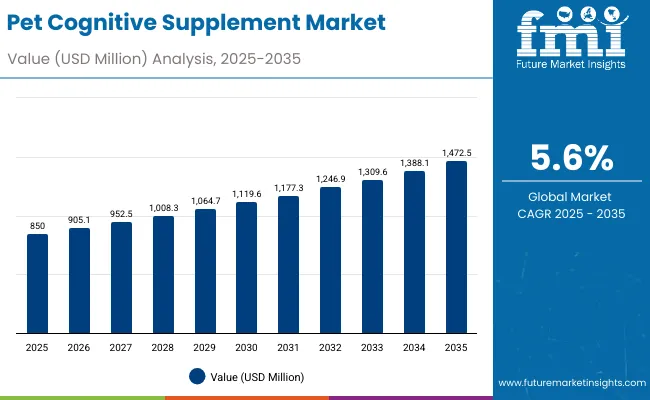

The pet cognitive supplement market is projected to grow from USD 850 million in 2025 to approximately USD 1,472.5 million by 2035, recording an absolute increase of USD 622.5 million over the forecast period at a CAGR of 5.6%. The scale and pace of expansion align with steady pet humanization trends across veterinary care, premium pet nutrition, and companion animal healthcare sectors, where cognitive support influences neurological health, behavioral wellness, and quality-of-life outcomes.

Between 2025 and 2030, the market increases to USD 1,130 Million, contributing 45.8% of decade growth as pet owners adopt advanced brain health formulations and replace basic nutritional supplements. The larger 54.2% contribution during 2030 to 2035 reflects deeper integration of specialized cognitive ingredients, veterinary-recommended formulations, and targeted delivery systems supporting high-performance neurological support in aging pet care, anxiety management, and memory enhancement applications.

Pet Cognitive Supplement Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 850.0 million |

| Market Forecast Value (2035) | USD 1,472.5 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

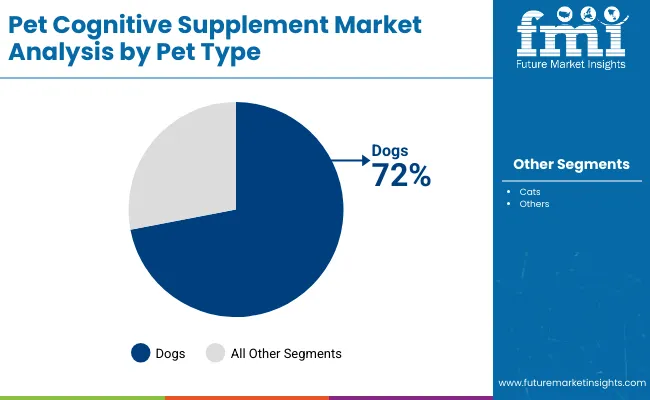

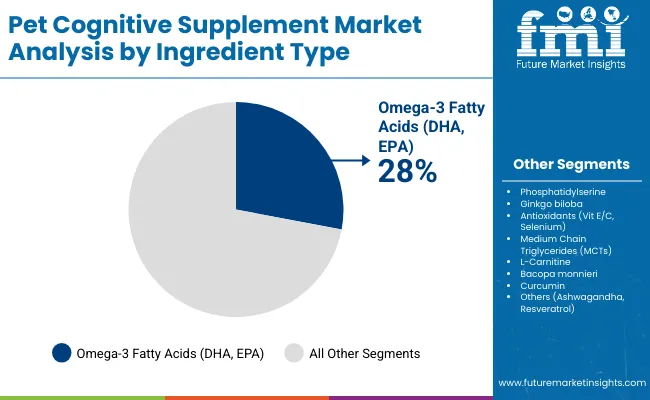

Pet type segmentation reinforces these performance priorities: dogs hold ~72% share due to superior research validation and behavioral assessment capabilities, while cats at ~26% offer specialized neurological requirements in applications requiring feline-specific cognitive support within complex veterinary environments. By ingredient, omega-3 fatty acids lead with ~28%, followed by antioxidants at ~12% and phosphatidylserine at ~10%, reflecting widespread adoption across memory enhancement, neuroprotection, and aging-related cognitive support processes.

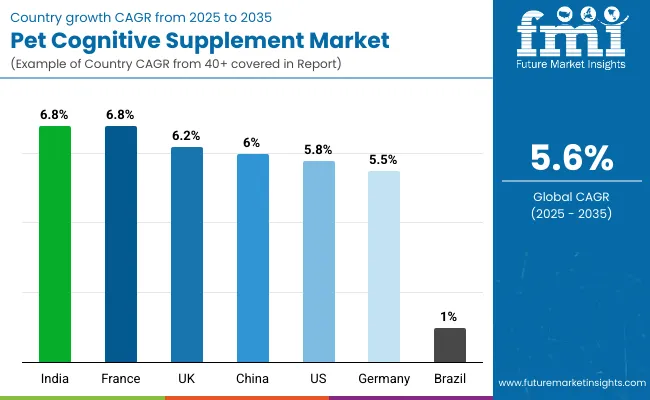

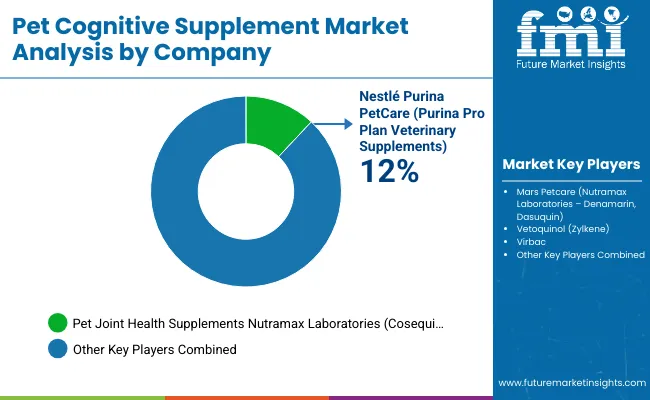

Geographically, the market is led by India and France, supported by pet humanization expansion, veterinary cognitive health awareness, and premium pet care development. UK (6.2%) and Japan (6.3%) sustain growth through advanced veterinary standards and pet wellness ecosystems, while South Korea (6.1%), China (6.0%), USA (5.8%), Germany (5.5%), and Brazil (1.0%) grow through incremental modernization rather than category transformation. Competitive structure remains moderately consolidated, with Nestlé Purina PetCare, Mars Petcare, and Vetoquinol collectively holding significant market share, while regional manufacturers compete through specialized formulations, veterinary partnerships, and application-specific support near pet care distribution hubs.

Manufacturing consolidation reflects the specialized nature of cognitive health ingredient processing where technical expertise and quality control systems determine competitive positioning. Nestlé Purina PetCare, Mars Petcare, and Vetoquinol maintain significant market positions through integrated supply chains and veterinary relationships that secure distribution channels across multiple pet care segments. These companies leverage established formulation capabilities to maintain premium positioning in memory enhancement and neuroprotection applications.

Distribution channel dynamics favor veterinary clinics representing primary sales channels due to professional recommendations and established trust relationships with pet owners. Pet specialty stores serve knowledgeable consumers seeking premium cognitive health solutions while online retail enables direct access to specialized formulations and convenient repeat purchasing. Mass market channels provide broader accessibility for standard cognitive supplement products targeting mainstream pet care applications.

Pet health is being redefined by the accelerating rise of pet humanization. As households across developed and emerging markets increasingly treat pets as family members, demand is shifting from basic nutrition to specialized cognitive support and neurological wellness solutions. Premium pet care now includes supplements designed to enhance memory, emotional balance, and long-term brain health, reflecting a broader shift toward preventive care rather than reactive treatment. This shift is especially visible in performance-focused categories, where cognitive enhancements are becoming a defining factor of perceived product value rather than a niche benefit.

Demographic transitions reinforce this momentum. The aging pet population is expanding rapidly, and conditions related to cognitive decline once accepted as inevitable are now being proactively managed. At the same time, Millennial and Gen Z pet owners are over-indexing on early intervention and preventive supplementation, allocating higher discretionary spend to science-backed solutions that promise long-term neurological resilience. Veterinary professionals have become pivotal purchase influencers by recommending supplements for anxiety, memory preservation, and age-related cognitive impairment significantly improving adoption rates.

Scientific advancements underpin the market’s credibility. Research into companion-animal cognition, neuroprotection, and behavioral wellness is creating a deeper evidence base for next-generation ingredients. Innovation is now centered on bioavailability optimization, precision-formulated delivery systems, and functional ingredients with measurable cognitive outcomes. Product differentiation increasingly depends on validated neurological benefits, clinical substantiation, and high manufacturing standards raising the bar for new entrants and pressuring legacy brands reliant on generic formulations.

| Category | Segments Covered |

|---|---|

| By Pet Type | Dogs, Cats, Others (Rabbits, Birds) |

| By Ingredient Type | Omega-3 Fatty Acids (DHA, EPA), Phosphatidylserine, Ginkgo Biloba, Antioxidants (Vitamin E, C, Selenium), Medium Chain Triglycerides (MCTs), L-Carnitine, Bacopa Monnieri, Curcumin, Others (Ashwagandha, Resveratrol) |

| By Form | Chewables, Powders, Liquids, Capsules/Tablets, Soft Gels |

| By Function | Memory Enhancement, Anxiety & Stress Reduction, Neuroprotection, Aging-related Cognitive Support |

| By Sales Channel | Veterinary Clinics, Pet Specialty Stores, Online Retail, Supermarkets/Hypermarkets, Direct-to-Consumer (DTC) |

| By Life Stage | Puppies/Kittens, Adult, Senior |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Dogs |

|

| Cats |

|

| Others (Rabbits, Birds) |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Omega-3 Fatty Acids (DHA, EPA) |

|

| Phosphatidylserine |

|

| Ginkgo Biloba |

|

| Antioxidants (Vitamin E, C, Selenium) |

|

| Medium Chain Triglycerides (MCTs) |

|

| L-Carnitine |

|

| Bacopa Monnieri |

|

| Curcumin |

|

| Others (Ashwagandha, Resveratrol) |

|

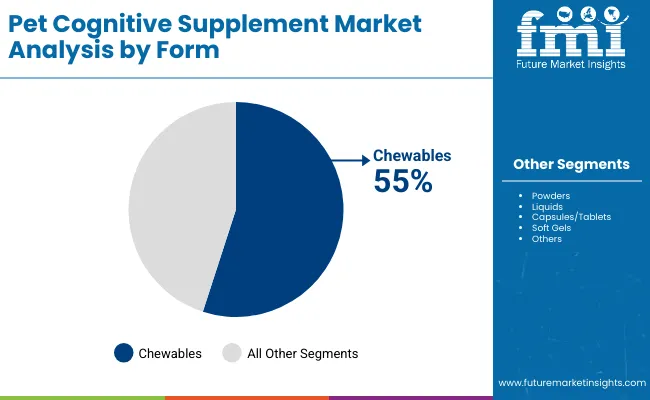

| Form | Status & Outlook 2025-2035 |

|---|---|

| Chewables |

|

| Powders |

|

| Liquids |

|

| Capsules/Tablets |

|

| Soft Gels |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 6.8% |

| France | 6.7% |

| UK | 6.2% |

| China | 6.0% |

| USA | 5.8% |

| Germany | 5.5% |

| Brazil | 1.0% |

Revenue from pet cognitive supplements in India is projected to exhibit strong growth driven by expanding pet ownership demographics and comprehensive pet humanization trends creating substantial opportunities for cognitive health suppliers across companion animal operations, premium pet care applications, and veterinary specialty sectors. The country's developing pet care infrastructure and expanding veterinary awareness capabilities are creating significant demand for both conventional and advanced cognitive supplement ingredients. Major pet care companies are establishing comprehensive local cognitive health processing facilities to support large-scale distribution operations and meet growing demand for neurological support solutions.

Urbanization trends and increasing disposable incomes are supporting widespread adoption of premium pet cognitive supplements across metropolitan regions, driving demand for high-quality neurological ingredients. Pet care modernization programs and specialized veterinary development are creating substantial opportunities for cognitive health suppliers requiring reliable bioavailability and cost-effective brain health supplement solutions. Companion animal care growth and premium pet product development are facilitating adoption of specialty cognitive ingredients throughout major urban regions.

Revenue from pet cognitive supplements in France is expanding supported by extensive premium pet care expansion and comprehensive veterinary cognitive health development creating demand for reliable brain health ingredients across diverse pet care categories and specialty neurological segments. The country's established veterinary tradition and expanding pet humanization capabilities are driving demand for cognitive supplement solutions that provide consistent neurological performance while supporting cost-effective veterinary requirements. Pet care processors and manufacturers are investing in local cognitive health facilities to support growing pet ownership and cognitive supplement demand.

Premium pet care operations expansion and veterinary cognitive health capability development are creating opportunities for brain health ingredients across diverse pet care segments requiring reliable neurological benefits and competitive processing costs. Pet care modernization and cognitive health technology advancement are driving investments in neurological supply chains supporting cognitive performance requirements throughout major veterinary regions. Veterinary cognitive health growth and specialty pet care development programs are enhancing demand for processing-grade cognitive supplements throughout premium pet care areas.

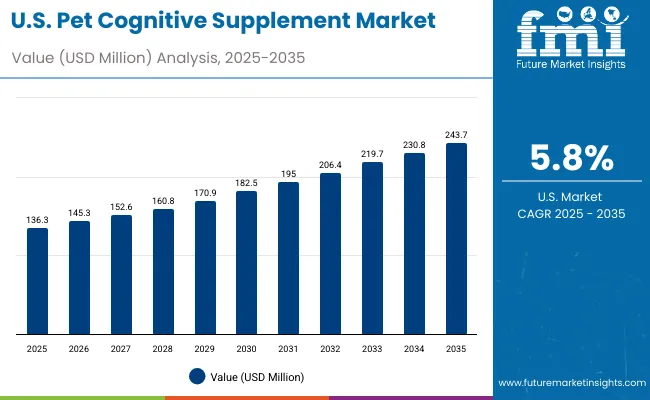

Demand for pet cognitive supplements in USA is projected to grow supported by the country's expanding pet care manufacturing base and veterinary cognitive health technologies requiring advanced brain health systems for companion animal care and specialized neurological applications. American pet care companies are implementing cognitive health systems that support advanced veterinary techniques, operational efficiency, and comprehensive quality protocols. The market is characterized by focus on operational excellence, neurological performance, and compliance with veterinary medicine quality standards.

Premium pet care industry investments are prioritizing advanced cognitive health technologies that demonstrate superior neurological benefits and quality while meeting American veterinary standards. Pet health leadership programs and operational excellence initiatives are driving adoption of precision-engineered cognitive supplement ingredients that support advanced veterinary systems and neurological performance optimization. Research and development programs for cognitive enhancement are facilitating adoption of specialized processing techniques throughout major pet care centers.

Revenue from pet cognitive supplements in UK is growing driven by advanced pet care development programs and increasing veterinary cognitive health innovation creating opportunities for brain health suppliers serving both companion animal operations and specialty veterinary contractors. The country's extensive pet ownership base and expanding cognitive health awareness are creating demand for neurological ingredients that support diverse cognitive requirements while maintaining veterinary performance standards. Pet care manufacturers and specialty ingredient service providers are developing procurement strategies to support operational efficiency and regulatory compliance.

Advanced veterinary development programs and cognitive health manufacturing are facilitating adoption of brain health ingredients capable of supporting diverse neurological requirements and competitive processing standards. Pet cognitive health innovation and performance-focused veterinary development programs are enhancing demand for processing-grade cognitive supplements that support operational efficiency and neurological reliability. Premium pet care market expansion and specialty cognitive health development are creating opportunities for advanced brain health processing capabilities across UK pet care manufacturing facilities.

Demand for pet cognitive supplements in Germany is projected to grow driven by premium pet care manufacturing excellence and specialty cognitive health capabilities supporting advanced veterinary development and comprehensive companion animal applications. The country's established veterinary processing tradition and growing premium pet care market segments are creating demand for high-quality cognitive supplement ingredients that support operational performance and neurological standards. Pet care manufacturers and processing suppliers are maintaining comprehensive development capabilities to support diverse veterinary requirements.

Premium pet care manufacturing and specialty cognitive health programs are supporting demand for processing-grade brain health supplements that meet contemporary neurological and reliability standards. Companion animal development and performance-focused veterinary programs are creating opportunities for specialized cognitive supplement ingredients that provide comprehensive neurological support. Manufacturing modernization and pet care quality enhancement programs are facilitating adoption of advanced cognitive health capabilities throughout major veterinary regions.

Revenue from pet cognitive supplements in China is expanding at 6.0% CAGR supported by extensive pet ownership growth and comprehensive pet care industry development creating demand for reliable cognitive health ingredients across diverse companion animal categories and specialty veterinary segments. The country's growing pet care position and expanding veterinary capabilities are driving demand for cognitive supplement solutions that provide consistent neurological performance while supporting cost-effective processing requirements.

Pet care operations expansion and veterinary cognitive health capability development are creating opportunities for brain health ingredients across diverse pet care segments requiring reliable neurological benefits and competitive processing costs. Pet care modernization and cognitive health technology advancement are driving investments in veterinary supply chains supporting neurological performance requirements throughout major pet care regions. Veterinary cognitive health growth and specialty pet care development programs are enhancing demand for processing-grade cognitive supplements throughout companion animal care areas.

Demand for pet cognitive supplements in Brazil is projected to grow at 1.0% CAGR reflecting the country's developing pet care infrastructure and economic considerations affecting premium cognitive health adoption. The market demonstrates potential for steady growth as pet ownership increases and veterinary cognitive health awareness expands throughout major urban centers.

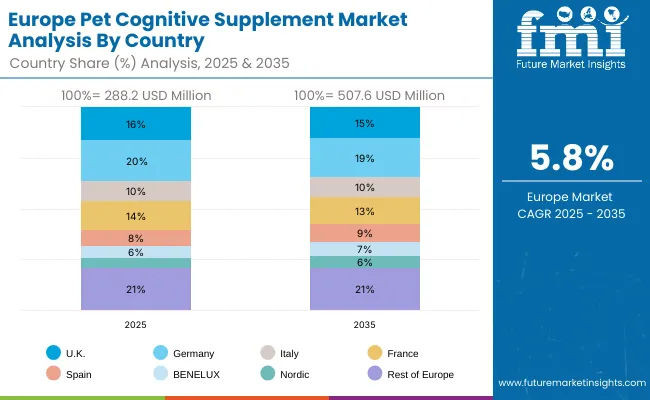

European pet cognitive supplement operations are increasingly differentiated between Western European premium processing and Eastern European cost-competitive manufacturing. German (USD 96.2 million) and UK facilities (USD 81.2 million) dominate premium pet cognitive health processing, leveraging advanced veterinary technologies and strict quality protocols that command price premiums in global markets. German processors maintain leadership in high-performance cognitive supplement applications, with major pet care companies driving technical specifications that smaller suppliers must meet to access supply contracts.

France (USD 71.1 million), Italy (USD 50.8 million), and Spain (USD 40.6 million) operations focus on specialized applications and regional market requirements. BENELUX countries (USD 35.5 million), Nordic regions (USD 30.4 million), and Rest of Europe (USD 106.6 million) including Eastern European operations are capturing volume-oriented processing contracts through labor cost advantages and EU regulatory compliance, particularly in standard cognitive supplement ingredients for pet care applications.

The regulatory environment presents both opportunities and constraints. EU pet food regulations and veterinary medicine directives create barriers for novel cognitive ingredients but establish quality standards that favor established European processors over imports. Brexit has fragmented UK sourcing from EU suppliers, creating opportunities for direct relationships between processors and British pet care manufacturers.

Supply chain consolidation accelerates as processors seek economies of scale to absorb rising energy costs and compliance expenses. Vertical integration increases, with major pet care manufacturers acquiring cognitive health facilities to secure brain health supplies and quality control. Smaller processors face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream pet cognitive supplement manufacturing requirements.

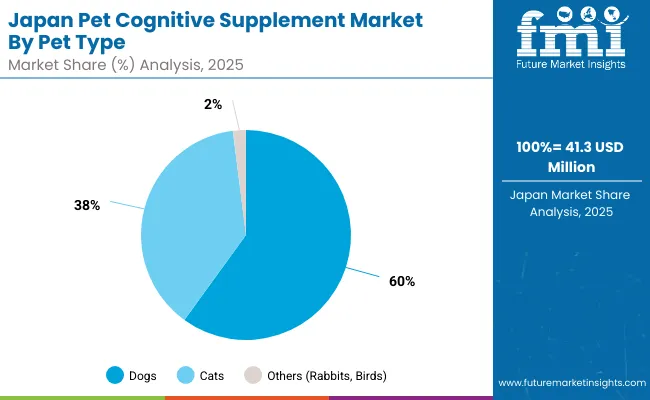

Japanese Pet Cognitive Supplement operations reflect the country's exacting quality standards and sophisticated pet care expectations. Major pet care manufacturers maintain rigorous supplier qualification processes that often exceed international standards, requiring extensive documentation, batch testing, and facility audits that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports premium product positioning.

The Japanese market demonstrates unique pet type preferences with Dogs accounting for 60.0%, Cats 38.0%, and Others 2.0%. Companies require specific cognitive ingredient ratios and neurological specifications that differ from Western applications, driving demand for customized processing capabilities.

Regulatory oversight emphasizes comprehensive veterinary ingredient management and traceability requirements that surpass most international standards. The pet supplement registration system requires detailed ingredient sourcing information, creating advantages for suppliers with transparent supply chains and comprehensive documentation systems.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese companies typically maintain long-term supplier relationships spanning decades, with annual contract negotiations emphasizing quality consistency over price competition. This stability supports investment in specialized cognitive health equipment tailored to Japanese specifications.

South Korean Pet Cognitive Supplement operations reflect the country's advanced pet care sector and technology-oriented business model. Major pet care companies drive sophisticated ingredient procurement strategies, establishing direct relationships with global suppliers to secure consistent quality and pricing for their cognitive supplement operations targeting both domestic and regional markets.

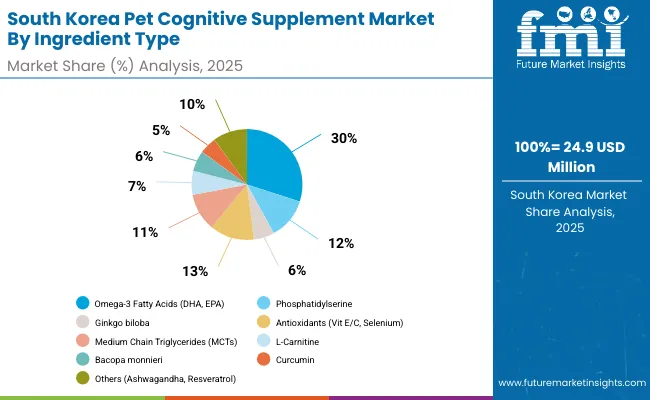

The Korean market demonstrates particular strength in ingredient distribution with Omega-3 Fatty Acids accounting for 30.0%, Antioxidants 13.0%, Phosphatidylserine 12.0%, Medium Chain Triglycerides 11.0%, Others 10.0%, L-Carnitine 7.0%, Ginkgo Biloba 6.0%, BacopaMonnieri 6.0%, and Curcumin 5.0%. This technology-focused approach creates demand for specific neurological specifications that differ from Western applications, requiring suppliers to adapt cognitive health and purification techniques.

Regulatory frameworks emphasize pet health ingredient safety and traceability, with Korean veterinary administration standards often exceeding international requirements. This creates barriers for smaller pet care suppliers but benefits established processors who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with comprehensive certification and documentation systems.

Supply chain efficiency remains critical given Korea's geographic limitations and import dependence. Companies increasingly pursue long-term contracts with suppliers in United States, Germany, and Japan to ensure reliable access to cognitive ingredients while managing foreign exchange risks. Technical logistics investments support quality preservation during extended shipping periods.

The market faces pressure from rising labor costs and competition from lower-cost regional manufacturers, driving automation investments and consolidation among smaller processors. However, the premium positioning of Korean pet care brands internationally continues to support demand for high-quality cognitive supplement ingredients that meet stringent specifications.

Profit pools are consolidating upstream in scaled cognitive health production systems and downstream in value-added specialty formulations for companion animal care, veterinary applications, and premium pet health solutions where certification, traceability, and consistent neurological benefits command premiums. Value is migrating from raw ingredient commodity trading to specification-tight, application-ready cognitive supplements where technical expertise and quality control drive competitive advantage.

Several archetypes set the pace: global pet care integrators defending share through production scale and technical reliability; multi-ingredient processors that manage complexity and serve diverse applications; specialty cognitive health developers with formulation expertise and veterinary industry ties; and bioavailability-driven suppliers pulling volume in premium pet care and neurological support applications. Switching costs including re-qualification, neurological testing, performance validation, provide stability for incumbents, while supply shocks and regulatory changes reopen opportunities for diversified suppliers.

Consolidation and verticalization continue; digital procurement emerges in commodity ingredients while premium specifications remain relationship-led. Focus areas: lock veterinary and pet care pipelines with application-specific formulations and service level agreements; establish multi-ingredient production capabilities and technical disclosure; develop specialized cognitive health formulations with neurological claims

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD Million |

| Pet Type | Dogs, Cats, Others (Rabbits, Birds) |

| Ingredient Type | Omega-3 Fatty Acids (DHA, EPA), Phosphatidylserine, Ginkgo Biloba, Antioxidants (Vitamin E, C, Selenium), Medium Chain Triglycerides (MCTs), L-Carnitine, Bacopa Monnieri, Curcumin, Others (Ashwagandha, Resveratrol) |

| Form | Chewables, Powders, Liquids, Capsules/Tablets, Soft Gels |

| Function | Memory Enhancement, Anxiety & Stress Reduction, Neuroprotection, Aging-related Cognitive Support |

| Sales Channel | Veterinary Clinics, Pet Specialty Stores, Online Retail, Supermarkets/Hypermarkets, Direct-to-Consumer (DTC) |

| Life Stage | Puppies/Kittens, Adult, Senior |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, China, Japan, India, South Korea, France, UK, Brazil, and other 40+ countries |

| Key Companies Profiled | Nestlé Purina PetCare, Mars Petcare, Vetoquinol, Virbac, Swedencare |

| Additional Attributes | Dollar sales by pet type/ingredient type/form, regional demand (NA, EU, APAC), competitive landscape, chewables vs. other form adoption, production/processing integration, and advanced formulation innovations driving bioavailability enhancement, cognitive advancement, and neurological efficiency |

The pet cognitive supplement market is valued at USD 850.0 million in 2025.

The market is forecast to reach USD 1,472.5 million by 2035.

The market is projected to expand at a CAGR of 5.6% between 2025 and 2035.

Dogs are the leading pet type, accounting for about 72.0% of the global pet cognitive supplement market in 2025.

Omega-3 fatty acids (DHA, EPA) are the leading ingredient type, contributing around 28.0% share of the market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Industry Share Analysis for Pet Dietary Supplement Companies

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Probiotics Supplements Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Postbiotics Supplement Market – Trends, Demand & Pet Wellness

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Cognitive health supplements market analysis by product type, form, sales channel, functionality, and by region – Growth, trends, and Forecast from 2025 to 2035

UK Pet Dietary Supplement Market Growth – Trends, Demand & Forecast 2025-2035

Market Outlook of Omega-3 Pet Supplement by Pet, Type, Form, Application and Other Types Through 2035

USA Pet Dietary Supplement Market Insights – Size, Share & Industry Growth 2025-2035

Comprehensive Analysis of Europe Pet Food Supplements Market by Nature, Form, Pet Type and Distribution Channel through 2035

ASEAN Pet Dietary Supplement Market Report – Demand, Growth & Trends 2025-2035

Pet Skin & Coat Health Supplement Market Analysis by Pet Type, Form, Availability and Sales Channel Through 2035

Europe Pet Dietary Supplement Market Trends – Growth, Demand & Outlook 2025-2035

Australia Pet Dietary Supplement Market Analysis – Size, Share & Forecast 2025-2035

Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Dog Intestinal Health Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA