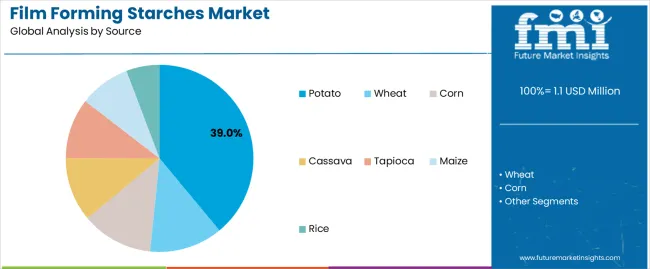

The film forming starches market is projected to grow from USD 1.1 million in 2025 to USD 1.9 million by 2035, advancing at a CAGR of 6.2%. Unlike petroleum-based polymers, this market is defined by bio-based feedstocks that allow integration across multiple value chains. Sources such as potato, wheat, corn, cassava, tapioca, maize, and rice provide the fundamental raw materials, each with distinct availability and cost profiles. Potato and wheat starch are widely used in Europe due to established agricultural bases, while corn and maize dominate in North America. Cassava and tapioca serve as cost-effective feedstocks in the Asia-Pacific region, offering high amylose content critical for film strength. Rice starch, though smaller in scale, offers clarity and smoothness, making it ideal for niche applications in edible films. This diversity of sources ensures regional flexibility and reduces dependence on petrochemical feedstocks.

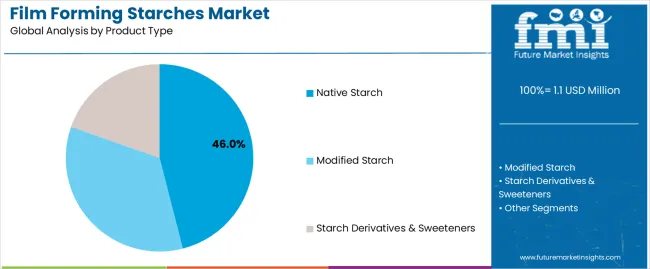

From a product type perspective, native starch plays a role in basic applications but faces limitations in moisture resistance and mechanical properties. Modified starch has emerged as the fastest-growing category due to chemical, physical, or enzymatic treatments that enhance film strength, water resistance, and elasticity. Starch derivatives and sweeteners also feed into the chain, as they can be converted into biopolymer intermediates for packaging and coating solutions. Investors would note that growth momentum is concentrated in modified starches, where R&D on blending with biopolymers or additives enhances functionality and widens end-use potential. This segment demonstrates clear commercial viability compared with petroleum-based alternatives.

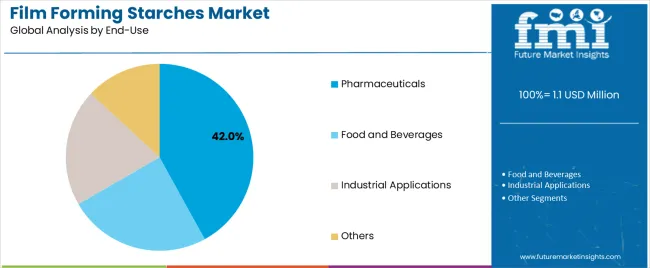

End-use applications highlight the market’s true scope. Pharmaceuticals employ film forming starches in capsule coatings, controlled release systems, and drug delivery films, emphasizing safety and biodegradability. Food and beverages represent the largest consumer, with starch-based films used in edible coatings, bakery wraps, fruit preservation, and biodegradable packaging. Industrial applications are growing as starch films find use in adhesives, coatings, and biodegradable packaging solutions that can partially substitute synthetic plastics. Other uses include agriculture, where starch-based films act as seed coatings or mulching layers, offering environmental benefits while addressing crop productivity challenges. Each of these end-use sectors demonstrates a clear shift away from petroleum-based materials, creating steady demand for starch alternatives.

Form analysis distinguishes between dry and liquid starch. Dry starch is the dominant form, suitable for storage, transportation, and bulk industrial applications. It is processed into film-forming powders or granules for food, pharma, and packaging sectors. Liquid starch, though smaller in share, is gaining ground where quick solubility and ease of integration are required, particularly in coatings and beverage formulations. Liquid forms help reduce processing steps, making them attractive for high-volume applications in packaging and industrial coatings.

The film forming starches market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its plastic alternatives adoption phase, expanding from USD 1.1 million to USD 1.9 million with steady annual increments averaging 7.5% growth. This period showcases the transition from conventional petroleum-based films to renewable starch-based systems with enhanced biodegradability and integrated functional property modifications becoming mainstream features.

The 2025-2030 phase adds USD 456.4 million to market value, representing 53% of total decade expansion. Market maturation factors include standardization of film performance specifications, declining costs for enzymatic modification processes, and increasing formulator awareness of starch film benefits reaching 76-81% effectiveness in pharmaceutical coating applications. Competitive landscape evolution during this period features established starch processors like Cargill and ADM expanding their film-grade portfolios while new entrants focus on specialized nano-starch solutions and enhanced moisture barrier technology.

From 2030 to 2035, market dynamics shift toward advanced functionalization and multi-sector deployment, with growth moderating from USD 1,506.4 million to USD 1,916.2 million, adding USD 409.8 million or 47% of total expansion. This phase transition logic centers on engineered starch composite systems, integration with active packaging platforms, and deployment across diverse environmentally-driven scenarios, becoming standard rather than specialized biomaterials. The competitive environment matures with focus shifting from basic film formation to comprehensive performance optimization and compatibility with industrial-scale processing operations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.1 million |

| Market Forecast (2035) | USD 1.9 million |

| Growth Rate | 6.20% CAGR |

| Leading Source | Potato |

| Primary Product Type | Native Starch |

The market demonstrates strong fundamentals with potato-based starches capturing a dominant share through superior film-forming properties and excellent clarity capabilities. Pharmaceutical applications drive primary demand, supported by increasing tablet coating requirements and controlled-release drug delivery solutions. Geographic expansion remains concentrated in Asia Pacific markets with rapidly expanding pharmaceutical manufacturing, while developed regions show steady adoption rates driven by biodegradable packaging mandates and rising food safety activity.

Market expansion rests on three fundamental shifts driving adoption across pharmaceutical and packaging sectors. Plastic reduction mandates create compelling advantages through biodegradable starch films that provide comprehensive environmental compliance with enhanced compostability, enabling brand owners to meet regulatory requirements and address consumer preferences while justifying material transitions over conventional petroleum polymers. Pharmaceutical industry growth accelerates worldwide as generic drug manufacturing drives tablet coating demand that delivers consistent drug release profiles across diverse dosage forms, enabling improved patient compliance that aligns with healthcare accessibility expectations and maximizes therapeutic efficacy. Clean label movement drives adoption from food manufacturers requiring natural coating solutions that maximize ingredient transparency while maintaining product protection during distribution and retail display operations.

Growth faces headwinds from moisture sensitivity variations that differ across humidity conditions regarding film integrity and barrier maintenance, potentially limiting application suitability in tropical climate categories. Processing temperature limitations also persist regarding thermal degradation susceptibility and drying energy requirements that may increase manufacturing costs in high-throughput production environments with rapid processing demands.

The film forming starches market represents a compelling intersection of biopolymer innovation, packaging transformation, and pharmaceutical technology. With robust growth projected from USD 1.1 million in 2025 to USD 1,916.2 million by 2035 at a 6.20% CAGR, this market is driven by increasing plastic reduction legislation trends, pharmaceutical excipient demand, and commercial requirements for biodegradable barrier material formats.

The market's expansion reflects a fundamental shift in how manufacturers and formulators approach renewable material infrastructure. Strong growth opportunities exist across diverse applications, from pharmaceutical companies requiring film coating systems to food manufacturers demanding edible packaging solutions. Geographic expansion is particularly pronounced in Asia-Pacific markets, led by China (8.37% CAGR) and India (7.75% CAGR), while established markets in North America and Europe drive innovation and specialized modification development.

The dominance of potato sources and pharmaceutical applications underscores the importance of proven film quality and functional versatility in driving adoption. Moisture sensitivity and processing complexity remain key challenges, creating opportunities for companies that can deliver reliable performance while maintaining formulation efficiency.

Primary Classification: The market segments by source into potato, wheat, corn, cassava, tapioca, maize, and rice categories, representing the evolution from conventional cereal starches to specialty tuber-based materials for comprehensive film forming operations.

Secondary Breakdown: Product type segmentation divides the market into native starch, modified starch, and starch derivatives & sweeteners sectors, reflecting distinct requirements for functionality enhancement, processing characteristics, and application versatility.

Tertiary Classification: End-use analysis covers pharmaceuticals, food and beverages, industrial applications, and others, demonstrating usage pattern variations across different functional requirements.

Quaternary Breakdown: Form segmentation encompasses dry and liquid formats, highlighting processing preference variations across different manufacturing scenarios.

Regional Classification: Geographic distribution covers North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific markets leading adoption while developed economies show steady growth patterns driven by regulatory compliance and innovation programs.

The segmentation structure reveals technology progression from basic native starches toward sophisticated chemically modified systems with enhanced barrier properties and specialized functional capabilities, while application diversity spans from pharmaceutical excipients to industrial adhesives requiring comprehensive performance solutions and regulatory approval systems.

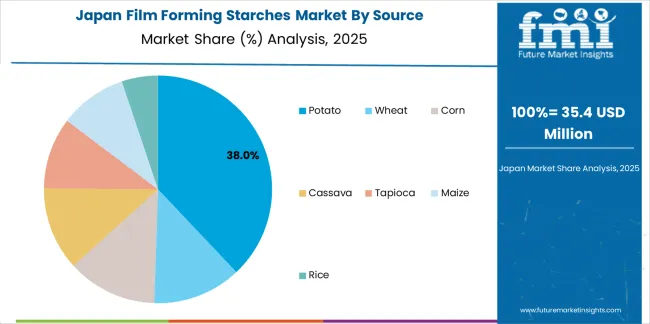

Potato segment is estimated to account for 39% of the film forming starches market share in 2025. The segment's leading position stems from its fundamental role as a critical component in high-quality film applications and its extensive use across multiple pharmaceutical and food coating sectors. Potato starch's dominance is attributed to its superior film-forming characteristics, including excellent clarity, neutral taste profile, and strong gel formation that make it indispensable for premium coating and edible film operations.

Market Position: Potato starch systems command the leading position in the film forming starches market through advanced granule structure properties, including comprehensive amylopectin content, uniform molecular distribution, and reliable film strength that enable formulators to deploy materials across diverse coating applications.

Value Drivers: The segment benefits from natural abundance in European growing regions that provides consistent raw material supply without requiring tropical climates. Exceptional film properties enable deployment in pharmaceutical tablet coating, confectionery glazing, and premium packaging applications where clarity and smoothness represent critical selection requirements.

Competitive Advantages: Potato starch systems differentiate through outstanding transparency characteristics, proven consumer acceptance, and compatibility with cold-water swelling modifications that enhance processing flexibility while maintaining clean label profiles suitable for diverse food and pharmaceutical applications.

Key market characteristics:

Native starch segment is projected to hold 46% of the film forming starches market share in 2025. The segment's strong market position is driven by the clean label appeal and regulatory simplicity, where unmodified starches serve as both functional ingredients and consumer-acceptable materials. The food industry's preference for minimal processing supports the segment's prominent position.

Market Context: Native starch applications represent the foundation of the market due to widespread regulatory approval and optimal balance between functionality, cost-effectiveness, and clean label positioning that extends market accessibility while maintaining acceptable performance characteristics.

Appeal Factors: Food formulators prioritize ingredient simplicity, allergen-free status, and compatibility with organic certification requirements that enable broad application deployment across multiple product categories. The segment benefits from established food safety status and consumer preferences that emphasize natural ingredient declarations for mainstream food products.

Growth Drivers: Organic food expansion incorporates native starches as standard ingredients for coating and encapsulation applications. At the same time, pharmaceutical developments are increasing adoption of minimally processed starches that comply with pharmacopeial standards and provide consistent excipient quality.

Market Challenges: Performance limitations in demanding applications may drive formulators toward chemically modified alternatives in extreme processing or storage scenarios.

Product type dynamics include:

Pharmaceuticals segment is projected to hold 42% of the film forming starches market share in 2025. The segment's market leadership is driven by the extensive use of starch films in tablet coating, capsule manufacturing, controlled-release formulations, and taste masking, where starches serve as both functional excipients and patient-friendly materials. The pharmaceutical industry's consistent demand for high-quality excipients supports the segment's dominant position.

Market Context: Pharmaceutical applications dominate the market due to widespread adoption of aqueous film coating technology and increasing focus on natural excipients, biocompatibility requirements, and regulatory approval pathways that extend formulation value while maintaining patient safety standards.

Appeal Factors: Pharmaceutical manufacturers prioritize excipient safety profiles, regulatory compliance documentation, and integration with existing coating equipment that enable coordinated deployment across multiple dosage form platforms. The segment benefits from substantial generic drug growth and industry standards that emphasize quality-by-design principles for robust manufacturing processes.

Growth Drivers: Oral solid dosage expansion incorporates film forming starches as preferred excipients for modified-release systems. At the same time, nutraceutical product development is increasing demand for vegetarian capsule alternatives that comply with dietary restrictions and enhance consumer acceptance.

Market Challenges: Synthetic polymer competition and gelatin dominance may limit market share gains in certain specialized formulation categories or cost-sensitive segments.

Application dynamics include:

Growth Accelerators: Environmental legislation drives primary adoption as film forming starches provide exceptional biodegradability that enables plastic replacement without compromising functional performance, supporting corporate commitments and regulatory compliance that require renewable material solutions. Generic pharmaceutical expansion accelerates market growth as developing economies increase drug manufacturing that maintains cost-effective excipient sourcing during production while enhancing formulation flexibility through naturally-derived coating materials. Consumer preference evolution increases worldwide, creating constant demand for clean label ingredients that complement transparent labeling and provide competitive advantages in natural product positioning.

Growth Inhibitors: Moisture sensitivity challenges differ across climate zones regarding film integrity and storage stability, which may limit market penetration and application reliability in high-humidity tropical regions with demanding environmental conditions. Processing complexity requirements persist regarding gelatinization temperature control and viscosity management that may increase formulation difficulty in facilities with limited technical expertise or equipment capabilities. Market competition from synthetic polymers and alternative biopolymers creates substitution concerns between different film-forming technologies and existing formulation preferences.

Market Evolution Patterns: Adoption accelerates in pharmaceutical and food sectors where natural ingredients justify material transitions, with geographic concentration in Asia Pacific transitioning toward capacity expansion in pharmaceutical manufacturing regions driven by generic drug production and food processing modernization. Technology development focuses on enhanced chemical modification methods, improved barrier property engineering, and integration with nanocomposite systems that optimize moisture resistance and mechanical performance. The market could face disruption if alternative biopolymer technologies or synthetic film formers significantly improve cost-performance ratios in coating applications.

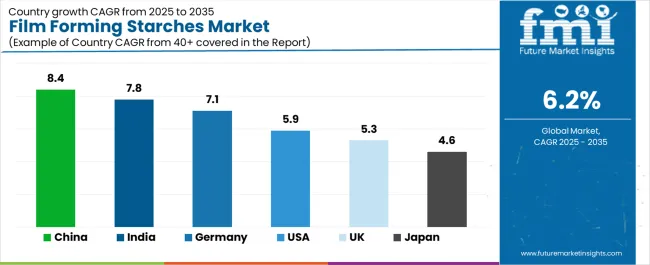

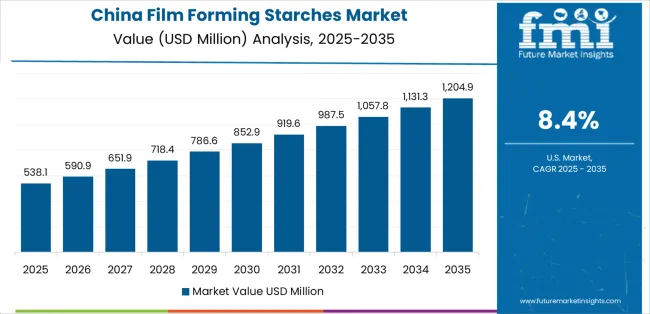

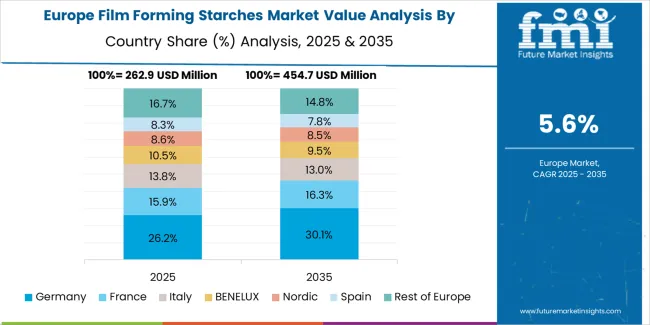

The Film Forming Starches Market demonstrates diverse regional dynamics. Growth Leaders include China (8.4% CAGR) and India (7.8% CAGR), supported by expanding food packaging, edible coatings, and bioplastic applications, alongside strong government emphasis on eco-friendly materials. Steady Performers include Germany (7.1% CAGR) and the USA (5.9% CAGR), where adoption is driven by established food processing, packaging industries, and rising demand for eco-friendly materials. Emerging Markets feature the UK (5.3% CAGR) and Japan (4.6% CAGR), where growth is anchored by specialty applications in high-value food packaging, coatings, and bio-based films.

| Country | CAGR (2025–2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.6% |

Asia-Pacific leads market growth, with China and India driving adoption through rising demand for eco-friendly food packaging, edible films, and bioplastics aligned with government-backed environmental initiatives. Europe maintains steady momentum, anchored by Germany, where regulatory pushes for eco-friendly packaging and advanced processing technologies enhance adoption, while the UK shows moderate uptake in specialty coatings and niche applications. North America, led by the USA, demonstrates moderate but stable growth as food manufacturers, packaging firms, and bio-based material innovators increasingly integrate film forming starches into eco-friendly product lines.

China establishes market leadership through large-scale investments in eco-friendly packaging, edible coatings, and starch-based bioplastics. The country’s 8.4% CAGR through 2035 reflects strong government initiatives promoting biodegradable and renewable packaging alternatives to reduce plastic dependency. Growth is concentrated in key hubs such as Guangdong, Jiangsu, and Shandong, where food processing and packaging industries are scaling starch-based film technologies.

Chinese manufacturers capitalize on abundant raw material availability and cost advantages to produce film forming starches for both domestic use and export markets. Distribution is strengthened through partnerships with food packaging suppliers, coating companies, and bioplastic developers, while government environmental mandates accelerate integration across multiple application segments.

Strategic Market Indicators:

In New Delhi, Mumbai, and Bangalore, film forming starches are being rapidly adopted for food packaging, edible coatings, and bio-based films, reflecting the country’s growing consumer demand for eco-friendly alternatives. The market is projected to grow at a strong 7.7% CAGR through 2035, supported by government initiatives on plastic reduction, rising exports of processed foods, and increasing investments in eco-friendly materials. Adoption is especially prominent in packaged snacks, confectionery, and fresh produce coatings, where film forming starches enhance shelf life and eco-friendly product performance. Indian producers are leveraging cost-effective raw materials and collaborating with international packaging firms to develop coated starch solutions that meet both domestic and export requirements.

Strategic Market Indicators:

Germany records a robust 7.1% CAGR through 2035, anchoring European demand for film forming starches. Growth is concentrated in food packaging, specialty coatings, and bioplastics, where stringent EU environmental regulations accelerate adoption. Industrial clusters in Bavaria and North Rhine-Westphalia are major hubs for starch film applications integrated into food packaging lines. German producers specialize in surface-modified and functionalized starches, optimized for flexible packaging films and bio-composite materials. Exports across the EU further reinforce Germany’s role as a premium supplier.

Strategic Market Indicators:

The USA market grows at 5.9% CAGR, supported by rising demand for eco-friendly packaging, biodegradable coatings, and bio-based films. Key growth centers include California, Texas, and the Midwest, where food processors and packaging innovators integrate film forming starches into both retail and industrial applications. Adoption is boosted by corporate environmental responsibility mandates, major retail chains requiring renewable packaging materials, and ongoing innovation in starch-based bioplastics. USA suppliers and research institutions are focusing on advanced starch blends with enhanced mechanical strength and barrier properties.

Strategic Market Indicators:

The UK market expands at a steady 5.3% CAGR, with adoption driven by food packaging, ready-meals, and bakery sectors. Industrial clusters in Midlands and South East England focus on niche starch applications in flexible packaging and coatings.

While domestic production capacity is limited, imports from Germany and Asia supply much of the local demand. Government-led plastic waste reduction policies and consumer preference for eco-friendly packaging are the main adoption drivers.

Strategic Market Indicators:

Japan advances at a 4.6% CAGR, reflecting steady but incremental adoption in high-value packaging, electronics coatings, and premium food sectors. Demand is anchored in Tokyo, Osaka, and Nagoya, where major food processors and packaging firms test starch-based films for specialty applications. Japanese suppliers emphasize precision, durability, and ultra-high purity starches, tailored for advanced applications, including electronics packaging films and premium edible coatings. Imports from Southeast Asia supplement bulk demand, while domestic producers concentrate on innovation.

Strategic Market Indicators:

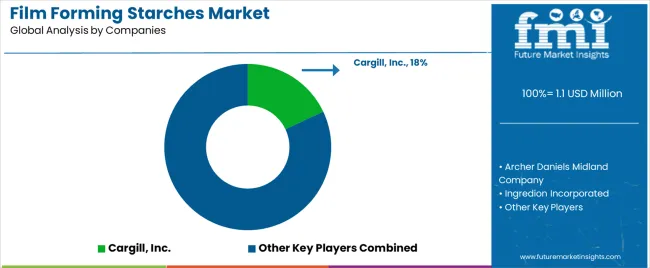

The film forming starches market operates with moderate concentration, featuring approximately 55-75 participants, where leading companies control roughly 51-58% of the global market share through established agricultural sourcing networks and comprehensive modification capabilities. Competition emphasizes product consistency, technical support, and regulatory compliance rather than price-based rivalry.

Market leaders encompass Cargill Inc., Archer Daniels Midland Company, and Ingredion Incorporated, which maintain competitive advantages through extensive agricultural supply chains, global processing footprints, and comprehensive technical service capabilities that create customer loyalty and support formulation requirements. These companies leverage decades of starch processing expertise and ongoing modification technology investments to develop advanced film forming products with exceptional functionality and regulatory documentation features.

Specialty challengers include Tate and Lyle PLC, AGRANA Beteiligungs AG, and Roquette Frères, which compete through specialized application focus and efficient regional operations that appeal to pharmaceutical formulators seeking customized excipient solutions and flexible supply arrangements. These companies differentiate through technical expertise emphasis and specialized pharmaceutical-grade production focus.

Market dynamics favor participants that combine reliable product quality with advanced technical support, including formulation development assistance and regulatory documentation provision. Competitive pressure intensifies as Asian starch processors expand pharmaceutical-grade capacity. At the same time, European specialty ingredient companies challenge established players through innovative modification technologies and certified biodegradable material offerings targeting premium packaging segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 million |

| Source | Potato, Wheat, Corn, Cassava, Tapioca, Maize, Rice |

| Product Type | Native Starch, Modified Starch, Starch Derivatives & Sweeteners |

| End-Use | Pharmaceuticals, Food and Beverages, Industrial Applications, Others |

| Form | Dry, Liquid |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | China, Germany, USA, Japan, UK, India, and 35+ additional countries |

| Key Companies Profiled | Cargill Inc., Archer Daniels Midland Company, Ingredion Incorporated, Tate and Lyle PLC, AGRANA Beteiligungs AG, Roquette Frères |

| Additional Attributes | Dollar sales by source and end-use categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with starch processors and pharmaceutical ingredient suppliers, formulator preferences for film quality and regulatory compliance, integration with coating equipment and packaging systems, innovations in chemical modification technology and barrier property enhancement, and development of specialized film forming solutions with enhanced moisture resistance capabilities and biodegradability features |

The global film forming starches market is estimated to be valued at USD 1.1 million in 2025.

The market size for the film forming starches market is projected to reach USD 1.9 million by 2035.

The film forming starches market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in film forming starches market are potato, wheat, corn, cassava, tapioca, maize and rice.

In terms of product type, native starch segment to command 46.0% share in the film forming starches market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

APET Film Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thin-film Platinum Resistance Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Platinum Resistance Temperature Sensor Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar Cells Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Photovoltaics Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Solar PV Backsheet Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Encapsulation TFE Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA