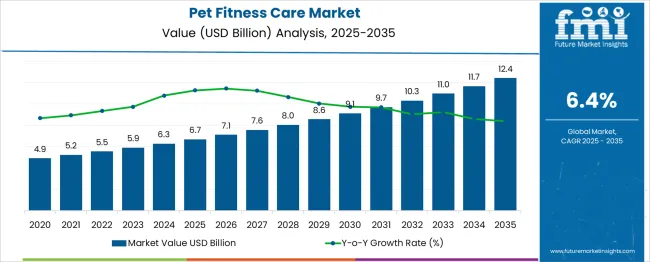

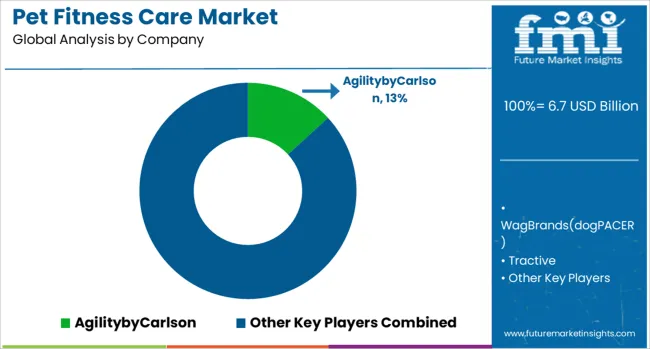

The Pet Fitness Care Market is estimated to be valued at USD 6.7 billion in 2025 and is projected to reach USD 12.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The pet fitness care market demonstrates a stable and consistent growth pattern, increasing from USD 4.9 billion in 2021 to USD 8.6 billion by 2030, resulting in an absolute dollar opportunity of USD 3.7 billion over the decade. This progression reflects a CAGR of approximately 6.8%, signaling steady demand expansion driven by rising pet ownership trends, growing emphasis on pet wellness, and the integration of digital fitness tracking solutions. Year-wise analysis illustrates this upward trend clearly. In 2021, the market stood at USD 4.9 billion, growing to USD 5.2 billion in 2022, and further to USD 5.5 billion in 2023.

The mid-decade years record stronger growth, with the market reaching USD 5.9 billion in 2024 and USD 6.3 billion in 2025, supported by the proliferation of smart wearables and connected health devices for pets. The second half of the decade reflects increased adoption of preventive care and fitness regimes, with the market expanding to USD 6.7 billion in 2026, USD 7.1 billion in 2027, and crossing USD 7.6 billion in 2028. The upward trajectory continues, reaching USD 8.0 billion in 2029 and USD 8.6 billion by 2030, signaling sustained growth momentum.

This strong outlook is reinforced by factors such as consumer willingness to invest in holistic pet wellness, technological innovation in health monitoring tools, and the rise of subscription-based fitness programs. Players introducing AI-driven activity trackers, personalized fitness apps, and integrated veterinary health solutions are expected to dominate, as the sector transitions toward a data-driven, preventive-care model that enhances pet health and longevity.

| Metric | Value |

|---|---|

| Pet Fitness Care Market Estimated Value in (2025 E) | USD 6.7 billion |

| Pet Fitness Care Market Forecast Value in (2035 F) | USD 12.4 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

The pet fitness care market holds a strategic position within multiple related sectors, including pet wellness products, veterinary healthcare services, pet wearable technology, pet food and nutrition, and smart pet accessories. Within the pet wellness category, fitness care solutions account for approximately 15 %, as activity monitoring and exercise-focused products form an essential part of overall pet health regimes. In veterinary healthcare services, the share is around 10 %, driven by preventive programs that emphasize obesity management and joint health through structured exercise plans. Pet wearable technology represents one of the highest overlaps, where fitness tracking devices contribute nearly 30 %, given their role in real-time monitoring of activity levels, calories burned, and behavioral patterns.

Within premium pet food and nutrition, fitness-focused supplements hold about 8 %, supporting energy and joint maintenance for active pets. For smart pet accessories, including interactive toys and exercise systems, fitness-related products account for approximately 12 %, driven by rising consumer interest in digital engagement for pets. This market’s expansion is fueled by growing awareness among pet owners about obesity risks, demand for personalized health monitoring, and the trend of integrating technology into pet care routines. Companies investing in AI-enabled activity trackers, subscription-based wellness programs, and integrated health platforms are well-positioned to capture increasing demand globally.

Increasing awareness among pet owners regarding the importance of preventive care, physical activity, and early disease detection has led to a higher demand for fitness-oriented solutions and services. The growing influence of digital platforms and wearable devices designed for pet activity monitoring has also played a crucial role in reshaping care routines.

Urbanization and lifestyle changes have contributed to a rise in obesity and inactivity in household pets, prompting greater adoption of professional pet fitness services and structured care regimens. Veterinary recommendations for routine physical assessments and personalized care plans further support this trend.

Regulatory emphasis on animal welfare and the rapid integration of AI and IoT in pet diagnostics and tracking are expected to enhance market value further. Over the forecast period, the market is likely to expand through subscription-based models, pet insurance tie-ins, and cross-channel retail integration.

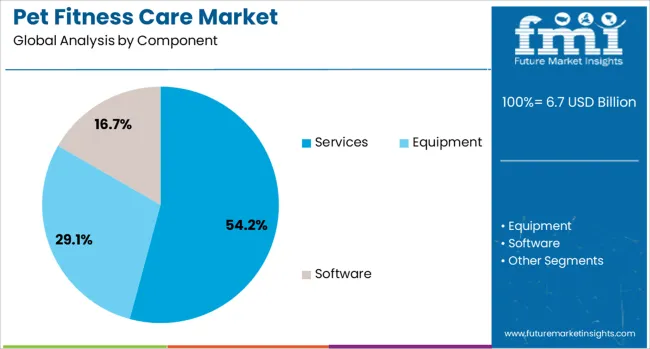

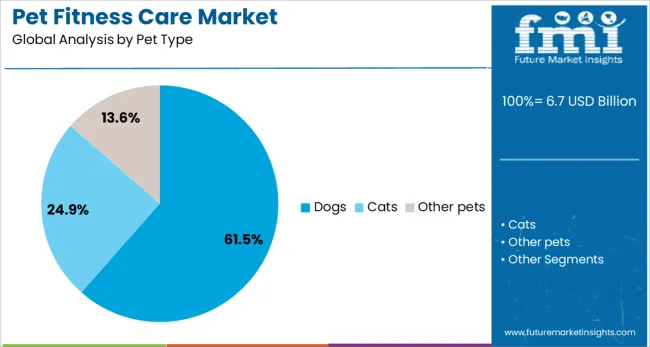

The pet fitness care market is segmented by component, pet type, and geographic regions. By component of the pet fitness care market is divided into Services, Equipment, and Software. The pet fitness care market is classified into Dogs, Cats, and Other pets. Regionally, the pet fitness care industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The services segment is projected to account for 54.2% of the total revenue share in the pet fitness care market in 2025, making it the most dominant component. This leading position is attributed to the increasing demand for specialized offerings such as wellness consultations, fitness training programs, hydrotherapy, physiotherapy, and personalized activity management plans. The expanding role of pet spas, fitness centers, and veterinary rehabilitation clinics has created structured service ecosystems aimed at improving mobility, weight management, and cardiovascular health in pets.

Enhanced access to certified trainers and veterinary physiotherapists, combined with awareness campaigns promoting regular physical evaluations, has supported continued growth. Digital platforms offering remote guidance, behavior tracking, and progress monitoring have increased convenience and encouraged recurring service adoption.

The services segment is also being driven by the growing integration of subscription-based wellness packages that combine diagnostics, diet, and exercise routines. As consumers seek holistic care experiences for their pets, the segment’s contribution is expected to remain consistently high throughout the forecast period.

The dogs segment is expected to represent 61.5% of the total pet fitness care market revenue in 2025, emerging as the most significant pet type. This dominance is being driven by the high global dog ownership rate and the associated demand for structured health and activity management programs. The segment's strength is further reinforced by the prevalence of lifestyle-related health issues such as obesity, joint disorders, and cardiovascular concerns, which are more frequently monitored and addressed in canine populations.

The rise of breed-specific fitness routines, behavioral conditioning, and agility training programs has added momentum to the segment. Veterinary guidance and preventive care protocols increasingly emphasize regular activity and tailored exercise regimens for dogs, contributing to wider market penetration.

Moreover, the availability of smart wearables, GPS-enabled trackers, and AI-driven monitoring apps tailored for dogs has improved owner engagement and fitness adherence. As households invest more in comprehensive health solutions for their pets, dogs are expected to remain the core focus of pet fitness innovations.

Pet fitness care demand is growing due to preventive health awareness, obesity concerns, and premium fitness services like gyms and therapy sessions. Digital tools such as smart collars, AI-driven apps, and activity trackers are enhancing personalized fitness plans and improving pet wellness outcomes.

Flanges usage has been influenced by the requirement for efficient piping connections in oil and gas exploration activities. Large-scale pipeline projects and offshore drilling operations have encouraged the procurement of high-strength flanges capable of withstanding extreme pressure and temperature. Demand has increased as companies favor materials like stainless steel and alloy steel for their corrosion resistance in harsh environments. This surge in applications is seen as a strategic shift toward operational safety and maintenance efficiency. Expansions in petrochemical complexes and LNG terminals have amplified the need for precise flange specifications to meet regulatory standards and process reliability requirements across upstream and downstream facilities.

Power generation facilities have adopted flanges extensively for boiler systems, turbines, and high-pressure steam lines. The transition toward combined cycle plants and the steady addition of thermal power units have required precision-engineered flanges that ensure leak-proof operations under cyclic load conditions. Maintenance schedules in nuclear and fossil fuel plants have encouraged periodic flange replacement, which influences repeat demand. The integration of advanced sealing technology into flange designs is regarded as a crucial factor in reducing operational downtime. Emerging trends indicate that pressure rating compliance and material durability are prioritized by utility operators, leading to consistent market momentum within industrial energy systems.

The market is witnessing strong traction for technology-enabled solutions, including smart collars, activity monitors, and AI-driven health tracking devices for pets. This surge is driven by the growing adoption of data-driven approaches to monitor pet health, prevent obesity, and track real-time activity levels. Consumers are increasingly integrating pet fitness into their lifestyle choices, with demand amplified by subscription-based digital fitness platforms and telehealth-linked wellness plans. Manufacturers that innovate through IoT integration and personalized analytics are gaining a competitive edge, as pet owners prioritize accurate health insights and preventive care over traditional reactive treatments.

A significant structural trend is the transition from treatment-focused pet care to proactive fitness and wellness regimes. Increased awareness about pet obesity, chronic conditions, and the role of fitness in longevity is reshaping purchase decisions. Products and services offering tailored workout plans, nutritional recommendations, and integrated veterinary guidance are witnessing higher adoption. This shift aligns with the premiumization trend in pet care, where consumers show willingness to invest in high-quality, comprehensive wellness solutions. Brands that provide bundled fitness ecosystems,combining physical activity, diet optimization, and digital tracking—are well-positioned to capture recurring revenue streams in this growing segment.

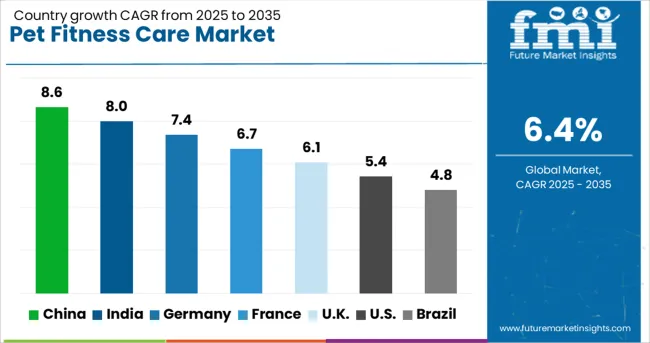

| Country | CAGR |

|---|---|

| China | 8.6% |

| India | 8.0% |

| Germany | 7.4% |

| France | 6.7% |

| UK | 6.1% |

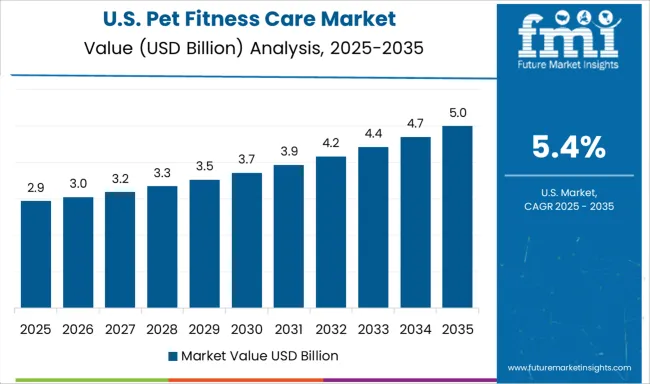

| USA | 5.4% |

| Brazil | 4.8% |

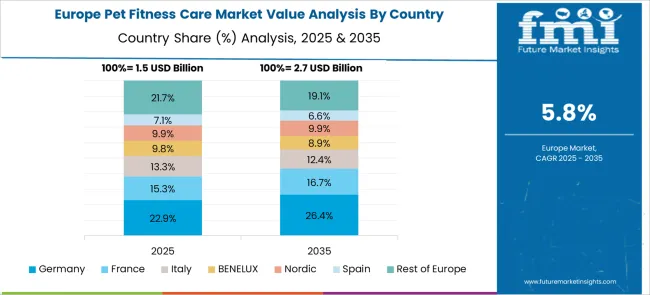

The pet fitness care industry, projected to expand at a global CAGR of 6.4% from 2025 to 2035, shows significant variation across leading countries. China is expected to record an 8.6% CAGR, driven by strong demand for premium pet wellness services and connected activity monitoring tools. India follows with an 8.0% CAGR, supported by a growing pet ownership base and rising focus on preventive health solutions within urban households. Germany demonstrates a 7.4% CAGR, driven by veterinary-backed fitness programs and an expanding market for tech-integrated exercise products. The United Kingdom, with a 6.1% CAGR, steady growth supported by specialized fitness studios and the adoption of AI-based monitoring systems. The United States shows a 5.4% CAGR, influenced by the integration of subscription-based fitness services and advanced activity trackers in mature markets. Rapid growth opportunities continue to emerge in Asia, while developed economies maintain consistent demand driven by premiumization trends. The report delivers an extensive review of over 40 countries, with these five highlighted for their strategic importance.

The CAGR of the pet fitness care market in the United States rose from nearly 4.3% during 2020–2024 to 5.4% for 2025–2035, influenced by structured wellness programs and higher integration of activity monitoring devices. Pet owners were encouraged by veterinary recommendations to include fitness routines, improving adoption of premium services such as treadmills, aquatic therapy, and weight management consultations. Growth was further driven by increased sales of subscription-based digital platforms offering customized workout plans. Partnerships between fitness providers and veterinary clinics created opportunities for targeted exercise plans. The gradual rise in disposable income for pet services supported the expansion of personalized offerings in urban households.

The CAGR in the United Kingdom climbed from about 4.9% during 2020–2024 to 6.1% in 2025–2035, due to stronger veterinary collaboration and wider promotion of structured activity programs for companion animals. The post-2025 phase witnessed the entry of advanced AI-enabled exercise planning platforms that adjusted regimens by breed and weight. Pet gyms, home workout equipment, and aquatic therapy sessions gained popularity through wellness campaigns targeted at obesity prevention. Digital integration became a primary driver, with NHS-linked awareness programs indirectly influencing the adoption of preventive measures for pets. The market saw premiumization trends as consumers opted for connected wearables to ensure real-time activity tracking.

The market in China increased from 6.4% CAGR during 2020–2024 to 8.6% from 2025–2035, driven by growing pet adoption and premium service awareness in tier-1 and tier-2 cities. Fitness care services became a vital component of veterinary preventive plans, with treadmill exercises and aquatic therapies gaining traction among pet owners focused on lifestyle health. Digital penetration through mobile fitness apps and e-commerce platforms significantly accelerated subscription models, offering AI-based activity monitoring. Regional service providers introduced bundled packages combining dietary counseling with structured exercise, which boosted engagement rates. Domestic brands invested heavily in smart wearable development, reducing dependency on imports for pet tracking devices.

India’s CAGR shifted from 5.7% during 2020–2024 to 8.0% in 2025–2035, as preventive care and lifestyle-driven pet services became more mainstream. Growth was supported by rising pet ownership in metro and semi-urban areas, coupled with strong adoption of connected wearables through e-commerce platforms. Domestic providers scaled services such as home-based treadmill workouts and aquatic therapy centers to cater to premium demand. AI-powered activity planners gained popularity among millennial owners seeking structured routines for pets. Pet wellness startups secured investments, enabling the launch of subscription fitness plans integrated with diet consultations. Expanding veterinary networks across Tier 2 cities further strengthened the demand outlook.

The CAGR in Germany moved from nearly 5.8% in 2020–2024 to 7.4% during 2025–2035, supported by structured veterinary wellness initiatives and growing emphasis on preventive health. Demand for advanced fitness programs expanded in metropolitan regions where specialty clinics offered treadmill sessions and physiotherapy for pets. Digital fitness solutions gained acceptance through integration with insurance-linked pet health plans, allowing owners to adopt personalized exercise strategies. Leading service providers introduced subscription models with AI-driven recommendations, which increased engagement for weight control and recovery care. The presence of high-income households supported faster penetration of connected devices for monitoring pet activity and health metrics.

The Pet Fitness Care Market is rapidly evolving beyond basic exercise equipment toward a technology-driven and experience-based ecosystem, reflecting the increasing emphasis on holistic pet wellness. Leading players are capitalizing on this trend by introducing integrated solutions that merge physical fitness with real-time health analytics. For instance, Tractive, Whistle Labs, and FitBark have revolutionized pet activity tracking through IoT-enabled wearables that monitor movement, caloric burn, sleep cycles, and behavioral patterns, empowering owners to make data-informed decisions about their pet’s lifestyle. These innovations are complemented by mobile application integration, offering interactive dashboards, health alerts, and vet connectivity features.

Beyond digital solutions, specialized service providers such as GoPet, FitPaws, and Gyms for Dogs are investing in structured agility programs and hydrotherapy options to address mobility issues and prevent obesity-related complications. Boutique operators like Woozelbears and Frolick Dogs have introduced premium fitness clubs offering behavioral training combined with endurance exercises, creating a differentiated service mix for affluent consumers. Furthermore, experiential offerings such as Pet Yoga, treadmill training, and aquatic fitness centers like Splash Canine Swim Club highlight the industry’s expansion into niche wellness services, driven by rising pet humanization trends. This convergence of connected health technology, personalized exercise regimes, and luxury wellness experiences positions the market for sustained growth, reinforcing the strategic importance of innovation and customer engagement in shaping future competitive advantage.

In April 2024, Tractive launched a Base Station device designed to extend battery life for its GPS & health trackers by establishing a dedicated power-saving zone.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.7 Billion |

| Component | Services, Equipment, and Software |

| Pet Type | Dogs, Cats, and Other pets |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AgilitybyCarlson, WagBrands(dogPACER), Tractive, WhistleLabs, FitBark, GoPet, FitPaws, GymsForDogs, Woozelbears, KathySantoDogTraining, FrolickDogs, PetYoga, and SplashCanineSwimClub |

| Additional Attributes | Dollar sales, share by region and product category, adoption of smart wearables, demand trends for premium fitness services, competitive benchmarking, pricing strategies, and growth projections across key markets. |

The global pet fitness care market is estimated to be valued at USD 6.7 billion in 2025.

The market size for the pet fitness care market is projected to reach USD 12.4 billion by 2035.

The pet fitness care market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in pet fitness care market are services, _agility & gym sessions, _outdoor fitness exercises, _physio assessments, _aquatic sessions, _yoga classes, _other services, equipment, _pet agility equipment, _treadmills & treadwheels, _balance training products, _other exercise equipment and software.

In terms of pet type, dogs segment to command 61.5% share in the pet fitness care market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA