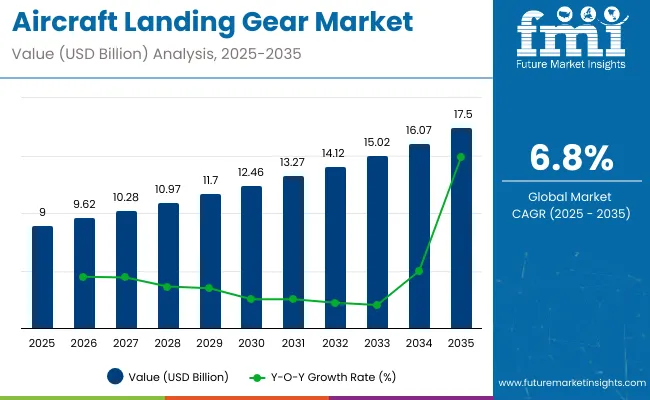

The aircraft landing gear market is valued at USD 9 billion in 2025 and will reach nearly USD 17.5 billion by 2035, advancing at a CAGR of 6.8% with a multiplying factor of about 1.94x.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 9 billion |

| Industry Value (2035F) | USD 17.5 billion |

| CAGR (2025 to 2035) | 6.8% |

Absolute dollar opportunity analysis highlights the incremental value created over the forecast period, which amounts to roughly 8.5 billion. This additional value represents the true expansion potential available for manufacturers, suppliers, and service providers beyond maintaining their existing market positions.

From 2025 to 2029, absolute dollar gains are moderate as growth is largely driven by rising aircraft deliveries and scheduled fleet replacements in commercial aviation. During 2030 to 2032, incremental gains accelerate due to higher production rates of narrow-body aircraft, strong demand from low-cost carriers, and increasing defense procurement. By the later stage of 2033 to 2035, absolute dollar opportunity peaks as global fleet size expands, driving replacement demand, overhauls, and upgrades to advanced landing gear systems with lighter materials, improved load-bearing capacity, and integrated health monitoring technologies. The cumulative opportunity over the decade underscores the need for stakeholders to prioritize innovation, cost-efficient manufacturing, and aftermarket services, as these areas account for a large share of the incremental 8.5 billion value expansion.

The aircraft landing gear market draws from multiple parent sectors. Aircraft OEMs contribute around 37%, as landing gear is a core system integrated during design and assembly of both commercial and defense aircraft. Landing gear component suppliers including struts, wheels, brakes, and actuators represent nearly 29%, manufacturing the precision parts that ensure structural reliability. Maintenance, repair, and overhaul (MRO) providers account for about 17%, as inspection and replacement cycles drive recurring demand. Defense aviation programs hold close to 10%, supporting specialized landing gear for combat and transport fleets. Material and forging industries comprise the remaining 7%, supplying titanium and advanced alloys for lightweight, high-strength assemblies.

Landing gear development is shifting toward lighter and more durable designs. High-strength alloys and composite materials are reducing landing gear weight by up to 15%, improving overall aircraft fuel efficiency. Advanced brake systems are incorporating electric actuation, lowering hydraulic dependency and cutting maintenance requirements by 10-12%. Airlines are investing more heavily in predictive health monitoring systems, extending service intervals and minimizing unplanned downtime. In defense, demand for ruggedized landing gear suited for short and rough-field operations is increasing. Regional and narrow-body aircraft orders are fueling fresh demand, while retrofit programs for carbon brake upgrades are gaining momentum across both civil and military fleets.

Growth is supported by rising aircraft deliveries, increased passenger traffic, and replacement of aging fleets across commercial and military aviation. Landing gear remains one of the heaviest and most critical subsystems, requiring reliability, safety, and durability. North America dominates the market with strong aerospace manufacturing, while Asia Pacific shows rapid growth as airlines expand fleets. Advancements in lightweight materials, such as titanium and composites, along with integration of health monitoring systems, are shaping future demand.

Driving Force Growth in Global Aircraft Deliveries

The surge in new aircraft deliveries is the most influential driver for the landing gear market. By 2035, the global commercial fleet is projected to surpass 46,000 aircraft, creating strong demand for landing gear systems in both new builds and retrofits. Military aircraft programs in the United States, China, and Europe also stimulate market growth. Landing gear plays a crucial role in takeoff and landing, absorbing impact and ensuring safe ground operations. In my view, increasing global connectivity and airline investments in fleet modernization will continue to boost demand for advanced landing gear solutions.

Growth Opportunity Lightweight and Smart Landing Gear

The shift toward lightweight and smart landing gear systems presents major opportunities. Use of titanium alloys, carbon composites, and additive manufacturing techniques reduces overall aircraft weight, enhancing fuel efficiency. Integration of sensors and health monitoring systems enables predictive maintenance, lowering operational costs and minimizing downtime. Expansion of regional and low-cost carriers also contributes to higher demand for cost-effective and durable landing gear. From my perspective, suppliers that focus on weight reduction technologies and smart diagnostics will remain competitive and capture market share in the evolving aerospace sector.

Emerging Trend Additive Manufacturing and Electric Taxiing

Additive manufacturing is emerging as a transformative trend in landing gear production, enabling complex geometries and reduced material waste. Electric taxiing systems are also being integrated into landing gear to lower fuel burn during ground operations, particularly at busy airports. Smart landing gear with integrated sensors improves operational efficiency by detecting wear, stress, and temperature variations in real time. In my opinion, these advancements will reshape maintenance practices and open new opportunities for OEMs and suppliers who embrace digitalization and sustainable technologies.

Market Challenge High Maintenance Costs and Safety Regulations

High maintenance costs and stringent safety regulations remain challenges in the aircraft landing gear market. Landing gear systems undergo heavy stress during takeoff and landing cycles, requiring frequent inspections, overhauls, and part replacements. Strict regulatory compliance adds to maintenance complexity and costs for operators. Smaller carriers often face budget pressures in maintaining sophisticated systems, while failures can cause severe operational and safety risks. In my opinion, innovation in materials, advanced coatings, and modular designs will be necessary to reduce maintenance costs and improve lifecycle efficiency.

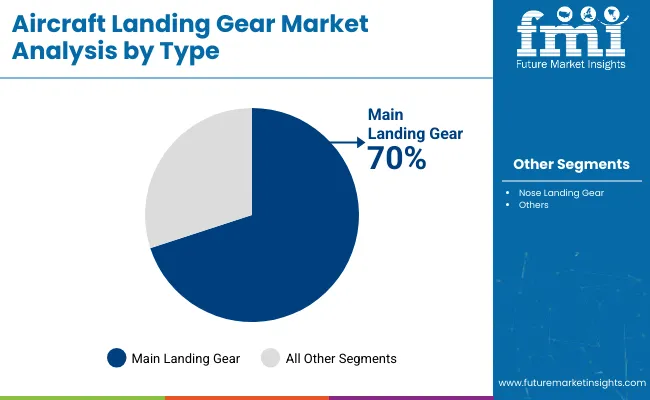

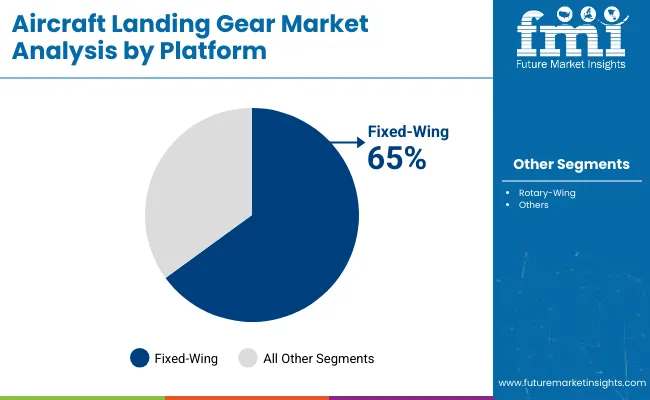

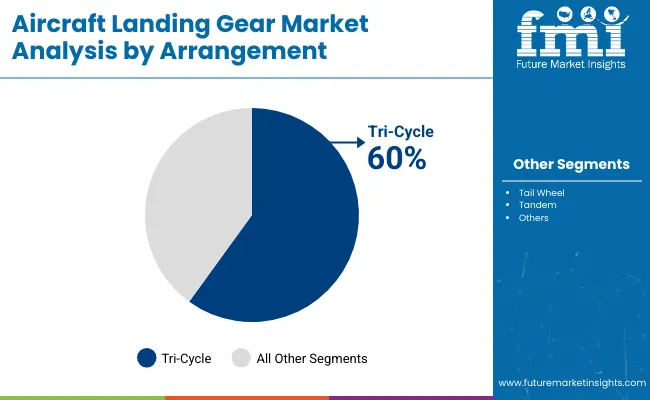

The aircraft landing gear market is shaped by rising aircraft production, fleet modernization, and the growing aftermarket demand for replacements. Main landing gear dominates overall share, reflecting its critical role in weight support and stability during take-off and landing. Fixed-wing platforms lead integration, while tri-cycle arrangements remain standard across commercial and defense fleets. Brakes, wheels, and retraction systems drive component sales, supported by OEM-led production and aftermarket servicing. Airlines focus on predictive maintenance strategies, while OEMs invest in lightweight materials for higher efficiency.

Main landing gear accounts for 70% share, making it the most important segment in aircraft landing gear systems. These assemblies carry the bulk of aircraft weight during taxiing, take-off, and landing. Commercial fleets rely heavily on durable main landing gear designs to ensure safety and reliability. OEMs integrate advanced retraction systems and stronger load-bearing materials to improve performance. Air force programs also prioritize main gear development for fighter jets requiring high-impact absorption. The aftermarket continues to grow as airlines replace worn assemblies across aging fleets.

Fixed-wing aircraft hold 65% share of the landing gear market, reflecting their dominance in both commercial and military aviation. Commercial narrow-body and wide-body fleets drive the highest demand for landing gear assemblies due to higher delivery volumes. Fixed-wing platforms require multiple retraction and steering systems, creating significant OEM and aftermarket opportunities. Military transport and fighter jets also strengthen demand with rugged designs built for high-performance landings. Ongoing fleet modernization, particularly in Asia-Pacific and North America, fuels further market expansion in this category.

Tri-cycle landing gear secures 60% share, making it the most widely adopted arrangement in the market. This configuration provides balanced stability during take-off, taxiing, and landing, especially in commercial aviation. Airlines and OEMs prefer tri-cycle systems for narrow-body and wide-body jets due to safety and passenger comfort. Regional aircraft programs also rely on this configuration for operational efficiency. Tandem and tail wheel arrangements serve specific use cases but remain less common. With growing global deliveries, tri-cycle configurations will continue to dominate new aircraft integration.

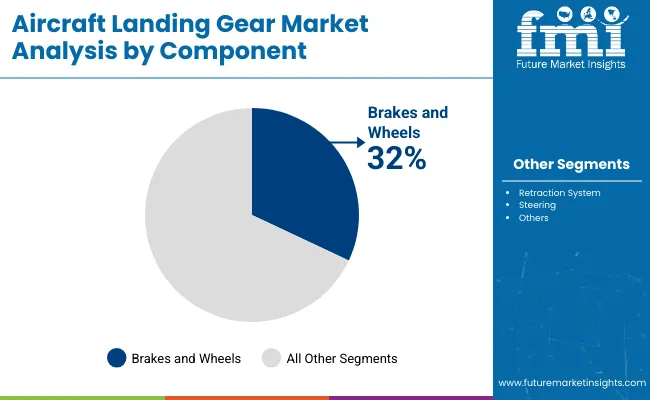

Brakes and wheels account for 32% share, emerging as the largest component category in the market. These systems are crucial for deceleration, ground handling, and safe stopping distances after landing. Airlines prioritize brake and wheel maintenance due to frequent wear from high-friction landings. OEMs are developing lighter wheel assemblies and carbon brakes to improve fuel efficiency and performance. The aftermarket sees strong demand as operators frequently replace brake pads and wheel components to maintain safety standards. This ensures consistent long-term growth for the segment.

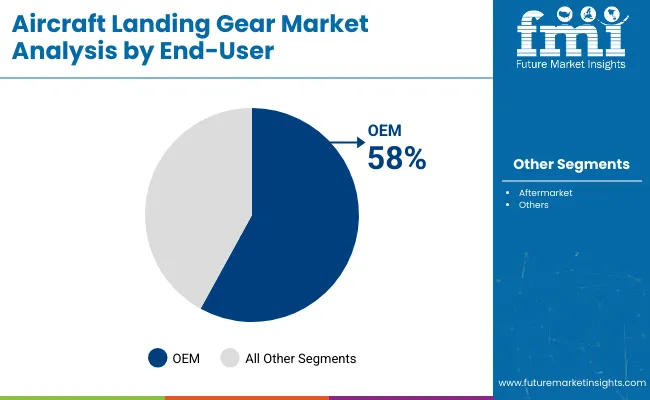

OEMs hold 58% share, the largest end-user segment in the aircraft landing gear market. Aircraft manufacturers integrate landing gear assemblies during production, ensuring compatibility with flight control and structural systems. Rising narrow-body aircraft deliveries drive demand for OEM-supplied gear. OEMs focus on partnerships with suppliers to enhance lightweight materials and modular designs. The aftermarket remains critical, but OEM installations form the backbone of long-term revenue streams. Fleet expansion in emerging regions continues to strengthen OEM orders for landing gear systems.

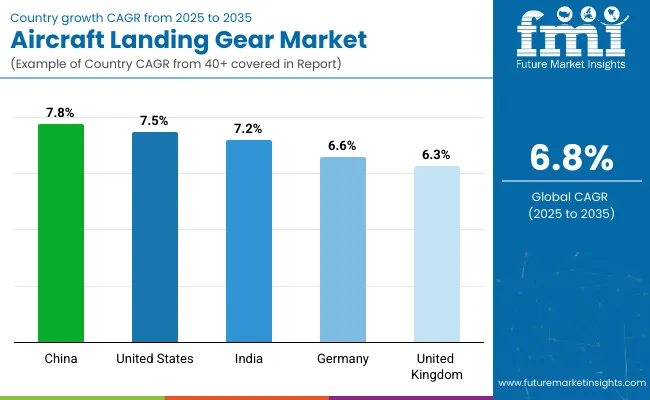

The United States records a CAGR of 7.5% from 2025 to 2035, +10% above the global average of 6.8%. Growth is tied to OECD-supported innovation in lightweight composites, advanced shock absorption systems, and sustained aerospace R&D investment. China follows at 7.8%, outperforming the global benchmark by +15%, supported by BRICS-led expansion in domestic aviation fleets and strong procurement from defense programs. India posts 7.2%, +6% above the global CAGR, reflecting rapid growth in regional air traffic and manufacturing initiatives aimed at strengthening the aerospace supply chain. Germany records 6.6%, slightly below the global average, influenced by strengths in precision engineering but constrained by mature aircraft replacement cycles. The United Kingdom stands at 6.3%, −7% under the global CAGR, shaped by gradual system modernization and joint European research initiatives. Data suggests BRICS economies emphasize large-scale fleet expansion, while OECD nations focus on advanced technology adoption and system refinement.

China’s aircraft landing gear market is projected to expand at a CAGR of 7.8%, outpacing the global average of 6.8%. Growth is closely tied to COMAC’s C919 and ARJ21 programs, which are generating consistent demand for hydraulic actuators, shock absorbers, and lightweight landing assemblies. Rising passenger volumes and the fleet expansion plans of China Southern and China Eastern further reinforce procurement. Domestic manufacturing policies are encouraging local suppliers to scale production, while partnerships with Safran and Liebherr enhance technology adoption. The high CAGR reflects a mix of fleet growth and a strong localization strategy in component manufacturing.

The United States market for aircraft landing gear is anticipated to grow at a CAGR of 7.5%, supported by Boeing’s 737 MAX and 787 production lines. The country’s leadership in widebody and narrowbody aircraft programs ensures recurring demand for advanced landing gear with fatigue-resistant alloys and digital load monitoring. Defense procurement, particularly for Lockheed Martin’s F-35 and Boeing’s P-8 Poseidon, creates additional demand. The CAGR reflects sustained replacement cycles and the integration of smart sensors into landing gear for predictive maintenance. Aftermarket services remain robust due to large fleets of older aircraft undergoing regular maintenance checks.

The aircraft landing gear market in India is projected to achieve a CAGR of 7.2%, supported by rapid commercial aviation expansion and defense upgrades. Deliveries from Airbus and Boeing to carriers like IndiGo, Air India, and Vistara significantly increase landing gear procurement needs. HAL’s indigenous Tejas fighter program and modernization of Sukhoi and Mirage fleets further stimulate hydraulic system requirements. The CAGR is underpinned by both civil fleet growth and defense integration, with a strong push from government initiatives favoring local sourcing. India’s focus on developing supplier clusters under the Make in India policy is also creating opportunities for global OEMs to set up joint ventures.

The aircraft landing gear market in Germany is expected to grow at a CAGR of 6.6%, closely tied to Airbus production in Hamburg and Bremen. The A320neo and A350 programs continue to be key demand generators for landing gear systems, including braking actuators and composite struts. Lufthansa Technik’s role in the MRO segment reinforces aftermarket demand for landing gear inspections and replacement parts. The CAGR reflects steady production rather than fleet surges, with a strong emphasis on technology refinement such as weight reduction and hybrid hydraulic-electric systems. Germany’s positioning as a European hub for both production and MRO activities sustains consistent market momentum.

The demand of aircraft landing gear in UK is projected to expand at a CAGR of 6.3%, driven by BAE Systems’ contributions to defense aircraft programs and participation in Airbus supply chains. The slower growth rate compared to Asia reflects limited fleet expansion in commercial airlines, with more emphasis on specialized defense projects. The UK is a key supplier of landing gear assemblies for military aircraft such as the Eurofighter Typhoon. Rolls-Royce’s role in integrated propulsion systems also supports coordination with landing gear manufacturers. The CAGR highlights stable but moderate growth, reflecting an ecosystem focused on quality and defense-oriented projects rather than volume-driven demand.

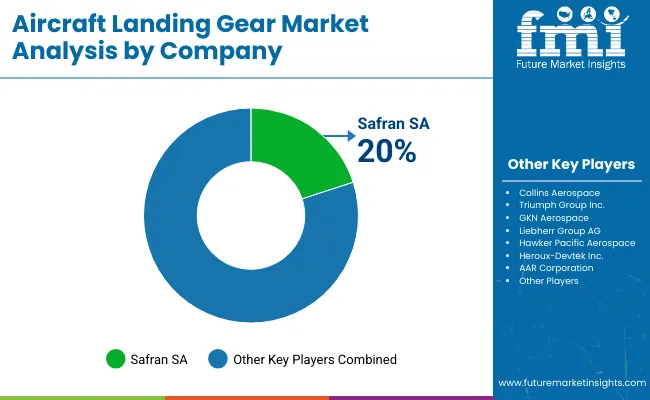

Competition in the aircraft landing gear market is being shaped by major aerospace suppliers and specialized manufacturers providing durable, high-performance solutions for commercial, regional, and military aircraft. Safran SA is assumed to be the leading player, supported by integrated landing systems, modular assemblies, and advanced actuation technologies. Collins Aerospace competes by offering lightweight, maintenance-friendly designs with improved reliability under extreme load conditions. Triumph Group, GKN Aerospace, and Liebherr Group AG reinforce their market presence through precision-engineered assemblies aligned with specific OEM and aftermarket requirements. Hawker Pacific Aerospace and Heroux-Devtek Inc. deliver niche solutions for business jets and regional aircraft, while AAR Corporation and Alaris Aerospace focus on repair, overhaul, and aftermarket support. Strategies across these companies are guided by product differentiation, lifecycle support, and partnerships with aircraft manufacturers to secure repeat business and long-term contracts. Emphasis is placed on expanding product lines, improving actuation efficiency, and reducing turnaround times during heavy maintenance checks.

Product offerings are highlighted in brochures with retractable and fixed landing gear systems, shock absorption technologies, brake control units, and hydraulic actuation modules. Materials are described as high-strength, corrosion-resistant alloys designed for extended operational life. Digital monitoring and predictive maintenance features are emphasized, ensuring safety, compliance with regulatory standards, and reduced downtime. Modular and scalable designs enable customization across narrow-body, wide-body, business jets, and rotary platforms. Collective focus across these companies is placed on reliability, operational efficiency, and support services, positioning them to meet growing demand for advanced landing gear systems in the aerospace market.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9 billion |

| Projected Market Size (2035) | USD 17.5 billion |

| CAGR (2025 to 2035) | 6.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projection Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Type Segments | Nose Landing Gear, Main Landing Gear |

| Platform Segments | Fixed-Wing, Rotary-Wing |

| Arrangement Segments | Tail Wheel, Tandem, Tri-Cycle |

| Component Segments | Retraction System, Brakes and Wheels, Steering, Others |

| End User Segments | OEM, Aftermarket |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, United Kingdom, France, Italy, China, Japan, India, UAE, South Africa |

| Leading Players | AAR Corporation, Alaris Aerospace, CIRCOR International Inc., Collins Aerospace, SPP Canada Aircraft Inc., Triumph Group Inc., Hawker Pacific Aerospace, Heroux-Devtek Inc., GKN Aerospace, Magellan Aerospace Corporation, Safran SA, Liebherr Group AG |

| Additional Attributes | Dollar sales by landing gear type and component, demand dynamics across commercial, military, and rotary-wing aircraft, regional adoption trends in North America, Europe, and Asia-Pacific, innovation in lightweight alloys, retraction systems, and steering mechanisms, environmental impact of material use and maintenance practices, emerging use in next-generation and eVTOL aircraft. |

The market size is valued at USD 9 billion in 2025.

It is projected to reach USD 17.5 billion by 2035.

The market is expected to grow at a CAGR of 6.8% during 2025-2035.

Main Landing Gear holds the largest share with 70% in 2025.

Safran SA is the leading player with 20% share.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Electric Motor Market Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Actuators Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Elevator Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Weapons Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA