America, Europe, Asia Pacific, Middle East Asia, Latin America |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, Australia, Saudi Arabia, United Arab Emirates, South Africa |

| Leading Players | Arkwin Industries Inc., Eaton Corporation plc, HYCOM, Liebherr -International Deutschland GmbH, Moog Inc., Parker Hannifin Corp, Safran S.A., Senior plc, Triumph Group, Woodward Inc. |

| Additional Attributes | Dollar sales by product and wing type, demand dynamics across commercial aviation, defense, and general aviation, regional adoption trends in North America, Europe, and Asia-Pacific, innovation in electro-hydraulic actuators and lightweight materials, environmental impact of fluid use and leakage prevention, and emerging use in more-electric and hybrid-electric aircraft systems. |

The market size is valued at USD 15 billion in 2025.

It is projected to reach USD 55.6 billion by 2035.

The market is expected to grow at a CAGR of 14% during 2025-2035.

Actuators hold the largest share with 24% in 2025.

Eaton Corporation is the leading player with 18% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Micro Turbine Engines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft De-icing Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Window Frame Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA