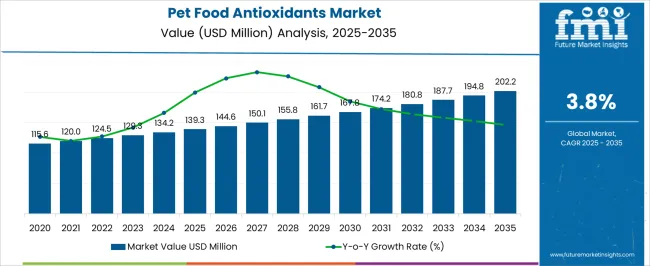

The pet food antioxidants market is estimated to be valued at USD 139.3 million in 2025 and is projected to reach USD 202.2 million by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period. The pet food antioxidants market is projected to generate an absolute gain of USD 62.9 million and a growth multiplier of 1.45x over the decade. This growth, supported by a steady CAGR of 3.8%, is driven by increasing consumer demand for high-quality pet foods that promote health, longevity, and vitality for pets.

During the first five years (2025–2030), the market will grow from USD 139.3 million to USD 167.8 million, adding USD 28.5 million, which accounts for 45.4% of the total incremental growth, with a 5-year multiplier of 1.2x. The second phase (2030–2035) contributes USD 34.4 million, representing 54.6% of the total growth, driven by the expanding pet food industry and increasing focus on functional pet foods. Annual increments rise from USD 5.1 million in early years to USD 6.8 million by 2035, driven by innovations in antioxidants used to preserve pet food, enhance pet health, and increase shelf life. Manufacturers focusing on the development of natural and effective antioxidant solutions for pet food will capture the largest share of this USD 62.9 million opportunity.

| Metric | Value |

|---|---|

| Pet Food Antioxidants Market Estimated Value in (2025 E) | USD 139.3 million |

| Pet Food Antioxidants Market Forecast Value in (2035 F) | USD 202.2 million |

| Forecast CAGR (2025 to 2035) | 3.8% |

Rising awareness around pet health and nutrition has increased the inclusion of natural preservative systems aimed at improving oxidative stability without compromising product safety. Regulatory restrictions on synthetic additives and a shift toward clean label formulations are further accelerating the adoption of antioxidant blends in pet food manufacturing. Innovation in plant-based antioxidant sources, along with the rise of premium and specialty pet food categories, is creating new growth opportunities.

Pet owners are increasingly seeking formulations that support long-term health, particularly for aging pets, which has bolstered demand for antioxidants with functional benefits. With continued focus on natural ingredient sourcing and product transparency, the market is expected to see widespread adoption across both developed and emerging pet care markets.

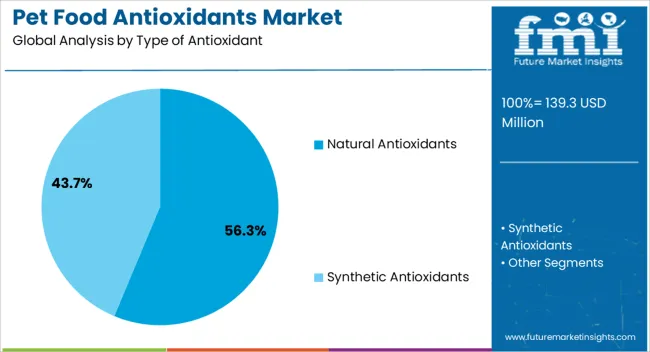

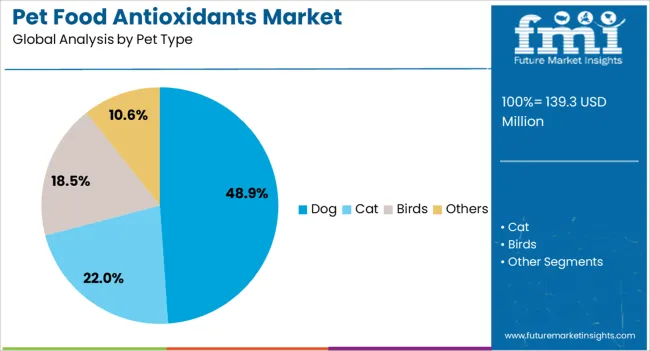

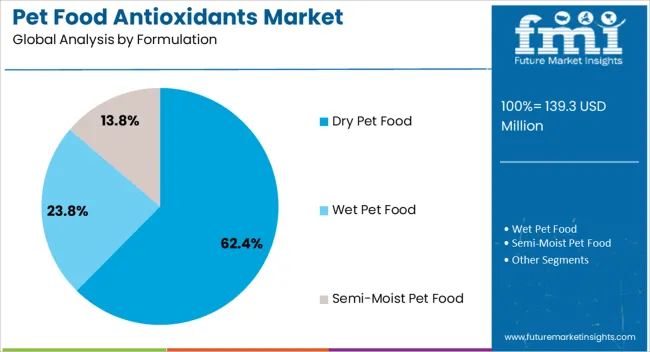

The pet food antioxidants market is segmented by type of antioxidant, pet type, formulation, and geographic regions. By type of antioxidant, the pet food antioxidants market is divided into Natural Antioxidants and Synthetic Antioxidants. In terms of pet type, the pet food antioxidants market is classified into Dog, Cat, Birds, and Others. Based on formulation, the pet food antioxidants market is segmented into Dry Pet Food, Wet Pet Food, and Semi-Moist Pet Food.

Regionally, the pet food antioxidants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Natural antioxidants are projected to account for 56.30% of the total revenue in the type of antioxidant category by 2025, making them the dominant segment. This growth is driven by increasing consumer preference for chemical free formulations and growing concerns over the long term effects of synthetic additives on pet health.

Plant derived antioxidants such as tocopherols and rosemary extract are being widely adopted due to their effectiveness in extending shelf life while aligning with natural product claims. Regulatory encouragement for clean label ingredients and the popularity of holistic pet diets have further reinforced the shift toward natural antioxidant solutions.

Manufacturers are responding with tailored antioxidant systems that deliver both preservation and health enhancement, strengthening this segment’s leadership.

The dog segment is expected to contribute 48.90% of the total market revenue within the pet type category, positioning it as the leading segment. This dominance is supported by the significantly larger dog population relative to other pets and the high per capita spending on dog food and wellness products.

Dogs require diets that are often rich in fats and proteins, making the inclusion of antioxidants critical to maintain product freshness and nutritional integrity. Additionally, the growing trend of functional and breed specific dog food has increased the demand for stable formulations enhanced with natural antioxidants.

Pet owners’ heightened focus on preventive care and active aging support has made antioxidant fortified food a consistent requirement in the canine nutrition landscape.

Dry pet food is projected to hold 62.40% of the market revenue within the formulation category by 2025, establishing it as the leading segment. This preference is attributed to its long shelf life, convenience in storage and feeding, and widespread availability across retail formats.

Dry formulations are more susceptible to oxidation due to their higher fat content and extended storage cycles, necessitating the use of robust antioxidant systems. The cost effectiveness of dry food and its compatibility with automated manufacturing processes further support its popularity.

As dry pet food continues to dominate shelf space and consumer purchasing behavior, the demand for effective antioxidant incorporation remains consistently high, reinforcing the leadership of this formulation type.

The pet food antioxidants market is driven by increasing demand for nutritional additives and opportunities in rising pet ownership and premium pet products. Emerging trends in natural and plant-based antioxidants are reshaping the market, while challenges like regulatory restrictions and ingredient sourcing remain obstacles. By 2025, addressing these challenges through strategic sourcing and compliance with regulations will be key for continued market expansion and meeting consumer demand for high-quality, antioxidant-rich pet food.

The pet food antioxidants market is expanding due to the increasing demand for nutritional additives in pet food. Antioxidants are essential for preserving the freshness and quality of pet food products while also offering health benefits to pets, such as improving their immune systems and reducing the risk of diseases. As pet owners continue to prioritize the health and well-being of their pets, the demand for antioxidant-rich pet food will continue to grow. By 2025, the market is expected to see significant growth as more pet food manufacturers incorporate antioxidants into their formulations.

Opportunities in the pet food antioxidants market are growing with the rise in pet ownership and the increasing demand for premium pet food products. As more people adopt pets globally, particularly in regions like North America, Europe, and parts of Asia, the demand for high-quality, nutritious pet food is rising. Pet owners are increasingly seeking products that offer specific health benefits for their pets, such as improved skin, coat, and digestive health. By 2025, the growing trend of premiumization in the pet food market will drive the need for antioxidant-rich formulations.

Emerging trends in the pet food antioxidants market include the growing preference for natural and plant-based antioxidants. As consumers become more conscious of the ingredients in their pet’s food, natural sources of antioxidants, such as fruits, vegetables, and herbs, are gaining popularity. These ingredients are perceived as healthier and safer for pets, contributing to the growing demand for plant-based antioxidants. By 2025, the market is expected to see a continued shift toward natural antioxidants in pet food as pet owners demand more wholesome and transparent options.

Despite growth, challenges such as regulatory restrictions and ingredient sourcing persist in the pet food antioxidants market. Various countries have stringent regulations governing the types and levels of antioxidants that can be used in pet food products. These regulations can limit the availability of certain ingredients and increase the cost of formulation. Additionally, sourcing high-quality natural antioxidants can be challenging and costly, particularly when demand exceeds supply. By 2025, overcoming these challenges will require manufacturers to adapt to regulatory changes and optimize their sourcing strategies.

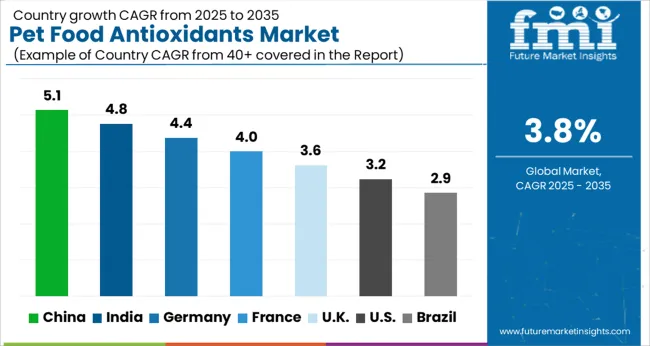

The global pet food antioxidants market is projected to grow at a 3.8% CAGR from 2025 to 2035. China leads with a growth rate of 5.1%, followed by India at 4.8%, and France at 4%. The United Kingdom records a growth rate of 3.6%, while the United States shows the slowest growth at 3.2%. These varying growth rates are driven by factors such as increasing pet ownership, the growing demand for premium pet food, and rising awareness about the health benefits of antioxidants in pet food. Emerging markets like China and India are experiencing higher growth due to rapid urbanization, increasing disposable incomes, and a growing awareness of pet nutrition. More mature markets like the USA and the UK see steady growth driven by trends in pet health, organic food, and the increasing demand for high-quality, functional pet food products. This report includes insights on 40+ countries; the top markets are shown here for reference.

The pet food antioxidants market in China is growing rapidly, with a projected CAGR of 5.1%. China’s expanding pet food sector, driven by rising pet ownership, increasing disposable incomes, and a growing focus on pet health, is fueling demand for antioxidants. The country’s growing middle class is increasingly adopting premium and nutritionally balanced pet food, which includes antioxidants to support pets’ health. Additionally, the growing awareness about pet aging, the desire for longevity, and the increasing use of functional ingredients in pet food are key drivers for the adoption of antioxidants in pet food formulations. Government initiatives to support pet care and nutrition are expected to further accelerate the demand for pet food antioxidants.

The pet food antioxidants market in India is projected to grow at a CAGR of 4.8%. India’s increasing pet ownership, combined with rising awareness about pet health and nutrition, is fueling the demand for pet food antioxidants. The country’s growing middle-class population, along with the increasing availability of premium pet food, has contributed to a shift towards high-quality ingredients like antioxidants. Additionally, the increasing focus on natural and organic pet food, along with the rising interest in functional ingredients, is driving the adoption of antioxidants. As India’s pet care sector continues to grow, the demand for pet food antioxidants is expected to rise steadily.

The pet food antioxidants market in France is projected to grow at a CAGR of 4%. France’s growing focus on pet health, coupled with the increasing demand for functional and nutritionally balanced pet food, is driving steady demand for pet food antioxidants. The country’s strong trend towards natural, organic, and health-conscious pet food is contributing to the rising use of antioxidants in pet food formulations. Additionally, increasing consumer awareness about the benefits of antioxidants in preventing aging and promoting pet health further accelerates market growth. France’s regulatory environment, which supports the use of safe and natural ingredients in pet food, also contributes to market expansion.

The pet food antioxidants market in the United Kingdom is projected to grow at a CAGR of 3.6%. The UK market is driven by the increasing demand for high-quality pet food products, with a focus on functional ingredients like antioxidants that enhance pet health. The growing trend of pet owners seeking premium and specialized pet food for their pets, particularly those with health concerns or aging pets, further fuels market growth. Additionally, the UK’s regulatory framework supporting the use of safe and natural ingredients in pet food, coupled with a shift towards organic pet food, accelerates the demand for antioxidants in pet food products.

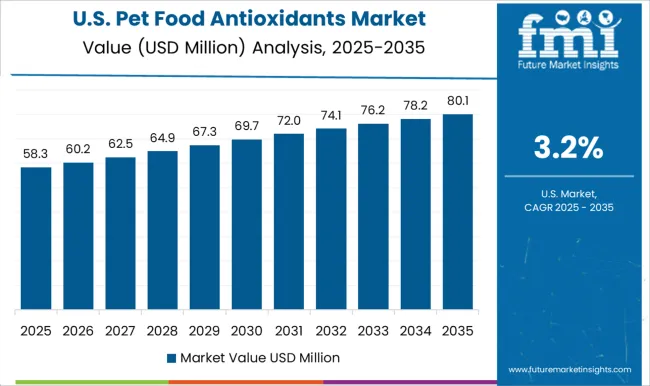

The pet food antioxidants market in the United States is expected to grow at a CAGR of 3.2%. The USA market remains steady, driven by the increasing awareness of pet health, the growing preference for premium pet food, and the rising interest in antioxidants as a functional ingredient to prevent aging and promote health. The increasing adoption of natural and organic pet food, as well as the demand for pet food that addresses specific health issues such as joint health and immune support, are key drivers for the growth of the pet food antioxidants market. Additionally, the USA pet care industry’s shift towards more sustainable and eco-friendly products continues to support market expansion.

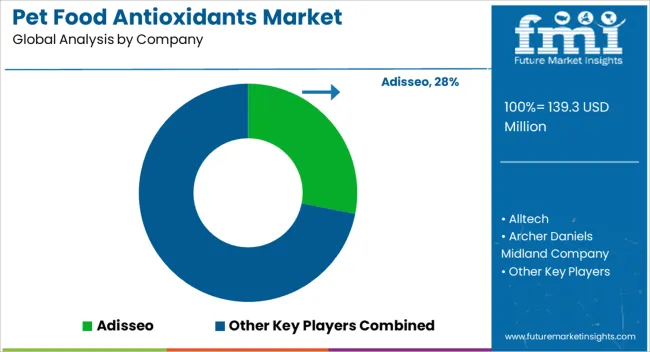

The pet food antioxidants market is dominated by Adisseo, which leads with its high-quality antioxidant solutions designed to preserve the freshness, nutritional value, and palatability of pet food products. Adisseo’s dominance is supported by its strong R&D capabilities, extensive product portfolio, and commitment to providing natural, effective antioxidants that meet the growing demand for safe and nutritious pet food. Key players such as BASF SE, Cargill, and Kemin maintain significant market shares by offering specialized antioxidant formulations that enhance the shelf life and stability of pet food, preventing nutrient degradation and rancidity. These companies focus on providing solutions that improve pet health and reduce oxidation in both dry and wet pet food varieties. Emerging players like Alltech, Archer Daniels Midland Company, and Novus International are expanding their market presence by offering tailored antioxidant solutions for specific pet food formulations, such as those for aging pets, sensitive digestion, or specific breed needs. Their strategies include improving product efficacy, focusing on natural and plant-based antioxidants, and addressing consumer demand for sustainable, clean-label ingredients. Market growth is driven by increasing pet ownership, rising consumer awareness of pet health and nutrition, and the growing preference for high-quality, preservative-free pet foods. Innovations in antioxidant sources, improved formulations, and sustainable ingredient sourcing are expected to continue shaping competitive dynamics and fuel further growth in the global pet food antioxidants market.

| Item | Value |

|---|---|

| Quantitative Units | USD 139.3 Million |

| Type of Antioxidant | Natural Antioxidants and Synthetic Antioxidants |

| Pet Type | Dog, Cat, Birds, and Others |

| Formulation | Dry Pet Food, Wet Pet Food, and Semi-Moist Pet Food |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Adisseo, Alltech, Archer Daniels Midland Company, BASF SE, Cargill, Caldic, Kemin, Koninklijke DSM N.V., Nutreco, and Novus International |

| Additional Attributes | Dollar sales by antioxidant type and application, demand dynamics across pet food, pet care, and nutraceutical sectors, regional trends in pet food antioxidants adoption, innovation in natural and plant-based antioxidant formulations, impact of regulatory standards on safety and quality, and emerging use cases in health-focused and functional pet food products. |

The global pet food antioxidants market is estimated to be valued at USD 139.3 million in 2025.

The market size for the pet food antioxidants market is projected to reach USD 202.2 million by 2035.

The pet food antioxidants market is expected to grow at a 3.8% CAGR between 2025 and 2035.

In terms of pet type, dog segment to command 48.9% share in the pet food antioxidants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refining Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA