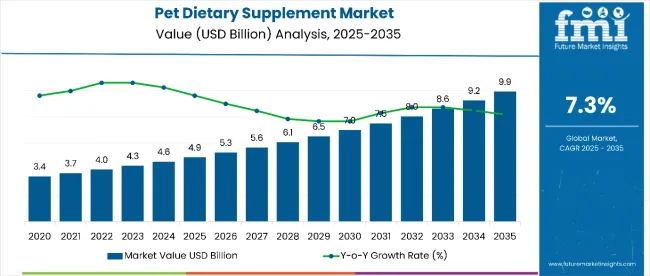

The pet dietary supplement market is estimated to be valued at USD 4.9 billion in 2025 and is projected to reach USD 9.9 billion by 2035, registering a CAGR of 7.3% over the forecast period. The market is projected to add an absolute dollar opportunity of USD 5.0 billion over the forecast period.

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 4.9 billion |

| Market Forecast Value in (2035F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

This reflects a 2x growth at a compound annual growth rate of 7.3%. By 2030, the market is expected to reach USD 6.9 billion, marking a significant milestone in its growth trajectory.

The markets evolution is expected to be shaped by rising pet humanization trends, increasing awareness of preventive pet healthcare, and growing availability of specialized supplements targeting conditions like joint health, digestive health, and skin and coat improvement. Demand will be particularly strong in premium and functional formulations supported by veterinarian recommendations and e-commerce accessibility. Additionally, sustained innovation in probiotic blends and omega-3 formulations is anticipated to widen product appeal across diverse pet health needs.

By 2030, the market is likely to reach approximately USD 6.9 billion, accounting for USD 2.0 billion in incremental value over the first half of the decade. This represents an absolute growth of USD 5.0 billion between 2025 and 2035. The remaining USD 3.0 billion is expected during the second half, suggesting a balanced yet steadily accelerating growth pattern. Product innovation around probiotics, omega-3 fatty acids, and condition-specific formulations is gaining traction, driven by increasing disposable incomes of pet owners and the shift toward holistic pet wellness.

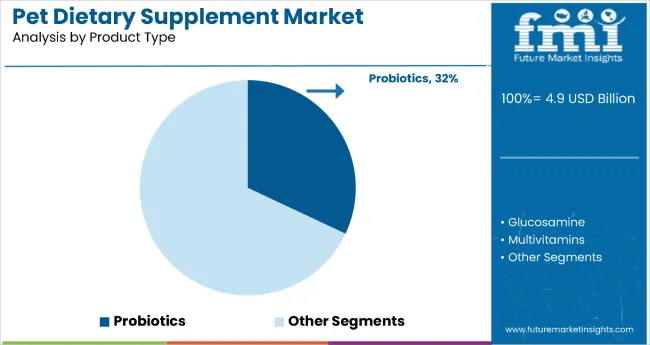

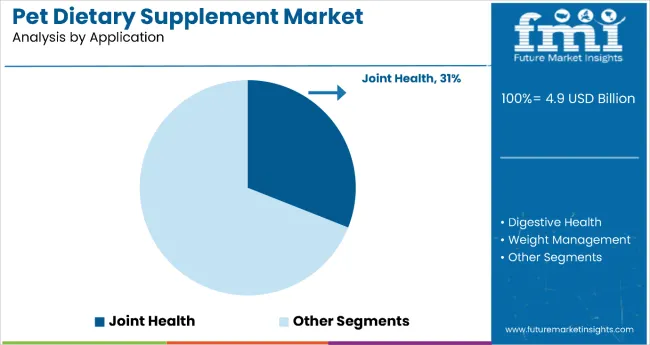

The market holds a significant position in the global pet wellness industry, driven by rising awareness of preventive health care for pets and the growing trend of pet humanization. It accounts for around 32% of the probiotic-based pet supplement segment, supported by its strong role in improving digestive health and immunity in companion animals. The market contributes nearly 31% to the joint health supplement segment for pets, reflecting demand for mobility-supporting formulations among aging pets. It holds close to 28% of the omega-3 fatty acid-based pet supplements segment, where these products are valued for promoting healthy skin and coat. The share in the premium pet supplement market reaches about 30%, fueled by consumer willingness to invest in specialized, vet-recommended, and high-quality formulations.

The market is undergoing structural change driven by increasing pet adoption rates, expansion of e-commerce distribution, and a shift toward natural, functional, and condition-specific products. Innovation in formulations particularly probiotics, glucosamine, and omega-3 blends combined with advanced delivery formats such as chews, powders, and liquid supplements is enhancing palatability and absorption. Manufacturers are also investing in veterinarian partnerships, premium branding, and targeted marketing to capture health-conscious pet owners seeking holistic solutions for their animals.

Pet dietary supplements’ proven benefits in supporting joint health, digestive function, skin and coat condition, and overall immunity make them a preferred choice for pet owners seeking preventive healthcare solutions.

Rising awareness of pet wellness and the humanization of pets are driving adoption, particularly for premium, vet-recommended, and functional formulations such as probiotics, glucosamine, and omega-3 blends. The shift toward clean-label, natural ingredients and innovations in supplement delivery formats, like chews, powders, and liquid concentrates are enhancing palatability, absorption, and convenience.

As global pet ownership expands and consumer spending on companion animal health continues to rise, the market outlook remains strong. With manufacturers and pet owners prioritizing efficacy, safety, and holistic well-being, pet dietary supplements are well-positioned to see sustained growth across diverse product categories and distribution channels.

The market is segmented by product type, application, and region. By product type, the market is divided into glucosamine, probiotics, multivitamins, omega-3 fatty acids, and others (herbal extracts, amino acids, minerals, and specialty pet nutrients). Based on application, the market is segmented into joint health, digestive health, weight management, skin and coat health, and dental care. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Probiotics are the most lucrative product type in the market, accounting for 32% of total market share in 2025. Their strong demand is driven by proven benefits in digestive health, nutrient absorption, and immune system support key priorities for pet owners concerned with preventive care. Probiotics cater to pets across all life stages, from puppies and kittens to senior animals, making them highly versatile. Advancements in microencapsulation technology ensure probiotic strains survive the acidic environment of the stomach, improving efficacy and expanding format options such as soft chews, powders, and liquid additives.

The segment benefits from high repeat purchase rates due to daily dosing needs and strong veterinarian endorsements, particularly for pets with gastrointestinal issues, allergies, or stress-related digestive disturbances. Positioned as a natural, clean-label alternative to pharmaceutical interventions, probiotics enjoy premium pricing, healthy profit margins, and growing adoption through both offline veterinary channels and online retail platforms.

Joint health is the most lucrative application segment, holding 31% share of the market in 2025. This dominance is fueled by the rising prevalence of osteoarthritis, hip dysplasia, and age-related mobility issues in pets conditions particularly common in large-breed dogs and aging cats. Owners increasingly adopt preventive supplementation for younger pets to delay joint deterioration, boosting long-term demand. Popular ingredients in this segment include glucosamine, chondroitin, MSM, collagen peptides, and omega-3 fatty acids, often formulated in combination for synergistic effects.

The market benefits from strong veterinary endorsement, as joint supplements are frequently recommended alongside weight management programs and physical therapy. The segment is further supported by palatable formats such as chews, treats, and flavored powders, encouraging consistent dosing. With an aging global pet population and heightened awareness of quality-of-life improvements, joint health supplements are expected to remain a high-margin, high-loyalty category with above-average repeat purchase rates.

From 2025 to 2035, pet care brands increasingly adopt science-backed formulations to improve efficacy, palatability, and targeted health outcomes for companion animals. This shift positions supplement manufacturers offering clinically validated, veterinarian-recommended products as key partners in supporting the next generation of pet wellness solutions.

Rising Pet Humanization Drives Pet Dietary Supplement Market Growth

The steady increase in global pet ownership, coupled with the humanization of pets, is identified as the primary catalyst for growth in the pet dietary supplement market. In 2024, heightened consumer awareness of preventive pet healthcare prompted leading brands to introduce specialized formulations addressing digestive health, joint support, skin and coat enhancement, and weight management. By 2025, demand was particularly strong for clean-label, natural-ingredient supplements aligned with holistic pet wellness trends.

These developments indicate that long-term lifestyle changes among pet owners, rather than short-term fads, drive purchasing patterns. Manufacturers providing premium, clinically supported supplements with proven safety and efficacy are well-positioned to capture sustained consumer loyalty.

Advanced Formulation and Delivery Innovation Creates Market Expansion Opportunity

In 2024, manufacturers began integrating innovative delivery formats such as soft chews, flavored powders, and liquid concentrates into product lines to improve compliance and dosing accuracy. By 2025, probiotic and omega-3 formulations featuring enhanced bioavailability and targeted release mechanisms were being incorporated into premium supplement ranges, enabling measurable improvements in pet health outcomes.

These advancements demonstrate that when cutting-edge delivery technologies are paired with high-quality, condition-specific formulations, both product performance and owner satisfaction are significantly enhanced. Brands that invest in palatability research, functional ingredient synergy, and clinical trials are gaining a competitive edge, offering superior products that strengthen veterinarian trust and drive repeat purchases.

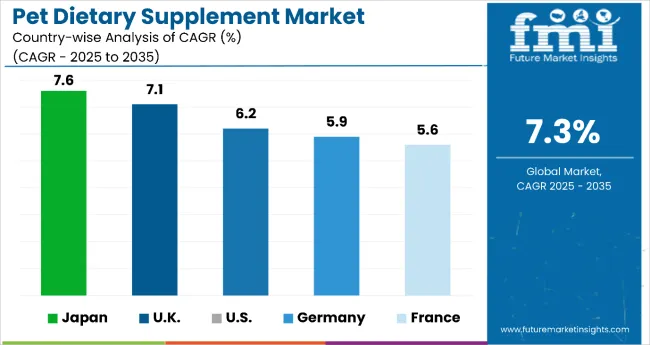

| Countries | CAGR |

|---|---|

| Japan | 7.6% |

| UK | 7.1% |

| USA | 6.2% |

| Germany | 5.9% |

| France | 5.6% |

Japan leads with the highest projected CAGR of 7.6%, driven by its aging pet population and premiumization trends. The UK follows closely at 7.1%, with organic and eco-friendly supplements gaining traction. The USA, at 6.2% CAGR, benefits from its large pet base and advanced nutraceutical infrastructure, with innovations in personalized nutrition. Germany posts a solid 5.9% CAGR, propelled by demand for high-quality, natural formulations under stringent quality standards. France, while slightly lower at 5.6% CAGR, shows strong momentum in herbal and plant-based offerings aligned with holistic wellness preferences.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

Pet dietary supplement market in Japan is projected to grow at a CAGR of 7.6% from 2025 to 2035, driven by a rising aging pet population and strong consumer preference for premium health supplements. Japan’s market has witnessed steady production capacity growth, supported by rising awareness among pet owners about preventive healthcare. The country’s rapidly aging pet population, particularly among dogs and cats, is driving demand for glucosamine, probiotics, and multivitamins.

Manufacturers are expanding specialized production lines to cater to small-batch, high-quality supplements that align with Japan’s stringent safety regulations. Technological innovation in formulation especially chewable tablets and functional treats is further enhancing market penetration. Domestic players are integrating human-grade ingredients to meet premium consumer expectations. The government’s veterinary health initiatives and rising disposable incomes are enabling more households to opt for preventive care products.

Sales of pet dietary supplements in the UK are expected to witness a CAGR of 7.1% during the forecast period, supported by heightened awareness of preventive pet healthcare. The United Kingdom’s pet dietary supplement market is undergoing notable output expansion, supported by surging demand for natural and functional health products for pets. Local producers are scaling manufacturing lines to cater to the growing popularity of probiotics and omega-3 fatty acids for digestive and skin health.

Consumer awareness of pet wellness, amplified by veterinary recommendations and social media campaigns, is driving product diversification. Investments in automated packaging and small-batch formulation facilities are increasing efficiency while maintaining product quality. Premiumization is evident, with rising demand for grain-free, allergen-free, and organic supplements.

Sales of pet dietary supplements in the USA will expand at a CAGR of 6.2% from 2025 to 2035, fueled by a large pet-owning population and an established nutraceutical industry. The USA remains a structural powerhouse in the pet dietary supplement sector, driven by an expansive domestic manufacturing base and evolving consumer priorities. Production capacity is being bolstered by the increasing adoption of preventive pet healthcare, particularly for joint and digestive health.

Companies are introducing advanced formulations such as soft chews, liquid additives, and breed-specific blends to cater to diverse market needs. Strategic acquisitions and partnerships with veterinary networks are enabling deeper market penetration. Automation and sustainability initiatives are reshaping production facilities, with an emphasis on recyclable packaging and clean-label ingredients. The growth of online subscription models is creating steady demand streams, encouraging sustained capacity utilization.

Revenue from pet dietary supplements in Germany will grow at a CAGR of 5.9% in the coming period, driven by a rising trend of treating pets as family members and prioritizing preventive healthcare. Germany’s pet dietary supplement market is witnessing robust capacity growth, supported by its strong pet ownership culture and emphasis on high-quality nutrition. Manufacturers are expanding facilities to meet increasing demand for products targeting joint, coat, and digestive health.

The market is influenced by Germany’s stringent quality control standards, pushing producers toward natural, certified, and allergen-free formulations. Investments in R&D are enabling the creation of innovative formats, such as functional snacks and liquid supplements. The veterinary channel remains a vital distribution route, offering specialized recommendations to health-conscious owners.

Demand for pet dietary supplement in France is forecasted to grow at a CAGR of 5.6% from 2025 to 2035, backed by a steady increase in pet ownership and awareness of holistic pet wellness. Domestic brands are focusing on herbal and plant-based supplements, aligning with the country’s broader preference for natural health solutions. Joint health, skin and coat, and digestive formulas remain the most sought-after categories.

Manufacturers are upgrading facilities to meet EU safety and labeling standards while also experimenting with innovative delivery formats like powdered mixes and functional chews. Partnerships between supplement makers and veterinary clinics are expanding awareness and adoption. The growth of specialized pet stores and online platforms is increasing product accessibility, especially for premium lines.

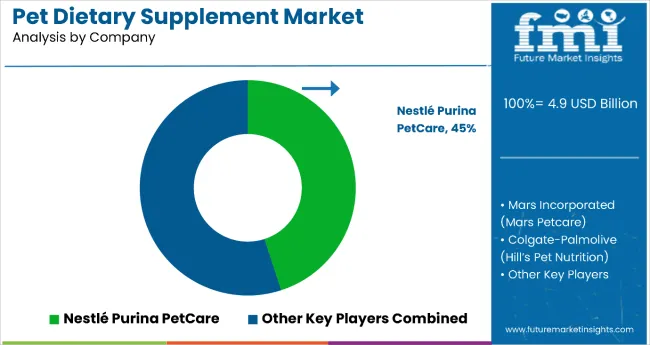

The market is moderately consolidated, with a mix of global pet care giants and specialized nutraceutical manufacturers offering diverse product portfolios across multiple health categories. Nestlé Purina PetCare leads the market with a 45% share, leveraging its extensive distribution network, strong brand loyalty, and wide range of formulations targeting joint, digestive, and skin health. Its strength lies in scientifically backed product lines and global marketing reach.

Mars Incorporated (Mars Petcare) maintains a strong position with diversified supplement offerings integrated into its established pet food brands, supported by strategic acquisitions and R&D investments. Colgate-Palmolive’s Hill’s Pet Nutrition focuses on veterinary-recommended formulations, providing high-trust solutions tailored to specific pet health needs.

Regional specialists and niche brands are increasingly gaining ground by introducing innovative formats such as soft chews, liquid drops, and functional treats, often targeting single-health benefits. Entry barriers remain substantial, driven by stringent regulatory frameworks, the need for clinical validation, and consumer demand for transparency in ingredient sourcing.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.9 Billion |

| Product Type | Probiotics, Glucosamine, Multivitamins, Omega-3 Fatty Acids, Others (including herbal extracts, minerals, and specialty blends) |

| Application | Joint Health, Digestive Health, Weight Management, Skin and Coat Health, Dental Care |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Country Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Nestlé SA, Mars Incorporated, NOW Foods, Blue Buffalo Co. Ltd., Ark Naturals, Virbac, Novotech Nutraceuticals Inc., Zoetis, PetAg Inc., VetClassics, GNC |

| Additional Attributes | Dollar sales by product type and application sector; rising pet humanization trends; increasing demand for targeted health supplements in aging pets; growing online retail penetration; premiumization and functional ingredient innovation; stringent safety and quality regulations driving trusted brand dominance |

The global pet dietary supplement market is estimated to be valued at USD 4.9 billion in 2025.

The market size for the pet dietary supplement market is projected to reach USD 9.6 billion by 2035.

The pet dietary supplement market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in pet dietary supplement market are multivitamins, glucosamine, probiotics, omega-3 fatty acids and others (herbal extracts, minerals, and specialty blends).

In terms of application, joint health segment to command 29.4% share in the pet dietary supplement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Industry Share Analysis for Pet Dietary Supplement Companies

UK Pet Dietary Supplement Market Growth – Trends, Demand & Forecast 2025-2035

USA Pet Dietary Supplement Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Pet Dietary Supplement Market Report – Demand, Growth & Trends 2025-2035

Europe Pet Dietary Supplement Market Trends – Growth, Demand & Outlook 2025-2035

Australia Pet Dietary Supplement Market Analysis – Size, Share & Forecast 2025-2035

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dietary Supplement Market Insights - Growth & Demand 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Market Outlook of Omega-3 Pet Supplement by Pet, Type, Form, Application and Other Types Through 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Korea Dietary Supplements Market Analysis by Ingredients, Form, Application, and Region Through 2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA