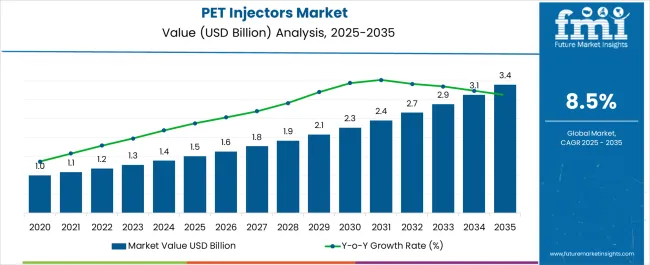

The PET Injectors Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 3.4 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

| Metric | Value |

|---|---|

| PET Injectors Market Estimated Value in (2025 E) | USD 1.5 billion |

| PET Injectors Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The PET Injectors market is witnessing steady growth, driven by the increasing prevalence of cancer and chronic diseases, which has elevated the demand for advanced diagnostic imaging. In 2025, the market is being shaped by the adoption of precise, automated systems that improve efficiency, safety, and patient throughput. Rising investment in nuclear medicine infrastructure, combined with the ongoing development of novel radiotracers, is enhancing the utility of PET injectors in clinical workflows.

The market is also benefiting from the transition from manual injection techniques to automated and software-enabled platforms, which minimize human error and reduce operational risks. Additionally, increasing awareness among healthcare providers about the importance of accurate dosing and repeatable injection protocols is influencing market expansion.

The integration of PET injectors with imaging systems is providing actionable insights for patient-specific treatment planning, particularly in oncology As healthcare systems globally continue to prioritize early disease detection and precision diagnostics, the PET Injectors market is anticipated to sustain strong growth momentum, with opportunities in automation and modality optimization supporting long-term adoption.

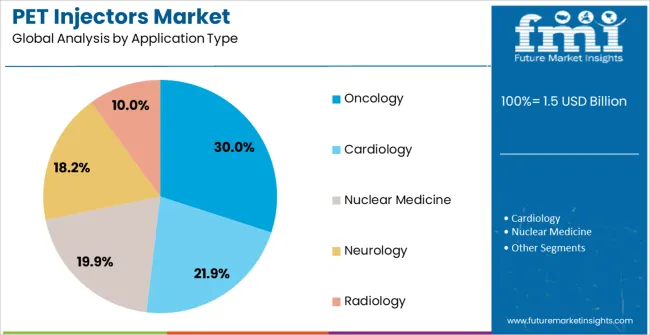

The pet injectors market is segmented by product type, modality type, application type, end user type, and geographic regions. By product type, pet injectors market is divided into Standalone PET Injectors and Portable PET Injectors. In terms of modality type, pet injectors market is classified into Automatic and Manual. Based on application type, pet injectors market is segmented into Oncology, Cardiology, Nuclear Medicine, Neurology, and Radiology. By end user type, pet injectors market is segmented into Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Home Care Settings, Research Laboratories, and Others. Regionally, the pet injectors industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Standalone PET Injectors product type is projected to hold 55.00% of the PET Injectors market revenue share in 2025, establishing it as the leading product type. This segment’s prominence is being attributed to its ability to offer flexible deployment without requiring integration into full imaging suites, which allows for streamlined operations in smaller clinics and specialized diagnostic centers. Standalone systems provide high reliability and operational independence, enabling healthcare facilities to maintain continuous service even during peak patient loads.

The growth of this segment has also been supported by the ease of calibration, improved safety features, and consistent radiotracer delivery that ensures accurate dosing and reproducible results. Additionally, standalone injectors allow rapid adoption across facilities that may not have the infrastructure for fully integrated PET/CT systems.

The combination of operational efficiency, safety, and adaptability to different clinical workflows has strengthened the position of standalone PET injectors as the preferred choice in the market As healthcare providers continue to seek scalable and cost-effective injection solutions, the segment is expected to maintain its leading revenue share.

The Automatic modality type is estimated to capture 60.00% of the PET Injectors market revenue share in 2025, making it the dominant modality in the market. This leadership is being driven by the growing demand for automation in nuclear medicine procedures to reduce manual intervention, minimize radiation exposure to staff, and improve procedural consistency. Automatic PET injectors deliver precise radiotracer dosing and timing control, which enhances diagnostic accuracy and repeatability across patient populations.

Adoption has been accelerated in high-volume hospitals and oncology centers, where patient throughput and safety considerations are critical. Moreover, the ability to integrate automatic injectors with imaging systems allows seamless workflow optimization, real-time monitoring, and compliance with strict clinical protocols.

Operational efficiency and adherence to safety regulations have made automatic injectors the preferred modality for institutions prioritizing patient-centric care and streamlined diagnostic processes As hospitals and clinics increasingly invest in automation technologies, this segment is expected to sustain its market dominance, driven by reliability, precision, and reduced operational risk.

The Oncology application type is anticipated to account for 30.00% of the PET Injectors market revenue share in 2025, establishing it as the leading application segment. This leadership is being attributed to the rising incidence of cancer worldwide, which has necessitated the use of advanced imaging techniques for early diagnosis, treatment planning, and therapy monitoring. PET injectors are being increasingly utilized to deliver radiotracers that highlight metabolic activity in tumors, enabling oncologists to tailor therapies with greater accuracy.

The growth of this segment has also been supported by clinical protocols recommending PET scans for staging, monitoring treatment response, and assessing recurrence risk. Moreover, the integration of PET injectors with imaging systems allows the precise delivery of tracers, which improves patient safety and diagnostic reliability.

As oncology treatments continue to advance and personalized medicine becomes more prevalent, the demand for PET injectors in this application is expected to remain strong Increasing awareness among healthcare providers and investments in cancer detection infrastructure are further reinforcing the segment’s leadership in the market.

Over the years, there has been substantial rise in positron emission tomography (PET) imaging procedures involving usage of PET injectors. The PET imaging technique deliver high standard functional and anatomical information, mostly in cardiology, oncology, radiology and others.

With increased usage of PET imaging systems, one could expect an increase in usage of radiopharmaceutical PET injectors in patients, starting from injecting multi-dose solution of fluorodeoxyglucose (FDG) or other radiopharmaceuticals. The market is dominated mostly by compact PET injectors that are easy to handle, with innovative designs and automated battery power support.

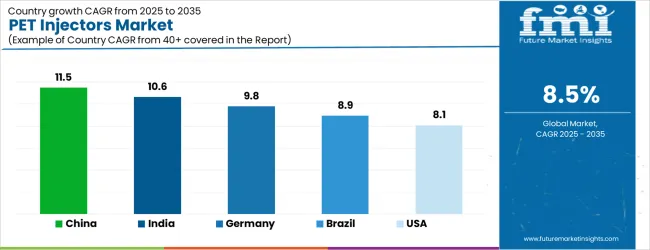

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| Brazil | 8.9% |

| USA | 8.1% |

| UK | 7.2% |

| Japan | 6.4% |

The PET Injectors Market is expected to register a CAGR of 8.5% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 11.5%, followed by India at 10.6%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 6.4%, yet still underscores a broadly positive trajectory for the global PET Injectors Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 9.8%. The USA PET Injectors Market is estimated to be valued at USD 553.7 million in 2025 and is anticipated to reach a valuation of USD 553.7 million by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 68.7 million and USD 43.1 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Product Type | Standalone PET Injectors and Portable PET Injectors |

| Modality Type | Automatic and Manual |

| Application Type | Oncology, Cardiology, Nuclear Medicine, Neurology, and Radiology |

| End User Type | Hospitals, Specialty Clinics, Ambulatory Surgical Centers, Home Care Settings, Research Laboratories, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

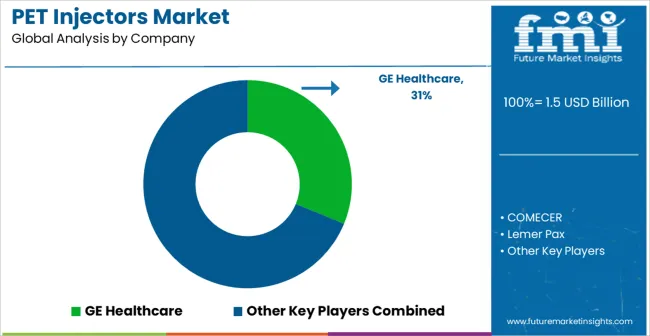

| Key Companies Profiled | GE Healthcare, COMECER, Lemer Pax, Bayer Healthcare, TEMA Sinergie, Bright Technologies, Sumitomo Heavy Industries, and Imaxeon |

The global PET injectors market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the PET injectors market is projected to reach USD 3.4 billion by 2035.

The PET injectors market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in PET injectors market are standalone PET injectors and portable PET injectors.

In terms of modality type, automatic segment to command 60.0% share in the PET injectors market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA