Consumer demand for eco-friendly construction materials, environmental conservation concerns, and technological advances in eco flooring are the major factors propelling the eco flooring market growth globally between 2025 and 2035. Comprising materials like bamboo, cork, reclaimed wood, recycled rubber and bio-based polymers, eco flooring is an earth friendly alternative to traditional flooring solutions, without compromising on durability and eminence.

Burgeoning focus on green building certifications and new developments in low-emission adhesives & non-toxic finishes aid market growth. In addition, the rise of sustainable architecture and the increase in circular economy investments are evolving the industry, as is regulation aiming to reduce the carbon footprint of whole sectors, including the built industry.

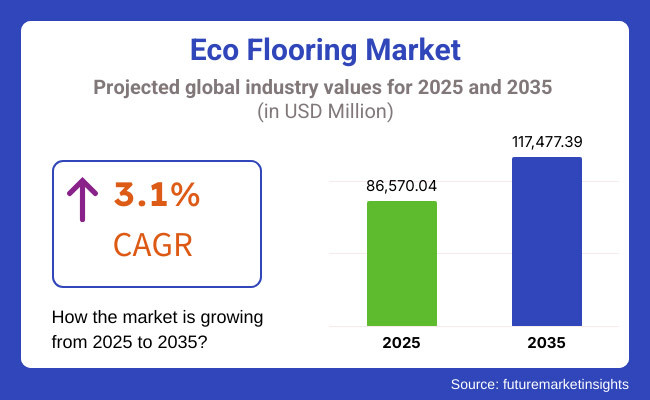

Beyond 2025, the eco flooring market is anticipated to reach USD 86,570.04 million by 2025. The worldwide marketplace for SaaS for enterprise is expected to proceed to see steady development at a projected CAGR of 3.1% from 2035 to succeed in USD 117,477.39 million.

The growth of the market is attributed to the growing adoption of sustainable interior solutions, increasing consumer preference for non-toxic and biodegradable flooring materials, and rising investments in next-generation recyclable flooring alternatives.

Further supporting the expansion of this market are the introduction of water-resistant coatings, the improvement of durability using nanotechnology, and the application of cost-efficient manufacturing processes. Moreover, the introduction of eco flooring solutions which can be recycled, reused, and are lightweight, is strengthening the market penetration and consumer adoption.

North America continues to lead the market for eco flooring, aligning consumer consumer consciousness around sustainability, demands for strict government regulations, which is pushing developers and contractors to promote sustainable building materials. Eco flooring and material investment continues in North America with biodegradable flooring solution. Next generation eco flooring, such as bamboo, engineered wood, and high durability and moisture resistance recycled content flooring, is being developed and commercialized primarily in the United States and Canada.

Market growth is driven by the increasing demand for sustainable home renovations, rising adoption of LEED-certified flooring materials, and the growing partnerships between real estate developers and sustainable material manufacturers. The rise of corporate sustainability initiatives and the increasing prevalence of net-zero construction projects are also driving innovation within the product and adoption of product.

The European market is defined by the rising demand for plastic free, recyclable flooring products, government policies encouraging the use of eco-friendly construction materials, and developments in engineered wood and bio-based polymer flooring technology. For instance, countries like Germany, France, and the UK are working on high-performance fully-recyclable & non-toxic residential, commercial, and industrial flooring.

An increasing focus on carbon emission reductions in building, new applications in prefabricated modular housing, and R&D into VOC-free floor finishing technology are driving more growth in the market. Further growth applications within premium sustainable building, energy-efficient commercial buildings and green accredited flooring systems are stimulating continued growth opportunities for manufacturers and suppliers.

The eco flooring market is expected to grow at the highest rate in the Asia-Pacific region in the near future due to the increase in urbanization and construction activities in developing countries such as India and China along with government initiatives towards promoting sustainable building materials. China, India, and Japan are spending much of their capital on cost-effective, high-performance eco flooring based on bamboo, recycled plastics, and natural fiber composites research.

Increasing demand for green flooring in residential and commercial buildings, rapid growth of smart cities, and changing regulatory scenario along with government initiatives to promote green infrastructure are driving regional demand. In addition, the growth of the market is further boosted by the rising knowledge of formaldehyde-free flooring and the evolution of high durability, low-maintenance products. Additionally, the market is also growing with the support of local sustainable flooring producers and partnerships with international architecture companies.

Challenge

High Production Costs and Limited Raw Material Availability

But high cost due to sourcing sustainable materials such as bamboo, cork, reclaimed wood and recycled composites hinders the growth of Eco flooring market. But to achieve durability, water resistance and aesthetic properties, all this needs special processing.

And, supply chain problems for green inputs such as metals, squandered affordability and scale of production, which inevitably limits energy costs to achieve more sustainable hydrogen. To overcome these challenges, industries will need to invest in scalable manufacturing technologies, alternative sustainable materials, and localized supply chains.

Stringent Environmental Regulations and Certification Requirements

Increasing government and environmental organization regulations coupled with stringent sustainability and certification standards like LEED, FSC and Floor Score affects the product development in the Eco flooring market. To comply with these regulations, car manufacturers must conduct their tests, source materials responsibly, and manufacture vehicles with low emissions.

The evolving regulatory landscape makes it increasingly challenging for organizations to champion compliance while balancing profitability. In response, companies should become more transparent, include green certifications, and use eco-friendly adhesives and finishes to comply with environmental regulations and consumers' needs.

Opportunity

Rising Consumer Demand for Sustainable and Non-Toxic Flooring Solutions

Increasing concern about environmental sustainability and indoor air quality is boosting the demand for non-toxic, low-VOC (volatile organic compound) flooring products. As consumers are shifting towards more environmentally-friendly options that not only reduce their carbon footprint but also allow them to beautify their homes.

Residential construction, commercial real estate, and hospitality are just a few industries pursuing sustainable flooring options in order to meet green building standards. This growing market segment will benefit companies that create new flooring materials that are non-toxic, biodegradable and sustainable.

Advancements in Recyclable and Renewable Flooring Technologies

Innovations in recyclable flooring materials, bio-based polymers, and modular eco-flooring solutions offer lucrative growth potential. Revolutionary technologies like water-resistant cork, reclaimed-wood composites and biodegradable vinyl alternatives are rebranding the business.

The rise of circular economy initiatives is also promoting the closed-loop manufacturing and end-of-life product recycling. Sustainable organizations with investments into energy-efficient production, upcycled flooring options, or AI-based sustainable design solutions will have a competitive advantage over their competitors in the changing eco flooring market.

The Eco flooring market is witnessing strong growth over the forecast period of 2020 to 2024, owing to increasing adoption rates. Manufacturers have concentrated on broadening product lines to include more bamboo, cork and recycled hardwood options while enhancing durability and affordability.

But material shortages, high costs and lack of large-scale manufacturing capability meant the technology has struggled to make it into the market. Businesses reacted by adopting energy-efficient production techniques, increasing green certifications and expanding digital marketing plans focused on sustainability-minded consumers.

Meanwhile, both bio-based flooring materials and AI-driven design customization are likely to breakthrough, alongside Smart sustainable surfaces from 2025 to 2035. You will innovate self-repairing floors, employ fully recyclable composite flooring, and maintain a low-carbon footprint supply chain that will challenge industry norms.

Furthermore, the utilization of blockchain technology for material traceability and AI-powered sustainability analytics will underpin greater transparency and consumer trust. The next stage of growth in the Eco flooring market will be led by companies that focus on innovation, adaptability to regulation, and circular economy agendas.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Adoption of LEED and FSC certifications for sustainability compliance |

| Technological Advancements | Growth in bamboo, cork, and reclaimed wood flooring |

| Industry Adoption | Increased use in residential and commercial green building projects |

| Supply Chain and Sourcing | Dependence on imported sustainable materials and manual production |

| Market Competition | Dominance of traditional flooring manufacturers integrating green options |

| Market Growth Drivers | Demand for indoor air quality improvements and toxin-free materials |

| Sustainability and Energy Efficiency | Initial focus on recyclable materials and VOC-free adhesives |

| Integration of Smart Monitoring | Limited consumer awareness of eco-friendly product impact |

| Advancements in Flooring Innovation | Development of water-resistant cork and reclaimed wood composites |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global carbon-neutral mandates, biodegradable flooring standards, and AI-driven compliance tracking |

| Technological Advancements | Development of bio-based polymers, self-repairing surfaces, and AI-enhanced sustainable design solutions |

| Industry Adoption | Widespread adoption in smart cities, prefabricated eco-homes, and sustainable workplace interiors |

| Supply Chain and Sourcing | Shift toward localized manufacturing, upcycled raw materials, and closed-loop production cycles |

| Market Competition | Rise of eco-tech flooring startups, AI-driven sustainable design firms, and digital-first green flooring brands |

| Market Growth Drivers | Growth in circular economy flooring, 3D-printed sustainable tiles, and decentralized green manufacturing hubs |

| Sustainability and Energy Efficiency | Large-scale implementation of carbon-negative flooring, solar-powered production facilities, and waste-free manufacturing |

| Integration of Smart Monitoring | AI-driven sustainability analytics, blockchain-based material traceability, and interactive digital eco-labeling |

| Advancements in Flooring Innovation | Introduction of biodegradable vinyl alternatives, AI-optimized durability testing, and self-sanitizing surfaces |

Expanding adoption of green building certifications, increased consumer demand for sustainable construction materials, combined with robust government mandate regarding environment friendly flooring solutions in the United States is the driving force behind the growth of the eco flooring market. The demand for non-toxic, durable commercial recyclable flooring options is also increasing and is thereby contributing to the expansion of the market.

Increasing investments in bamboo, cork, reclaimed wood, and recycled vinyl flooring products are anticipated to encourage the market growth along with the development of water-resistant as well as low-emission designs. In addition, incorporation of smart flooring technologies, antimicrobial coatings, and energy-efficient underlays are further augmenting product appeal.

Companies are also working on biodegradable, carbon-neutral, and locally sourced flooring solutions to respond to changing regulatory and consumer demands. Moreover, growing use of eco flooring in residential, commercial, and hospitality sectors will further upsurge demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.3% |

United Kingdom is an important eco flooring market owing to stringent sustainability policies, increasing focus on green architecture, and rising consumer awareness towards low-impact flooring alternatives. This, along with an increasing focus on lowering carbon footprints in the construction sector is also fuelling the market.

Government initiatives promoting recyclable and renewable flooring materials and products, along with developments in toxins-free adhesives and water-based finishes, increase market growth. In addition, new technologies for hybrid flooring, reclaimed hardwood, and bio-based polymers are being developed as well.

Companies are also making investments in sustainable supply chains, cradle-to-cradle certifications and zero-waste production processes. Rising demand for aesthetically pleasing, durable and sustainable flooring in upscale residential properties, office spaces and retail outlets is also contributing to market adoption across the UK. At the same time, the increase in digital sales platforms and sustainable flooring subscription services are further driving demand.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.9% |

The European eco flooring market is primarily driven by Germany, France and Italy, due to their more stringent environmental policies, increasing number of energy efficient houses, and rising investments in recyclable and renewable flooring materials.

Rapid market expansion is supported by the European Union’s focus on the promotion of low-carbon building materials as well as investments for non-toxic, chemical-free flooring options. Smart thermal-regulating flooring, cork composites, and bio-based resin flooring are also being used to help with energy efficiency.

The increasing need for visually attractive and eco-friendly flooring solutions in clients (shop) structures, lodges, and instructional establishments is also fuelling the market expansion. Biodegradable and recycled flooring materials are expanding within the market, and growing demand for formaldehyde-free and low-VOC flooring is encouraging more widespread adoption in the EU. In addition, stringent sustainability certifications and incentives for eco-conscious building projects are driving innovation in the eco flooring market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.0% |

Japan eco flooring market is driven by the sustainable urban development initiatives taken in the country, rapid adoption of energy efficient housing solutions and demand for innovative flooring materials. Market growth is propelled by a rising inclination towards conventional but eco-friendly flooring options.

With its focus on advanced material engineering, plus a new-found blending of bamboo tatami, thermally modified wood and high-strength bio-ceramic flooring, innovation is taking off in the country. Additionally, stringent government regulations on indoor air quality and sustainable building are driving businesses towards the development of low-carbon, VOC-free flooring systems.

The escalating need for moisture-resistant, low-maintenance, and non-toxic surfaces in residential and commercial segments is further propelling the growth of this market in Japan’s construction industry. In addition, advancing technologies behind Japan’s automated and sustainable flooring production, as well as smart flooring integration for better energy efficiency, are starting to revolutionize the green building products market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.2% |

South Korea is showing to be a key market place for the eco flooring as it finds the escalated demand for sustainable housing developing amongst consumers, increased adoption of green making specification and government incentives for eco pleasant construction resources.

The expansion of the market is driven by stringent environmental regulations and rising investments in high-performance, toxin-free flooring. Also, increasing flooring durability performance amid nanotechnology, heat-resistant compositions, and antibacterial coatings are being used in the country which is converting as an opportunity to enhance competitiveness. Increasing need for anti-slip, sound-absorbing & thermal-insulated flooring in commercial spaces, smart homes, and healthcare facilities is also encouraging market penetration.

The sustainability landscape is constantly evolving, and companies are turning towards next-generation sustainable materials, such as recycled rubber, organic fiber composites, and hybrid resin flooring. The demand for eco flooring solutions is being further stimulated by the rise in eco-conscious customers as well as the rise of sustainable construction projects in South Korea.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

A prominent natural eco-friendly choice is bamboo flooring, it grows so fast, is inherently strong and pretty! Bamboo floors are an increasingly popular option among consumers and businesses as they boast high sustainability credentials, resistance to moisture, and easy maintenance.

Innovations in strand-woven bamboo flooring, carbonized finishes, and click-lock installation systems are being realized in the market, making these products available for the residential and non-residential sectors. These characteristics of bamboo flooring, alongside its natural antimicrobial properties and compatibility with underfloor heating systems, too have contributed its popularity among eco-friendly homebuyers.

One of the soft cushioning floor materials, Cork flooring, possesses the good thermal insulation and sound absorption. And because it comes from the bark of cork oak trees, it serves as a renewable, biodegradable, hypoallergenic flooring material.

Cork flooring, more appropriate for residential and high-traffic areas, bedrooms and wellness centers, is preferred in homes and companies as it can deter mold and mildew, as well as pests. Also, better water-resistant properties are increasing the viability of cork floors for use in modern interiors and sustainable architecture, as well as ultra-toned and high-density options.

Eco flooring is still primarily driven by the residential sector, with home owners still seeking the sustainable, non-toxic and stylish flooring solutions. The desire for low-VOC (volatile organic compound) flooring, surfaces that are pet-friendly and easy-to-install options have contributed to the rise in popularity of engineered bamboo, floating cork floors and reclaimed wood planks.

Furthermore, the trend towards green-certified homes, and the LEED (Leadership in Energy and Environmental Design) certification programs push builders and renovators incorporate eco-friendly flooring materials with new housing developments.

This displays the significant contribution of the non-residential sector (commercial offices, hospitality, healthcare, and educational institutions), which is expanding the eco flooring market. Corporate sustainability goals and green building initiatives are driving many businesses to choose durable, easy to maintain, and environmentally responsible flooring solutions.

Cork and bamboo flooring have also begun breaking ground in hotels, coworking spaces, and retail shops where appearance and durability are paramount. There are also recycled glass tiles and linoleum with anti-bacterial properties, as well as rubber-based eco flooring solutions that have vastly multiplied the type of options for non-residential applications.

Mid-range eco flooring combines a balance between affordability, sustainability, and durability, making a popular choice with cost-conscious consumers and commercial projects with limited budget. Engineered bamboo, linoleum, and reclaimed wood flooring are all also included in this category and offer a cost-effective alternative to solid hardwood without sacrificing environment benefits.

In recent years, the availability of new modular, interlocking and DIY-friendly flooring approaches has further broadened the range of mid-range options, giving even more homeowners and business the opportunity to put in place sustainable flooring choices.

Premium eco flooring is designed for upscale residential properties, luxurious commercial interiors, and eco-sensitive designers. Plush bamboo planks, cork tiles and recycled glass flooring that can be tailored to specifications have come to the forefront of this segment, delivering distinctive textures, elaborate detailing and enhanced longevity.

On the other hand, heightened demand for zero-waste manufacturing, toxin-free adhesives, and artisanal flooring craftsmanship have boosted the premium category. As consumers search for earth-friendly flooring with a luxury look and long warranties, makers keep innovating with custom-stained cork, sustainable leather tiles and ultra-durable concrete flooring.

The main driving forces for the eco flooring market are the growing usage of sustainable building materials among the consumers supported by stringent environmental regulations by the government and the growing needs for energy-efficient homes and commercial blocks.

To satisfy eco-conscious consumers, companies are developing innovative non-toxic materials, content made from recycled parts, and low-emission flooring solutions. Among the biggest sustainable flooring trends are for bamboo and cork floors, recycled wood and rubber products, and bio-based finishes that protect the material’s longevity and aesthetic appeal.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Mohawk Industries, Inc. | 17-21% |

| Interface, Inc. | 13-17% |

| Shaw Industries Group, Inc. | 10-14% |

| Forbo Flooring Systems | 7-11% |

| Tarkett S.A. | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Mohawk Industries, Inc. | Leading provider of sustainable hardwood, bamboo, and recycled-content flooring solutions. |

| Interface, Inc. | Specializes in carbon-neutral carpet tiles and bio-based flooring solutions. |

| Shaw Industries Group, Inc. | Develops innovative eco-friendly flooring with Cradle-to-Cradle certification. |

| Forbo Flooring Systems | Offers natural linoleum and PVC-free flooring for residential and commercial applications. |

| Tarkett S.A. | Focuses on circular economy initiatives with recyclable and low-VOC flooring options. |

Key Company Insights

Mohawk Industries, Inc. (17-21%)

Mohawk is one of the pioneers of eco flooring as they have a wide variety of sustainable flooring including bamboo, reclaimed wood and recycled plastic carpets. The investment in state-of-the-art manufacturing processes reduces carbon footprint and increases product lifetime. Mohawk's circular economy initiatives complement the company's global distribution network and help establish the company as a leader in this growing category.

Interface, Inc. (13-17%)

Sustainability and innovation are at the forefront at Interface, modular and carbon neutral carpet tile and resilient flooring experts. A leader in closed-loop manufacturing, the company weaves recycled materials into its products. Interface is a leader in corporate sustainability and carbon footprint reduction programs, and remains the choice for eco-sensitive consumers and businesses.

Shaw Industries Group, Inc. (10-14%)

Shaw Industries has an expansive offering of sustainable flooring solutions - including Cradle-to-Cradle-certified carpets, sustainable hardwood, and bio-based flooring. It has both a recycling infrastructure and also repurposes post-consumer waste into new products. Shaw's emphasis on innovation and green building certifications further strengthens its competitive advantage in the market.

Forbo Flooring Systems (7-11%)

Forbo has its mettle in the form of natural linoleum flooring, which is biodegradable, PVC-free and made from renewable resources. The company specializes in health-conscious and low-emission flooring for both residents and commercial property. Forbo’s pioneering of antimicrobial, easy-to-care-for flooring solutions further solidifies their reputation with eco-minded consumers.

Tarkett S.A. (5-9%)

Tarkett develops recyclable and low-VOC flooring, and has incorporated post-consumer material into its product lines. The company promotes practices of the circular economy and works on closed-loop recycling initiatives. Their product offering includes durable vinyl, carpet tiles, and bio-based floor covering products that are designed to have a positive impact on the environment over the long term.

Other Key Players (35-45% Combined)

The eco flooring market is highly fragmented and comprises several layers of global and regional players who are engaged in the development of new products emphasizing sustainability, durability, and recyclability. Key players include:

The overall market size for eco flooring market was USD 86,570.04 million in 2025.

The eco flooring market expected to reach USD 117,477.39 million in 2035.

The demand for the eco flooring market will be driven by increasing consumer preference for sustainable building materials, rising awareness of environmental impact, growing government regulations promoting green construction, advancements in recyclable and renewable flooring technologies, and expanding residential and commercial construction projects.

The top 5 countries which drives the development of eco flooring market are USA, UK, Europe Union, Japan and South Korea.

Bamboo and cork flooring drive market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Sq ft) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 4: Global Market Volume (Sq ft) Forecast by Material Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: Global Market Volume (Sq ft) Forecast by End Use, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 8: Global Market Volume (Sq ft) Forecast by Price Range, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (Sq ft) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Sq ft) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 14: North America Market Volume (Sq ft) Forecast by Material Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: North America Market Volume (Sq ft) Forecast by End Use, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 18: North America Market Volume (Sq ft) Forecast by Price Range, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (Sq ft) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Sq ft) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 24: Latin America Market Volume (Sq ft) Forecast by Material Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 26: Latin America Market Volume (Sq ft) Forecast by End Use, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 28: Latin America Market Volume (Sq ft) Forecast by Price Range, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (Sq ft) Forecast by Distribution Channel, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Sq ft) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 34: Western Europe Market Volume (Sq ft) Forecast by Material Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: Western Europe Market Volume (Sq ft) Forecast by End Use, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 38: Western Europe Market Volume (Sq ft) Forecast by Price Range, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Western Europe Market Volume (Sq ft) Forecast by Distribution Channel, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Sq ft) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Sq ft) Forecast by Material Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 46: Eastern Europe Market Volume (Sq ft) Forecast by End Use, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 48: Eastern Europe Market Volume (Sq ft) Forecast by Price Range, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 50: Eastern Europe Market Volume (Sq ft) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Sq ft) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Sq ft) Forecast by Material Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Sq ft) Forecast by End Use, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Sq ft) Forecast by Price Range, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Sq ft) Forecast by Distribution Channel, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Sq ft) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 64: East Asia Market Volume (Sq ft) Forecast by Material Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 66: East Asia Market Volume (Sq ft) Forecast by End Use, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 68: East Asia Market Volume (Sq ft) Forecast by Price Range, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 70: East Asia Market Volume (Sq ft) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Sq ft) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Material Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Sq ft) Forecast by Material Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Sq ft) Forecast by End Use, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Sq ft) Forecast by Price Range, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Sq ft) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Sq ft) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 11: Global Market Volume (Sq ft) Analysis by Material Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 15: Global Market Volume (Sq ft) Analysis by End Use, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 19: Global Market Volume (Sq ft) Analysis by Price Range, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (Sq ft) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Material Type, 2023 to 2033

Figure 27: Global Market Attractiveness by End Use, 2023 to 2033

Figure 28: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Sq ft) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 41: North America Market Volume (Sq ft) Analysis by Material Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 45: North America Market Volume (Sq ft) Analysis by End Use, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 49: North America Market Volume (Sq ft) Analysis by Price Range, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (Sq ft) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Material Type, 2023 to 2033

Figure 57: North America Market Attractiveness by End Use, 2023 to 2033

Figure 58: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Sq ft) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 71: Latin America Market Volume (Sq ft) Analysis by Material Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 75: Latin America Market Volume (Sq ft) Analysis by End Use, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 79: Latin America Market Volume (Sq ft) Analysis by Price Range, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Sq ft) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Material Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Sq ft) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Sq ft) Analysis by Material Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 105: Western Europe Market Volume (Sq ft) Analysis by End Use, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 109: Western Europe Market Volume (Sq ft) Analysis by Price Range, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Western Europe Market Volume (Sq ft) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Sq ft) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Sq ft) Analysis by Material Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Sq ft) Analysis by End Use, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Sq ft) Analysis by Price Range, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Sq ft) Analysis by Distribution Channel, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Material Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Sq ft) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Sq ft) Analysis by Material Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Sq ft) Analysis by End Use, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Sq ft) Analysis by Price Range, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Sq ft) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Material Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Sq ft) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 191: East Asia Market Volume (Sq ft) Analysis by Material Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 195: East Asia Market Volume (Sq ft) Analysis by End Use, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 199: East Asia Market Volume (Sq ft) Analysis by Price Range, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: East Asia Market Volume (Sq ft) Analysis by Distribution Channel, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Material Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Price Range, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Material Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Sq ft) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Material Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Sq ft) Analysis by Material Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Material Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Sq ft) Analysis by End Use, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Sq ft) Analysis by Price Range, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Sq ft) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Material Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Price Range, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Eco-Friendly Webbing Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Tea Packaging Market Size and Share Forecast Outlook 2025 to 2035

Ecommerce Software and Platform Market Size and Share Forecast Outlook 2025 to 2035

Eco Friendly Laundry Product Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Beneficiation Reagents Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Precious Metal Beneficiation Reagents Market Forecast and Outlook 2025 to 2035

Eco-friendly Bottle Market Forecast and Outlook 2025 to 2035

Eco-Friendly Inks Market Size and Share Forecast Outlook 2025 to 2035

Economic Grade Precision Power Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Eco-friendly Toys Market Size and Share Forecast Outlook 2025 to 2035

Flooring Market Size and Share Forecast Outlook 2025 to 2035

Eco Funnel Market Size and Share Forecast Outlook 2025 to 2035

Eco Bowls Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Eco-Friendly Straws Market Growth - Demand & Forecast 2025 to 2035

Ecotel Tourism Industry Analysis by Accommodation Type, by Traveler, by Destination Type, and by Region - Forecast for 2025 to 2035

Eco-friendly Paper Plates Market Insights - Trends & Future Outlook 2025 to 2035

Flooring and Carpets Market - Trends, Growth & Forecast 2025 to 2035

Market Share Distribution Among Eco-Friendly Candle Manufacturers

Understanding Eco-Friendly Inks Market Share Trends

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA