The ASEAN Pet Dietary Supplement market is set to grow from an estimated USD 82.5 million in 2025 to USD 257.2 million by 2035, with a compound annual growth rate (CAGR) of 12% during the forecast period.

| Attributes | Value |

|---|---|

| Estimated ASEAN Industry Size (2025E) | USD 82.5 million |

| Projected ASEAN Value ( 2035F) | USD 257.2 million |

| Value-based CAGR ( 2025 to 2035) | 12% |

The ASEAN (Association of Southeast Asian Nations) pet dietary supplement market shows remarkable growth because pet owners grow while incomes increase and owners understand better how essential it is to support pet health and nutrition. Multiple pet-owning households across the region now seek quality dietary supplements because more families acquired pets primarily including dogs and cats. Increasing levels of pet owner awareness about pet health has resulted in a market transformation towards prophylactic care measures and wellness products. Social media together with online platforms act as main contributors to this industry trend because they enable pet owners to disseminate beneficial information about caring for pets and their nutrition.

A wide variety of dietary supplements including vitamins and minerals plus probiotics and herbal preparations define the pet supplement market across ASEAN nations. Market demand has increased for natural over organic products because consumers want clean-label products without artificial additives. Pet owners who focus on humanizing their pets now seek premium dietary solutions that address their pets' health requirements.

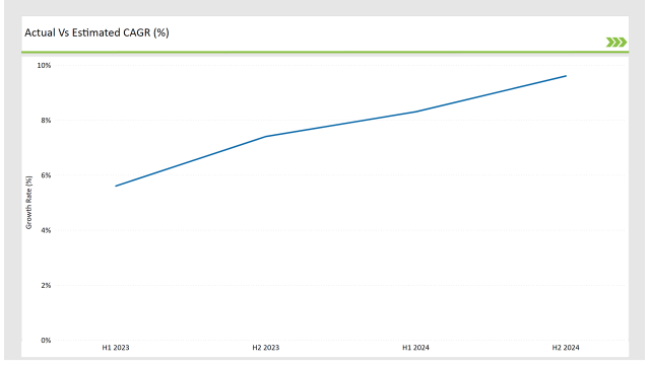

The table below provides a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the ASEAN Pet Dietary Supplement market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies the period from January to June, and H2 Signifies the period from July to December.

For the ASEAN Pet Dietary Supplement market, the sector is predicted to grow at a CAGR of 5.6% during the first half of 2024, increasing to 7.4% in the second half of the same year. In 2024, the growth rate is expected to decrease slightly to 8.3% in H1 but is expected to rise to 9.3% in H2.

This pattern reveals a decrease of 20 basis points from the first half of 2024 to the first half of 2025, followed by an increase of 20 basis points in the second half of 2025 compared to the second half of 2024.

| Date | Development/M&A Activity & Details |

|---|---|

| 2024 | Launch of a new line of organic pet supplements by XYZ Company, focusing on holistic health. |

| 2024 | Introduction of a subscription-based model for pet dietary supplements by ABC Pet Care, enhancing customer loyalty. |

| 2025 | The partnership between DEF Supplements and a leading veterinary clinic to promote joint health products. |

| 2025 | Expansion of GHI Pet Products into the ASEAN market, introducing a range of probiotics for pets. |

Rise of Natural and Organic Supplements

The pet dietary supplement industry is now showing extensive movement toward more natural and organic product choices. Pet owners today focus on understanding their pets' food ingredients, so they choose supplements that contain no artificial components, chemical additives, or industrial processing residues, the same way they would for human supplements. Natural products gain popularity as pet owners discover their health benefits and want clear ingredient information on product labels.

Pet owners increasingly choose natural supplement options featuring herbal remedies together with omega-3 fatty acids and probiotics because these help improve their pets' complete health status. Pet population treatment as members of human families increases consumer demand because of the growing humanization trend.

The pet owner demographic shows increased interest in purchasing expensive, organic products that help their pets live longer and healthier lives.

Growth of E-commerce in Pet Supplement Sales

E-commerce expansion created revolutionary changes in how pet dietary supplement businesses sell their products in the ASEAN region. Since internet connectivity and smartphone usage have risen steadily pet owners select online platforms to care for their pets. Through e-commerce, consumers gain both convenience and access to a larger variety of products at better prices than conventional physical stores.

Pet owners are using specialized pet e-commerce websites alongside online marketplaces to obtain their pet dietary supplements. Consumers benefit from these platforms which combine product details with customer reviews and straightforward brand access to help them make knowledgeable purchase choices. Online shopping gained accelerated growth through the COVID-19 pandemic because consumers selected this option to reduce their exposure to crowded markets.

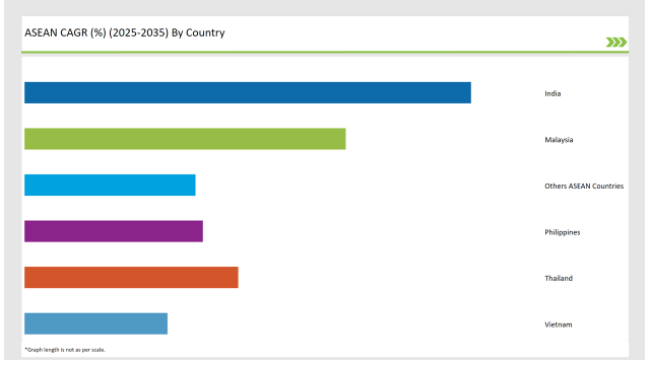

The following table shows the estimated growth rates of the top four markets. These countries are set to exhibit high consumption, recording high CAGRs through 2035.

The pet dietary supplement business sector in India is expanding rapidly because of various market dynamics. The expansion of pet ownership rates specifically within city areas along with rising suburban owner numbers creates a growing demand for products that assist pet well-being.

The expanding trend of pet adoption creates new awareness about pet welfare demands that lead owners to invest in dietary supplements for their pets. People who have pets are eager to buy premium products that guarantee enhanced pet wellness.

In India, the pet humanization trend grows stronger as more pet owners start treating their pets as part of their family unit. The market's evolution has generated stronger interest in preventive animal wellness so owners now commonly seek supplements to boost their pet's wellness.

The pet dietary supplement business sector in India is expanding rapidly because of various market dynamics. The expansion of pet ownership rates specifically within city areas along with rising suburban owner numbers creates a growing demand for products that assist pet well-being. The expanding trend of pet adoption creates new awareness about pet welfare demands that lead owners to invest in dietary supplements for their pets.

The market keeps expanding because Indian pet owners have more disposable cash along with modifications to their modern lifestyles. People who have pets are eager to buy premium products that guarantee enhanced pet wellness.

In India, the pet humanization trend grows stronger as more pet owners start treating their pets as part of their family unit. The market's evolution has generated stronger interest in preventive animal wellness so owners now commonly seek supplements to boost their pet's wellness.

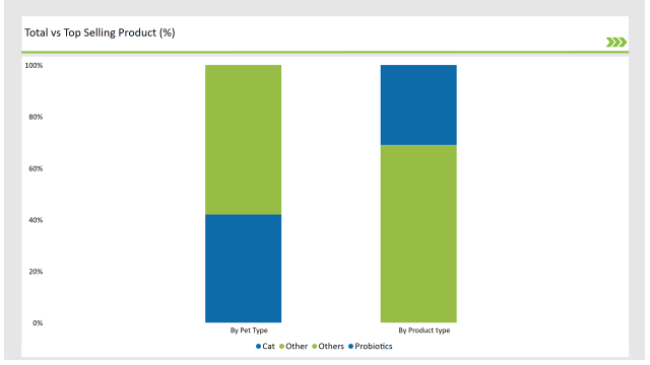

Probiotics are emerging as a dominant segment in the pet dietary supplement market, accounting for a significant share of the market. These beneficial bacteria are known to support digestive health, enhance immune function, and improve overall well-being in pets. As pet owners become more aware of the importance of gut health, the demand for probiotic supplements is on the rise.

The increasing prevalence of digestive issues in pets, such as diarrhea and constipation, has further fueled the demand for probiotic products. Pet owners are seeking effective solutions to address these concerns, leading to a growing interest in probiotic formulations. Additionally, the trend of humanization of pets has prompted owners to seek high-quality, science-backed products that promote their pets' health.

Chewable supplements are gaining popularity in the pet dietary supplement market, particularly among pet owners looking for convenient and palatable options for their pets. These supplements are designed to be easily consumed by pets, making them an attractive choice for pet owners who may struggle to administer pills or powders.

Chewable supplements often come in flavors that appeal to pets, such as chicken, beef, or peanut butter, making them more enticing for pets to consume. This palatability is crucial, as it encourages regular use and adherence to supplementation routines.

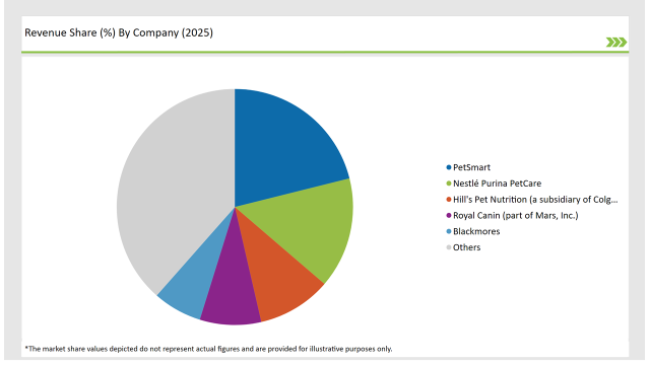

2025 Market Share of ASEAN Pet Dietary Supplement Manufacturers

Note: The above chart is indicative

The rising demand for pet health products drives an expanding number of competitors into the competitive pet dietary supplement market. Both existing market participants and new competitors direct their efforts toward creating innovative products while differentiating their offerings through strategic marketing programs to grow their market positions.

As per Pet Type, the industry has been categorized into, Birds, and Others.

As a Product Type, the industry has been categorized into Product Type: Glucosamine, Probiotics, Multivitamins, Omega 3 fatty acids, and others

As an Application, the industry has been categorized into Joint Health, Digestive Health, Weight Management, Skin and Coat Health, Dental Care, and Others.

Industry analysis has been carried out in key countries of India, Malaysia, Thailand, Philippines, Vietnam, and other ASEAN Countries.

The ASEAN Pet Dietary Supplement market is projected to grow at a CAGR of 12% from 2025 to 2035.

By 2035, the market is expected to reach an estimated value of USD 257.2 million.

India are key Country with high consumption rates in the ASEAN Pet Dietary Supplement market.

Leading manufacturers include Nestlé Purina PetCare, Hill's Pet Nutrition (a subsidiary of Colgate-Palmolive), Royal Canin (part of Mars, Inc.), Blackmores, and NutraPet the key players in the ASEAN market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Pet Dietary Supplement Companies

UK Pet Dietary Supplement Market Growth – Trends, Demand & Forecast 2025-2035

USA Pet Dietary Supplement Market Insights – Size, Share & Industry Growth 2025-2035

Europe Pet Dietary Supplement Market Trends – Growth, Demand & Outlook 2025-2035

Australia Pet Dietary Supplement Market Analysis – Size, Share & Forecast 2025-2035

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

ASEAN PET Preform Market Outlook – Share, Growth & Forecast 2025-2035

Dietary Supplement Market Insights - Growth & Demand 2025 to 2035

Dietary Supplements Packaging Market Analysis – Trends & Forecast 2025-2035

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Probiotic Supplements Market Trends – Growth, Demand & Forecast 2025-2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

ASEAN Postbiotic Pet Food Market Analysis – Demand, Growth & Forecast 2025-2035

ASEAN Plant-Based Pet Food Market Insights – Demand, Size & Industry Trends 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA