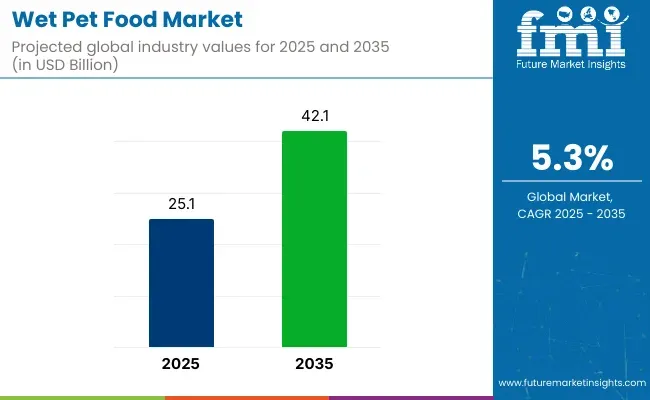

The wet pet food market is projected to be valued at USD 25.1 billion in 2025 and is anticipated to grow to USD 42.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. The increasing demand for premium and nutritionally balanced pet food is driving the growth of the wet pet food segment. As pet ownership continues to rise globally and consumers become more invested in the health and well-being of their pets, the wet pet food market is gaining significant traction.

A major driver of the market’s growth is the growing trend toward humanization of pets, where owners seek to provide high-quality, nutritious food for their animals similar to the food they consume. Wet pet food, known for its high moisture content and palatability, is gaining preference due to its perceived health benefits, such as hydration and improved digestion. Additionally, the increasing availability of premium, organic, and specialty wet pet food options is attracting pet owners who are willing to invest in products that promote their pets' health and longevity.

Recent developments in the wet pet food market include innovations in product formulations, such as the inclusion of functional ingredients like probiotics, vitamins, and minerals to cater to specific health needs of pets.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 25.1 billion |

| Industry Value (2035F) | USD 42.1 billion |

| CAGR (2025 to 2035) | 5.3% |

On February 20, 2025, Freshpet announced its first-ever net income for the fiscal year 2024, totaling USD 46.9 million, a significant turnaround from a net loss of USD 33.6 million in 2023. The company reported net sales of USD 975.2 million, marking a 27.2% increase from the previous year.

This growth was attributed to a 26.1% rise in sales volume and improved gross margins. The positive financial performance reflects Freshpet's expanding presence in the wet pet food market and its commitment to providing fresh, high-quality products for pets. As the market continues to grow, ongoing product innovation, increased pet ownership, and rising awareness of pet health will drive the continued expansion of the wet pet food market.

Per capita spending on wet pet food varies across regions, influenced by factors such as pet ownership trends, disposable income, urban lifestyles, and increasing awareness of pet nutrition. Developed countries typically show higher spending, driven by the humanization of pets, demand for premium nutrition, and widespread availability of packaged products. In contrast, emerging markets are witnessing gradual growth as pet care habits evolve and commercial pet food becomes more accessible.

Labeling certifications play a crucial role in the wet pet food market by ensuring product safety, nutritional transparency, and ethical sourcing. Certifications also support compliance with local and international regulatory standards and promote trust in premium and specialty pet food offerings.

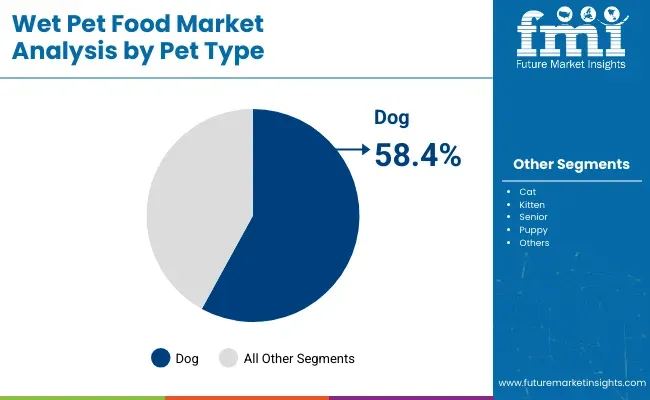

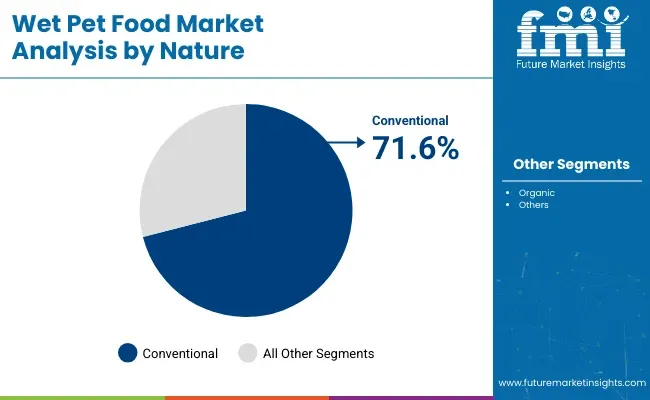

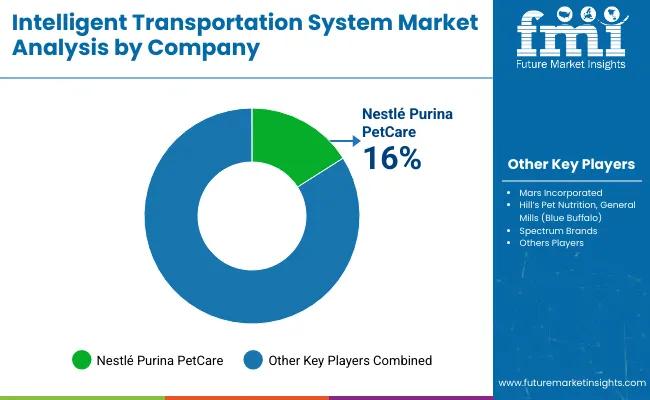

The global wet pet food market is expected to expand steadily through 2035, driven by rising pet ownership and premiumization trends. In 2025, the dog segment is projected to hold 58.4% of the pet type market share, while the conventional segment is expected to capture 71.6% of the nature segment. Key players include Mars Petcare, Nestlé Purina, and Hill’s Pet Nutrition.

The dog segment is projected to command 58.4% of the pet type market share in 2025. Increasing dog ownership, especially in urban areas, fuels demand for high-quality wet food products tailored to breed, age, and health needs. Pet parents are opting for formulations with natural ingredients, enhanced palatability, and functional benefits like joint health and digestion support.

Mars Petcare and Nestlé Purina are innovating with grain-free, protein-rich, and specialty diets to meet evolving consumer preferences. Additionally, rising awareness about pet nutrition and humanization trends are propelling the segment’s steady growth.

The conventional segment is expected to hold 71.6% of the nature segment market share in 2025. Conventional wet pet foods, made with standard ingredients and traditional formulations, remain popular due to affordability and wide availability. This segment covers popular canned foods and pouches that appeal to mass-market consumers.

Companies like Hill’s Pet Nutrition maintain strong market presence by offering consistent quality and value. Despite rising interest in organic and natural variants, conventional wet food continues to meet the needs of a broad consumer base, particularly in emerging markets where cost sensitivity is higher. Its dominance ensures it remains a foundational pillar of the wet pet food market.

Difficulties related to wet pet food compared with dry formats include shorter shelf life, higher transportation and storage costs, and a limited recyclability of non-recyclable and multilayer pouches, along with associated environmental impact. And rising meat prices and regulatory caps on preservatives add complexity to cost-effective production and distribution, particularly in developing markets.

There is also an opportunity to develop wet meals that support digestive health, probiotic-enhanced stews, and protein-rich broths for their health needs. Human-grade, ethically sourced, and minimally processed wet food recipes continue to drive growth, particularly among millennial and Gen Z pet parents. The growth of compostable pouches, refillable containers and plastic-free trays will also help to re-design products, particularly in parts of the world where sustainability is a key driver.

The USA wet pet food market is witnessing strong growth, supported by rising pet humanization, increasing demand for high moisture diets, and growing premium pet care trends. Pet owners want food made with natural ingredients, want grain-free recipes and also functional nutrition to help maintain digestive health, coat quality and joint care.

Formats of wet food are becoming fashionable among senior pets and picky eaters. Top manufacturers are launching single-serve trays, recyclable packaging and breed-specific formulations to seize changing consumer preferences.

| Country | CAGR (2025 to 2035) |

|---|---|

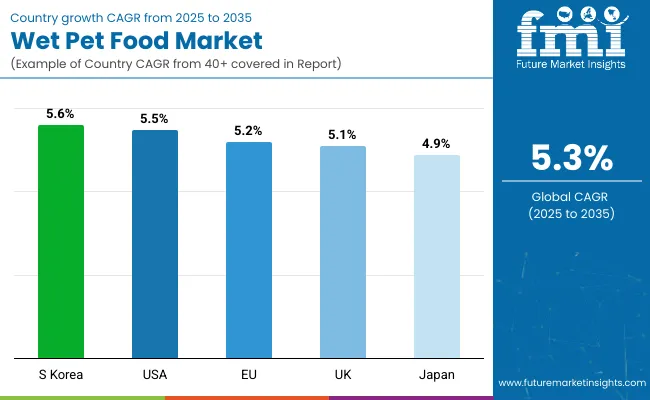

| United States | 5.5% |

The wet pet food segment is consistently expanding in the UK as pet parents opt for nutritionally-balanced and treat-like meal formats. Additional key growth drivers include veterinary-recommended wet diets and organic ingredient claims.

The growing trend of small-breed ownership and the growing popularity of rescue pet adoption have contributed to demand for smaller wet foods sold in pouches or cans. So, too, are sustainability concerns, with consumers carrying the brand sustainability into their buying behaviour and favouring brands that use responsibly sourced ingredients and recyclable packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.1% |

Growth in the pet ownership, increased availability of premium products, and the aging pet population are contributing to the EU wet pet food market expansion as well, with Germany, France, and the Netherlands the leading country markets. Pet food is a shared category between EU consumers, who favour transparency, traceable ingredients and veterinary-grade formulations.

There is also a strong demand for recipes including regional meats, superfoods or minimal additives. Alignment in regulations around pet nutrition labeling and sustainable sourcing supports innovation among both private-label and heritage pet food brands.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.2% |

Japan’s wet pet food market is expanding steadily driven by a growing pet population and a preference for soft-textured, portion-controlled meals. Japanese pet owners care about digestibility, taste and nutrition balance, and treat their pets as family. Wet food is often served in jelly, sauce or mousse formats along with dry kibble. Alongside this trend, functional wet diets are being domestically-developed for joint support, kidney health, and weight management, in addition to basic but aesthetic packaging.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

With single-person households and younger consumers driving pet ownership in South Korea, the country’s wet pet food business is growing fast. Pet parents are looking for premium wet meals that are comparable to human food, meaning recipes made with fresh meat, vegetables and herbal extracts.

Pet cafés and social media influencers are helping to generate visibility for artisanal and gourmet-style wet dead foods. Domestic firms focused on clean-label claims and traditional Korean ingredients adapted to take into account pets’ health and palatability for their non-animal products.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

Global pet ownership is also rising, hence the growing preference for premium and high-protein diets is driving the expansion of the wet pet food market, as well as consumer focus on palatability and digestion health of pets, and hydration support offered by wet pet food.

Wet pet food is especially favoured by senior pets, picky eaters and pet parents looking for human-grade and grain-free options. Pet humanization trends, growing markets for veterinary-recommended diets, growing e-commerce, and innovation in sustainable packaging and clean-label formulations are key market drivers.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 25.1 billion |

| Projected Market Size (2035) | USD 42.1 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for dollar sales |

| Pet Types Analyzed (Segment 1) | Cat, Kitten, Senior, Dog, Puppy, Adult, Senior, Others |

| Nature of Products Analyzed (Segment 2) | Organic, Conventional |

| Sources Analyzed (Segment 3) | Animal Derived, Plant Derived, Insect Derived |

| Sales Channels Analyzed (Segment 4) | Offline Sales Channel, Supermarkets/Hypermarkets, Pet Stores, Convenience Store, Other Sales Channel, Online Sales Channel, Company Website, E-commerce Platform |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East and Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, ANZ, GCC Countries, South Africa |

| Key Players influencing the Wet Pet Food Market | Mars, Incorporated, Nestlé Purina PetCare, Hill’s Pet Nutrition, General Mills (Blue Buffalo), Spectrum Brands, Wellness Pet Company (WellPet), The Honest Kitchen, Freshpet, Inc., Nature’s Logic, Ziwipeak |

| Additional Attributes | dollar sales, CAGR trends, pet type segmentation, nature and source preferences, sales channel distribution, competitor dollar sales & market share, regional growth patterns |

The overall market size for the wet pet food market was USD 25.1 billion in 2025.

The wet pet food market is expected to reach USD 42.1 billion in 2035.

The demand for wet pet food will be driven by increasing pet humanization, rising awareness of pet nutrition and digestive health, growing demand for palatable and moisture-rich food formats, and advancements in clean-label, organic, and premium product offerings.

The top 5 countries driving the development of the wet pet food market are the USA, Germany, the UK, Japan, and Brazil.

The conventional products segment is expected to command a significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

Wet Food for Cat Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Wet Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Antioxidants Market Size and Share Forecast Outlook 2025 to 2035

PET Food Trays Market Size and Share Forecast Outlook 2025 to 2035

Pet Food and Supplement Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Additives Market - Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Processing Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Market Analysis Size, Share, and Forecast Outlook 2025 to 2035

Pet Food Palatants Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Pet Food Packaging Industry Analysis in Europe - Size, Share, and Forecast 2025 to 2035

Pet Food Premix Market Analysis by Pet Type, Ingredient Type, Formand Sales ChannelThrough 2035

Pet Food Microalgae Market Insights - Nutritional Benefits & Growth 2025 to 2035

Pet Food Extrusion Market Analysis by Product Type, Animal Type, Ingredient Type, Extruder Type, Ingredient, Process and Region Through 2035

Pet Food Flavor Enhancers Market – Growth, Demand & Innovation

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA