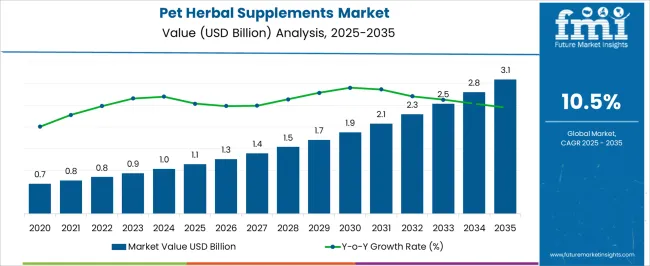

The Pet Herbal Supplements Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 10.5% over the forecast period. Beginning at USD 0.7 billion in 2020, the market saw gradual adoption as pet owners became increasingly aware of herbal and natural health solutions, favoring alternatives to conventional synthetic products.

Early years reflected consistent growth, with the market rising to USD 0.8 billion in 2021 and steadily climbing through 2023, reaching USD 0.9 billion. By 2024, the market will have further advanced to USD 1.0 billion, marking the foundation for accelerated penetration. The period from 2025 to 2030 marked a phase of more rapid expansion, with the market increasing from USD 1.1 billion to USD 1.9 billion. This growth was driven by rising consumer preference for natural and holistic pet care options, fueled by concerns over side effects associated with synthetic supplements and a heightened emphasis on pet wellness.

During this time, manufacturers expanded product offerings to include specialized herbal formulations targeting digestive health, joint support, anxiety relief, and overall vitality, broadening market reach. From 2031 to 2035, growth sustained momentum as the market advanced from USD 2.1 billion to USD 3.1 billion, supported by ongoing research validating the efficacy and safety of herbal ingredients, expanded distribution channels, and increasing regulatory acceptance. Innovations in supplement delivery formats, including palatable chews and liquid extracts, enhanced user convenience and compliance, encouraging wider adoption among pet owners.

Overall, the pet herbal supplements market is poised for robust and continuous growth through 2035, fueled by evolving consumer preferences, increased health consciousness among pet owners, and sustained product innovation within the natural pet care industry.

| Metric | Value |

|---|---|

| Pet Herbal Supplements Market Estimated Value in (2025 E) | USD 1.1 billion |

| Pet Herbal Supplements Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 10.5% |

The pet herbal supplements market is witnessing accelerated growth, supported by rising awareness of natural pet care, clean-label product formulations, and pet humanization trends. Increasing concerns over side effects associated with synthetic supplements have shifted preferences toward plant-based, holistic alternatives for pet wellness.

Veterinarians and pet owners alike are recognizing the role of herbs in managing common health issues such as inflammation, digestion, anxiety, and immune support. E-commerce expansion and growing retail shelf space for pet nutraceuticals are also enhancing accessibility to a wider consumer base.

In addition, regulatory advancements in pet food and supplement labeling have increased transparency, thereby strengthening consumer trust. Investment in R&D to develop condition-specific herbal blends, along with promotional campaigns by premium pet brands, is expected to further stimulate demand across global markets.

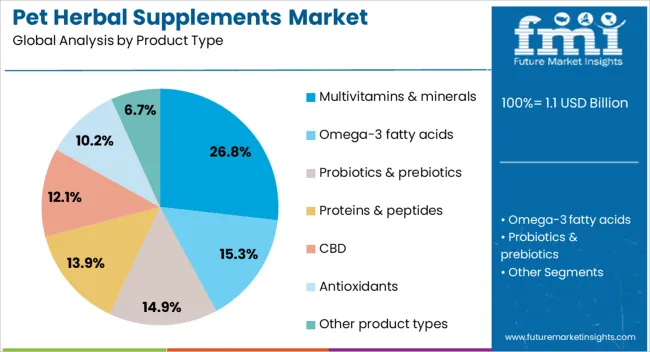

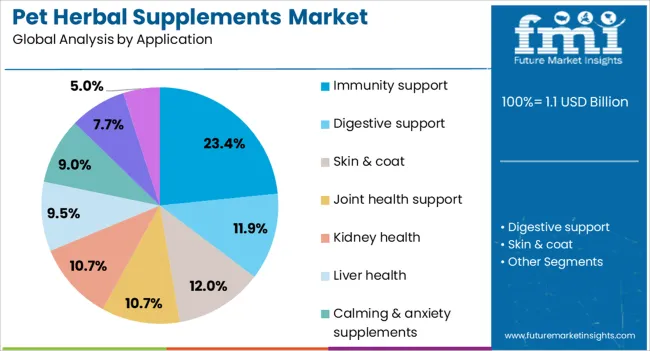

The pet herbal supplements market is segmented by product type, application, pet type, dosage form, distribution channel, and geographic regions. The pet herbal supplements market is divided by product type into Multivitamins & minerals, Omega-3 fatty acids, Probiotics & prebiotics, Proteins & peptides, CBD, Antioxidants, and Other product types. In terms of application, the pet herbal supplements market is classified into Immunity support, Digestive support, Skin & coat, Joint health support, Kidney health, Liver health, Calming & anxiety supplements, Respiratory health, and Other applications.

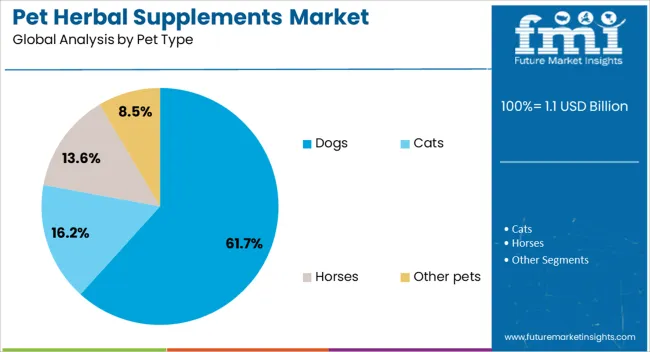

Based on the type of pet, the pet herbal supplements market is segmented into Dogs, Cats, Horses, and Other pets. The pet herbal supplements market is segmented by dosage form into Gummies & chewable, Tablets & capsules, Powders, Liquids, and Other dosage forms. The distribution channel of the pet herbal supplements market is segmented into Online, Offline, Veterinary pharmacies, Pet specialty stores, and Retail stores. Regionally, the pet herbal supplements industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Multivitamins & minerals are anticipated to contribute 26.80% of the overall market share in 2025, making them the leading product type in the pet herbal supplements landscape. This dominance is being driven by the growing use of multi-functional supplements to support comprehensive health across life stages.

Formulations that combine essential nutrients with herbal extracts such as ashwagandha, turmeric, or echinacea are gaining traction for their convenience and efficacy. These products are being positioned as daily wellness boosters, simplifying dosage and compliance for pet owners.

The ability to address multiple concerns such as joint strength, skin health, and digestion through a single format has contributed to increased consumer acceptance. Furthermore, sustained marketing efforts around preventative care have expanded the appeal of multivitamin-based herbal blends across both urban and semi-urban markets.

Immunity support is projected to account for 23.40% of the total market revenue in 2025, establishing it as the leading application segment. Rising incidences of infections, allergies, and chronic inflammatory conditions in companion animals have heightened the demand for immune-boosting formulations.

The segment’s growth is being fueled by the inclusion of immune-modulating herbs such as astragalus root, elderberry, and medicinal mushrooms, which are recognized for their adaptogenic and antimicrobial properties. Consumer focus has increasingly shifted toward preventive health strategies in pets, particularly among aging animals or breeds with known vulnerabilities.

As veterinary professionals recommend herbal immunity supplements alongside traditional care, their credibility and market reach continue to expand. Increased product availability in both powder and chewable formats has further supported adoption among pet owners prioritizing long-term health management.

Dogs are expected to dominate the market with a 61.70% share in 2025, making them the leading pet type segment in herbal supplement adoption. This leadership is attributed to their larger population share among companion animals, greater exposure to environmental stressors, and broader acceptance of supplement regimens among dog owners.

The demand for herbal supplements for dogs spans a wide spectrum of health concerns, including mobility, digestion, skin health, and behavior. As owners seek natural ways to improve the lifespan and vitality of their pets, the market has responded with breed-specific, age-specific, and condition-specific herbal formulations.

Additionally, the higher dosage requirements for larger animals like dogs contribute to higher unit volumes and recurring purchases. The growing popularity of functional treats and nutraceutical-infused snacks for dogs continues to reinforce their market dominance within the category.

The pet herbal supplements market is driven by a growing demand for natural pet care solutions and increased focus on pet health. E-commerce is expanding market reach, while regulatory challenges and consumer trust remain key hurdles to overcome.

The increasing focus on natural and holistic care for pets is driving the demand for herbal supplements. Pet owners are seeking alternatives to pharmaceutical treatments for common issues like anxiety, joint pain, and digestive problems. This trend is fueled by growing awareness of the potential side effects of conventional medications. Herbal supplements are seen as a safer, more natural approach, with ingredients such as turmeric, valerian, and chamomile gaining popularity. The shift toward plant-based and organic products is further boosting the demand for herbal supplements, as pet owners become more conscious of what they are feeding their pets.

As pet health and wellness trends continue to rise, more pet owners are looking for ways to improve their pets' quality of life. Herbal supplements are becoming a go-to option for preventive health care, as they are perceived to promote overall well-being without the side effects of synthetic drugs. The demand for supplements targeting specific health concerns such as skin conditions, joint health, and anxiety is growing. The aging pet population, which is more prone to health issues, is creating a larger market for pet herbal supplements. As pets are seen more as family members, their health needs are prioritized, contributing to market growth.

The rise of e-commerce has been a major factor in the growth of the pet herbal supplements market. Online platforms allow pet owners to easily access a wide range of herbal supplements and natural remedies. This convenience, combined with direct-to-consumer sales models, is expanding the reach of these products globally. Consumers are also increasingly looking for personalized recommendations and reviews, which they can easily access online. The shift toward online shopping is also creating opportunities for niche herbal supplement brands to enter the market and compete with larger, established pet care companies, thus fostering market expansion.

The pet herbal supplements market faces challenges related to regulatory oversight and consumer trust. While demand for these products is growing, the lack of standardization in the industry poses risks regarding product quality and efficacy. Pet owners are often skeptical about the claims made by manufacturers, leading to a need for greater transparency and quality assurance. As regulations vary by region, manufacturers must navigate complex compliance requirements. Clinical studies and certifications will be crucial in increasing consumer confidence in herbal supplements. Addressing these concerns and ensuring high product quality will be key to long-term market success.

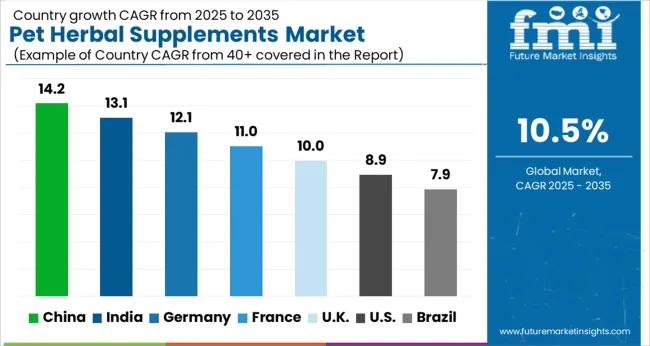

The pet herbal supplements market is projected to grow globally at a CAGR of 10.5% from 2025 to 2035, fueled by increasing pet ownership, growing awareness of pet health, and the rising demand for natural, plant-based supplements. China leads with a CAGR of 14.2%, driven by rapid urbanization, increasing pet adoption, and rising consumer demand for holistic and natural health solutions for pets. India follows at 13.1%, supported by growing pet populations, rising disposable incomes, and the increasing focus on natural and organic products in pet care.

France grows at 11.0%, benefiting from the rising trend of preventive healthcare for pets, with a particular focus on natural supplements. The United Kingdom achieves a CAGR of 10.0%, reflecting strong demand for high-quality pet wellness products, while the United States records a CAGR of 8.9%, supported by a steady market for premium, natural pet care solutions. This growth trajectory reflects the increasing preference for natural and holistic pet care products, driven by the rising demand for pet health and wellness solutions across the globe.

The UK’s pet herbal supplements market grew at a CAGR of 7.8% from 2020 to 2024 and is projected to rise to 10.0% during 2025-2035. The earlier growth was moderate, driven by rising awareness of pet health, increased pet ownership, and a shift towards natural and plant-based supplements for pets. As consumer preferences evolve, the market is expected to accelerate in the coming decade due to the growing demand for holistic and preventive care solutions for pets. The rise in demand for natural alternatives to conventional pet medicine, alongside an increase in pet wellness products in retail channels, will significantly boost market growth. The UK’s focus on sustainability and organic pet care products will further contribute to the growth of herbal supplements for pets.

China’s pet herbal supplements market is projected to grow at a CAGR of 14.2% from 2025 to 2035, leading the global market. The market grew at a CAGR of 11.5% from 2020 to 2024, fueled by China’s rapidly growing pet industry, increased disposable incomes, and rising awareness of pet health and wellness. The accelerated growth over the next decade will be driven by expanding middle-class pet owners seeking natural and holistic health solutions for their pets. China’s increasing demand for pet supplements, coupled with a growing focus on premium pet wellness products, will continue to drive the market forward. Furthermore, increasing trust in natural remedies and preventive healthcare will enhance adoption rates of herbal supplements for pets.

India’s pet herbal supplements market is expected to grow at a CAGR of 13.1% from 2025 to 2035, surpassing the global average of 10.5%. The market grew at a CAGR of 10.3% from 2020 to 2024, driven by the increasing pet population, a rising middle class, and growing awareness about the importance of natural supplements in pet care. The acceleration in the next decade is attributed to the rapid urbanization, increasing pet ownership in cities, and the shift toward natural and sustainable pet care products. As India’s pet care industry expands, pet owners will increasingly look for organic and herbal alternatives to improve their pets' health, driving the demand for herbal supplements. Increased availability and affordability of herbal supplements will further fuel market growth.

France’s pet herbal supplements market is projected to grow at a CAGR of 11.0% from 2025 to 2035. The market grew at a CAGR of 9.5% from 2020 to 2024, driven by growing awareness of holistic health and wellness for pets, as well as increasing interest in natural and organic products. The expected acceleration in growth is linked to the growing demand for pet wellness and the increasing popularity of herbal remedies for pets. France’s demand for herbal supplements will be supported by consumer preferences for sustainable, eco-friendly products, as well as the rise in pet health trends, including preventive care and natural treatment options. As the market for premium and organic pet care products grows, the adoption of herbal supplements will continue to increase.

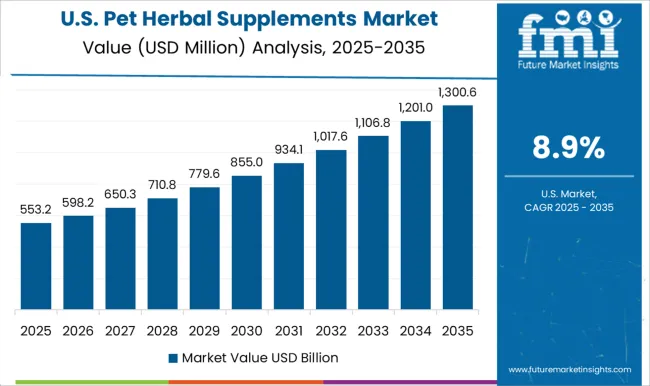

The USA pet herbal supplements market is projected to grow at a CAGR of 8.9% from 2025 to 2035. The market grew at a CAGR of 7.2% from 2020 to 2024, supported by growing consumer interest in pet wellness and the increasing trend of natural, plant-based solutions for pets. The USA market is expected to see higher growth as more pet owners seek alternatives to traditional pet medications, focusing on holistic care and preventive health measures. Additionally, the rise in premium pet care products and the growing focus on sustainable pet health solutions will further support the demand for herbal supplements. The availability of a wide range of products through retail and online channels will also contribute to market growth.

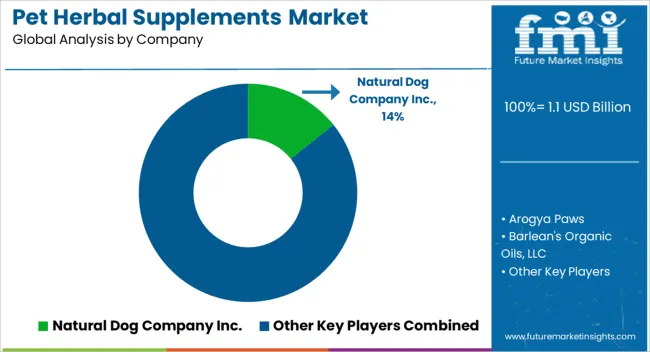

The pet herbal supplements market is characterized by a range of established and emerging players such as Natural Dog Company Inc., Arogya Paws, Barlean's Organic Oils, LLC, BB Herbal (BB Pet Supplies), Dorwest Herbs Ltd., and Dr. Harvey's, each competing on product quality, ingredient sourcing, and brand reputation. Natural Dog Company Inc. has a strong presence with its focus on high-quality, natural supplements targeting specific pet health needs, such as joint health and digestion. Arogya Paws stands out for its premium range of Ayurvedic-based herbal supplements for pets, emphasizing holistic health solutions.

Barlean's Organic Oils, LLC offers a diverse product line of herbal supplements, including oils and powders, with a focus on organic and sustainable sourcing. BB Herbal (BB Pet Supplies) is known for its affordable yet effective herbal supplements, catering to a broad pet owner demographic. Dorwest Herbs Ltd. specializes in traditional herbal remedies, offering products that have been trusted for decades in the pet industry.

Dr. Harvey's offers a unique range of plant-based supplements and holistic pet foods, emphasizing overall well-being. The competitive environment is driven by increasing demand for natural and organic pet care products, with companies focusing on high-quality ingredients and customer trust. Strategies among these players include diversifying product offerings, expanding distribution channels, and investing in consumer education to promote the benefits of herbal supplements for pets. Collaborations with veterinarians and pet wellness influencers are pivotal for brand awareness and market expansion. As the market grows, future positioning will depend on maintaining quality, transparency, and strong consumer relationships.

Bayer has expanded its portfolio to include herbal supplements for pets, focusing on promoting joint health and digestive wellness through natural ingredients. They are leveraging their strong R&D capabilities to incorporate plant-based and herbal remedies into their product offerings.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Product Type | Multivitamins & minerals, Omega-3 fatty acids, Probiotics & prebiotics, Proteins & peptides, CBD, Antioxidants, and Other product types |

| Application | Immunity support, Digestive support, Skin & coat, Joint health support, Kidney health, Liver health, Calming & anxiety supplements, Respiratory health, and Other applications |

| Pet Type | Dogs, Cats, Horses, and Other pets |

| Dosage Form | Gummies & chewable, Tablets & capsules, Powders, Liquids, and Other dosage forms |

| Distribution Channel | Online, Offline, Veterinary pharmacies, Pet specialty stores, and Retail stores |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Natural Dog Company Inc., Arogya Paws, Barlean's Organic Oils, LLC, BB Herbal (BB Pet Supplies), Dorwest Herbs Ltd, Dr. Harvey's, DSM, EdensHerbals, Herbal Dogs Co, HERBPET, LLC, Hilton Herbs, and Nature's Pet Herbals |

| Additional Attributes | Dollar sales by region, market share of key players, consumer preferences for herbal vs synthetic supplements, growth trends in natural pet care, demand for specific health concerns (e.g., joint health, anxiety), and competitive strategies. |

The global pet herbal supplements market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the pet herbal supplements market is projected to reach USD 3.1 billion by 2035.

The pet herbal supplements market is expected to grow at a 10.5% CAGR between 2025 and 2035.

The key product types in pet herbal supplements market are multivitamins & minerals, omega-3 fatty acids, probiotics & prebiotics, proteins & peptides, cbd, antioxidants and other product types.

In terms of application, immunity support segment to command 23.4% share in the pet herbal supplements market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA