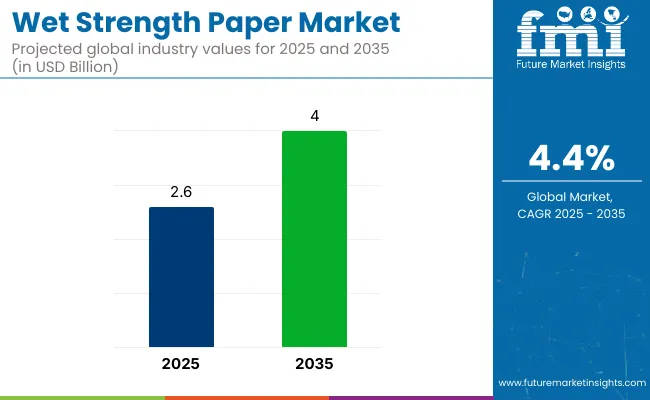

The global wet strength paper market is set to record USD 2.6 billion in 2025 and USD 4 billion by 2035, registering a CAGR of 4.4% during the forecast period. Industry growth is being driven by the increasing demand for high-performance paper products in various applications such as packaging, tissues, labels, andindustrial paper products. Wet strength paper, which maintains its integrity and performance when exposed to moisture, is becoming essential in industries requiring enhanced durability and functionality in humid conditions.

The rise in the use of wet strength paper in food packaging and consumer goods packaging is further fuelingindustry expansion. As environmental concerns around single-use plastics increase, the demand for eco-friendly alternatives like wet strength paper is also on the rise.

The development of sustainable wet strength agents, which offer improved biodegradability and environmental performance, is helping meet the rising consumer demand for eco-friendly packaging solutions. These innovations are expected to accelerate the adoption of wet strength paper across industries.

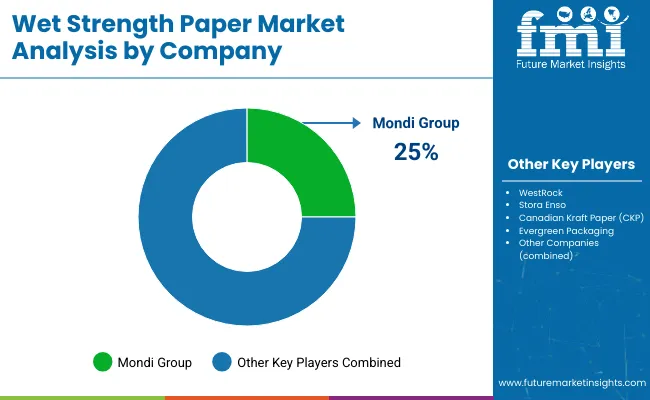

Key players such as Mondi Group, WestRock, Stora Enso, Canadian Kraft Paper (CKP), and Evergreen Packaging are investing in research and development to improve the performance, sustainability, and cost-effectiveness of wet strength paper.

The growing focus on sustainable packaging solutions and the increasing shift toward paper-based packaging for food and beverage products are expected to further contribute to industry growth. As regulatory pressures around packaging materials tighten globally, the wet strength paper Market is expected to witness consistent growth through 2035.

The wet strength paper industry is expected to experience significant growth by 2025, driven by increased demand for durable, moisture-resistant packaging materials, with a focus on kraft paper, virgin pulp, and beverage labels.

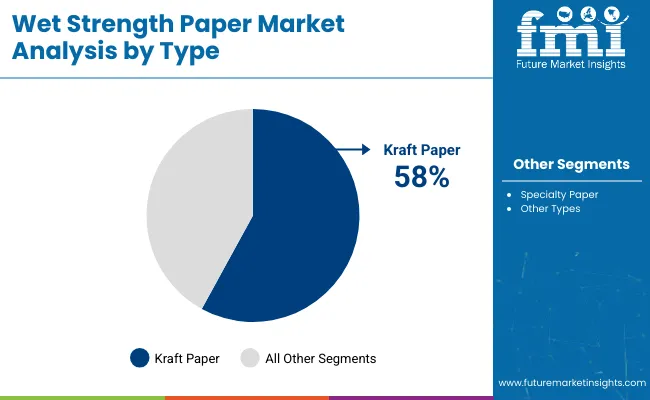

Kraft paper is projected to dominate the wet strength paper industry with a 58% share in 2025. Known for its strength, durability, and resistance to tearing, it is widely used in applications requiring high performance under wet conditions. Kraft paper’s ability to withstand harsh environments makes it ideal for food and beverage packaging, especially for items that require water resistance.

Virgin pulp is projected to account for 60% of the wet strength paper industry in 2025. This raw material is essential for creating high-quality, strong, and durable paper products. Virgin pulp provides superior uniformity, tensile strength, and resistance to tearing, which are necessary for wet strength paper applications.

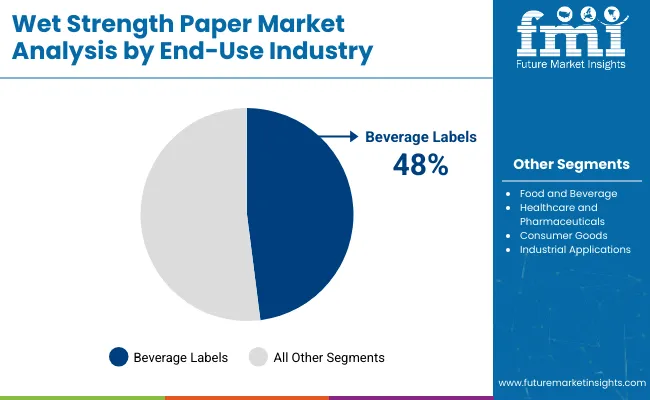

Beverage labels are expected to lead the end-use industry segment of the wet strength paper industry, capturing 48% of the industry share in 2025. The demand for durable, water-resistant labels is driven by the growing need for high-quality, moisture-resistant packaging for beverages.

The wet strength paper industry is growing due to rising demand for moisture-resistant packaging solutions. However, high production costs and environmental concerns related to additives are limiting widespread adoption and growth.

Increasing demand for durable, moisture-resistant packaging solutions is driving industry growth

The demand for durable and moisture-resistant packaging solutions is significantly boosting the wet strength paper industry. Industries such as food and beverage, pharmaceuticals, and consumer goods are increasingly adopting wet strength paper to ensure product integrity during transportation and storage. This specialized paper offers enhanced resistance to moisture, preventing degradation and maintaining the quality of packaged goods.

Technological advancements in resin formulations and fiber treatments have further improved the performance of wet strength paper, making it a preferred choice for manufacturers seeking reliable and cost-effective packaging materials. As global trade and e-commerce continue to grow, the need for such packaging solutions is expected to rise correspondingly.

High production costs and environmental concerns related to certain additives are limiting industry growth

Despite the advantages, the wet strength paper industry faces challenges related to high production costs and environmental concerns. The incorporation of wet strength additives, such as resins, into paper products can increase manufacturing expenses, making them less competitive compared to traditional packaging materials.

Additionally, certain additives may raise environmental concerns due to their chemical composition and potential impact on recyclability. Regulatory pressures and consumer preference for eco-friendly products are prompting manufacturers to seek alternative, sustainable solutions. Balancing performance, cost, and environmental impact remains a critical challenge for the wet strength paper industry as it strives to meet evolving industry demands.

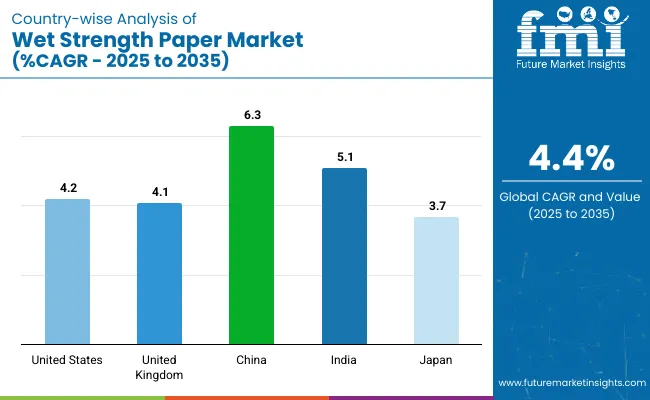

The wet strength paper industry is expected to grow steadily through 2035, driven by rising demand for durable packaging and tissue products. China and India lead growth, while the USA and UK focus on innovation and sustainability.

| Countries | Estimated CAGR (%) |

|---|---|

| United States | 4.2% |

| United Kingdom | 4.1% |

| China | 6.3% |

| India | 5.1% |

| Japan | 3.7% |

The United States wet strength paper industry is expected to grow at a CAGR of 4.2% through 2035. Growth is driven by increasing demand for packaging and tissue products with enhanced durability.

The United Kingdom wet strength paper industry is projected to grow at a CAGR of 4.1% through 2035. Growth is driven by the demand for sustainable packaging solutions and eco-friendly alternatives to plastic.

The wet strength paper industry is projected to grow at a CAGR of 6.3% through 2035. Expansion is driven by rapid industrialization and increased demand for packaging automation. Domestic companies like Shanghai Ruian and Jinan Xintian Packaging

The wet strength paper industry is expected to grow at a CAGR of 5.1% through 2035. The industry is being fueled by expanding industrial infrastructure and rising demand for efficient packaging solutions across various sectors. Companies like Universal Packaging and Altech are providing advanced shrink tunnel solutions for food, beverage, and pharmaceutical sectors.

The wet strength paper industry is forecasted to grow at a CAGR of 3.7% through 2035. Growth is supported by technological advancements and stringent environmental regulations. Companies such as Kawasaki Heavy Industries and Fujitsu are developing high-performance machines with a focus on efficiency and reduced emissions.

The industry is marked by a blend of established leaders and emerging players. Key companies like Pixelle Specialty Solutions, WestRock, and Twin Rivers Paper Company dominate the industry with broad product ranges and advanced manufacturing capabilities. These giants invest heavily in R\&D to innovate and improve paper strength and sustainability.

For instance, WestRock is focusing on creating environmentally friendly, high-performance wet strength paper. Emerging players, such as Golden Paper Company and Framarx/Waxstar, target niche segments by offering specialized products. They often capitalize on local production capabilities and flexibility to cater to specific regional demands.

The industry presents moderate entry barriers due to the strong position of established players with vast distribution networks. However, innovation in sustainable products is a key opportunity for new entrants. While large players are consolidating to increase their global reach, the industry remains fragmented, offering growth potential for smaller, specialized companies focusing on custom solutions.

Recent Wet Strength Paper Industry News

Between 2024 and 2025, notable advancements were made in the wet strength paper industry. In 2024, Mondi Group launched a new line of wet strength paper products, designed to offer enhanced durability and moisture resistance.In 2025, Canadian Kraft Paper introduced an innovative wet strength sack kraft paper with improved strength properties.

These developments highlight the industry's focus on sustainability and the demand for high-performance paper solutions. Both companies continue to innovate in response to growing industry needs, showcasing their commitment to providing durable, eco-friendly solutions for various industrial and commercial applications.

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 2.6 billion |

| Projected Industry Size (2035) | USD 4 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Types Analyzed (Segment 1) | Kraft paper; Specialty paper; Other types (e.g., absorbent paper) |

| Raw Materials Analyzed (Segment 2) | Virgin pulp; Recycled pulp |

| End-Use Industries Covered (Segment 3) | Beverage labels; Food and beverage; Healthcare and pharmaceuticals; Consumer goods; Industrial applications |

| Regions Covered | North America; Europe; Asia Pacific |

| Countries Covered | United States; Canada; Germany; United Kingdom; France; Italy; Spain; Netherlands; China; India; Japan |

| Leading Industry Suppliers | Pixelle Specialty Solutions®, EMI Specialty Papers, WestRock Company, Golden Paper Company Limited, American Kraft Paper Industries LLC, Papertec Inc., Twin Rivers Paper Company, FLEXLINK, LLC, Gordon Paper Company Inc, and Framarx / Waxstar. |

| Additional Attributes | Dollar sales by paper type ( kraft vs specialty); Trends in sustainability and recycling rates for wet strength paper; Growth of wet strength paper in eco-friendly packaging applications; Regional demand for beverage labels and food packaging |

The industry is segmented into kraft paper, specialty paper, and other types (e.g., absorbent paper).

The industry includes virgin pulp and recycled pulp.

The industry covers beverage labels, food and beverage, healthcare and pharmaceuticals, consumer goods, and industrial applications.

The industry spans North America, Europe, and Asia Pacific.

The wet strength paper industry is expected to reach USD 4 billion by 2035.

The industry size is projected to be USD 2.6 billion in 2025.

The wet strength paper industry is expected to grow at a CAGR of 4.4% from 2025 to 2035.

Key players include Pixelle Specialty Solutions®, EMI Specialty Papers, WestRock Company, Golden Paper Company Limited, American Kraft Paper Industries LLC, Papertec Inc., Twin Rivers Paper Company, FLEXLINK, LLC, Gordon Paper Company Inc, and Framarx/Waxstar.

The demand for wet strength paper is driven by its increasing use in packaging, particularly for food packaging, as well as its enhanced durability and strength in wet conditions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Paperboard Partition Market Size and Share Forecast Outlook 2025 to 2035

Paper Box Market Size and Share Forecast Outlook 2025 to 2035

Paper Edge Protector Market Size and Share Forecast Outlook 2025 to 2035

Paper Cup Lids Market Size and Share Forecast Outlook 2025 to 2035

Paper Pallet Market Size and Share Forecast Outlook 2025 to 2035

Paper and Paperboard Packaging Market Forecast and Outlook 2025 to 2035

Wet Food for Cat Market Size and Share Forecast Outlook 2025 to 2035

Paper Wrap Market Size and Share Forecast Outlook 2025 to 2035

Paper Cups Market Size and Share Forecast Outlook 2025 to 2035

Paper Core Market Size and Share Forecast Outlook 2025 to 2035

Paper Bags Market Size and Share Forecast Outlook 2025 to 2035

Paper Processing Resins Market Size and Share Forecast Outlook 2025 to 2035

Paper Tester Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkin Converting Lines Market Size and Share Forecast Outlook 2025 to 2035

Wet Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Paper Packaging Tapes Market Size and Share Forecast Outlook 2025 to 2035

Paper Napkins Converting Machines Market Size and Share Forecast Outlook 2025 to 2035

Paper Coating Binders Market Size and Share Forecast Outlook 2025 to 2035

Wetting Agent Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA