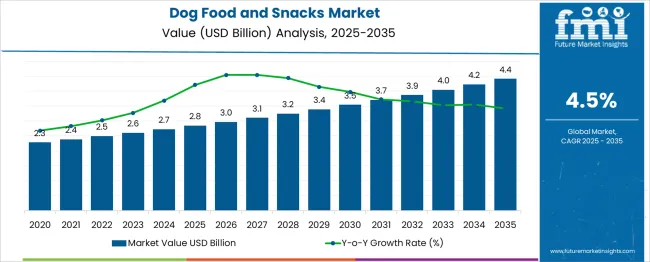

The Dog Food and Snacks Market is estimated to be valued at USD 2.8 billion in 2025 and is projected to reach USD 4.4 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period. This steady growth shows sustained consumer spending on pet nutrition and the increasing humanization of pets, driving demand for premium and specialty dog food products.

By 2030, the market is projected to grow to USD 3.5 billion, yielding a five-year absolute increase of USD 0.7 billion, accounting for nearly 44% of the total value growth forecasted through 2035. Year-on-year growth during this period remains consistent, with incremental annual increases of approximately USD 0.1 to 0.2 billion. This expansion is primarily fueled by rising pet ownership in urban areas, increasing disposable incomes, and a growing preference for organic, grain-free, and functional dog food formulations.

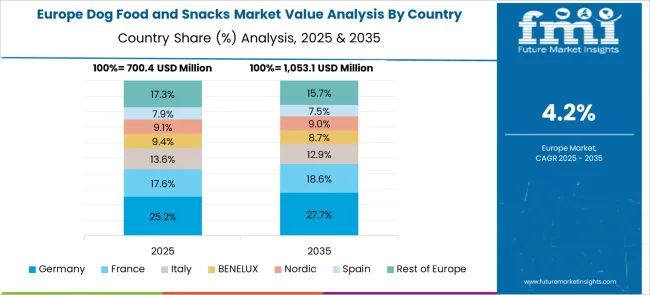

The market’s value growth is further supported by innovations in packaging, enhanced flavors, and nutritionally enriched snacks that cater to specific dietary needs. North America and Europe continue to dominate market share, while emerging markets in Asia-Pacific are witnessing accelerated adoption driven by evolving pet care trends. The dog food and snacks segment remains poised for steady and predictable growth aligned with broader pet wellness trends globally.

| Metric | Value |

|---|---|

| Dog Food and Snacks Market Estimated Value in (2025 E) | USD 2.8 billion |

| Dog Food and Snacks Market Forecast Value in (2035 F) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

Several core parent segments shape the dog food and snacks market, each contributing distinct shares based on feeding habits, nutrition focus, and purchase patterns. The largest contributor is dry dog food, holding around 38–42% of the total market. This category includes kibble formulations tailored for different breeds, sizes, and life stages, favored for convenience, shelf stability, and cost-effectiveness.

Wet or canned dog food follows with a share of approximately 25–28%, offering higher moisture content and palatability, often positioned for premium or specialized diets. Dog treats and snacks account for about 18–20%, driven by demand for functional chews, training rewards, and indulgent snacks, with growing emphasis on natural and grain-free variants.

The frozen and refrigerated dog food segment contributes roughly 5–7%, benefiting from rising adoption of raw and minimally processed diets. Veterinary-prescribed or therapeutic dog food represents another 4–5%, targeted at managing health conditions such as allergies, joint issues, and weight control. Remaining niche categories, including dehydrated, freeze-dried, and home-delivered fresh meals, collectively add about 3–4%.

The dog food and snacks market is undergoing substantial evolution, shaped by shifting consumer attitudes toward pet health, nutrition, and well-being. The increasing preference for high-quality, nutrient-dense formulations has fueled innovation in both dry and wet food categories, particularly among urban pet owners who are seeking convenience without compromising on nutritional value.

The growing awareness of specific dietary needs for different breeds, life stages, and health conditions is fostering a demand surge for scientifically formulated and functional food products. Additionally, the expansion of organized retail, e-commerce penetration, and direct-to-consumer pet food models has made premium offerings more accessible.

The market is also being influenced by sustainability trends, with brands incorporating clean labels, traceable sourcing, and eco-conscious packaging. Future growth is expected to be reinforced by ongoing product diversification, strategic partnerships in the veterinary and nutraceutical segments, and digital engagement strategies that emphasize transparency, ingredient sourcing, and personalized nutrition planning for dogs across geographies.

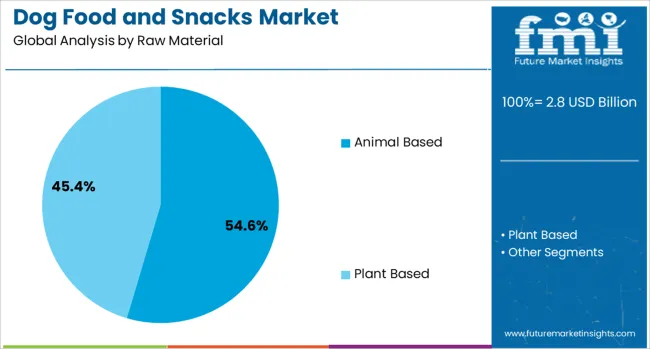

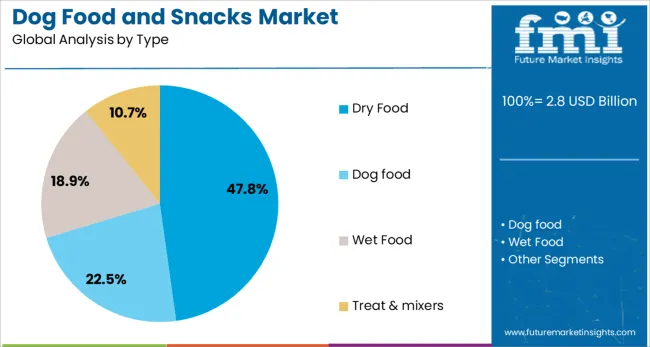

The dog food and snacks market is segmented by raw material, type, product, cost category, distribution channel, and geographic regions. The raw materials of the dog food and snacks market are divided into animal-based and plant-based. In terms of the type of dog food and snacks, the market is classified into Dry Food, Wet Food, and Treats & Mixers.

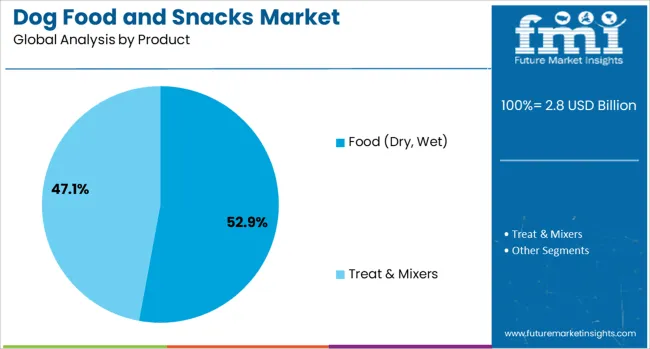

The dog food and snacks market is segmented into Food (Dry, Wet) and Treat & Mixers. The dog food and snacks market is segmented by cost category into Premium Pet Food and Bulk Pet Food. The dog food and snacks market is segmented by distribution channel into Supermarkets/Hypermarkets, Specialized Pet Food Shops, Online, and Others.

Regionally, the dog food and snacks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The animal-based raw material segment is expected to hold 54.6% of the overall dog food and snacks market revenue share in 2025, marking it as the dominant source of formulation. This segment's leading position is driven by the high digestibility, bioavailability, and amino acid profile offered by animal proteins, which are essential for canine growth, muscle maintenance, and overall health.

Animal-based ingredients have been favored due to their alignment with the natural carnivorous tendencies of dogs, resulting in enhanced palatability and higher nutrient absorption. The preference for real meat, organ inclusions, and meat meals has been further supported by rising consumer scrutiny toward ingredient authenticity.

Additionally, the increasing availability of premium variants with novel proteins such as duck, lamb, and salmon has supported diversification within the animal-based category. The capacity of these ingredients to support functional benefits such as skin health, coat shine, and joint mobility has made animal-based raw materials the primary choice for health-conscious pet owners seeking tailored dietary solutions.

The dry food segment is projected to account for 47.8% of the dog food and snacks market revenue share in 2025, maintaining its role as the most consumed type. This leadership is attributed to its longer shelf life, ease of storage, and affordability, which make it suitable for daily feeding routines across varied income groups.

Dry formulations are widely adopted due to their dental benefits, as the kibble texture helps reduce plaque and tartar buildup in dogs. The format's cost efficiency and compatibility with automated feeders and portion control mechanisms have supported its continued use among busy pet owners.

Manufacturers have leveraged advances in extrusion and coating technologies to enhance flavor profiles, nutritional content, and digestibility, leading to stronger brand loyalty and repeat purchases. The segment’s broad distribution across retail, veterinary clinics, and e-commerce platforms, coupled with targeted marketing campaigns promoting health claims and breed-specific needs, has further bolstered its widespread adoption across global markets.

The food segment, including both dry and wet varieties, is anticipated to contribute 52.9% of the dog food and snacks market revenue share in 2025, indicating its central position in consumer preferences. This dominance is a result of sustained demand for nutritionally balanced meals tailored to specific life stages, activity levels, and health goals.

Both dry and wet food formats have been widely adopted due to their convenience, portion accuracy, and alignment with veterinary dietary recommendations. The inclusion of superfoods, probiotics, and functional ingredients has added further value to food formulations, encouraging pet parents to prioritize complete meal plans over ad hoc snack-based feeding.

As health and longevity remain central concerns among dog owners, the segment’s strength is reinforced by its ability to deliver measurable health outcomes such as weight control, digestive support, and immune system enhancement. The rising frequency of pet wellness visits and dietary consultations has also played a role in reinforcing the food segment's significance in routine pet care.

Opportunities in premium and functional pet nutrition are shaping strong growth in the global dog food and snacks market. Trends such as pet humanization and personalized nutrition are expanding product offerings and consumer spending.

Pet owners are increasingly seeking premium and functional dog food and snacks that cater to their pets' specific health needs. Products enriched with natural ingredients, tailored nutrition, and functional benefits such as joint support, digestive health, and skin care are gaining popularity. This trend reflects a broader shift towards treating pets as family members, with owners willing to invest in high-quality products that enhance their pets' well-being.

Manufacturers are responding by innovating and expanding their product lines to meet these demands. The rise in disposable incomes and changing lifestyles further support the growth of this segment, particularly in developed markets where consumers are more inclined to spend on premium pet care products.

The expansion of online retail and direct-to-consumer channels is significantly impacting the dog food and snacks market. E-commerce platforms offer convenience, a wide range of product options, and the ability to compare prices, making it easier for consumers to purchase pet food and snacks. Subscription services are also gaining traction, providing regular deliveries of pet products tailored to individual needs.

This shift towards online shopping is particularly evident in regions with high internet penetration and tech-savvy consumers. Retailers are investing in user-friendly websites, personalized recommendations, and efficient delivery systems to enhance the customer experience. As a result, online sales are becoming an increasingly important distribution channel, complementing traditional brick-and-mortar stores and contributing to the overall market growth.

The dog food and snacks market is experiencing a shift towards premiumization, driven by consumers treating pets as family members. This trend is evident in the growing demand for high-quality, nutritious, and specialty pet foods and treats. Pet owners are increasingly seeking products that mirror human food standards, leading to the rise of organic, grain-free, and functional treats. Brands are responding by introducing gourmet options, personalized nutrition plans, and products catering to specific health needs, such as dental care or joint support.

This humanization of pet products is reshaping the market, with consumers willing to invest more in their pets' well-being, thereby driving growth in the premium segment. Companies are capitalizing on this trend by expanding their product lines to include high-quality ingredients and innovative formulations that appeal to health-conscious pet owners.

The rise of e-commerce presents significant opportunities for the dog food and snacks market. Online platforms offer convenience, a wide range of products, and personalized services, attracting a growing number of pet owners. Subscription-based models and direct-to-consumer (DTC) sales are gaining traction, allowing brands to build customer loyalty and streamline distribution.

E-commerce enables companies to reach a broader audience, including those in remote areas, and gather valuable consumer data to tailor marketing strategies. The shift towards online shopping is particularly pronounced among younger pet owners who value convenience and personalized experiences. Brands that invest in user-friendly websites, efficient delivery systems, and targeted digital marketing are well-positioned to capitalize on this trend, expanding their market share and enhancing customer satisfaction in the competitive pet care industry.

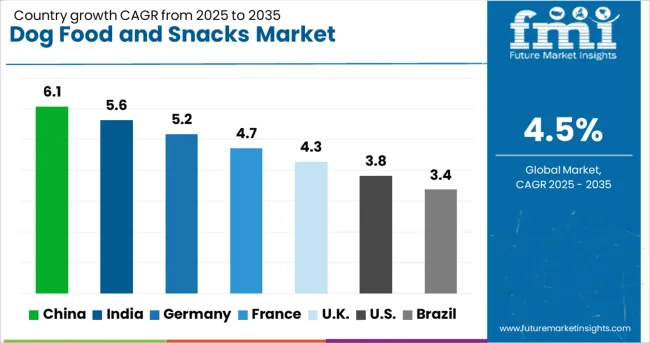

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The global dog food and snacks market is forecasted to grow at a CAGR of 4.5% through 2035, driven by rising pet ownership and increased demand for specialized nutrition products. Among BRICS nations, China leads with 6.1% growth, supported by expanding pet retail networks and local manufacturing. India follows at 5.6%, where rising disposable incomes have increased spending on pet care. In the OECD region, Germany shows 5.2% growth, backed by established pet food producers and stringent quality controls.

France, growing at 4.7%, benefits from steady consumption in premium and natural pet food segments. The United Kingdom, at 4.3%, reflects consistent demand through retail chains and veterinary recommendations. Market developments have been influenced by product safety regulations, labeling standards, and import-export guidelines. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The dog food and snacks market in China is growing at a CAGR of 6.1%, driven by rising pet ownership and increasing consumer focus on premium nutrition. Dry kibble and wet food formulations with added vitamins and minerals have been widely adopted. Grain-free and limited-ingredient snack varieties have been introduced to cater to sensitivity concerns. Production capacities have been scaled up to meet expanding retail and e-commerce demand. Packaging innovations such as resealable bags and portion-controlled packs have been implemented to enhance convenience and freshness. Regional distributors have increased stock levels of organic and functional treat options. Collaborations between manufacturers and veterinary nutritionists have resulted in fortified product lines aimed at different life stages.

In India, dog food and snacks market is advancing at a CAGR of 5.6%, supported by urban pet owners seeking balanced nutrition and convenience. Dry food with fortified proteins and essential fatty acids has been popularized through retail and online channels. Treats formulated with natural ingredients and low additives have gained traction. Small and medium manufacturers have been supplying region-specific flavors to cater to local preferences. Packaging improvements such as easy-tear sachets and transparent windows have been introduced. Veterinarians have been recommending nutritionally balanced snack options for dental health and digestion. Distribution networks have expanded into tier-2 and tier-3 cities, increasing market penetration.

Dog food and snacks market in Germany is expanding at a CAGR of 5.2%, fueled by premium product demand and health-focused formulations. Grain-free and hypoallergenic food options have been supplied extensively through specialty pet stores and online platforms. Treats enriched with omega fatty acids and probiotics have been integrated into regular feeding routines. Packaging with sustainability-focused materials has been increasingly adopted. Veterinary clinics and pet nutritionists have partnered with manufacturers to endorse clinical nutrition products. Functional snacks targeting joint health and digestive balance have been developed. Distribution has been optimized to support quick replenishment across retail and e-commerce channels.

In France, the dog food and snacks market is growing at a CAGR of 4.7%, with demand driven by health-conscious pet owners and premiumization trends. Natural and organic snack options have been increasingly sourced to meet consumer preferences. Small-batch production of grain-free treats with functional ingredients such as glucosamine and antioxidants has been introduced. Packaging designs with resealable features and portion control have been widely adopted. Collaborations with pet wellness experts have led to development of tailored nutrition snacks for aging dogs and weight management. Retailers have expanded shelf space dedicated to premium and specialized dog food and snack ranges.

The dog food and snacks market in the United Kingdom is growing at a CAGR of 4.3%, supported by increasing consumer awareness of pet health and nutrition. Functional treats fortified with vitamins, minerals, and antioxidants have been introduced to address specific health concerns such as dental hygiene and coat health. Packaging with resealable closures and recyclable materials has been adopted to meet consumer convenience and environmental preferences. Partnerships between snack producers and veterinary professionals have led to growth in clinical nutrition product lines. Distribution through specialty pet retailers and online platforms has been strengthened to enhance accessibility. Customized flavor varieties and size-appropriate snack options have been developed to meet diverse dog breeds and preferences.

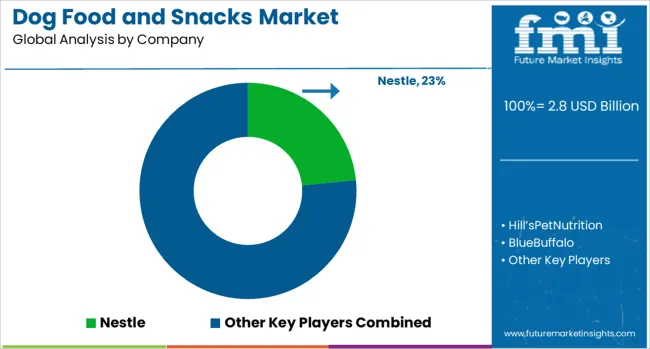

The dog food and snacks market is characterized by a dynamic blend of global food conglomerates and premium pet nutrition specialists, each addressing evolving consumer preferences toward pet wellness and natural formulations. Brands like Nestlé’s Purina dominate with science-backed, balanced meals, offering tailored diets that address life stage, breed size, and health-specific concerns.

Their global footprint and robust R&D capabilities allow them to stay ahead of trends in functional pet nutrition. Hill’s Pet Nutrition, a division of Colgate-Palmolive, reinforces the medical-nutrition segment, developing veterinarian-recommended products for dogs with conditions such as renal disease, obesity, and food sensitivities. Meanwhile, Blue Buffalo, part of General Mills, has carved out a significant share in the natural and grain-free category, appealing to consumers who prioritize clean-label and minimally processed ingredients.

Champion Petfoods, with its brands Orijen and Acana, focuses on biologically appropriate, high-protein diets featuring raw and freeze-dried options, aligning with trends in ancestral pet feeding. Deuerer, a private-label leader in Europe, specializes in premium snacks and treats made with natural meats and novel proteins, gaining traction among discerning pet owners.

The J.M. Smucker Company, through Natural Balance and Rachael Ray Nutrish, offers a blend of traditional and modern formulations, targeting value and nutrition-conscious consumers alike. Together, these companies shape a competitive and rapidly innovating market. Key drivers include humanization of pets, demand for health-oriented formulations, and transparency in sourcing pushing brands to invest in clean nutrition, advanced veterinary science, and sustainable packaging solutions.

On February 7, 2025, UK retailer Pets at Home launched "Chick Bites," the world's first dog treats made from lab-grown chicken meat produced by Meatly. This innovation follows the UK's approval for cultivated meat in pet food, aiming to provide a sustainable alternative to conventional dog treats.

The treats combine plant-based ingredients with Meatly's cultivated chicken, offering a nutritious and environmentally friendly option for pet owners. The limited release began at the Pets at Home store in Brentford, London, on February 7, 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.8 Billion |

| Raw Material | Animal Based and Plant Based |

| Type | Dry Food, Dog food, Wet Food, and Treat & mixers |

| Product | Food (Dry, Wet) and Treat & Mixers |

| Cost Category | Premium Pet Food and Bulk Pet Food |

| Distribution Channel | Supermarkets/Hypermarkets, Specialized Pet Food Shops, Online, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nestle, Hill’sPetNutrition, BlueBuffalo, Deuerer, TheJ.M.SmuckerCompany(NaturalBalance,Nutrish), and ChampionPetfoods |

| Additional Attributes | Dollar sales by dog food and snacks type, including dry kibble, wet food, treats, and chews, by distribution channel such as supermarkets, specialty stores, and online platforms, and by geographic region including North America, Europe, and Asia-Pacific; demand driven by rising pet ownership, humanization of pets, and increasing awareness of pet health and nutrition; innovation in functional ingredients, personalized nutrition, and sustainable sourcing; costs influenced by raw material prices and supply chain dynamics; and emerging use cases in premium, organic, and lab-grown meat-based products. |

The global dog food and snacks market is estimated to be valued at USD 2.8 billion in 2025.

The market size for the dog food and snacks market is projected to reach USD 4.4 billion by 2035.

The dog food and snacks market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in dog food and snacks market are animal based and plant based.

In terms of type, dry food segment to command 47.8% share in the dog food and snacks market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dog Treat Launcher Market Size and Share Forecast Outlook 2025 to 2035

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

Dog Training Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dog Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dog Float Market Size and Share Forecast Outlook 2025 to 2035

Dog Gates, Doors, & Pens Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Safety Leash Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Collars Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Dental Chews Market Analysis by Product Type, Age, Flavor, Application and Sales Channel Through 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Competitive Overview of Dog Gates, Doors and Pens Companies

Dog Food Market Analysis - Size, Share, and Forecast 2025 to 2035

Dog Food Topper Market Analysis - Size, Share, and Forecast 2024 to 2034

Dog Food Flavours Market

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Dog Dewormers Market - Growth & Demand 2025 to 2035

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Cat and Dog Food Topper Market Insights – Pet Nutrition & Industry Expansion 2024-2034

Aortic Endografts Industry Analysis by Product, Procedure, Material, End Users and Regions 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA