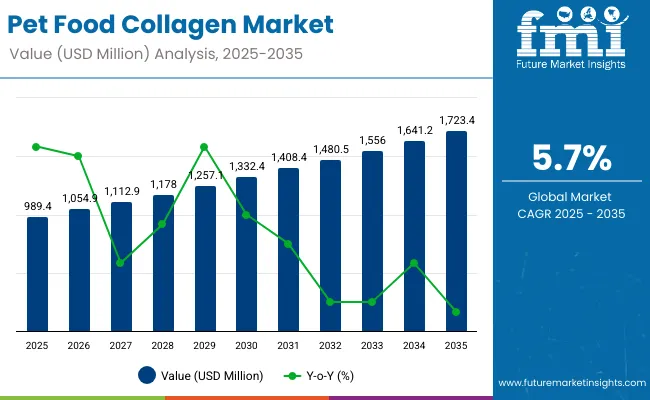

The global pet food collagen market is projected to grow from USD 989.4 million in 2025 to approximately USD 1,723.4 million by 2035, recording an absolute increase of USD 734.0 million over the forecast period. This translates into a total growth of 74.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 5.7% between 2025 and 2035. The shift is driven by pet nutrition systems that are becoming more humanization-focused, health-specialized, and sensitive to aging-related wellness variations.

As veterinary clinics, specialty pet stores, premium pet care facilities, and companion animal healthcare providers add more specialized collagen protocols and functional nutrition systems, the tolerance for nutritional gaps drops. Pet food collagen appeals here because it supports joint health reliably, enhances skin and coat quality consistently, and integrates well into existing feeding architectures without requiring redesign of nutrition protocols or supplement layouts.

Pet Food Collagen Market Key Takeaways

| Metric | Value |

|---|---|

| Market Value (2025) | USD 989.4 million |

| Market Forecast Value (2035) | USD 1,723.4 million |

| Forecast CAGR (2025 to 2035) | 5.7% |

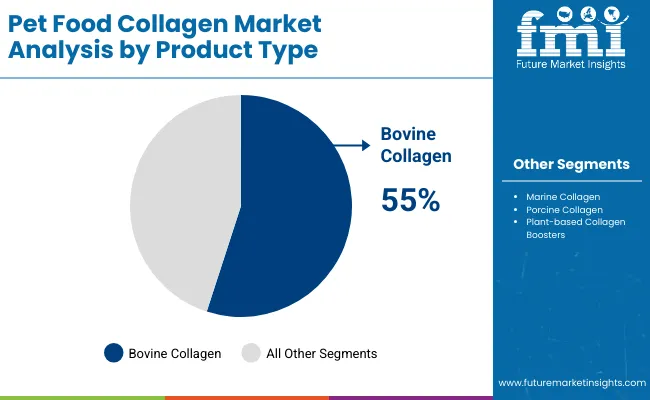

The bovine collagen category, representing about 55% of demand, remains the workhorse segment due to its widespread fit in joint health applications, aging support systems, daily supplement programs, and therapeutic nutrition facilities. On the demand side, dogs account for the majority of total market consumption because joint health requirements, aging demographics, and premium nutrition pressures are highest in these environments.

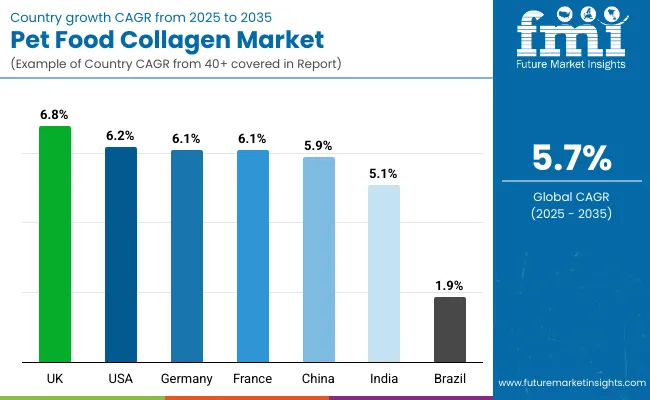

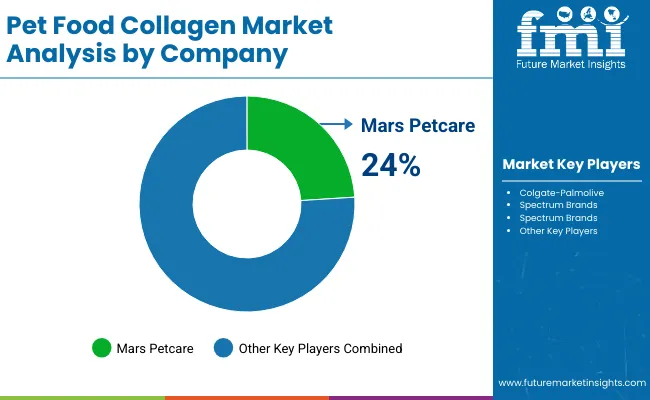

Geographically, the market is led by UK (6.8% CAGR) and USA (6.2% CAGR), supported by pet humanization expansion, premium nutrition development, and wellness policy incentives. Germany (6.1%) and France (6.0%) sustain growth through advanced veterinary standards and pet wellness ecosystems, while China (5.9%), India (5.1%), and Brazil (1.9%) grow through incremental adoption rather than category transformation. Competition remains moderately consolidated, with Nestlé Purina PetCare, Mars Petcare, and Colgate-Palmolive competing through specialized formulations, faster bioavailability validation, and application-specific support near pet nutrition distribution hubs.

Innovation focus areas include advanced processing technologies for bioavailability enhancement, specialized formulations targeting specific health claims, and technical innovations integrating intelligent processing management for sophisticated pet nutritional solutions. Companies developing evidence-based collagen health claims through clinical validation maintain competitive advantages in veterinary-recommended segments where professional endorsement drives purchasing decisions rather than price considerations alone, supporting continued market expansion across diverse companion animal applications and therapeutic requirements.

Competitive positioning reflects manufacturing scale economics where larger processors including Nestlé Purina PetCare, Mars Petcare, and Colgate-Palmolive achieve cost advantages through integrated production systems and comprehensive ingredient procurement capabilities. These companies leverage established formulation expertise and veterinary relationships to maintain premium positioning while smaller specialized companies focus on niche applications requiring custom formulations and technical support services.

| NUTRITIONAL & HEALTH TRENDS | MANUFACTURING REQUIREMENTS | REGULATORY & QUALITY STANDARDS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

| By Product Type | Bovine Collagen, Marine Collagen, Porcine Collagen, Plant-based Collagen Boosters |

| By Format | Powder, Liquid, Soft Chews, Treat Sticks, Capsules/Tablets, Infused Kibble |

| By Source Type | Type I Collagen, Type II Collagen, Type III Collagen, Hydrolyzed Collagen (Collagen Peptides), Gelatin |

| By Pet Type | Dogs, Cats, Other Pets (horses, small mammals) |

| By Health Claim | Joint Health & Mobility, Skin & Coat Health, Digestive Support, Aging Support, Bone & Muscle Strength |

| By Sales Channel | Veterinary Clinics, Specialty Pet Stores, E-commerce, Mass Retailers, Subscription/DTC |

| By Application | Daily Supplements, Therapeutic/Prescription Nutrition, Functional Treats, Meal Toppers, Dental Chews |

| By Claim Positioning | Organic, Non-GMO, Grass-fed/Bioavailable Source, Grain-Free, Human-Grade |

| By Region | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

Bovine collagen will remain the dominant segment through 2035, holding its 55% share advantage built on functional maturity, broad clinical familiarity, and the widest applicability across joint health, aging support, and general wellness formulations. Its growth trajectory is steady at approximately 6.2% CAGR, supported by a large, stable supply chain and predictable performance outcomes in both therapeutic and preventive use cases. The key vulnerability is exposure to raw-material price volatility, which could pressure margins and accelerate customer migration to alternatives if price gaps widen materially.

Marine collagen is positioned for accelerated premium-tier expansion. With a projected 7% CAGR, its growth is fueled by superior bioavailability perceptions and increasing presence in high-end formulations designed for mobility enhancement, recovery, and advanced cognitive wellness. Adoption is being driven by therapeutic-grade products and premium supplement brands rather than mass-market consumption. Expect sustained momentum in specialized applications but watch for potential constraints tied to sourcing sustainability and traceability requirements.

Plant-based collagen boosters represent the fastest-growing frontier, projected at 8.5% CAGR. Although starting from a smaller base, they benefit from alignment with broader plant-based nutrition trends and rising interest in alternative proteins among younger pet owners. Their trajectory depends heavily on scientific validation and demonstrated efficacy relative to animal-derived collagen. If clinical evidence strengthens and consumer education improves, this segment could shift from niche positioning to mainstream acceleration.

Porcine collagen continues to deliver moderate 4.5% CAGR growth anchored in traditional supplement applications and cost-advantage positioning. Despite stability in conventional demand, momentum is comparatively weaker as marine and plant-based options gain competitive ground. Transition risk is real: without innovation or repositioning, porcine collagen may gradually lose share, particularly in premium and therapeutic categories driven by perception-led differentiation.

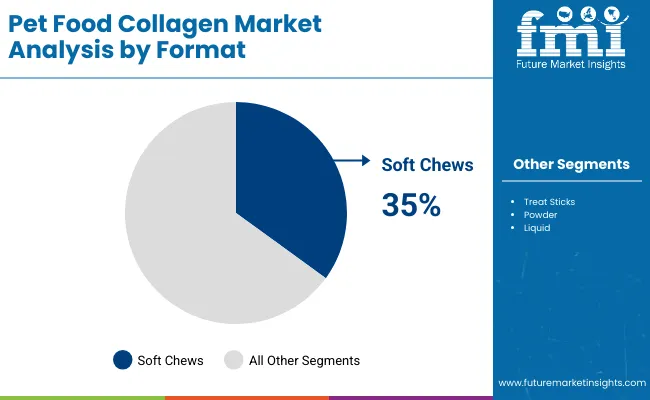

Soft chews will remain the anchor format of the market through 2035. With a 35% share in 2025 and a projected 7.5% CAGR, they combine three things pet owners care about: ease of administration, high palatability, and minimal disruption to daily routines. They are particularly effective in aging and mobility-focused regimens where long-term compliance matters. The main operational risk is shelf stability, especially in humid climates where texture degradation and microbial risk can undermine both product quality and brand trust. Players that get formulation, packaging, and distribution climate-control right will consolidate share; those that cut corners here will pay in returns and reputational damage.

Infused kibble is the genuine breakout format. At 8.2% CAGR, it benefits from being embedded directly into daily feeding rituals, reducing the "extra step" friction associated with standalone supplements. Adoption is rising fastest in premium and super-premium pet food lines, where collagen is bundled with holistic formulations (joint, coat, gut, and cognitive support). However, it is also the most technically demanding format: high-temperature processing, extrusion, and storage can erode collagen functionality if not tightly controlled. Brands that market "fortified" kibble without protecting bioactive integrity risk a widening gap between the label claim and the actual physiological benefit.

Treat sticks sit in a hybrid space part indulgence, part delivery mechanism. Growing at 6.5% CAGR with a 20% share, they ride on pet-owner bonding moments while quietly serving as a supplementation channel. Their strength lies in engagement: owners feel they are "rewarding" rather than "medicating" their pets. Over time, though, calorie density, formulation trade-offs (taste vs. active dosage), and positioning (treat vs. therapeutic) will determine how defensible this category is as more functional treats flood the market.

Powder formats grow at a moderate 6.8% CAGR but play a disproportionately important role in professional and custom applications. Their key advantage is flexibility: adjustable dosing, easy integration into home-cooked meals or wet food, and suitability for pets with specific dietary constraints. They tend to be favored by more informed or highly engaged owners and by veterinary professionals who want dosing precision. The trade-off is convenience powders require effort and habit formation, which means mass-market uptake will always be capped relative to plug-and-play formats like soft chews and infused kibble.

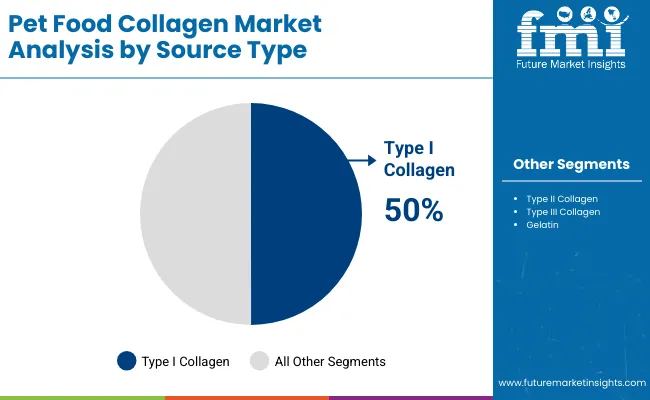

Type I collagen will remain the workhorse of the category through 2035. With roughly half of total usage in 2025 and a projected 6.5% CAGR, it underpins most "general health and aging" propositions joint comfort, skin integrity, and overall structural support. Its appeal lies in breadth rather than sharp differentiation: it is well understood, relatively predictable in formulation, and compatible with multiple delivery formats. The constraint is economic rather than conceptual. Extraction and purification are complex, and any sustained rise in input or processing costs will quickly show up in pricing, pushing some brands toward cheaper, lower-purity options that risk undermining trust and efficacy.

Hydrolyzed collagen (collagen peptides) is where most of the "value upgrade" is happening. Growing at around 7.8% CAGR, this segment is shaped by one core promise: higher bioavailability and more reliable absorption. That promise justifies premium pricing, more sophisticated delivery systems, and tighter integration with performance-led claims (mobility, recovery, resilience in aging pets). It is also where processing sophistication matters most enzymatic hydrolysis profiles, molecular weight distribution, and carrier systems become levers for differentiation. As more brands crowd into this narrative, the winners will be those that can consistently link specific peptide characteristics to measurable outcomes rather than generic "better absorption" slogans.

Type II collagen is a smaller but strategically important niche, tied closely to joint-specific and cartilage-focused applications. Its growth at 6.8% CAGR reflects rising demand for more targeted interventions in mobility and degenerative joint conditions, especially among aging or large-breed animals. The segment behaves more like a quasi-therapeutic space than a routine wellness add-on: dosing, sourcing, and co-formulation with other joint-support ingredients (e.g., glucosamine, chondroitin, hyaluronic acid) will shape clinical and commercial performance. It is unlikely to dominate volume, but it can command disproportionate influence in high-need, high-willingness-to-pay segments.

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

| Global Pet Humanization Growth Continuing expansion of pet humanization trends across established and emerging markets driving demand for high-bioavailability collagen supplement solutions. Aging Pet Population Demographics Increasing adoption of advanced nutritional delivery systems importance in pet health efficiency and bioavailability optimization. Premium Pet Supplement Demand Growing demand for collagen-based supplements that support both performance benefits and processing efficiency in pet nutrition manufacturing. | Raw Material Price Volatility Price fluctuations affecting production costs and supply chain predictability for manufacturers. Technical Qualification Requirements Complex technical requirements across applications affecting product development and standardization. Competition from Alternatives Alternative joint health and nutritional delivery technologies affecting market selection and development. | Advanced Processing Technologies Integration of advanced collagen processing systems, manufacturing innovations, and quality control solutions enabling superior operational efficiency. Performance Enhancement Enhanced absorption control, improved joint health support, and advanced bioavailability capabilities compared to traditional supplement systems. Specialized Formulations Development of specialized collagen grades and custom formulations providing enhanced performance benefits and application-specific optimization. Technical Innovation Integration of advanced collagen development and intelligent processing management for sophisticated pet nutritional solutions. |

| Countries | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

| USA | 6.2% |

| Germany | 6.1% |

| France | 6.0% |

| China | 5.9% |

| India | 5.1% |

| Brazil | 1.9% |

The UK’s pet food collagen market is influenced by high pet insurance penetration, strong veterinary practice standards, and post-Brexit logistics friction. Insurance matters because it shifts spend from "out-of-pocket guilt purchases" to "covered clinical recommendations." When vets prescribe or recommend joint-support diets or collagen chews for osteoarthritis, insured owners are far more likely to accept premium SKUs. RCVS-driven practice norms and evidence expectations also raise the bar: brands trying to win vet endorsement must show decent formulation quality, traceability, and at least some data on mobility outcomes.

Post-Brexit is the grit in the machine. Importing collagen, finished supplements, or specialized ingredients from EU suppliers now means more paperwork, more documentation around animal origin and by-products, and occasional delays. That hurts low-margin players more than large integrated groups. Net effect: the UK becomes an attractive but demanding collagen market; good upside for brands that can navigate insurance-linked vet channels and maintain compliant EU/UK supply chains, but unforgiving for cheap, under-documented imports that used to slip in under lighter regimes.

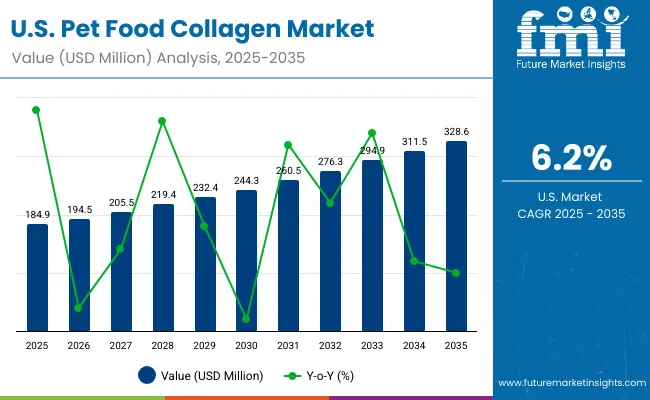

Chewy, Amazon, and brand-owned DTC sites compress the distance between marketing and purchase. If a dog owner sees a joint-health ad, reads a few reviews, and finds a "subscribe & save" soft-chew collagen, conversion can happen without a vet ever touching the decision. That favors strong brands with marketing muscle and subscription frameworks.

On the clinical side, corporate vet hospital groups and clinic chains standardize protocols, formularies, and preferred partners. Get into their system and collagen products can move at scale. Overlay this with the regulatory grey: collagen products are often marketed as "supplements," but when claims creep toward treating disease. Smart players design claims, labeling, and vet-detailing carefully; enough clinical seriousness to be credible, not so much that they trigger a regulatory hammer.

Germany’s pet food collagen market is shaped by a deep regulatory culture and a broadly conservative approach to animal-origin inputs. It’s not enough to say "bovine collagen from good sources"; brands are expected to show where animals come from, how by-products are managed, and whether manufacturing aligns with broader EU rules. EFSA opinions, BfR guidance, and the general German tendency toward over-documentation rather than under-documentation mean that origin, traceability, and processing conditions matter as much as the marketing story.

This has two consequences. First, collagen from poorly characterized or ambiguous sources becomes a hard sell, especially when linked to countries with weaker veterinary controls. Second, the hurdle favors players who invest in clean supply chains: audited slaughterhouses, controlled hydrolysis facilities, and robust residue and contaminant testing. German consumers already lean toward "quality and safety over bargain bin," and vets reflect that mindset. For collagen brands, the opportunity is to position around reliability, joint-health effectiveness, and sourcing integrity; the risk is that any scandal or poor-quality batch can kill trust not just for a product, but for the category in that clinic network.

India’s pet food collagen market is basically a premium island surrounded by a vast low-budget ocean. Pet ownership is growing quickly, but mass spend is still in basic kibble, homemade diets, and low-cost treats. Collagen plays mostly in metro and tier-1 urban pockets; families treating dogs like kids, frequenting chain clinics, and buying imported or premium domestic brands online. Here, collagen chews and joint-support treats can ride on rising awareness of hip dysplasia, arthritis in larger breeds, and Instagram-fueled "pet parenting."

Outside these metros, price is king. A single collagen chew that costs as much as a kilo of basic food will not scale. Even inside big cities, owners often trade off between vaccines, diagnostics, grooming, and supplements. Vets may recommend collagen, but compliance depends heavily on perceived results and visible mobility improvement. The path forward is stacked: starter SKUs at accessible price points, multi-benefit products (joint + coat + immunity) to justify spend, and education focused on working breeds, large dogs, and aging pets. India is a growth story, but it’s a long, grindypremiumization curve, not an overnight goldmine.

Brazil is structurally interesting for pet food collagen because it has abundant animal by-products from large beef and poultry industries, yet a pet market still constrained by income and price sensitivity. On the supply side, collagen extraction from local slaughterhouse by-products is a textbook circular-economy play cheap feedstock, strong export experience, and technical know-how from human food and pharma collagen. This gives Brazilian producers a cost base that many import-dependent countries cannot match.

Demand, however, is heavily skewed toward urban centers like São Paulo and Rio, where premium pet food, supplements, and vet chains are concentrated. Outside those zones, owners still gravitate toward economy and mid-tier products; a collagen chew has to fight for wallet share against vaccines, basic food, and routine care. Export orientation complicates the picture: some of the best collagen may leave the country for higher-margin overseas markets, while domestic brands juggle between serving local price-sensitive pet owners and chasing foreign hard currency. For collagen players, Brazil is both a sourcing powerhouse and a selective domestic market: high potential in urban premium niches, but tight price ceilings and big regional inequality in actual purchasing power.

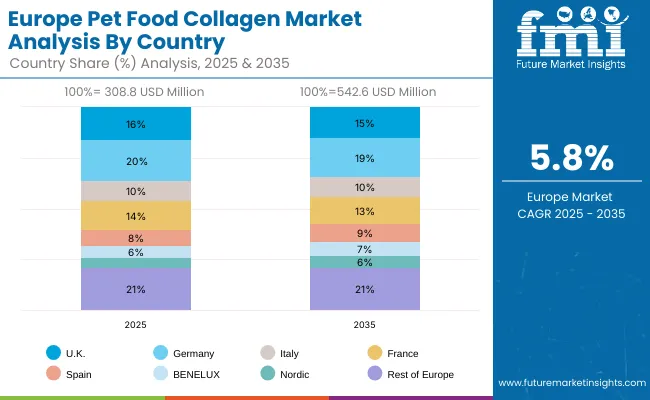

European pet food collagen operations are increasingly polarized between Western European precision processing and Eastern European cost-competitive manufacturing. German (USD 61.8 million) and UK facilities (USD 49.4 million) dominate premium veterinary nutrition and pet supplement collagen processing, leveraging advanced pet nutritional technologies and strict quality protocols that command price premiums in global markets. German processors maintain leadership in high-performance collagen applications, with major pet supplement companies driving technical specifications that smaller suppliers must meet to access supply contracts.

France (USD 43.3 million), Italy (USD 30.9 million), and Spain (USD 24.7 million) operations focus on specialized applications and regional market requirements. BENELUX (USD 18.5 million), Nordic (USD 15.4 million), and Rest of Europe (USD 64.9 million) including Eastern European operations in Poland, Hungary, and Czech Republic are capturing volume-oriented processing contracts through labor cost advantages and EU regulatory compliance, particularly in standard collagen ingredients for pet supplement applications.

The regulatory environment presents both opportunities and constraints. EU pet food regulations and supplement directives create barriers for novel collagen ingredients but establish quality standards that favor established European processors over imports. Brexit has fragmented UK sourcing from EU suppliers, creating opportunities for direct relationships between processors and British pet supplement manufacturers.

Supply chain consolidation accelerates as processors seek economies of scale to absorb rising energy costs and compliance expenses. Vertical integration increases, with major pet supplement manufacturers acquiring processing facilities to secure collagen supplies and quality control. Smaller processors face pressure to specialize in niche applications or risk displacement by larger, more efficient operations serving mainstream pet nutrition manufacturing requirements.

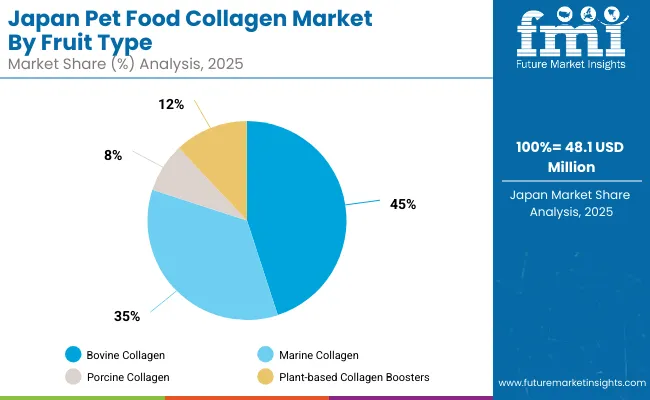

Japanese Pet Food Collagen operations reflect the country's exacting quality standards and sophisticated pet nutritional expectations. Major pet supplement manufacturers maintain rigorous supplier qualification processes that often exceed international standards, requiring extensive documentation, batch testing, and facility audits that can take 12-18 months to complete. This creates high barriers for new suppliers but ensures consistent quality that supports premium product positioning.

The Japanese market demonstrates unique application preferences with Joint Health & Mobility accounting for 40.0%, Skin & Coat Health 25.0%, Aging Support 20.0%, Digestive Support 10.0%, and Bone & Muscle Strength 5.0%. Companies require specific collagen ratios and purity specifications that differ from Western applications, driving demand for customized processing capabilities.

Japanese market demonstrates unique product type preferences with Bovine Collagen accounting for 45.0%, Marine Collagen 35.0%, Plant-based Collagen Boosters 12.0%, and Porcine Collagen 8.0%. Companies require specific molecular binding and bioavailability specifications that differ from Western applications, driving demand for customized collagen capabilities.

Regulatory oversight emphasizes comprehensive pet nutritional ingredient management and traceability requirements that surpass most international standards. The pet supplement registration system requires detailed ingredient sourcing information, creating advantages for suppliers with transparent supply chains and comprehensive documentation systems.

Supply chain management focuses on relationship-based partnerships rather than purely transactional procurement. Japanese companies typically maintain long-term supplier relationships spanning decades, with annual contract negotiations emphasizing quality consistency over price competition. This stability supports investment in specialized processing equipment tailored to Japanese specifications.

South Korean Pet Food Collagen operations reflect the country's advanced pet care sector and export-oriented business model. Major pet supplement companies drive sophisticated ingredient procurement strategies, establishing direct relationships with global suppliers to secure consistent quality and pricing for their pet nutrition and supplement operations targeting both domestic and international markets.

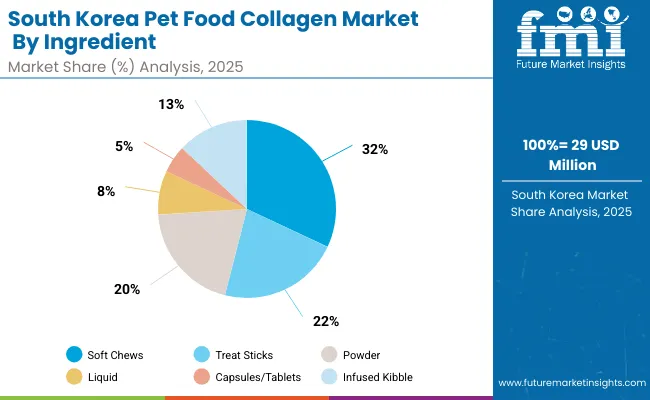

The Korean market demonstrates particular strength in format distribution with Soft Chews accounting for 32.0%, Treat Sticks 22.0%, Powder 20.0%, Infused Kibble 13.0%, Liquid 8.0%, and Capsules/Tablets 5.0%. This convenience-focused approach creates demand for specific bioavailability specifications that differ from Western applications, requiring suppliers to adapt collagen processing and purification techniques.

Regulatory frameworks emphasize pet nutritional ingredient safety and traceability, with Korean food administration standards often exceeding international requirements. This creates barriers for smaller pet supplement suppliers but benefits established processors who can demonstrate compliance capabilities. The regulatory environment particularly favors suppliers with comprehensive certification and documentation systems.

Supply chain efficiency remains critical given Korea's geographic limitations and import dependence. Companies increasingly pursue long-term contracts with suppliers in United States, Germany, and Japan to ensure reliable access to raw materials while managing foreign exchange risks. Technical logistics investments support quality preservation during extended shipping periods.

The market faces pressure from rising labor costs and competition from lower-cost regional manufacturers, driving automation investments and consolidation among smaller processors. However, the premium positioning of Korean pet supplement brands internationally continues to support demand for high-quality collagen ingredients that meet stringent specifications.

Profit pools are consolidating upstream in scaled collagen production systems and downstream in value-added specialty grades for pet supplements, veterinary nutrition, and therapeutic applications where certification, traceability, and consistent bioavailability command premiums. Value is migrating from raw collagen commodity trading to specification-tight, application-ready collagen formulations where technical expertise and quality control drive competitive advantage.

Several archetypes set the pace: global pet nutrition integrators defending share through production scale and technical reliability; multi-application processors that manage complexity and serve diverse pet segments; specialty collagen developers with formulation expertise and veterinary industry ties; and bioavailability-driven suppliers pulling volume in premium pet supplement and therapeutic applications. Switching costs including re-qualification, bioavailability testing, performance validation, provide stability for incumbents, while supply shocks and regulatory changes reopen opportunities for diversified suppliers.

Consolidation and verticalization continue; digital procurement emerges in commodity grades while premium specifications remain relationship-led. Focus areas: lock veterinary and pet nutrition pipelines with application-specific grades and service level agreements; establish multi-application production capabilities and technical disclosure; develop specialized collagen formulations with bioavailability claims.

| Stakeholder Type | Primary Advantage | Repeatable Plays |

|---|---|---|

| Global pet nutrition integrators | Scale, production integration, technical reliability | Long-term contracts, tight specs, co-development with veterinary/nutrition |

| Multi-application processors | Application diversification, segment expertise, supply flexibility | Multi-segment serving, technical support, quality assurance across applications |

| Specialty collagen developers | Formulation expertise and industry relationships | Custom formulations, bioavailability science, performance SLAs |

| Bioavailability suppliers | Application-focused demand and specialized service | Technical bioavailability claims, specialized formulations, application activation |

| Pet nutritional distributors & platforms | Technical support for mid-tier manufacturers | Application selection, smaller volumes, technical service |

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 989.4 Million |

| Product Type | Bovine Collagen, Marine Collagen, Porcine Collagen, Plant-based Collagen Boosters |

| Format | Powder, Liquid, Soft Chews, Treat Sticks, Capsules/Tablets, Infused Kibble |

| Source Type | Type I Collagen, Type II Collagen, Type III Collagen, Hydrolyzed Collagen (Collagen Peptides), Gelatin |

| Pet Type | Dogs, Cats, Other Pets (horses, small mammals) |

| Health Claim | Joint Health & Mobility, Skin & Coat Health, Digestive Support, Aging Support, Bone & Muscle Strength |

| Sales Channel | Veterinary Clinics, Specialty Pet Stores, E-commerce, Mass Retailers, Subscription/DTC |

| Application | Daily Supplements, Therapeutic/Prescription Nutrition, Functional Treats, Meal Toppers, Dental Chews |

| Claim Positioning | Organic, Non-GMO, Grass-fed/Bioavailable Source, Grain-Free, Human-Grade |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, China, Japan, India, South Korea, France, UK, Brazil, and other 40+ countries |

| Key Companies Profiled | Nestlé Purina PetCare, Mars Petcare, Colgate-Palmolive (Hill's Pet Nutrition), Spectrum Brands, Zesty Paws |

| Additional Attributes | Dollar sales by product type/format/source type/pet type/health claim/sales channel/application/claim positioning, regional demand (NA, EU, APAC), competitive landscape, soft chews vs. powder adoption, production/processing integration, and advanced processing innovations driving bioavailability enhancement, technical advancement, and efficiency |

The pet food collagen market is valued at USD 989.4 million in 2025. Demand is led by bovine collagen, soft-chew formats, and dog-focused joint health and mobility products sold through specialty pet stores and veterinary channels.

The market is forecast to reach USD 1,723.4 million by 2035, growing at a CAGR of 5.7% between 2025 and 2035. Growth is driven by pet humanization, aging pet populations, and greater reliance on evidence-based joint, skin, and coat health supplements.

Bovine collagen accounts for about 55% of product-type demand in 2025, supported by broad clinical familiarity and versatile joint health use. Soft chews lead by format with roughly 35% share, reflecting their convenience, palatability, and strong fit with daily supplementation routines.

Dogs are the primary consumers of collagen-based pet nutrition, reflecting higher joint health needs and stronger premiumization in dog food and supplements. Joint health and mobility is the leading health claim, followed by skin and coat, aging support, and digestive wellness propositions.

Europe, North America, and South Asia & Pacific are the key growth regions. Among countries, the UK (6.8% CAGR), USA (6.2%), Germany (6.1%), France (6.0%), and China (5.9%) lead expansion, while India grows from metro-led premium niches and Brazil balances strong by-product supply with price-sensitive demand.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Canned Pet Food Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA