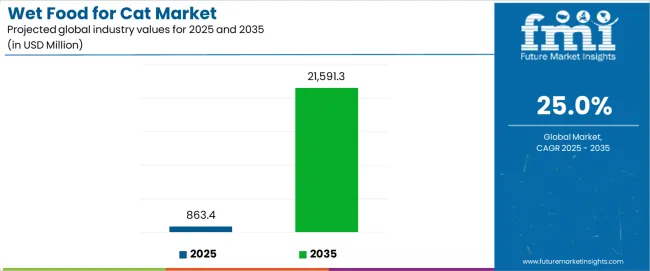

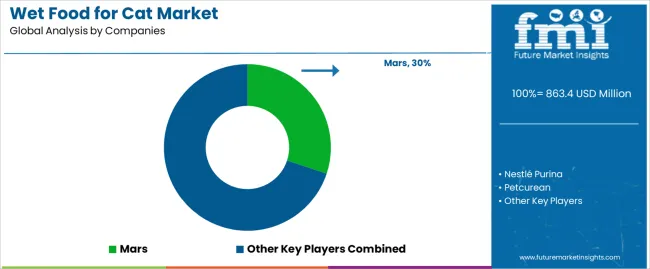

The wet food for cat market is valued at USD 863.4 million in 2025 and is projected to surge to USD 21,591.3 million by 2035, marking a 25% CAGR. The wet food for cat market will expand by nearly 25X over the decade, with its trajectory shaped by clear structural trends that are transforming feline nutrition from a basic dietary function into a premiumized, wellness-oriented, and convenience-driven industry.

A top trend is the acceleration of pet humanization, where owners increasingly treat cats as family members and demand food products that mirror human dietary values. Wet food is gaining prominence because it delivers high palatability, varied textures, and visible quality compared to dry formats. As consumers shift toward premium feeding, formulations enriched with functional ingredients such as probiotics, omega fatty acids, and immune-boosting supplements are becoming mainstream expectations. Specialized diets targeting urinary tract health, digestive balance, weight management, and hairball reduction are also expanding the wet food category, signaling a shift toward therapeutic nutrition.

Another key trend is the surge of premium packaging innovation, which aligns with both convenience and portion control. Single-serve pouches, resealable trays, and recyclable cans are being adopted as cat owners demand freshness, hygiene, and easy storage. Brands are investing in eco-friendly materials and sustainable sourcing certifications, responding to consumer concerns about environmental impact. Packaging differentiation is also playing a marketing role, with premium designs highlighting natural ingredients, transparency in sourcing, and veterinary endorsements.

Digital integration and the growth of pet e-commerce are transforming distribution dynamics. Subscription-based delivery models and personalized nutrition platforms are pushing wet cat food adoption at scale. Online platforms enable brand discovery, targeted marketing, and consumer feedback loops, allowing manufacturers to adapt formulations rapidly to evolving preferences. Integration with pet wellness apps and health monitoring platforms is an emerging trend, where feeding data becomes part of broader pet care management, linking nutrition to lifestyle and veterinary oversight. Regional consumption patterns add another layer. Mature markets in North America and Europe are witnessing strong demand for organic, grain-free, and functional wet foods as owners opt for premium brands. Asia Pacific, particularly China and India, is projected to show the fastest expansion due to rapid urbanization, rising disposable income, and increased cat adoption rates. This region is expected to be pivotal in driving volume growth, while developed markets sustain value growth through higher per-unit spending.

The competitive landscape is being redefined by the entry of premium brands, veterinary-endorsed product lines, and new entrants targeting natural and specialty niches. Multinationals are consolidating their portfolios with acquisitions in the pet nutrition space, while smaller, agile players differentiate through ingredient innovation and transparent branding.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | Standard wet food products (canned, pouches) | 48% | Volume-driven, mainstream formulations |

| Premium nutrition products | 22% | Specialized ingredients, grain-free options | |

| Kitten-specific formulations | 15% | Growth stage nutrition, developmental support | |

| Therapeutic & specialized diets | 10% | Veterinary recommendations, health conditions | |

| Organic & natural formulations | 5% | Clean label, sustainability focus | |

| Future (3-5 yrs) | Premium & super-premium segments | 35-40% | Human-grade ingredients, sustainability |

| Functional nutrition products | 20-25% | Health benefits, immunity support | |

| Subscription & direct-to-consumer | 15-18% | Convenience, personalization options | |

| Specialized dietary solutions | 12-15% | Age-specific, breed-specific formulations | |

| Sustainable packaging formats | 8-10% | Eco-friendly materials, recyclability | |

| Digital nutrition services | 3-5% | Personalized recommendations, feeding analytics |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 863.4 million |

| Market Forecast (2035) | USD 21,591.3 million |

| Growth Rate | 25.0% CAGR |

| Leading Packaging Format | Pouches |

| Primary Application | Adult Cat Segment |

The wet food for cat market demonstrates exceptional fundamentals with pouch packaging formats capturing a dominant share through superior convenience features and cat feeding optimization. Adult cat applications drive primary demand, supported by increasing PET ownership rates and premium nutrition requirements. Geographic expansion remains concentrated in developed markets with established PET care infrastructure, while emerging economies show explosive adoption rates driven by rising disposable incomes and growing PET humanization trends.

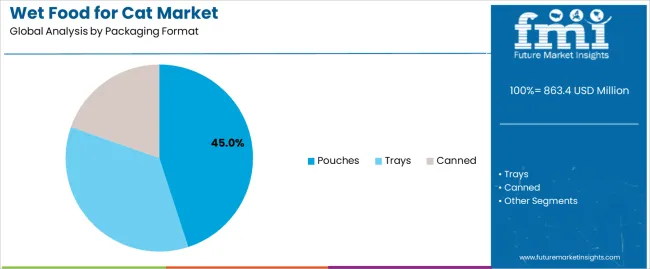

Primary Classification: The wet food for cat market segments by packaging format into canned, pouches, and trays, representing the evolution from traditional feeding containers to convenient nutrition delivery solutions for comprehensive feline feeding optimization.

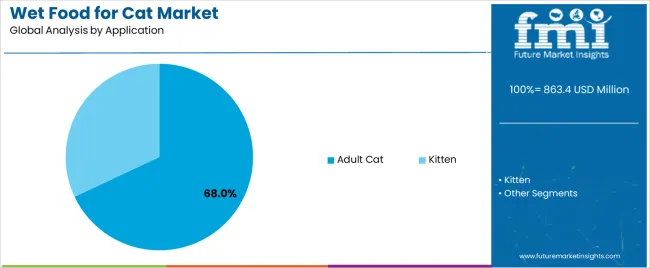

Secondary Classification: Application segmentation divides the wet food for cat market into kitten and adult cat categories, reflecting distinct requirements for nutritional needs, developmental stages, and feeding behavior standards.

Regional Classification: Geographic distribution covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and Middle East & Africa, with developed markets leading adoption while emerging economies show accelerating growth patterns driven by PET ownership expansion programs.

The segmentation structure reveals packaging progression from standard containers toward sophisticated feeding solutions with enhanced convenience and preservation capabilities, while application diversity spans from kitten nutrition to adult cat maintenance requiring specialized dietary formulations.

Market Position: Pouches command the leading position in the wet food for cat market with 45% market share through advanced convenience features, including superior portability, portion control optimization, and freshness preservation that enable PET owners to achieve optimal feeding consistency across diverse household and lifestyle environments.

Value Drivers: The segment benefits from consumer preference for convenient feeding systems that provide consistent freshness performance, minimal waste generation, and storage efficiency optimization without requiring significant refrigeration modifications. Advanced packaging design features enable single-serving portions, easy opening mechanisms, and integration with modern lifestyle patterns, where convenience and product quality represent critical purchase requirements.

Competitive Advantages: Pouches differentiate through proven freshness reliability, consistent palatability characteristics, and integration with on-the-go feeding systems that enhance PET owner satisfaction while maintaining optimal nutrition standards suitable for diverse cat breeds and life stages.

Key market characteristics:

Canned wet food maintains a 35% market position in the wet food for cat market due to its established market presence and value advantages. These formats appeal to consumers requiring cost-effective feeding solutions with competitive pricing for mainstream cat nutrition applications. Market growth is driven by value-conscious PET owners, emphasizing reliable nutrition delivery and operational simplicity through proven packaging designs.

Tray packaging captures 20% market share through specialized feeding requirements in premium segments, multi-cat households, and serving convenience applications. These consumers demand flexible portion sizes capable of accommodating varied feeding preferences while providing effective freshness capabilities and presentation appeal.

Market Context: Adult Cat applications demonstrate the highest market share in the wet food for cat market with 68% share due to widespread ownership of adult felines and increasing focus on maintenance nutrition optimization, health management efficiency, and dietary wellness applications that maximize longevity while maintaining quality of life standards.

Appeal Factors: Adult cat owners prioritize nutrition completeness, health maintenance support, and integration with existing feeding routines that enable consistent dietary management across extended PET lifespans. The segment benefits from substantial market presence and veterinary recommendations that emphasize the importance of balanced nutrition for adult feline health and wellness applications.

Growth Drivers: Pet ownership expansion programs incorporate adult cat nutrition as standard care practice for long-term health maintenance, while veterinary guidance increases demand for specialized dietary capabilities that comply with health standards and minimize nutritional deficiencies.

Market Challenges: Varying dietary preferences and palatability requirements may limit product standardization across different breeds or health scenarios.

Application dynamics include:

Kitten applications capture 32% market share through specialized nutritional requirements in developmental stages, growth support, and immune system development applications. These PET owners demand premium nutrition products capable of supporting rapid growth while providing effective digestive support and nutritional balance capabilities.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Pet humanization & premiumization trends (emotional bonding, lifestyle integration) | ★★★★★ | Pet owners increasingly view cats as family members; demand for human-grade ingredients and premium nutrition drives market expansion. |

| Driver | Rising disposable incomes & spending power (middle class expansion, urbanization) | ★★★★★ | Higher purchasing capacity enables premium product adoption; willingness to invest in PET health and nutrition accelerates category growth. |

| Driver | Health & wellness awareness (veterinary recommendations, nutritional education) | ★★★★☆ | Growing understanding of feline dietary needs; focus on disease prevention and optimal nutrition drives demand for specialized formulations. |

| Restraint | Price sensitivity & economic uncertainty (cost of living pressures, inflation) | ★★★★☆ | Budget-conscious consumers defer premium purchases; increases value segment competition and slows super-premium adoption in emerging markets. |

| Restraint | Shelf life & storage challenges (cold chain requirements, spoilage risks) | ★★★☆☆ | Opened packages require refrigeration; shorter shelf life compared to dry food creates inventory management complexity for retailers. |

| Trend | Sustainability & eco-packaging (recyclable materials, carbon footprint reduction) | ★★★★★ | Environmental consciousness drives packaging innovation; sustainable sourcing and eco-friendly materials become core brand differentiators. |

| Trend | Personalized nutrition & customization (breed-specific, age-specific formulations) | ★★★★☆ | Tailored dietary solutions for individual cats; subscription models and personalized recommendations drive consumer engagement and loyalty. |

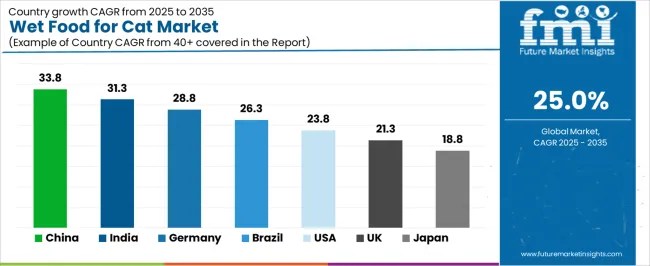

The wet food for cat market demonstrates varied regional dynamics with Growth Leaders including China (33.8% growth rate) and India (31.3% growth rate) driving explosive expansion through PET ownership initiatives and premium nutrition adoption. Steady Performers encompass Germany (28.8% growth rate), Brazil (26.3% growth rate), and developed regions, benefiting from established PET care industries and premium product acceptance. Emerging Markets feature United States (23.8% growth rate) and developed regions, where mature PET ownership and health-focused feeding practices support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through PET ownership expansion and premiumization trends, while South Asian countries maintain explosive growth supported by rising disposable incomes and urbanization. North American and European markets show strong expansion driven by health-focused nutrition and sustainability integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 33.8% | Focus on premium positioning and local taste preferences | Regulatory changes; local competition |

| India | 31.3% | Lead with affordable premium products and education | Distribution challenges; price sensitivity |

| Germany | 28.8% | Provide sustainability-focused premium products | Over-engineering; strict regulations |

| Brazil | 26.3% | Value-oriented premium models with quality assurance | Import duties; economic volatility |

| United States | 23.8% | Offer innovation and specialized formulations | Market saturation; intense competition |

| United Kingdom | 21.3% | Push health-focused premium products | Brexit impacts; supply chain issues |

| Japan | 18.8% | Premium quality and convenience-focused solutions | Aging population; market maturity |

China establishes fastest market growth through explosive PET ownership expansion and comprehensive premium nutrition adoption, integrating wet cat food products as standard components in urban PET care and middle-class lifestyle installations. The country's 33.8% growth rate reflects urbanization initiatives promoting PET ownership and disposable income growth that mandate the use of premium feeding solutions in metropolitan and suburban households. Growth concentrates in major urban centers, including Beijing, Shanghai, and Guangzhou, where PET care development showcases integrated nutrition systems that appeal to PET owners seeking advanced dietary optimization capabilities and convenience applications.

Chinese manufacturers are developing locally-adapted formulations that combine domestic flavor preferences with international quality standards, including premium ingredient sourcing and enhanced palatability capabilities. Distribution channels through e-commerce platforms and PET specialty retailers expand market access, while social media influence supports adoption across diverse urban and emerging consumer segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, urban households and affluent PET owners are implementing premium wet cat food products as standard nutrition solutions for health optimization and wellness applications, driven by increasing disposable incomes and PET ownership programs that emphasize the importance of quality nutrition capabilities. The wet food for cat market holds a 31.3% growth rate, supported by urbanization initiatives and middle-class expansion programs that promote premium PET care products for urban and suburban households. Indian consumers are adopting wet food products that provide consistent nutritional performance and health benefits, particularly appealing in metropolitan regions where PET wellness and quality feeding represent critical care requirements.

Market expansion benefits from growing veterinary awareness and international brand presence that enable access to premium nutrition products for health-conscious PET owners. Product adoption follows patterns established in urban consumer goods, where quality and brand reputation drive purchase decisions and feeding practices.

Market Intelligence Brief:

Germany establishes market leadership through comprehensive premium PET care programs and advanced sustainability infrastructure development, integrating wet cat food products across health-conscious and environmentally-aware applications. The country's 28.8% growth rate reflects established PET ownership culture and mature premium nutrition adoption that supports widespread use of high-quality feeding solutions in urban and suburban households. Growth concentrates in major metropolitan areas where PET care showcases mature premium product deployment that appeals to consumers seeking proven nutritional capabilities and sustainability applications.

German consumers leverage established retail networks and comprehensive sustainability standards, including eco-packaging programs and organic certification that create brand loyalty and purchasing preferences. The wet food for cat market benefits from mature environmental standards and quality requirements that mandate premium product features while supporting innovation, advancement, and sustainability optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse urban PET ownership, including middle-class growth in São Paulo and Rio de Janeiro, PET care facility development, and urbanization programs that increasingly incorporate premium feeding solutions for companion animal wellness applications. The country maintains a 26.3% growth rate, driven by rising PET ownership activity and increasing recognition of nutrition quality benefits, including health maintenance and palatability advantages.

Market dynamics focus on value-oriented premium solutions that balance advanced nutritional performance with affordability considerations important to Brazilian PET owners. Growing urban PET population creates continued demand for quality wet food products in new household acquisitions and feeding practice modernization.

Strategic Market Considerations:

United States establishes market leadership through comprehensive PET care programs and advanced retail infrastructure development, integrating wet cat food products across health-focused and convenience-driven applications. The country's 23.8% growth rate reflects established PET ownership relationships and mature premium product adoption that supports widespread use of specialized feeding solutions in diverse household types. Growth concentrates in urban and suburban centers where PET care showcases mature premium deployment that appeals to health-conscious consumers seeking proven nutritional capabilities and convenience applications.

American brands leverage established distribution networks and comprehensive product innovation capabilities, including specialized formulations and subscription services that create customer relationships and competitive advantages. The wet food for cat market benefits from mature retail standards and veterinary integration that mandate quality product features while supporting category advancement and dietary optimization.

Market Intelligence Brief:

United Kingdom's advanced PET care market demonstrates sophisticated wet cat food deployment with documented health effectiveness in companion animal applications and wellness programs through integration with existing veterinary systems and PET care infrastructure. The country leverages consumer awareness in PET nutrition and health consciousness to maintain a 21.3% growth rate. Urban centers, including London, Manchester, and Edinburgh, showcase premium installations where wet food products integrate with comprehensive PET wellness platforms and veterinary management systems to optimize health outcomes and feeding effectiveness.

British consumers prioritize product quality and ethical sourcing in PET food selection, creating demand for premium products with advanced features, including sustainability certifications and health benefit claims. The wet food for cat market benefits from an established PET care infrastructure and a willingness to invest in premium nutrition products that provide long-term health benefits and compliance with animal welfare standards.

Market Intelligence Brief:

Japan's market maintains a 18.8% growth rate through established premium PET care culture and sophisticated product preferences, where wet cat food represents standard feeding practice in urban households and specialized PET care scenarios. The country benefits from high PET ownership rates and advanced nutrition awareness that support consistent demand for quality feeding solutions.

Market characteristics include preference for small-portion packaging, premium ingredient quality, and convenience features that align with Japanese consumer preferences and lifestyle patterns. Distribution through convenience stores and PET specialty retailers provides extensive market access.

Strategic Market Considerations:

The wet food for cat market in Europe is projected to grow from USD 180.2 million in 2025 to USD 4,518.3 million by 2035, registering a CAGR of 28.8% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, increasing slightly to 33.1% by 2035, supported by its advanced PET care infrastructure and strong sustainability focus in major urban centers including Berlin and Munich.

United Kingdom follows with a 24.6% share in 2025, projected to reach 25.2% by 2035, driven by comprehensive premium PET food adoption and health-focused feeding programs. France holds a 19.8% share in 2025, expected to reach 20.1% by 2035 through specialized gourmet formulations and quality compliance requirements. Italy commands a 13.7% share, while Spain accounts for 9.5% in 2025. The rest of Europe region is anticipated to maintain stability, with its collective share moving from 6.8% to 6.4% by 2035, attributed to steady premium product adoption in Nordic countries and emerging Eastern European markets implementing PET care modernization programs.

| Stakeholder | What they actually control | Typical strengths | Typical blind spots |

|---|---|---|---|

| Global platforms | Distribution reach, brand portfolio, manufacturing scale | Broad availability, proven quality, multi-market presence | Innovation speed; local taste adaptation |

| Premium innovators | Product development; specialized formulations; clean label positioning | Latest nutrition science; attractive health benefits | Distribution density outside premium channels; price accessibility |

| Regional specialists | Local preferences, market understanding, distribution partnerships | "Close to consumer" insights; cultural adaptation; pragmatic pricing | Technology gaps; sustainability credentials |

| Sustainability leaders | Eco-packaging innovation, ethical sourcing, transparency programs | Consumer trust; environmental credentials; premium positioning | Cost structure if over-invested; scalability limitations |

| Direct-to-consumer brands | Customer relationships, subscription models, personalization | Lowest intermediary costs; data insights; consumer engagement | Physical retail presence; brand awareness building |

| Item | Value |

|---|---|

| Quantitative Units | USD 863.4 million |

| Packaging Format | Canned, Pouches, Trays |

| Application | Kitten, Adult Cat |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, Middle East & Africa |

| Countries Covered | United States, China, Germany, India, United Kingdom, Japan, Brazil, France, Italy, Spain, and 20+ additional countries |

| Key Companies Profiled | Mars, Nestlé Purina, Petcurean, United Petfood, PLB International, Champion Petfoods, Wellness Pet Company, Colgate-Palmolive, ZIWI Pets, Farmina, Yantai China Pet Foods, Shandong Gambol Pet Group |

| Additional Attributes | Dollar sales by packaging format and application categories, regional adoption trends across East Asia, South Asia Pacific, and North America, competitive landscape with PET food manufacturers and specialty retailers, consumer preferences for premium nutrition and convenience features, integration with veterinary recommendations and health monitoring systems, innovations in formulation technology and packaging enhancement, and development of sustainable feeding solutions with enhanced palatability and nutritional optimization capabilities. |

The global wet food for cat market is estimated to be valued at USD 863.4 million in 2025.

The market size for the wet food for cat market is projected to reach USD 21,591.3 million by 2035.

The wet food for cat market is expected to grow at a 25.0% CAGR between 2025 and 2035.

The key product types in wet food for cat market are pouches, trays and canned.

In terms of application, adult cat segment to command 68.0% share in the wet food for cat market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wetting Agent Market Size and Share Forecast Outlook 2025 to 2035

Wet Mix Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Wet Process Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wet Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Wet Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Wet Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Wet Strength Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wet Wipes Canister Market - Demand & Forecast 2025 to 2035

Wetsuit Market Trends - Growth, Demand & Forecast 2025 to 2035

Wet Wipes Market - Trends & Forecast 2025 to 2035

Wet Glue Labelling Machines Market

Wet Fertilizer Spreaders Market

Wet Ink Coding Machines Market

Wet Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Burn-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA