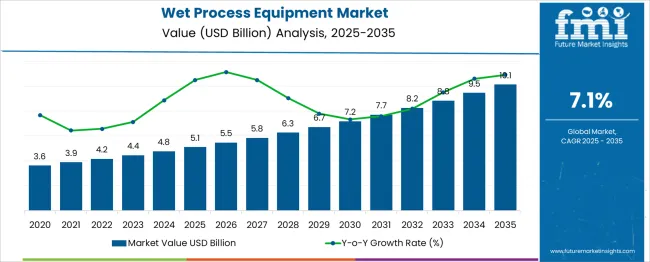

The global wet process equipment market is forecasted to grow from USD 5.1 billion in 2025 to approximately USD 10.1 billion by 2035, recording an absolute increase of USD 5.01 billion over the forecast period. This translates into a total growth of 98.0%, with the market forecast to expand at a CAGR of 7.1% between 2025 and 2035. The market size is expected to grow by nearly 1.98X during the same period, supported by the rising adoption of advanced semiconductor manufacturing processes and increasing demand for precision cleaning and etching solutions in electronics fabrication.

Between 2025 and 2030, the wet process equipment market is projected to expand from USD 5.11 billion to USD 7.19 billion, resulting in a value increase of USD 2.08 billion, which represents 41.5% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of advanced node semiconductor manufacturing, increasing demand for precision cleaning in MEMS fabrication, and growing awareness among manufacturers about contamination control requirements. Equipment manufacturers are expanding their technological capabilities to address the growing complexity of wafer processing requirements across different technology nodes.

From 2030 to 2035, the market is forecast to grow from USD 7.19 billion to USD 10.12 billion, adding another USD 2.93 billion, which constitutes 58.5% of the ten-year expansion. This period is expected to be characterized by expansion of next-generation semiconductor fabrication facilities, integration of automation and process control technologies, and development of specialized equipment for emerging applications. The growing adoption of advanced packaging technologies and heterogeneous integration will drive demand for more sophisticated wet processing solutions and technical expertise.

Between 2020 and 2025, the Wet Process Equipment market experienced steady expansion, driven by increasing semiconductor production capacity and growing adoption of advanced cleaning and etching processes. The market developed as semiconductor manufacturers recognized the critical importance of contamination control and surface preparation in achieving higher yields. Technology companies began emphasizing process optimization and equipment efficiency to meet stringent manufacturing requirements and cost targets.

| Metric | Value |

|---|---|

| Wet Process Equipment Market Value (2025) | USD 5.1 billion |

| Wet Process Equipment Market Forecast Value (2035) | USD 10.1 billion |

| Wet Process Equipment Market Forecast CAGR | 7.1% |

Market expansion is being supported by the rapid increase in semiconductor manufacturing capacity worldwide and the corresponding need for advanced wet processing equipment in fabrication facilities. Modern semiconductor devices rely on precise cleaning, etching, and stripping processes to ensure proper device performance and manufacturing yields. The complexity of advanced technology nodes requires sophisticated wet processing equipment that can deliver consistent results while maintaining process control and minimizing defects.

The growing complexity of device architectures and increasing quality requirements are driving demand for specialized wet process equipment with advanced capabilities and process monitoring features. Semiconductor manufacturers are increasingly requiring equipment that can handle multiple process steps with high throughput and reliability. Manufacturing specifications and technology roadmaps are establishing standardized process requirements that demand specialized equipment design and engineering expertise.

The market is segmented by product type outlook, type outlook, application outlook, and region. By product type outlook, the market is divided into cleaning systems, etching systems, stripping systems, and others. Based on type outlook, the market is categorized into automatic, semi-automatic, and manual. In terms of application outlook, the market is segmented into semiconductor, MEMS, solar, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Semiconductor applications are projected to account for 75.5% of the Wet Process Equipment market in 2025. This leading share is supported by the widespread adoption of wet processing in semiconductor manufacturing for cleaning, etching, and surface preparation applications. Semiconductor fabrication requires multiple wet processing steps throughout the manufacturing flow, from wafer cleaning to photoresist stripping. The segment benefits from continuous technology advancement and increasing investment in semiconductor manufacturing capacity globally.

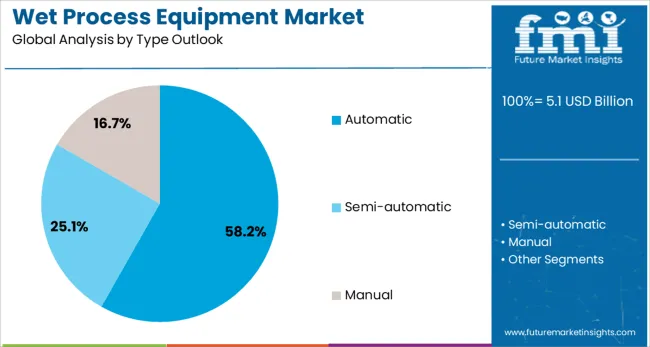

Automatic equipment is expected to represent 58.2% of wet process equipment demand in 2025. This dominant share reflects the high adoption of automated systems in modern semiconductor fabrication facilities requiring consistent process control and high throughput. Automatic wet process equipment provides superior reproducibility, reduced operator intervention, and enhanced process monitoring capabilities. The segment benefits from growing focus on manufacturing efficiency and yield optimization in advanced technology nodes.

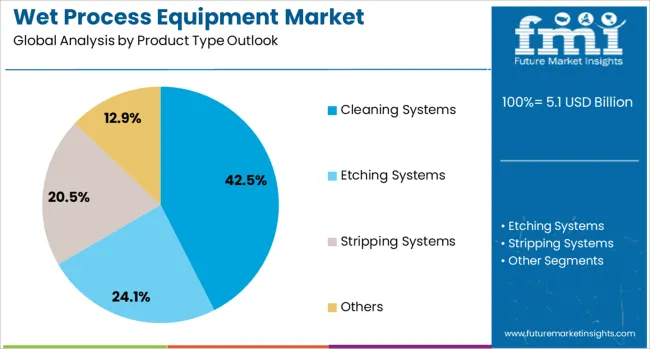

Cleaning systems are projected to contribute 42.5% of the market in 2025, representing the largest product category in wet process equipment. These systems provide critical contamination removal and surface preparation functions throughout semiconductor manufacturing processes. Cleaning equipment serves multiple process steps including pre-diffusion cleaning, post-etch cleaning, and final cleaning applications. The segment is supported by growing requirements for particle and contamination control in advanced semiconductor manufacturing.

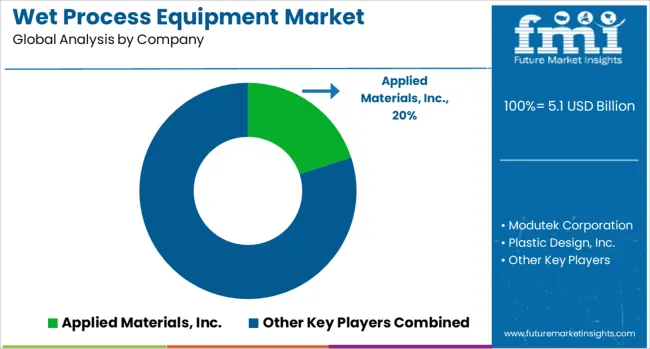

Applied Materials Inc. is projected to contribute 20% of the market in 2025, representing a leading position in wet process equipment supply. The company offers comprehensive equipment solutions with a focus on innovation and process integration. Applied Materials maintains a strong presence across multiple application segments through advanced technology development and customer support. The company benefits from established relationships with major semiconductor manufacturers and comprehensive product portfolio spanning various process applications.

The Wet Process Equipment market is advancing steadily due to increasing semiconductor production and growing recognition of process criticality. However, the market faces challenges including high equipment costs, complex process requirements, and need for continuous technology upgrades. Standardization efforts and technology roadmap alignment continue to influence equipment development and market adoption patterns.

The growing deployment of advanced semiconductor manufacturing nodes is enabling production of more sophisticated devices while maintaining cost efficiency and yield targets. Equipment manufacturers are developing solutions incorporating advanced process control and monitoring capabilities that provide enhanced performance without compromising throughput. These developments are particularly valuable for semiconductor manufacturers and foundries that require cutting-edge equipment solutions for next-generation device production.

Modern wet process equipment manufacturers are incorporating advanced automation systems and process control technologies that improve consistency and reduce operational costs. Integration of real-time monitoring systems and data analytics enables more precise process control and comprehensive production documentation. Advanced automation also supports development of specialized process recipes with enhanced capabilities including improved uniformity, reduced chemical consumption, and optimized cycle times.

| Country | CAGR (2025-2035) |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| United Kingdom | 6.7% |

| United States | 6.0% |

| Brazil | 5.3% |

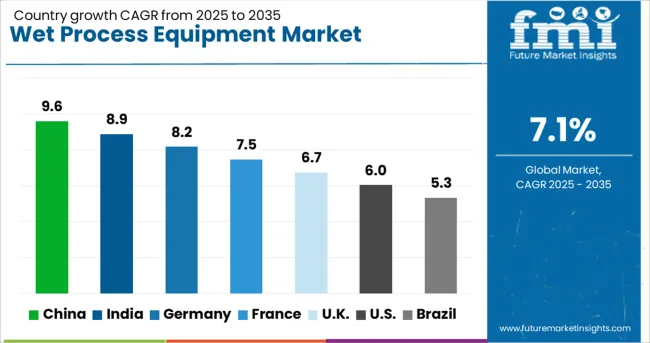

China is set to lead the global wet process equipment market with the fastest projected CAGR of 9.6% through 2035, fueled by aggressive semiconductor manufacturing expansion and government-backed self-sufficiency goals. India follows closely with 8.9% CAGR, driven by its push toward semiconductor independence and electronics manufacturing growth. Germany maintains strong momentum at 8.2%, leveraging precision engineering and advanced technology innovation. France records steady growth at 7.5%, focusing on specialized applications such as MEMS and nanotechnology. The United Kingdom, with a 6.7% CAGR, emphasizes research-driven demand and academic-industry collaboration. The United States grows at 6.0%, sustaining leadership in advanced nodes and next-generation technologies. Brazil shows more moderate progress with a 5.3% CAGR, reflecting developing semiconductor and electronics capabilities.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

Revenue from wet process equipment in China is projected to exhibit the highest growth rate with a CAGR of 9.6% through 2035, driven by massive semiconductor manufacturing capacity expansion and government support for domestic technology development. The country's ambitious semiconductor self-sufficiency goals and increasing fab construction are creating unprecedented demand for wet process equipment. Major international and domestic equipment suppliers are establishing comprehensive support networks to serve the rapidly expanding Chinese semiconductor industry.

Revenue from wet process equipment in India is expanding at a CAGR of 8.9%, supported by increasing electronics manufacturing initiatives and emerging semiconductor fabrication projects. The country's growing focus on semiconductor self-reliance and electronics assembly is driving demand for wet processing capabilities. Equipment suppliers and technology providers are establishing presence to support India's semiconductor ambitions and growing electronics ecosystem.

Demand for wet process equipment in Germany is projected to grow at a CAGR of 8.2%, supported by the country's emphasis on precision engineering and semiconductor technology innovation. German equipment manufacturers are developing advanced wet processing solutions that meet stringent performance and reliability requirements. The market is characterized by focus on technical excellence, process innovation, and environmental consciousness in equipment design.

Revenue from wet process equipment in France is growing at a CAGR of 7.5%, driven by increasing adoption in semiconductor research and specialized manufacturing applications. The country's focus on advanced materials and nanotechnology is creating demand for precision wet processing capabilities. Equipment suppliers are providing solutions tailored to research institutions and specialized manufacturing facilities throughout France.

Market Growth and Insights for Wet Process Equipment in the UK

Demand for wet process equipment in the United Kingdom is expanding at a CAGR of 6.7%, driven by strong research infrastructure and emerging technology development initiatives. British universities and research centers are investing in wet processing capabilities for advanced materials and device research. The market benefits from collaborative programs between academia and industry focusing on next-generation semiconductor technologies.

Demand Outlook for Wet Process Equipment in the USA

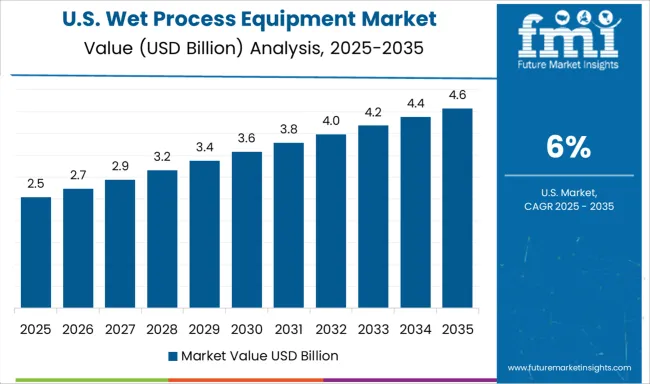

Revenue from wet process equipment in the United States is projected to grow at a CAGR of 6.0%, supported by focus on leading-edge technology development and manufacturing innovation. American semiconductor manufacturers and equipment suppliers are developing next-generation wet processing solutions for advanced nodes. The market is characterized by focus on breakthrough technologies and comprehensive ecosystem development.

Demand for wet process equipment in Brazil is growing at a CAGR of 5.3%, driven by developing semiconductor assembly and test operations and regional electronics manufacturing growth. The country's expanding technology sector is creating opportunities for wet processing equipment in various applications. Equipment suppliers are establishing service and support capabilities to address growing regional market requirements.

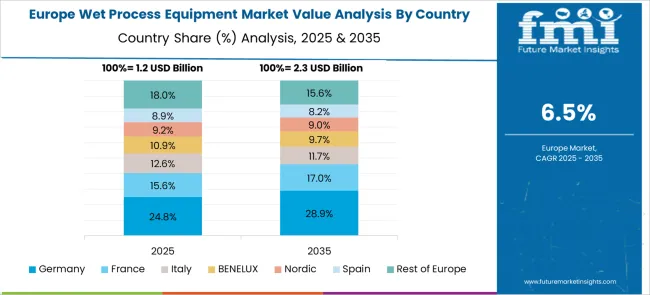

The wet process equipment market in Europe shows diversified product adoption patterns across different segments. Cleaning systems maintain significant presence serving semiconductor and MEMS manufacturing facilities throughout the region. Etching systems address critical patterning and surface modification requirements in advanced device fabrication. Stripping systems provide essential photoresist removal and surface cleaning functions. The market reflects strong focus on process innovation and environmental compliance across European manufacturing facilities. Germany leads regional demand due to its extensive semiconductor equipment manufacturing and research infrastructure. France demonstrates growing adoption in specialized applications while the United Kingdom focuses on research and development activities.

The wet process equipment market is defined by competition among equipment manufacturers, technology developers, and system integrators. Companies are investing in advanced process technologies, automation capabilities, equipment reliability, and customer support to deliver high-performance, efficient, and cost-effective processing solutions. Strategic partnerships, technological innovation, and global service networks are central to strengthening product portfolios and market presence.

Applied Materials Inc. offers comprehensive wet process equipment solutions with focus on innovation, integration, and manufacturing excellence across semiconductor applications. Modutek Corporation provides specialized wet bench equipment with focus on customization and process flexibility. Plastic Design Inc. delivers cost-effective wet processing solutions for various industrial applications. Tokyo Electron Limited emphasizes advanced technology and comprehensive process solutions for semiconductor manufacturing.

Lam Research Corporation offers innovative wet clean technology with focus on advanced node requirements. Felcon Ltd. provides specialized wet processing equipment for research and production applications. SCREEN Holdings Co. Ltd. delivers single-wafer and batch wet processing solutions. Semes Co. Ltd. offers comprehensive cleaning and etching equipment. Shibaura Mechatronics Corporation provides wet processing systems for flat panel display and semiconductor applications. Rena Technologies GmbH specializes in wet chemical processing equipment. Veeco Instruments Inc., Akrion Systems LLC, MicroTech Systems Inc., Wafer Process Systems Inc., and Solid State Equipment LLC offer various wet processing solutions for semiconductor and related applications.

| Item | Value |

| Quantitative Units | USD 5.1 billion |

| Product Type Outlook | Cleaning Systems, Etching Systems, Stripping Systems, Others |

| Type Outlook | Automatic, Semi-automatic, Manual |

| Application Outlook | Semiconductor, MEMS, Solar, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, India, China, United Kingdom, Japan, Brazil, France, and 40+ countries |

| Key Companies Profiled | Applied Materials Inc.; Modutek Corporation; Plastic Design Inc.; Tokyo Electron Limited; Lam Research Corporation; Felcon Ltd.; SCREEN Holdings Co. Ltd.; Semes Co. Ltd.; Shibaura Mechatronics Corporation; Rena Technologies GmbH; Veeco Instruments Inc.; Akrion Systems LLC; MicroTech Systems Inc.; Wafer Process Systems Inc.; Solid State Equipment LLC |

| Additional Attributes | Dollar sales by product type, equipment type, and application, regional demand trends across Asia Pacific, Europe, and North America, competitive landscape with established players and emerging suppliers, buyer preferences for automation versus manual systems, integration with Industry 4.0 and smart manufacturing platforms, innovations in process control and monitoring capabilities, and adoption of environmentally sustainable wet processing technologies for reduced chemical consumption and waste generation. |

The global wet process equipment market is estimated to be valued at USD 5.1 billion in 2025.

The market size for the wet process equipment market is projected to reach USD 10.1 billion by 2035.

The wet process equipment market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in wet process equipment market are cleaning systems, etching systems, stripping systems and others.

In terms of type outlook, automatic segment to command 58.2% share in the wet process equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Wet Food for Cat Market Size and Share Forecast Outlook 2025 to 2035

Wet Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Wetting Agent Market Size and Share Forecast Outlook 2025 to 2035

Wet Mix Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Wet Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Wet Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wet Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Wet Strength Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wet Wipes Canister Market - Demand & Forecast 2025 to 2035

Wetsuit Market Trends - Growth, Demand & Forecast 2025 to 2035

Wet Wipes Market - Trends & Forecast 2025 to 2035

Wet Glue Labelling Machines Market

Wet Fertilizer Spreaders Market

Wet Ink Coding Machines Market

Burn-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Corn Wet Milling Services Market Size, Growth, and Forecast for 2025 to 2035

Canned Wet Cat Food Market Size and Share Forecast Outlook 2025 to 2035

Thermal-Wet Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA