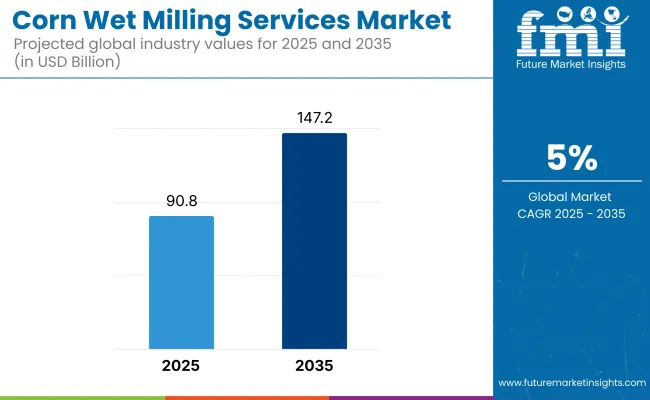

The corn wet milling market is anticipated to be valued at USD 90.8 billion in 2025 and is projected to expand to USD 147.2 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.0%.

The United States remains the most lucrative market owing to substantial corn production capacity and established food processing industries. China emerges as the fastest-growing country during the forecast period, driven by expanding food processing capacities and the increasing application of corn-derived ingredients in various industrial sectors.

Growth within the corn wet milling market is primarily fueled by the increasing demand for processed food products and beverages, escalating industrial usage of corn-based products, and the rising consumer preference for bio-based ingredients over synthetic alternatives.

The functional properties of corn-derived products such as sweeteners, ethanol, starches, and co-products like gluten feed and meal significantly contribute to their extensive application scope. However, market expansion faces restraints from fluctuating raw material prices and regulatory pressures concerning environmental sustainability.

Additionally, ongoing technological advancements enhancing process efficiencies and yield are key trends influencing market dynamics, as companies adopt innovative approaches to reduce costs and enhance sustainability.

Looking forward from 2025 to 2035, the corn wet milling market is expected to witness continued investments in technological advancements aimed at process optimization, reduced environmental impact, and increased production efficiencies. The growing global awareness and regulatory emphasis on sustainable and bio-based ingredients are expected to further drive industry growth.

Companies within the market will likely focus on strategic collaborations and capacity expansions, catering to diversified applications across food, beverages, pharmaceuticals, and industrial sectors, thus maintaining robust market momentum throughout the forecast period.

The table below presents a comparative assessment of the variation in CAGR over six-month periods for the base year (2024) and the current year (2025) for the global corn wet milling services market. This analysis highlights key performance shifts and revenue realization patterns, offering stakeholders a clearer understanding of the market’s growth trajectory.

| Particular | H1 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 4.6% |

| Particular | H2 |

|---|---|

| Year | 2024 to 2034 |

| CAGR | 5.0% |

| Particular | H1 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 4.7% |

| Particular | H2 |

|---|---|

| Year | 2025 to 2035 |

| CAGR | 5.1% |

The first half of the year (H1) spans from January to June, while the second half (H2) includes the months from July to December. From 2025 to 2035, the market is projected to experience steady growth, with the first half (H1) of the decade growing at a CAGR of 4.9%, followed by a slightly higher CAGR of 5.1% in the second half (H2). Moving into the next phase from H1 2025 to H2 2035, the CAGR is projected to increase to 5.0% in the first half and maintain a stable growth rate of 5.0% in the second half. In the first half (H1), the sector witnessed a growth of 10 BPS, while in the second half (H2), the business saw a decline of 10 BPS.

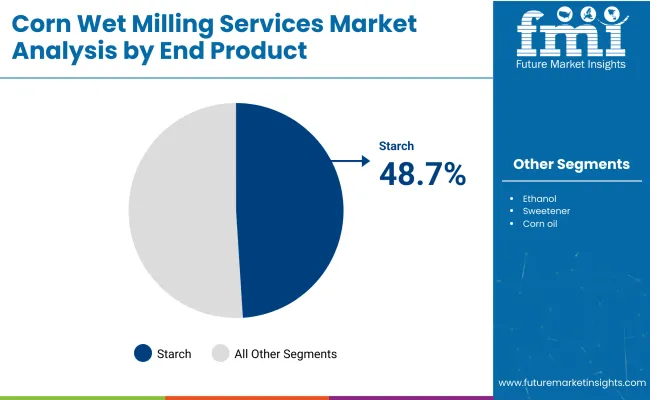

The starch segment is projected to hold a commanding 48.7% share of the global corn wet milling market in 2025, maintaining its lead through 2035 with consistent application growth and downstream value chain integration. Its dominance is attributed not only to volume but to strategic functionality across both food-grade and industrial-grade use cases.

Positioned at the convergence of ingredient functionality and cost-efficiency, corn-derived starch is increasingly being leveraged for texture enhancement, moisture retention, and viscosity control, thereby strengthening its role across processed food formulations.

In industrial domains, starch’s utility in adhesives, paper manufacturing, and biodegradable materials is being reinforced by shifting regulatory frameworks that favor bio-based inputs. As sustainability metrics tighten across the value chain, the starch segment is expected to benefit from continued alignment with clean-label, plant-based, and circular economy principles.

Emerging markets such as Southeast Asia and Latin America are anticipated to accelerate demand due to increased industrialization and rapid food sector development. At the same time, innovations in enzymatic conversion, fermentation, and clean extraction technologies are projected to drive yield gains and operational cost reductions. Going forward, starch’s central role in functional ingredient systems and its adaptability across high-growth verticals positions it as the economic engine of the corn wet milling secto

The sweeteners segment is projected to account for approximately 28% of the global corn wet milling market in 2025, with a steady upward trajectory through 2035 driven by its dual presence in both food innovation and bio-industrial solutions.

This segment’s strategic importance lies in its ability to bridge health-focused reformulations and cost-sensitive industrial applications. In the food and beverage industry, the rising adoption of corn-derived sweeteners, including high-fructose variants, reflects a shift toward customizable sweetness profiles that balance functionality, caloric control, and shelf-life extension.

While demand moderation is evident in saturated markets due to sugar-reduction campaigns, growth is expected to accelerate in Asia and Africa where processed food penetration is increasing and regulatory landscapes remain comparatively permissive.

On the industrial side, sweeteners are finding renewed relevance in fermentation-based biomanufacturing and pharmaceutical excipients, reinforcing their utility beyond flavor enhancement. Strategic partnerships between ingredient manufacturers and CPG brands are expected to further optimize sweetener portfolios for taste masking, energy modulation, and natural claim support.

Looking ahead, innovation in low-glycemic, fiber-enhanced sweeteners and enzymatic conversion techniques will elevate the sweetener segment’s role from a commodity input to a functional, narrative-rich ingredient class-positioning it as a high-leverage growth node within the corn wet milling ecosystem.

Diversification of Corn-Based Sweeteners Beyond HFCS

The global market is witnessing a shift in demand for a wider variety of corn-based sweeteners beyond high-fructose corn syrup (HFCS). As health-conscious consumers seek alternatives to HFCS due to concerns about obesity and diabetes, manufacturers are diversifying their product portfolios by offering glucose syrup, maltodextrin, and dextrose-based sweeteners. This shift is prompting wet milling companies to refine extraction and purification techniques to enhance the taste and functional properties of these sweeteners for use in bakery, confectionery, and beverage applications. Manufacturers are also focusing on optimizing enzymatic hydrolysis processes to create customized sweetener solutions for food and pharmaceutical industries. The demand for natural sweeteners derived from corn starch is leading to increased investments in research and development, enabling companies to differentiate their offerings in a competitive market.

Growth in Demand for Corn-Derived Functional Ingredients

The rising demand for functional food and nutraceutical ingredients has significantly influenced the industry. Corn-derived functional ingredients such as resistant starch, soluble fibers, and corn proteins are increasingly being used in fortified foods, sports nutrition, and dietary supplements. As consumers prioritize gut health, weight management, and protein-enriched diets, manufacturers are developing innovative processing methods to enhance the bioavailability and stability of these ingredients. Corn protein isolates and hydrolysates are gaining traction as plant-based protein alternatives, driving wet milling facilities to improve fractionation techniques to isolate higher-purity protein components. Functional corn fiber is also gaining popularity as a prebiotic ingredient in digestive health products, encouraging companies to expand their corn fiber extraction capabilities and forge partnerships with health-focused food brands.

Expansion of Industrial Applications for Corn-Derived Polymers

Beyond food and beverages, the demand for corn-derived polymers such as polylactic acid (PLA) and starch-based bioplastics is reshaping the corn wet milling landscape. With the growing emphasis on bio-based materials for packaging, textiles, and industrial applications, manufacturers are increasing their wet milling capacities to cater to this expanding sector. The rising use of starch-based adhesives, films, and biodegradable plastics has prompted wet millers to develop enhanced separation techniques to yield high-quality industrial starches with improved binding and film-forming properties. Companies are also leveraging modified starch applications in pharmaceuticals, paper, and oil drilling industries, leading to diversified revenue streams. Wet milling firms are investing in fermentation-based production methods to create bio-based polymers that meet sustainability criteria while ensuring cost-effectiveness for large-scale industrial adoption.

Increased Reliance on Co-Product Utilization for Revenue Maximization

The global corn wet milling industry is witnessing a growing focus on maximizing the value of co-products such as corn oil, gluten meal, and fiber. With increasing cost pressures, manufacturers are optimizing processing methods to extract high-value components that can be utilized in various industries, including animal feed, biodiesel, and specialty chemicals. Corn oil refining for edible and industrial purposes is gaining traction, with companies integrating advanced oil extraction techniques to enhance yield and quality. Wet milling firms are also targeting the livestock industry by improving the nutritional composition of corn gluten meal and fiber, making them more suitable for animal feed applications. Additionally, by-product valorization is driving investments in innovative fermentation technologies to convert corn processing residues into high-value bio-based chemicals, creating additional revenue streams for wet millers.

The last five years have seen an increase in industry demands for starches, sweeteners, and ethanol that are corn-based. Demand in food, beverage, and industrial applications has driven fast-scale manufacturers into almost full capacity processing and maximizing efficiency in extraction. Corn-based applications are popular in biofuels, pharmaceuticals, and personal care products. Consumer demand for natural and functional ingredients has further led to the growth of corn-derived sweeteners and proteins.

Going forward, industry growth is predicted to stem from innovation in corn-based polymers with high-performance starches and functional special ingredients responding to changing consumer requirements. Key players from within the industry are now committing investments into green processing technologies while maximizing utilization of co-products and enhancing yield efficiency as a means to regain competitiveness. Further diversification into non-food and beverage applications such as packaging, adhesives, and bioplastics is expected to witness further growth of the industry over the next decade.

Comparative Industry Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increasing industry demand for starch, sweeteners, and ethanol from corn due to food, beverage, and biofuel markets. | Entering bioplastics, pharmaceutical excipients, and environmentally friendly packaging as companies seek sustainable alternatives. |

| Supply chain disruptions and volatile corn prices impacted production costs and profitability. | Supply chain management and precision agriculture through AI enhance sourcing, price stability, and operational efficiency. |

| Growing demand for high-fructose corn syrup (HFCS) in processed foods and drinks in spite of health issues. | Transition towards low-calorie and natural sweeteners like stevia and monk fruit, decreasing HFCS dependence. |

| Regulatory scrutiny over genetically modified (GM) corn and chemical processing methods influenced industry strategies. | Advanced enzyme-based and green processing technologies improve sustainability and regulatory compliance. |

| Expansion of corn wet milling by-products like corn gluten meal and corn oil into animal feed and industrial applications. | Innovations in valorization of by-products for bio-based chemicals, biodegradable plastics, and sustainable feed formulations. |

| Rising investments in automation and energy-efficient milling technologies to improve productivity. | AI and IoT-integrated milling operations enhance yield optimization, waste reduction, and predictive maintenance. |

For food, beverages, biofuels, and industrial applications, milling is critical in extracting high-purity starches, sweeteners, and proteins from corn. Low-cost and accurate milling technology is currently in high demand with the advent of impeller/impact mills/hammer mills/roller mills, which enhance yields and minimize material loss leading to improved efficiency and optimized recovery. The increasing utilization of corn-derived items in plant-based food, biodegradable plastics, and pharmaceuticals contributes to an uptrend in milling infrastructure development.

Dent corn is the most commonly utilized corn for wet milling services because it has a high starch content and is readily available. Dent corn or field corn is the predominant variety grown all over the world and is thus an economical raw material for wet milling. Its starch yield is high, thereby making it the best for manufacturing corn starch, sweeteners, ethanol, and other industrial products, which are core products of the wet milling process. Dent corn's versatility in manufacturing food-grade as well as industrial-grade products adds to its preference for manufacturers.

Expansion in the biofuels industry can be attributed to rising demand, especially from North America and Europe, where government ethanol blending mandates help reduce carbon emissions. The USA Renewable Fuel Standard (RFS) and the EU’s Renewable Energy Directive (RED II) are pressurizing fuel firms to increase the quantity of ethanol in gasoline, fuelling production even further. Enhanced fermentation and distillation help yield a greater amount of ethanol from corn per unit area of land, thereby increasing the efficiency of conversion and limiting waste stream. Increasing shift toward sustainable fuel alternatives additionally spurs investments toward green ethanol processing technologies.

Starch is the dominant end product of corn wet milling services, comprising a major percentage of the output of the industry. Starches find numerous applications in several industries like food & beverages, paper production, pharmaceuticals, and textiles owing to their function and versatility. Corn starch is an essential ingredient in food thickeners, bakery items, and processed foods, and it also functions as a binding agent in industrial use. Increasing demand for gluten-free and clean-label products also propels the use of corn starch in food formulations. Industrial-grade starches are also a key component in biodegradable plastics and adhesives, facilitating the shift toward sustainable solutions.

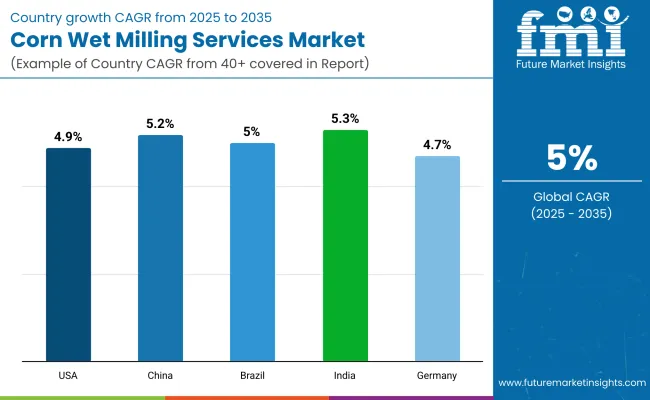

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

| China | 5.2% |

| Brazil | 5.0% |

| India | 5.3% |

| Germany | 4.7% |

The USA holds a major proportion of the global corn wet milling services industry share and is anticipated to grow at a CAGR of 4.9% during 2025 to 2035, estimates FMI. This growth is driven by robust demand for corn products in the food and beverage, pharmaceutical, and biofuels sectors. The nation's established infrastructure and innovation in mill technology has allowed for effective production and supply of quality corn derivatives, such as starches, sweeteners, and ethanol. Further, the major industry participants still spend significantly on research and development, spurring innovation and industry growth. Increased demand for natural and organic foods also stimulates demand for natural and organic corn-derived starches and sweeteners, further adding to the industry dominance.

Growth Drivers in the USA

| Key Drivers | Details |

|---|---|

| Strong Demand Across Several Industries | Food, pharma, and biofuels heavily utilize corn-based ingredients. |

| New Milling Technology | Improved wet milling technology for greater productivity and quality of product. |

| High Consumer Demand for Natural Ingredients | Greater demand for organic and non-GMO corn products. |

As per FMI, the China corn wet milling services market will expand at a CAGR of 5.2% over 2025 to 2035 due to urbanization and population expansion. Population expansion and urbanization have accelerated food ingredient processing demand and, as a result, investment in food technology and mills. Agricultural policies by the government have reinforced corn cultivation with an assured supply of raw materials. Another crucial driver of demand is functional foods and nutraceuticals, with customers increasingly becoming health-conscious and requiring corn-based ingredients.

rowth Drivers in China

| Key Drivers | Details |

|---|---|

| Increasing Demand for Processed Foods | Rising urbanization and income are driving increased consumption. |

| Government Support to Corn Production | Policies drive a stable supply of raw materials to the wet mills. |

| Increasing Functional Food & Nutraceutical Industry | Health-conscious consumers drive increased use of corn ingredients. |

The Brazilian industry is projected to grow at 5.0% CAGR during 2025 to 2035, with increased corn production in the nation and agro-export emphasis. The nation's wet milling industry is backed by industrialized factory complexes and eco-friendly processing methods, increasing efficiency while minimizing environmental effects. The production of biofuels, in particular ethanol, has also increased, further increasing demand for corn-based products.

Growth Drivers in Brazil

| Key Drivers | Details |

|---|---|

| Plentiful Corn Production | Brazil is among the world's top corn producers. |

| Expansion of the Biofuel Industry | Growing demand for ethanol drives corn wet milling applications. |

| Investments in Sustainable Milling Practices | Emphasis on green processing and resource conservation. |

India's wet corn milling industry is anticipated to grow at the highest rate among the larger markets, at a 5.3% CAGR from 2025 to 2035, cites FMI. Growth is driven by the increasing consumption of corn-derived starches, sweeteners, and ethanol in various industries. The growth of the food and beverages industry, along with government pro-ethanol production policies, has consolidated India's wet milling sector. Investment in advanced milling facilities is also boosting processing efficiency and product quality. FMI forecasts the Indian industry to grow at 5.3% CAGR over the study period, aided by increasing industrial usage and government pro-ethanol policies.

Growth Drivers in India

| Key Drivers | Details |

|---|---|

| Increased Demand for Corn Ingredients | Expansion of food, pharmaceutical, and ethanol business. |

| Government Ethanol-Blending Programs | Policies that promote additional production of ethanol from corn. |

| Upgrade of Milling Infrastructure | Modern processing technologies enhance efficiency and product quality. |

The German corn wet milling services market is expected to register a CAGR of 4.7% from 2025 to 2035, led by increasing demand for bio-chemicals and modified starches. The country's technologically advanced food and beverage industry is among the largest users of corn ingredients. Greater emphasis on sustainable and bio-based inputs has boosted demand for alternatives to corn-based chemical and plastic solutions. Furthermore, advancements in enzyme-based milling technologies improved the rate of extraction efficiency as well as the quality of the resultant products.

Growth Drivers in Germany

| Key Drivers | Details |

|---|---|

| Increased Demand for Altered Starches | Food, adhesive, and pharmaceutical uses. |

| Improved Technology for Enzyme-Based Milling | More cost-effective and less costly to process. |

| Increased Focus on Bio-Based Chemicals | Renewable alternative to conventional chemicals. |

The global corn wet milling services market is characterized by a mix of multinational corporations (MNCs), regional players, and Chinese manufacturers, each playing a crucial role in shaping industry dynamics. MNCs hold a significant share of the industry, leveraging their extensive processing capacities, global distribution networks, and strong financial backing. These companies focus on expanding production facilities, integrating advanced milling technologies, and optimizing extraction processes to maintain a competitive edge. Their ability to cater to diverse end-use industries, including food and beverages, pharmaceuticals, biofuels, and industrial applications, has reinforced their industry dominance.

Regional players have gained prominence by catering to local demand, ensuring cost-effective production, and offering customized corn-based ingredients suited to regional preferences. These companies often focus on specific product lines, such as modified starches, glucose syrups, and native starches, to strengthen their industry positioning. Many regional players have adopted strategies such as joint ventures, mergers, and capacity expansion to enhance their competitiveness. The demand for clean-label and naturally processed ingredients has also driven them to refine wet milling techniques and adopt sustainable processing solutions.

Chinese manufacturers are becoming increasingly influential in the corn wet milling industry, benefiting from abundant raw material availability, government support, and cost-efficient processing methods. Their growing presence in international markets, particularly in supplying bulk starches, sweeteners, and ethanol, has contributed to heightened competition. As Chinese producers expand their export capabilities, they continue to challenge established players by offering competitive pricing and high production volumes, driving further industry fragmentation.

The global corn wet milling services market is largely competitive in nature, driven substantially by increasing demand for products from corn bases in food and beverages, animal and human nutrition, pharmaceuticals, and, in addition, biofuels. The advancement in technology-of-milling, sustainable initiatives, and the growing consumer preference for clean-label and non-GMO ingredients give industry momentum. Production-efficiency initiatives, optimized supply chains, and strategic collaborations are some investments companies make to strengthen their industry position.

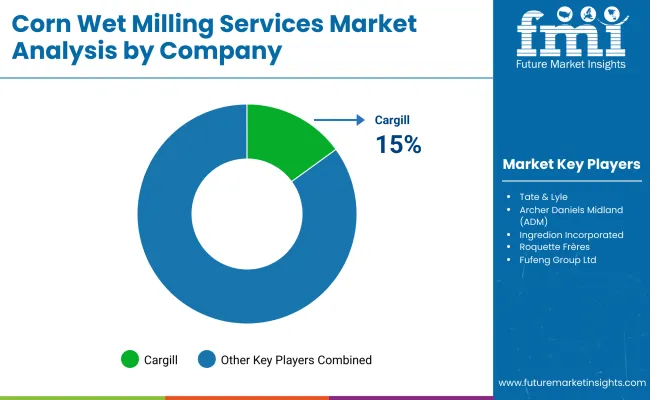

A few key players in the industry include Cargill, ADM, Ingredion, Tate & Lyle, and Roquette, all of whom boast extensive processing capabilities, diverse product portfolio offerings, and a global distribution network. The Innovation opportunities provided by enzymes and bioprocessing technologies, which effectively convert the mainstream of starch subsidiary products, further extend into high-value segments such as specialty starches, high-fructose corn syrup, and bio-based chemicals and new types of products.

Sustainability is not only a competitive factor but also shows trends among companies investing in water- and energy-efficient processing, waste minimization, and ethical sourcing. Hence, mergers and acquisitions, as well as geographic extension, continue to shape the competitive landscape of the industry. Those investing in R&D, compliance with regulatory demands, and other differentiated products will fortify their position in this changing industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Cargill | 15-19% |

| Tate & Lyle | 12-16% |

| Archer Daniels Midland (ADM) | 10-14% |

| Ingredion Incorporated | 9-13% |

| Roquette Frères | 7-11% |

| Other Companies (combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Cargill | Leading supplier of starches, sweeteners, and bio-industrial solutions focused on sustainability and efficiency. |

| Tate & Lyle | Corn starches, emulsifiers, and high-intensity sweeteners for food and beverage applications are their specialties. |

| Archer Daniels Midland (ADM) | Offers a wide range of corn wet milling products, including ethanol, feed ingredients, and specialty starches. |

| Ingredion Incorporated | Specializing in clean-label starches, plant-based proteins, and specialty sweeteners. |

| Roquette Frères | Focusing on biopharmaceutical applications, plant-based nutrition, and starch derivatives. |

Cargill (15-19%)

Industry leader with a strong focus on sustainability, investing in bio-based solutions and energy-efficient milling technologies.

Tate & Lyle (12-16%)

Strengthening its position through specialty ingredient innovations and high-value corn derivatives.

Archer Daniels Midland (ADM) (10-14%)

Expanding its global footprint in biofuels and sustainable ingredient solutions.

Ingredion Incorporated (9-13%)

Driving growth through clean-label innovations and plant-based food applications.

Roquette Frères (7-11%)

Focusing on pharmaceutical-grade ingredients and alternative protein sources.

Other Key Players (30-40% Combined)

The industry is slated to reach USD 90.8 billion in 2025.

The industry is predicted to reach USD 147.2 billion by 2035.

Key players include Cargill, Tate & Lyle, Archer Daniels Midland (ADM), Ingredion Incorporated, Roquette Frères, Fufeng Group Ltd., AGRANA Beteiligungs-AG, Tereos Group, Global Bio-Chem Technology Group, and Gulshan Polyols Ltd.

India, slated to grow at 5.3% CAGR during the forecast period, is poised for the fastest growth.

Starch is the key end use product.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Corn Milling Machine Market Size and Share Forecast Outlook 2025 to 2035

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Wet Food for Cat Market Size and Share Forecast Outlook 2025 to 2035

Wet Food Pouch Market Size and Share Forecast Outlook 2025 to 2035

Corn-Based Plastics for Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wetting Agent Market Size and Share Forecast Outlook 2025 to 2035

Wet Mix Plant Market Analysis and Opportunity Assessment in India Size and Share Forecast Outlook 2025 to 2035

Corn Flour Market Size and Share Forecast Outlook 2025 to 2035

Wet Process Equipment Market Size and Share Forecast Outlook 2025 to 2035

Cornstarch Packaging Market Size and Share Forecast Outlook 2025 to 2035

Wet Vacuum Pumps Market Size and Share Forecast Outlook 2025 to 2035

Wet Electrostatic Precipitator Market Size and Share Forecast Outlook 2025 to 2035

Wet Pet Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wet Vacuum Cleaner Market Size and Share Forecast Outlook 2025 to 2035

Corneal Ulcer Treatment Market Size, Growth, and Forecast for 2025 to 2035

Corn Puff Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corner Pads Market Insights - Growth & Demand 2025 to 2035

Corn Steep Powder Market Size, Growth, and Forecast for 2025 to 2035

Wet Strength Paper Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Wet Wipes Canister Market - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA