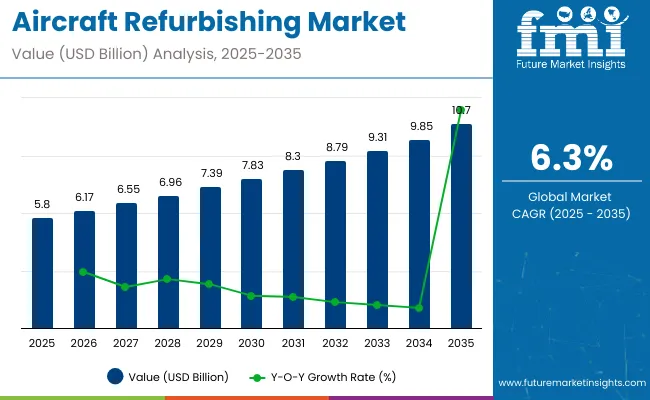

The aircraft refurbishing market is valued at USD 5.8 billion in 2025 and is expected to reach approximately USD 10.7 billion by 2035, growing at a CAGR of 6.3%, with a multiplying factor of about 1.84x over the decade. Inflection point mapping highlights the periods where growth accelerates or decelerates due to shifts in demand, technology adoption, and regulatory influences. The first inflection point occurs in the late 2020s, driven by rising demand for cabin modernization, lightweight interiors, and enhanced passenger comfort in narrow-body and regional aircraft fleets. Airlines focus on refurbishment as a cost-efficient alternative to fleet replacement, which temporarily accelerates market activity.

A second inflection point emerges in the early 2030s as technological upgrades, such as digital avionics retrofits, connectivity enhancements, and fuel-efficient modifications, gain traction. This period sees accelerated adoption as operators integrate advanced systems to comply with new safety and environmental regulations while improving operational efficiency. The later stage, toward 2035, marks a stabilization phase where the market growth aligns with ongoing replacement cycles and continuous improvement in refurbishment offerings. Inflection point mapping demonstrates how market dynamics evolve in response to regulatory changes, innovation, and airline fleet strategies, providing a roadmap for manufacturers, MRO service providers, and investors to anticipate periods of heightened activity and plan capacity, investment, and service offerings accordingly.

The aircraft refurbishing market is shaped by several contributing sectors. Airlines and commercial operators account for approximately 40%, driving demand for cabin upgrades, interior replacements, and life-extension programs. Maintenance, repair, and overhaul (MRO) service providers represent about 28%, performing technical inspections, structural modifications, and system refurbishments. Cabin equipment and interior component manufacturers contribute roughly 17%, supplying seats, galleys, in-flight entertainment, and cabin panels. Aerospace engineering and design consultancies hold close to 10%, supporting custom layouts and compliance with regulatory standards. Material and coating suppliers comprise the remaining 5%, providing lightweight composites, upholstery, and protective finishes.

The market is witnessing growth driven by airline cost optimization and passenger experience enhancement. Global airline retrofitting activity increased by 12% year-on-year, with narrow-body fleets dominating refurbishment volumes. Lightweight composite cabin panels and modular seating systems are reducing aircraft weight by up to 8-10%, improving fuel efficiency. Digital cabin management systems are being integrated into refurbished aircraft, enabling smart lighting, personalized in-flight entertainment, and enhanced monitoring of cabin conditions. Airlines are increasingly combining scheduled maintenance with interior upgrades to minimize downtime, while sustainable materials and eco-friendly coatings are gaining traction to reduce environmental impact.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 5.8 billion |

| Industry Value (2035F) | USD 10.7 billion |

| CAGR (2025 to 2035) | 6.3% |

Growth is driven by rising demand for cabin modernization, seat replacement, and avionics upgrades in commercial and private aircraft. Airlines are focusing on refurbishing older fleets to enhance passenger comfort, extend aircraft life, and comply with updated safety regulations. North America holds the largest share due to mature airline networks and strong refurbishment capabilities, while Asia Pacific is witnessing rapid adoption as growing fleets require cabin upgrades and maintenance. Refurbishment activities also include interior design, galley modernization, and installation of in-flight entertainment and connectivity systems.

Driving Force Fleet Modernization and Passenger Experience

Increasing fleet modernization initiatives and the focus on passenger experience are the primary drivers of the aircraft refurbishing market. Airlines are refurbishing interiors to improve seating configurations, cabin aesthetics, and in-flight amenities. Avionics upgrades enhance operational efficiency and safety compliance. Regional airlines are refurbishing aircraft to meet local regulatory standards and enhance brand perception. In my view, refurbishing is a cost-effective strategy for carriers to optimize operational life and maintain competitiveness while catering to evolving passenger expectations.

Growth Opportunity Cabin Interiors and Connectivity Solutions

Cabin interiors and in-flight connectivity present significant growth opportunities. Demand for lightweight seating, modular cabin designs, and advanced galley systems is rising. Airlines are also investing in Wi-Fi, entertainment systems, and connectivity solutions to enhance customer experience. The trend toward premium cabin offerings and business class enhancements is creating additional refurbishment opportunities. From my perspective, suppliers specializing in cabin design, seating technology, and digital connectivity will capture higher market share as airlines prioritize passenger satisfaction and operational efficiency.

Emerging Trend Digital Refurbishment and Predictive Maintenance

Digital refurbishment solutions and predictive maintenance are transforming the aircraft refurbishing sector. 3D modeling, virtual reality, and simulation tools enable precise cabin redesign and optimized space utilization. Predictive maintenance integrated with refurbishment schedules reduces downtime and operational disruption. Airlines are increasingly using data-driven tools to prioritize refurbishing activities and extend aircraft lifecycle. In my view, technology-driven refurbishment will become a key differentiator, allowing operators to improve efficiency, reduce costs, and deliver superior passenger experiences.

Market Challenge High Costs and Downtime

High costs and operational downtime remain significant challenges in the aircraft refurbishing market. Refurbishing activities require significant capital investment in materials, labor, and technology. Aircraft out of service for refurbishment may impact airline schedules and revenue. Compliance with safety and regulatory standards increases complexity and costs, particularly for international fleets. In my opinion, balancing investment with minimal downtime and efficient project management is critical for airlines to maximize refurbishment benefits and maintain operational continuity.

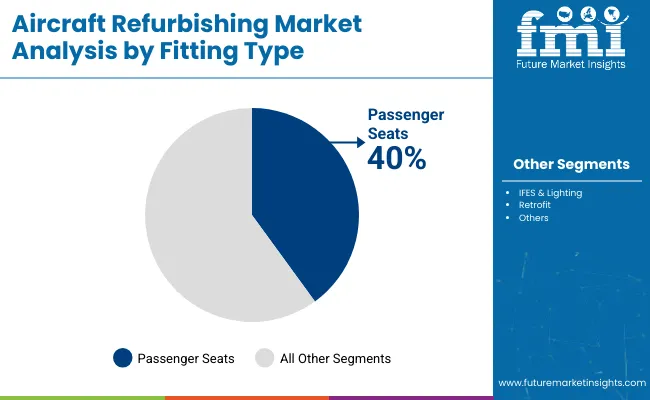

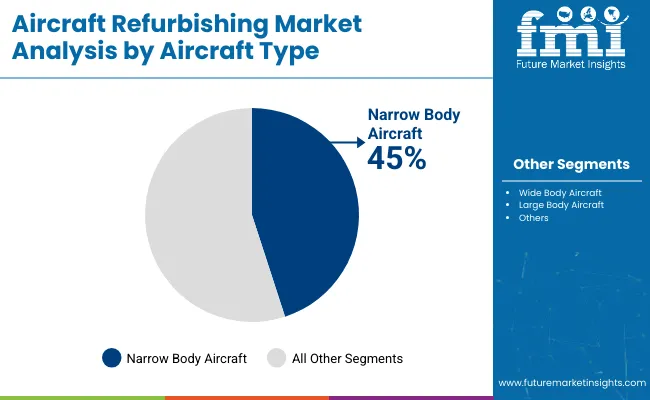

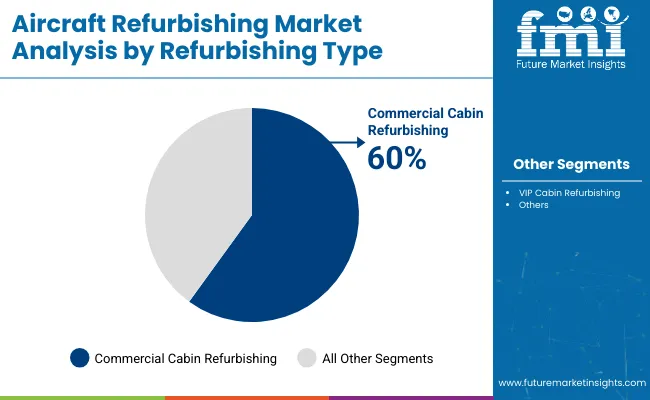

The aircraft refurbishing market is witnessing strong growth due to rising demand for cabin upgrades, retrofits, and modern passenger amenities. Narrow-body aircraft dominate refurbishment programs, while wide-body and large-body aircraft follow closely. Passenger seats and in-flight entertainment systems (IFES) along with lighting upgrades represent the leading fitting types. Commercial cabin refurbishing drives the largest segment, though VIP and specialized cabins are also increasing. Airlines focus on extending aircraft lifecycle, enhancing passenger experience, and meeting evolving regulatory standards, while refurbishment providers integrate modern materials, modular seating, and energy-efficient systems to optimize operational efficiency.

Passenger seats hold 40% share, the largest among fitting types. Airlines prioritize seat upgrades for comfort, weight reduction, and modular configuration flexibility. New-generation seats incorporate ergonomic designs, integrated power outlets, and lightweight structures to improve passenger experience and reduce fuel consumption. Narrow-body fleets undergo frequent retrofitting to maintain competitiveness in regional and short-haul routes. Commercial operators also outsource installation and certification to refurbishing specialists. Airlines targeting premium economy or business-class upgrades continue to invest heavily in advanced seat modules to differentiate service offerings and meet passenger expectations.

Narrow-body aircraft account for 45% share, leading refurbishment demand. Their prevalence in regional and short-haul operations creates frequent opportunities for interior upgrades. Retrofit programs focus on seating, lighting, and entertainment system improvements to enhance passenger experience. Operators also implement ergonomic and space-efficient designs to maximize seating capacity without sacrificing comfort. Wide-body aircraft follow with 35% share, primarily in long-haul fleet modernization. Large-body aircraft represent 20% and are often refurbished for specialized VIP or high-capacity configurations. Geographic growth is strongest in Asia-Pacific and North America, where airline competition drives refurbishment initiatives.

Commercial cabin refurbishing holds 60% share, the largest segment in the market. Airlines upgrade seats, IFES, lighting, and galley systems to extend aircraft lifecycle and improve passenger satisfaction. Programs focus on modular solutions for fast turnaround and minimal downtime during maintenance schedules. Refurbishing providers collaborate with OEMs and interior specialists to integrate ergonomic and energy-efficient components. Rising demand in narrow-body and wide-body fleets contributes heavily, while VIP and executive cabins account for specialized projects. Continuous cabin modernization supports airline branding, operational efficiency, and compliance with evolving safety regulations.

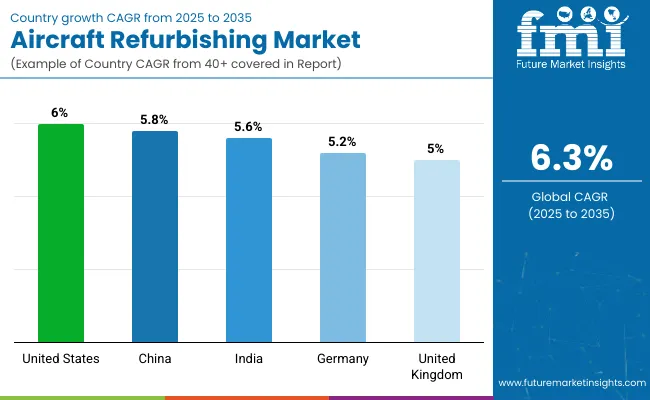

The aircraft refurbishing market is growing steadily from 2025 to 2035, driven by the need to extend aircraft lifecycles, improve operational efficiency, and comply with evolving safety standards. The United States leads with a CAGR of 6.0%, reflecting OECD-backed investment in cabin modernization, avionics upgrades, and maintenance services for both commercial and business fleets. China follows at 5.8%, supported by BRICS-led expansion of domestic airline operations and rising demand for cost-efficient fleet refurbishment solutions.

India records 5.6%, reflecting increased regional air travel and the need to maintain older aircraft while scaling operations. Germany posts 5.2%, slightly below the global trend, shaped by a mature aviation market with incremental adoption of advanced refurbishment technologies. The United Kingdom stands at 5.0%, −17% under the USA benchmark, reflecting a focus on selective upgrades within established fleets rather than large-scale overhauls. Overall, BRICS economies are driving volume through fleet expansion, while OECD countries emphasize technological upgrades, precision, and regulatory compliance in aircraft refurbishment.

The United States aircraft refurbishing market is projected to grow at a CAGR of 6.0%, driven by high fleet utilization and aging commercial aircraft requiring interior, avionics, and landing gear upgrades. Major MRO players such as Boeing Global Services and Delta TechOps support refurbishing operations, providing cabin retrofits, composite repairs, and avionics modernization. Growth is also fueled by regional carriers expanding fleet interiors to enhance passenger experience. Defense fleet refurbishments for aircraft such as C-130 and P-8 Poseidon add incremental demand. Technological integration in cabin management and predictive maintenance supports faster turnaround. The combination of high fleet density, aftermarket demand, and technological upgrades explains the steady CAGR.

The aircraft refurbishing market in China is expected to grow at a CAGR of 5.8%, propelled by the rapid expansion of domestic carriers and regional fleet modernization programs. COMAC’s C919 and ARJ21 require scheduled retrofits in avionics and cabin interiors, while carriers such as China Eastern and Air China increasingly invest in customized seating and in-flight entertainment upgrades. Partnerships with global MRO providers, including Lufthansa Technik and ST Aerospace, ensure access to advanced refurbishing technologies. The CAGR reflects both civil fleet expansion and rising defense aircraft maintenance for regional transport and training fleets.

The aircraft refurbishing market in India is projected to grow at a CAGR of 5.6%, fueled by domestic carrier expansion and government-led defense modernization initiatives. Airlines such as IndiGo and Air India upgrade cabin interiors, seating configurations, and avionics to improve passenger comfort and operational efficiency. HAL and DRDO maintain refurbishment programs for fighter jets and transport aircraft, boosting demand for high-performance structural components. Investment in digital MRO platforms enhances scheduling and predictive maintenance, reducing turnaround times. Growth is supported by increasing regional connectivity under the UDAN scheme and higher emphasis on fleet longevity.

The demand of aircraft refurbishing in Germany is expected to grow at a CAGR of 5.2%, driven primarily by Lufthansa Technik and the presence of major Airbus production facilities. Aircraft interior retrofitting, structural reinforcement, and avionics modernization are key services. The market benefits from Europe’s strict safety and operational compliance standards, which necessitate periodic refurbishments. Defense refurbishments for Eurofighter Typhoon and transport aircraft also contribute. The CAGR reflects steady demand in both civil and military segments, supported by advanced engineering capabilities and a well-established MRO ecosystem.

The aircraft refurbishing market in United States is projected to grow at a CAGR of 5.0%, influenced by BAE Systems, Rolls-Royce, and regional MRO hubs. Civil refurbishing focuses on interior upgrades, avionics retrofits, and lightweight structural improvements. Defense refurbishments for aircraft such as the Typhoon and Hawk trainer jets sustain market activity. Investments in robotics-assisted cabin refurbishment and predictive diagnostics improve turnaround times. The CAGR reflects moderate growth, balancing civil fleet modernization and defense maintenance programs, with emphasis on quality and technical precision rather than large-scale volume expansion.

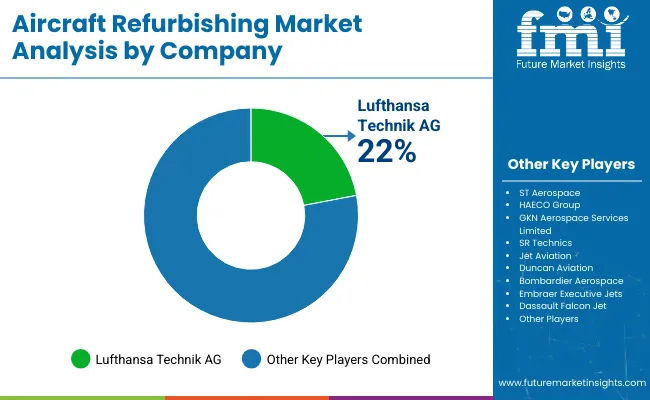

The aircraft refurbishing market is moderately consolidated, shaped by major global maintenance, repair, and overhaul (MRO) providers offering comprehensive cabin refurbishment, avionics upgrades, and exterior maintenance solutions. Lufthansa Technik AG is widely recognized as the market leader, supported by its extensive service portfolio that includes modular cabin upgrades, interior reconfigurations, and specialized refurbishing for commercial, business, and regional aircraft.

ST Aerospace and HAECO Group hold strong competitive positions with end-to-end refurbishment capabilities, covering cabin interiors, galley and lavatory systems, and aircraft exterior finishing. GKN Aerospace Services Limited and SR Technics reinforce market depth through precision engineering, structural modifications, and avionics retrofits, extending aircraft lifecycle and operational efficiency.

In the business aviation segment, Jet Aviation and Duncan Aviation focus on executive jet refurbishing, emphasizing luxury interiors, lightweight materials, digital entertainment integration, and personalized design solutions. Meanwhile, OEM-backed programs from Bombardier Aerospace, Embraer Executive Jets, and Dassault Falcon Jet provide factory-certified refurbishments aligned with warranty standards and aviation compliance.

Key market strategies center on quick turnaround times, modular cabin solutions, and regulatory adherence, while product portfolios highlight lightweight seat assemblies, ergonomic designs, advanced lighting and climate control systems, and digital cockpit upgrades. Lifecycle support, global service networks, and sustainability in materials continue to drive competitiveness and customer loyalty across both commercial and business aviation segments.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 5.8 billion |

| Projected Market Size (2035) | USD 10.7 billion |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Fitting Type Segments | Retrofit, IFES & Lighting, Passenger Seats |

| Aircraft Type Segments | Large Body Aircraft, Wide Body Aircraft, Narrow Body Aircraft |

| Refurbishing Type Segments | VIP Cabin Refurbishing, Commercial Cabin Refurbishing |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa |

| Leading Players |

Lufthansa Technik AG, ST Aerospace, HAECO Group, GKN Aerospace Services Limited, SR Technics, Jet Aviation, Duncan Aviation, Bombardier Aerospace, Embraer Executive Jets, Dassault Falcon Jet. |

| Additional Attributes | Dollar sales by fitting type and aircraft segment, demand dynamics across VIP and commercial cabin refurbishing, regional adoption trends in North America, Europe, and Asia-Pacific, innovation in cabin design, lightweight materials, and in-flight systems, environmental impact of material recycling and maintenance, emerging use in premium and next-generation aircraft interiors. |

The market size is valued at USD 5.8 billion in 2025.

It is projected to reach USD 10.7 billion by 2035.

The market is expected to grow at a CAGR of 6.3% during 2025-2035.

Passenger Seats hold the largest share with 40% in 2025.

Lufthansa Technik AG is the leading player with 22% share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA