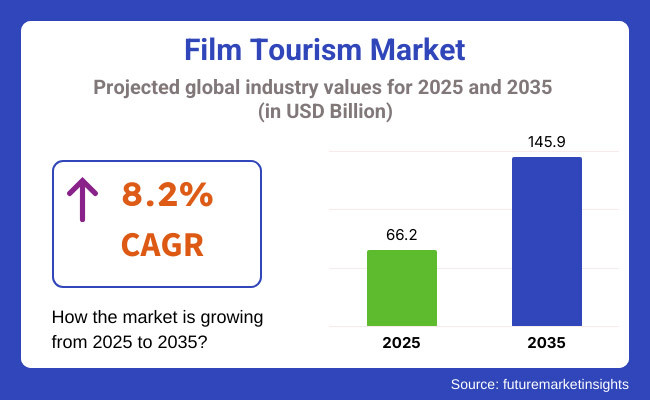

The global film tourism industry is expected to grow from USD 66.2 billion in 2025 to USD 145.9 billion by 2035, at a CAGR of 8.2%. Key factors driving the market growth include growing fan base of famous characters, up-surge in streaming platforms, and the increasing popularity of blockbuster franchises.

Travel agencies and tourism boards based in iconic spots are rebranding their film tourism products as they become a part of one interactive experience, screen-to-fan interaction, and high-end hospitality.

Hobbiton, New Zealand; Harry Potter Studio Tour in the United Kingdom; and Universal Studios, California; just to mention a few, are cinema tourist magnets. Target points such as Game of Thrones settings in Iceland and K-drama filming locations in South Korea are attracting global tourists who want to immerse themselves in on-site worlds.

Technological innovations are transforming film tourism in the form of AR-boosted movie location walks, AI-driven trip planning, and interactive virtual reality (VR) reconstructions of iconic movie sets. Sustainability is also the characteristic trend, with responsible tourism programs promoting environmentally friendly visits to restored filming locations.

Tourism businesses and destination authorities are using blockbuster movies and television shows to draw tourists. Places such as Hobbiton in New Zealand, Dubrovnik in Croatia, and Skellig Michael in Ireland have experienced exponential growth in tourist arrivals. A few destinations have created film-themed guided tours, interactive exhibits, and VR-based experiences to increase traveler interaction.

During 2020 to 2024, the film tourism market expanded steadily with a CAGR of 7.5% as per data from streaming platforms in terms of rising demand for foreign locations. In the year 2024, the market value was USD 61.1 billion because of the popularity of series like Netflix's The Witcher (Hungary, Poland) and HBO's Game of Thrones (Croatia, Spain). Marvel's Black Panther also marketed South Africa and Busan, South Korea.

During 2025 to 2035, the market is likely to grow with a CAGR of 8.2%, to USD 145.9 billion in 2035. It will be driven by experiential travel based on movie themes, personalized tour plans with AI-powered suggestions, and VR location preview.

| Key Trends | How They Are Shaping the Industry |

|---|---|

| AI-driven Personalized Tours | AI examines travel-related film tastes to propose personalized film tourism travel plans. In Tokyo, AI suggests innovative travel itineraries for anime fans to visit Ghibli Park, while crime drama enthusiasts see the noir film neighborhoods of Los Angeles. |

| Augmented Reality (AR) Film Locations | In London, AR apps allow tourists to watch scenes from Harry Potter unfold as they stand in real filming locations like King's Cross Station. |

| Themed Resorts and Attractions | Disney’s Star Wars: Galactic Starcruiser hotel in Florida offers immersive overnight stays, creating new film-based travel revenue streams. |

| Sustainable Film Tourism | Destinations like Iceland are implementing eco-tourism policies to balance the influx of film tourists drawn by the Game of Thrones and Interstellar locations. |

| Interactive Studio Experiences | Warner Bros. London and Universal Studios Hollywood offer behind-the-scenes film production experiences, increasing visitor engagement. |

Sustainable film tourism is on the rise as travelers look for sustainable travel. Countries like New Zealand and Iceland have conservation as their top priority in order to retain natural film locations. Digital immersion, such as VR recreations of film sites, minimizes over-tourism at delicate sites.

Comparative Analysis: Film Tourism vs. Entertainment Tourism

| Film Tourism | Entertainment Tourism |

|---|---|

| Travel inspired by visiting locations featured in films and television series. | Travel focused on attending live entertainment events such as concerts, festivals, and theme parks. |

| Estimated at USD 61.1 billion in 2024, projected to reach USD 145.9 billion by 2035. | The global entertainment and media market was valued at over USD 2.5 trillion in 2024. |

| Projected CAGR of 7.2% from 2022 to 2028. | Varies by sector; for example, the global online travel market is expected to grow from nearly USD 600 billion in 2023 to over USD 800 billion by 2027. |

| Popularity of films/TV shows, desire to experience filming locations, social media influence. | Demand for live experiences, celebrity influence, advancements in event technology. |

| Tours of New Zealand's "Lord of the Rings" sites; visits to Dubrovnik, Croatia, featured in "Game of Thrones". | Attendance at Coachella Music Festival; visits to Disneyland theme parks. |

| Significant local economic boosts; e.g., "Game of Thrones" filming locations in Northern Ireland saw tourism increase by 120%. | Major contributor to global economy; e.g., Taylor Swift's "Eras Tour" generated over USD 2 billion in direct spending and boosted local economies worldwide. |

Both film tourism and entertainment tourism industries are flourishing worldwide with their individual focus on different categories of travellers. Film tourism witnesses a spurt whenever a movie makes a global appeal as it creates excitement among the tourists to visit real locations featured in popular media. For instance, after the Harry Potter film was released, a 50% spurt in visitors was observed at related sites in the UK. Similarly, New Zealand tourism has witnessed an up surge after the release of The Lord of the Rings.

Conversely, entertainment tourism is primarily concerned with live attractions and events. Coachella music festivals are among the popular attractions that receive a great number of visitors annually, thereby playing a large role in supporting the local economy. Theme parks like Disneyland are also among the most visited attractions, with Disney parks raking in billions every year.

Location and studio movie tourism continues to maintain a significant market segment in the industry. The studios offer the behind-the-scenes access that enthusiasts propel into the filmmaking process. Warner Bros. Studio Tour Hollywood, for instance, offers tourists the glimpse at soundstages employed in iconic productions such as Friends and Batman. Similarly, Harry Potter Studio Tour boasts authentic sets like the Great Hall and Diagon Alley, which have been attracting over 2 million visitors annually.

The use of technology is further promoting studio and location-based tourism. AR-enabled tours in Los Angeles allow visitors to digitally overlay film scenes on real locations, which has been creating an interactive storytelling experience.

Besides, studios are also integrating AI-driven customization, where visitors can insert themselves into famous movie scenes via green screen experiences. With fan engagement continuing to rise, studio and location-based tourism will remain a significant growth driver in the film tourism industry.

Film fans are at the core of film tourism revenue because they have high consumption on engaging and VIP experiences. Compared to tourists who are visiting leisurely, film fans consider film-inspired holidays more important and invest in upscale packages that enrich their experience of beloved films and TV shows.

Film fans often take overseas holidays to tour notable film locations. For example, The Lord of the Rings series fans journey from all over the globe to Hobbiton in New Zealand and spend money on guided tours, themed lodgings, and rare merchandise. In the same vein, Harry Potter character fans stream to Warner Bros. Studio Tour London, paying for VIP visits that provide behind-the-scenes exposure and individual interactions with props and sets.

Film-themed destinations bring in considerable revenue through leveraging dedicated fan enthusiasm. Universal Studios in Orlando, Tokyo, and Hollywood draw millions of tourists to The Wizarding World of Harry Potter on a regular basis, with tourists spending money on interactive wands, butterbeer, and personalized Hogwarts robes. Such brand dedication translates to longer stays and greater per capita expenditures.

Domestic vs. International Film Tourists in Top 10 Countries

| Countries | Domestic Film Tourists (%) |

|---|---|

| United States | USA: 55% |

| United Kingdom | UK: 50% |

| France | France: 60% |

| Japan | Japan: 70% |

| South Korea | S. Korea: 65% |

| Australia | Australia: 55% |

| New Zealand | N. Zealand: 40% |

| Spain | Spain: 50% |

| Canada | Canada: 58% |

| Italy | Italy: 53% |

| Countries | International Film Tourists (%) |

|---|---|

| United States | USA: 45% |

| United Kingdom | UK: 50% |

| France | France: 40% |

| Japan | Japan: 30% |

| South Korea | S. Korea: 35% |

| Australia | Australia: 45% |

| New Zealand | N. Zealand: 60% |

| Spain | Spain: 50% |

| Canada | Canada: 42% |

| Italy | Italy: 47% |

The United States controls the world film tourism business through Hollywood. Los Angeles which is also regarded as the center of film tourism, generates impressive revenues through tourists each year to its iconic studios, film-themed rides and attractions, and famous film locations.

Hollywood's Walk of Fame, with more than 2,700 brass stars, is still one of the most popular film tourism destinations, providing fans with a tangible link to the actors and directors. Universal Studios Hollywood takes it a step further by providing immersive experiences like the Jurassic World Ride and The Wizarding World of Harry Potter, which has been merging storytelling with high-tech theme park excitement.

Outside of Hollywood, New York City has become a film tourism destination, with tourists looking for famous sites from such classics as Home Alone 2 and Ghostbusters. Central Park, the Empire State Building, and the Friends apartment building are always drawing fans who are looking to recreate movie moments.

The city is also successful as a destination for escorted film location tours, like those centered on movies like Sex and the City and The Marvelous Mrs. Maisel. In a further example, Georgia has become a leading destination for film tourism due to its thriving film industry which is driven by productions such as The Walking Dead and the Marvel Cinematic Universe.

The USA is also at the forefront of technology-based film tourism growth. VR-enhanced studio tours, AI-led location tours, and metaverse-based film experiences are defining the future of film-inspired travel. Disney and Universal are leading the way by incorporating augmented reality storytelling into their theme parks, developing customized and interactive film-based experiences.

With its extensive collection of filming sites, studio tours, and movie-themed attractions, the United States is still the world leader in film tourism, drawing millions of avid film fans who want to experience the magic of the movies.

The United Kingdom is a leader in international film tourism, providing tourists with access to some of the world's most iconic film sets and movie locations. London is still the hub, attracting millions of Harry Potter enthusiasts annually to the Warner Bros. Studio Tour in Leavesden. Tourists walk through genuine sets like the Great Hall, the Forbidden Forest, and Platform 9¾, while interactive displays give them an immersive experience of the wizarding world.

Beyond London, Scotland captivates movie lovers with its film scenery from Harry Potter, Outlander, and Bond films. The Glenfinnan Viaduct, which became famous due to the Hogwarts Express, is visited by thousands of tourists eager to witness the steam train journey made famous by the franchise. Edinburgh Castle and the Scottish Highlands, meanwhile, are pilgrimage sites for Outlander fans, who are treated to behind-the-scenes trivia about the time-traveling series through tours.

James Bond legacy also cemented the UK's reputation as a destination for film tourism. London's MI6 headquarters, Scotland's Skyfall locales, and Westminster's modernized streets of Spectre are a heart-pounding experience for enthusiasts of the Bond series. This is completed by Pinewood Studios, the home of the Bond series, which hosts sporadic behind-the-scenes activities that allow people to catch a glimpse of how the world's most iconic spy films are made.

British literary and period dramas are also major contributors to film tourism. Highclere Castle, which is the actual Downton Abbey home, receives thousands of visitors a year for themed tours recreating the lives of the upper class as shown in the series. In the same manner, the picturesque Cotswolds country villages, which have appeared in Bridget Jones's Diary and Pride & Prejudice, attract movie lovers in quest of idyllic locations.

The UK is leading the way in film tourism by integrating AR-led city tours, which enable tourists to superimpose classic movie scenes over real locations using mobile applications. With its unrivaled blend of studio tours, vintage filming locations, and innovative experiences, the United Kingdom is still the leader in global film tourism.

| Factor | Impact on the Industry |

|---|---|

| AI-driven Personalized Tours | Enhances visitor engagement with tailored film-related itineraries |

| Augmented Reality (AR) | Offers immersive, real-time film scene recreations at locations |

| Sustainable Film Tourism | Encourages eco-conscious travel practices to balance mass tourism |

| Interactive Studio Experiences | Increases revenue by merging tourism with film production insights |

| Expansion of Streaming-driven Tourism | Boosts interest in lesser-known filming locations |

The global film tourism industry is extremely competitive, with companies always innovating to attract tourists in search of authentic movie experiences. Industry leaders like Disney, Universal, and Warner Bros. corner the market by constantly developing more film-themed experiences, studio tours, and interactive activities. Universal Studios, for instance, has grown its Harry Potter-themed areas in several of its locations, introducing VR-supported rides and AI-powered character interactions to better immerse fans.

Streaming giants like Amazon Prime Video and Netflix are also revolutionizing film tourism. Tourism based on locations has been driven by hit series like Stranger Things and The Witcher, and local tour operators have designed guided tours in cities like Atlanta and Budapest. These streaming giants collaborate with tourist boards to develop official film trails, which sustain the local economy and attract international visitors.

Technology is the most important factor in shaping the competitive environment. AI and AR-guided tours enable travelers to overlay digital movie scenes onto actual locations, and it is an immersive experience. Japan's anime tourism market has benefited from this, beginning AR-led tours in Tokyo's Akihabara district where tourists can interact with their favorite characters.

Sustainability is a significant differentiator between market leaders. Tour operators and studios now center on green travel, with nations like Iceland and New Zealand applying conservation policies to protect film locations. With mounting competition, stakeholders in the industry will continue applying innovation to reshape the future of film tourism.

Recent Developments in the Global Film Tourism Industry

The global film tourism industry is expected to grow from USD 66.2 billion in 2025 to USD 145.9 billion by 2035, reflecting a CAGR of 8.2%.

Rising fan engagement, streaming platform influence, and technological advancements in immersive experiences drive market growth.

Leading companies include Disney, Universal Studios, Warner Bros., Netflix, Amazon Prime Video, and regional tourism boards promoting film locations.

AI-powered guided tours, AR-enhanced film site experiences, VR studio recreations, and blockchain-enabled film ocation certifications are reshaping film tourism.

Domestic travelers account for a significant portion of film tourism revenue, frequently visiting local filming locations, participating in themed events, and engaging in weekend film-inspired getaways.

Sustainability plays a key role in film tourism, with operators implementing conservation measures, eco-friendly set tours, and responsible visitor guidelines to preserve filming locations.

Travelers increasingly prioritize interactive experiences, eco-friendly film site visits, and culturally immersive film tourism activities.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 6: Global Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 12: North America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 14: North America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 16: Latin America Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 18: Latin America Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 20: Latin America Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 22: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 24: Western Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 26: Western Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 28: Western Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: Eastern Europe Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 31: Eastern Europe Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 32: Eastern Europe Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 34: Eastern Europe Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 36: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: South Asia and Pacific Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 38: South Asia and Pacific Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 39: South Asia and Pacific Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 40: South Asia and Pacific Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 42: South Asia and Pacific Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 43: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: East Asia Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 45: East Asia Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 46: East Asia Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 47: East Asia Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 48: East Asia Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Table 50: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 51: Middle East and Africa Market Value (US$ Million) Forecast by Location Type, 2018 to 2033

Table 52: Middle East and Africa Market Value (US$ Million) Forecast by Booking Channel, 2018 to 2033

Table 53: Middle East and Africa Market Value (US$ Million) Forecast by Tourist Type, 2018 to 2033

Table 54: Middle East and Africa Market Value (US$ Million) Forecast by Tour Type, 2018 to 2033

Table 55: Middle East and Africa Market Value (US$ Million) Forecast by Consumer Orientation, 2018 to 2033

Table 56: Middle East and Africa Market Value (US$ Million) Forecast by Age Group, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 7: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 18: Global Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 19: Global Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 20: Global Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 26: Global Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 27: Global Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 28: Global Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 29: Global Market Attractiveness by Location Type, 2023 to 2033

Figure 30: Global Market Attractiveness by Booking Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Tourist Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Tour Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 34: Global Market Attractiveness by Age Group, 2023 to 2033

Figure 35: Global Market Attractiveness by Region, 2023 to 2033

Figure 36: North America Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 46: North America Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 47: North America Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 48: North America Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 49: North America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 56: North America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 57: North America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 58: North America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 59: North America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 60: North America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 61: North America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 62: North America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 63: North America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 64: North America Market Attractiveness by Location Type, 2023 to 2033

Figure 65: North America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 66: North America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 67: North America Market Attractiveness by Tour Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 69: North America Market Attractiveness by Age Group, 2023 to 2033

Figure 70: North America Market Attractiveness by Country, 2023 to 2033

Figure 71: Latin America Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 72: Latin America Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 79: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Latin America Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 82: Latin America Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 83: Latin America Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 84: Latin America Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 88: Latin America Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 89: Latin America Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 90: Latin America Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 91: Latin America Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 92: Latin America Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 93: Latin America Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 94: Latin America Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 95: Latin America Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 96: Latin America Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 99: Latin America Market Attractiveness by Location Type, 2023 to 2033

Figure 100: Latin America Market Attractiveness by Booking Channel, 2023 to 2033

Figure 101: Latin America Market Attractiveness by Tourist Type, 2023 to 2033

Figure 102: Latin America Market Attractiveness by Tour Type, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Age Group, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 106: Western Europe Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 107: Western Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Western Europe Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 120: Western Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 121: Western Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 122: Western Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 123: Western Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 124: Western Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 125: Western Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 126: Western Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 127: Western Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 128: Western Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 132: Western Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 133: Western Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 134: Western Europe Market Attractiveness by Location Type, 2023 to 2033

Figure 135: Western Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 136: Western Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 137: Western Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 138: Western Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 141: Eastern Europe Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 143: Eastern Europe Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 144: Eastern Europe Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 149: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 150: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 152: Eastern Europe Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 153: Eastern Europe Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 154: Eastern Europe Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 155: Eastern Europe Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 156: Eastern Europe Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 157: Eastern Europe Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 158: Eastern Europe Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 159: Eastern Europe Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 160: Eastern Europe Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 164: Eastern Europe Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 165: Eastern Europe Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 166: Eastern Europe Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 167: Eastern Europe Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 168: Eastern Europe Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 169: Eastern Europe Market Attractiveness by Location Type, 2023 to 2033

Figure 170: Eastern Europe Market Attractiveness by Booking Channel, 2023 to 2033

Figure 171: Eastern Europe Market Attractiveness by Tourist Type, 2023 to 2033

Figure 172: Eastern Europe Market Attractiveness by Tour Type, 2023 to 2033

Figure 173: Eastern Europe Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 174: Eastern Europe Market Attractiveness by Age Group, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 176: South Asia and Pacific Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 178: South Asia and Pacific Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 179: South Asia and Pacific Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 180: South Asia and Pacific Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 184: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 185: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 187: South Asia and Pacific Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 188: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 189: South Asia and Pacific Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 190: South Asia and Pacific Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 191: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 192: South Asia and Pacific Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 197: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 199: South Asia and Pacific Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 200: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 201: South Asia and Pacific Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 202: South Asia and Pacific Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 203: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 204: South Asia and Pacific Market Attractiveness by Location Type, 2023 to 2033

Figure 205: South Asia and Pacific Market Attractiveness by Booking Channel, 2023 to 2033

Figure 206: South Asia and Pacific Market Attractiveness by Tourist Type, 2023 to 2033

Figure 207: South Asia and Pacific Market Attractiveness by Tour Type, 2023 to 2033

Figure 208: South Asia and Pacific Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 209: South Asia and Pacific Market Attractiveness by Age Group, 2023 to 2033

Figure 210: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 211: East Asia Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 212: East Asia Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 213: East Asia Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 214: East Asia Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 215: East Asia Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 216: East Asia Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 219: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 220: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 222: East Asia Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 223: East Asia Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 224: East Asia Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 228: East Asia Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 229: East Asia Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 230: East Asia Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 231: East Asia Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 232: East Asia Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 233: East Asia Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 234: East Asia Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 235: East Asia Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 236: East Asia Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 239: East Asia Market Attractiveness by Location Type, 2023 to 2033

Figure 240: East Asia Market Attractiveness by Booking Channel, 2023 to 2033

Figure 241: East Asia Market Attractiveness by Tourist Type, 2023 to 2033

Figure 242: East Asia Market Attractiveness by Tour Type, 2023 to 2033

Figure 243: East Asia Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 244: East Asia Market Attractiveness by Age Group, 2023 to 2033

Figure 245: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 246: Middle East and Africa Market Value (US$ Million) by Location Type, 2023 to 2033

Figure 247: Middle East and Africa Market Value (US$ Million) by Booking Channel, 2023 to 2033

Figure 248: Middle East and Africa Market Value (US$ Million) by Tourist Type, 2023 to 2033

Figure 249: Middle East and Africa Market Value (US$ Million) by Tour Type, 2023 to 2033

Figure 250: Middle East and Africa Market Value (US$ Million) by Consumer Orientation, 2023 to 2033

Figure 251: Middle East and Africa Market Value (US$ Million) by Age Group, 2023 to 2033

Figure 252: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 254: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 255: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) Analysis by Location Type, 2018 to 2033

Figure 257: Middle East and Africa Market Value Share (%) and BPS Analysis by Location Type, 2023 to 2033

Figure 258: Middle East and Africa Market Y-o-Y Growth (%) Projections by Location Type, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Booking Channel, 2018 to 2033

Figure 260: Middle East and Africa Market Value Share (%) and BPS Analysis by Booking Channel, 2023 to 2033

Figure 261: Middle East and Africa Market Y-o-Y Growth (%) Projections by Booking Channel, 2023 to 2033

Figure 262: Middle East and Africa Market Value (US$ Million) Analysis by Tourist Type, 2018 to 2033

Figure 263: Middle East and Africa Market Value Share (%) and BPS Analysis by Tourist Type, 2023 to 2033

Figure 264: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tourist Type, 2023 to 2033

Figure 265: Middle East and Africa Market Value (US$ Million) Analysis by Tour Type, 2018 to 2033

Figure 266: Middle East and Africa Market Value Share (%) and BPS Analysis by Tour Type, 2023 to 2033

Figure 267: Middle East and Africa Market Y-o-Y Growth (%) Projections by Tour Type, 2023 to 2033

Figure 268: Middle East and Africa Market Value (US$ Million) Analysis by Consumer Orientation, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Consumer Orientation, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Consumer Orientation, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Age Group, 2018 to 2033

Figure 272: Middle East and Africa Market Value Share (%) and BPS Analysis by Age Group, 2023 to 2033

Figure 273: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age Group, 2023 to 2033

Figure 274: Middle East and Africa Market Attractiveness by Location Type, 2023 to 2033

Figure 275: Middle East and Africa Market Attractiveness by Booking Channel, 2023 to 2033

Figure 276: Middle East and Africa Market Attractiveness by Tourist Type, 2023 to 2033

Figure 277: Middle East and Africa Market Attractiveness by Tour Type, 2023 to 2033

Figure 278: Middle East and Africa Market Attractiveness by Consumer Orientation, 2023 to 2033

Figure 279: Middle East and Africa Market Attractiveness by Age Group, 2023 to 2033

Figure 280: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Film and TV IP Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Tourism Independent Contractor Model Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Tourism Industry Analysis in Japan - Size, Share, & Forecast Outlook 2025 to 2035

Tourism Market Trends – Growth & Forecast 2025 to 2035

Tourism Industry Big Data Analytics Market Analysis by Application, by End, by Region – Forecast for 2025 to 2035

Assessing Tourism Industry Loyalty Program Market Share & Industry Trends

Tourism Industry Loyalty Programs Sector Analysis by Program Type by Traveler Profile by Region - Forecast for 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Market Share Insights of Tourism Security Service Providers

Tourism Security Market Analysis by Service Type, by End User, and by Region – Forecast for 2025 to 2035

Filmic Tapes Market

PC Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Geotourism Market Share

Geotourism Market Insights - Growth & Trends 2025 to 2035

Global Ecotourism Market Insights – Growth & Demand 2025–2035

PE Film Market Insights – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA