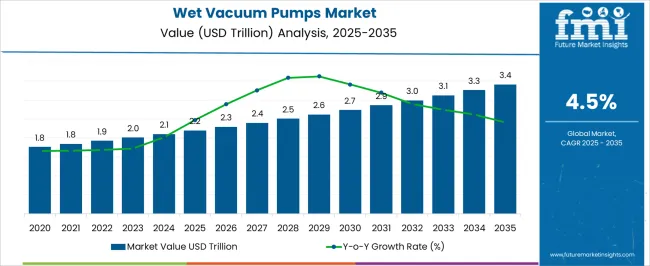

The wet vacuum pumps market is projected at USD 2.2 trillion in 2025 and expected to reach USD 3.4 trillion by 2035, reflecting a CAGR of 4.5% over the forecast period. The absolute dollar opportunity during this time frame amounts to USD 1.2 trillion, representing the incremental market value created as adoption broadens. Between 2025 and 2030, growth is gradual as the market moves from steady expansion to broader use across industries.

From 2030 to 2035, the Wet Vacuum Pumps Market strengthens further, with values rising from USD 2.7 trillion to USD 3.4 trillion, representing nearly half of the total absolute dollar opportunity. This phase of consolidation highlights the market’s ability to maintain long-term demand while unlocking a significant USD 0.7 trillion during these five years alone. Businesses targeting this window can focus on differentiated service offerings, aftermarket support, and cross-industry penetration to maximize returns. The cumulative USD 1.2 trillion opportunity from 2025 to 2035 underscores a market that, while steady, presents high-value expansion potential.

| Metric | Value |

|---|---|

| Wet Vacuum Pumps Market Estimated Value in (2025 E) | USD 2.2 trillion |

| Wet Vacuum Pumps Market Forecast Value in (2035 F) | USD 3.4 trillion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The wet vacuum pumps market, valued at USD 2.2 trillion in 2025 and projected to reach USD 3.4 trillion by 2035 at a CAGR of 4.5%, shows limited seasonality, as demand is largely driven by industrial and commercial applications that operate year-round. However, minor fluctuations may occur due to maintenance shutdowns, plant overhauls, or budget cycles that impact procurement patterns. Some regions may also show seasonal variations in manufacturing intensity, such as lower activity during extreme weather or holiday periods, but these effects are temporary and do not significantly disrupt the steady underlying growth trajectory observed in the long-term forecast.

Cyclicality plays a more significant role in shaping the Wet Vacuum Pumps market as demand is closely tied to industrial output, construction activity, and overall capital investment trends. In periods of economic expansion, orders typically rise as industries scale operations, while during downturns, procurement may be delayed, leading to cyclical slowdowns.

Despite these fluctuations, the forecasted growth from USD 2.2 trillion in 2025 to USD 3.4 trillion by 2035 reflects steady long-term adoption, as essential industries maintain baseline demand.

The wet vacuum pumps market is growing steadily, driven by rising demand across industrial processes that require efficient handling of wet and vapor-laden gases. This includes applications in pharmaceuticals, chemicals, and food processing, where moisture tolerance and corrosion resistance are critical.

Wet vacuum pumps offer operational advantages such as lower maintenance, better handling of condensable vapors, and quieter operation compared to their dry counterparts. Growing investment in green chemical manufacturing, expansion of wastewater treatment plants, and stricter emission standards are prompting end-users to adopt liquid-based pumping systems.

The integration of automation and smart monitoring features further supports the reliability and predictive maintenance of these pumps, solidifying their role in modern industrial infrastructure.

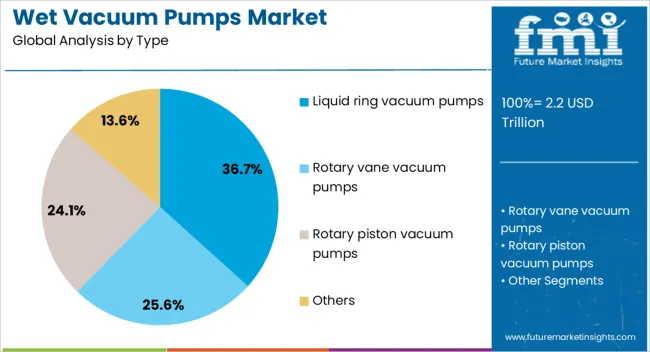

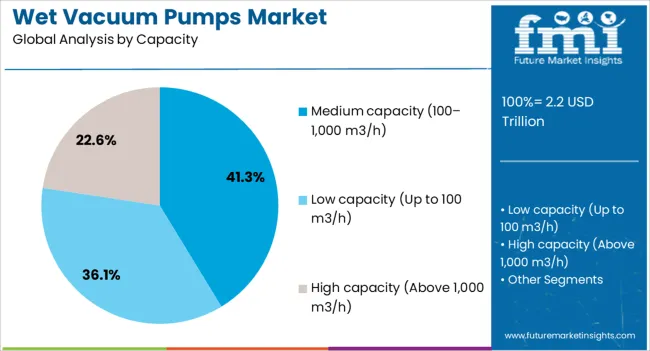

The wet vacuum pumps market is segmented by type, capacity, application, distribution channel, and geographic regions. By type, wet vacuum pumps market is divided into Liquid ring vacuum pumps, Rotary vane vacuum pumps, Rotary piston vacuum pumps, and Others. In terms of capacity, wet vacuum pumps market is classified into Medium capacity (100–1,000 m3/h), Low capacity (Up to 100 m3/h), and High capacity (Above 1,000 m3/h).

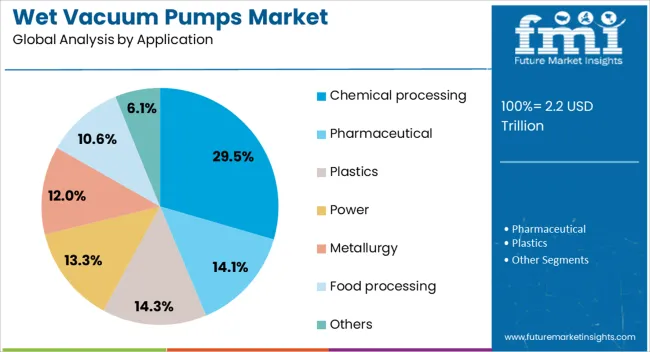

Based on application, wet vacuum pumps market is segmented into Chemical processing, Pharmaceutical, Plastics, Power, Metallurgy, Food processing, and Others. By distribution channel, wet vacuum pumps market is segmented into Direct sales and Indirect sales. Regionally, the wet vacuum pumps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Liquid ring vacuum pumps are set to lead the wet vacuum pumps market with a projected 36.7% share in 2025. These pumps are highly favored for their robust design, tolerance to contaminants, and ability to operate efficiently in humid or wet process environments.

Their ability to handle saturated gases without damage has made them ideal for industries such as paper, power generation, and petrochemicals. Additionally, their relatively simple mechanical structure reduces downtime and maintenance complexity.

As industries focus on reliability and continuous operation, liquid ring pumps are being widely deployed in vacuum distillation, vapor recovery, and condenser exhausting applications.

The medium capacity range is expected to dominate with a 41.3% market share by 2025. This segment's prominence is fueled by its flexibility to serve both batch and continuous operations across medium-sized manufacturing facilities.

Medium-capacity pumps strike a balance between performance and energy efficiency, offering optimal flow rates for various plant sizes without overdesigning systems. As mid-scale processing units expand globally, particularly in emerging economies, demand for pumps in this capacity bracket is expected to grow consistently.

Their adaptability to retrofitting projects and compact installation footprint further enhances their attractiveness in both greenfield and brownfield projects.

Chemical processing is anticipated to account for 29.5% of the market in 2025, emerging as the leading application segment. The sector’s dependence on vacuum technology for distillation, crystallization, solvent recovery, and drying processes makes wet vacuum pumps indispensable.

Liquid ring pumps, in particular, are favored for their resistance to aggressive chemical vapors and safe operation in potentially explosive environments. As chemical manufacturers aim to reduce emissions and improve plant safety, the demand for sealed, non-polluting wet pump systems has risen.

Continuous investments in specialty chemicals and green chemistry practices are also expanding the application base for these pumps in both established and new chemical clusters worldwide.

The wet vacuum pumps market is expanding steadily as industries such as chemicals, pharmaceuticals, food processing, and power generation require efficient solutions for handling gases, vapors, and liquids in critical processes. Wet vacuum pumps are valued for their durability, ability to handle wet or corrosive gases, and suitability for continuous operation.

Growing investments in industrial automation, stricter environmental compliance, and rising demand for high-performance pumping solutions are supporting adoption. Companies that focus on energy efficiency, low maintenance requirements, and customized solutions for demanding applications are well-positioned to capture market opportunities in diverse industrial sectors.

One of the key challenges in the wet vacuum pumps market relates to maintenance intensity and operating expenses. These pumps often require regular servicing due to wear from liquid seals, corrosion risks, and exposure to abrasive materials. Operating costs also increase with the need for continuous water supply in liquid ring vacuum pumps, alongside energy consumption in large-scale applications. Industries with tight operating budgets may hesitate to adopt or expand wet vacuum pump usage due to lifecycle costs. Manufacturers must address these challenges through innovations in material durability, water-saving designs, and energy-efficient technologies to reduce long-term costs and improve overall reliability for end-users.

Growing emphasis on energy-efficient equipment and sustainable operations is shaping market trends. End-users across industries are prioritizing wet vacuum pumps that reduce water consumption, minimize power usage, and comply with stricter environmental regulations. Innovative pump designs with closed-loop water systems, advanced sealing mechanisms, and variable frequency drives are gaining traction. Additionally, the integration of digital monitoring and predictive maintenance technologies is enabling industries to optimize performance and reduce unplanned downtime. These trends reflect a broader shift toward sustainable, automated, and intelligent pumping systems that align with corporate sustainability goals and regulatory requirements, enhancing adoption across process-intensive industries.

Significant opportunities are emerging from expanding industrial sectors and modernization initiatives in established economies. Industries such as chemicals, pharmaceuticals, and food processing are increasing investments in efficient vacuum systems to meet production and regulatory demands. Growth in power generation and environmental applications, such as wastewater treatment, also fuels demand for reliable wet vacuum pumps.

Emerging economies undergoing industrialization are particularly promising markets, as they require scalable and cost-effective solutions to support manufacturing expansion. Companies that deliver pumps with enhanced performance, durability, and energy efficiency, coupled with strong after-sales support, are positioned to capture a growing share of this expanding market.

Supply chain disruptions and regulatory pressures are acting as restraints in the wet vacuum pumps market. Shortages in critical raw materials such as stainless steel and specialized alloys can delay manufacturing and increase costs. Global logistics challenges further complicate the timely delivery of pumps and spare parts.

Stringent environmental regulations concerning wastewater management and emissions from pumping systems increase compliance costs. Smaller manufacturers may struggle to meet regulatory standards, limiting their competitiveness. Until supply chains stabilize and compliance requirements become more standardized, some end-users may face higher procurement costs and delays, impacting adoption rates across industries.

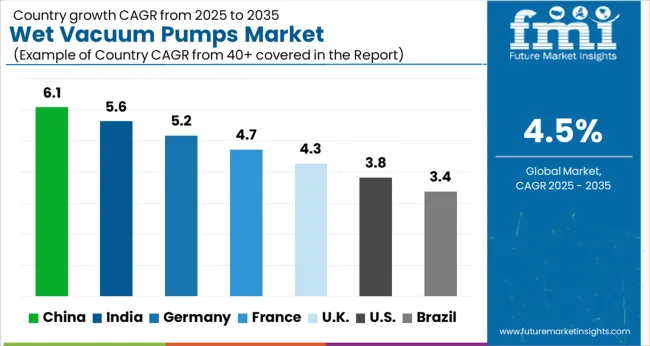

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

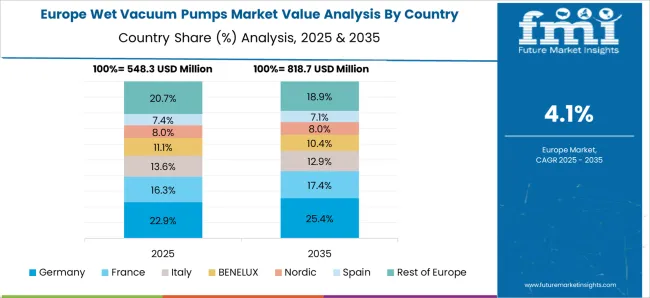

The global wet vacuum pumps market has been projected to expand at a CAGR of 4.5% through 2035, driven by demand in chemical processing, pharmaceuticals, and wastewater treatment industries. Within Asia, China has been recorded at 6.1%, supported by rising industrial production and wastewater infrastructure investments, while India has been observed at 5.6%, reflecting its increasing use in chemical and pharmaceutical facilities. In Europe, Germany has been measured at 5.2%, where integration into chemical processing plants and food industries has been steadily maintained, and France has been noted at 4.7%, with adoption being encouraged in water treatment and manufacturing operations. The United Kingdom has been tracked at 4.3%, reflecting moderate growth in life sciences and industrial segments, while the USA has been recorded at 3.8%, with applications in petrochemical, power generation, and municipal treatment being consistently utilized. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The market for wet vacuum pumps in China is expanding at a CAGR of 6.1%, supported by strong industrial growth, chemical processing, and electronics manufacturing. Local manufacturers are developing advanced pump systems to serve semiconductor fabrication, pharmaceutical production, and chemical processing industries. Government programs promoting domestic manufacturing and technological innovation are enhancing adoption. Pilot deployments in high-tech manufacturing facilities demonstrate improved energy efficiency, reliable performance, and longer operational lifecycles. Partnerships between manufacturers, research institutes, and industrial enterprises are contributing to advancements in pump efficiency and durability. Rising investment in electronics and chemical industries continues to drive the demand for wet vacuum pumps in China.

The market for wet vacuum pumps in India is projected to grow at a CAGR of 5.6%, driven by rising demand from pharmaceuticals, chemicals, and food processing industries. Manufacturers are supplying efficient pumps to improve industrial operations requiring consistent vacuum performance. Government initiatives promoting industrial modernization, chemical manufacturing, and healthcare infrastructure are supporting the adoption of wet vacuum pumps. Demonstration projects in pharmaceutical and food processing facilities highlight benefits such as better process control, energy efficiency, and reduced downtime. Partnerships with local engineering firms and technology providers are further improving product reliability and operational integration. Growing emphasis on process efficiency and industrial productivity is accelerating market growth in India.

The market for wet vacuum pumps in Germany is expanding at a CAGR of 5.2%, supported by strong manufacturing sectors including chemicals, pharmaceuticals, and semiconductors. Manufacturers are offering advanced wet vacuum pumps designed for high precision and durability to meet the needs of advanced industries. Government programs promoting industrial digitization and green manufacturing are contributing to adoption. Demonstration projects in chemical and semiconductor facilities show benefits including improved energy efficiency, reliable performance, and process stability. Collaborations between industrial enterprises, research centers, and pump manufacturers are fostering innovations in sustainable and efficient vacuum technologies. Germany’s advanced manufacturing ecosystem continues to drive demand for wet vacuum pumps.

The market for wet vacuum pumps in the United Kingdom is advancing at a CAGR of 4.3%, supported by applications in pharmaceuticals, healthcare, and food processing. Manufacturers are offering wet vacuum pump systems to meet growing needs for efficient and environmentally compliant solutions in industrial settings. Government support for industrial innovation and green technology adoption is fostering adoption. Pilot projects in pharmaceutical facilities demonstrate improved process reliability, enhanced energy efficiency, and reduced maintenance costs. Collaborations between pump manufacturers, research bodies, and industrial enterprises are contributing to the development of advanced and sustainable solutions. Expanding pharmaceutical and food processing industries are sustaining demand in the United Kingdom.

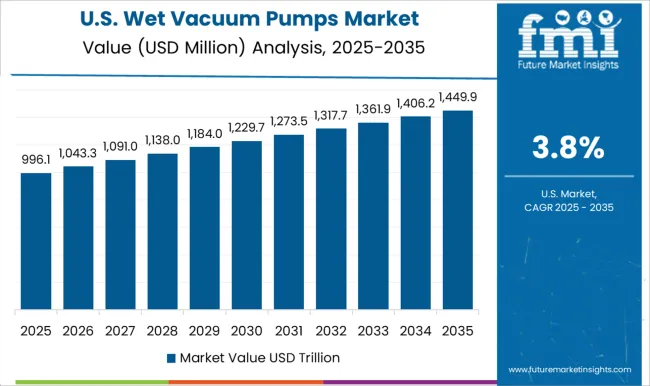

The market for wet vacuum pumps in the United States is recording a CAGR of 3.8%, with growth fueled by semiconductor, chemical, and healthcare industries. Manufacturers provide high-performance pumps tailored for applications requiring precision, efficiency, and environmental compliance. Government initiatives promoting advanced manufacturing, clean energy, and innovation are supporting market development. Demonstration projects in semiconductor and pharmaceutical facilities highlight operational benefits including improved efficiency, reliable performance, and reduced emissions. Partnerships between technology providers, industrial enterprises, and research institutes are helping to advance sustainable vacuum technologies. The expanding semiconductor industry and focus on advanced manufacturing remain key drivers for wet vacuum pumps in the United States.

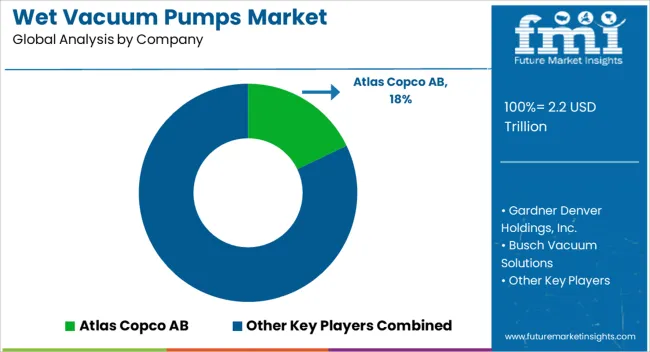

Competition in the wet vacuum pumps market is shaped by performance efficiency, operational durability, and integration with industrial processes across chemical, pharmaceutical, and food sectors. Atlas Copco, Gardner Denver, and Busch Vacuum Solutions compete on broad portfolios, with brochures highlighting flow rates, moisture handling capability, and reliability in continuous operation. Pfeiffer Vacuum, Edwards, and ULVAC emphasize technical documentation on energy performance, sealing technologies, and corrosion resistance. Leybold and Ebara Corporation address heavy-duty and high-capacity demands, with materials showcasing scalability of pump sizes, operational safety, and compatibility with demanding fluids. Becker Pumps and Dekker focus on cost-sensitive applications, with brochures outlining simplified installation, serviceability, and lifecycle cost savings. Tuthill, Hokaido, and Graham Corporation provide specialized units tailored to niche industrial environments, while Flowserve incorporates wet vacuum solutions into wider pumping and fluid handling portfolios.

Differentiation is often claimed through detailed specification sheets, maintenance schedules, and environmental compliance notes found in product literature. Strategies followed by leading players center on efficiency, reliability, and global deployment flexibility. Product portfolios are adjusted to address process-specific requirements in petrochemicals, pharmaceuticals, and wastewater treatment. Strategic alliances with distributors and integrators are maintained to secure a presence in regional markets. Observed industry patterns show emphasis placed on modular product lines, service networks, and aftermarket supply of parts. Development pipelines often include compact pumps designed for confined production areas, alongside larger systems configured for industrial-scale operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Trillion |

| Type | Liquid ring vacuum pumps, Rotary vane vacuum pumps, Rotary piston vacuum pumps, and Others |

| Capacity | Medium capacity (100–1,000 m3/h), Low capacity (Up to 100 m3/h), and High capacity (Above 1,000 m3/h) |

| Application | Chemical processing, Pharmaceutical, Plastics, Power, Metallurgy, Food processing, and Others |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Copco AB, Gardner Denver Holdings, Inc., Busch Vacuum Solutions, Pfeiffer Vacuum GmbH, Edwards Vacuum, ULVAC, Inc., Leybold GmbH, Ebara Corporation, Becker Pumps Corporation, Dekker Vacuum Technologies, Inc., Tuthill Corporation, Hokaido Co., Ltd., Pfeiffer Vacuum Technology AG, Graham Corporation, and Flowserve Corporation |

| Additional Attributes | Dollar sales by type including liquid ring, water jet, and steam jet pumps, application across chemical processing, oil & gas, pharmaceuticals, and power generation, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising industrialization, demand for efficient vacuum systems, and increasing adoption in process industries. |

The global wet vacuum pumps market is estimated to be valued at USD 2.2 trillion in 2025.

The market size for the wet vacuum pumps market is projected to reach USD 3.4 trillion by 2035.

The wet vacuum pumps market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in wet vacuum pumps market are liquid ring vacuum pumps, rotary vane vacuum pumps, rotary piston vacuum pumps and others.

In terms of capacity, medium capacity (100–1,000 m3/h) segment to command 41.3% share in the wet vacuum pumps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wet Food for Cat Market Size and Share Forecast Outlook 2025 to 2035

Wet Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Wetting Agent Market Size and Share Forecast Outlook 2025 to 2035

Wet Mix Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Wet Process Equipment Market Size and Share Forecast Outlook 2025 to 2035

Wet Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wet Strength Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wet Wipes Canister Market - Demand & Forecast 2025 to 2035

Wetsuit Market Trends - Growth, Demand & Forecast 2025 to 2035

Wet Wipes Market - Trends & Forecast 2025 to 2035

Wet Glue Labelling Machines Market

Wet Fertilizer Spreaders Market

Wet Ink Coding Machines Market

Wet Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Burn-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Dry and Wet Wipes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA