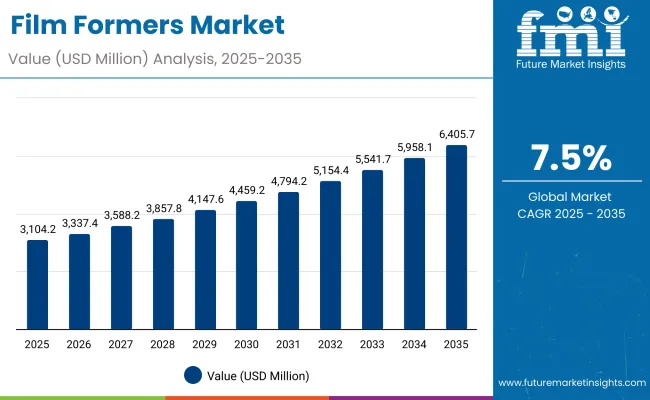

rise to USD 6,405.7 million by 2035. This trajectory signifies an incremental gain of USD 3,301.5 million, effectively representing a doubling of market size across the decade. A compound annual growth rate of 7.5% has been projected, underscoring the sustained momentum expected for this category of formulation ingredients.

Film Formers Market Key Takeaways

| Metric | Value |

|---|---|

| Film Formers Market Estimated Value in (2025E) | USD 3,104.2 million |

| Film Formers Market Forecast Value in (2035F) | USD 6,405.7 million |

| Forecast CAGR (2025 to 2035) | 7.50% |

During the first phase spanning 2025 to 2030, the market is projected to expand from USD 3,104.2 million to USD 4,459.2 million, contributing USD 1,355 million or nearly 41% of the total decade growth. This stage of development is expected to be defined by progressive adoption in cosmetics and personal care applications, where durability, long-wear attributes, and resistance to environmental stressors are increasingly prioritized. Demand in this phase will be reinforced by innovation in color cosmetics and sun care formulations.

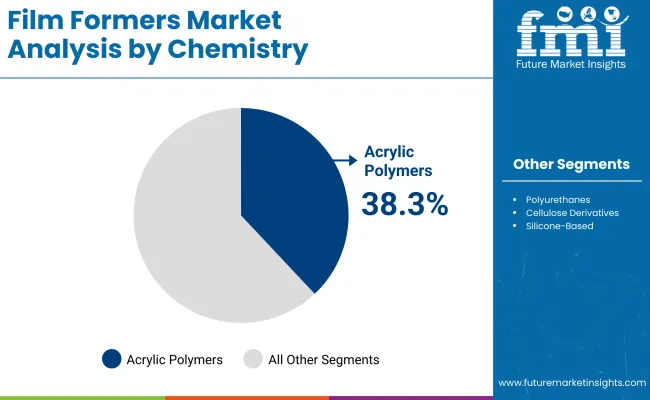

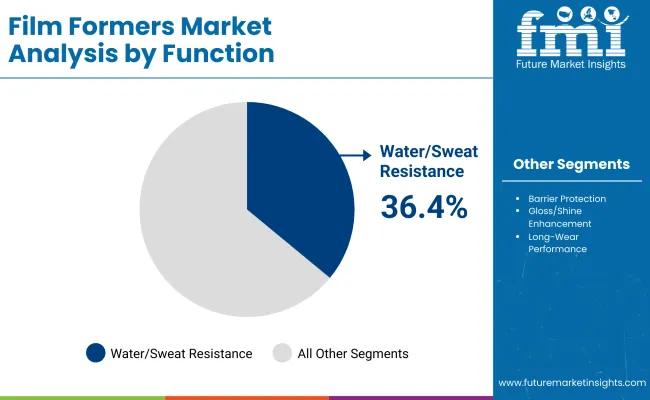

The second phase, covering 2030 to 2035, is forecast to add USD 1,946.5 million in value, accounting for 59% of the decade’s expansion as the market advances from USD 4,459.2 million to USD 6,405.7 million. Accelerated adoption during this period is anticipated to be driven by the surge in hybrid dermocosmetic formats, sustainability-linked innovation, and rising premium skincare applications. Acrylic polymers are projected to retain dominance with a 38.3% share in 2025, while water and sweat resistance functionality is set to lead the function segment with a 36.4% share, reinforcing their critical role in advanced formulation development.

Between 2020 and 2024, the film formers category was steadily reinforced by innovation in cosmetics and personal care, with momentum largely attributed to performance-driven adoption across color cosmetics and sun care. The decade ahead is forecast to deliver a doubling of market value, moving from USD 3,104.2 million in 2025 to USD 6,405.7 million in 2035. During this period, acrylic polymers are expected to dominate formulations owing to their balanced functional performance, while water and sweat resistance is projected to remain the leading functional driver with 36.4% share in 2025. Growth in Asia-Pacific and Europe is anticipated to be accelerated by rising demand for dermocosmetics and sustainable ingredient innovation, whereas North America will continue to provide stable adoption across premium and hybrid product lines. Competitive positioning is expected to be shaped not only by product innovation but also by the ability of leading players such as Ashland, BASF, Dow, and Evonik to scale bio-based alternatives, ensure regulatory compliance, and deliver multifunctionality. Market advantage is projected to increasingly rest on sustainability credentials, ingredient transparency, and adaptability to hybrid formulations.

Growth in the film formers market is being driven by rising demand for long-wear, water-resistant, and multifunctional ingredients that enhance performance across cosmetics and personal care formulations. Increased consumer preference for durability, sweat resistance, and gloss-enhancing properties has reinforced the importance of these raw materials in advanced product development. Regulatory emphasis on safer, cleaner-label formulations has further encouraged the adoption of water-based dispersions, aligning sustainability goals with performance requirements. Expanding dermocosmetic and hybrid product categories are also fueling growth, as film formers are being positioned as critical enablers of efficacy and sensory appeal. Regional momentum is being particularly reinforced in Asia-Pacific, where rapid growth in beauty and skincare consumption is converging with rising domestic innovation. Future expansion is expected to be propelled by bio-based and multifunctional film formers, which will address both environmental concerns and the demand for premium formulations, ensuring stronger adoption across global markets.

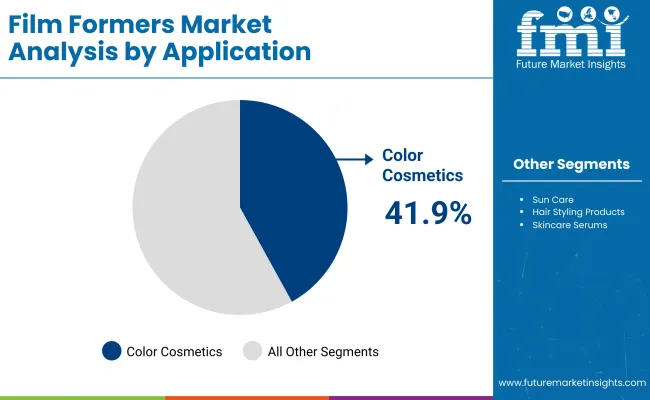

The film formers market has been segmented based on chemistry, function, and application, reflecting the critical parameters shaping demand in formulation development. Each segment is contributing distinctly to the overall growth of the industry, with leading categories demonstrating strong adoption across cosmetics, personal care, and dermocosmetic applications. Market shares in 2025 highlight the dominance of acrylic polymers within chemistry, the significance of water and sweat resistance under function, and the strong positioning of color cosmetics within application. These insights underline how performance-driven attributes and consumer preferences are influencing ingredient selection. Forward momentum is expected to be reinforced by sustainability trends, clean-label compliance, and innovation targeting hybrid formulations that meet evolving global requirements.

| Chemistry | Market Value Share, 2025 |

|---|---|

| Acrylic polymers | 38.3% |

| Others | 61.7% |

Acrylic polymers are projected to capture 38.3% share (USD 1,188.91 million) in 2025, while others are expected to hold 61.7% share (USD 1,915.29 million) of the chemistry segment. This dominance is being reinforced by their balanced performance across durability, adhesion, and compatibility with varied formulations. Other chemistries are anticipated to sustain relevance by addressing niche performance needs in specialized products. Innovation pipelines focusing on sustainable and bio-based polymer solutions are expected to accelerate growth in both categories. Demand will increasingly be shaped by regulatory compliance, clean-label positioning, and the capacity of chemistries to provide multifunctional performance in advanced personal care and dermocosmetic formulations.

| Function | Market Value Share, 2025 |

|---|---|

| Water/sweat resistance | 36.4% |

| Others | 63.6% |

Water and sweat resistance is forecast to hold 36.4% share (USD 1,129.93 million) in 2025, while other functions will contribute 63.6% share (USD 1,974.27 million). This share is being supported by the growing importance of long-lasting performance in outdoor, sports, and active-lifestyle cosmetics. The remainder will be attributed to other functions such as gloss enhancement, barrier protection, and long-wear efficacy. Segment momentum will be reinforced by the rising trend of hybrid formulations that combine beauty and protection, appealing strongly to consumers seeking multifunctional performance. Future innovation in this space is expected to be guided by sustainability, bio-based ingredients, and heightened regulatory scrutiny across international markets.

| Application | Market Value Share, 2025 |

|---|---|

| Color cosmetics | 41.9% |

| Others | 58.1% |

Color cosmetics are anticipated to command 41.9% share (USD 1,300.66 million) in 2025, whereas other applications will account for 58.1% share (USD 1,803.54 million). This growth is being reinforced by demand for long-wear and high-performance attributes in lip, eye, and face products. The remainder will be contributed by applications such as sun care, skincare serums, and hair styling. Expanding consumer preference for multifunctional and hybrid cosmetics is expected to reinforce adoption across both premium and mass-market segments. Growth will further be supported by strong innovation pipelines in dermocosmetics and personalized beauty solutions. The ability of film formers to improve wearability, stability, and sensorial qualities will remain central to their application dominance.

The film formers market is being shaped by complex regulatory expectations and evolving consumer demands, where sustainability, multifunctionality, and sensory enhancement are prioritized. Despite innovation-led opportunities, challenges around formulation transparency and raw material costs continue to influence competitive positioning across regions.

Shift Toward Hybrid Cosmetic and Dermocosmetic Formats

A significant driver is being observed in the integration of film formers into hybrid cosmetic and dermocosmetic formulations, where therapeutic efficacy is combined with aesthetic appeal. This dynamic has been reinforced by consumer expectations for multifunctional products that provide long-wear performance alongside active skin benefits. Formulators are increasingly embedding film formers into serums and sun care products to ensure barrier protection, stability, and sensory appeal without compromising compliance. This integration is expected to widen the market’s addressable scope, with dermocosmetics evolving into a mainstream segment that requires ingredients delivering clinical-grade performance. The capacity of film formers to support both functional and therapeutic attributes positions them as indispensable in next-generation hybrid formulations.

Volatility in Raw Material Availability and Sustainability Pressure

A key restraint is being identified in the volatility of raw material supply chains and the heightened sustainability scrutiny surrounding polymer-based chemistries. Dependence on petrochemical-derived feedstocks has exposed the market to cost fluctuations and supply interruptions, particularly in fast-growing regions. Additionally, mounting regulatory oversight on ingredient safety and environmental footprint has placed film formers under close examination. Pressure to transition toward bio-based and biodegradable alternatives is intensifying, yet scale and cost competitiveness remain unresolved barriers. This dual challenge of supply vulnerability and compliance-driven reformulation is expected to limit short-term margins. However, firms that invest in circular feedstocks and transparent sourcing are likely to mitigate this restraint and secure competitive advantage.

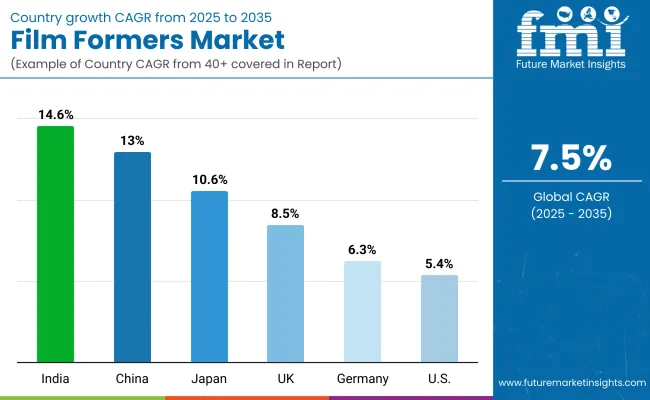

| Country | CAGR |

|---|---|

| China | 13.0% |

| USA | 5.4% |

| India | 14.6% |

| UK | 8.5% |

| Germany | 6.3% |

| Japan | 10.6% |

The film formers market is displaying distinct growth trajectories across key countries, influenced by evolving consumer expectations, regulatory frameworks, and industrial innovation. India is projected to expand at the fastest pace with a CAGR of 14.6% between 2025 and 2035, supported by surging demand for premium beauty and personal care products and rapid capacity expansion within domestic manufacturing. China follows closely with a 13.0% CAGR, where rising adoption of hybrid cosmetic and dermocosmetic formats, coupled with government-backed sustainability initiatives, is reinforcing large-scale deployment of advanced formulation ingredients. Japan, at 10.6% CAGR, is strengthening its position through science-driven innovation in multifunctional and high-performance ingredients aligned with clean beauty trends.

Europe is forecast to maintain steady growth at 7.9%, with Germany at 6.3% and the UK at 8.5%, reflecting compliance-led demand for sustainable raw materials and the influence of established premium cosmetic markets. The USA is expected to expand more moderately at 5.4%, where mature industry structures and a focus on clinical skincare formats sustain incremental adoption. Collectively, these dynamics highlight how Asia-Pacific is set to outpace other regions, while Europe and North America are projected to consolidate growth through sustainability, innovation, and premiumization strategies.

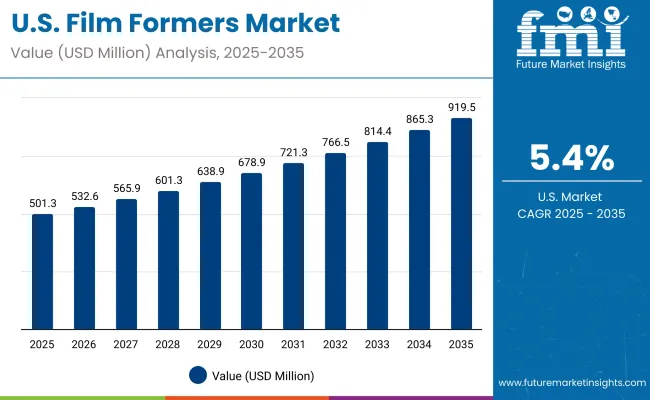

| Year | USA Film Formers Market (USD Million) |

|---|---|

| 2025 | 501.30 |

| 2026 | 532.65 |

| 2027 | 565.96 |

| 2028 | 601.36 |

| 2029 | 638.97 |

| 2030 | 678.93 |

| 2031 | 721.39 |

| 2032 | 766.51 |

| 2033 | 814.45 |

| 2034 | 865.39 |

| 2035 | 919.51 |

The film formers market in the United States is projected to grow at a CAGR of 5.4% from 2025 to 2035. Expansion is expected to be anchored in premium cosmetics and clinical skincare, where long-wear, water/sweat resistance, and sensorial finish are prioritized. Compliance-led reformulation is anticipated to favor water-based dispersions and cleaner chemistries, steering innovation pipelines toward acrylic systems and multifunctional blends.

The film formers market in the UK is projected to expand at a CAGR of 8.5% between 2025 and 2035. Growth is being reinforced by the rising adoption of performance-driven cosmetics and personal care products, particularly in premium and niche segments. Clean-label compliance and sustainability pressures are anticipated to accelerate the transition toward water-based dispersions. The country’s established presence in dermocosmetic research is expected to fuel demand for multifunctional film formers that deliver clinical-grade performance.

The film formers market in India is expected to grow at a CAGR of 14.6% during 2025 to 2035, positioning it as the fastest-expanding country market. Expansion is being powered by a surge in domestic consumption of cosmetics and personal care products, along with rapid local manufacturing growth. Increased investment in hybrid skincare and haircare innovations is projected to strengthen the role of film formers as critical enablers of performance. Global players are anticipated to expand regional partnerships to capture the rising demand.

The film formers market in China is projected to register a CAGR of 13.0% from 2025 to 2035. Demand is being shaped by the rapid expansion of dermocosmetics, hybrid formats, and advanced sun care applications. Regulatory emphasis on ingredient transparency and eco-friendly formulations is anticipated to accelerate adoption of sustainable film formers. Domestic innovators are strengthening their R&D pipelines to address consumer expectations for multifunctional performance.

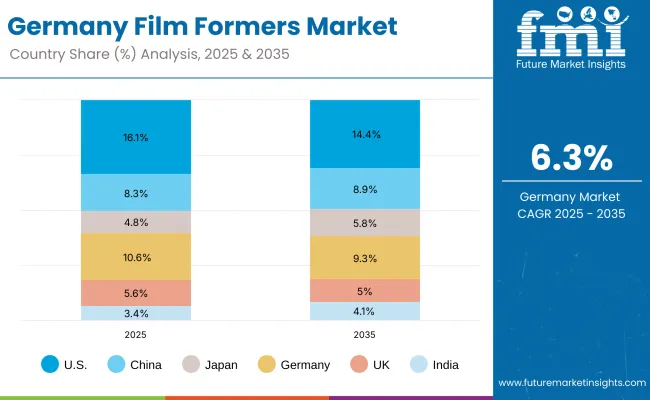

| Country | 2025 |

|---|---|

| USA | 16.1% |

| China | 8.3% |

| Japan | 4.8% |

| Germany | 10.6% |

| UK | 5.6% |

| India | 3.4% |

| Country | 2035 |

|---|---|

| USA | 14.4% |

| China | 8.9% |

| Japan | 5.8% |

| Germany | 9.3% |

| UK | 5.0% |

| India | 4.1% |

The film formers market in Germany is forecast to advance at a CAGR of 6.3% between 2025 and 2035. Expansion is being reinforced by the dominance of premium skincare and regulatory-led sustainability initiatives. The country’s strong influence on European compliance standards positions it as a key hub for sustainable and high-performance formulations. Functional attributes such as barrier protection and durability are expected to remain highly prioritized in formulation strategies.

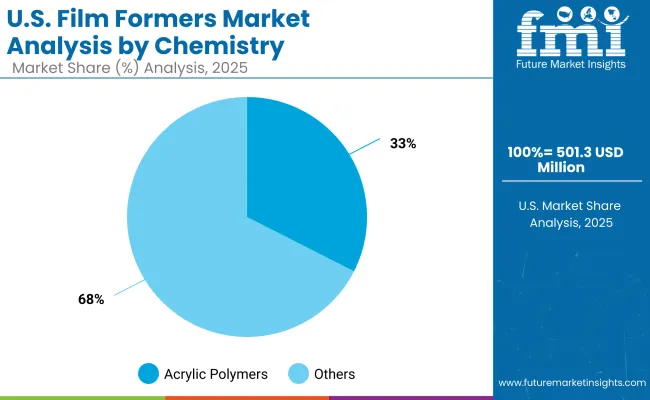

| USA By Chemistry | Market Value Share, 2025 |

|---|---|

| Acrylic polymers | 32.5% |

| Others | 67.5% |

The film formers market in the United States is projected at USD 501.30 million in 2025. Acrylic polymers contribute 32.5%, while other chemistries hold 67.5%, underscoring the greater reliance on diversified raw material bases. This dominance of alternative chemistries reflects the flexibility required to address regulatory compliance, clean-label demands, and hybrid formulations that extend beyond traditional acrylic systems. Acrylic polymers are still positioned as a critical backbone, given their balance of durability and film integrity. However, the transition toward specialty blends, including silicones, polyurethanes, and cellulose derivatives, is expected to gain momentum as consumer and brand priorities shift toward multifunctionality and sustainability. This structural change highlights the evolving balance between performance optimization and environmental stewardship, making chemistry selection a pivotal driver of USA market competitiveness.

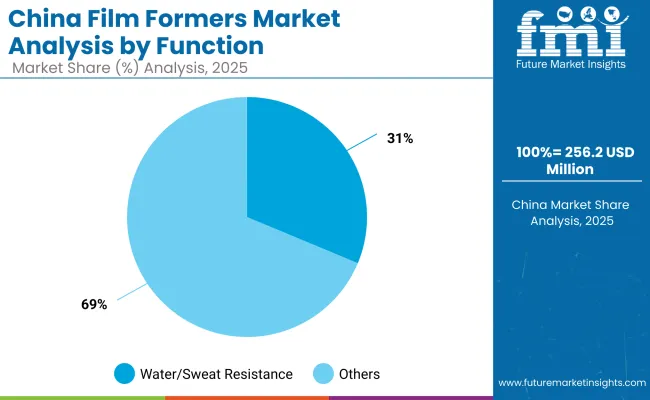

| China By Function | Market Value Share, 2025 |

|---|---|

| Water/sweat resistance | 31.3% |

| Others | 68.7% |

The film formers market in China is estimated at USD 256.22 million in 2025. Water and sweat resistance contributes 31.3%, while other functions dominate with 68.7%, indicating broader demand for gloss, barrier protection, and multi-functional performance. The emphasis on water- and sweat-resistant formulations is being reinforced by strong consumer demand in outdoor beauty and active-lifestyle categories, supported by the country’s rising sun care consumption. However, the larger share of other functions reflects the shift toward hybrid formats in color cosmetics and skincare, where sensorial quality and durability are increasingly prioritized.

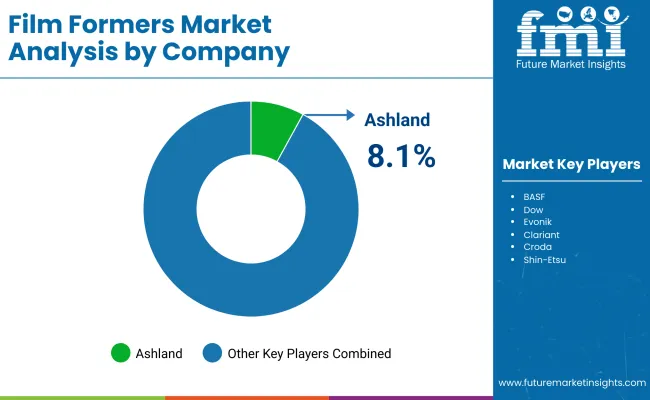

| Company | Global Value Share 2025 |

|---|---|

| Ashland | 8.1% |

| Others | 91.9% |

The film formers market has been characterized as moderately fragmented, with global leaders, mid-sized specialty players, and niche formulators competing across color cosmetics, sun care, skincare, and professional haircare. Scale in polymer chemistry, regulatory stewardship, and application laboratories has been leveraged by leading suppliers to secure specifications with multinational brands. Strategies have increasingly emphasized multifunctional acrylic systems, polyurethane hybrids, and silicone or cellulose-based options that enable water-based dispersions, long-wear performance, and sensorial enhancement. Commercial models have been shifting toward solution selling, where technical service, claim-substantiation support, and compliance documentation are bundled to de-risk launches. Sustainability has been positioned as a core differentiator through bio-based inputs, lower-VOC systems, and transparent traceability. Regional challengers have competed on agility and cost-to-serve, while majors have protected share via co-development programs and application centers. Over the outlook period, competitive advantage is expected to accrue to suppliers that align scale manufacturing with rapid reformulation capability, evidence-backed performance claims, and region-specific regulatory expertise.

Key Developments in Film Formers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 3,104.2 million (2025) - USD 6,405.7 million (2035) |

| Chemistry | Acrylic polymers, Polyurethanes, Cellulose derivatives, Silicone-based film formers |

| Function | Barrier protection, Gloss/shine enhancement, Water/sweat resistance, Long-wear performance |

| Application | Color cosmetics (lip, eye), Sun care, Hair styling products, Skincare serums |

| Physical Form | Water-based dispersions, Solvent-based solutions, Powdered resins |

| End-use Industry | Cosmetics & personal care, Dermocosmetics, Professional haircare |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Ashland, BASF, Dow, Evonik, Eastman, Clariant, Croda, Shin-Etsu, Givaudan Active Beauty, Lubrizol |

| Additional Attributes | Dollar sales by chemistry, function, and application; rapid adoption in color cosmetics and sun care; expansion of hybrid dermocosmetic formulations; sustainability-driven transition toward bio-based polymers; regional growth led by India, China, and Japan; regulatory influence shaping cleaner-label innovation. |

The global Film Formers Market is estimated to be valued at USD 3,104.2 million in 2025.

The market size for the Film Formers Market is projected to reach USD 6,405.7 million by 2035.

The Film Formers Market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in the Film Formers Market are acrylic polymers, polyurethanes, cellulose derivatives, and silicone-based film formers.

In terms of function, the water/sweat resistance segment is expected to command 36.4% share in the Film Formers Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Film Wrapped Wire Market Size and Share Forecast Outlook 2025 to 2035

Film-Insulated Wire Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PC Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

PE Film Market Insights – Growth & Forecast 2024-2034

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Breaking Down PCR Films Market Share & Industry Positioning

PCR Films Market Analysis by PET, PS, PVC Through 2035

PBS Film Market Trends & Industry Growth Forecast 2024-2034

Microfilm Reader Market Size and Share Forecast Outlook 2025 to 2035

PDLC Film for Building Market Size and Share Forecast Outlook 2025 to 2035

APET Film Market Size and Share Forecast Outlook 2025 to 2035

Thin Film Coatings Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA