The pet perfume market is witnessing steady expansion driven by the growing trend of pet humanization and the increasing inclination of owners to invest in grooming and hygiene products. The market outlook remains optimistic as consumer awareness regarding pet wellness and odor control continues to rise. Premiumization of pet care products and innovations in natural, non-toxic fragrance formulations have further strengthened market growth.

The introduction of organic and cruelty-free pet perfumes aligned with sustainability trends has boosted product adoption in developed and emerging regions alike. Additionally, the proliferation of online retail platforms and social media marketing has enhanced brand visibility and accessibility of premium grooming products.

Manufacturers are increasingly focusing on hypoallergenic and long-lasting scent formulations suitable for different pet types, enhancing user satisfaction and product loyalty As disposable income and pet ownership rates rise globally, the market for pet perfumes is projected to grow consistently, driven by a combination of lifestyle shifts, product diversification, and consumer-driven quality preferences.

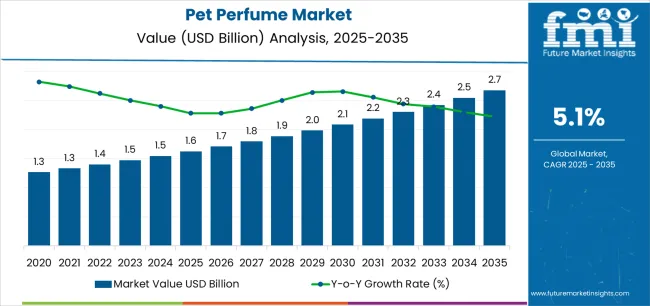

| Metric | Value |

|---|---|

| Pet Perfume Market Estimated Value in (2025 E) | USD 1.6 billion |

| Pet Perfume Market Forecast Value in (2035 F) | USD 2.7 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

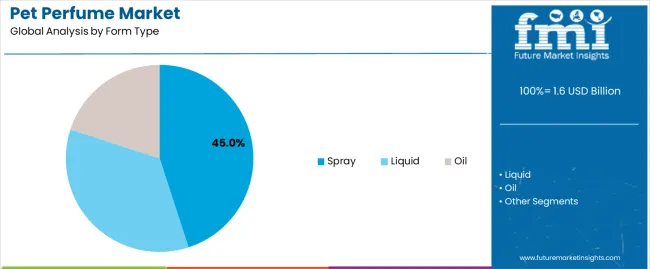

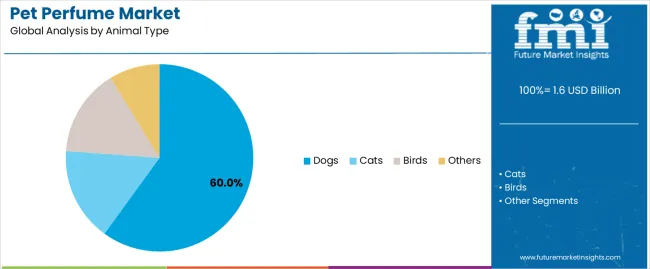

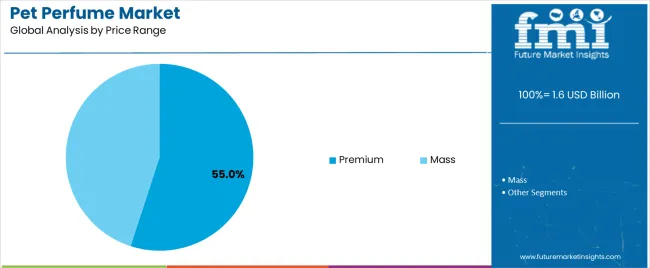

The market is segmented by Form Type, Animal Type, Price Range, Ingredient Type, and Sales Channel and region. By Form Type, the market is divided into Spray, Liquid, and Oil. In terms of Animal Type, the market is classified into Dogs, Cats, Birds, and Others. Based on Price Range, the market is segmented into Premium and Mass. By Ingredient Type, the market is divided into Non-Alcoholic and Alcoholic. By Sales Channel, the market is segmented into Online Retailing, Veterinary Clinics, Wholesalers/Distributors, Supermarkets/Hypermarkets, Pharmacy/Drugstores, Convenience Store, Pet Specialty Stores, and Other Sales Channel. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The spray segment is projected to hold 45.00% of the pet perfume market revenue share in 2025, making it the leading form type. The dominance of this segment is attributed to its ease of application, even scent distribution, and convenience for frequent use. Spray perfumes allow for quick grooming sessions without causing discomfort to pets, which has significantly increased their adoption among pet owners.

The versatility of spray formulations, suitable for both short and long-haired animals, has also contributed to their wide acceptance. Furthermore, advancements in fragrance encapsulation technology have improved scent retention, ensuring freshness for extended periods.

The availability of portable and travel-friendly packaging has further supported consumer preference for spray-based perfumes The segment’s growth is reinforced by increasing demand for hassle-free grooming solutions that balance hygiene and comfort, positioning sprays as a preferred choice across households and grooming service providers.

The dogs segment is expected to capture 60.00% of the pet perfume market revenue share in 2025, maintaining its leading position among animal types. This dominance has been driven by the rising global dog ownership and the growing emphasis on hygiene and odor management in domestic pets. Dogs, being more active and frequently exposed to outdoor environments, have created a higher demand for deodorizing and refreshing products.

The availability of a wide range of dog-specific perfume variants, including those formulated with skin-safe and pH-balanced ingredients, has further fueled adoption. Pet owners are increasingly choosing premium grooming products to enhance pet comfort and bonding experiences, which has positively influenced product penetration.

The growth of grooming salons and specialized pet care centers offering scented treatments for dogs has also strengthened market presence The segment continues to benefit from the emotional value placed on canine care and the steady rise in expenditure on pet hygiene and grooming essentials.

The premium segment is anticipated to account for 55.00% of the pet perfume market revenue in 2025, marking it as the dominant price category. This leadership is primarily supported by the increasing consumer shift toward high-quality, luxurious, and safe grooming products. The growing awareness of ingredients, coupled with the rising influence of social media and celebrity pet endorsements, has contributed to the popularity of premium pet perfumes.

These products are typically formulated with natural extracts, essential oils, and hypoallergenic components that ensure both safety and long-lasting fragrance, which appeals to discerning pet owners. Additionally, packaging innovations and personalized fragrance options have elevated the appeal of premium offerings.

The willingness of consumers to spend more on premium grooming products reflects the changing perception of pets as family members The premium segment is further strengthened by strong distribution networks, brand reputation, and increasing demand in urban households seeking superior-quality grooming solutions.

The sales of the global pet perfume market grew at a CAGR of 4.9% between 2020 and 2025, and it is projected to grow at a CAGR of ~5.3% during the forecast period from 2025 to 2035. Growth in this market is attributed to the rising importance of personal pet grooming, further pushing for a steady recovery in the short term, with a positive growth stance in the long run. The market is expected to be driven by increased spending on personal pet products along with continuous innovation in pet perfume products.

Factors such as rising pet dog adoption and increasing awareness of pet hygiene are estimated to contribute to sales growth. Further, increasing consumers’ income and standard of living are expected to have a positive impact on the market. The growing e-commerce industry is expected to have a positive impact on the pet perfume industry.

For instance, according to the American Pet Products Association, pet ownership in the United States has jumped significantly over the years. As of 2025, 66% of United States households own a pet.

Increasing Pet Ownership Rates and Humanization of Pets

The rise in the number of pet owners followed by a surge in the humanization of pets, treating them like family members, and providing heightened care & attention has LED to an increase in demand for pet perfume among the population bifurcation which is anticipated to boost market growth.

An estimated 1.6 million European households have at least one pet, according to a survey conducted by the Federation of European Pet Food Producers (FEDIAF) in 2025. Between dogs and cats, the two most popular pets for Europeans to own there are an estimated 66 million pet dogs in Europe - with around double at about 60 million cats. The highest rates of pet ownership are in Western Europe and Northern Europe.

For instance, in Sweden, 60% of households own at least one pet, while in the Netherlands the figure is 52%. On the other hand, pet ownership rates are lower in countries such as Spain 28% and Italy 26%.

Availability of Diverse Fragrance Options for Pets

A variety of fragrance options addresses the different preferences of pet owners who want their pets to smell unique. Brands are offering an expensive range of fragrances, from floral and fruity to more exotic and seasonal scents, allowing consumers to choose products that best suit their pets' personalities or specific occasions.

The variety not only adds to the appeal of perfumes for pets but also encourages repeat sales because it allows owners to try out different fragrances. Additionally, the ability to customize or select specific fragrances helps brands differentiate themselves in a competitive market, driving growth and customer loyalty.

For instance, Pawfume offers a premium grooming and deodorizing spray that is popular among pet owners. The company products offer long-lasting freshness and come in various scents, appealing to diverse consumer preferences while ensuring safety for pets

Pet Owners Are Increasingly Preferring Natural and Organic Ingredients in Pet Perfumes

Rising awareness of the health and safety of pets increasing the popularity of natural and organic ingredient-based pet perfumes. Consumers have become more conscious of the ingredients in their own personal care products, they are now applying the same to the products they are using for their pets. Natural and organic pet perfumes are free from harsh chemicals, synthetic fragrances, and artificial preservatives, which can cause allergic reactions, skin irritations, or other health issues in pets.

Natural and organic perfumes are made from essential oils and plant extracts and offer safer as well as therapeutic benefits, such as calming effects or improved fur conditions driving demand for these natural and organic options and it is further driven by a broader trend toward sustainability and eco-friendliness.

Growing Demand for Premium and Luxury Pet Products

The demand for premium and luxury pet products has been on the rise, fueled by a combination of factors, including higher disposable incomes, the humanization of pets, and a growing awareness of pet health and wellness. High-end brands have recognized this shift and are offering a wide range of luxury items, from designer clothing and gourmet treats to bespoke beds and high-tech gadgets.

For instance, according to a recent study spending market growth in the pet perfume industry about to reach 7.2% annually by 2035, after below-average growth of 2.5% projected in 2025 and 3.9% in 2025. As a result, the market for premium pet products continues to expand, reflecting a broader trend toward treating pets with the same care and attention as human family members.

Pet owners in the United States spent USD 1.6 billion on their pets in 2025, a 10.68% increase from 2025 (USD 1.5 billion). This includes USD 58.1 billion for pet food and treats, USD 31.5 billion for supplies, live animals, and over-the-counter drugs, USD 35.9 billion for veterinarian treatment, and USD 11.4 billion for additional services including boarding, grooming, pet insurance, and training.

According to the American Pet Products Association between 2020 and 2025, the amount spent on pets in the United States increased by 51.16% from USD 2.7 billion to USD 1.6 billion. The United States pet perfume market is expected to experience notable growth by 2035.

In recent years, China has contributed significantly to the pet perfume market. The increasing sales of pet perfume are due to the growing pet adoption, influencing the pet perfume market in China.

The pet owners consider a lot about the health and hygiene of their pets and see them as members of the family. These concerns lead to spending more of their income on their pet’s well-being ushering in pet perfume market trends. China is ahead when it comes to pet perfume production as there is a high presence of chemical industries and a massive production capacity surging the pet perfume markets.

In the United Kingdom pet owners are willingly invest in premium products that enhance pets well-being and comfort. The desire to provide pets with a luxurious lifestyle is bolstering demand for pet fragrances, which are now viewed as an essential part of grooming routines rather than mere luxuries.

This shift is further supported by the broader trend of spending on high-quality, specialty pet products, indicating that pet owners are prioritizing the comfort and aesthetics of their pets, driving the growth and expansion of the pet perfume market.

Dogs Are the Most Common and Popular Pets

| Animal Type | Dog |

|---|---|

| Value Share (2025) | 37.8% |

Countries in North America and Europe are seeing significant growth in dog ownership due the factors such as social shifts in how dogs are perceived and dogs are not just viewed as pets but as integral members of the family. Additionally, the growing number of homes with a single person across Europe has also played a fundamental role in increasing dog adoption. As more individuals choose to live alone, dogs offer companionship and a sense of security, that accompany solo living.

Due to all of the foregoing factors, the dog category in the animal type segment contributes the most with a market share of 37.8% in the market and the segment is likely to dominate in the forecast period.

Pet Allergies Define the Ingredients of the Product

| Ingredient Type | Non-Alcoholic |

|---|---|

| Value Share (2025) | 68.3% |

Non-alcoholic perfumes, make up a substantial 68.3% of the market share in 2025, are formulated without these harsh ingredients, making them a safer choice for households with pets. The perfumes use alternative bases that are less likely to irritate a pet's skin or respiratory system, thereby reducing the risk of adverse reactions. By opting for non-alcoholic options, pet owners enjoy fragrances without compromising their pets' well-being, reflecting a broader trend of increased consideration for pet safety in consumer choices.

Premium Ranged Products Are Preferred by Pet Owners Across the Globe

| Price Range | Premium |

|---|---|

| Value Share (2025) | 56% |

Based on tourism type, religious and heritage tours are expected to emerge as the most lucrative segment in the South Africa faith-based tourism market. Religious and heritage tours have become increasingly popular among young adults in South Africa, driven by a growing interest in cultural exploration and spiritual experiences.

In the pet perfume market, consumers worldwide show a clear preference for premium-range products, which hold a significant 56% value share in 2025. The preference shows a growing trend as pet owners are willing to spend more on high-quality, luxurious pet fragrances. Premium pet perfumes are favored for their superior ingredients, long-lasting scents, and often sophisticated packaging, which contribute to a sense of indulgence and exclusivity.

Companies operating in the pet perfume market are aiming at strategic collaborations and partnerships with other producers to develop their product range to address the demand of an increasing number of consumers.

For instance

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD Million/million for Value |

| Key Regions Covered | North America; Latin America; Europe; Asia Pacific; MEA |

| Key Segments Covered | Form Type, Animal Type, Price Range, Ingredient Type, Sales Channel, Region |

| Key Companies Profiled | Mipuchi; Captain Zack; Odo-Rite; Alpha Aromatics; Boltz; Petveda; Pets Empire; Bodhi Dog; Earth Bath; South Barks; Lambert Kay; Guangzhou Yilong Daily Chemicals Company Ltd; Borammy; Melao; Arm & Hammer; Nature's Miracle; Vetnique Labs; Others (As per Request) |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global pet perfume market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the pet perfume market is projected to reach USD 2.7 billion by 2035.

The pet perfume market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in pet perfume market are spray, liquid and oil.

In terms of animal type, dogs segment to command 60.0% share in the pet perfume market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

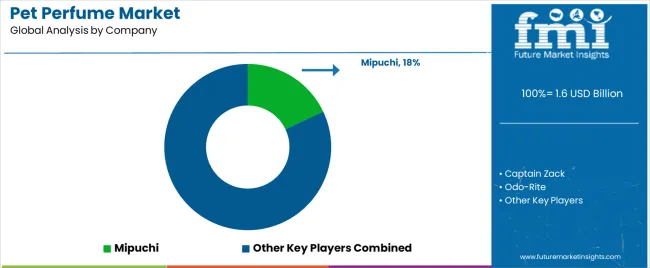

Market Share Distribution Among Pet Perfume Providers

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Perfume Packs Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA