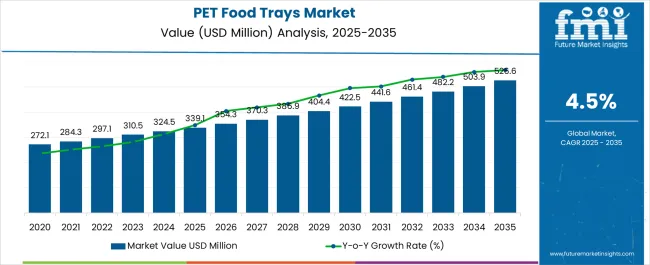

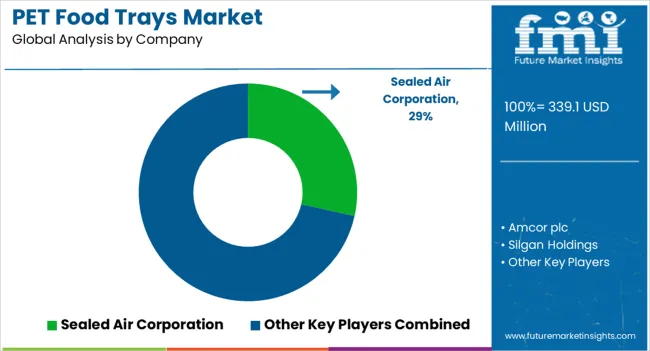

The PET food trays market is estimated to be valued at USD 339.1 million in 2025 and is projected to reach USD 526.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The market demonstrates steady expansion driven by premium pet food packaging trends, portion control demands, and convenience-focused pet ownership patterns that require specialized containers maintaining food freshness while providing easy serving and storage capabilities. Pet food manufacturers implement thermoformed PET tray systems that accommodate wet food formulations, treats, and fresh pet meals while providing barrier properties against moisture migration and contamination throughout distribution channels. The material's clarity and presentation characteristics enable visual product appeal that supports premium pricing strategies while meeting food safety standards required for direct pet food contact applications.

Wet pet food packaging represents the dominant application segment where PET trays provide superior moisture barrier properties and structural integrity necessary for automated filling, sealing, and sterilization processes common in commercial pet food production. Manufacturing facilities specify tray configurations that accommodate diverse product consistencies from pâtés to chunky formulations while maintaining seal integrity throughout thermal processing cycles and extended shelf life requirements. Quality control protocols emphasize container dimensional consistency, seal strength verification, and material compatibility testing with pet food ingredients that could affect tray performance during storage and handling operations.

Premium pet food markets demonstrate increasing adoption of multi-compartment PET trays that enable portion separation and ingredient variety within single serving containers that appeal to pet owners seeking convenience and nutritional diversity. Specialty diet applications utilize trays designed for prescription diets, organic formulations, and breed-specific nutrition programs where portion accuracy and contamination prevention justify premium packaging investments. Fresh pet food delivery services implement refrigerated-compatible PET trays that maintain product quality during cold chain distribution while providing consumer-friendly presentation and reheating capabilities.

Technology advancement trajectories concentrate on barrier enhancement technologies and modified atmosphere packaging integration that extends product shelf life while preserving nutritional content and palatability characteristics essential for pet food acceptance. Active packaging features incorporate oxygen scavengers and moisture control systems within tray structures that provide enhanced protection beyond traditional passive barrier properties. Smart packaging development explores freshness indicators and temperature monitoring capabilities that provide pet owners with quality assurance information throughout product storage periods.

Manufacturing process innovations emphasize thermoforming precision and cycle time optimization that reduce production costs while maintaining tray quality and dimensional consistency necessary for automated filling and sealing operations. Inline quality control systems monitor tray formation characteristics including wall thickness distribution, corner integrity, and rim quality that affect sealing performance and container strength. Energy efficiency improvements reduce heating costs while maintaining forming temperatures necessary for achieving desired tray properties and surface finish characteristics.

| Metric | Value |

|---|---|

| PET Food Trays Market Estimated Value in (2025E) | USD 339.1 million |

| PET Food Trays Market Forecast Value in (2035F) | USD 526.6 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

The PET food trays market is gaining traction due to rising demand for sustainable, durable, and cost efficient packaging solutions across the food industry. Increasing consumption of ready to eat meals, frozen products, and convenience foods has accelerated the adoption of PET trays owing to their superior barrier properties and recyclability.

Regulatory initiatives promoting the reduction of single use plastics are further supporting the transition to recyclable PET packaging. Advancements in thermoforming and lightweighting technologies have enhanced tray durability while reducing material usage, aligning with both cost optimization and environmental goals.

The outlook remains positive as food producers increasingly prefer PET trays for their compatibility with automated packaging lines, product safety assurance, and strong consumer acceptance. Market growth is further reinforced by the rising integration of recycled PET content, supporting circular economy objectives and meeting brand commitments toward sustainability.

The C PET material segment is projected to hold 54.20% of total market revenue by 2025, positioning it as the leading material category. This dominance is attributed to the material’s excellent thermal stability, recyclability, and suitability for both hot and cold food applications.

C PET trays are increasingly adopted due to their ability to withstand microwave and oven heating, providing versatility in food packaging. In addition, compliance with stringent food safety regulations and the growing preference for sustainable packaging have reinforced their adoption.

The balance of performance, durability, and sustainability credentials has secured C PET as the most widely used material in the market.

The single cavity product type is expected to account for 62.70% of total revenue by 2025, making it the dominant format in the product type category. Its leadership is driven by demand for portion control, cost effectiveness, and ease of use across food service and retail channels.

Single cavity trays are widely preferred for ready meals and frozen food products as they simplify packaging processes and enhance convenience for consumers. Their compatibility with automated filling systems and standardized storage solutions has further strengthened their position.

As food manufacturers prioritize efficiency and consumer convenience, the single cavity segment continues to hold a substantial market share.

The food producers and processors segment is projected to capture 47.80% of the total market revenue by 2025 under the end use category, establishing itself as the leading segment. This growth is driven by the rising scale of packaged food production, demand for extended shelf life solutions, and the need for efficient logistics.

PET trays offer strength, product protection, and sustainability, aligning with operational and branding priorities of large scale producers. Their compatibility with high speed packaging lines and ability to maintain food freshness have made them integral to production processes.

As global demand for packaged and processed foods rises, food producers and processors continue to represent the core end use segment for PET trays.

The global PET food trays market witnessed a CAGR of 4.0% during the historic period with a market value of USD 339.1 Million in 2025.

Food packaging has advanced from a simple container to hold food to something that does not interfere with the quality of food. With the upgradation in the packaging material food packaging evolved for the material which can be recyclable in nature and PET food trays came out as an option. With the increased consumption of packaged and frozen food, the demand for PET food trays is projected to surge in the forecasted period.

The demand for PET food trays increased as people switched to take-away orders due to the COVID-19 pandemic. The rising consumption of packed food and frozen food augment the sales of PET food trays. Rising trends towards modernization, rise in disposable income, and altering food consumption habits of an individual fuel the demand for packaged food, which result in the market growth of PET food trays during the forecast period.

The consumers are increasingly seeking convenient ready-to-eat and on-to-go snack food throughout the day. The demand for both salted and sweet snacks increased the demand for the packaging material for the product. As per the research manufacturer in snacks & dry food industry are looking for a sustainable packaging solution to reduce their carbon foot prints. PET food trays are 100% recyclable in nature creating its demand in snack and dry food market.

With the excellent tensile and flexibility of PET material, the PET food trays can be molded into different shapes and sizes, which can help various restaurants and quick service restaurants to create a brand differentiator and position themself. This helps in generating hefty demand for the PET food trays in the HORECA industry. The PET food trays can be designed as per the requirement of the QSRs giving them a competitive edge and gain significant market share.

PET is a strong, clear, and lightweight plastic that is widely adopted in packaging food and beverages sector. Compare to the other polymer used in food packaging, which possesses lower thermal stability and gets deformed when little pressure is applied to it. Consuming the product made from packing material that is not suitable for warm or heated food may cause an adverse effect on the health of the consumer. Polystyrene is one of the materials used to manufacture food trays. Environmental protection agency recognizes styrene (the primary molecule of polystyrene) as having an adverse effect on human health. Polystyrene is also considered carcinogenic in nature by the WHO. PET is highly recyclable in nature, while the other polymer utilized in the manufacturing of food trays are not recyclable in nature

PET is globally approved for safety as it does not interfere with the quality of the product kept inside it. In addition to this, the PET material does not contain any biphenol-A or phthalates. The unique feature of PET material makes it accepted worldwide in the food and beverage industry and transportation of PET-derived food trays are easy due to their lightweight property. The unique features of Pet material compared to the other plastic materials in the market, PET remains one prospective material for manufacturing food trays.

The C-PET food trays segment is anticipated to grow 1.6 times the current market value during the forecast period. C-PET (crystallized polyethylene terephthalate) has evolved as one of the materials for manufacturing PET food trays due to their property to withstand the temperature of -4o Fahrenheit way up to 400o Fahrenheit. With the high heat stability, the PET food trays will expand their sales in the quick-service restaurant and especially for the freezer to oven or freezer-to-microwave food. C-PET boosts the barrier property ensuring the food has the best protection and maintains its integrity. This is important in meeting the customer’s expectations regarding safety and health.

C-PET possess better-sealing property and is compatible with all kind of top seal and flow packing. C-PET possesses a highly effective barrier against water, oxygen, and carbon dioxide which eliminates the risk of contamination extends the shelf life of food and improves food quality PET food trays made from C-Pet material are 100% recyclable, thus eliminating the usage of plastic in food packaging which will surge in the demand for C-PET food trays.

The food producers & processors segment is projected to hold nearly 33% of the market value share by the end of next five years. PET food trays protect against spoilage and off-coloring for frozen foods. PET food trays are easy to fill, seal, and store. It pose excellent moisture-blocking properties and are resistant to bacteria & other microorganisms which may spoil or deteriorate the quality of frozen food. PET food Trays are resistant to grease water and oil. These trays are rigid and do not reform when light pressure is applied to them, making it easy to transport. PET food trays are approved by USFDA for food packaging making it compliant in various parts across the globe. PET food trays possess excellent thermal stability making it a package of choice for microwave foods. The surge in consumption of packed food along with launch of variety of food products by the food brands create high demand for PET food trays based on its mentioned benefits.

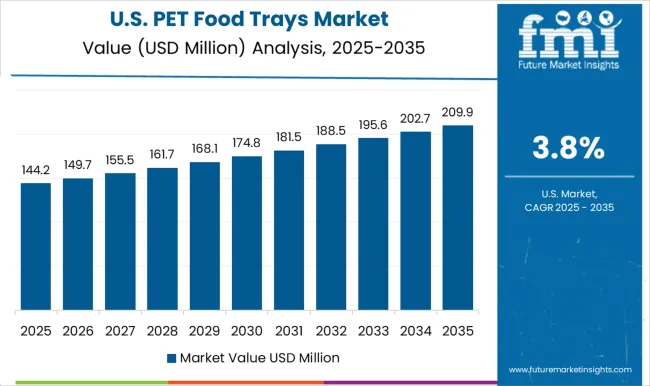

| Country | USA |

|---|---|

| Market Share (2025) | 28.3% |

| Market Share (2035) | 25.7% |

| BPS Analysis | -260 |

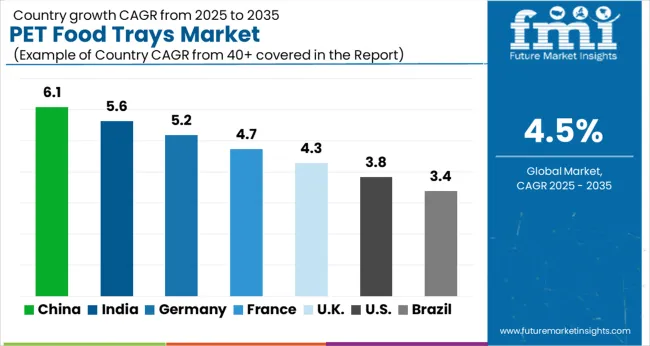

| Country | China |

|---|---|

| Market Share (2025) | 9.2% |

| Market Share (2035) | 11.0% |

| BPS Analysis | +180 |

| Country | Germany |

|---|---|

| Market Share (2025) | 6.7% |

| Market Share (2035) | 5.2% |

| BPS Analysis | -150 |

| Country | United Kingdom |

|---|---|

| Market Share (2025) | 5.3% |

| Market Share (2035) | 5.7% |

| BPS Analysis | +40 |

| Country | India |

|---|---|

| Market Share (2025) | 4.4% |

| Market Share (2035) | 6.1% |

| BPS Analysis | +170 |

The USA PET food trays market is expected to surge with a CAGR of 3.1% over the forecast period. The huge expenditure on food consumption in the USA is the major factor fuelling the demand for food packaging along with PET food trays. According to the Federal Reserve Economic Data, the retail sale of food and beverage surged from USD 272.1 billion in 2020 to USD 339.1 billion in 2025. Also, the USA comprises more than 20,000 quick service restaurants. QSRs are one of the prospective markets for PET food trays which in turn will lead to a rise in sales for PET food trays in the forecast period.

India is expected to hold around 43% of the South Asia PET food trays market by the end of 2025. According to the report published by the Ministry of Commerce and Industry, the market for food service in India is projected to increase from USD 526.6 billion to USD 79.65 billion by 2035. With the increase in disposable income and rise in the consumption of quick food due to the busy lifestyle of Indian citizens, the market for food delivery and QSRs is rising exponentially with a CAGR of 23% throughout the FY 20–25, making the QSRs as the fastest growing sub-category in the food service industry. Overall 2.1% of India's GDP is contributed by the food service industry out of which a total 4% to the food service industry is contributed by QSRs. The increasing share of QSRs in the Indian market creates a surge in demand for PET food trays.

The PET food trays market is led by major global and regional packaging manufacturers focused on product safety, durability, and production efficiency. Sealed Air Corporation holds a leading position with thermoformed PET trays designed for ready meals, fresh food, and protein packaging. Its trays offer high clarity, temperature resistance, and secure sealing for extended shelf life. Amcor plc supplies PET food trays optimized for lightweighting and high-barrier protection across chilled and frozen food categories, serving large retail and foodservice clients.

Silgan Holdings Inc. and Sonoco Products Company provide PET trays engineered for strength, impact resistance, and reliable sealing performance in meat, poultry, and bakery packaging. Pactiv LLC maintains a strong presence in North America with customizable PET trays designed for food processors and restaurants, emphasizing efficiency in sealing and labeling operations.

CKF Inc. and Easy Pak LLC manufacture PET food trays for ready-to-eat and takeaway markets, offering designs suited to automated filling and sealing lines. Anchor Packaging Inc. delivers heat-resistant PET trays compatible with both microwave and oven use, popular in retail meal packaging. Novolex Holdings LLC and D&W Fine Pack focus on single-use and reusable PET trays for supermarkets and food distributors, emphasizing product protection and presentation quality.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.5% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Billion, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Material, Product Type, End Use, Region |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Western Europe; Eastern Europe; Central Asia; Russia & Belarus; Balkan Countries; Baltic Countries; Middle East & Africa |

| Key Countries Covered | USA, Canada, Mexico, Brazil, Germany, United Kingdom, France, Italy, Spain, Russia, China, Japan, India, GCC countries, Australia & New Zealand |

| Key Companies Profiled |

Sealed Air Corporation, Amcor plc, Silgan Holdings Inc., Sonoco Products Company, Pactiv LLC, CKF Inc., Easy Pak LLC, Anchor Packaging Inc., Novolex Holdings LLC, and D&W Fine Pack. |

| Customization & Pricing | Available upon Request |

The global pet food trays market is estimated to be valued at USD 339.1 million in 2025.

The market size for the pet food trays market is projected to reach USD 526.6 million by 2035.

The pet food trays market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in pet food trays market are c - pet, r - pet and a - pet.

In terms of product type, single cavity segment to command 62.7% share in the pet food trays market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Key Companies & Market Share in the Food Trays Sector

CPET Trays Market

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Partition Trays Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA