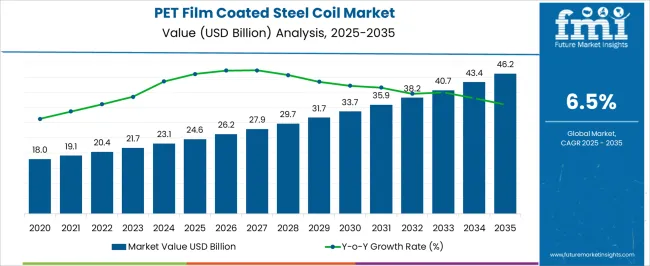

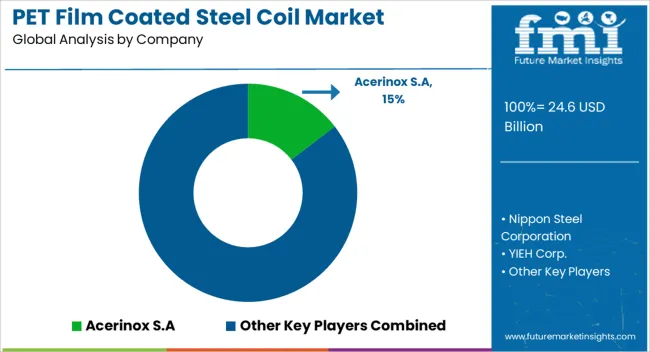

The PET film coated steel coil market is estimated to be valued at USD 24.6 billion in 2025 and is projected to reach USD 46.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

Yearly progress shows values reaching 26.2 billion in 2026 and 27.9 billion in 2027, reflecting consistent uptake across construction, consumer appliances, and packaging sectors. Analysts view this early phase as foundational, where product durability, corrosion resistance, and surface aesthetics drive steady adoption.

The block curve suggests strong mid-term resilience as manufacturers adapt to diverse application requirements. By 2028, values are projected to climb to 29.7 billion, advancing further to 31.7 billion in 2029 and 33.7 billion in 2030. This five-year block highlights compound gains of over USD 9 billion, a sign of deepening market penetration. Industry experts argue that PET film coated steel coils are increasingly regarded as cost-efficient alternatives to painted or laminated substrates due to their superior mechanical strength and protective qualities. The trajectory confirms their growing role in industrial supply chains, with incremental investments expected in production facilities and regional distribution networks to capture new demand pockets worldwide.

| Metric | Value |

|---|---|

| PET Film Coated Steel Coil Market Estimated Value in (2025 E) | USD 24.6 billion |

| PET Film Coated Steel Coil Market Forecast Value in (2035 F) | USD 46.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The PET film coated steel coil segment is estimated to hold nearly 12% of the coated steel market, about 10% of the metal packaging materials market, close to 8% of the construction and building materials market, nearly 6% of the automotive materials market, and around 7% of the industrial coatings market. Together, these figures amount to an aggregated share of approximately 43% across its parent sectors. This weight underscores the strategic value of PET film coated steel coil as a preferred solution where durability, formability, and aesthetic appeal converge. Its use has been widely established in food and beverage packaging, architectural panels, and automotive components, where corrosion resistance and design versatility are decisive.

Market specialists view this material not only as a protective layer but as a product enabler that influences how industries manage cost efficiency and product differentiation. The demand has been shaped by replacement of traditional coating systems and the preference for sustainable, high-performance alternatives that deliver both functionality and design flexibility. PET film coated steel coil is seen as indispensable in industries where packaging integrity, structural safety, and visual quality must be maintained consistently. This positioning has allowed it to evolve from being a specialty material into a competitive force within its parent markets, with its influence extending across supply chains and procurement strategies globally.

The PET film coated steel coil market is experiencing steady expansion, driven by rising demand for durable, corrosion-resistant, and aesthetically appealing materials across consumer appliance manufacturing. Industry developments and manufacturing sector reports have underscored PET-coated steel’s ability to combine mechanical strength with superior surface finish, making it a preferred choice for applications requiring both performance and visual appeal.

Advancements in coating technologies have improved UV resistance, impact strength, and color stability, broadening the product’s suitability for varied climatic conditions. Appliance manufacturers are increasingly adopting PET film coated steel to meet energy efficiency standards and extend product lifecycles, aligning with consumer preferences for long-lasting, low-maintenance goods.

Supply chain integration between steel producers and appliance OEMs has enhanced cost efficiencies and product customization capabilities. Looking forward, market growth is expected to be driven by expanding usage in high-end consumer appliances, infrastructure modernization in emerging markets, and innovations in eco-friendly coating materials that meet evolving environmental regulations.

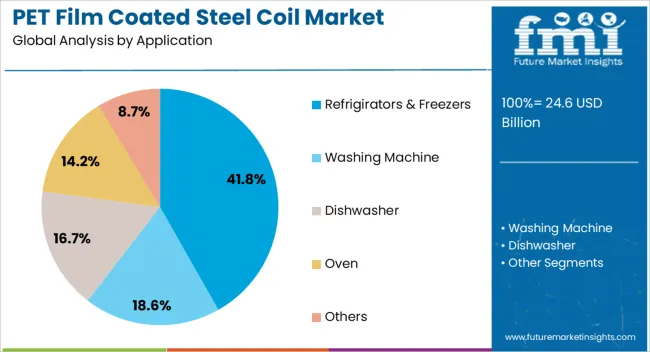

The pet film coated steel coil market is segmented by application, and geographic regions. By application, pet film coated steel coil market is divided into refrigirators & freezers, washing machine, dishwasher, oven, and others. Regionally, the pet film coated steel coil industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The refrigerators and freezers segment is projected to account for 41.80% of the PET film coated steel coil market revenue in 2025, maintaining its leadership due to the material’s proven performance in appliance manufacturing. PET film coated steel offers high resistance to moisture, stains, and chemical exposure, which is critical for maintaining appliance aesthetics and structural integrity over time.

Appliance industry reports have highlighted its role in providing design flexibility, with a wide range of colors, textures, and finishes enhancing product differentiation in competitive retail markets. Additionally, the smooth and non-porous surface of PET-coated steel supports hygiene compliance, an important factor in food storage equipment.

The material’s energy efficiency contribution, through improved insulation performance and reduced thermal bridging, has further strengthened its adoption in refrigerator and freezer production. With consumer demand for premium, durable, and stylish appliances continuing to rise globally, the refrigerators and freezers segment is expected to remain the dominant application area for PET film coated steel coils.

The PET film coated steel coil market is expected to expand as industries seek corrosion-resistant, durable, and visually appealing materials for construction, appliances, and packaging. Demand is reinforced by rising applications in roofing, wall cladding, and home appliances. Opportunities are unfolding through customized coatings, export potential, and the integration of PET films with specialty finishes. Trends highlight the move toward lightweight materials, enhanced surface aesthetics, and recyclable grades. Yet, challenges such as fluctuating raw material prices, competitive substitutes, and regional compliance norms continue to influence industry performance.

Demand for PET film coated steel coils has been reinforced by their durability, resistance to corrosion, and aesthetic appeal, making them suitable for building and appliance applications. The construction industry has leaned on these coils for roofing, wall cladding, and ceiling panels, where longevity and low maintenance are valued. Home appliance manufacturers prefer PET-coated steel for refrigerators, washing machines, and ovens, as it combines strength with decorative finishes. Opinions suggest that industries are increasingly opting for PET-coated steel coils over painted alternatives due to enhanced weather resistance and design flexibility. Packaging applications, particularly in food and beverage, have further supported demand as these materials offer strong barrier properties. This breadth of application demonstrates why PET film coated steel coils are positioned as strategic materials across multiple high-demand sectors.

Opportunities in the PET film coated steel coil market are being shaped by rising export potential and growing demand for customized product grades. Manufacturers are tapping into overseas construction and appliance markets where corrosion-resistant materials are prioritized. Customization opportunities exist in providing coils with varied finishes such as matte, high-gloss, or textured surfaces to meet aesthetic and functional needs. Opinions highlight that opportunities are strongest in developing economies where infrastructure expansion creates large-scale demand. Export-oriented production is also emerging as a growth lever for producers seeking to expand beyond saturated domestic markets. Partnerships with appliance brands and construction firms for co-developing tailored solutions offer another pathway. These opportunities underscore how diversification and differentiation are becoming essential strategies to capture long-term growth in the PET film coated steel coil sector.

Trends influencing the PET film coated steel coil market revolve around enhanced design aesthetics, lightweight construction materials, and recyclable coatings. Architects and builders are increasingly favoring PET-coated steel for projects requiring both durability and modern visual appeal. Appliance manufacturers are trending toward stylish finishes that improve consumer appeal, using PET-coated steel for sleek surfaces. Opinions suggest that recyclable PET coatings are gaining preference in markets where regulatory pressure and consumer expectations push for eco-compliant solutions. Lightweight PET-coated steel is also trending in modular construction and prefabricated housing projects, offering easier installation without compromising strength. Decorative applications in furniture and interior design have further highlighted this trend, as industries explore new uses beyond traditional segments. Collectively, these trends reflect a shift toward functionality paired with enhanced design, strengthening the long-term outlook for PET-coated steel coils.

Challenges for the PET film coated steel coil market include raw material volatility, substitute competition, and regulatory compliance. Prices of steel and PET resins fluctuate, creating cost unpredictability that pressures profit margins for manufacturers. Substitute materials such as aluminum composites and PVC-coated panels pose competitive threats, especially in price-sensitive markets. Opinions stress that regulatory compliance regarding food-grade packaging and building material standards adds complexity and increases costs for producers. Smaller manufacturers face barriers in scaling production due to high capital requirements for coating technology. Inconsistent supply chain efficiency, particularly in developing regions, further challenges timely delivery. These structural issues indicate that while PET film coated steel coils deliver performance advantages, market growth is hindered by cost instability and competitive pressures. Addressing these challenges through innovation and supply chain resilience is essential for long-term expansion.

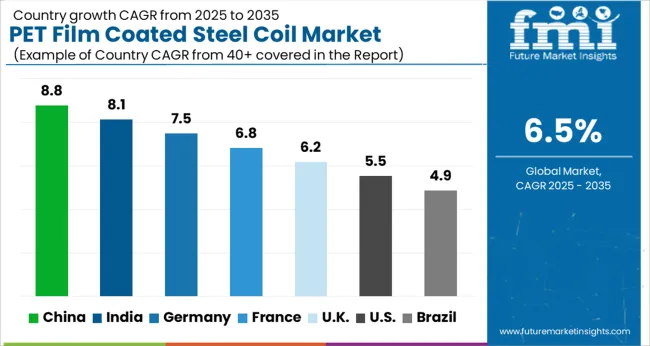

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| U.K. | 6.2% |

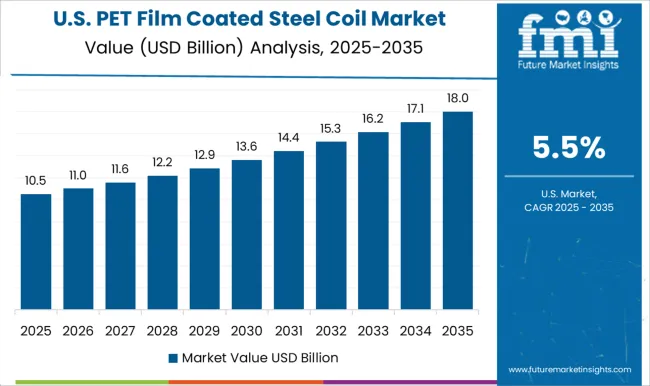

| U.S. | 5.5% |

| Brazil | 4.9% |

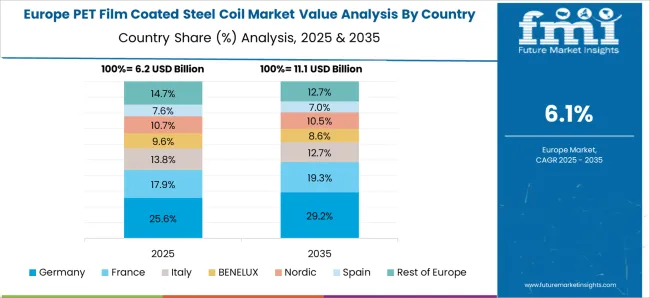

The global PET film coated steel coil market is projected to expand at a CAGR of 6.5% between 2025 and 2035. China leads with 8.8%, followed by India at 8.1% and Germany at 7.5%. The United Kingdom is expected to grow at 6.2%, while the United States records 5.5%. Growth is shaped by rising applications in construction, appliances, and packaging where PET film coating enhances corrosion resistance, aesthetics, and durability. Asian markets expand faster due to manufacturing scale and domestic demand across infrastructure and consumer goods. European markets emphasize premium quality and compliance with standards, while the U.S. reflects maturity, relying on innovation in specialized applications such as food contact safe laminates and high performance cladding solutions. This report includes insights on 40+ countries; the top markets are shown here for reference.

The PET film coated steel coil market in China is projected to grow at a CAGR of 8.8%. Expansion is fueled by construction projects, appliance manufacturing, and packaging industries adopting coated steel for its enhanced durability and design flexibility. Domestic mills scale production capacities to meet rising demand for prefabricated building components and decorative panels. Export competitiveness strengthens China’s role in global trade, supplying both standard and specialty grades. Government backed industrial initiatives and steady demand from real estate and infrastructure support long term momentum.

The PET film coated steel coil market in India is forecast to grow at a CAGR of 8.1%. Demand is propelled by growth in housing, infrastructure, and consumer appliances where corrosion resistance and decorative finishes are highly valued. Domestic manufacturers expand capacity with advanced coating lines to reduce import dependence. Government initiatives for affordable housing and smart infrastructure boost usage in construction segments. Rising middle class consumption also lifts demand for appliances and furniture, reinforcing market expansion.

The PET film coated steel coil market in Germany is projected to grow at a CAGR of 7.5%. Strong demand is supported by construction, automotive, and industrial equipment sectors where performance and aesthetics are equally important. German manufacturers emphasize high quality coatings meeting EU standards for food safety, corrosion resistance, and durability. Adoption is also driven by prefabricated modular housing projects and the packaging industry. Technological collaborations between steel producers and chemical companies strengthen product innovation and ensure long term competitiveness.

The PET film coated steel coil market in the UK is projected to expand at a CAGR of 6.2%. Growth is supported by demand from construction, retail interiors, and architectural cladding segments. UK based distributors and importers prioritize high performance coils that meet quality certifications. Demand is influenced by refurbishment projects and urban redevelopment, where decorative finishes and durability are critical. Packaging and appliance sectors also contribute, though on a smaller scale compared to construction. The market maintains moderate momentum due to established infrastructure and reliance on imports.

The PET film coated steel coil market in the US is expected to grow at a CAGR of 5.5%. Growth remains modest due to the maturity of construction and appliance markets, but opportunities exist in premium applications. Adoption is concentrated in food grade packaging, architectural cladding, and specialized construction where PET coatings ensure hygiene, corrosion resistance, and design appeal. Domestic producers focus on high performance laminates for niche sectors, while imports supplement mainstream demand. Innovation in coatings that extend durability and aesthetic options supports steady adoption, even as overall growth lags behind Asia and Europe.

Competition in PET film coated steel coil has been structured around how clearly companies position durability, aesthetics, and processing convenience in brochures. Nippon Steel and Acerinox emphasize premium coil quality, with brochures that detail corrosion resistance, UV stability, and uniform adhesion of PET layers across construction and appliance applications. YIEH Corp. and Uttam Galva Steels present product catalogues that stress coil width flexibility, color options, and embossing capability, making brochures critical for specifiers seeking architectural finishes. American Nickeloid markets decorative laminates with brochures highlighting design versatility and proven coil coating technology, while Kolor Metal positions brochures on colorfastness, warranty coverage, and eco friendly laminates.

Chinese suppliers like Jiangyin Everest, Wofeng Metallic Material, and Boxing County Fuhong compete aggressively through brochures that emphasize affordability, large order capacity, and diverse textures. Brochure content is crafted to balance engineering metrics with visual samples, giving buyers tangible evidence of finish quality. Strategy has focused on translating technical coatings into procurement friendly documentation. Brochures frequently highlight PET film thickness ranges, salt spray resistance, gloss retention, and forming behavior, making side by side comparison straightforward. Leading players back their brochures with case references in roofing, wall cladding, and household appliances, strengthening credibility. Regional competitors emphasize delivery flexibility, low minimum order quantities, and customization options directly in product literature to capture contractors and OEMs.

Success depends less on general brand recognition and more on how brochures simplify specification, warranty terms, and lifecycle cost advantages. In this market, buyers scrutinize brochures to judge durability claims, aesthetics, and application fit. Competitive edge is secured when brochures showcase tested performance metrics alongside visual design guides, enabling PET film coated steel coils to be evaluated as both a technical solution and a design choice.

| Item | Value |

|---|---|

| Quantitative Units | USD 24.6 billion |

| Application | Refrigirators & Freezers, Washing Machine, Dishwasher, Oven, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Acerinox S.A, Nippon Steel Corporation, YIEH Corp., Uttam Galva Steels Limited, Jiangyin Everest Import and Export Co., Ltd., Kolor Metal A/S, American Nickeloid Company Inc., Chongqing Youngson Metal, Jiangyin Wofeng Metallic Material Co. Ltd., and Boxing County Fuhong New Materials Co., Ltd. |

| Additional Attributes | Dollar sales by product type (matte finish, high-gloss, embossed, specialty coated), Dollar sales by application (construction, appliances, automotive, packaging, furniture), Trends in lightweight and corrosion-resistant coated steel adoption, Role of PET film in enhancing durability, aesthetics, and chemical resistance, Growth in demand from appliance manufacturing and architectural panels, Regional usage patterns across Asia Pacific, Europe, and North America. |

The global PET film coated steel coil market is estimated to be valued at USD 24.6 billion in 2025.

The market size for the PET film coated steel coil market is projected to reach USD 46.2 billion by 2035.

The PET film coated steel coil market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in PET film coated steel coil market are refrigirators & freezers, washing machine, dishwasher, oven and others.

In terms of application, the refrigerators and freezers segment is set to command 41.8% share in the PET film coated steel coil market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA