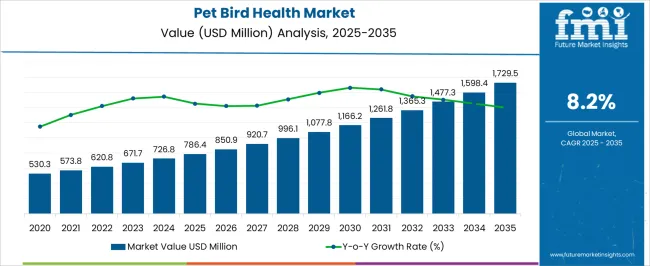

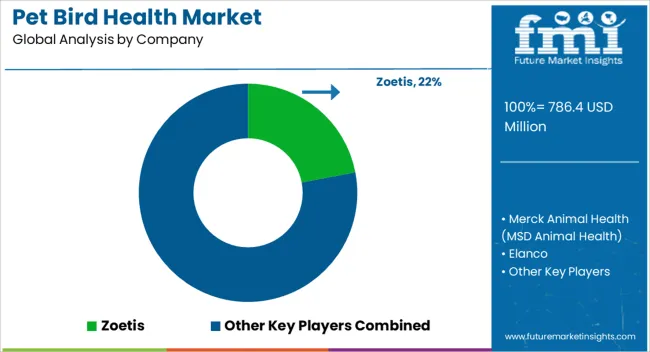

The pet bird health market is valued at USD 786.4 million in 2025 and is expected to expand to USD 1,729.5 million by 2035, registering a CAGR of 8.2%. From 2021 to 2025, the market rises from USD 530.3 million to USD 786.4 million, reflecting a strong initial growth phase driven by increasing adoption of companion birds, heightened awareness of avian diseases, and rising investments in preventive healthcare products.

Annual increments show steady momentum, reaching USD 573.8 million in 2022, USD 620.8 million in 2023, USD 671.7 million in 2024, and USD 726.8 million just before the 2025 milestone. Growth during this phase is supported by expanding veterinary services, rising availability of specialized feed supplements, and enhanced diagnostic offerings. Between 2026 and 2030, the market continues its upward trajectory from USD 786.4 million to USD 1,166.2 million. Intermediate values progress to USD 850.9 million in 2026, USD 920.7 million in 2027, USD 996.1 million in 2028, USD 1,077.8 million in 2029, and USD 1,166.2 million in 2030. This period shows accelerated momentum as product portfolios diversify, including herbal supplements, disease-specific medications, and nutraceuticals tailored for companion birds.

From 2031 to 2035, the market strengthens further, reaching USD 1,729.5 million. Values advance to USD 1,261.8 million in 2031, USD 1,365.3 million in 2032, USD 1,477.3 million in 2033, USD 1,598.4 million in 2034, culminating at USD 1,729.5 million in 2035.

| Metric | Value |

|---|---|

| Pet Bird Health Market Estimated Value in (2025 E) | USD 786.4 million |

| Pet Bird Health Market Forecast Value in (2035 F) | USD 1729.5 million |

| Forecast CAGR (2025 to 2035) | 8.2% |

The pet bird health market is influenced by multiple parent markets that together shape its growth, innovation, and demand across consumer and veterinary segments. The pet care market serves as the broadest parent, with pet bird health contributing around 15-18%. Within this larger sector, health-focused offerings for companion birds have gained traction as owners invest in nutrition, wellness, and accessories to maintain longevity and vitality.

The veterinary healthcare market also plays a central role, accounting for nearly 12-14% of the share. This includes specialized avian veterinary services, diagnostics, and preventive care treatments designed to address bird-specific illnesses and wellness management. The animal nutrition market contributes approximately 10-12%, as fortified feeds, calcium supplements, probiotics, and vitamin formulations are becoming critical in managing bird immunity and bone strength, reflecting the nutritional needs of exotic and domestic species. The pet pharmaceuticals market represents about 7-9% of the sector, focusing on therapeutic solutions such as antibiotics, antifungal drugs, and treatments for parasitic infections.

These pharmaceutical products are vital for addressing common diseases that affect pet birds, highlighting the medical side of avian care. Lastly, the pet accessories and supplies market accounts for around 6-8%. While indirect, this segment supports bird health through enriched cages, perches, grooming products, and toys that enhance physical and psychological well-being.

A shift toward preventive healthcare, along with the availability of specialized products and services, is driving consistent demand across both urban and rural regions. The market is benefiting from improved diagnostic capabilities, targeted pharmaceuticals, and specialized nutritional supplements that address a wide range of avian health conditions.

Increased investment in avian veterinary infrastructure and the growth of exotic pet insurance coverage have further strengthened market penetration. Additionally, regulatory frameworks promoting responsible pet ownership and disease control are encouraging higher spending on pet bird health solutions.

Future growth is expected to be supported by ongoing innovations in product formulations, minimally invasive treatments, and digital health monitoring tools. As awareness campaigns and veterinary outreach programs expand, the market is positioned for sustained growth, with strong opportunities in both developed and emerging economies.

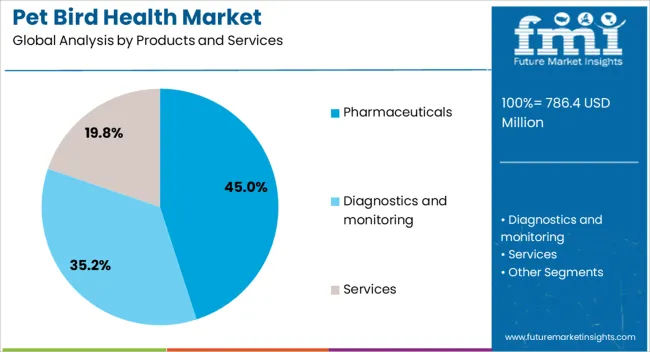

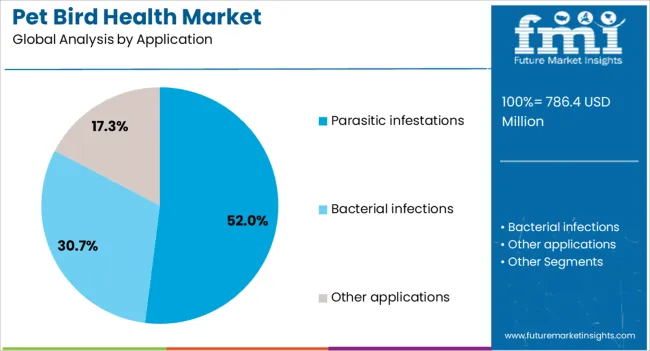

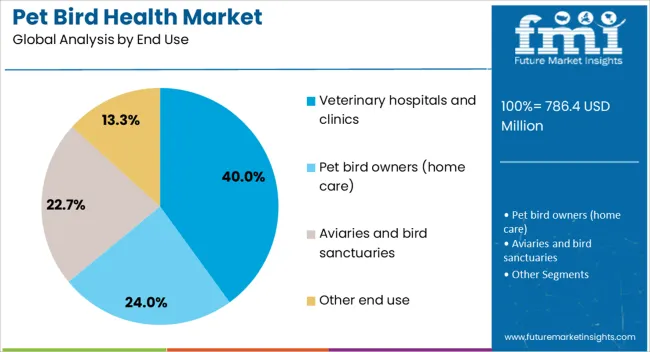

The pet bird health market is segmented by products and services, application, end use, and geographic regions. By products and services, pet bird health market is divided into Pharmaceuticals, Diagnostics and monitoring, and Services. In terms of application, pet bird health market is classified into Parasitic infestations, Bacterial infections, and Other applications.

Based on end use, pet bird health market is segmented into Veterinary hospitals and clinics, Pet bird owners (home care), Aviaries and bird sanctuaries, and Other end use. Regionally, the pet bird health industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The pharmaceuticals subsegment within the products and services category is projected to hold 45% of the Pet Bird Health market revenue share in 2025, making it the dominant offering. This leadership has been supported by the growing need for targeted treatment options to address a wide range of avian diseases, including respiratory conditions, infections, and nutritional deficiencies. Pharmaceutical products designed specifically for birds have gained traction due to their proven efficacy, ease of administration, and compatibility with preventive healthcare plans.

The expansion of veterinary formularies to include advanced antibiotics, antifungals, and immune boosters has enhanced treatment outcomes. Moreover, increased availability through veterinary hospitals, clinics, and specialized pet retailers has facilitated wider adoption.

The demand for high-quality pharmaceuticals has also been reinforced by stricter disease control measures, which have prompted bird owners to seek professional-grade treatment options This consistent need for reliable and effective medications has firmly positioned pharmaceuticals at the forefront of the Pet Bird Health market.

The parasitic infestations application segment is expected to command 52% of the Pet Bird Health market revenue share in 2025, underscoring its significant role in avian healthcare. The prevalence of external and internal parasites in both captive and free-ranging birds has driven strong demand for effective diagnostic and treatment solutions. Advances in antiparasitic drug formulations, coupled with improved delivery methods, have enhanced treatment success rates and reduced the recurrence of infestations.

The increased focus on preventive care has further contributed to the adoption of regular parasite screening and prophylactic treatments. Veterinary professionals have emphasized parasite management as a critical component of avian wellness programs, particularly in environments where birds are housed in close proximity.

Additionally, public health considerations linked to zoonotic parasites have reinforced the importance of this segment. The combination of medical necessity, regulatory compliance, and owner awareness has ensured the continued dominance of parasitic infestations as a leading application area in the market.

The veterinary hospitals and clinics subsegment in the end use category is anticipated to hold 40% of the Pet Bird Health market revenue share in 2025, establishing it as the primary point of care. The availability of specialized avian veterinary expertise and advanced diagnostic and surgical capabilities within these facilities has driven this prominence. Comprehensive service offerings, including preventive check-ups, emergency care, and surgical interventions, have positioned hospitals and clinics as trusted providers for bird owners.

The integration of in-house laboratories and imaging equipment has facilitated faster diagnosis and treatment, improving patient outcomes. Veterinary hospitals and clinics also serve as key distribution points for pharmaceuticals, supplements, and preventive care products, further enhancing their role in the market.

As bird owners increasingly seek professional and specialized care, the demand for services provided by veterinary hospitals and clinics is expected to remain strong. This segment’s established infrastructure and trusted reputation continue to underpin its market leadership.

The pet bird health market is expanding, fueled by rising bird ownership and stronger awareness of preventive care. Owners increasingly seek specialized nutrition, supplements, and veterinary services to improve avian well-being. High treatment costs, limited veterinary expertise, and restricted access to specialized pharmaceuticals remain barriers. Expanding opportunities are emerging in nutrition, immune boosters, and species-specific feed, supported by digital veterinary platforms and retail growth. With technology integration, product innovation, and expanded distribution channels, the market is evolving into a comprehensive ecosystem that prioritizes long-term health and care for companion birds.

Birds are increasingly valued not only as exotic pets but also as companions that require specialized care. Owners are becoming more informed about preventive health measures, nutritional supplements, and regular veterinary check-ups. Growth in specialized avian clinics and online veterinary consultation services has further expanded access to proper care. Products such as vitamins, probiotics, and disease-prevention supplements are gaining traction among bird owners seeking to improve lifespan and quality of life. Manufacturers are also offering tailored diets, grooming products, and behavioral health solutions, creating a comprehensive ecosystem for avian care. As the perception of birds shifts from decorative pets to cherished companions, the demand for targeted healthcare services and specialized products continues to rise.

Specialized care for birds often requires advanced diagnostic tools, unique medications, and surgical expertise, which makes treatment more expensive compared to common companion animals. In many regions, access to trained avian veterinarians remains limited, forcing owners to travel long distances or rely on general pet care providers who may lack expertise in bird-specific conditions. Limited availability of vaccines and approved avian pharmaceuticals further complicates treatment options. Cost barriers discourage some owners from pursuing preventive care, resulting in delayed or inadequate treatment of diseases. Regulatory restrictions on importing specialized bird medications also restrict product availability in certain regions. These limitations hinder market expansion, highlighting the need for affordable products, better-trained professionals, and improved access to avian healthcare infrastructure.

Manufacturers are formulating advanced dietary supplements enriched with amino acids, vitamins, and minerals to address deficiencies in common pet bird diets. Preventive healthcare solutions such as immune boosters, probiotics, and parasite control products are also witnessing rising adoption. Demand for specialized feed tailored to different species, such as parrots, canaries, and finches, is growing rapidly as owners become more attentive to dietary needs. Companies are also exploring herbal and natural formulations to appeal to health-conscious buyers. E-commerce platforms are further amplifying opportunities, enabling global access to specialized bird health products that were previously unavailable in local markets. The rising focus on preventive care is creating long-term opportunities by reducing treatment costs and improving overall avian well-being, making nutrition and supplementation a central growth avenue.

Wearable devices for monitoring bird activity, weight, and behavior are being introduced to help owners track health in real time. Digital veterinary platforms are enabling consultations with avian specialists, breaking geographic barriers and increasing accessibility. Retail expansion is also broadening market presence, with specialized bird health products now available through pet stores, online marketplaces, and subscription delivery services. Brands are leveraging direct-to-consumer models to provide customized recommendations and bundled health kits for specific species. Marketing campaigns highlighting holistic avian care are boosting awareness and engagement. Regional markets with rising pet bird adoption, particularly in urban centers, are showing strong uptake of these innovations. Together, these trends are driving greater accessibility, personalization, and technological integration in pet bird healthcare.

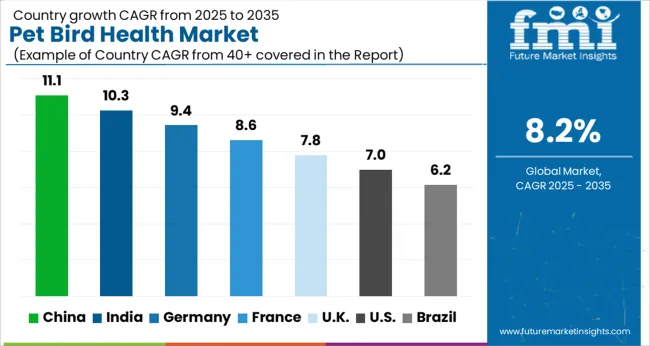

| Country | CAGR |

|---|---|

| China | 11.1% |

| India | 10.3% |

| Germany | 9.4% |

| France | 8.6% |

| UK | 7.8% |

| USA | 7.0% |

| Brazil | 6.2% |

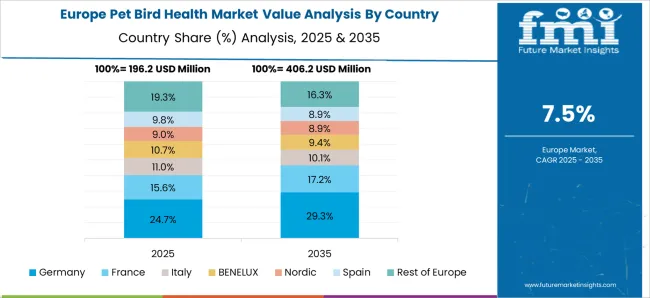

The pet bird health market is expected to expand at a global CAGR of 8.2% from 2025 to 2035. China leads with 11.1%, followed by India at 10.3% and Germany at 9.4%, while the United Kingdom posts 7.8% and the United States records 7.0%. China and India secure the largest growth premiums of +2.9% and +2.1% above the baseline, driven by rising bird ownership, expanding veterinary services, and retail distribution. Germany’s strong pet culture contributes steady gains, while the UK and USA reflect moderate but reliable growth supported by exotic bird care, advanced veterinary infrastructure, and specialty nutrition. The analysis spans over 40+ countries, with the leading markets shown below.

China is projected to lead the global pet bird health market, expanding at a CAGR of 11.1% between 2025 and 2035. Growth is driven by the increasing popularity of pet birds as companions in urban households, alongside rising disposable incomes that enable higher spending on animal care. The expanding veterinary infrastructure in metropolitan cities has also supported stronger adoption of specialized healthcare for pet birds, covering vaccinations, parasite management, and nutritional supplements. E-commerce and pet retail chains are strengthening distribution channels for feed additives, supplements, and veterinary care products.Domestic companies are investing in locally produced products while international players are entering with premium formulations.

The pet bird health market in India is forecasted to grow at a CAGR of 10.3% from 2025 to 2035. Pet ownership trends are rising among middle-class households, where birds are increasingly seen as affordable companions. This shift is driving higher consumption of feed supplements, vitamins, and avian healthcare products. The presence of aviculture communities and small-scale breeders is also creating consistent demand for disease management solutions and vaccinations. Government efforts to improve veterinary infrastructure and increased private investment in animal health are enhancing treatment availability. With multinational brands entering the Indian market, coupled with growing domestic manufacturing, India is set to become a major regional hub for pet bird healthcare products.

Germany is projected to grow at a CAGR of 9.4% between 2025 and 2035 in the pet bird health market. The country’s strong pet culture and emphasis on animal welfare have positioned bird healthcare as an essential segment within the veterinary industry. German households show significant interest in exotic bird species, which often require specialized nutrition and veterinary care. The market is supported by advanced veterinary clinics that offer diagnostic, preventive, and therapeutic services for avian species. Demand for fortified feeds, probiotics, and immune boosters is rising as owners focus on preventive care. International companies with advanced formulations are targeting Germany due to its large consumer base, while local firms focus on tailored solutions.

The United Kingdom is anticipated to grow at a CAGR of 7.8% from 2025 to 2035 in the pet bird health market. The country has a well-established culture of pet ownership, with bird enthusiasts forming a significant part of the community. Demand for veterinary services, nutritional products, and preventive treatments for avian health is rising. Specialty bird products, such as tailored feeds, vitamin mixes, and disease-prevention medicines, are seeing growing retail visibility. Online veterinary consultations are becoming increasingly popular, especially for bird owners in smaller towns with limited access to avian specialists. Import regulations and quality standards ensure that products meet high safety and efficacy benchmarks, encouraging consumer confidenc

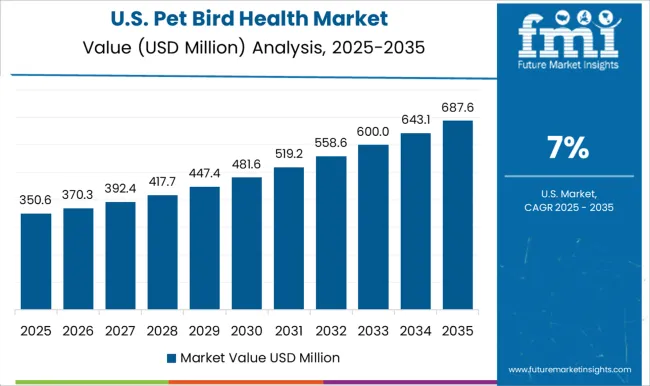

The United States is forecasted to grow at a CAGR of 7.0% between 2025 and 2035 in the pet bird health market. The country’s large pet industry and high spending per household are key factors fueling demand for advanced avian healthcare solutions. Veterinary clinics and hospitals are offering specialized services for pet birds, including diagnostics, surgery, and preventive care. The rising popularity of exotic species such as parrots and macaws has further boosted demand for specialized nutrition and disease management products. Bird rescue organizations and aviculture clubs play a significant role in spreading awareness and influencing purchase patterns. Online platforms and subscription models are reshaping distribution, providing convenient access to supplements and medicines.

In the pet bird health market, competition revolves around preventive care, nutritional supplements, and disease management solutions tailored for avian species. Zoetis leads with a comprehensive portfolio of vaccines, antiparasitics, and diagnostics, supported by strong distribution networks that ensure availability across veterinary channels. Merck Animal Health (MSD Animal Health) competes with avian vaccines and biosecurity-focused solutions, placing emphasis on disease prevention for both companion birds and poultry sectors. Elanco positions itself through targeted antiparasitics, probiotics, and nutritional support products, catering to bird owners seeking reliable wellness solutions. Boehringer Ingelheim emphasizes vaccines and specialized treatments that address respiratory and gastrointestinal challenges common in pet birds. Ceva Animal Health extends its competitive edge with avian vaccines and supplements focused on gut health and immunity, while Vetoquinol offers a range of antimicrobial and supportive therapies, targeting small animal veterinarians and exotic pet practices.

Strategies across these companies emphasize R&D, partnerships with veterinary professionals, and expanding distribution into emerging pet care markets where bird ownership is increasing. Zoetis focuses on broadening diagnostic and preventive offerings, reinforcing its presence in exotic animal care. MSD and Boehringer Ingelheim continue investing in avian vaccine technology to improve safety and coverage. Elanco and Ceva prioritize nutritional health and preventive therapies, supporting owners seeking daily wellness options. Vetoquinol differentiates through its emphasis on accessible products for small veterinary practices, ensuring wider reach in fragmented markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 786.4 Million |

| Products and Services | Pharmaceuticals, Diagnostics and monitoring, and Services |

| Application | Parasitic infestations, Bacterial infections, and Other applications |

| End Use | Veterinary hospitals and clinics, Pet bird owners (home care), Aviaries and bird sanctuaries, and Other end use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis, Merck Animal Health (MSD Animal Health), Elanco, Boehringer Ingelheim, Ceva Animal Health, Vetoquinol, and Other regional/specialist suppliers |

| Additional Attributes | Dollar sales by product type (vaccines, therapeutics, nutritional supplements), species served (parrots, canaries, finches, cockatiels), and treatment type (preventive, curative). Demand dynamics are driven by rising pet ownership, growing awareness of avian health, and veterinary adoption of advanced therapeutics. Regional trends indicate strong growth in North America and Europe, supported by established veterinary networks, and increasing demand in Asia-Pacific due to rising pet bird popularity and enhanced veterinary services. |

The global pet bird health market is estimated to be valued at USD 786.4 million in 2025.

The market size for the pet bird health market is projected to reach USD 1,729.5 million by 2035.

The pet bird health market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in pet bird health market are pharmaceuticals, _drugs, _vaccines, _nutritional supplements, diagnostics and monitoring, _diagnostic equipment, _monitoring devices, _consumables, services and _ (services — e.g., grooming, boarding).

In terms of application, parasitic infestations segment to command 52.0% share in the pet bird health market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pet Blood Pressure Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA