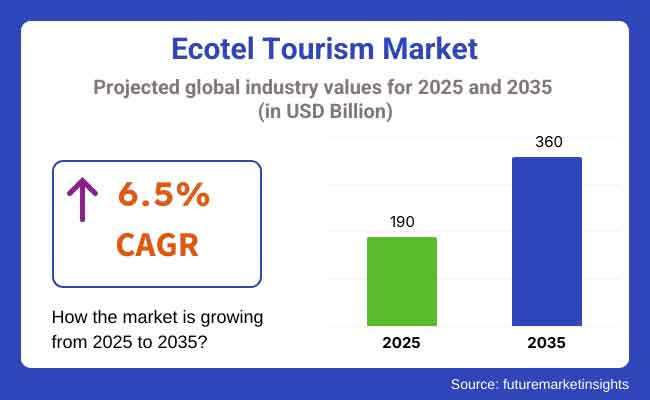

The global ecotel tourism market was valued at USD 190 billion in 2025 and is expected to reach USD 360 billion by 2035, at a CAGR of 6.5% during the forecast period. Market growth is driven by the growing demand for sustainable travel, government support of sustainable tourism, and increasing demand for carbon-neutral lodging from consumers.

Hospitality executives are revitalizing conventional accommodations, reimagining solar resorts and zero-waste operations as eco-friendly oases. Established operators such as Six Senses, Banyan Tree, and Club Med are all leading the way for sustainable hospitality, alongside pioneering new off-grid brands like EcoCamp Patagonia and Whitepod Switzerland. Costa Rica, Bhutan and New Zealand have also introduced regulatory reforms that promote sustainable tourism investment, propelling growth across the sector.

The COVID-19 pandemic hit the ecotel tourism industry hard. The industry witnessed growth at a CAGR of 4.2% between 2020 and 2024. The market is expected to hit USD 190 billion with green certifications, nature-based travel experiences, and a growing commitment to responsible tourism by 2025.

High-end eco-tourism is led by brands like Singita and Soneva, which provide premium, conservation-focused stays. At the other end of the spectrum, budget-friendly eco-lodges such as Selina and Basecamp Explorer serve price-sensitive visitors. Technology is also revolutionizing ecotel tourism, with all aspects of sustainability in operation covered by a blockchain based carbon offset program and AI driven energy management systems.

| Countries | Ecotel Travelers (2024) |

|---|---|

| United States | 10 Million |

| Costa Rica | 7 Million |

| Spain | 5 Million |

| Thailand | 6 Million |

| UAE | 4 Million |

| Brazil | 4 Million |

| Australia | 3 Million |

| India | 7 Million |

| China | 6 Million |

Smart & Sustainable Hospitality

Hotels and resorts are using smart technology to maximize energy use and cut waste. Even more IoT-based energy-saving systems, AI-fuelled water conservation initiatives, and blockchain technology-enabled sustainability monitoring-everything is changing the way of working.

For instance, Fairmont Hotels employs AI-powered predictive maintenance to cut down on water and energy usage, and Accor’s eco-certified hotels utilize intelligent climate control systems to drive down emissions. Green Key-certified hotels across the world are also salvaging data to optimize eco-friendly practices that drive the industry towards sustainability.

Carbon-Neutral Resort Developments

The need for carbon-neutral lodging is driving developers to build LEED-certified resorts and to incorporate off-grid accommodations. Business such as Habitas and Fogo Island Inn have led zero-carbon hospitality by introducing solar power, water conservation processes and reforestation projects.

Soneva Fushi in the Maldives is fully powered by solar energy, and Costa Rica’s Lapa Rios Lodge protects more than 1,000 acres of rainforest through responsible travel. Travelers with a conscience are increasingly flocking to these places, where their stays help fund environmental restoration projects.

Growth of Ethical & Community-Based Tourism

Community-based tourism is becoming popular as travelers look for authentic, enriching cultural experiences that are favorable to local communities. Initiatives like National Geographic’s Unique Lodges and G Adventures’ community-tourism projects direct cash to local economies while protecting native cultures.

Bhutan’s government limits its annual number of tourists and levies sustainable tourism fees in a bid to protect the environment over the long term. In the meantime, Thailand’s Elephant Hills advocates for ethical encounters with elephants, providing an alternative to exploitative animal tourism habits.

Expansion of Workcations in Natural Settings

The demand for long stays in nature-rich settings is being driven by remote work culture. Resorts are catering as well, with ecotels providing high-speed internet and co-working spaces in picturesque settings. For example, Selina’s eco-workspaces in South America merge eco-friendly accommodations with digital nomad-friendly features.

Likewise, environmental villages in Portugal’s Azores and Bali’s Ubud are drawing remote pros who want work-life balance in eco-minded places. This trend is projected to continue as companies adopt flexible work policies that create even greater demand for sustainable long-term stays.

| Factor | Impact on Ecotel Tourism |

|---|---|

| AI & Smart Energy Systems | Automating resource conservation and minimizing waste. |

| Blockchain for Carbon Offsets | Enhancing transparency in sustainable tourism investments. |

| Green Resort Development | Expanding eco-certified hospitality offerings worldwide. |

| Workcation & Sustainable Remote Work | Driving demand for nature-integrated co-working spaces. |

| Ethical & Localized Tourism | Encouraging partnerships with indigenous communities. |

Eco-lodges are shifting the hospitality paradigm, offering guests immersive, sustainable, and close-to-nature experiences. Eco-lodge: unlike conventional hotels, eco-lodging's priority is the environment by harmonising with the landscape and drastically curbing carbon footprints.

Properties such as Mashpi Lodge in Ecuador and Finca Rosa Blanca in Costa Rica are made of sustainably sourced materials and run on renewable energy. Many eco-lodges also protect local biodiversity, such as the Peru-based Inkaterra, which safeguards endangered species in the Amazon rainforest.

Eco-lodges specifically appeal to travelers who desire adventure, wellness and responsible tourism. Botswana’s Okavango Delta lodges provide wildlife safaris with conservationist guides, informing guests about habitat protection. Over in the Canadian

Rockies, eco-lodges including Emerald Lake Lodge offer off-grid overnight adventures where guests can hike, canoe and join in reforestation efforts. As slow travel becomes more trendy, eco-lodges are gaining long-term visitors seeking immersive, nature-connected experiences, proving their relevance in sustainable tourism’s future.

As luxury travelers head to beautiful coasts to enjoy low-impact adventures, coastal ecotourism destinations often see massive returns. In the Maldives, eco-resorts such as the Soneva Jani are incorporating solar power, overwater farms, and marine conservation into their offerings, making the country a leader in this segment. In Mexico, the Xcaret Hotels of Riviera Maya operate under a circular economy model, recycling water, composting organic waste and using local craftspeople to produce an authentic experience for guests.

But coastal eco-tourism is not only for luxury travellers. In Portugal, low-impact sports are a focus at surf-centric eco-lodges like Bukubaki, which advocates for marine biodiversity. Likewise, Australia’s Southern Ocean Lodge on Kangaroo Island is focused on conservation-based tourism, with escorted tours into protected coastal reserves. In some coastal countries like Seychelles and Belize, marine protected areas are increasingly being utilized by the governments to strengthen the nation´s tourism offering while supporting both economic and ecological sustainability for the long run.

With climate-conscious travelers seeking carbon-neutral vacations, coastal eco-resorts are responding with net-zero architecture, artificial reef restoration programs and sustainable seafood sourcing. The growth of this segment underscores that coastal eco-tourism has remained a significant revenue driver, finding a way to strike a balance between luxury and conservation to serve changing traveler wishes.

Consumer demand for eco-friendly lodging, alongside well-developed sustainability policies and extensive areas of protected natural resources, have also ensured that ecotel tourism remains a strong focus for United States (USA) tourism.

The national parks, conservation reserves and eco-certified hotels are flourishing as travelers are gravitating toward sustainable lodgings. Operators like Under Canvas have seized on this trend, providing luxury glamping experiences at iconic destinations like Yellowstone and Zion National Park, where guests can revel in nature without sacrificing comfort.

In addition to glamping, hotel chains such as Marriott and Hilton are investing in green-certified properties and introducing energy-efficient designs, water recycling systems and waste reduction initiatives. Platinum-certified Bardessono Hotel & Spa is one of California’s eco-hotels on the carbon-neutral hospitality change-over. The WildSpring Guest Habitat in Oregon operates 100% on renewable energy, demonstrating that sustainability and profit don’t always have to be at odds.

The rising demand for sustainable urban lodging is also driving innovation. Cities like San Francisco and Seattle adopted stringent green-building codes, sparking the growth of eco-hotels like 1 Hotel San Francisco, which relies on repurposed materials and renewable energy sources.

This broadening range of sustainability also became a driver to more ecotel investments as the USA government continues to push this growth providing tax incentives for sustainable developments. However, not all was doom and gloom, the USA maintains its lead in this shift, with programs like the Sustainable Travel International and Zero Waste Hospitality programs picking up steam.

In fact, Costa Rica has established itself as a global leader in its field - green tourism, for the reason of its rich biodiversity, rigorous conservation policies and community-produced ecotourism efforts. More than a quarter of the nation’s land is safeguarded as national parks and wildlife reserves, drawing eco-minded travelers looking for immersive nature experiences. Places like the Nayara Tented Camp, within Arenal Volcano National Park, offer luxury accommodations while taking an active role in protecting rainforests and rehabilitating wildlife.

The role of government has been significant in promoting sustainable tourism through the introduction of strict environmental regulations and incentives for businesses to adopt eco-friendly practices. Costa Rica’s Certification for Sustainable Tourism (CST) program rates hotels and tour operators on sustainability performance, and that travelers help fund conservation efforts. Hotels such as Lapa Rios Lodge on the Osa Peninsula meet the CST’s highest standards through local sourcing, extensive water conservation and full reliance on solar power.

Costa Rica’s ecotel tourism model is also based on community participation. Indigenous peoples of the Talamanca region run ecolodges and guided treks through the rainforest, giving visitors the opportunity to learn about (and support) local cultures, while generating economic development. The adventure-focused ecotourism of wildlife safaris in Corcovado National Park and scuba diving in Cocos Island cater to thrill-seekers who want to experience Costa Rica’s diverse ecosystems in responsible ways.

In addition, Costa Rica’s sustainable tourism initiatives do not stop with where you stay. National carriers and transport services have carbon offset programs, and the nation aims to be carbon-neutral by 2050. As international travelers pursue authenticity and responsibility in their travel experiences, Costa Rica continues to be a pioneer in sustainable tourism, showing the world that economic growth does not have to come at the cost of environmental detriment.

With a massive hospitality brand establishment and newer sustainable brands in the global ecotel tourism market competing for monopolisation of the segment. Now the high-end eco-tourism space is dominated by major international hotel chains such as Six Senses, Banyan Tree and Fairmont, which have implemented a range of pioneering sustainability measures including carbon-neutral operations, regenerative tourism initiatives, and eco-friendly designs. The brands keep adding to their portfolios, snatching up prime locations in biodiversity hotspots such as the Galápagos Islands, the Maldives and the Amazon rainforest.

Mid-tier and boutique operators, including EcoCamp Patagonia and Whitepod Switzerland, carve out niches with intimate, off-grid offerings aimed at nature-deprived tourists. These brands also stand apart with low-impact construction, locally sourced cuisine and conservation partnerships that deepen environmental and social responsibility.

The competition is also being disrupted by technology start-ups through decentralized, community-driven eco-tourism platform. Businesses such as Regenerative Travel and Nature. house links travellers to independently operated eco-lodges and sustainable retreats that immerse them in the destination while also providing direct support to local conservation efforts. For example, Winding Tree have established a blockchain-based travel booking system that improve transparency in sustainable tourism, as it allows travelers to verify the carbon footprint of the sustainable accommodation they are booking.

Greener certifications, from programs like Costa Rica’s CST and the European Union’s EU Ecolabel for sustainable accommodations, can induce governments and regulators to exert influence over market competition. Credibility and access to government-backed incentives provide competitive advantages to properties meeting rigorous environmental standards.

With the rise in ecotel tourism demand, industry pioneers are ramping up investments in green gladiator infrastructure, AI-powered resource management, and circular economy models. The increasing demand for low-impact regenerative travel, in turn, guarantees that competition will fuel continual innovation, making ecotel tourism an active, fast-paced system.

Recent Developments in Ecotel Tourism

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Segments Covered | Accomodation Type, Traveler Profile, Destination Type |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; MEA |

| Key Companies Profiled | Six Senses; Banyan Tree; Fairmont; EcoCamp Patagonia; Whitepod; Wilderness Safaris |

The global ecotel tourism industry stands at USD 190 billion in 2025 and is set to exceed USD 360 billion by 2035, growing at a CAGR of 6.5%.

Growth stems from increasing consumer awareness of sustainable travel, rising government incentives for eco-friendly infrastructure, advancements in energy-efficient lodging, and the growing popularity of carbon-neutral hospitality.

North America, Europe, and Asia-Pacific dominate the ecotel tourism industry, with the USA, Costa Rica, Thailand, and New Zealand leading in sustainability initiatives.

AI-driven energy management, blockchain-enabled carbon tracking, and IoT-powered water conservation systems are revolutionizing the ecotel industry.

Sustainability is central to ecotel tourism, with properties investing in LEED-certified developments, solar-powered accommodations, regenerative agriculture, and zero-waste hospitality.

Major players include Six Senses, Banyan Tree, Fairmont, EcoCamp Patagonia, Whitepod Switzerland, and Regenerative Travel.

Challenges include high initial investment costs for green infrastructure, varying global regulations, and balancing sustainability with profitability.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 28: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 34: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 40: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 42: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 46: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 48: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 16: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 23: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 24: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 25: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Tour Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 29: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 55: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Tour Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 59: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 67: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 85: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Tour Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 97: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 101: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 102: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 103: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 104: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 105: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 107: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 108: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 113: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 114: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 115: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 127: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 131: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 132: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 133: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 134: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 135: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 136: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 137: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 138: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 139: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 143: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 144: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 145: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 157: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 161: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 162: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 163: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 164: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 165: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 166: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 167: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 168: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 169: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 173: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 174: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 175: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Tour Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 191: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 192: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 193: East Asia Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 194: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 195: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 196: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 199: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 203: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 204: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 205: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Tour Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 217: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 223: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 226: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 229: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 235: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Tour Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

Art Tourism Market Analysis by, by Service Category, by End, by Booking Channel by Region Forecast: 2025 to 2035

Analyzing War Tourism Market Share & Industry Leaders

War Tourism Market Insights - Size, Trends & Forecast 2025 to 2035

Agritourism Market Growth – Forecast 2024-2034

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Wine Tourism Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Market Share Breakdown of Wine Tourism Manufacturers

Golf Tourism Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA