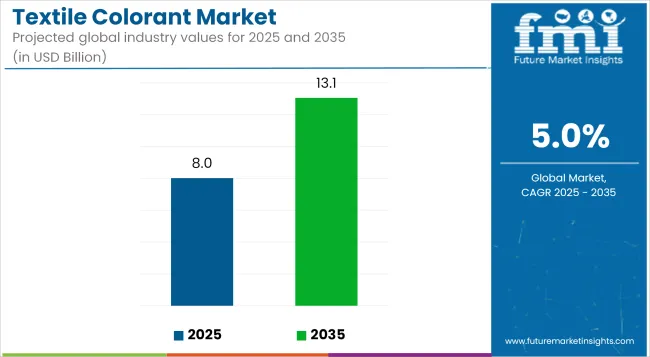

The global textile colorant market is estimated to be valued at USD 8.02 billion in 2025 and is forecast to reach approximately USD 13.06 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.0% during the forecast period. Growth is being driven by increasing demand for durable, high-performance colored fabrics and a global shift toward resource-efficient and low-impact dyeing technologies.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 8.02 billion |

| Projected Global Value (2035F) | USD 13.06 billion |

| Value-based CAGR (2025 to 2035) | 5.0% |

Textile colorants are applied across various segments of the textile industry to impart aesthetic appeal and functionality to fabrics used in apparel, home furnishings, industrial textiles, and technical applications. Advances in formulation science have enabled the development of colorants that offer high colorfastness, UV resistance, and compatibility with diverse fabric substrates such as cotton, polyester, nylon, and blended fibers.

Growing environmental concerns and regulatory mandates are influencing product development strategies across the textile chemicals industry. Manufacturers are prioritizing the creation of low-VOC, heavy metal-free, and water-conserving dye systems in response to sustainability commitments and stricter wastewater discharge regulations. These efforts are particularly prominent in regions where water-intensive dyeing practices have come under scrutiny.

The rising adoption of digital textile printing is contributing to demand for high-performance reactive, disperse, and pigment-based colorants. The technology enables precision application of dyes and reduces dye bath waste, making it suitable for customized, short-run production cycles. Textile producers are increasingly investing in these systems to align with changing fashion cycles and on-demand manufacturing models.

In Asia Pacific, significant production volumes are concentrated in countries such as China, India, and Bangladesh, where textile manufacturing remains a cornerstone of industrial output. Environmental policy shifts in these countries are encouraging the adoption of closed-loop dyeing systems and wastewater recycling, further driving the market for compliant dye formulations. In Europe and North America, consumer preferences for non-toxic and sustainably dyed garments are influencing sourcing practices across apparel and home textile brands.

Bio-based and enzymatic dye alternatives are also being explored by textile chemical manufacturers as part of broader decarbonization strategies. These solutions aim to replace synthetic intermediates with renewable inputs, reducing both the carbon footprint and aquatic toxicity associated with conventional textile colorant use.

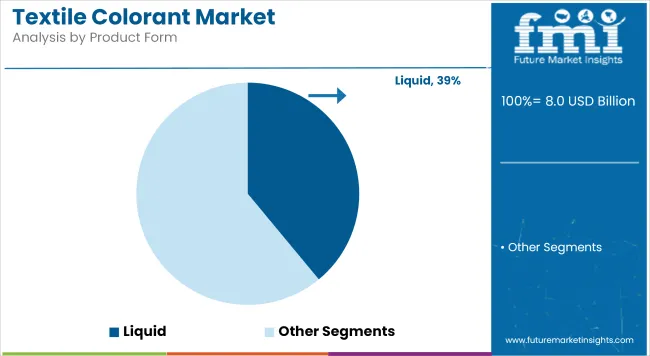

The liquid form segment is projected to account for approximately 39% of the global textile colorant market share in 2025 and is expected to grow at a CAGR of 5.2% through 2035. Liquid colorants are increasingly adopted in high-throughput textile printing and dyeing operations because they offer better dispersion, faster mixing, and reduced dust generation compared to powders and granules.

Their use is also rising in automated systems where dosing precision and process control are key. As textile manufacturers modernize their operations and focus on cleaner production practices, liquid colorants continue to align with these efficiency and safety goals.

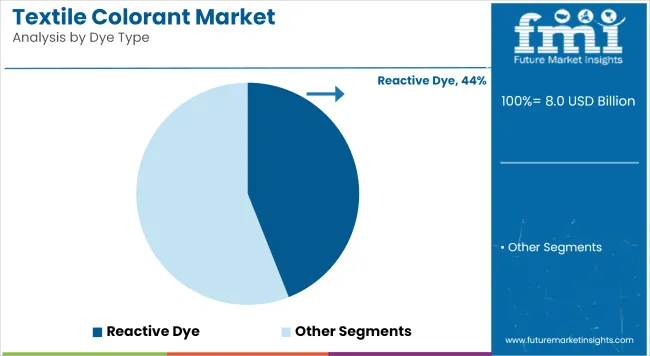

The reactive dye segment is estimated to hold approximately 44% of the global textile colorant market share in 2025 and is projected to grow at a CAGR of 5.1% through 2035. These dyes form covalent bonds with fiber molecules, resulting in high wash-fastness and vibrant coloration, especially for natural fibers.

They are the preferred choice for dyeing cotton fabrics in apparel, home textiles, and workwear. Advancements in low-salt, high-exhaust formulations are helping reduce the environmental impact of reactive dyeing. As demand for durable and eco-labeled cotton textiles increases, the use of reactive dyes remains integral to the colorant strategies of mills and dye houses worldwide.

Environmental Impact, Chemical Compliance, and Cost Pressure

The textile colorant market is facing significant challenges linked to environmental toxicity, effluent discharge regulation, and raw material volatility. Conventional synthetic dyes including azo, disperse, and reactive dyes are under increasing scrutiny for heavy metal content, endocrine-disrupting properties, and wastewater contamination, particularly in major textile-producing countries like China, India, and Bangladesh.

Additionally, stringent global compliance norms such as REACH (EU), ZDHC, and GOTS are compelling manufacturers to reformulate or phase out non-compliant chemistries. Coupled with rising production costs and brand-level sustainability mandates, this is pressuring colorant suppliers to innovate or exit low-margin, high-risk segments.

Bio-Based Dyes, Digital Textile Printing, and Fashion Circularity

Despite these hurdles, the market is rapidly evolving with sustainable, high-performance colorant systems. The push for clean fashion and circular design is driving demand for low-impact dyes, natural pigments, and biodegradable auxiliaries that reduce water, energy, and chemical use.

Digital textile printing (DTP), particularly in on-demand and mass customization segments, is transforming dye consumption patterns favouring pigment inks, reactive inkjet dyes, and eco-dispersed formulations for polyester and cotton. Meanwhile, bioengineering companies and material science start-ups are developing plant-based, microbial, and enzymatically derived colorants, reshaping the future of dye chemistry in slow fashion and eco-brands.

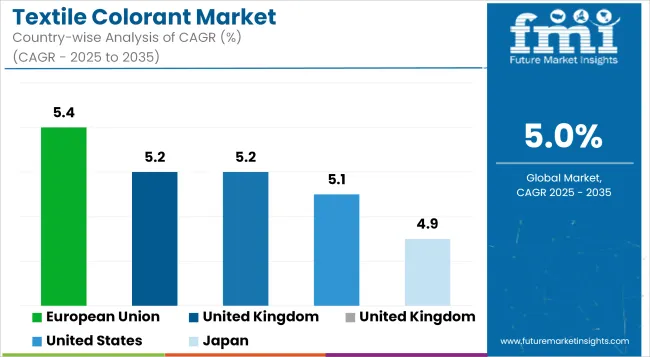

The textile colorant market in the United States is booming primarily because people have begun to care more about sustainable fashion and working to create better homes for future generations. Greater environmental awareness among consumers as well as shareholder constraints with respect to these harmful chemicals are both propelling bio-based pigments and reduced-impact dyes forward. Advances that bypass the dying process altogether have also helped the industry expand.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

Driven by the increase in sustainable textiles production, the United Kingdom's Textile Colorant Market is trending steadily upwards. As the burgeoning popularity of organic and low impact dyes continues to grow, a new approach to colouring processes is also promotion this market forward.

The government shows a supportive role for sustainable fashion initiatives with its aid of paired practices recycling old into new.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The European Union is enjoying impressive growth in the textile colorant market thanks largely to stringent environmental regulations and high local demand for sustainable textiles. Those countries taking a lead on ecological dye technology - Italy, Germany, and France - are showing positive strides toward biodegradability and water-saving processes. Calls for a more transparent supply string are another driver to take advantage of green certificates which mean something now.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.4% |

Japan’s textile colorant market is showing moderate growth, with emphasis onprecision dyeing, minimal waste production, and high-performance colorantsfor functional and fashion textiles. The market is supported by technological innovations in digital textile printing, antimicrobial fabrics, andcolorfast synthetic dye formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

South Korea’s textile colorant marketis one of steady growth fuelled by a strong textile manufacturing base and expanding foreign appetite for sustainably dyed fabrics. The country's growing emphasis on innovation in ecology-economics plus smart production processes for textiles is causatively producing new colorants. Adoption of R&D-enabled technology and digitalization in production systems is also brightening market prospects.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

Companies are increasingly introducing innovative dyes and chemicals that support eco-efficient production, with a strong emphasis on reducing water and energy consumption. New products are designed to meet the growing demand for sustainable solutions in both apparel and technical textiles. The shift towards greener chemistry is further supported by trade events showcasing eco-friendly colorants, performance dyes, and digital printing chemicals, reflecting the industry's commitment to sustainability.

The overall market size for Textile Colorant market was USD 8.02 billion in 2025.

The Textile Colorant market is expected to reach USD 13.06 billion in 2035.

Rising temperatures, increasing urbanization, energy-efficient cooling needs, and growing demand across households and commercial spaces will drive Textile Colorant market growth, supported by innovations in design, dye types, and fiber compatibility.

The top 5 countries which drives the development of Textile Colorant market are USA, European Union, Japan, South Korea and UK.

Powder-Based Textile Colorants demand supplier to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Textile Coatings Market Size and Share Forecast Outlook 2025 to 2035

Textile Machine Lubricants Market Size and Share Forecast Outlook 2025 to 2035

Textile Based pH Controllers Market Size and Share Forecast Outlook 2025 to 2035

Textile Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Textile Waste Recycling Machine Market Size and Share Forecast Outlook 2025 to 2035

Textile Recycling Market Analysis by Material, Source, Process, and Region: Forecast for 2025 and 2035

Textile Flooring Market Trends & Growth 2025 to 2035

Textile Tester Market Growth – Trends & Forecast 2025 to 2035

Textile Colors Market Growth - Trends & Forecast 2025 to 2035

Textile Testing, Inspection, and Certification (TIC) Market Insights - Growth & Forecast 2025 to 2035

Textile Staples Market Size & Trends 2025 to 2035

Textile Auxiliaries Market Trends 2024-2034

Textile Printing Ink Market

Geotextile Tube Market Growth – Trends & Forecast 2024-2034

Agri Textiles Market Size and Share Forecast Outlook 2025 to 2035

Asia Textile Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Agro textiles Market

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Ceramic Textile Market Size and Share Forecast Outlook 2025 to 2035

Digital Textile Printing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA