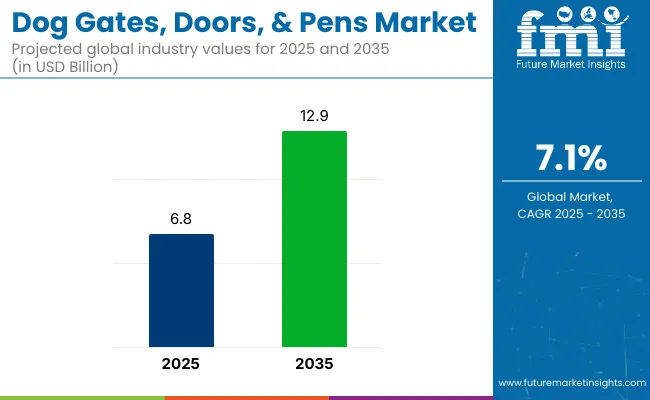

The global dog gates, doors, and pens market is valued at USD 6.8 billion in 2025 and is slated to register USD 12.9 billion by 2035, reflecting a CAGR of 7.1% over the forecast period. The market is set to witness significant growth from 2025 to 2035, driven by the increasing number of pet owners, rising concerns about pet safety, and innovations in pet containment solutions.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6.8 billion |

| Industry Value (2035F) | USD 12.9 billion |

| CAGR (2025 to 2035) | 7.1% |

As pet humanization trends accelerate, consumers are increasingly investing in specialized products that offer security, comfort, and controlled movement for dogs in both indoor and outdoor environments. Urbanization, smaller living spaces, and growing adoption of rescue animals are also supporting market expansion.

Product innovation is reshaping the category, with manufacturers introducing versatile, foldable, and easy-to-install gates, doors, and pens designed for varied home layouts and travel needs. Smart pet doors with microchip recognition, weather-resistant materials, and app-based access control are gaining popularity among tech-savvy pet owners.

Additionally, collapsible pens, modular gate systems, and barrier-free entry options are enhancing convenience and portability. Brands are also focusing on aesthetics, offering products in wood, metal, and transparent materials that blend seamlessly with modern home interiors. E-commerce platforms are playing a critical role in expanding product reach and offering comparison tools that aid consumer decision-making.

Regulatory standards promoting pet welfare and growing awareness of responsible pet ownership are reinforcing market growth across regions. In North America and Europe, pet safety guidelines and home modification trends are influencing purchasing behavior.

Meanwhile, in emerging markets across Asia Pacific and Latin America, rising disposable income, expanding pet care retail infrastructure, and an increase in first-time pet ownership are creating strong demand for affordable and functional containment solutions. As households continue to treat pets as family members, the dog gates, doors, and pens market is expected to grow steadily, driven by design innovation, safety priorities, and evolving consumer lifestyles.

The market is segmented based on product type, sales channel, end user, and region. By product type, the market includes electronic, non-electronic, gates, doors, pens, and others (such as modular barrier systems and foldable fences). In terms of sales channel, it is categorized into online, retail stores, departmental stores, and others (including pet expos, home improvement outlets, and direct sales).

Based on end user, the market comprises residential, commercial, veterinary clinics, and others (such as animal shelters, dog training centers, and pet boarding facilities). Regionally, the market is segmented into North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

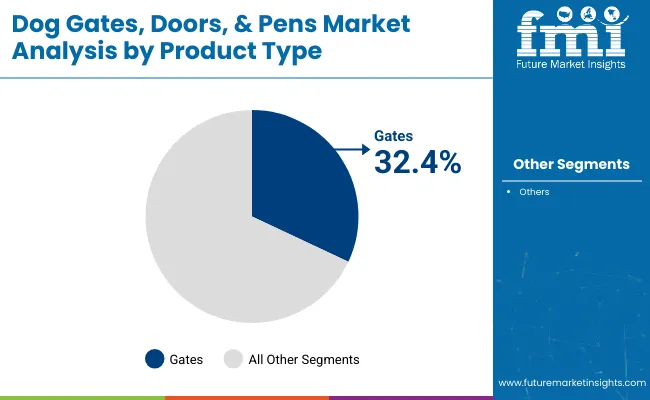

The gates segment is projected to lead the product type category within the dog gates, doors, and pens market, holding 32.4% of the global market share in 2025. Dog gates remain the most favored choice among pet owners, especially for indoor applications where safety and space segmentation are priorities.

| Product Type Segment | Market Share (2025) |

|---|---|

| Gates | 32.4% |

These products are known for their easy installation, adjustability, and aesthetic compatibility with home interiors. Gates serve as a temporary barrier while maintaining visibility and airflow, which is especially useful in multi-pet households or when isolating pets during training. Brands like Carlson Pet Products, Regalo International, and Richell USA have been expanding their offerings with pressure-mounted, hardware-mounted, and freestanding options.

Innovations in design now include expandable widths, chew-resistant materials, and dual-lock mechanisms for enhanced safety. Rising pet adoption in urban areas has increased the demand for compact and portable gate systems suitable for apartments and condos.

Additionally, multifunctional pet gates that double as playpens or room dividers are attracting interest among modern pet parents. The use of premium woods, metals, and eco-friendly materials also boosts appeal across affluent consumer groups. The gates segment is well-positioned to maintain its leadership due to consistent innovations and its essential utility in residential pet care.

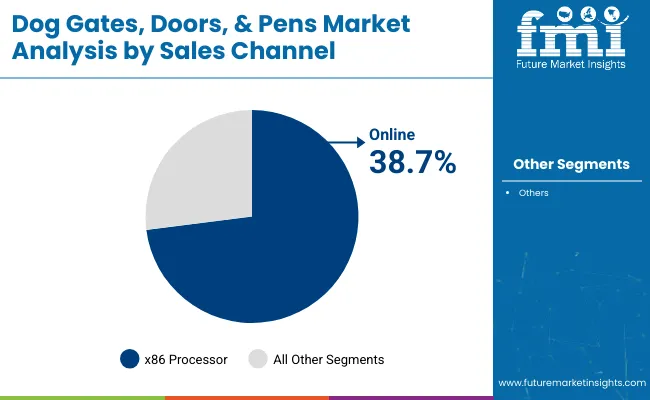

The online segment is forecasted to dominate sales channels in the dog gates, doors, and pens market with a 38.7% market share in 2025. A combination of convenience, variety, and direct-to-door delivery is fueling the growth of e-commerce sales across pet product categories.

| Sales Channel Segment | Market Share (2025) |

|---|---|

| Online | 38.7% |

Platforms such as Amazon, Chewy, and Flipkart, along with brand-specific DTC websites, are offering competitive pricing, subscription-based deals, and quick shipping. The growing millennial and Gen Z customer base, who rely heavily on digital platforms for pet care purchases, are key contributors to this shift. Detailed product descriptions, user reviews, virtual try-ons, and AI-driven recommendations enhance the buyer experience.

Moreover, the expansion of logistics networks and improved return policies have built trust among pet parents shopping online. Post-pandemic, many consumers have continued preferring contactless and digital shopping, making online channels not just convenient but also essential.

Brands such as PetSafe and MidWest Homes for Pets are strengthening their online presence with influencer marketing and real-time customer support. Additionally, product bundles and personalization options offered online are rarely matched by offline channels. With high adoption across both developed and emerging regions, the online segment is expected to retain its stronghold well during the forecast period.

The commercial segment is expected to register the fastest CAGR of 7.6% from 2025 to 2035 in the dog gates, doors, and pens market. This category includes veterinary clinics, pet cafés, grooming centers, training schools, and other public-facing pet service providers. Rising pet ownership is encouraging businesses to offer dog-friendly facilities, and safety is a top concern.

Dog gates and pens are being adopted to manage animal movement, reduce risk during social interactions, and ensure space demarcation. Unlike residential products, commercial-grade gates and pens focus on durability, ease of cleaning, and secure locking mechanisms. Leading brands such as Richell and North States are introducing heavy-duty, foldable, and expandable pen systems that suit mobile services and on-site pet events.

Moreover, the global rise in pet tourism and the emergence of pet resorts are adding momentum to this segment. As awareness grows about the emotional well-being of pets, more commercial spaces are incorporating open play zones with barrier systems to improve pet comfort. Regulatory emphasis on pet welfare in commercial settings also plays a critical role in accelerating adoption. This segment’s robust growth reflects a broader trend of professionalizing pet care, creating long-term demand for smart, modular containment solutions.

| End User Segment | CAGR (2025 to 2035) |

|---|---|

| Commercial | 7.6% |

The pet quadrangle request faces challenges like high costs of smart pet doors, complex installations, and sustainability enterprises. Varying precious sizes bear different product lines, while force chain dislocations impact pricing and vacuity. Growing competition demands invention and strong brand positioning to stand out.

The pet quadrangle request offers great openings for invention. Smart pet doors with RFID and Bluetooth enhance security and convenience. Eco-friendly accoutrements and customizable designs appeal to ultramodern consumers.

E-commerce expansion allows brands to reach global requests, while the rise of pet-friendly spaces boosts demand for portable enclosures. Investing in durable, rainfall- resistant out-of-door results can unleash new profit aqueducts.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 10.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 6.90 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 9.50 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 8.70 |

| Country | Japan |

|---|---|

| Population (millions) | 123.3 |

| Estimated Per Capita Spending (USD) | 7.40 |

The USA dominates the global dog gates, doors, and pens market, with premium pet safety solutions driving growth. Pet owners prefer smart pet doors with microchip access and weather-resistant gates. E-commerce platforms and specialty pet stores fuel demand, while customization and multi-functional pet enclosures gain popularity.

China’s USD 9.79 billion market thrives on increasing pet adoption and rising disposable income. Consumers favor high-quality, durable pet barriers, while smart pet doors gain traction. Urbanization and apartment living further boost demand for space-efficient dog pens.

Germany’s USD 798.95 million market benefits from a strong pet-friendly culture. Consumers prefer eco-friendly and adjustable pet barriers. Demand for high-tech pet doors with motion sensors grows, and veterinary recommendations influence buying choices.

The UK market, valued at USD 594.21 million, sees increasing adoption of safety-focused dog enclosures. Pet owners prioritize automated, energy-efficient pet doors. Subscription-based pet accessory services and DTC brands expand product accessibility.

Japan’s USD 912.42 million market grows as compact, apartment-friendly dog pens gain traction. Consumers seek foldable, lightweight barriers and automated smart pet doors. Retail chains and online marketplaces cater to demand for space-saving and aesthetic pet enclosures.

The dog gates, doors, and pens market is witnessing steady growth as pet owners prioritize convenience, safety, and home integration solutions for their pets. A survey of 250 respondents across North America, Europe, and Asia-Pacific highlights key trends shaping consumer preferences in this market.

Pet safety and home adaptability drive purchases, with 67% of dog owners considering safety as the primary factor when selecting gates, doors, and pens. Among urban pet owners, 58% prefer adjustable or retractable gates that seamlessly fit into different home layouts. Meanwhile, 45% of suburban and rural respondents prioritize durability and outdoor-friendly designs for larger breeds and multi-pet households.

Electronic and smart pet doors gain popularity, as 64% of respondents express interest in automatic and microchip-enabled doors that provide controlled access. Tech-savvy pet owners, particularly millennials (70%) and Gen Z (62%), prefer doors integrated with RFID tags or app-based monitoring systems. However, 45% of budget-conscious buyers still opt for traditional manual pet doors due to affordability.

Customization and aesthetic appeal influence buying decisions, with 55% of pet owners seeking gates and pens that match home interiors. Demand for wooden and transparent acrylic designs is rising, particularly in urban apartments (48%) and modern homes (50%). Meanwhile, foldable and portable pens attract 40% of respondents, especially those who travel frequently or live in compact spaces.

E-commerce dominates purchasing trends, with 68% of respondents preferring to buy dog gates, doors, and pens online due to wider selections and competitive pricing. Platforms like Amazon, Chewy, and regional pet-specialty websites lead sales, while 40% of respondents still prefer in-store purchases for product demonstrations and quality checks.

As pet owners seek smarter, safer, and aesthetically appealing solutions, the dog gates, doors, and pens market is expected to expand further. Brands can leverage technological innovations, customizable designs, and omnichannel retail strategies to capture growing consumer demand.

The market in the United States is showing steady momentum, supported by rising pet adoption rates, a growing awareness around pet safety, and an increase in demand for automated pet door technologies. Households are increasingly opting for smart and app-enabled pet entry systems, with significant adoption of electronic doors that can be integrated into home automation networks.

This shift is further supported by the broader trend of enhancing home safety for pets through indoor and outdoor enclosures. The proliferation of e-commerce platforms and direct-to-consumer pet accessory sales is also driving accessibility to new and innovative pet containment products. Leading players in this space include Carlson Pet Products, PetSafe, and Richell USA. The USA dog gates, doors, and pens market is anticipated to expand at a CAGR of 6.4% between 2025 and 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.4% |

In the United Kingdom, the dog gates, doors, and pens market continues to grow as more households adopt dogs and prioritize secure, efficient access systems for their pets. Consumers are increasingly leaning towards energy-efficient and technology-enhanced pet doors, such as RFID and microchip-enabled options that enhance both convenience and pet security.

Flexible and portable pet pens have gained popularity, especially among urban pet owners who value compact and expandable solutions. Eco-friendly product preferences are also influencing purchases, with biodegradable and recyclable pet accessories gaining traction. Companies such as SureFlap, Babydan, and Doggy Mate dominate the UK landscape. The UK dog gates, doors, and pens market is projected to grow at a CAGR of 6.1% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.1% |

Germany’s market is growing steadily, with a strong consumer focus on premium, durable, and modular enclosures. Buyers favor weatherproof and insulated pet doors that help improve energy efficiency, especially in colder regions. Homeowners are also seeking adjustable dog gates that ensure safety while fitting aesthetically into home layouts.

Smart home compatibility is becoming an important purchase criterion, with IoT-enabled pet doors gradually becoming more mainstream. German consumers are willing to invest in high-quality products that blend convenience, safety, and sustainability. Notable market players include Trixie, Ferplast, and Karlie. Germany’s dog gates, doors, and pens market is forecasted to expand at a CAGR of 6.3% between 2025 and 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.3% |

India’s dog gates, doors, and pens market is witnessing rapid expansion due to a rise in pet ownership, increased disposable income among urban populations, and the growing popularity of cost-effective pet care solutions. Consumers are increasingly attracted to budget-friendly, locally manufactured pet accessories that are both functional and travel-friendly.

Foldable and portable pet pens are witnessing increased demand among pet owners who prioritize convenience and mobility. E-commerce platforms such as Flipkart and Amazon are playing a key role in improving product availability and reach. Domestic brands like Heads Up For Tails, Trixie, and Pawzone are gaining significant ground. India’s dog gates, doors, and pens market is anticipated to register a CAGR of 6.9% from 2025 to 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.9% |

China’s market is expanding rapidly, fueled by rising urbanization, higher disposable incomes, and a strong push toward premium and smart pet care product. Automatic and AI-enabled pet doors are gaining popularity as pet owners seek enhanced convenience and integration with smart home systems.

There is also increasing demand for aesthetically pleasing and multifunctional enclosures that align with contemporary home decor trends. The growth of cross-border e-commerce and an influx of global pet brands have further boosted product variety and quality in the Chinese market. Major players include Petkit, Xiaomi, and Ferplast. The dog gates, doors, and pens market in China is expected to grow at a CAGR of 7.2% between 2025 and 2035.

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.2% |

The Dog Gates, Doors, & Pens Market is experiencing significant growth, driven by adding precious power and a heightened focus on precious safety and convenience. Manufacturers are constituting eco-friendly paraphernalia and smart technologies to meet evolving consumer demands. The request is characterized by a mix of established companies and arising players, all seeking to capture a share of this expanding sedulity.

The global market is expected to grow from USD 6.8 billion in 2025 to USD 12.9 billion by 2035, registering a CAGR of 7.1% during the forecast period.

The gates segment is projected to hold the largest share, accounting for 32.4% of the global market in 2025 due to its versatility, ease of use, and suitability for residential environments.

The online sales channel is anticipated to lead with a 38.7% market share in 2025, driven by convenience, product variety, and rising consumer preference for e-commerce.

The commercial segment, including veterinary clinics, pet cafés, and boarding centers, is expected to grow at the fastest CAGR of 7.6% between 2025 and 2035.

China is forecasted to grow at the fastest rate, with a projected CAGR of 7.2% from 2025 to 2035, driven by rising urbanization and demand for smart pet care solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Dog Gates, Doors and Pens Companies

Dog Treat Launcher Market Size and Share Forecast Outlook 2025 to 2035

Dog Footwear Market Size and Share Forecast Outlook 2025 to 2035

Dog Training Equipment Market Size and Share Forecast Outlook 2025 to 2035

Dog Vaccine Market Size and Share Forecast Outlook 2025 to 2035

Dog Food Market Analysis - Size, Share, and Forecast 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Dog Food and Snacks Market Size and Share Forecast Outlook 2025 to 2035

Dog Float Market Size and Share Forecast Outlook 2025 to 2035

Dog Safety Leash Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Collars Market Analysis - Trends, Growth & Forecast 2025 to 2035

Dog Dental Chews Market Analysis by Product Type, Age, Flavor, Application and Sales Channel Through 2035

Dog Food Topper Market Analysis - Size, Share, and Forecast 2024 to 2034

Dog Food Flavours Market

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Vegan Dog Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Europe Dog Dewormers Market - Growth & Demand 2025 to 2035

Natural Dog Treat Market Product Type, Age, Distribution Channel, Application and Protein Type Through 2035

Cat and Dog Food Topper Market Insights – Pet Nutrition & Industry Expansion 2024-2034

Aortic Endografts Industry Analysis by Product, Procedure, Material, End Users and Regions 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA