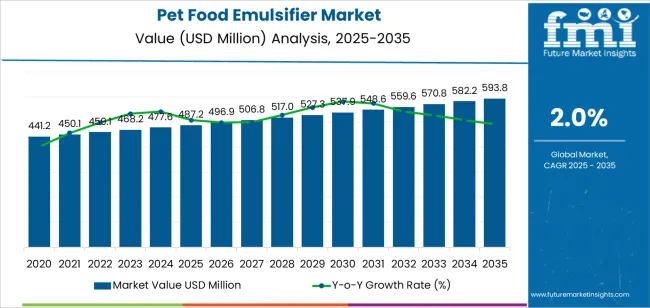

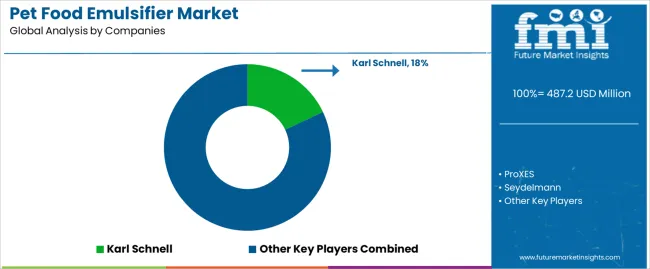

The pet food emulsifier market is valued at USD 487.2 million in 2025 and is forecasted to reach USD 593.8 million by 2035, growing at a CAGR of 2.0%. Market growth is supported by expanding pet food production, increasing focus on product texture and consistency, and rising consumer demand for premium and nutritionally balanced formulations. Emulsifiers play a critical role in ensuring uniform fat distribution, moisture retention, and stable texture in wet and semi-moist pet food products, contributing to improved palatability and shelf life.

High shear emulsifiers account for the leading market share due to their efficiency in producing fine, stable emulsions and their adaptability to high-capacity production environments. These systems are widely used in the mixing and homogenization of meat, fats, and liquid additives, ensuring consistent quality across product batches. Technological advancements in rotor-stator design, process automation, and hygienic construction are enhancing processing efficiency and compliance with food safety standards.

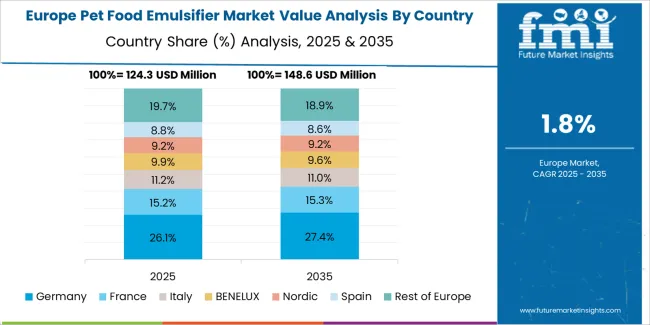

Asia Pacific leads market expansion, driven by growing pet ownership and manufacturing capacity in China and India. Europe and North America maintain stable demand through established pet food brands and a focus on clean-label production practices. Key companies include Karl Schnell, ProXES, Seydelmann, Scansteel Foodtech A/S, LASKA, Silverson, Handtmann Group, and Shanghai Yuedi Machinery Equipment Co., focusing precision mixing, process optimization, and energy efficiency.

The growth contribution index indicates that the majority of incremental expansion will stem from the processed pet food segment, driven by rising demand for consistent texture, extended shelf life, and improved nutrient dispersion. Between 2025 and 2029, wet and semi-moist formulations will account for the largest contribution to growth as manufacturers focus on maintaining product stability and palatability through controlled emulsification.

From 2030 to 2035, the growth contribution will gradually shift toward natural and plant-based emulsifiers as clean-label and ecofriendly trends gain traction. Regional contributions will remain led by North America and Europe, where established pet food manufacturers continue to refine formulations for premium and functional products. Emerging economies in Asia-Pacific will show incremental gains through expanding production capacity and pet ownership rates. The overall growth contribution index reflects a steady but concentrated market evolution, with expansion primarily driven by formulation innovation, process optimization, and gradual diversification toward environmentally responsible ingredient sourcing in the global pet food manufacturing industry.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 487.2 million |

| Market Forecast Value (2035) | USD 593.8 million |

| Forecast CAGR (2025-2035) | 2.0% |

The pet food emulsifier market is growing as manufacturers seek improved texture, stability and nutritional delivery in both dry and wet pet-food formulations. Emulsifiers support consistent fat dispersion, moisture retention and ingredient homogenisation in complex recipes such as grain-free kibble, canned wet food and treat formats. Rising pet ownership, premiumisation of pet diets and increasing demand for functional ingredients drive adoption of specialised emulsifiers tailored for digestibility, label-friendly sourcing and novel protein blends. Growth is aided by ingredient innovation such as citrus fibre, lecithin and plant-derived emulsifiers that align with clean-label and ecofriendly trends visible in pet nutrition. Regulatory focus on formulation safety and hygiene in pet-food manufacturing encourages use of trusted emulsifier systems to enhance shelf-life and reduce processing variability.

Challenges include higher cost of advanced or natural emulsifier systems, specialised formulation requirements for pet-food applications and competition from multifunctional additives that perform emulsification along with other functions. Some smaller pet-food producers may delay emulsifier upgrades due to cost sensitivities or limited awareness.

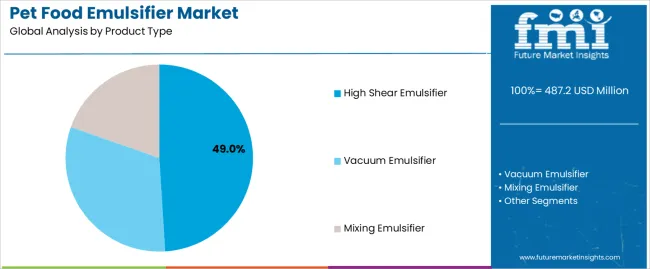

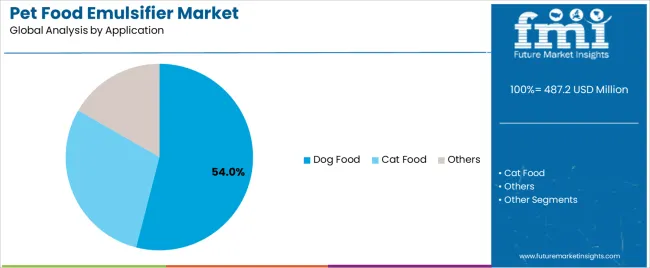

The pet food emulsifier market is segmented by product type and application. By product type, the market is divided into vacuum emulsifier, high shear emulsifier, and mixing emulsifier. Based on application, it is categorized into dog food, cat food, and others. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

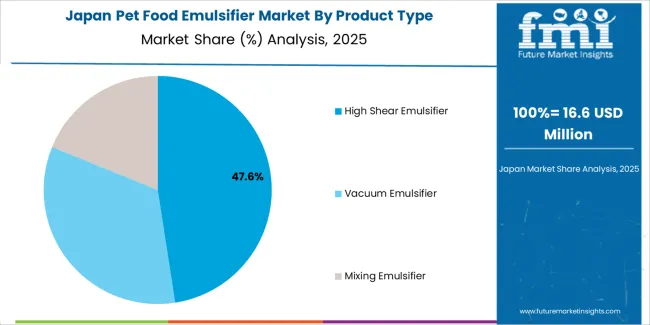

The high shear emulsifier segment holds the leading position in the pet food emulsifier market, representing an estimated 49.0% of total market share in 2025. High shear emulsifiers are widely used in pet food production due to their superior ability to disperse fats, oils, and additives uniformly, ensuring consistent texture, stability, and palatability in final formulations. Their design enables rapid homogenization of multiphase mixtures, reducing processing time and improving product quality across both dry and wet feed manufacturing lines.

This segment’s dominance is supported by its extensive adoption in large-scale pet food facilities producing high-value, protein-rich formulations for dogs and cats. The precise control over particle size and viscosity achieved by high shear systems also enhances nutrient absorption and storage stability. The vacuum emulsifier segment, estimated at 32.0%, is gaining traction for applications requiring air-free processing and improved preservation of sensitive ingredients. The mixing emulsifier category, accounting for approximately 19.0%, continues to serve small and mid-scale producers focusing cost efficiency and standard blending performance.

Key factors supporting the high shear emulsifier segment include:

The dog food segment accounts for approximately 54.0% of the pet food emulsifier market in 2025. This leadership reflects the larger global consumption of dog food products and the higher production volume of emulsified formulations in dry, wet, and semi-moist categories. Emulsifiers play a crucial role in stabilizing mixtures containing meat, fats, and water, improving digestibility and nutrient distribution in processed dog diets.

The cat food segment follows, representing an estimated 33.0% of the market, supported by the growing demand for premium and grain-free formulations where emulsifiers aid in maintaining consistency and preventing phase separation. The others category, including feed for small mammals and specialty pets, holds the remaining 13.0% share, driven by the gradual expansion of niche pet product manufacturing.

Primary dynamics driving demand from the dog food segment include:

Rising pet-food production, demand for premium textures and functional ingredients increase emulsifier usage.

The pet food emulsifier market is propelled by the growing global pet population and increased per-capita spend on premium pet-food formulations. Manufacturers are developing products with smoother texture, enhanced digestibility, and improved shelf-life, which drive usage of emulsifiers that stabilise fat and water phases. Trends toward grain-free, high-protein and wet-pet-food formats also require tailored emulsification systems to maintain product integrity and appearance. The expansion of pet-food manufacturing in emerging markets further amplifies demand for processing aids such as emulsifiers in both dry and semi-moist pet-food segments.

High raw-material cost, clean-label pressures and regulatory scrutiny limit market acceleration.

Emulsifier production often relies on specialty raw materials and advanced processing, driving cost premiums that may hinder adoption in value-sensitive pet-food segments. Growing consumer demand for clean-label and minimal-additive pet-foods creates pressure to substitute traditional emulsifiers with natural or minimally processed alternatives, which can reduce performance or raise reformulation cost. Regional regulatory variations in pet-food additive approvals and labelling requirements add complexity to scale adoption globally and delay product launch timelines.

Development of natural and bio-based emulsifiers, regional manufacturing growth and integration into functional pet-food systems shape market direction.

Manufacturers are increasingly introducing emulsifiers derived from plant-based phospholipids, lecithin and enzyme-modified starches to meet clean-label pet-food demand. Pet-food processing capacity growth in Asia-Pacific and Latin America is creating local demand for emulsifier supply and formulation support. There is a movement toward multifunctional additives, emulsifiers that also deliver fat-oxidation protection, improved mouth-feel or nutritional delivery in pet-foods, reflecting the convergence of processing aid and functional ingredient roles in the pet-food sector.

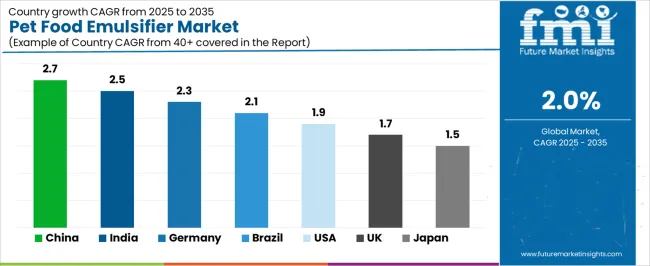

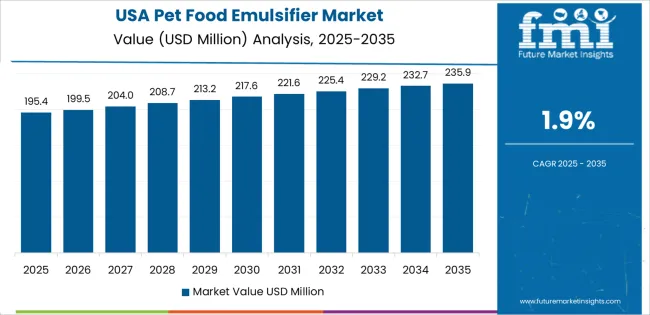

The global pet food emulsifier market is expanding moderately through 2035, supported by pet population growth, rising processed feed production, and technological improvements in ingredient blending. China leads with a 2.7% CAGR, followed by India at 2.5%, reflecting rising pet ownership and industrial feed manufacturing. Germany grows at 2.3%, driven by regulatory compliance and product safety standards. Brazil records 2.1%, supported by processed pet food exports and ingredient innovation. The United States posts 1.9%, driven by product diversification and clean-label trends, while the United Kingdom (1.7%) and Japan (1.5%) maintain steady market growth through premium formulation development and R&D-driven ingredient enhancement.

| Country | CAGR (%) |

|---|---|

| China | 2.7 |

| India | 2.5 |

| Germany | 2.3 |

| Brazil | 2.1 |

| USA | 1.9 |

| UK | 1.7 |

| Japan | 1.5 |

China’s market grows at 2.7% CAGR, driven by rising demand for processed and premium pet food, particularly among urban consumers. Domestic manufacturers are improving emulsifier formulations for moisture retention, texture consistency, and fat distribution. The growth of pet food processing plants supports higher adoption of lecithin and mono-diglyceride-based emulsifiers. Expansion in export-oriented feed production and technological advancements in blending equipment strengthen domestic supply capability. Regulatory improvements under the Feed Quality and Safety Supervision Regulation reinforce product standardization and quality control in ingredient manufacturing.

Key Market Factors:

India’s market grows at 2.5% CAGR, supported by expanding pet care awareness, manufacturing capacity, and demand for high-quality formulations. Local producers are incorporating emulsifiers in dry and wet pet food to enhance texture uniformity and ingredient blending. The Make in India program encourages domestic manufacturing of feed additives, reducing reliance on imports. Increasing disposable income and retail expansion in tier-two cities are boosting demand for processed and nutritionally balanced pet foods. The industry’s transition toward organized production ensures higher adoption of functional emulsifiers for moisture retention and product stability.

Market Development Factors:

Germany’s market grows at 2.3% CAGR, supported by advanced feed technology, strict quality regulations, and high pet ownership rates. Manufacturers use plant-derived emulsifiers to meet clean-label and ecofriendly requirements. Compliance with EU Feed Hygiene Regulation (EC No. 183/2005) ensures product safety and traceability. R&D initiatives focus on optimizing lecithin blends and enzyme-assisted emulsifier systems for enhanced digestibility. The country’s strong premium pet food segment continues to drive demand for high-functionality ingredients designed to improve nutrient absorption and processing efficiency.

Key Market Characteristics:

Brazil’s market grows at 2.1% CAGR, supported by domestic pet food expansion, agribusiness strength, and export growth. Local producers are incorporating emulsifiers into meat-based and grain-inclusive feed formulations to improve stability and uniform mixing. The Agro 4.0 initiative promotes feed manufacturing automation and ingredient optimization. Growing export activity to Latin American and European markets drives compliance with international feed standards. Collaboration between feed processors and ingredient suppliers supports development of high-performing emulsifier systems suitable for humid environments and extended storage conditions.

Market Development Factors:

The United States grows at 1.9% CAGR, reflecting maturity in pet food manufacturing and a shift toward clean-label and functional formulations. Manufacturers are using lecithin, mono-diglycerides, and polysorbates to stabilize fat and protein blends in wet and semi-moist foods. The Food Safety Modernization Act (FSMA) enforces strict ingredient traceability and hygiene controls. Consumer demand for natural emulsifiers derived from soy and sunflower sources continues to rise. Product differentiation in texture, mouthfeel, and moisture control remains a key competitive factor among leading pet food brands.

Key Market Factors:

The United Kingdom’s market grows at 1.7% CAGR, supported by demand for premium pet food, ingredient transparency, and formulation innovation. Domestic producers are focusing sustainable, plant-based emulsifiers suitable for both wet and dry feed applications. Compliance with Feed Hygiene Regulation (EC No. 183/2005) and local quality standards ensures market consistency. The rise in online pet food retail channels supports private-label brand expansion, further increasing additive adoption. Investment in ingredient R&D and ecofriendly supply chains aligns with national food technology objectives.

Market Development Factors:

Japan’s market grows at 1.5% CAGR, reflecting steady demand in a mature, highly regulated pet food industry. Manufacturers focus on precision formulation using emulsifiers to maintain texture uniformity and moisture balance in small-batch production. Importers supply specialized emulsifiers for high-moisture and grain-free diets. The Food Sanitation Act and Feed Safety Law ensure high ingredient quality and labeling compliance. Growth in premium pet food brands focusing digestibility and palatability supports incremental adoption of multifunctional emulsifiers.

Key Market Characteristics:

The pet food emulsifier market is moderately consolidated, comprising approximately ten key manufacturers specializing in food processing and homogenization equipment for wet and semi-moist pet food production. Karl Schnell leads the market with an estimated 18.0% global share, supported by its advanced emulsification systems, precision engineering, and consistent supply to industrial pet food processors in Europe and North America. Its leadership is reinforced by durable machinery design, hygienic construction standards, and compatibility with continuous processing lines.

ProXES, Seydelmann, and Scansteel Foodtech A/S follow as major competitors, focusing on high-shear emulsifying and grinding systems designed for uniform fat, protein dispersion. Their competitive advantage lies in energy-efficient designs, automated control systems, and flexibility for diverse product viscosities. LASKA and Silverson maintain mid-tier positions through expertise in rotor, stator mixing and modular equipment adaptable to both human and animal food processing lines.

Chinese and Asian manufacturers such as Shanghai Yuedi Machinery Equipment, Wuxi YK Automation Technology, and Shanghai H-Plus Machinery compete through cost efficiency, shorter delivery cycles, and rapid customization for regional producers. Ding-Han Machinery Co., Ltd. strengthens market diversity with compact emulsifying solutions suitable for small to mid-scale operations.

Competition in this market centers on emulsion stability, throughput capacity, and sanitary design, with manufacturers prioritizing equipment reliability, ease of maintenance, and compliance with feed safety regulations. Growth is driven by rising demand for premium pet food formulations requiring consistent texture, nutritional uniformity, and production efficiency across global processing facilities.

| Items | Values |

|---|---|

| Quantitative Units | USD million |

| Product Type | Vacuum Emulsifier, High Shear Emulsifier, Mixing Emulsifier |

| Application | Dog Food, Cat Food, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | India, China, USA, Germany, South Korea, Japan, Italy, and 40+ countries |

| Key Companies Profiled | Karl Schnell, ProXES, Seydelmann, Scansteel Foodtech A/S, LASKA, Silverson, Handtmann Group, Shanghai Yuedi Machinery Equipment Co., Ltd., Wuxi YK Automation Technology Co., Ltd., Shanghai H-Plus Machinery Co., Ltd., Ding-Han Machinery Co., Ltd. |

| Additional Attributes | Dollar sales by product type and application categories; regional adoption trends across Asia Pacific, Europe, and North America; competitive landscape of emulsifier and food processing equipment manufacturers; advancements in high-shear and vacuum emulsification technologies; integration with automated pet food production and formulation systems. |

The global pet food emulsifier market is estimated to be valued at USD 487.2 million in 2025.

The market size for the pet food emulsifier market is projected to reach USD 593.8 million by 2035.

The pet food emulsifier market is expected to grow at a 2.0% CAGR between 2025 and 2035.

The key product types in pet food emulsifier market are high shear emulsifier, vacuum emulsifier and mixing emulsifier.

In terms of application, dog food segment to command 54.0% share in the pet food emulsifier market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA