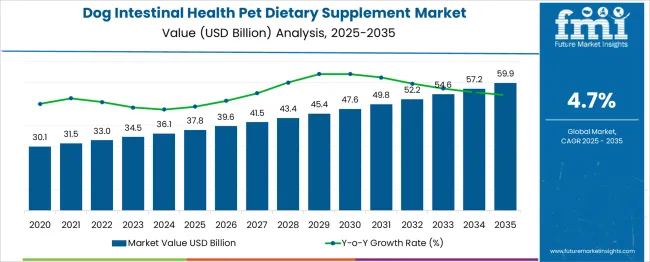

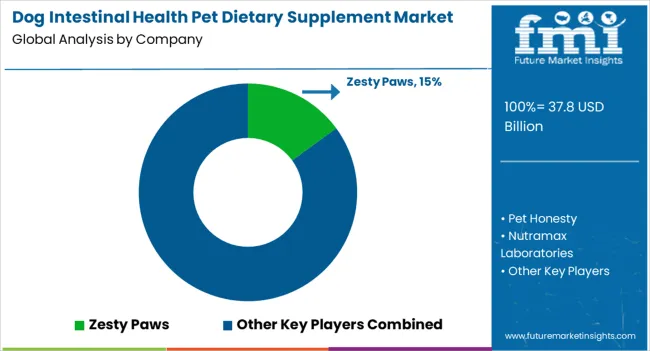

The dog intestinal health pet dietary supplement market is estimated to be valued at USD 37.8 billion in 2025 and is projected to reach USD 59.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.7% over the forecast period. Annual value additions range from USD 1.7 billion to USD 2.7 billion, with the smallest increment between 2025 and 2026 and the highest between 2034 and 2035. The average yearly gain is approximately USD 2.2 billion. Fluctuations remain narrow across the timeline, indicating limited deviation from the growth baseline. This consistency places the market in a low-volatility range based on absolute year-on-year change. The growth rate volatility index, calculated using the standard deviation of annual increments against the mean, confirms minor variance over the forecast period. Demand appears to be driven by steady product adoption, regular pet healthcare routines, and repeat purchasing behavior rather than reactive or seasonal spikes.

Structural factors such as increased focus on preventive digestive health and expanding product accessibility through online and in-store retail have contributed to this stability. The low volatility environment supports multi-year investment cycles and long-term brand planning, particularly for suppliers emphasizing ingredient quality, formulation stability, and consumer education in the pet health segment.

| Metric | Value |

|---|---|

| Dog Intestinal Health Pet Dietary Supplement Market Estimated Value in (2025 E) | USD 37.8 billion |

| Dog Intestinal Health Pet Dietary Supplement Market Forecast Value in (2035 F) | USD 59.9 billion |

| Forecast CAGR (2025 to 2035) | 4.7% |

Supplements for canine intestinal health account for about 70% of the broader pet digestive health supplements segment, being the dominant therapeutic niche in gut wellness. Within the entire pet dietary supplements market, they represent roughly 25–30%, as digestion-focused products make up a significant portion of overall supplement use. In the more specific probiotics and prebiotics shop, they hold around 15–20%, driven by rising dog owner demand for multi-strain formulations and prebiotic fibers. As part of the general pet health and wellness supplements category, intestinal health products contribute 10–15%, falling behind joint, skin and immunity supplements. Against the massive pet food and nutrition market, they comprise only 1–2%, since core revenues lie in daily food rather than specialized supplements. The market is expanding rapidly as demand increases for digestive support products tailored to gut wellness. Major leaders include Mars Petcare, Hill’s Pet Nutrition, Nestlé Purina, Virbac, Elanco, Vetoquinol, Ark Naturals, Nutritional Veterinary Care, and Wellness Pet Company. Top companies focus on multi-strain probiotic and prebiotic blends, natural and organic ingredient sourcing, and chewable treats for easier pet compliance. Personalized nutrition models are emerging with subscription-based channels and direct-to-consumer formats offering tailored formulations. Brands invest in expanding veterinary and retail distribution networks across North America, Europe, and Asia Pacific. Consumer emphasis on microbiome balance drives product innovation in powder drops, capsules, and immunostimulant combinations. Regulatory ambiguity remains a challenge but growing education and DTC transparency strengthen trust in the category.

The Dog Intestinal Health Pet Dietary Supplement market is demonstrating strong growth momentum, supported by rising awareness of canine gut health and its direct correlation with immunity, mood regulation, and overall well-being. Pet owners are increasingly prioritizing preventive healthcare, resulting in higher demand for targeted digestive supplements. Industry dynamics are also being shaped by the growing premiumization trend in the pet nutrition sector, along with expanded veterinary endorsements of gastrointestinal support formulations.

Manufacturers are focusing on clean-label, functional ingredients with proven benefits, aligning with shifting consumer preferences for natural and science-backed products. Additionally, online and specialty retail distribution channels are contributing to broader access and consumer education.

The future outlook for this market remains optimistic, with ongoing product innovation, improved palatability formats, and research-driven marketing expected to reinforce long-term adoption. As companion animal lifespans increase and the role of pets within households continues to evolve, digestive health supplements are anticipated to remain a critical category within pet wellness portfolios..

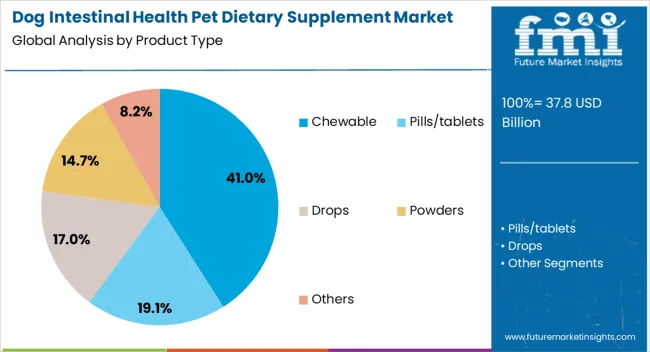

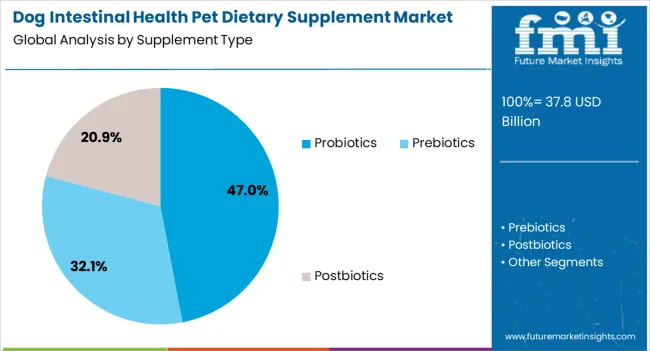

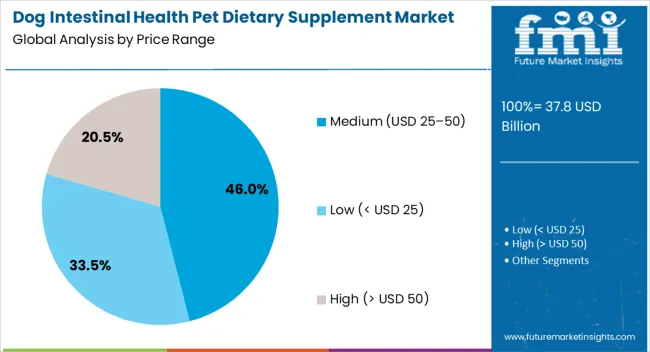

The dog intestinal health pet dietary supplement market is segmented by product type, supplement type, price range, application, distribution channel, and geographic regions. By product type, the dog intestinal health pet dietary supplement market is divided into Chewable. In terms of supplement type, the dog intestinal health pet dietary supplement market is classified into Probiotics, Prebiotics, Postbiotics, Immunostimulants, Phytogenic, and Butyric acid. Based on the price range of the dog intestinal health pet dietary supplement market, it is segmented into Medium (USD 25–50), Low (< USD 25), and High (> USD 50). By application, the dog intestinal health pet dietary supplement market is segmented into Digestive health. The distribution channel of the dog intestinal health pet dietary supplement market is segmented into Online and Offline. Regionally, the dog intestinal health pet dietary supplement industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The chewable segment is projected to account for 41% of the Dog Intestinal Health Pet Dietary Supplement market revenue share in 2025, positioning it as the leading product type. Growth in this segment has been supported by improved palatability and ease of administration, which contribute to higher compliance among pets and convenience for owners. Chewable supplements have been developed to resemble treats, encouraging daily consumption without the stress associated with pill-based products.

Formulation flexibility has also enabled the inclusion of active compounds such as probiotics, prebiotics, and digestive enzymes in an appealing format. Veterinary professionals have increasingly recommended chewable products due to their efficacy and ease of administration.

As consumers seek both functional and enjoyable health solutions for their pets, chewable formats have successfully addressed this dual demand. Enhanced shelf stability, flavor variety, and targeted digestive benefits have further strengthened the position of chewables within the broader intestinal health segment of canine supplements..

The probiotics segment is expected to hold 47% of the Dog Intestinal Health Pet Dietary Supplement market revenue share in 2025, emerging as the dominant supplement type. Its leadership position has been reinforced by extensive clinical validation of probiotics’ role in supporting gut flora balance, immune modulation, and digestive function. Pet owners have increasingly recognized probiotics as a core element of daily preventive health regimens for dogs, especially in managing gastrointestinal sensitivities, irregular stool patterns, and dietary transitions.

Product innovation has enabled stable probiotic strains to be incorporated into various delivery formats, maintaining efficacy throughout storage and digestion. Veterinary endorsements and educational outreach from manufacturers have further contributed to consumer confidence in probiotics as a primary digestive aid.

Regulatory approval of specific strains and growing interest in microbiome research have also played a role in expanding market acceptance. As demand continues for natural, non-pharmaceutical approaches to gastrointestinal wellness, probiotics are expected to remain the cornerstone of supplement strategies within this segment..

The medium price range segment, defined as products priced between USD 25 and 50, is projected to contribute 46% of the Dog Intestinal Health Pet Dietary Supplement market revenue share in 2025, making it the leading pricing tier. This segment's dominance has been driven by its balance between perceived quality and affordability, appealing to a broad consumer base seeking trusted yet accessible solutions. Products within this price band have consistently offered value through clinically supported ingredients, moderate dosage durations, and reliable brand recognition.

Pet owners have shown a willingness to invest in digestive health products when they perceive tangible health benefits, particularly in formats supported by veterinary guidance. Additionally, medium-priced supplements have often included premium features such as grain-free, non-GMO, or organic certifications without commanding the highest price tags.

Retailers have responded by prioritizing this tier in both brick-and-mortar and online listings, reinforcing its availability and visibility. As consumer expectations evolve, the medium price range continues to capture sustained demand by delivering both performance and accessibility..

Growth in canine digestive supplements has been driven by increased pet owner awareness of gut health and wellness. Probiotic‑based products represented over 42 % of total intestinal supplement sales in 2024. Senior dogs made up about 34 % of the market consumer base, showing a strong preference for fiber‑rich and digestive enzyme blends. Veterinarian guidance was influential in 56 % of purchase decisions within urban clinics. Subscription models for monthly probiotic refills accounted for 28 % of online revenue. Chewables and powder formats improved dosing accuracy and user compliance in households with busy pets and mobility-challenged owners.

Owners interest in maintaining healthy canine digestive systems has led many to seek supplements for routine wellness. Veterinarians in clinics began recommending combination formulations during 45 % of consultations involving digestive or immune‑support concerns. Senior dog populations, representing nearly 32 % of pet demographics in developed markets, showed elevated demand for postbiotic and prebiotic support. Visible improvements in stool consistency and activity levels reported through user feedback enhanced confidence in product efficacy. Subscription packages featuring consistent dosing reminders and bundled shipping contributed to 41 % retention among urban pet owners. Social and influencer content that highlighted digestive health stories further accelerated market penetration and brand trust.

Advanced probiotic strains such as Bifidobacterium and Saccharomycetes added to retail prices, causing average product cost to rise by 22 % over simpler single-strain formulas. Stability losses during transport and storage resulted in approximately 8 % of product units showing reduced viability upon delivery. Inconsistent regulations across regions forced formulation adjustments, leading to dual-label variants in 17 % of global brands. Digestive upset occurred in 5 % of pets when higher colony-forming units were administered without titration periods. Manufacturers incurred extra compliance-related costs in ensuring ingredient transparency and cross-border label accuracy.

Tailored gut-health formulations combining probiotics, prebiotics, and digestive enzymes have appealed to breed-specific or age-specific needs. Clinically validated blends that reduce flatulence or lower stool pH aligned with veterinary testing protocols and have been adopted in 26 % of new product categories. Postbiotic and enzyme combinations recorded higher retention rates among pet owners with food-sensitive dogs. Pilot programs in canine clinics deploying gut-microbiome tests with postbiotic follow-up supplements boosted repeat orders. Cold-chain logistics and lyophilization improved stability in tropical climates. Private-label partnerships with veterinary networks and diagnostic labs contributed to higher brand credibility and better recommendation rates.

Chewable tablets captured 41 % of intestinal supplement sales owing to ease of administration and flavor masking. Clean label and natural ingredients, such as chicory root, pumpkin fiber, and inulin, are featured on 55 % of new product packaging. DTC platforms offering refill subscriptions and delivery reminders reached 28 % of online buyers. QR codes linking to microbiome education and batch tracking appeared on 23 % of packages. Seasonal “digestive reset” kits combining hydration blends and supplements accounted for 31 % trial conversions among new users. Regional ingredient preferences—such as pumpkin in North America and chicory in Europe—reflected cultural trust and influenced repeat purchase rates.

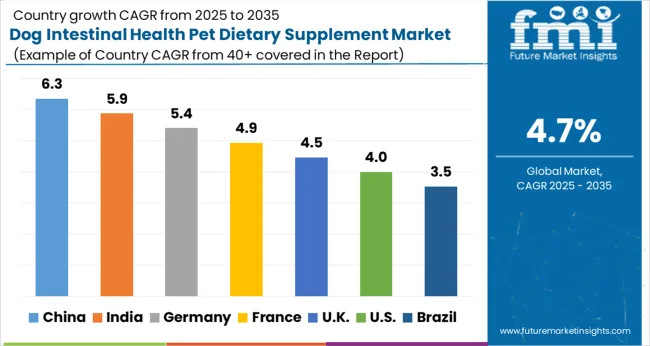

| Country | CAGR |

|---|---|

| China | 6.3% |

| India | 5.9% |

| Germany | 5.4% |

| France | 4.9% |

| UK | 4.5% |

| USA | 4.0% |

| Brazil | 3.5% |

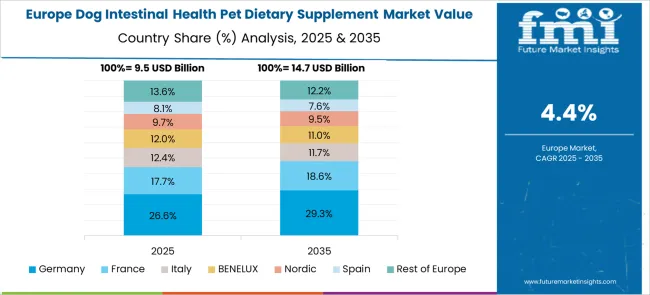

The global dog intestinal health pet dietary supplement market is expected to grow at a CAGR of 4.7% from 2025 to 2035. China is advancing at 6.3%, translating to 1.34x the global rate, driven by expanded veterinary care networks and urban pet ownership trends. India follows at 5.9% (1.26x), where higher awareness of gut-specific supplements is influencing purchasing behavior in metro regions. Germany (OECD) grows at 5.4%, or 1.15x, as demand rises for functional supplements in the premium pet segment. The United Kingdom (OECD) is slightly below the global average at 4.5% (0.96x), amid moderate product penetration outside urban centers. The United States (OECD) expands at 4.0%, equal to 0.85x, limited by fragmented distribution and low adoption in non-veterinary retail channels. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference.

China held 6.3% of global demand in 2025. Pet owners in Shanghai, Shenzhen, and Guangzhou prioritized digestive formulations containing Bacillus coagulans and Lactobacillus acidophilus. Rising cases of canine diarrhea and flatulence drove clinical trials involving multi-strain synbiotics. Domestic brands adopted ingredient traceability on e-commerce platforms to build trust. Sales skewed toward chewable and freeze-dried formats with verified prebiotic and enzyme content. Distribution expanded through veterinary hospitals integrating diagnostic tools for gut flora imbalance detection.

India accounted for 5.9% of global market share in 2025. Functional ingredients like papain and fennel extract were used to address enzyme insufficiency in desi and cross-breed dogs. Veterinary practitioners in Bengaluru, Pune, and Delhi adopted digestive enzyme pastes and powders for rescue and fostered animals. Domestic companies reformulated supplements for improved shelf life in humid zones. Pricing played a decisive role in uptake, especially for products under ₹300 per bottle.

Germany represented 5.4% of global demand in 2025. Demand focused on non-GMO, additive-free formulations compliant with Regulation (EC) No 767/2009 for feed supplements. Gut health supplements were marketed with organic certification and featured clean-label prebiotics like chicory and Jerusalem artichoke. Owners of shepherds and retrievers prioritized digestion aids for gluten sensitivity and age-related enzyme decline. Veterinary distributors bundled microbiome mapping services with gut relief capsules.

The United Kingdom accounted for 4.5% of global share in 2025. Targeted formulations addressed breed-specific digestive issues in Cavaliers, Bulldogs, and Retrievers. Digestive soft chews with charcoal, psyllium husk, and marshmallow root were introduced. Subscription models with dosing protocols based on weight and breed were preferred in cities like Manchester and London. Growth was linked to gut health products promoted via veterinary influencer campaigns on TikTok and Instagram.

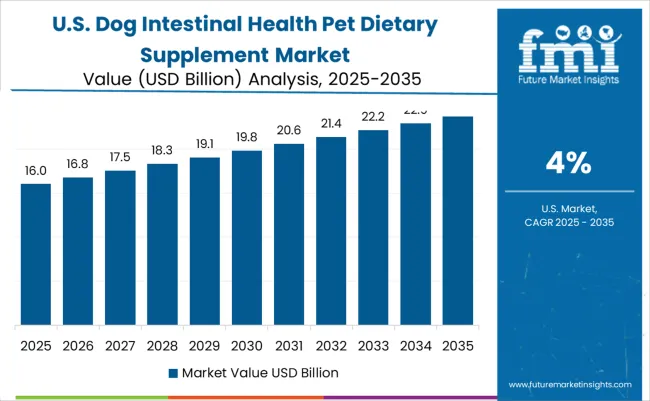

The United States accounted for 4.0% of global market in 2025. Products combining digestive enzymes, fiber blends, and probiotic strains dominated sales. Brands included added postbiotics for long-term GI tract balance. Sales were concentrated in pet specialty retail and through online platforms like Chewy and Amazon. Canine allergies and food sensitivities prompted demand for gluten-free, soy-free, and dairy-free digestive health formulas, particularly for Labradors and Pitbulls.

The dog intestinal health pet dietary supplement market is shaped by companies offering probiotics, digestive enzymes, and fiber-based formulations targeting gut balance, nutrient absorption, and stool quality. Zesty Paws leads with functional soft chews featuring branded probiotics such as DE111® and BC30™, marketed for daily digestive support. Pet Honesty delivers gut health supplements combining prebiotics, pumpkin, and enzyme blends, emphasizing natural ingredients and vet-formulated claims. Nutramax Laboratories offers the Proviable® product line, widely used in clinical settings to manage acute gastrointestinal disturbances and support recovery during antibiotic therapy.

Zesty Paws updated its probiotic soft chew formulas for gut health, but received mixed feedback due to ingredient changes in senior-specific lines. Pet Honesty expanded its digestive product line and scaled digital advertising to strengthen its direct-to-consumer footprint. Nutramax Laboratories extended its probiotic blends with clinically supported fiber combinations, reinforcing its presence in vet-recommended supplements. VetriScience maintained its focus on science-backed formulas for immune and digestive support. NaturVet emphasized herbal and enzyme blends for natural gut balance, while Ark Naturals advanced its organic probiotic offerings. Nestlé Purina incorporated intestinal health into functional snacks and soft chews, using its broad veterinary and retail network for market reach. Brands continue to differentiate through multi-strain formulations, vet endorsements, and personalized nutrition for breed and age-specific gut health concerns.

| Item | Value |

|---|---|

| Quantitative Units | USD 37.8 Billion |

| Product Type | Chewable |

| Supplement Type | Probiotics, Prebiotics, Postbiotics, Immunostimulants, Phytogenic, and Butyric acid |

| Price Range | Medium (USD 25–50), Low (< USD 25), and High (> USD 50) |

| Application | Digestive health |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zesty Paws, Pet Honesty, Nutramax Laboratories, VetriScience, Nestlé Purina, NaturVet, and Ark Naturals |

| Additional Attributes | Dollar sales by format (powder, chewable, liquid) and application (probiotics, digestive enzymes, prebiotics), demand across pet owners, veterinary clinics, and online retail, regional trends led by Asia Pacific with North America catching up, innovation in shelf stable formulations and microbiome targeted blends, and environmental impact through reduced food waste, improved animal wellness outcomes, and cleaner ingredient sourcing. |

The global dog intestinal health pet dietary supplement market is estimated to be valued at USD 37.8 billion in 2025.

The market size for the dog intestinal health pet dietary supplement market is projected to reach USD 59.9 billion by 2035.

The dog intestinal health pet dietary supplement market is expected to grow at a 4.7% CAGR between 2025 and 2035.

The key product types in dog intestinal health pet dietary supplement market are chewable, _pills/tablets, _drops, _powders and _others.

In terms of supplement type, probiotics segment to command 47.0% share in the dog intestinal health pet dietary supplement market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dog Treat Launcher Market Size and Share Forecast Outlook 2025 to 2035

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

Dog Training Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dog Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Dog Food Market Analysis - Size, Share, and Forecast 2025 to 2035

Dog Food and Snacks Market Size and Share Forecast Outlook 2025 to 2035

Dog Float Market Size and Share Forecast Outlook 2025 to 2035

Dog Gates, Doors, & Pens Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Safety Leash Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Collars Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Dental Chews Market Analysis by Product Type, Age, Flavor, Application and Sales Channel Through 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Competitive Overview of Dog Gates, Doors and Pens Companies

Dog Food Topper Market Analysis - Size, Share, and Forecast 2024 to 2034

Dog Food Flavours Market

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Dog Dewormers Market - Growth & Demand 2025 to 2035

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Cat and Dog Food Topper Market Insights – Pet Nutrition & Industry Expansion 2024-2034

Aortic Endografts Industry Analysis by Product, Procedure, Material, End Users and Regions 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA